Key Insights

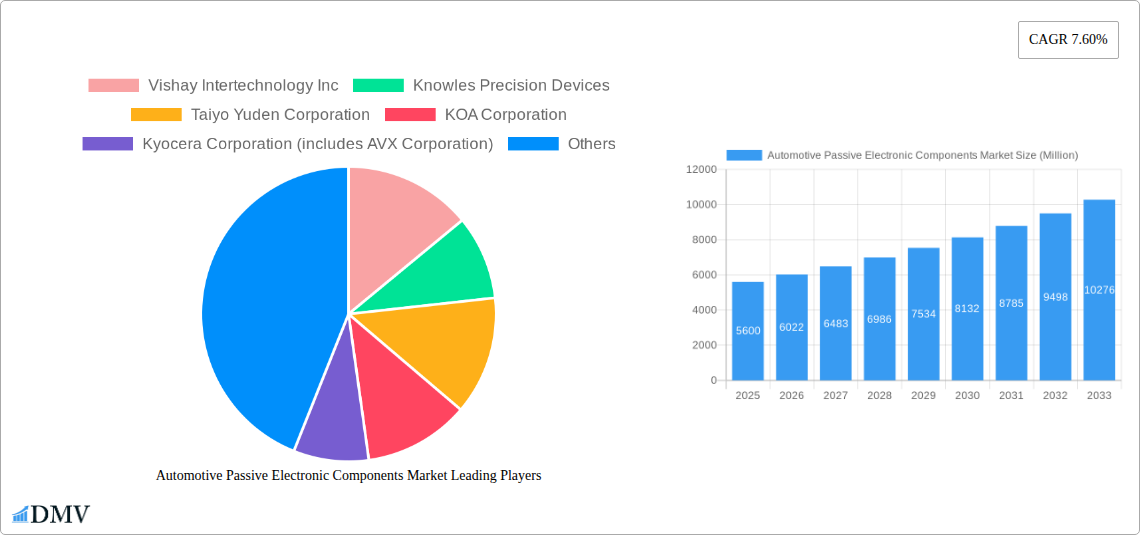

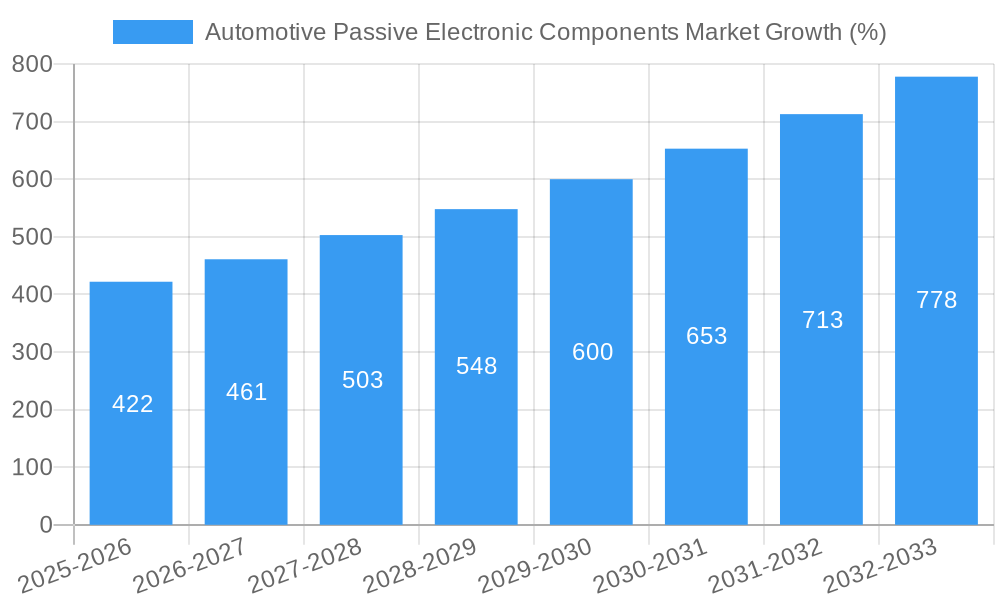

The automotive passive electronic components market, valued at $5.6 billion in 2025, is projected to experience robust growth, driven by the increasing electrification of vehicles and the rising adoption of advanced driver-assistance systems (ADAS). The market's Compound Annual Growth Rate (CAGR) of 7.6% from 2025 to 2033 signifies a significant expansion, fueled by the demand for higher performance, miniaturization, and improved fuel efficiency in automobiles. Key growth drivers include the proliferation of electric vehicles (EVs) and hybrid electric vehicles (HEVs), which require significantly more passive components than traditional internal combustion engine (ICE) vehicles. Furthermore, the integration of sophisticated features like ADAS, infotainment systems, and connected car technologies necessitates a substantial increase in the number and complexity of passive components. The market is segmented by type, including capacitors, supercapacitors, inductors, resistors, and other specialty components like EMC filters. Leading players such as Vishay Intertechnology, Knowles Precision Devices, and TDK Corporation are strategically investing in research and development to enhance product performance and cater to the evolving needs of the automotive industry. Growth may be slightly moderated by factors such as supply chain constraints and potential fluctuations in raw material prices. However, the long-term outlook remains positive, driven by the continued technological advancements and the global shift towards electric mobility.

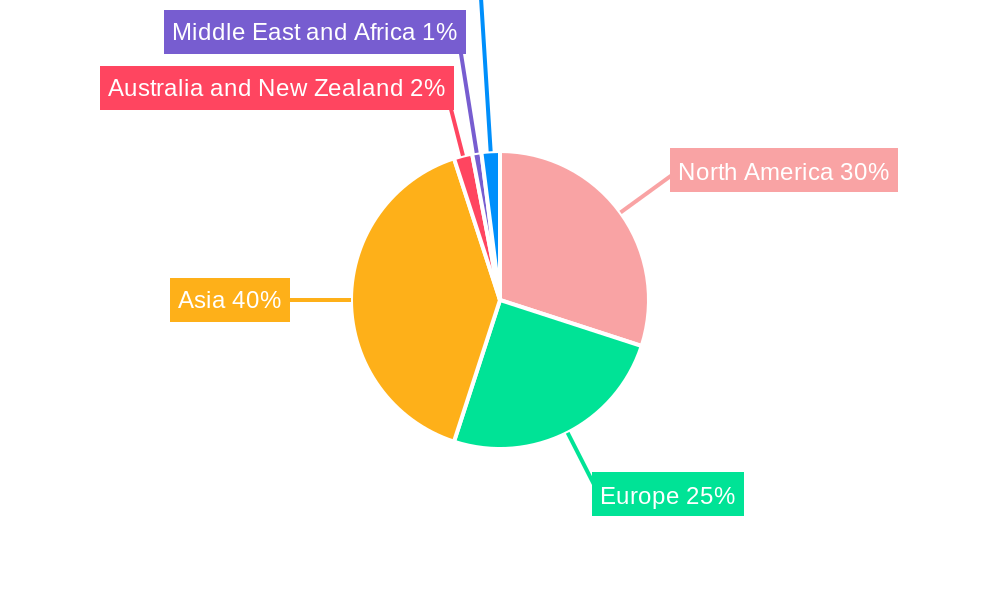

The Asia-Pacific region is expected to dominate the market owing to the significant growth in automotive production and the increasing adoption of electric and hybrid vehicles in countries like China, Japan, and South Korea. North America and Europe will also witness substantial growth, driven by stringent emission regulations and the rising demand for advanced automotive features. The market is characterized by intense competition among established players and emerging companies, leading to innovation in material science, miniaturization techniques, and improved component performance. Companies are focusing on strategic partnerships and collaborations to expand their market reach and gain a competitive edge. This competitive landscape is expected to drive further innovation and efficiency improvements within the automotive passive electronic components sector throughout the forecast period.

Automotive Passive Electronic Components Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the Automotive Passive Electronic Components Market, offering a detailed overview of market dynamics, key players, and future growth prospects. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The market is projected to reach xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This report is indispensable for stakeholders seeking to understand the complexities of this rapidly evolving market and make informed strategic decisions.

Automotive Passive Electronic Components Market Composition & Trends

The Automotive Passive Electronic Components Market, valued at xx Million in 2025, is characterized by a moderately concentrated landscape. Major players, including Vishay Intertechnology Inc, Knowles Precision Devices, Taiyo Yuden Corporation, KOA Corporation, Kyocera Corporation (including AVX Corporation), Rubycon Corporation, Yageo Corporation, TDK Corporation, Nippon Chemi-Con Corporation, Murata Manufacturing Co Ltd, Panasonic Corporation, and Samsung Electro-Mechanical, hold significant market share, although the exact distribution varies by component type. Innovation is driven by the increasing demand for advanced driver-assistance systems (ADAS), electric vehicles (EVs), and connected car technologies. Stringent safety and emission regulations are shaping the market, demanding higher performance and reliability from passive components. Substitute products are limited, primarily due to the specific performance requirements of automotive applications. The end-user profile encompasses major automotive manufacturers, Tier 1 suppliers, and smaller specialized component manufacturers. Mergers and acquisitions (M&A) activity has been relatively moderate in recent years, with deal values totaling approximately xx Million during the historical period (2019-2024), primarily focused on strengthening supply chains and expanding product portfolios.

- Market Concentration: Moderately concentrated, with top 10 players holding approximately xx% of the market share.

- Innovation Catalysts: ADAS, EVs, connected car technologies, and stringent regulatory requirements.

- Regulatory Landscape: Stringent safety and emission standards driving demand for high-performance components.

- Substitute Products: Limited substitutes due to stringent performance requirements.

- End-User Profile: Automotive OEMs, Tier 1 suppliers, and specialized component manufacturers.

- M&A Activities: Moderate activity (2019-2024), with total deal values estimated at xx Million.

Automotive Passive Electronic Components Market Industry Evolution

The Automotive Passive Electronic Components Market has witnessed significant growth over the historical period (2019-2024), fueled by the global automotive industry's expansion and technological advancements. The market exhibited a CAGR of xx% between 2019 and 2024, driven primarily by the increasing adoption of EVs and the proliferation of electronic features in vehicles. Technological advancements, including the development of miniaturized components, higher-power capacitors, and improved EMC filters, have played a crucial role in driving market growth. Shifting consumer demands for improved fuel efficiency, enhanced safety features, and advanced infotainment systems are also major contributors. The forecast period (2025-2033) is expected to witness continued growth, albeit at a slightly moderated pace, driven by factors such as the increasing penetration of EVs, the growing adoption of autonomous driving technologies, and continuous improvement in electronic components. The market is expected to be significantly impacted by the integration of advanced driver-assistance systems (ADAS), which are increasingly reliant on high-performance passive electronic components. The adoption rate of advanced components like supercapacitors is projected to grow at xx% annually from 2025 to 2033, leading to substantial market expansion.

Leading Regions, Countries, or Segments in Automotive Passive Electronic Components Market

The Asia-Pacific region is currently the dominant market for automotive passive electronic components, driven by the high concentration of automotive manufacturing hubs in countries like China, Japan, and South Korea.

Key Drivers in Asia-Pacific:

- Significant investments in automotive manufacturing and R&D.

- Strong government support for the automotive and electronics industries.

- High volume production of vehicles.

- Growing adoption of EVs and connected car technologies.

Dominance Factors: The region's dominance is attributed to a combination of factors, including the large-scale production of vehicles, the presence of major automotive manufacturers, and a robust supplier base. The high volume of vehicle production in the region leads to increased demand for passive electronic components, driving market growth. The significant investments made by both automotive manufacturers and governments in the region further contribute to market expansion.

Among the component types, Capacitors (including supercapacitors) hold the largest market share, accounting for approximately xx% of the total market in 2025. This dominance is due to their extensive usage in various automotive applications, including power supply systems, energy storage, and signal processing circuits. The increasing integration of supercapacitors in hybrid and electric vehicles further drives the segment's growth.

Automotive Passive Electronic Components Market Product Innovations

Recent innovations have focused on miniaturization, increased power handling capabilities, improved temperature stability, and enhanced reliability. For instance, the introduction of advanced multilayer ceramic capacitors (MLCCs) with higher capacitance density and smaller footprints enables more efficient electronic designs. Similarly, the development of high-voltage, high-capacity supercapacitors provides improved power storage solutions for hybrid and electric vehicles, offering better performance and longer lifespans. These advancements enhance the overall performance and efficiency of automotive electronic systems.

Propelling Factors for Automotive Passive Electronic Components Market Growth

The growth of the automotive passive electronic components market is primarily driven by technological advancements, stringent emission regulations, and the escalating demand for enhanced vehicle features. The shift towards electric and hybrid vehicles is a significant driver, as these vehicles require a higher number of electronic components compared to traditional internal combustion engine (ICE) vehicles. Furthermore, the increasing adoption of advanced driver-assistance systems (ADAS) and connected car technologies contributes to the surge in demand for high-performance passive electronic components. Government regulations promoting fuel efficiency and emission reductions further stimulate market growth by creating demand for more efficient electronic components.

Obstacles in the Automotive Passive Electronic Components Market

The automotive passive electronic components market faces challenges such as supply chain disruptions, intense competition, and stringent quality control standards. Geopolitical instability can cause significant supply chain disruptions, impacting component availability and pricing. The highly competitive market environment necessitates continuous innovation and cost optimization to maintain profitability. Strict quality and reliability standards imposed by automotive manufacturers also add complexity and cost to the manufacturing process, affecting margins.

Future Opportunities in Automotive Passive Electronic Components Market

Future opportunities lie in the increasing adoption of autonomous driving technologies, the growth of the electric vehicle market, and the development of advanced energy storage solutions. The development of smaller, higher-performance components will open new avenues for innovation. Furthermore, the growing demand for advanced driver-assistance systems (ADAS) and vehicle electrification will create significant growth opportunities for manufacturers of passive electronic components. Expanding into new geographical markets, particularly in developing economies with burgeoning automotive sectors, also presents substantial opportunities.

Major Players in the Automotive Passive Electronic Components Market Ecosystem

- Vishay Intertechnology Inc

- Knowles Precision Devices

- Taiyo Yuden Corporation

- KOA Corporation

- Kyocera Corporation (includes AVX Corporation)

- Rubycon Corporation

- Yageo Corporation

- TDK Corporation

- Nippon Chemi-Con Corporation

- Murata Manufacturing Co Ltd

- Panasonic Corporation

- Samsung Electro-Mechanical

Key Developments in Automotive Passive Electronic Components Market Industry

- March 2024: Knowles Precision Devices launched new Electric Double-Layer Capacitor (EDLC) modules, offering increased operating voltages and space savings for applications including EVs and battery/capacitor hybrids.

- February 2024: Taiyo Yuden completed a new building for manufacturing barium titanate, a key raw material for multilayer ceramic capacitors, ensuring a consistent supply for its customers.

Strategic Automotive Passive Electronic Components Market Forecast

The automotive passive electronic components market is poised for robust growth over the forecast period (2025-2033), driven by the continued expansion of the automotive industry, technological advancements, and the rising demand for electric and connected vehicles. Opportunities exist in developing higher-performance components, expanding into new markets, and capitalizing on the increasing integration of advanced driver-assistance systems (ADAS). The market's future growth will heavily depend on the pace of technological advancements, regulatory changes, and the overall health of the global automotive industry.

Automotive Passive Electronic Components Market Segmentation

-

1. Type

-

1.1. Capacitors

- 1.1.1. Ceramic Capacitors

- 1.1.2. Tantalum Capacitors

- 1.1.3. Aluminum Electrolytic Capacitors

- 1.1.4. Paper and Plastic Film Capacitors

- 1.1.5. Supercapacitors

- 1.2. Inductors

-

1.3. Resistors

- 1.3.1. Surface-mounted Chips

- 1.3.2. Network and Array

- 1.3.3. Other Specialty

- 1.4. EMC Filters

-

1.1. Capacitors

Automotive Passive Electronic Components Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Middle East and Africa

- 6. Latin America

Automotive Passive Electronic Components Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Usage of Advanced Electronic Devices in the Industry; Increasing Preference for Miniaturized Designs

- 3.3. Market Restrains

- 3.3.1. Fluctuating Prices of Critical Metals Used in Manufacturing of Passive Electronic Components/ Challenges in the manufacturing of various Passive Components

- 3.4. Market Trends

- 3.4.1. Capacitors to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Passive Electronic Components Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Capacitors

- 5.1.1.1. Ceramic Capacitors

- 5.1.1.2. Tantalum Capacitors

- 5.1.1.3. Aluminum Electrolytic Capacitors

- 5.1.1.4. Paper and Plastic Film Capacitors

- 5.1.1.5. Supercapacitors

- 5.1.2. Inductors

- 5.1.3. Resistors

- 5.1.3.1. Surface-mounted Chips

- 5.1.3.2. Network and Array

- 5.1.3.3. Other Specialty

- 5.1.4. EMC Filters

- 5.1.1. Capacitors

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia

- 5.2.4. Australia and New Zealand

- 5.2.5. Middle East and Africa

- 5.2.6. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Automotive Passive Electronic Components Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Capacitors

- 6.1.1.1. Ceramic Capacitors

- 6.1.1.2. Tantalum Capacitors

- 6.1.1.3. Aluminum Electrolytic Capacitors

- 6.1.1.4. Paper and Plastic Film Capacitors

- 6.1.1.5. Supercapacitors

- 6.1.2. Inductors

- 6.1.3. Resistors

- 6.1.3.1. Surface-mounted Chips

- 6.1.3.2. Network and Array

- 6.1.3.3. Other Specialty

- 6.1.4. EMC Filters

- 6.1.1. Capacitors

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Automotive Passive Electronic Components Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Capacitors

- 7.1.1.1. Ceramic Capacitors

- 7.1.1.2. Tantalum Capacitors

- 7.1.1.3. Aluminum Electrolytic Capacitors

- 7.1.1.4. Paper and Plastic Film Capacitors

- 7.1.1.5. Supercapacitors

- 7.1.2. Inductors

- 7.1.3. Resistors

- 7.1.3.1. Surface-mounted Chips

- 7.1.3.2. Network and Array

- 7.1.3.3. Other Specialty

- 7.1.4. EMC Filters

- 7.1.1. Capacitors

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Automotive Passive Electronic Components Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Capacitors

- 8.1.1.1. Ceramic Capacitors

- 8.1.1.2. Tantalum Capacitors

- 8.1.1.3. Aluminum Electrolytic Capacitors

- 8.1.1.4. Paper and Plastic Film Capacitors

- 8.1.1.5. Supercapacitors

- 8.1.2. Inductors

- 8.1.3. Resistors

- 8.1.3.1. Surface-mounted Chips

- 8.1.3.2. Network and Array

- 8.1.3.3. Other Specialty

- 8.1.4. EMC Filters

- 8.1.1. Capacitors

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia and New Zealand Automotive Passive Electronic Components Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Capacitors

- 9.1.1.1. Ceramic Capacitors

- 9.1.1.2. Tantalum Capacitors

- 9.1.1.3. Aluminum Electrolytic Capacitors

- 9.1.1.4. Paper and Plastic Film Capacitors

- 9.1.1.5. Supercapacitors

- 9.1.2. Inductors

- 9.1.3. Resistors

- 9.1.3.1. Surface-mounted Chips

- 9.1.3.2. Network and Array

- 9.1.3.3. Other Specialty

- 9.1.4. EMC Filters

- 9.1.1. Capacitors

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Automotive Passive Electronic Components Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Capacitors

- 10.1.1.1. Ceramic Capacitors

- 10.1.1.2. Tantalum Capacitors

- 10.1.1.3. Aluminum Electrolytic Capacitors

- 10.1.1.4. Paper and Plastic Film Capacitors

- 10.1.1.5. Supercapacitors

- 10.1.2. Inductors

- 10.1.3. Resistors

- 10.1.3.1. Surface-mounted Chips

- 10.1.3.2. Network and Array

- 10.1.3.3. Other Specialty

- 10.1.4. EMC Filters

- 10.1.1. Capacitors

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Latin America Automotive Passive Electronic Components Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Capacitors

- 11.1.1.1. Ceramic Capacitors

- 11.1.1.2. Tantalum Capacitors

- 11.1.1.3. Aluminum Electrolytic Capacitors

- 11.1.1.4. Paper and Plastic Film Capacitors

- 11.1.1.5. Supercapacitors

- 11.1.2. Inductors

- 11.1.3. Resistors

- 11.1.3.1. Surface-mounted Chips

- 11.1.3.2. Network and Array

- 11.1.3.3. Other Specialty

- 11.1.4. EMC Filters

- 11.1.1. Capacitors

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. North America Automotive Passive Electronic Components Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Europe Automotive Passive Electronic Components Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Asia Automotive Passive Electronic Components Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Australia and New Zealand Automotive Passive Electronic Components Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Middle East and Africa Automotive Passive Electronic Components Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. Latin America Automotive Passive Electronic Components Market Analysis, Insights and Forecast, 2019-2031

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1.

- 18. Competitive Analysis

- 18.1. Global Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Vishay Intertechnology Inc

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Knowles Precision Devices

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Taiyo Yuden Corporation

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 KOA Corporation

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Kyocera Corporation (includes AVX Corporation)

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Rubycon Corporation

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Yageo Corporation

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 TDK Corporation

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Nippon Chemi-Con Corporatio

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Murata Manufacturing Co Ltd

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.11 Panasonic Corporation

- 18.2.11.1. Overview

- 18.2.11.2. Products

- 18.2.11.3. SWOT Analysis

- 18.2.11.4. Recent Developments

- 18.2.11.5. Financials (Based on Availability)

- 18.2.12 Samsung Electro-Mechanical

- 18.2.12.1. Overview

- 18.2.12.2. Products

- 18.2.12.3. SWOT Analysis

- 18.2.12.4. Recent Developments

- 18.2.12.5. Financials (Based on Availability)

- 18.2.1 Vishay Intertechnology Inc

List of Figures

- Figure 1: Global Automotive Passive Electronic Components Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Automotive Passive Electronic Components Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Automotive Passive Electronic Components Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Automotive Passive Electronic Components Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Automotive Passive Electronic Components Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Automotive Passive Electronic Components Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Automotive Passive Electronic Components Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Australia and New Zealand Automotive Passive Electronic Components Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Australia and New Zealand Automotive Passive Electronic Components Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Automotive Passive Electronic Components Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Automotive Passive Electronic Components Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: Latin America Automotive Passive Electronic Components Market Revenue (Million), by Country 2024 & 2032

- Figure 13: Latin America Automotive Passive Electronic Components Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Automotive Passive Electronic Components Market Revenue (Million), by Type 2024 & 2032

- Figure 15: North America Automotive Passive Electronic Components Market Revenue Share (%), by Type 2024 & 2032

- Figure 16: North America Automotive Passive Electronic Components Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Automotive Passive Electronic Components Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Automotive Passive Electronic Components Market Revenue (Million), by Type 2024 & 2032

- Figure 19: Europe Automotive Passive Electronic Components Market Revenue Share (%), by Type 2024 & 2032

- Figure 20: Europe Automotive Passive Electronic Components Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Automotive Passive Electronic Components Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Asia Automotive Passive Electronic Components Market Revenue (Million), by Type 2024 & 2032

- Figure 23: Asia Automotive Passive Electronic Components Market Revenue Share (%), by Type 2024 & 2032

- Figure 24: Asia Automotive Passive Electronic Components Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Asia Automotive Passive Electronic Components Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Australia and New Zealand Automotive Passive Electronic Components Market Revenue (Million), by Type 2024 & 2032

- Figure 27: Australia and New Zealand Automotive Passive Electronic Components Market Revenue Share (%), by Type 2024 & 2032

- Figure 28: Australia and New Zealand Automotive Passive Electronic Components Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Australia and New Zealand Automotive Passive Electronic Components Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Middle East and Africa Automotive Passive Electronic Components Market Revenue (Million), by Type 2024 & 2032

- Figure 31: Middle East and Africa Automotive Passive Electronic Components Market Revenue Share (%), by Type 2024 & 2032

- Figure 32: Middle East and Africa Automotive Passive Electronic Components Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Middle East and Africa Automotive Passive Electronic Components Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Latin America Automotive Passive Electronic Components Market Revenue (Million), by Type 2024 & 2032

- Figure 35: Latin America Automotive Passive Electronic Components Market Revenue Share (%), by Type 2024 & 2032

- Figure 36: Latin America Automotive Passive Electronic Components Market Revenue (Million), by Country 2024 & 2032

- Figure 37: Latin America Automotive Passive Electronic Components Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Automotive Passive Electronic Components Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Automotive Passive Electronic Components Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Automotive Passive Electronic Components Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Automotive Passive Electronic Components Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Automotive Passive Electronic Components Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Global Automotive Passive Electronic Components Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Automotive Passive Electronic Components Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Automotive Passive Electronic Components Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Automotive Passive Electronic Components Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Automotive Passive Electronic Components Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Automotive Passive Electronic Components Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Automotive Passive Electronic Components Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Automotive Passive Electronic Components Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Automotive Passive Electronic Components Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Automotive Passive Electronic Components Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Automotive Passive Electronic Components Market Revenue Million Forecast, by Type 2019 & 2032

- Table 17: Global Automotive Passive Electronic Components Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Automotive Passive Electronic Components Market Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Global Automotive Passive Electronic Components Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Automotive Passive Electronic Components Market Revenue Million Forecast, by Type 2019 & 2032

- Table 21: Global Automotive Passive Electronic Components Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Automotive Passive Electronic Components Market Revenue Million Forecast, by Type 2019 & 2032

- Table 23: Global Automotive Passive Electronic Components Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Automotive Passive Electronic Components Market Revenue Million Forecast, by Type 2019 & 2032

- Table 25: Global Automotive Passive Electronic Components Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global Automotive Passive Electronic Components Market Revenue Million Forecast, by Type 2019 & 2032

- Table 27: Global Automotive Passive Electronic Components Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Passive Electronic Components Market?

The projected CAGR is approximately 7.60%.

2. Which companies are prominent players in the Automotive Passive Electronic Components Market?

Key companies in the market include Vishay Intertechnology Inc, Knowles Precision Devices, Taiyo Yuden Corporation, KOA Corporation, Kyocera Corporation (includes AVX Corporation), Rubycon Corporation, Yageo Corporation, TDK Corporation, Nippon Chemi-Con Corporatio, Murata Manufacturing Co Ltd, Panasonic Corporation, Samsung Electro-Mechanical.

3. What are the main segments of the Automotive Passive Electronic Components Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.60 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Usage of Advanced Electronic Devices in the Industry; Increasing Preference for Miniaturized Designs.

6. What are the notable trends driving market growth?

Capacitors to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Fluctuating Prices of Critical Metals Used in Manufacturing of Passive Electronic Components/ Challenges in the manufacturing of various Passive Components.

8. Can you provide examples of recent developments in the market?

March 2024: Knowles Precision Devices, a provider of top-quality components and solutions, released its newest Electric double-layer capacitor (EDLC) modules, also known as supercapacitor modules. These advanced capacitors, constructed using Knowles' Cornell Dubilier brand DGH and DSF Series supercapacitors, come in a three-cell package for increased operating voltages and save space on printed circuit boards. The high capacity of these supercapacitors enables them to support additional batteries or even replace batteries in various applications. These supercapacitors are well-suited for providing power for electric vehicle transportation, powering pulse battery packs, creating battery/capacitor hybrids, or any situation requiring substantial energy storage.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Passive Electronic Components Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Passive Electronic Components Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Passive Electronic Components Market?

To stay informed about further developments, trends, and reports in the Automotive Passive Electronic Components Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence