Key Insights

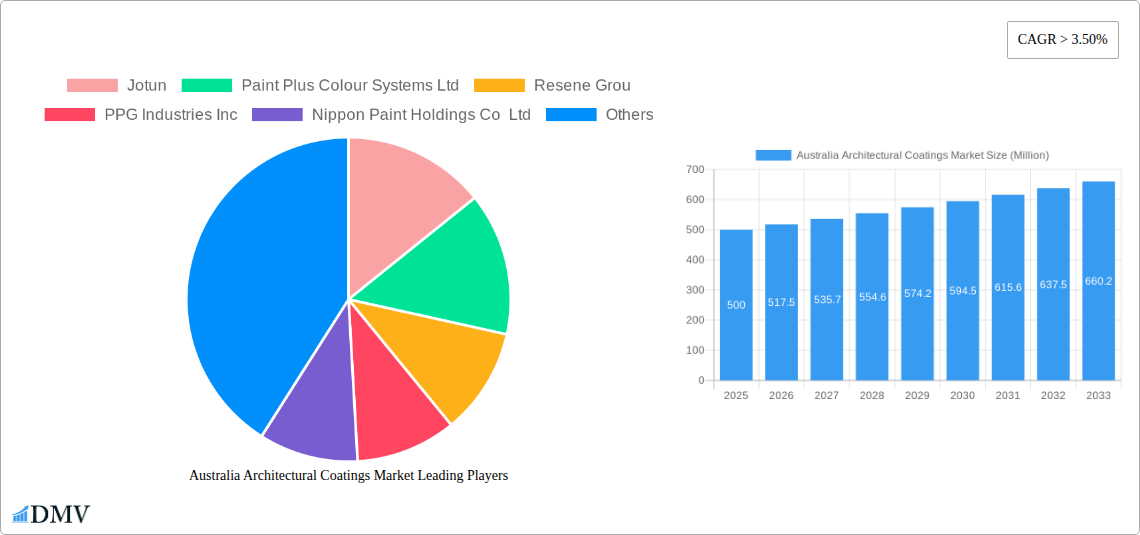

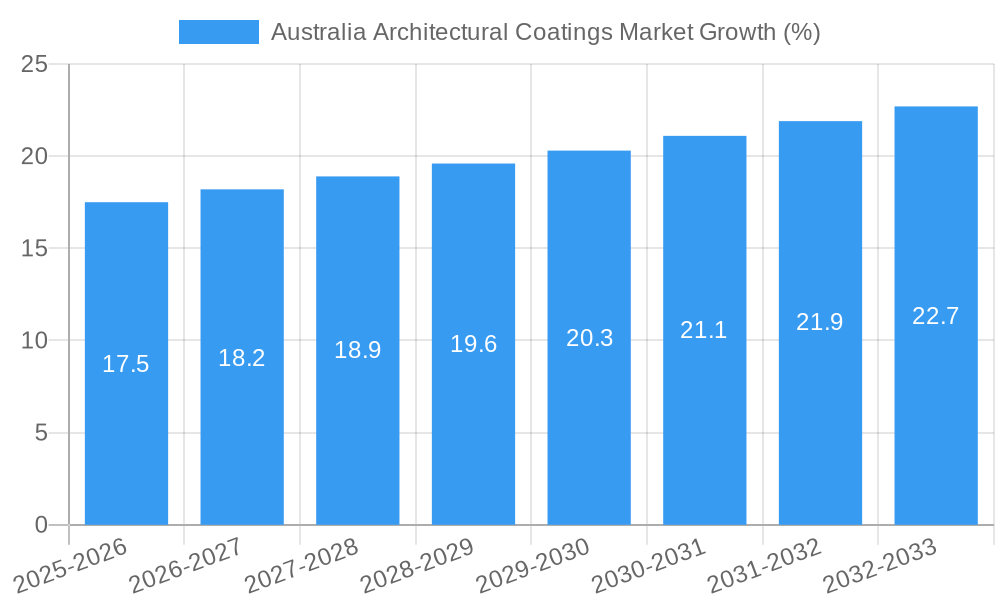

The Australian architectural coatings market, valued at approximately $X million in 2025, is projected to experience robust growth, with a compound annual growth rate (CAGR) exceeding 3.50% from 2025 to 2033. This growth is fueled by several key drivers. Firstly, significant investments in infrastructure projects across residential and commercial sectors are stimulating demand for high-quality paints and coatings. Secondly, increasing urbanization and a growing population are leading to a surge in new construction activity, further boosting market expansion. A rising awareness of sustainable building practices is also influencing market dynamics, with a growing preference for eco-friendly, waterborne coatings. However, the market faces challenges, including fluctuating raw material prices and potential supply chain disruptions. The market segmentation reveals a strong presence of both solventborne and waterborne coatings, with acrylic, alkyd, and polyurethane resins dominating the resin type segment. The commercial sector currently holds a larger market share compared to the residential sector, although residential construction is anticipated to witness significant growth over the forecast period. Key players, including Jotun, PPG Industries Inc., and Nippon Paint Holdings Co Ltd., are actively involved in the market, engaged in product innovation and strategic expansion to cater to the evolving needs of the Australian architectural coatings sector.

The competitive landscape is characterized by both established multinational corporations and local players. Major companies are focusing on developing advanced coatings with enhanced durability, weather resistance, and aesthetic appeal. Furthermore, the increasing demand for specialized coatings, such as those with antimicrobial properties or improved fire resistance, presents opportunities for market expansion. The Australian government's initiatives to promote sustainable building practices are also positively influencing the demand for eco-friendly architectural coatings. Despite potential challenges related to price volatility and global economic conditions, the Australian architectural coatings market is poised for continued growth driven by strong construction activity and increasing consumer demand for high-performance and aesthetically pleasing coatings. The shift towards sustainable options will continue shaping market trends and influencing product development strategies.

Australia Architectural Coatings Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the Australia Architectural Coatings Market, covering the period 2019-2033, with a focus on the year 2025. It delves into market dynamics, competitive landscapes, technological advancements, and future growth prospects, equipping stakeholders with crucial data-driven insights for strategic decision-making. The market is expected to reach xx Million by 2033, showcasing significant growth potential.

Australia Architectural Coatings Market Composition & Trends

This section offers a detailed evaluation of the Australian architectural coatings market's structure and evolving trends. We analyze market concentration, revealing the dominant players and their respective market shares. Innovation catalysts, such as the increasing demand for sustainable and eco-friendly coatings, are explored alongside the regulatory landscape and its impact on market growth. The report also examines the influence of substitute products and the changing end-user profiles, highlighting the shift in demand across residential and commercial segments. Finally, a comprehensive review of recent mergers and acquisitions (M&A) activities is provided, including an analysis of deal values and their implications for the market.

- Market Concentration: The Australian architectural coatings market exhibits a moderately concentrated structure, with the top 5 players holding an estimated xx% market share in 2024.

- M&A Activity: Significant M&A activity has shaped the market landscape. For instance, the Hempel A/S acquisition of Wattyl in February 2021 and Nippon Paint's acquisition of DuluxGroup in January 2021 significantly altered market dynamics, resulting in an estimated xx Million increase in market value.

- Innovation Catalysts: The growing demand for low-VOC, sustainable, and high-performance coatings is driving innovation within the market.

- Regulatory Landscape: Stringent environmental regulations are impacting the formulation and production of architectural coatings, prompting a shift towards eco-friendly options.

Australia Architectural Coatings Market Industry Evolution

This section analyzes the historical (2019-2024), base (2025), and forecast (2025-2033) periods, focusing on the growth trajectory, technological shifts, and evolving consumer preferences in the Australian architectural coatings market. We will examine growth rates across various segments, adoption rates of new technologies, and the impact of changing consumer demands on product development and marketing strategies. Specific data points, such as compound annual growth rates (CAGR) and market penetration rates for key technologies, will be provided. The increasing adoption of waterborne coatings and the growing preference for durable and aesthetically appealing finishes are discussed in depth. The impact of economic fluctuations and government policies on market growth will also be analyzed. The market is expected to demonstrate a CAGR of xx% during the forecast period.

Leading Regions, Countries, or Segments in Australia Architectural Coatings Market

This section pinpoints the leading segments within the Australian architectural coatings market, examining factors contributing to their dominance. We provide a detailed analysis of the leading sub-end-user segments (commercial and residential), technologies (solventborne and waterborne), and resins (acrylic, alkyd, epoxy, polyester, polyurethane, and other resin types).

Key Drivers:

- Commercial Segment: Strong growth driven by infrastructure development and commercial construction projects. Government investment in infrastructure projects and increasing urbanization are key contributors.

- Waterborne Technology: Rapid adoption due to environmental regulations and health concerns associated with solventborne coatings. The stricter regulations are driving this segment.

- Acrylic Resin: High market share due to its versatility, cost-effectiveness, and excellent performance characteristics. Its adaptability to diverse climates ensures its dominance.

Dominance Factors: The dominance of these segments is attributable to a combination of factors including favorable government policies, rising construction activities, and growing consumer awareness about sustainability and health concerns.

Australia Architectural Coatings Market Product Innovations

Recent innovations in architectural coatings include the development of self-cleaning, anti-graffiti, and antimicrobial coatings. These advancements offer enhanced durability, improved aesthetics, and increased functionality, catering to the growing demand for high-performance and sustainable products. The integration of nanotechnology and advanced polymer chemistry has led to the creation of coatings with superior properties, such as increased resistance to UV degradation, weathering, and microbial growth. Manufacturers are increasingly focusing on developing customized solutions tailored to specific applications and climate conditions.

Propelling Factors for Australia Architectural Coatings Market Growth

The Australian architectural coatings market's growth is fueled by several key factors. Increased construction activity, driven by population growth and urbanization, is a major driver. Government initiatives promoting sustainable building practices and stricter environmental regulations are also propelling demand for eco-friendly coatings. Furthermore, the rising consumer preference for aesthetically pleasing and durable finishes is further boosting market growth.

Obstacles in the Australia Architectural Coatings Market

Challenges facing the Australian architectural coatings market include fluctuating raw material prices, supply chain disruptions caused by global events, and intense competition among established and emerging players. Stringent environmental regulations and evolving consumer preferences require manufacturers to constantly innovate and adapt their product offerings, adding to the complexities of the market. These factors can significantly impact production costs and profitability.

Future Opportunities in Australia Architectural Coatings Market

Future growth opportunities lie in the increasing demand for specialized coatings, such as those with self-cleaning or anti-graffiti properties. The expanding use of smart coatings with integrated sensors and the development of sustainable and bio-based alternatives represent promising avenues for market expansion. Furthermore, exploring niche markets and catering to specialized customer needs will be key to future success.

Major Players in the Australia Architectural Coatings Market Ecosystem

- Jotun

- Paint Plus Colour Systems Ltd

- Resene Group

- PPG Industries Inc

- Nippon Paint Holdings Co Ltd

- Axalta Coating Systems

- Hempel A/S

- Apco Coatings (NZ) Ltd

- Haymes

- Keim Mineral Paints Australia

Key Developments in Australia Architectural Coatings Market Industry

- January 2021: Nippon Paint Holdings Co., Ltd. acquired a 100% share in DuluxGroup Ltd., significantly boosting its market presence.

- February 2021: Hempel A/S acquired Wattyl, expanding its portfolio and market share in Australia and New Zealand.

Strategic Australia Architectural Coatings Market Forecast

The Australian architectural coatings market is poised for continued growth, driven by robust construction activity, increasing urbanization, and the rising demand for high-performance and sustainable coatings. The adoption of innovative technologies and the focus on eco-friendly solutions will further fuel market expansion, presenting significant opportunities for established players and new entrants alike. The market is anticipated to see a steady growth trajectory, exceeding xx Million in revenue by 2033.

Australia Architectural Coatings Market Segmentation

-

1. Sub End User

- 1.1. Commercial

- 1.2. Residential

-

2. Technology

- 2.1. Solventborne

- 2.2. Waterborne

-

3. Resin

- 3.1. Acrylic

- 3.2. Alkyd

- 3.3. Epoxy

- 3.4. Polyester

- 3.5. Polyurethane

- 3.6. Other Resin Types

Australia Architectural Coatings Market Segmentation By Geography

- 1. Australia

Australia Architectural Coatings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand from the Construction Industry; Growing Applications in the HVAC Industry

- 3.3. Market Restrains

- 3.3.1. Market Saturation in Applications; Unfavorable Conditions Arising due to the Impact of COVID-19

- 3.4. Market Trends

- 3.4.1. Residential is the largest segment by Sub End User.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Architectural Coatings Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sub End User

- 5.1.1. Commercial

- 5.1.2. Residential

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Solventborne

- 5.2.2. Waterborne

- 5.3. Market Analysis, Insights and Forecast - by Resin

- 5.3.1. Acrylic

- 5.3.2. Alkyd

- 5.3.3. Epoxy

- 5.3.4. Polyester

- 5.3.5. Polyurethane

- 5.3.6. Other Resin Types

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Sub End User

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Jotun

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Paint Plus Colour Systems Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Resene Grou

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PPG Industries Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nippon Paint Holdings Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Axalta Coating Systems

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hempel A/S

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Apco Coatings (NZ) Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Haymes

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Keim Mineral Paints Australia

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Jotun

List of Figures

- Figure 1: Australia Architectural Coatings Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia Architectural Coatings Market Share (%) by Company 2024

List of Tables

- Table 1: Australia Architectural Coatings Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia Architectural Coatings Market Revenue Million Forecast, by Sub End User 2019 & 2032

- Table 3: Australia Architectural Coatings Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 4: Australia Architectural Coatings Market Revenue Million Forecast, by Resin 2019 & 2032

- Table 5: Australia Architectural Coatings Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Australia Architectural Coatings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Australia Architectural Coatings Market Revenue Million Forecast, by Sub End User 2019 & 2032

- Table 8: Australia Architectural Coatings Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 9: Australia Architectural Coatings Market Revenue Million Forecast, by Resin 2019 & 2032

- Table 10: Australia Architectural Coatings Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Architectural Coatings Market?

The projected CAGR is approximately > 3.50%.

2. Which companies are prominent players in the Australia Architectural Coatings Market?

Key companies in the market include Jotun, Paint Plus Colour Systems Ltd, Resene Grou, PPG Industries Inc, Nippon Paint Holdings Co Ltd, Axalta Coating Systems, Hempel A/S, Apco Coatings (NZ) Ltd, Haymes, Keim Mineral Paints Australia.

3. What are the main segments of the Australia Architectural Coatings Market?

The market segments include Sub End User, Technology, Resin.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand from the Construction Industry; Growing Applications in the HVAC Industry.

6. What are the notable trends driving market growth?

Residential is the largest segment by Sub End User..

7. Are there any restraints impacting market growth?

Market Saturation in Applications; Unfavorable Conditions Arising due to the Impact of COVID-19.

8. Can you provide examples of recent developments in the market?

February 2021: Hempel A/S acquired Wattyl, one of Australia and New Zealand's leading and highly distinguished manufacturers of paint for the decorative and protective segmentsJanuary 2021: Nippon Paint Holdings Co., Ltd. Holdings Co. has acquired a 100% share in DuluxGroup Ltd., a prominent Australian paint manufacturer. Through this acquisition, Nippon Paint Holdings Co., Ltd. aims to boost its paints and coatings business in Australia and New Zealand.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Architectural Coatings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Architectural Coatings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Architectural Coatings Market?

To stay informed about further developments, trends, and reports in the Australia Architectural Coatings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence