Key Insights

The Asia Pacific spirits market is projected to reach $48.3 billion by 2033, growing at a Compound Annual Growth Rate (CAGR) of 7.4% from the base year 2024. This significant expansion is driven by increasing disposable incomes, especially in burgeoning economies like China and India, which fuels higher consumer spending on premium alcoholic beverages. A growing middle class with a preference for sophisticated drinking experiences further accelerates this trend. The market is also stimulated by the rising popularity of craft spirits and innovative product offerings, including flavored whiskeys and ready-to-drink cocktails. Enhanced market accessibility and consumer convenience are facilitated by the expansion of online retail channels and diversified distribution networks. However, stringent government regulations on alcohol consumption and growing health consciousness may present market restraints. The market is segmented by distribution channel (specialty/liquor stores, online retail, on-trade, other channels) and product type (whiskey, vodka, rum, brandy, other types). Key industry participants such as Pernod Ricard SA, Asahi Group Holdings Ltd, and Diageo PLC are actively competing through continuous innovation and product portfolio expansion to meet evolving consumer demands.

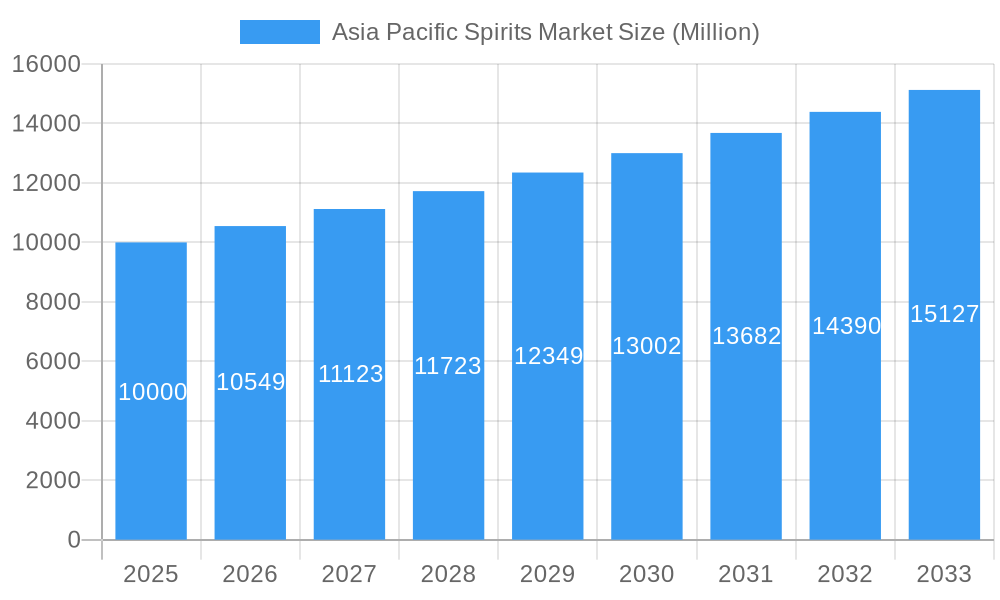

Asia Pacific Spirits Market Market Size (In Billion)

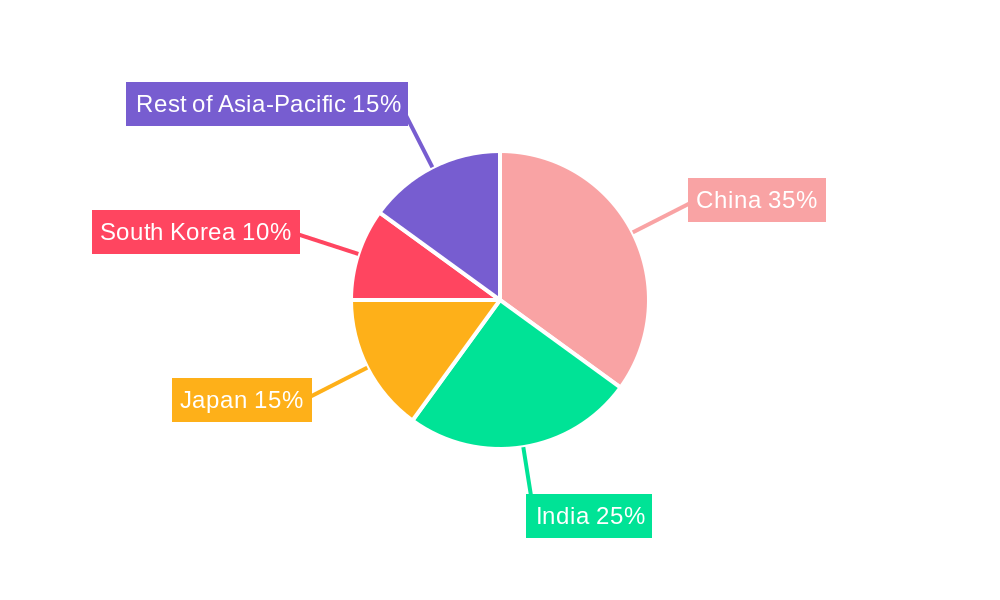

China, India, and Japan are anticipated to be the primary growth engines within the Asia Pacific region. China's expanding middle class and increasing demand for international spirits brands present substantial opportunities. India's large population and rising alcohol consumption rates are another significant growth driver. Japan, with its mature and sophisticated spirits market, continues to offer opportunities for both domestic and international brands, particularly in premium segments. Market success for various players will depend on their ability to adapt to local preferences, effectively navigate regulatory environments, and leverage emerging distribution channels. The forecast period from 2024 to 2033 indicates considerable market size expansion, propelled by consistent economic growth and evolving consumer behaviors across the Asia-Pacific region, making it a promising sector for established and emerging players in the alcoholic beverage industry.

Asia Pacific Spirits Market Company Market Share

This comprehensive report offers a detailed analysis of the Asia Pacific spirits market, covering market size, key trends, major players, and future growth prospects. With a study period from 2019 to 2033, a base year of 2024, and a forecast period of 2024-2033, this report is an essential resource for stakeholders seeking to understand and capitalize on the dynamic opportunities within this lucrative market. The report includes detailed segment breakdowns by product type and distribution channel, alongside an in-depth analysis of key industry developments and competitive landscapes. Market values are expressed in billions.

Asia Pacific Spirits Market Composition & Trends

This section delves into the competitive dynamics of the Asia Pacific spirits market, examining market concentration, innovation drivers, regulatory landscapes, substitute products, consumer profiles, and mergers & acquisitions (M&A) activity. The report analyzes the market share distribution among key players, including Pernod Ricard SA, Asahi Group Holdings Ltd, Bacardi Limited, Suntory Holdings Limited, and others, providing a comprehensive overview of the competitive landscape. M&A activity is scrutinized, evaluating deal values and their impact on market consolidation. The influence of regulatory frameworks on market access and product development is also considered, along with the impact of substitute beverages and evolving consumer preferences. The report also profiles key end-users, identifying their purchasing behaviors and preferences.

- Market Concentration: The market exhibits a [xx]% concentration ratio (CRx), indicating [describe the level of concentration - e.g., a highly concentrated or fragmented market].

- Innovation Catalysts: Premiumization, craft spirits, and functional beverages drive innovation.

- Regulatory Landscape: Varying alcohol regulations across the region significantly impact market dynamics.

- Substitute Products: The rise of non-alcoholic beverages and other lifestyle choices poses a competitive threat.

- End-User Profiles: [Insert summary of key consumer demographics and drinking habits – e.g., rising disposable incomes, changing tastes, and age demographics].

- M&A Activity: Total M&A deal value in the last 5 years is estimated at [xx] Million. Key deals include [mention a few significant acquisitions, including the Diageo-Nao Spirits deal in 2022].

Asia Pacific Spirits Market Industry Evolution

This section provides a historical and projected analysis of the Asia Pacific spirits market's growth trajectory, focusing on the period from 2019 to 2033. It incorporates technological advancements like e-commerce platforms and sophisticated supply chains, as well as shifts in consumer preferences toward premiumization, health-conscious options, and the growing popularity of craft spirits. Specific growth rates for sub-segments and overall market values for both historical and projected periods are presented. The impact of consumer behaviors and purchasing trends, such as increased preference for specific spirits categories, are meticulously evaluated.

[Insert 600 words analyzing market growth trajectories, technological advancements, and shifting consumer demands, including specific data points like growth rates and adoption metrics. Data should include specific examples and support conclusions. For example: "The market experienced a CAGR of X% between 2019 and 2024, driven primarily by Y. The forecast projects a CAGR of Z% between 2025 and 2033 due to A, B, and C.”]

Leading Regions, Countries, or Segments in Asia Pacific Spirits Market

This section identifies the dominant regions, countries, and segments within the Asia Pacific spirits market. It analyzes factors driving dominance within each segment, including key drivers such as investment trends and regulatory support. The analysis considers both product types (Whiskey, Vodka, Rum, Brandy, Other Product Types) and distribution channels (Specialty/Liquor Stores, Online Retail Stores, On-trade, Other Sales Channels).

Key Drivers & Dominance Factors:

- Product Type: [Analyze the dominance of each product type - e.g., Whiskey is the leading category due to factors like X and Y. Provide data points to support analysis.]

- Distribution Channel: [Analyze the dominance of each distribution channel – e.g., On-trade dominates due to factors like X and Y. Provide data points to support analysis.]

[Insert 600 words of in-depth analysis using bullet points for key drivers and paragraphs for dominance analysis. The analysis should correlate drivers to the dominance of a specific region, country or segment.]

Asia Pacific Spirits Market Product Innovations

This section examines recent and significant product innovations within the Asia Pacific spirits market. It details the application of these new products and their respective performance metrics, including unique selling propositions and technological advancements used in production or marketing. Examples of new product launches and their impact on market trends will be illustrated.

[Insert 100-150 words detailing product innovations, applications, and performance metrics. Highlight USPs and technological advancements.]

Propelling Factors for Asia Pacific Spirits Market Growth

Several factors contribute to the growth of the Asia Pacific spirits market. Technological advancements in production and distribution enhance efficiency and reach. Economic growth boosts disposable incomes, increasing spending on premium products. Favorable regulatory environments in some regions further stimulate growth.

[Insert 150 words identifying key growth drivers, focusing on technological, economic, and regulatory influences with specific examples.]

Obstacles in the Asia Pacific Spirits Market

The Asia Pacific spirits market faces certain challenges, including stringent regulatory hurdles in some regions, which can limit market access and increase compliance costs. Supply chain disruptions caused by geopolitical instability or pandemics can impact production and distribution. Intense competition from both established players and emerging craft distilleries further complicates the market landscape.

[Insert 150 words discussing barriers and restraints, covering regulatory challenges, supply chain disruptions, and competitive pressures with quantifiable impacts (e.g., estimate cost of regulatory compliance).]

Future Opportunities in Asia Pacific Spirits Market

Future opportunities exist in expanding into new, underpenetrated markets within the region, adopting innovative technologies such as AI-powered personalization in marketing and production optimization, and catering to evolving consumer trends like health-conscious and sustainable spirits options.

[Insert 150 words highlighting emerging opportunities, focusing on new markets, technologies, or consumer trends.]

Major Players in the Asia Pacific Spirits Market Ecosystem

- Pernod Ricard SA

- Asahi Group Holdings Ltd

- Bacardi Limited

- Suntory Holdings Limited

- Wuliangye Yibin Co

- Allied Blenders & Distillers (Officer's Choice)

- Remy Cointreau SA

- Yanghe Global

- Davide Campari-Milano NV

- LVMH Moët Hennessy Louis Vuitton

- Thai Beverage PLC

- Diageo PLC

Key Developments in Asia Pacific Spirits Market Industry

- January 2023: Campari launched nine new products in India, signaling a focus on premiumization.

- March 2022: Diageo acquired a 22.5% stake in Nao Spirits, indicating growth in the craft gin sector.

- March 2022: Bacardi India launched "Good Man" brandy, entering the IMFL category.

Strategic Asia Pacific Spirits Market Forecast

The Asia Pacific spirits market is poised for continued growth, driven by factors such as increasing disposable incomes, evolving consumer preferences, and the introduction of innovative products. The market's expansion into new consumer segments and geographical areas presents significant opportunities for both established players and new entrants. Specific growth projections for sub-segments and the overall market for the forecast period of 2025-2033 will be presented.

[Insert 150 words summarizing growth catalysts, focusing on future opportunities and market potential.]

Asia Pacific Spirits Market Segmentation

-

1. Product Type

- 1.1. Whiskey

- 1.2. Vodka

- 1.3. Rum

- 1.4. Brandy

- 1.5. Other Product Types

-

2. Distribution Channel

- 2.1. Specialty/Liquor Stores

- 2.2. Online Retail Stores

- 2.3. On-trade

- 2.4. Other Sales Channels

-

3. Geography

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia-Pacific

Asia Pacific Spirits Market Segmentation By Geography

- 1. India

- 2. China

- 3. Japan

- 4. Australia

- 5. Rest of Asia Pacific

Asia Pacific Spirits Market Regional Market Share

Geographic Coverage of Asia Pacific Spirits Market

Asia Pacific Spirits Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Escalating Consumer Investment in Preventive Healthcare Products; Increasing Algal Protein Applications Among Various Supplements

- 3.3. Market Restrains

- 3.3.1. Availability of Alternative Protein Sources

- 3.4. Market Trends

- 3.4.1. Increasing Expenditure on Alcoholic Beverages in the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Spirits Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Whiskey

- 5.1.2. Vodka

- 5.1.3. Rum

- 5.1.4. Brandy

- 5.1.5. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Specialty/Liquor Stores

- 5.2.2. Online Retail Stores

- 5.2.3. On-trade

- 5.2.4. Other Sales Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. India

- 5.3.2. China

- 5.3.3. Japan

- 5.3.4. Australia

- 5.3.5. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.4.2. China

- 5.4.3. Japan

- 5.4.4. Australia

- 5.4.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. India Asia Pacific Spirits Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Whiskey

- 6.1.2. Vodka

- 6.1.3. Rum

- 6.1.4. Brandy

- 6.1.5. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Specialty/Liquor Stores

- 6.2.2. Online Retail Stores

- 6.2.3. On-trade

- 6.2.4. Other Sales Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. India

- 6.3.2. China

- 6.3.3. Japan

- 6.3.4. Australia

- 6.3.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. China Asia Pacific Spirits Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Whiskey

- 7.1.2. Vodka

- 7.1.3. Rum

- 7.1.4. Brandy

- 7.1.5. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Specialty/Liquor Stores

- 7.2.2. Online Retail Stores

- 7.2.3. On-trade

- 7.2.4. Other Sales Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. India

- 7.3.2. China

- 7.3.3. Japan

- 7.3.4. Australia

- 7.3.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Japan Asia Pacific Spirits Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Whiskey

- 8.1.2. Vodka

- 8.1.3. Rum

- 8.1.4. Brandy

- 8.1.5. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Specialty/Liquor Stores

- 8.2.2. Online Retail Stores

- 8.2.3. On-trade

- 8.2.4. Other Sales Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. India

- 8.3.2. China

- 8.3.3. Japan

- 8.3.4. Australia

- 8.3.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Australia Asia Pacific Spirits Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Whiskey

- 9.1.2. Vodka

- 9.1.3. Rum

- 9.1.4. Brandy

- 9.1.5. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Specialty/Liquor Stores

- 9.2.2. Online Retail Stores

- 9.2.3. On-trade

- 9.2.4. Other Sales Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. India

- 9.3.2. China

- 9.3.3. Japan

- 9.3.4. Australia

- 9.3.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Rest of Asia Pacific Asia Pacific Spirits Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Whiskey

- 10.1.2. Vodka

- 10.1.3. Rum

- 10.1.4. Brandy

- 10.1.5. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Specialty/Liquor Stores

- 10.2.2. Online Retail Stores

- 10.2.3. On-trade

- 10.2.4. Other Sales Channels

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. India

- 10.3.2. China

- 10.3.3. Japan

- 10.3.4. Australia

- 10.3.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Pernod Ricard SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Asahi Group Holdings Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bacardi Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Suntory Holdings Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Wuliangye Yibin Co

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Allied Blenders & Distillers (Officer's Choice)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Remy Cointreau SA*List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Yanghe Global

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Davide Campari-Milano NV

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 LVMH Moët Hennessy Louis Vuitton

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Thai Beverage PLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Diageo PLC

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Pernod Ricard SA

List of Figures

- Figure 1: Asia Pacific Spirits Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Spirits Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Spirits Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Asia Pacific Spirits Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Asia Pacific Spirits Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Asia Pacific Spirits Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Asia Pacific Spirits Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Asia Pacific Spirits Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: Asia Pacific Spirits Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Asia Pacific Spirits Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Asia Pacific Spirits Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: Asia Pacific Spirits Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: Asia Pacific Spirits Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Asia Pacific Spirits Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Asia Pacific Spirits Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: Asia Pacific Spirits Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: Asia Pacific Spirits Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Asia Pacific Spirits Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Asia Pacific Spirits Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 18: Asia Pacific Spirits Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 19: Asia Pacific Spirits Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Asia Pacific Spirits Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Asia Pacific Spirits Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 22: Asia Pacific Spirits Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 23: Asia Pacific Spirits Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: Asia Pacific Spirits Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Spirits Market?

The projected CAGR is approximately 7.4%.

2. Which companies are prominent players in the Asia Pacific Spirits Market?

Key companies in the market include Pernod Ricard SA, Asahi Group Holdings Ltd, Bacardi Limited, Suntory Holdings Limited, Wuliangye Yibin Co, Allied Blenders & Distillers (Officer's Choice), Remy Cointreau SA*List Not Exhaustive, Yanghe Global, Davide Campari-Milano NV, LVMH Moët Hennessy Louis Vuitton, Thai Beverage PLC, Diageo PLC.

3. What are the main segments of the Asia Pacific Spirits Market?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 48.3 billion as of 2022.

5. What are some drivers contributing to market growth?

Escalating Consumer Investment in Preventive Healthcare Products; Increasing Algal Protein Applications Among Various Supplements.

6. What are the notable trends driving market growth?

Increasing Expenditure on Alcoholic Beverages in the Region.

7. Are there any restraints impacting market growth?

Availability of Alternative Protein Sources.

8. Can you provide examples of recent developments in the market?

In January 2023, Spirits maker Campari announced to launch nine new products across different categories in India, where it sees rising consumption and greater premiumization. The maker of Aperol, Campari, Skyy Vodka, and Wild Turkey in India announced that it would bring its Bisquit & Dubouché cognac, Appleton Aged rum, The Glen Grant 21 Arboralis whisky, agave spirit Montelobos Mezcal, Espolon Tequila, a liqueur Frangelico, and bitter aperitif Cynar to the Indian market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Spirits Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Spirits Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Spirits Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Spirits Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence