Key Insights

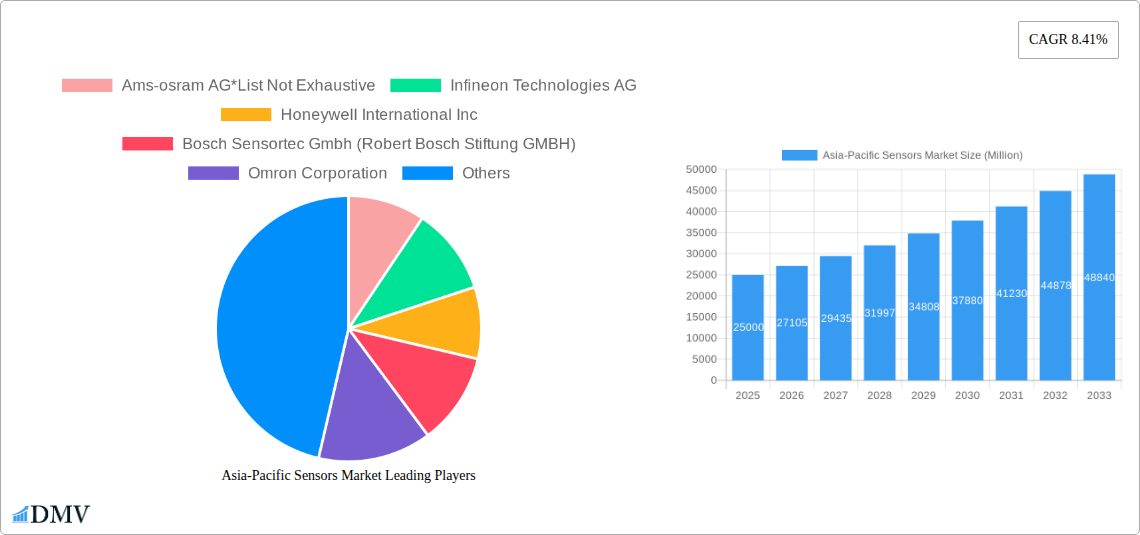

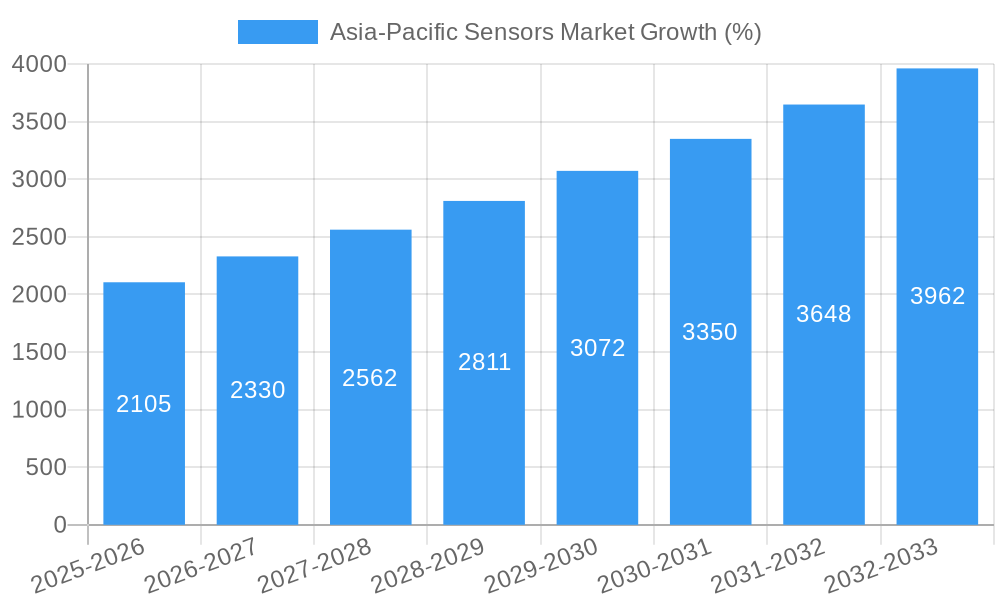

The Asia-Pacific sensors market is experiencing robust growth, projected to reach a significant value by 2033, driven by a compound annual growth rate (CAGR) of 8.41%. This expansion is fueled by several key factors. The increasing adoption of automation and Industry 4.0 technologies across diverse sectors like automotive, consumer electronics, and healthcare is a major catalyst. The region's burgeoning electronics manufacturing industry, particularly in China, India, and Japan, significantly contributes to the demand for various sensor types, including temperature, pressure, and flow sensors. Furthermore, government initiatives promoting technological advancements and smart city projects are further stimulating market growth. The rising demand for advanced driver-assistance systems (ADAS) in the automotive industry and the proliferation of connected devices in the consumer electronics sector are also key drivers. While challenges remain, such as the high initial investment costs associated with sensor integration and the potential for supply chain disruptions, the overall market outlook remains positive.

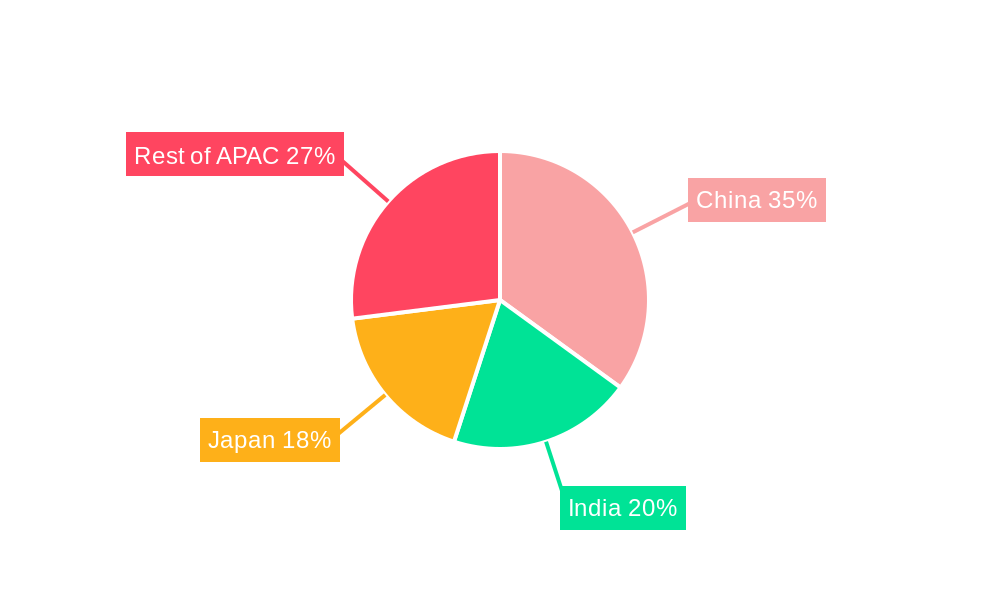

The market segmentation reveals strong growth across diverse applications. The consumer electronics segment, encompassing energy-efficient appliances and smart home devices, shows significant potential. Similarly, the medical and wellness sectors are driving demand for advanced biosensors and wearable health monitoring devices. The industrial and other segments, including construction, agriculture, and mining, contribute significantly to the overall market size due to increasing automation in these sectors. Geographically, China and India represent the largest markets within the Asia-Pacific region, driven by their large populations and expanding industrial bases. Japan, with its advanced technological capabilities, also holds a substantial market share. The competitive landscape is characterized by the presence of both global and regional players, leading to innovation and price competition. The strategic alliances and mergers and acquisitions observed in the sector are expected to further shape the market dynamics in the coming years.

Asia-Pacific Sensors Market Report: 2019-2033

This comprehensive report offers an in-depth analysis of the Asia-Pacific sensors market, providing invaluable insights for stakeholders seeking to navigate this dynamic landscape. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers a robust understanding of past performance, present market dynamics, and future growth potential. The market is segmented by country (China, India, Japan, Rest of APAC), parameters measured (temperature, pressure, level, flow, proximity, environmental, chemical, inertial, magnetic, vibration, other), mode of operation (optical, electrical resistance, biosensors, piezoresistive, image, capacitive, piezoelectric, lidar, radar, other), and end-user industry (automotive, consumer electronics, medical and wellness, industrial, agriculture, construction, aerospace & defense). Key players analyzed include AMS-OSRAM AG, Infineon Technologies AG, Honeywell International Inc, Bosch Sensortec GmbH, Omron Corporation, Omega Engineering Inc, NXP Semiconductors NV, Texas Instruments Incorporated, Rockwell Automation Inc, and STMicroelectronics NV. The report's total market value prediction for 2025 is xx Million.

Asia-Pacific Sensors Market Market Composition & Trends

The Asia-Pacific sensors market exhibits a moderately fragmented structure, with several key players vying for market share. Market concentration is influenced by factors including technological advancements, regulatory shifts, and the presence of substitute products. The market’s growth is driven by increasing demand across various end-user industries, particularly automotive, consumer electronics, and industrial automation. Significant M&A activity has been observed, with deal values reaching xx Million in 2024, reflecting the strategic importance of the sector.

- Market Share Distribution: The top 5 players account for approximately xx% of the market share in 2025, indicating a competitive landscape.

- Innovation Catalysts: The rise of IoT, AI, and Industry 4.0 is fueling innovation, driving the adoption of advanced sensor technologies.

- Regulatory Landscape: Government initiatives promoting digitalization and smart technologies across various sectors are shaping market growth.

- Substitute Products: The availability of alternative technologies presents a challenge, but the unique functionalities of sensors maintain their market relevance.

- End-User Profiles: The expanding consumer electronics market and the increasing automation in industrial settings are key drivers of market demand.

- M&A Activities: Recent mergers and acquisitions have focused on expanding product portfolios and geographic reach, consolidating market share. The average deal value is projected at xx Million in 2025.

Asia-Pacific Sensors Market Industry Evolution

The Asia-Pacific sensors market has witnessed significant growth, driven by technological advancements, increasing digitalization, and rising demand from diverse end-user industries. The market expanded at a CAGR of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033), reaching xx Million by 2033. This expansion is fueled by the increasing adoption of smart technologies across various sectors. The integration of sensors in IoT devices, autonomous vehicles, and advanced manufacturing systems is a major growth catalyst. Furthermore, the rising demand for precision measurement and monitoring in healthcare, environmental monitoring, and industrial automation contributes significantly to market growth. Consumer preferences are shifting toward intelligent devices, requiring more sophisticated and miniaturized sensors. The market is also witnessing the emergence of advanced sensor technologies like MEMS sensors, LiDAR, and biosensors, enhancing performance and applications.

Leading Regions, Countries, or Segments in Asia-Pacific Sensors Market

- Dominant Region/Country: China dominates the Asia-Pacific sensors market, driven by its robust manufacturing sector, burgeoning electronics industry, and significant investments in smart city infrastructure. India is showing rapid growth, fueled by government initiatives and increasing industrial automation.

- Dominant Segment (by End-User Industry): The automotive sector is a major driver of growth, with the increasing adoption of advanced driver-assistance systems (ADAS) and autonomous vehicles. The consumer electronics segment also exhibits strong growth, fueled by the rising demand for smart devices.

- Dominant Segment (by Parameter Measured): Temperature and pressure sensors hold significant market share due to their widespread use across diverse applications.

- Key Drivers (China): Massive investments in infrastructure development, supportive government policies promoting technological advancements, and a large domestic market are key growth drivers.

- Key Drivers (India): Government initiatives focusing on digitalization, smart city projects, and the Make in India campaign are propelling market growth.

- Key Drivers (Japan): Technological leadership, a strong automotive industry, and the increasing demand for advanced sensors in robotics and industrial automation are major drivers.

Asia-Pacific Sensors Market Product Innovations

Recent innovations include miniaturized sensors with improved accuracy and sensitivity, low-power consumption sensors for extended battery life in IoT devices, and the integration of AI and machine learning capabilities for enhanced data processing and decision-making. The development of multi-sensor modules combining different sensing functionalities into a single unit is also gaining traction, simplifying integration and reducing costs. These advancements are leading to new applications in various fields, including healthcare, environmental monitoring, and industrial automation, along with improvements in accuracy and reliability.

Propelling Factors for Asia-Pacific Sensors Market Growth

The market is driven by technological advancements like miniaturization, enhanced sensitivity, and lower power consumption, leading to wider adoption. Economic factors such as rising disposable incomes and increasing industrialization in developing economies fuel demand. Favorable government regulations promoting digitalization and smart technologies, along with investments in infrastructure development across the region, further accelerate market growth. Examples include smart city initiatives and government support for the development of advanced manufacturing facilities.

Obstacles in the Asia-Pacific Sensors Market Market

Supply chain disruptions caused by geopolitical instability can create significant challenges, impacting sensor availability and pricing. Stricter regulatory frameworks in certain areas can increase compliance costs for companies. Intense competition from both established players and new entrants puts pressure on pricing and profit margins. These obstacles need to be considered for accurate market projections. The impact of these factors can lead to xx% reduction in the expected market growth in certain years.

Future Opportunities in Asia-Pacific Sensors Market

Emerging opportunities lie in the expanding IoT market, with increasing demand for connected devices across diverse sectors. The development of advanced sensor technologies like biosensors and LiDAR opens up new application areas in healthcare, environmental monitoring, and autonomous driving. The growing focus on sustainability and environmental monitoring creates demand for sensors used in air and water quality monitoring. Expansion into new markets and leveraging advanced manufacturing techniques can create a significant growth opportunity.

Major Players in the Asia-Pacific Sensors Market Ecosystem

- AMS-OSRAM AG

- Infineon Technologies AG

- Honeywell International Inc

- Bosch Sensortec GmbH

- Omron Corporation

- Omega Engineering Inc

- NXP Semiconductors NV

- Texas Instruments Incorporated

- Rockwell Automation Inc

- STMicroelectronics NV

Key Developments in Asia-Pacific Sensors Market Industry

- February 2023: The Jammu and Kashmir government's INR 30.40 crore "Sensor-based Smart Agriculture" project signifies increased investment in agricultural technology and IoT applications, driving demand for sensors in this sector.

- May 2022: Panasonic i-PRO Sensing Solutions' launch of a new multi-sensor camera range with AI capabilities in APAC demonstrates the ongoing innovation and expansion within the market, particularly in security and surveillance applications.

Strategic Asia-Pacific Sensors Market Market Forecast

The Asia-Pacific sensors market is poised for robust growth, driven by technological advancements, increasing digitalization across various sectors, and supportive government policies. The expanding IoT market, rising demand for autonomous vehicles, and the growing focus on smart city development will continue to fuel market expansion. While challenges like supply chain disruptions and intense competition exist, the long-term outlook remains positive, with significant growth potential across various segments and geographies. The market is expected to reach xx Million by 2033, presenting lucrative opportunities for both established players and new entrants.

Asia-Pacific Sensors Market Segmentation

-

1. Parameters Measured

- 1.1. Temperature

- 1.2. Pressure

- 1.3. Level

- 1.4. Flow

- 1.5. Proximity

- 1.6. Environmental

- 1.7. Chemical

- 1.8. Inertial

- 1.9. Magnetic

- 1.10. Vibration

- 1.11. Other Parameters Measured

-

2. Mode of Operation

- 2.1. Optical

- 2.2. Electrical Resistance

- 2.3. Biosensors

- 2.4. Piezoresistive

- 2.5. Image

- 2.6. Capacitive

- 2.7. Piezoelectric

- 2.8. Lidar

- 2.9. Radar

- 2.10. Other Modes of Operation

-

3. End-User Industry

- 3.1. Automotive

-

3.2. Consumer Electronics

- 3.2.1. Smartphones

- 3.2.2. Tablets, Laptops, and Computers

- 3.2.3. Wearable Devices

- 3.2.4. Smart Appliances or Devices

- 3.2.5. Other Consumer Electronics

- 3.3. Energy

- 3.4. Industrial And Other

- 3.5. Medical And Wellness

- 3.6. Construction, Agriculture, And Mining

- 3.7. Aerospace

- 3.8. Defense

Asia-Pacific Sensors Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Sensors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.41% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Emergence of Automation And Industry 4.; Rapid Growth in the Consumer Electronics Industry

- 3.3. Market Restrains

- 3.3.1. High Initial Costs Involved

- 3.4. Market Trends

- 3.4.1. Consumer Electronics Industry is Expected to Hold a Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Sensors Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Parameters Measured

- 5.1.1. Temperature

- 5.1.2. Pressure

- 5.1.3. Level

- 5.1.4. Flow

- 5.1.5. Proximity

- 5.1.6. Environmental

- 5.1.7. Chemical

- 5.1.8. Inertial

- 5.1.9. Magnetic

- 5.1.10. Vibration

- 5.1.11. Other Parameters Measured

- 5.2. Market Analysis, Insights and Forecast - by Mode of Operation

- 5.2.1. Optical

- 5.2.2. Electrical Resistance

- 5.2.3. Biosensors

- 5.2.4. Piezoresistive

- 5.2.5. Image

- 5.2.6. Capacitive

- 5.2.7. Piezoelectric

- 5.2.8. Lidar

- 5.2.9. Radar

- 5.2.10. Other Modes of Operation

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Automotive

- 5.3.2. Consumer Electronics

- 5.3.2.1. Smartphones

- 5.3.2.2. Tablets, Laptops, and Computers

- 5.3.2.3. Wearable Devices

- 5.3.2.4. Smart Appliances or Devices

- 5.3.2.5. Other Consumer Electronics

- 5.3.3. Energy

- 5.3.4. Industrial And Other

- 5.3.5. Medical And Wellness

- 5.3.6. Construction, Agriculture, And Mining

- 5.3.7. Aerospace

- 5.3.8. Defense

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Parameters Measured

- 6. China Asia-Pacific Sensors Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia-Pacific Sensors Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia-Pacific Sensors Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia-Pacific Sensors Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia-Pacific Sensors Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia-Pacific Sensors Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia-Pacific Sensors Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Ams-osram AG*List Not Exhaustive

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Infineon Technologies AG

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Honeywell International Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Bosch Sensortec Gmbh (Robert Bosch Stiftung GMBH)

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Omron Corporation

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Omega Engineering Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 NXP Semiconductors Nv

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Texas Instruments Incorporated

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Rockwell Automation Inc

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Stmicroelectronics NV

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Ams-osram AG*List Not Exhaustive

List of Figures

- Figure 1: Asia-Pacific Sensors Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Sensors Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Sensors Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Sensors Market Revenue Million Forecast, by Parameters Measured 2019 & 2032

- Table 3: Asia-Pacific Sensors Market Revenue Million Forecast, by Mode of Operation 2019 & 2032

- Table 4: Asia-Pacific Sensors Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 5: Asia-Pacific Sensors Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Asia-Pacific Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: China Asia-Pacific Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Japan Asia-Pacific Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India Asia-Pacific Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Korea Asia-Pacific Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Taiwan Asia-Pacific Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Australia Asia-Pacific Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Asia-Pacific Asia-Pacific Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Asia-Pacific Sensors Market Revenue Million Forecast, by Parameters Measured 2019 & 2032

- Table 15: Asia-Pacific Sensors Market Revenue Million Forecast, by Mode of Operation 2019 & 2032

- Table 16: Asia-Pacific Sensors Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 17: Asia-Pacific Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: China Asia-Pacific Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Japan Asia-Pacific Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: South Korea Asia-Pacific Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: India Asia-Pacific Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Australia Asia-Pacific Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: New Zealand Asia-Pacific Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Indonesia Asia-Pacific Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Malaysia Asia-Pacific Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Singapore Asia-Pacific Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Thailand Asia-Pacific Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Vietnam Asia-Pacific Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Philippines Asia-Pacific Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Sensors Market?

The projected CAGR is approximately 8.41%.

2. Which companies are prominent players in the Asia-Pacific Sensors Market?

Key companies in the market include Ams-osram AG*List Not Exhaustive, Infineon Technologies AG, Honeywell International Inc, Bosch Sensortec Gmbh (Robert Bosch Stiftung GMBH), Omron Corporation, Omega Engineering Inc, NXP Semiconductors Nv, Texas Instruments Incorporated, Rockwell Automation Inc, Stmicroelectronics NV.

3. What are the main segments of the Asia-Pacific Sensors Market?

The market segments include Parameters Measured, Mode of Operation, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Emergence of Automation And Industry 4.; Rapid Growth in the Consumer Electronics Industry.

6. What are the notable trends driving market growth?

Consumer Electronics Industry is Expected to Hold a Significant Share.

7. Are there any restraints impacting market growth?

High Initial Costs Involved.

8. Can you provide examples of recent developments in the market?

February 2023: The government of Jammu and Kashmir approved an INR 30.40 crore project, "Sensor-based Smart Agriculture," envisaging the integration of agriculture with technology driven by artificial insemination and IoT for automation of practices, enhanced resource use efficiency, and profitability. The project would enable the use of high-tech polyhouses for the cultivation of cash crops throughout the year with the application of IoT and automation for monitoring the microclimatic parameters of plants.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Sensors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Sensors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Sensors Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Sensors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence