Key Insights

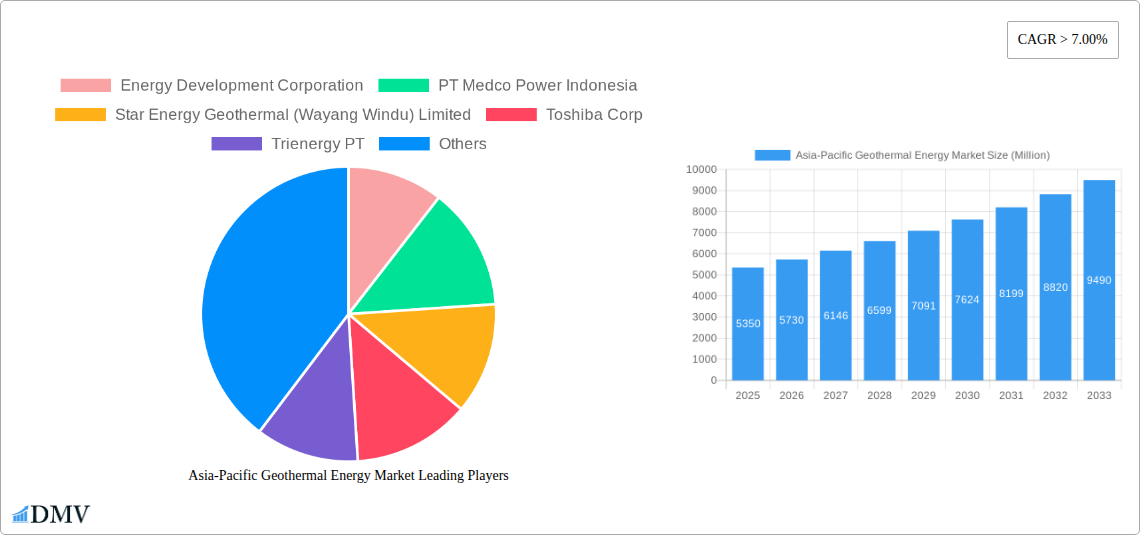

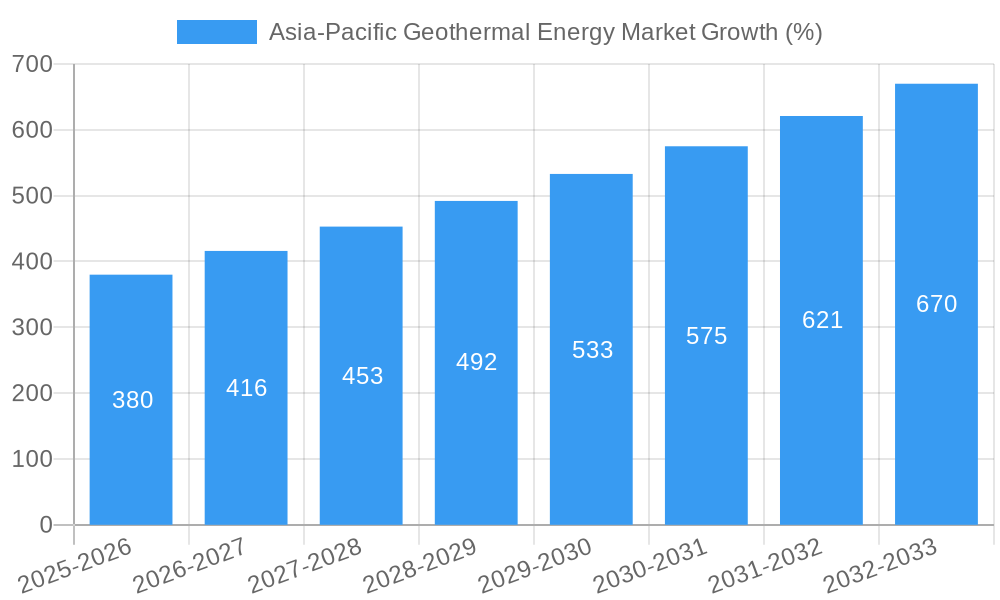

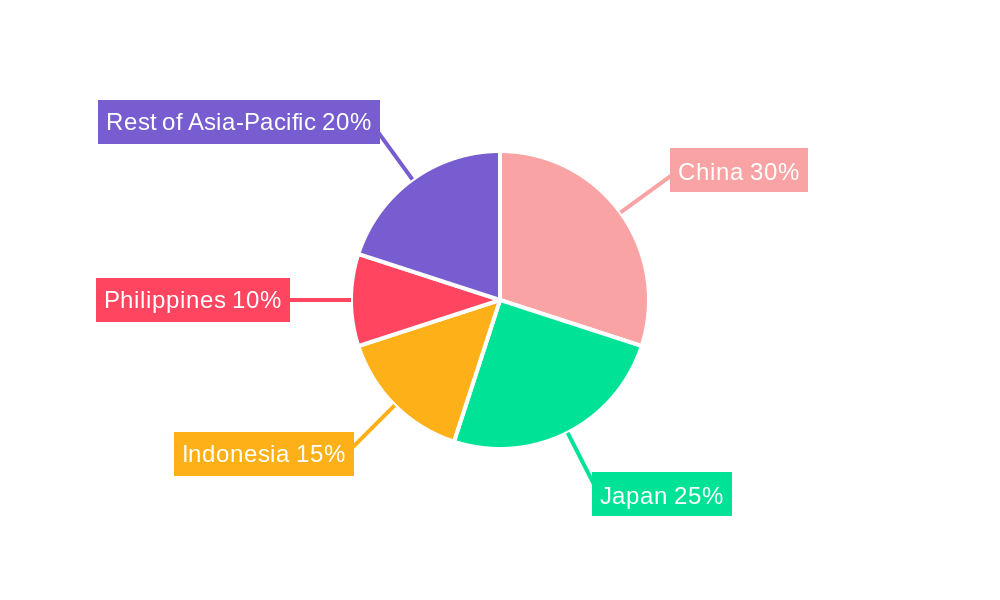

The Asia-Pacific geothermal energy market is experiencing robust growth, driven by increasing energy demands, supportive government policies promoting renewable energy sources, and the region's significant geothermal resources. A CAGR exceeding 7% from 2019 to 2024 indicates a strong historical trajectory. While the exact market size in 2025 (the base year) is unspecified, extrapolating from the provided CAGR and assuming a 2024 market size of approximately $5 billion (a plausible figure given the market's scale and growth rate), the 2025 market size is estimated to be around $5.35 billion. This growth is fueled by several key factors. China, Japan, Indonesia, and the Philippines are leading contributors due to their substantial geothermal potential and investment in geothermal power plants. The shift towards energy diversification to mitigate climate change and ensure energy security further strengthens the market's outlook. Technological advancements in geothermal exploration and power plant efficiency, like the increasing adoption of binary plants, are improving cost-effectiveness and expanding potential applications. However, the market also faces challenges, including high initial investment costs, geological uncertainties, and environmental concerns associated with geothermal resource development, requiring careful site selection and environmental impact assessments. The segmentation by plant type (dry steam, flash, and binary) reflects the technological diversity and varying suitability for different geological conditions across the Asia-Pacific region.

Looking forward to 2033, the market is projected to experience continued expansion, though the growth rate might moderate slightly as the market matures. The continued development of existing geothermal fields and the exploration of new resources will be critical to sustain this growth. The ongoing focus on improving energy efficiency and reducing carbon emissions will further stimulate the demand for clean and sustainable energy sources like geothermal, solidifying its position as a crucial part of the region's energy mix. Key players like Energy Development Corporation, Pertamina Geothermal Energy, and others, are continuously investing in capacity expansion and technological upgrades, ensuring the market's dynamism and future growth potential. This necessitates a strategic approach focusing on overcoming geographical limitations, reducing investment risks, and ensuring environmentally sound practices to fully realize the considerable potential of Asia-Pacific's geothermal energy sector.

Asia-Pacific Geothermal Energy Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Asia-Pacific geothermal energy market, offering a comprehensive overview of its current state, future trajectory, and key players. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report is invaluable for investors, industry stakeholders, and policymakers seeking to understand and capitalize on the burgeoning opportunities within this dynamic sector. The market is expected to reach xx Million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of xx% during the forecast period.

Asia-Pacific Geothermal Energy Market Market Composition & Trends

This section delves into the intricate structure of the Asia-Pacific geothermal energy market, examining market concentration, innovation drivers, regulatory frameworks, substitute technologies, end-user profiles, and mergers & acquisitions (M&A) activities. The market exhibits a moderately concentrated landscape, with key players like Energy Development Corporation and Pertamina Geothermal Energy holding significant market share. However, the emergence of smaller, innovative companies is driving competition.

- Market Share Distribution: Energy Development Corporation holds an estimated xx% market share, followed by Pertamina Geothermal Energy at xx%, and other players accounting for the remaining xx%.

- Innovation Catalysts: Government incentives, technological advancements in binary plants, and rising demand for renewable energy are key drivers of innovation.

- Regulatory Landscape: Varied regulatory frameworks across the Asia-Pacific region influence market dynamics, with some countries offering more supportive policies than others.

- Substitute Products: Fossil fuels and other renewable energy sources (solar, wind) pose competition to geothermal energy.

- End-User Profiles: Major end-users include power utilities, industrial facilities, and residential consumers.

- M&A Activities: The past five years have seen xx M&A deals in the Asia-Pacific geothermal energy market, with a total value of approximately xx Million. These transactions indicate strategic consolidation and expansion within the sector.

Asia-Pacific Geothermal Energy Market Industry Evolution

This section analyses the evolutionary path of the Asia-Pacific geothermal energy market, tracing its growth trajectories, technological advancements, and evolving consumer preferences. The market has witnessed significant growth driven by rising energy demand, increasing environmental concerns, and supportive government policies. Technological advancements, particularly in binary plant technology, have enhanced efficiency and reduced costs. Consumer demand is shifting towards cleaner and sustainable energy solutions, further boosting market growth.

The market experienced a CAGR of xx% from 2019 to 2024, and is projected to grow at a CAGR of xx% from 2025 to 2033. Adoption of geothermal energy is increasing, with xx% of new power generation capacity in certain regions coming from geothermal sources. Technological advancements, such as enhanced geothermal systems (EGS), are opening up new avenues for geothermal energy exploitation. Increased investment in research and development (R&D) is further accelerating the pace of innovation.

Leading Regions, Countries, or Segments in Asia-Pacific Geothermal Energy Market

Indonesia and the Philippines are currently the leading countries in the Asia-Pacific geothermal energy market, fueled by abundant geothermal resources and supportive government policies. Among Geothermal Power Plant types, Flash Plants currently dominate, though Binary Plants are witnessing increasing adoption due to their suitability for lower-temperature resources.

- Key Drivers in Indonesia: Abundant geothermal resources, government initiatives promoting renewable energy, and significant investments in geothermal power plant projects.

- Key Drivers in the Philippines: Established geothermal power generation infrastructure, favorable regulatory environment, and ongoing exploration activities.

- Dominance of Flash Plants: Established technology, relatively high efficiency in high-enthalpy fields, and lower initial investment costs.

- Growth of Binary Plants: Suitability for low-enthalpy resources, expanding the potential geothermal sites, and improved efficiency in resource utilization.

Asia-Pacific Geothermal Energy Market Product Innovations

Recent innovations in geothermal technology include advancements in drilling techniques, improved turbine designs for enhanced energy conversion, and the development of hybrid systems combining geothermal with other renewable energy sources. These innovations are improving efficiency, reducing costs, and expanding the applicability of geothermal energy to a wider range of resource types and geographical locations. Enhanced data analytics and predictive maintenance are also enhancing operational performance and reducing downtime.

Propelling Factors for Asia-Pacific Geothermal Energy Market Growth

Several factors contribute to the growth of the Asia-Pacific geothermal energy market: Firstly, the increasing demand for clean and sustainable energy sources is driving investments in geothermal power generation. Secondly, supportive government policies and financial incentives are encouraging the development of geothermal projects. Thirdly, technological advancements are making geothermal energy more efficient and cost-effective. Examples include improvements in drilling techniques and the development of enhanced geothermal systems (EGS).

Obstacles in the Asia-Pacific Geothermal Energy Market Market

Challenges hindering the growth of the geothermal energy market include high initial capital costs for geothermal power plant construction, geological uncertainties associated with resource exploration and development, and the complex permitting and regulatory processes in some regions. Supply chain disruptions related to specialized equipment can also impact project timelines and costs. Competition from other renewable energy sources and fossil fuels also presents a challenge.

Future Opportunities in Asia-Pacific Geothermal Energy Market

Future opportunities include expanding geothermal energy into new geographical areas with untapped resources, further developing binary and enhanced geothermal systems (EGS) technologies, and integrating geothermal energy into smart grids and energy storage solutions. Developing innovative financing mechanisms and improving public awareness of geothermal energy's benefits are crucial for market expansion.

Major Players in the Asia-Pacific Geothermal Energy Market Ecosystem

- Energy Development Corporation

- PT Medco Power Indonesia

- Star Energy Geothermal (Wayang Windu) Limited

- Toshiba Corp

- Trienergy PT

- Pertamina Geothermal Energy PT

- PT WIJAYA KARYA (Persero) Tbk

- Mercury NZ Ltd

- PT Bali Energy Ltd

- PT Supreme Energy

Key Developments in Asia-Pacific Geothermal Energy Market Industry

- 2021 (Q4): The Philippines' Kalinga Geothermal Power Plant enters the well development phase; construction expected to start in 2025, commissioning in 2026.

- 2021 (Q3): PT Geo Dipa initiates drilling operations for Patuha geothermal power plant expansion and Dieng 2 power plant projects in Central Java; expected completion by 2023.

Strategic Asia-Pacific Geothermal Energy Market Market Forecast

The Asia-Pacific geothermal energy market is poised for significant growth, driven by increasing energy demand, environmental concerns, and technological advancements. Further development of EGS technology and expansion into new markets will unlock substantial potential. Government support and continued private investment will be vital in driving this growth. The market is expected to see a substantial increase in capacity additions, leading to significant revenue generation throughout the forecast period.

Asia-Pacific Geothermal Energy Market Segmentation

-

1. Geothermal Power Plant Type

- 1.1. Dry Steam

- 1.2. Flash Plants

- 1.3. Binary Plants

-

2. Geography

- 2.1. Indonesia

- 2.2. Philippines

- 2.3. Japan

- 2.4. Rest of Asia-Pacific

Asia-Pacific Geothermal Energy Market Segmentation By Geography

- 1. Indonesia

- 2. Philippines

- 3. Japan

- 4. Rest of Asia Pacific

Asia-Pacific Geothermal Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 7.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Increasing Electricity Demand from Manufacturing

- 3.2.2 Construction

- 3.2.3 and Mining Industries4.; The Availability of a Broad Range of Fuel Sources for Electricity Generation

- 3.3. Market Restrains

- 3.3.1. 4.; Phasing Out of Coal-based Power Plants

- 3.4. Market Trends

- 3.4.1. Binary Plants Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Geothermal Energy Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Geothermal Power Plant Type

- 5.1.1. Dry Steam

- 5.1.2. Flash Plants

- 5.1.3. Binary Plants

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Indonesia

- 5.2.2. Philippines

- 5.2.3. Japan

- 5.2.4. Rest of Asia-Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Indonesia

- 5.3.2. Philippines

- 5.3.3. Japan

- 5.3.4. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Geothermal Power Plant Type

- 6. Indonesia Asia-Pacific Geothermal Energy Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Geothermal Power Plant Type

- 6.1.1. Dry Steam

- 6.1.2. Flash Plants

- 6.1.3. Binary Plants

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Indonesia

- 6.2.2. Philippines

- 6.2.3. Japan

- 6.2.4. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Geothermal Power Plant Type

- 7. Philippines Asia-Pacific Geothermal Energy Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Geothermal Power Plant Type

- 7.1.1. Dry Steam

- 7.1.2. Flash Plants

- 7.1.3. Binary Plants

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Indonesia

- 7.2.2. Philippines

- 7.2.3. Japan

- 7.2.4. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Geothermal Power Plant Type

- 8. Japan Asia-Pacific Geothermal Energy Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Geothermal Power Plant Type

- 8.1.1. Dry Steam

- 8.1.2. Flash Plants

- 8.1.3. Binary Plants

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Indonesia

- 8.2.2. Philippines

- 8.2.3. Japan

- 8.2.4. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Geothermal Power Plant Type

- 9. Rest of Asia Pacific Asia-Pacific Geothermal Energy Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Geothermal Power Plant Type

- 9.1.1. Dry Steam

- 9.1.2. Flash Plants

- 9.1.3. Binary Plants

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Indonesia

- 9.2.2. Philippines

- 9.2.3. Japan

- 9.2.4. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Geothermal Power Plant Type

- 10. China Asia-Pacific Geothermal Energy Market Analysis, Insights and Forecast, 2019-2031

- 11. Japan Asia-Pacific Geothermal Energy Market Analysis, Insights and Forecast, 2019-2031

- 12. India Asia-Pacific Geothermal Energy Market Analysis, Insights and Forecast, 2019-2031

- 13. South Korea Asia-Pacific Geothermal Energy Market Analysis, Insights and Forecast, 2019-2031

- 14. Taiwan Asia-Pacific Geothermal Energy Market Analysis, Insights and Forecast, 2019-2031

- 15. Australia Asia-Pacific Geothermal Energy Market Analysis, Insights and Forecast, 2019-2031

- 16. Rest of Asia-Pacific Asia-Pacific Geothermal Energy Market Analysis, Insights and Forecast, 2019-2031

- 17. Competitive Analysis

- 17.1. Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Energy Development Corporation

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 PT Medco Power Indonesia

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Star Energy Geothermal (Wayang Windu) Limited

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Toshiba Corp

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Trienergy PT

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Pertamina Geothermal Energy PT

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 PT WIJAYA KARYA (Persero) Tbk

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Mercury NZ Ltd

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 PT Bali Energy Ltd *List Not Exhaustive

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 PT Supreme Energy

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.1 Energy Development Corporation

List of Figures

- Figure 1: Asia-Pacific Geothermal Energy Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Geothermal Energy Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Geothermal Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Geothermal Energy Market Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 3: Asia-Pacific Geothermal Energy Market Revenue Million Forecast, by Geothermal Power Plant Type 2019 & 2032

- Table 4: Asia-Pacific Geothermal Energy Market Volume Gigawatt Forecast, by Geothermal Power Plant Type 2019 & 2032

- Table 5: Asia-Pacific Geothermal Energy Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: Asia-Pacific Geothermal Energy Market Volume Gigawatt Forecast, by Geography 2019 & 2032

- Table 7: Asia-Pacific Geothermal Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Asia-Pacific Geothermal Energy Market Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 9: Asia-Pacific Geothermal Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Asia-Pacific Geothermal Energy Market Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 11: China Asia-Pacific Geothermal Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: China Asia-Pacific Geothermal Energy Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 13: Japan Asia-Pacific Geothermal Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Japan Asia-Pacific Geothermal Energy Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 15: India Asia-Pacific Geothermal Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: India Asia-Pacific Geothermal Energy Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 17: South Korea Asia-Pacific Geothermal Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea Asia-Pacific Geothermal Energy Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 19: Taiwan Asia-Pacific Geothermal Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Taiwan Asia-Pacific Geothermal Energy Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 21: Australia Asia-Pacific Geothermal Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Australia Asia-Pacific Geothermal Energy Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 23: Rest of Asia-Pacific Asia-Pacific Geothermal Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Asia-Pacific Asia-Pacific Geothermal Energy Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 25: Asia-Pacific Geothermal Energy Market Revenue Million Forecast, by Geothermal Power Plant Type 2019 & 2032

- Table 26: Asia-Pacific Geothermal Energy Market Volume Gigawatt Forecast, by Geothermal Power Plant Type 2019 & 2032

- Table 27: Asia-Pacific Geothermal Energy Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 28: Asia-Pacific Geothermal Energy Market Volume Gigawatt Forecast, by Geography 2019 & 2032

- Table 29: Asia-Pacific Geothermal Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Asia-Pacific Geothermal Energy Market Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 31: Asia-Pacific Geothermal Energy Market Revenue Million Forecast, by Geothermal Power Plant Type 2019 & 2032

- Table 32: Asia-Pacific Geothermal Energy Market Volume Gigawatt Forecast, by Geothermal Power Plant Type 2019 & 2032

- Table 33: Asia-Pacific Geothermal Energy Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 34: Asia-Pacific Geothermal Energy Market Volume Gigawatt Forecast, by Geography 2019 & 2032

- Table 35: Asia-Pacific Geothermal Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Asia-Pacific Geothermal Energy Market Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 37: Asia-Pacific Geothermal Energy Market Revenue Million Forecast, by Geothermal Power Plant Type 2019 & 2032

- Table 38: Asia-Pacific Geothermal Energy Market Volume Gigawatt Forecast, by Geothermal Power Plant Type 2019 & 2032

- Table 39: Asia-Pacific Geothermal Energy Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 40: Asia-Pacific Geothermal Energy Market Volume Gigawatt Forecast, by Geography 2019 & 2032

- Table 41: Asia-Pacific Geothermal Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Asia-Pacific Geothermal Energy Market Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 43: Asia-Pacific Geothermal Energy Market Revenue Million Forecast, by Geothermal Power Plant Type 2019 & 2032

- Table 44: Asia-Pacific Geothermal Energy Market Volume Gigawatt Forecast, by Geothermal Power Plant Type 2019 & 2032

- Table 45: Asia-Pacific Geothermal Energy Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 46: Asia-Pacific Geothermal Energy Market Volume Gigawatt Forecast, by Geography 2019 & 2032

- Table 47: Asia-Pacific Geothermal Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 48: Asia-Pacific Geothermal Energy Market Volume Gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Geothermal Energy Market?

The projected CAGR is approximately > 7.00%.

2. Which companies are prominent players in the Asia-Pacific Geothermal Energy Market?

Key companies in the market include Energy Development Corporation, PT Medco Power Indonesia, Star Energy Geothermal (Wayang Windu) Limited, Toshiba Corp, Trienergy PT, Pertamina Geothermal Energy PT, PT WIJAYA KARYA (Persero) Tbk, Mercury NZ Ltd, PT Bali Energy Ltd *List Not Exhaustive, PT Supreme Energy.

3. What are the main segments of the Asia-Pacific Geothermal Energy Market?

The market segments include Geothermal Power Plant Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Electricity Demand from Manufacturing. Construction. and Mining Industries4.; The Availability of a Broad Range of Fuel Sources for Electricity Generation.

6. What are the notable trends driving market growth?

Binary Plants Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Phasing Out of Coal-based Power Plants.

8. Can you provide examples of recent developments in the market?

In 2021, the Philippines's Kalinga Geothermal Power Plant developers Allfirst Kalinga, Aragorn Power and Energy and Guidance Management announced that the power plant is currently under well development phase after completing the exploration phase. The power plant construction is expected to start in 2025 and the commissioning is likely to take place in 2026.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Geothermal Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Geothermal Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Geothermal Energy Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Geothermal Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence