Key Insights

The Asia-Pacific ammonia market is experiencing robust growth, driven by increasing demand from the fertilizer industry, particularly in rapidly developing economies like India, China, and Indonesia. The region's burgeoning agricultural sector, coupled with rising population and food security concerns, fuels the need for nitrogen-based fertilizers, with ammonia serving as a critical raw material. Furthermore, the growing industrial applications of ammonia, including in the production of plastics, refrigerants, and explosives, contribute significantly to market expansion. While historical data from 2019-2024 indicates a steady growth trajectory, the forecast period (2025-2033) projects even more significant expansion. This accelerated growth is attributed to ongoing investments in ammonia production capacity, particularly in countries with abundant natural gas resources. Technological advancements in ammonia synthesis and distribution are also playing a crucial role, leading to increased efficiency and reduced production costs. However, environmental concerns related to ammonia emissions and its impact on air and water quality pose a challenge. Regulatory measures aimed at mitigating these environmental concerns, alongside the volatility of natural gas prices (a key input for ammonia production), will influence market dynamics in the coming years. The market is likely to see continued consolidation as larger players acquire smaller producers to enhance their market share and optimize production capabilities.

The Asia-Pacific ammonia market's sustained growth hinges on several factors: consistent agricultural growth across the region, ongoing industrialization demanding ammonia-derived products, and government initiatives aimed at boosting food production. However, challenges remain in terms of navigating fluctuating energy prices, addressing environmental concerns through sustainable production practices, and ensuring equitable distribution of ammonia to meet the needs of both large-scale industrial users and smaller-scale farmers. Addressing these challenges will be crucial for unlocking the full potential of the Asia-Pacific ammonia market and ensuring its continued, sustainable expansion.

Asia-Pacific Ammonia Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the Asia-Pacific ammonia market, offering a detailed examination of market trends, competitive dynamics, and future growth prospects. Spanning the period from 2019 to 2033, with a focus on 2025, this study delivers crucial data and forecasts for stakeholders across the value chain. The report includes granular analysis of market segmentation, technological advancements, and key industry players, equipping businesses with actionable insights for strategic decision-making. The market is expected to reach XX Million by 2033, exhibiting a CAGR of XX% during the forecast period (2025-2033).

Asia-Pacific Ammonia Market Composition & Trends

This section delves into the intricate composition of the Asia-Pacific ammonia market, providing a granular understanding of its current state and future trajectory. We evaluate market concentration, revealing the dominance of key players and their respective market shares. The analysis further explores innovation catalysts, highlighting technological breakthroughs and their impact on market dynamics. Regulatory landscapes across the region are scrutinized, examining their influence on market growth and investment decisions. Furthermore, the report considers substitute products and their competitive threat, analyzing their impact on ammonia demand. End-user profiles are thoroughly examined, providing a clear picture of the diverse applications of ammonia across various industries. Finally, the analysis encompasses M&A activities, providing an overview of recent deals and their implications for market consolidation.

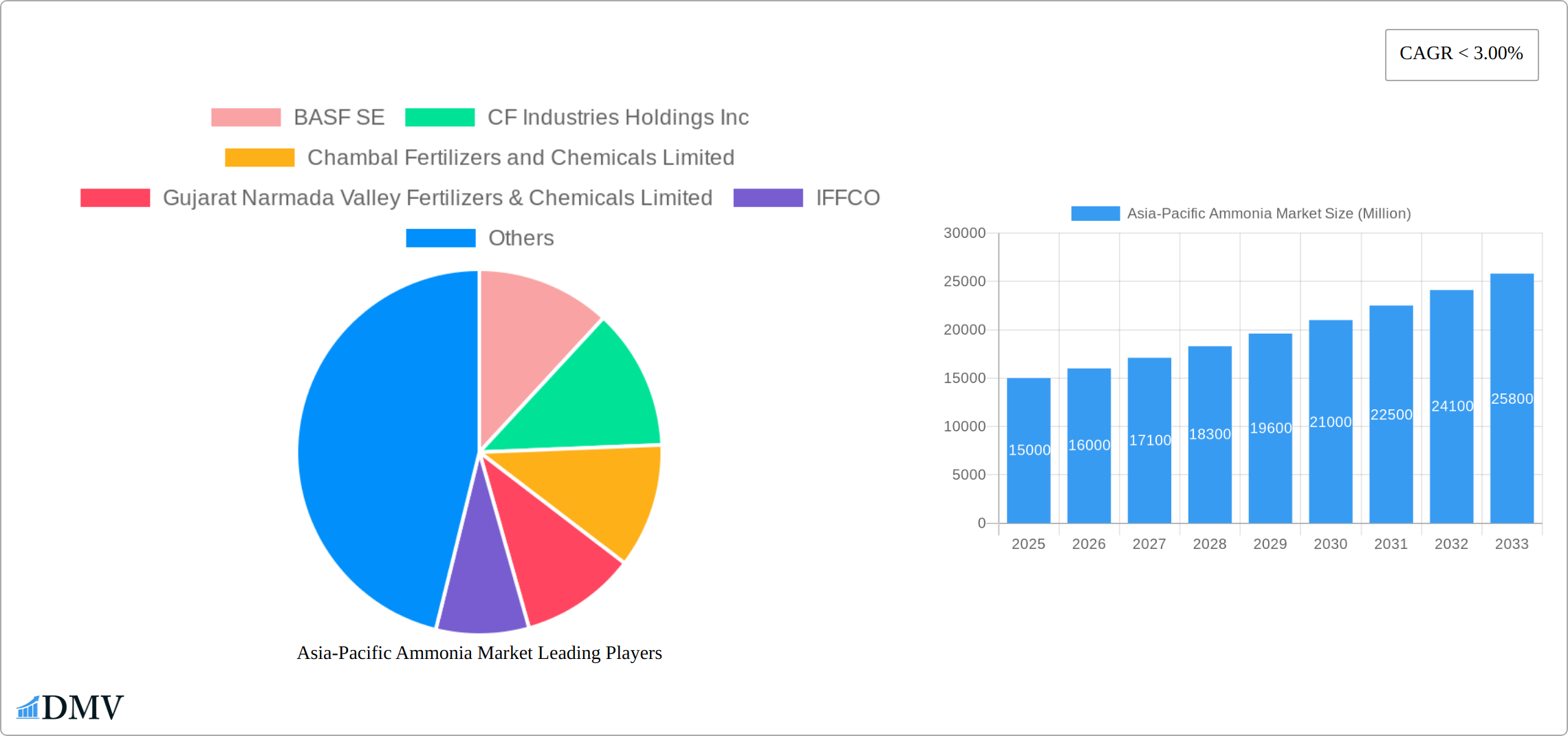

- Market Share Distribution: A detailed breakdown of market share held by key players, including BASF SE, CF Industries Holdings Inc, and others. XX% of the market is currently controlled by the top 5 players.

- M&A Deal Values: Analysis of the financial value of significant mergers and acquisitions within the past 5 years, totaling an estimated XX Million.

- Regulatory Landscape: A comprehensive overview of key regulations and policies impacting the ammonia market across the Asia-Pacific region.

- Innovation Catalysts: Detailed examination of emerging technologies and their potential to disrupt the ammonia market, including green ammonia production.

Asia-Pacific Ammonia Market Industry Evolution

This section provides a detailed analysis of the Asia-Pacific ammonia market's evolution. It explores the historical market growth trajectory from 2019 to 2024 and projects future growth to 2033, pinpointing key inflection points and drivers. We examine technological advancements, such as improved production processes and the emergence of green ammonia, analyzing their impact on cost reduction and environmental sustainability. Shifting consumer demands are also considered, focusing on the increasing preference for sustainable and environmentally friendly ammonia production methods. Detailed data points are incorporated, including precise growth rates and adoption metrics for various technologies.

Leading Regions, Countries, or Segments in Asia-Pacific Ammonia Market

This segment identifies the dominant regions, countries, and segments within the Asia-Pacific ammonia market. The analysis delves into the reasons behind their dominance, focusing on factors such as favorable government policies, robust infrastructure, and substantial investment. Specific data points highlighting the contribution of each dominant region are included.

- Key Drivers of Dominance:

- India: Strong demand driven by agricultural fertilizer needs, significant investments in infrastructure, and favorable government policies.

- China: Large-scale industrial applications, substantial production capacity, and a growing focus on green ammonia development.

- Other Countries: Analysis of the contributions of other key countries such as Malaysia, Australia and Indonesia.

Asia-Pacific Ammonia Market Product Innovations

This section highlights recent innovations in ammonia production, focusing on improved efficiency, reduced environmental impact and novel applications. We analyze the unique selling propositions of these new products and their adoption rates. Technological advancements such as the use of renewable energy sources for ammonia production and the development of advanced catalysts are highlighted.

Propelling Factors for Asia-Pacific Ammonia Market Growth

The growth of the Asia-Pacific ammonia market is driven by several key factors. The rising demand for fertilizers in the agricultural sector remains a dominant force, particularly in rapidly developing economies. Additionally, the increasing industrial utilization of ammonia in various applications, coupled with government incentives and investments in green ammonia technologies, is fueling market expansion. These factors, along with supportive regulatory frameworks and technological advancements, create a positive growth outlook.

Obstacles in the Asia-Pacific Ammonia Market

Despite its substantial growth potential, the Asia-Pacific ammonia market faces several challenges. Fluctuations in raw material prices, supply chain disruptions, and intense competition among producers are significant factors. Furthermore, stringent environmental regulations and concerns about ammonia's environmental impact present hurdles. These challenges can influence production costs, market access and sustainability goals.

Future Opportunities in Asia-Pacific Ammonia Market

The future of the Asia-Pacific ammonia market holds substantial opportunities. The growing adoption of green ammonia technologies, driven by sustainability concerns, presents a significant market segment. Furthermore, exploring new applications for ammonia, particularly in the energy sector as a hydrogen carrier, offers immense potential. Expanding into emerging markets with high agricultural growth rates and industrial development also provides new avenues for growth.

Major Players in the Asia-Pacific Ammonia Market Ecosystem

- BASF SE

- CF Industries Holdings Inc

- Chambal Fertilizers and Chemicals Limited

- Gujarat Narmada Valley Fertilizers & Chemicals Limited

- IFFCO

- Indorama Corporation

- National Fertilizers Limited

- Petroliam Nasional Berhad (PETRONAS)

- Pride-Chem Industries

- Rashtriya Chemicals and Fertilizers Limited

- SABIC

- Yara

- List Not Exhaustive

Key Developments in Asia-Pacific Ammonia Market Industry

- October 2023: Gentari (Petronas) and AM Green partnered with GIC, committing USD 2 Billion to produce 5,000 kilotons of green ammonia annually in India by 2030. This signifies a major investment in green ammonia production and its potential to reshape the market.

- July 2024: Rashtriya Chemicals and Fertilizers Limited contracted Topsoe AS to revamp its ammonia plant in Thal, India, focusing on reducing energy consumption. This highlights the ongoing efforts to improve production efficiency and sustainability.

Strategic Asia-Pacific Ammonia Market Forecast

The Asia-Pacific ammonia market is poised for significant growth driven by rising fertilizer demand, industrial applications, and the increasing adoption of green ammonia technologies. Government initiatives supporting sustainable ammonia production and the continuous technological advancements to enhance efficiency and reduce emissions further contribute to a positive outlook. The market's future trajectory indicates substantial expansion, presenting lucrative opportunities for investors and businesses alike.

Asia-Pacific Ammonia Market Segmentation

-

1. Type

- 1.1. Liquid

- 1.2. Gas

-

2. End-user Industry

- 2.1. Agriculture

- 2.2. Textile

- 2.3. Mining

- 2.4. Pharmaceutical

- 2.5. Refrigeration

- 2.6. Other End-user Industries

Asia-Pacific Ammonia Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Ammonia Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Abundant Use in the Fertilizers Industry; Increasing Usage to Produce Explosives

- 3.3. Market Restrains

- 3.3.1. Abundant Use in the Fertilizers Industry; Increasing Usage to Produce Explosives

- 3.4. Market Trends

- 3.4.1. Expanding Agricultural Industry Driving Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Ammonia Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Liquid

- 5.1.2. Gas

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Agriculture

- 5.2.2. Textile

- 5.2.3. Mining

- 5.2.4. Pharmaceutical

- 5.2.5. Refrigeration

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 BASF SE

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CF Industries Holdings Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Chambal Fertilizers and Chemicals Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Gujarat Narmada Valley Fertilizers & Chemicals Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 IFFCO

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Indorama Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 National Fertilizers Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Petroliam Nasional Berhad (PETRONAS)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Pride-Chem Industries

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Rashtriya Chemicals and Fertilizers Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 SABIC

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Yara*List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 BASF SE

List of Figures

- Figure 1: Asia-Pacific Ammonia Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Ammonia Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Ammonia Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Ammonia Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Asia-Pacific Ammonia Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Asia-Pacific Ammonia Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Asia-Pacific Ammonia Market Revenue Million Forecast, by Type 2019 & 2032

- Table 6: Asia-Pacific Ammonia Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 7: Asia-Pacific Ammonia Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: China Asia-Pacific Ammonia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Japan Asia-Pacific Ammonia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Korea Asia-Pacific Ammonia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: India Asia-Pacific Ammonia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Australia Asia-Pacific Ammonia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: New Zealand Asia-Pacific Ammonia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Indonesia Asia-Pacific Ammonia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Malaysia Asia-Pacific Ammonia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Singapore Asia-Pacific Ammonia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Thailand Asia-Pacific Ammonia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Vietnam Asia-Pacific Ammonia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Philippines Asia-Pacific Ammonia Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Ammonia Market?

The projected CAGR is approximately < 3.00%.

2. Which companies are prominent players in the Asia-Pacific Ammonia Market?

Key companies in the market include BASF SE, CF Industries Holdings Inc, Chambal Fertilizers and Chemicals Limited, Gujarat Narmada Valley Fertilizers & Chemicals Limited, IFFCO, Indorama Corporation, National Fertilizers Limited, Petroliam Nasional Berhad (PETRONAS), Pride-Chem Industries, Rashtriya Chemicals and Fertilizers Limited, SABIC, Yara*List Not Exhaustive.

3. What are the main segments of the Asia-Pacific Ammonia Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Abundant Use in the Fertilizers Industry; Increasing Usage to Produce Explosives.

6. What are the notable trends driving market growth?

Expanding Agricultural Industry Driving Market Growth.

7. Are there any restraints impacting market growth?

Abundant Use in the Fertilizers Industry; Increasing Usage to Produce Explosives.

8. Can you provide examples of recent developments in the market?

July 2024: Rashtriya Chemicals and Fertilizers Limited approved a contract with Topsoe AS to revamp its ammonia plant in Thal, Maharashtra, India. The contract includes procuring a basic engineering design package and supplying proprietary equipment and catalysts. This project targets reducing the plant's specific energy consumption.October 2023: Gentari, the clean energy arm of Malaysia’s Petroliam Nasional Bhd (Petronas), and AM Green, a producer specializing in hydrogen and ammonia, signed agreements with Singapore's investment entity, GIC. Together, they committed a substantial USD 2 billion to a shared goal of producing 5,000 kilotons annually of green ammonia in India by 2030.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Ammonia Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Ammonia Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Ammonia Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Ammonia Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence