Key Insights

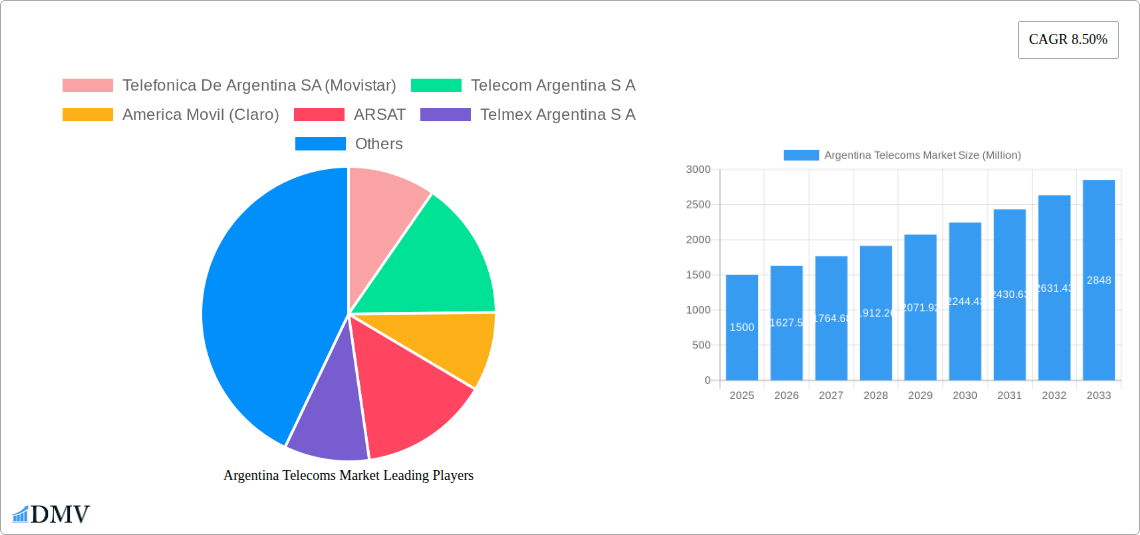

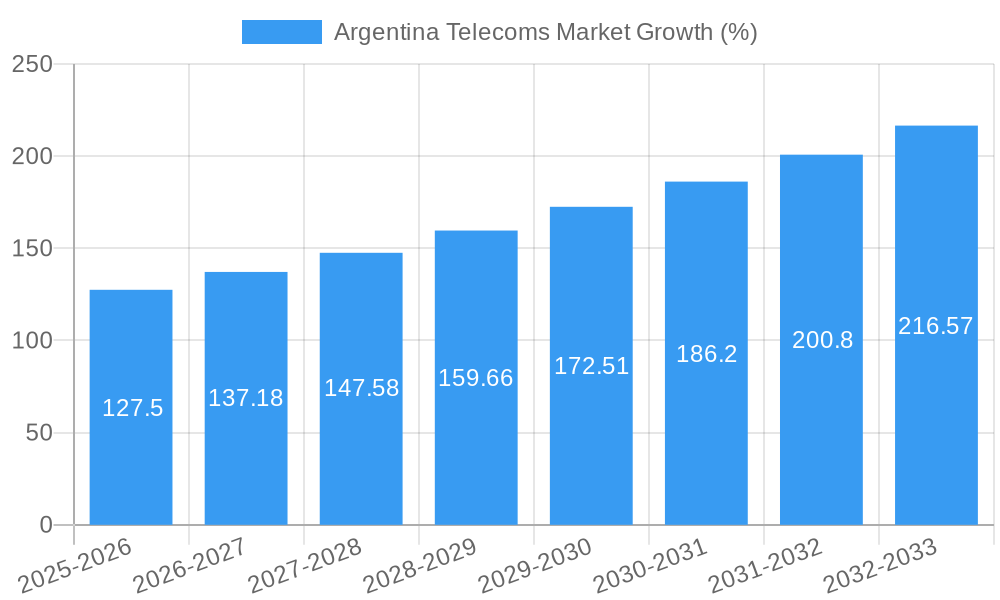

The Argentina Telecoms market, valued at approximately $XX million in 2025, exhibits robust growth potential, projected to maintain a Compound Annual Growth Rate (CAGR) of 8.50% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing smartphone penetration and data consumption are significantly boosting demand for mobile data and messaging services, particularly internet and handset data packages. The rising popularity of over-the-top (OTT) platforms and pay-TV services further contributes to market growth. Competitive pricing strategies, including package discounts offered by operators like Telefonica De Argentina SA (Movistar), Telecom Argentina S A, and America Movil (Claro), are driving affordability and accessibility. However, economic instability and regulatory hurdles pose challenges to sustained growth. Furthermore, the market's competitive landscape, with established players like ARSAT and Telmex Argentina S A alongside smaller providers such as Telecentro SA, continues to influence pricing and service innovation. Segment analysis reveals that wireless data and messaging services constitute a dominant portion of the market, driven by the aforementioned factors. Voice services, though mature, remain a significant contributor, while the OTT and PayTV sector displays impressive growth potential with increasing penetration rates. The forecast period (2025-2033) suggests a trajectory of continuous growth, influenced by factors such as government investments in digital infrastructure and the expanding middle class.

The market segmentation reveals interesting dynamics. While wireless data and messaging services, including various data packages and bundled discounts, form the largest segment, the growth of OTT and PayTV services is expected to be substantial. Voice services, while a mature segment, will still contribute significantly to the overall revenue, though its growth rate may be comparatively slower than other segments. Analyzing the Average Revenue Per User (ARPU) for the services segment will provide crucial insights into the pricing strategies and profitability of different service offerings. The competitive landscape with established players like Telefonica, Telecom Argentina, and America Movil alongside smaller operators like ARSAT and Telecentro will continue shaping market dynamics. Future growth will hinge on the success of these companies in adapting to evolving consumer demands, investing in network infrastructure, and navigating economic challenges. Sustained infrastructure investment by the government, along with the continued rise of the middle class, will be pivotal to the telecom sector's future expansion.

Argentina Telecoms Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Argentina telecoms market, encompassing market size, segmentation, competitive landscape, technological advancements, and future growth prospects. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is essential for stakeholders seeking to understand the dynamics of this rapidly evolving market and make informed strategic decisions.

Argentina Telecoms Market Market Composition & Trends

This section delves into the competitive landscape of the Argentinian telecoms market, examining market concentration, innovation drivers, regulatory influences, substitute products, end-user behavior, and mergers & acquisitions (M&A) activity. The analysis includes a granular breakdown of market share distribution among key players and a review of significant M&A deals and their financial implications.

Market Concentration: The Argentinian telecoms market is characterized by a moderately concentrated structure, with Telefonica de Argentina SA (Movistar), Telecom Argentina S.A., and America Movil (Claro) holding the lion's share of the market. Smaller players like ARSAT, Telmex Argentina S.A., and Telecentro S.A. also contribute significantly, particularly in niche segments. Market share data for 2024 indicates Movistar holds approximately xx%, Telecom Argentina xx%, and Claro xx%, with the remaining players sharing the rest.

Innovation Catalysts: The market is driven by ongoing investments in 5G infrastructure, the expansion of fiber optic networks, and the increasing adoption of cloud-based services. The government's focus on bridging the digital divide further fuels innovation.

Regulatory Landscape: The regulatory environment, governed by ENACOM, significantly impacts market dynamics. Recent spectrum auctions and regulations pertaining to network infrastructure deployment and pricing strategies influence the competitive landscape.

Substitute Products: The rise of Over-the-Top (OTT) services presents a considerable challenge to traditional telecom providers, particularly in voice and messaging. The report analyzes the impact of these substitute products on market revenue streams.

End-User Profiles: The report segments the end-user base based on demographics, usage patterns, and technological adoption levels, providing a clear understanding of consumer behavior and preferences.

M&A Activities: The section includes an analysis of recent and past M&A activities in the Argentinian telecoms market, quantifying deal values (in Millions of ARS) and analyzing their impact on market structure and competition. For instance, the Movistar-Metrotel partnership, announced in October 2022, signifies a strategic move towards infrastructure consolidation and improved service coverage. The total value of M&A deals in the period 2019-2024 is estimated at xx Million.

Argentina Telecoms Market Industry Evolution

This section analyzes the evolutionary trajectory of the Argentina telecoms market, focusing on market growth, technological advancements, and evolving consumer preferences. Specific data points such as Compound Annual Growth Rates (CAGR) and technology adoption rates are provided for the period 2019-2024 and projected for 2025-2033. The impact of key events, such as the COVID-19 pandemic, on market growth is also addressed.

The market has experienced significant growth, driven by factors like increased mobile penetration, growing demand for high-speed data services, and the adoption of innovative technologies. The CAGR for the overall telecoms market during 2019-2024 was approximately xx%, fueled by robust growth in the wireless data and messaging segment. The projected CAGR for 2025-2033 is xx%, with 5G deployment and the expansion of fixed broadband access expected to be key growth drivers. Furthermore, the adoption of OTT services and the shift towards bundled packages are significantly impacting the revenue streams of traditional telecom operators. The increasing demand for better internet speeds and reliability, especially in rural areas, is a driving factor. The market also shows significant changes in user behavior, reflected in the consumption of various services.

Leading Regions, Countries, or Segments in Argentina Telecoms Market

This section identifies the dominant regions, countries, or segments within the Argentina telecoms market. The analysis focuses on Segmentation by Services: Voice Services, Wireless: Data and Messaging Services, and OTT and PayTV Services. Key drivers like investment trends and regulatory support are highlighted using bullet points, with paragraphs offering deeper analysis of dominance factors. Average Revenue Per User (ARPU) data is included for the overall services segment.

Dominant Segment: The wireless data and messaging segment is the most dominant, driven by the increasing penetration of smartphones and the rising demand for high-speed internet access.

Key Drivers for Wireless Data and Messaging:

- Significant investments in mobile network infrastructure, including the rollout of 5G.

- Government initiatives promoting digital inclusion and broadband access.

- Growing demand for data-intensive applications, such as video streaming and social media.

- Aggressive pricing strategies and attractive data packages.

Market Size Estimates (Millions):

- Voice Services: 2020 - xx; 2027 - xx

- Wireless Data & Messaging: 2020 - xx; 2027 - xx

- OTT & PayTV: 2020 - xx; 2027 - xx

ARPU (Millions): Overall Services Segment (2024): xx

The dominance of this segment is further cemented by the aggressive expansion of 4G and 5G networks, the increased affordability of smartphones, and the surge in demand for internet-based applications. Further analysis of the growth trajectories and market dynamics provides deep insights into the potential for future development.

Argentina Telecoms Market Product Innovations

This section details recent product innovations, applications, and performance metrics. Focus is placed on unique selling propositions (USPs) and technological advancements. The introduction of innovative data packages, bundled services, and value-added services such as cloud storage and cybersecurity solutions is a key aspect of the market's evolution. The rise of 5G technology is also discussed, with the emphasis on its impact on data speeds and capabilities. The competition is fierce, forcing providers to continually improve their offerings and introduce innovative services to retain customers and attract new ones.

Propelling Factors for Argentina Telecoms Market Growth

Several factors are driving the growth of the Argentina telecoms market. Technological advancements, particularly the deployment of 5G and fiber optic networks, are significantly improving network speeds and capacity. Economic growth, although fluctuating, leads to increased disposable income and consumer spending on telecom services. The government's commitment to expanding digital infrastructure, coupled with supportive regulatory frameworks, plays a vital role in market expansion.

Obstacles in the Argentina Telecoms Market Market

Despite the growth potential, several obstacles hinder the market's expansion. Regulatory hurdles, such as licensing processes and spectrum allocation policies, can delay infrastructure development. Economic instability and inflation can impact consumer spending and investment. The highly competitive market environment, with several established players, creates intense price competition, potentially impacting profitability.

Future Opportunities in Argentina Telecoms Market

Future opportunities lie in several areas. Expanding 5G coverage, especially in underserved rural areas, presents a significant opportunity for growth. The increased demand for IoT (Internet of Things) devices and services offers a new revenue stream. Moreover, focusing on customized bundled services based on consumer needs will allow operators to enhance customer retention and acquire new ones. The continuous evolution of technologies, such as AI and machine learning, will also influence the future of the market.

Major Players in the Argentina Telecoms Market Ecosystem

- Telefonica De Argentina SA (Movistar)

- Telecom Argentina S A

- America Movil (Claro)

- ARSAT

- Telmex Argentina S A

- Telecentro SA

Key Developments in Argentina Telecoms Market Industry

November 2022: Telecom Argentina announced the completion of its 5G core deployment by 2024, deploying an autonomous 5G core and utilizing dynamic spectrum sharing (DSS). Over 160 5G sites are anticipated by year-end.

October 2022: Movistar partnered with Metrotel for coordinated infrastructure installation, aiming to improve connectivity and introduce new offerings.

Strategic Argentina Telecoms Market Market Forecast

The Argentina telecoms market is poised for continued growth, driven by 5G deployment, increasing data consumption, and government initiatives. The market's expansion into IoT and the adoption of advanced technologies promise further growth. Addressing challenges like regulatory hurdles and economic volatility will be crucial for maximizing market potential.

Argentina Telecoms Market Segmentation

-

1. Service Type

- 1.1. Voice services

- 1.2. data services

- 1.3. OTT and PayTV services

-

2. Technology

- 2.1. Fixed-line

- 2.2. wireless

- 2.3. satellite

-

3. End User

- 3.1. Consumers

- 3.2. businesses

- 3.3. government agencies

Argentina Telecoms Market Segmentation By Geography

- 1. Argentina

Argentina Telecoms Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wide Internet Coverage; Robust OTT Demand

- 3.3. Market Restrains

- 3.3.1. Limitation of Real-time Wireless Control Due to Communication Delays

- 3.4. Market Trends

- 3.4.1. Robust Internet Coverage

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Argentina Telecoms Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Voice services

- 5.1.2. data services

- 5.1.3. OTT and PayTV services

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Fixed-line

- 5.2.2. wireless

- 5.2.3. satellite

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Consumers

- 5.3.2. businesses

- 5.3.3. government agencies

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Argentina

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Telefonica De Argentina SA (Movistar)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Telecom Argentina S A

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 America Movil (Claro)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ARSAT

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Telmex Argentina S A

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Telecentro SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Telefonica De Argentina SA (Movistar)

List of Figures

- Figure 1: Argentina Telecoms Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Argentina Telecoms Market Share (%) by Company 2024

List of Tables

- Table 1: Argentina Telecoms Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Argentina Telecoms Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Argentina Telecoms Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 4: Argentina Telecoms Market Volume K Unit Forecast, by Service Type 2019 & 2032

- Table 5: Argentina Telecoms Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 6: Argentina Telecoms Market Volume K Unit Forecast, by Technology 2019 & 2032

- Table 7: Argentina Telecoms Market Revenue Million Forecast, by End User 2019 & 2032

- Table 8: Argentina Telecoms Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 9: Argentina Telecoms Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Argentina Telecoms Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: Argentina Telecoms Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Argentina Telecoms Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Argentina Telecoms Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 14: Argentina Telecoms Market Volume K Unit Forecast, by Service Type 2019 & 2032

- Table 15: Argentina Telecoms Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 16: Argentina Telecoms Market Volume K Unit Forecast, by Technology 2019 & 2032

- Table 17: Argentina Telecoms Market Revenue Million Forecast, by End User 2019 & 2032

- Table 18: Argentina Telecoms Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 19: Argentina Telecoms Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Argentina Telecoms Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Argentina Telecoms Market?

The projected CAGR is approximately 8.50%.

2. Which companies are prominent players in the Argentina Telecoms Market?

Key companies in the market include Telefonica De Argentina SA (Movistar), Telecom Argentina S A, America Movil (Claro), ARSAT, Telmex Argentina S A, Telecentro SA.

3. What are the main segments of the Argentina Telecoms Market?

The market segments include Service Type, Technology, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Wide Internet Coverage; Robust OTT Demand.

6. What are the notable trends driving market growth?

Robust Internet Coverage.

7. Are there any restraints impacting market growth?

Limitation of Real-time Wireless Control Due to Communication Delays.

8. Can you provide examples of recent developments in the market?

In November 2022, Telecom Argentina announced that it would finish the 5G core deployment in 2024. To prepare for the spectrum auction that industry regulator Enacom intends to organize in the first quarter of 2023, the operator has started deploying an autonomous 5G core. The business has begun rolling out 5G in dynamic spectrum sharing (DSS) mode to finish the process in 2024 and anticipates having more than 160 sites by the end of 2022.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Argentina Telecoms Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Argentina Telecoms Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Argentina Telecoms Market?

To stay informed about further developments, trends, and reports in the Argentina Telecoms Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence