Key Insights

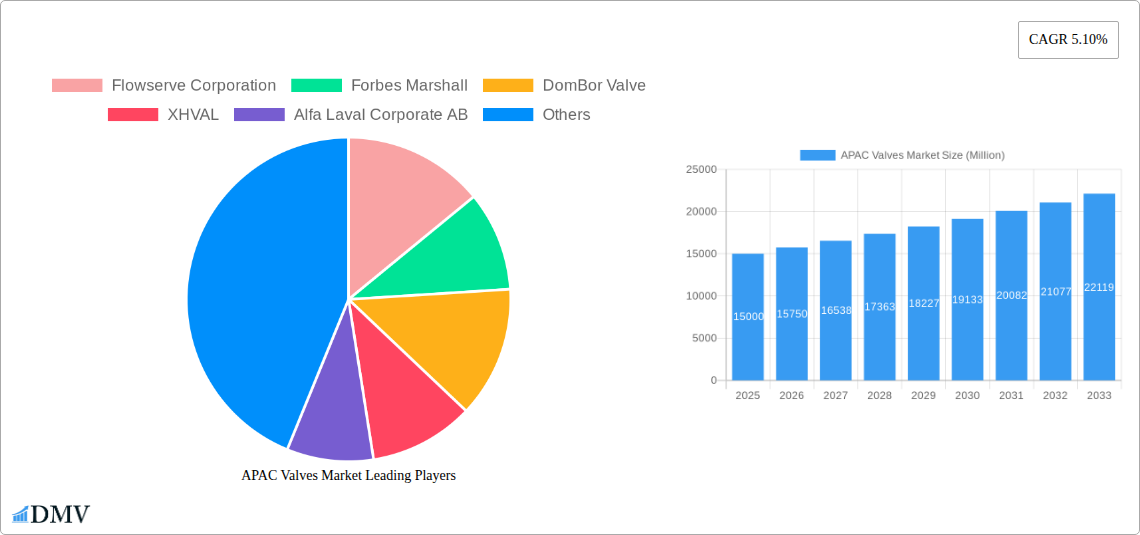

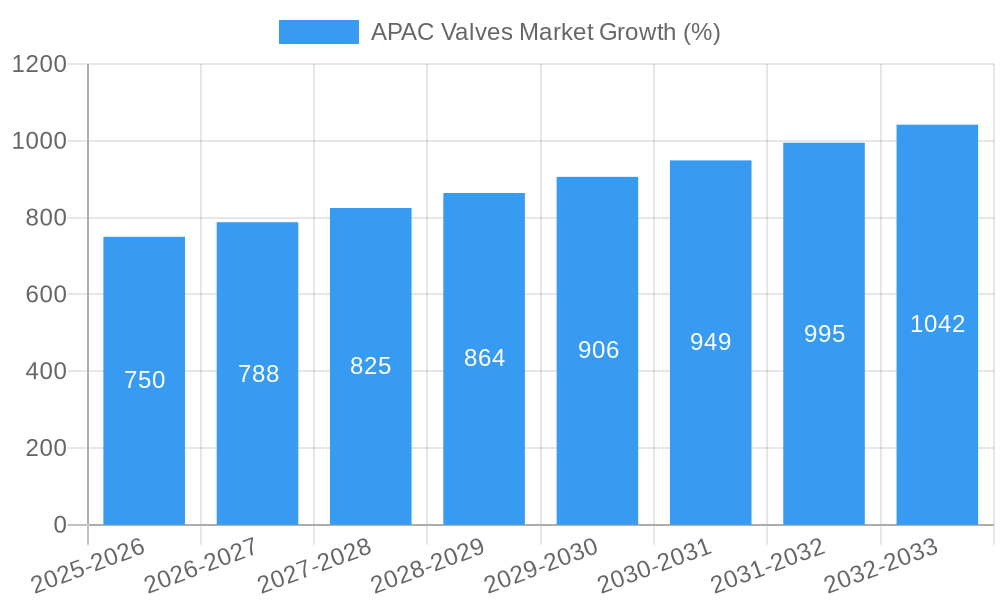

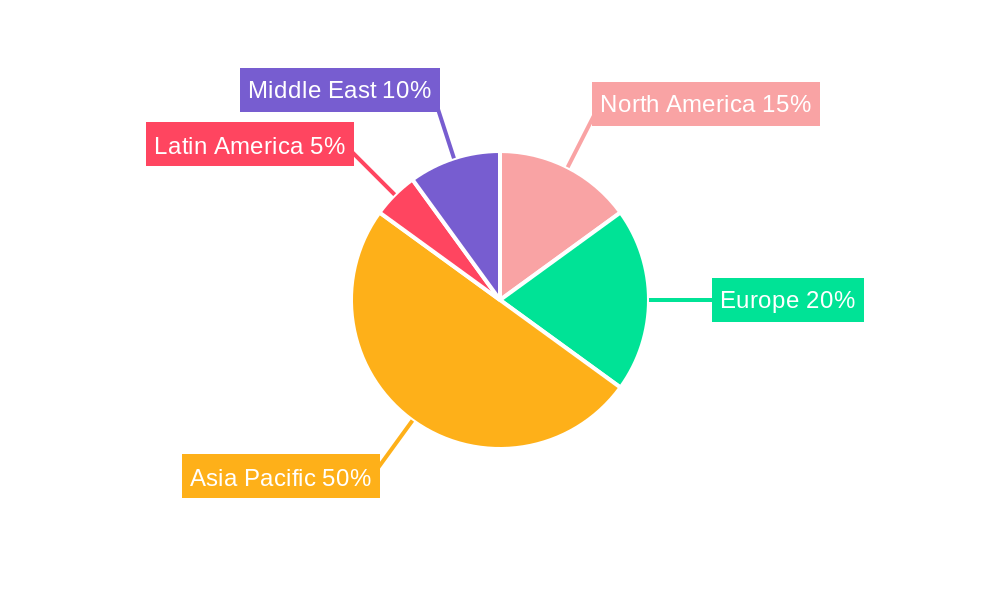

The Asia-Pacific (APAC) valves market is experiencing robust growth, driven by the region's expanding industrialization, particularly within the oil & gas, power generation, and chemical sectors. A Compound Annual Growth Rate (CAGR) of 5.10% from 2019 to 2024 suggests a continuously expanding market, projected to further increase over the forecast period (2025-2033). Key growth drivers include increasing investments in infrastructure projects, rising demand for energy, and stringent environmental regulations promoting efficient fluid control solutions. China and India, as major economies in the region, are significant contributors to market growth, fueled by their burgeoning industrial sectors and substantial energy demands. However, fluctuating raw material prices and potential supply chain disruptions pose challenges to sustained expansion. The market is segmented by valve type (ball, butterfly, gate/globe/check, plug, control, others), end-user industry (oil & gas, power generation, chemical, water & wastewater, mining, others), and geography (China, India, South Korea, Japan, Australia & New Zealand, Rest of APAC). The dominance of certain valve types, such as ball and butterfly valves, due to their versatility and cost-effectiveness, is shaping market dynamics. Furthermore, technological advancements, such as the adoption of smart valves and automation solutions, are expected to influence market trends in the coming years. Competition amongst established players like Flowserve Corporation, Emerson Electric Co., and KITZ Corporation, alongside emerging regional players, is intensifying.

The continued expansion of the APAC valves market is expected to be fueled by increasing investments in renewable energy infrastructure, particularly in solar and wind power generation projects. Government initiatives promoting sustainable development and industrial modernization are further driving market expansion. The water & wastewater treatment sector also presents a significant growth opportunity, driven by the need to improve water management and reduce water loss. The market will continue to witness increased adoption of advanced materials and technologies to enhance valve performance, durability, and efficiency. However, potential economic slowdowns in certain APAC countries and geopolitical uncertainties could present moderate headwinds. The long-term outlook, however, remains optimistic, with continuous growth predicted throughout the forecast period, propelled by steady industrial expansion and infrastructure development. The segment breakdown by valve type, end-user, and geography will continue to evolve, reflecting the diverse needs of the APAC region's dynamic industrial landscape.

APAC Valves Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Asia-Pacific (APAC) valves market, offering a comprehensive overview of market dynamics, growth trajectories, key players, and future opportunities. Covering the period from 2019 to 2033, with a focus on 2025, this report is an invaluable resource for stakeholders seeking to understand and capitalize on the burgeoning APAC valves market. The market is segmented by type (ball, butterfly, gate/globe/check, plug, control, other), end-user industry (oil & gas, power generation, chemical, water & wastewater, mining, others), and country (China, India, South Korea, Japan, Australia & New Zealand, Rest of APAC). The total market value is estimated at xx Million in 2025, projected to reach xx Million by 2033.

APAC Valves Market Composition & Trends

The APAC valves market exhibits a moderately concentrated landscape, with key players like Flowserve Corporation, Forbes Marshall, DomBor Valve, XHVAL, Alfa Laval Corporate AB, Emerson Electric Co, Samson Controls Inc, ZECO VALVE GROUP, Avcon Controls Pvt Ltd, The Weir Group plc, Schlumberger Limited, and KITZ Corporation holding significant market share. Market share distribution varies across segments, with ball and butterfly valves dominating the type segment. Innovation is driven by the increasing demand for advanced materials, automation, and digitalization in various end-user industries. Stringent environmental regulations, particularly in China and India, are shaping the market, favoring energy-efficient and environmentally friendly valve solutions. Substitute products, such as smart valves, are emerging, potentially impacting market share. M&A activity is moderate, with deal values averaging xx Million per transaction in the recent past (2020-2024). End-user profiles are diverse, ranging from large multinational corporations to small and medium-sized enterprises (SMEs).

- Market Concentration: Moderately concentrated, with top 10 players holding xx% market share in 2025.

- Innovation Catalysts: Demand for smart valves, advanced materials, and automation.

- Regulatory Landscape: Stringent environmental regulations driving adoption of energy-efficient valves.

- Substitute Products: Smart valves and other advanced technologies posing potential competition.

- End-user Profiles: Diverse range, including large corporations and SMEs.

- M&A Activity: Moderate, with average deal values of xx Million (2020-2024).

APAC Valves Market Industry Evolution

The APAC valves market has witnessed robust growth over the historical period (2019-2024), fueled by rapid industrialization, infrastructure development, and increasing investments in energy and water management. The market expanded at a CAGR of xx% during this period. Technological advancements, such as the introduction of smart valves with integrated sensors and remote monitoring capabilities, are transforming the industry. These innovations enhance operational efficiency, reduce maintenance costs, and improve safety. Shifting consumer demands towards sustainable and environmentally friendly solutions are influencing product development and adoption. The forecast period (2025-2033) anticipates continued growth, driven by robust economic expansion in several APAC countries, particularly in Southeast Asia, and an increasing focus on smart city initiatives. We project a CAGR of xx% for the forecast period, exceeding the historical growth rate due to the confluence of various factors. Adoption of smart valves is expected to grow at xx% CAGR from 2025-2033, driven by cost-savings and efficiency gains.

Leading Regions, Countries, or Segments in APAC Valves Market

Dominant Region/Country: China holds the largest market share in the APAC valves market, driven by its massive industrial base, significant investments in infrastructure projects, and robust growth across various end-user industries.

Dominant Segment (By Type): The ball valve segment dominates by volume, owing to its versatility, cost-effectiveness, and ease of maintenance. Butterfly valves also represent a significant segment due to their large flow capacity. The Gate/Globe/Check valve segment maintains substantial market share owing to its diverse applications across various industries.

Dominant Segment (By End-user Industry): The oil & gas sector is a key driver of market growth, with significant demand for specialized valves suited for high-pressure and harsh operating conditions. The power generation sector is also a major consumer of valves, followed by the chemical industry.

Key Drivers:

- China: Massive infrastructure projects, industrial expansion, and government initiatives promoting energy efficiency and environmental sustainability.

- India: Rapid industrialization, growing investments in the energy sector, and increasing urbanization.

- Oil & Gas: Significant investments in upstream and downstream activities, necessitating sophisticated and reliable valves.

- Power Generation: Expansion of power generation capacity, driven by increasing energy demand.

- Chemical: Growing chemical production and processing, demanding specialized valves for handling corrosive fluids.

APAC Valves Market Product Innovations

Recent innovations include smart valves with embedded sensors for real-time monitoring and predictive maintenance, along with the development of advanced materials such as corrosion-resistant alloys and lightweight composites to enhance valve durability and lifespan. Improved sealing technologies have significantly enhanced the operational efficiency and safety of valves in diverse applications. These advancements have resulted in valves with higher pressure ratings, improved flow control, and longer operational life cycles, leading to cost reductions for end-users.

Propelling Factors for APAC Valves Market Growth

The APAC valves market is experiencing strong growth propelled by factors such as increasing industrialization, urbanization, and infrastructure development across the region. The burgeoning energy and water management sectors contribute significantly to this growth. Government initiatives promoting energy efficiency and environmental sustainability also drive demand for advanced and eco-friendly valve technologies. Furthermore, technological advancements in valve design and materials contribute to higher efficiency, longer lifespan, and reduced maintenance costs. Economic growth and increasing investments in various industries, such as oil & gas, power generation, and chemicals, fuel the growth of the APAC valves market.

Obstacles in the APAC Valves Market

Challenges include supply chain disruptions impacting material availability and production timelines. Stricter environmental regulations may lead to increased manufacturing costs and compliance requirements. Intense competition among established and emerging players further poses a challenge to market expansion. The overall impact of these constraints on the market growth is estimated to be around xx% in 2025.

Future Opportunities in APAC Valves Market

Significant opportunities lie in the increasing adoption of smart valves and digitally enabled solutions, particularly in sectors such as water management and industrial automation. Growth in renewable energy sources, such as solar and wind power, will drive demand for specific valve technologies. Expansion of chemical processing and manufacturing activities in Southeast Asia represents another lucrative opportunity. Lastly, addressing the increasing demand for improved water management solutions in urban areas provides considerable market potential.

Major Players in the APAC Valves Market Ecosystem

- Flowserve Corporation

- Forbes Marshall

- DomBor Valve

- XHVAL

- Alfa Laval Corporate AB

- Emerson Electric Co

- Samson Controls Inc

- ZECO VALVE GROUP

- Avcon Controls Pvt Ltd

- The Weir Group plc

- Schlumberger Limited

- KITZ Corporation

Key Developments in APAC Valves Market Industry

- December 2021: Emerson introduced the easy-eTM Trim Cartridge, streamlining valve repair and reducing maintenance costs.

- March 2022: HYDAC launched the HPK16SE/SF piloted directional control valve, offering high pressure and flow capabilities.

Strategic APAC Valves Market Forecast

The APAC valves market is poised for sustained growth, driven by robust economic expansion, infrastructure development, and technological advancements. The increasing adoption of smart valves, coupled with the growth of renewable energy and improved water management solutions, presents significant opportunities for market expansion. The market's potential is substantial, with continued growth anticipated throughout the forecast period (2025-2033).

APAC Valves Market Segmentation

-

1. Type

- 1.1. Ball

- 1.2. Butterfly

- 1.3. Gate/Globe/Check

- 1.4. Plug

- 1.5. Control

- 1.6. Other Types

-

2. End-user Industry

- 2.1. Oil & Gas

- 2.2. Power Generation

- 2.3. Chemical

- 2.4. Water & Wastewater

- 2.5. Mining

- 2.6. Other End-user Industries

APAC Valves Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. ASEAN

- 1.6. Oceania

- 1.7. Rest of Asia Pacific

APAC Valves Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Valve Use in the Oil and Gas Industry; Increased Utilization of Ball Valves and Butterfly Valves

- 3.3. Market Restrains

- 3.3.1. Low resistance to cavitation & choke and limited throttling in case of low pressure

- 3.4. Market Trends

- 3.4.1. Oil & Gas Industry Expected to Hold a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Valves Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Ball

- 5.1.2. Butterfly

- 5.1.3. Gate/Globe/Check

- 5.1.4. Plug

- 5.1.5. Control

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Oil & Gas

- 5.2.2. Power Generation

- 5.2.3. Chemical

- 5.2.4. Water & Wastewater

- 5.2.5. Mining

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America APAC Valves Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Asia Pacific APAC Valves Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Europe APAC Valves Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Latin America APAC Valves Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Middle East APAC Valves Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Flowserve Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Forbes Marshall

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 DomBor Valve

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 XHVAL

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Alfa Laval Corporate AB

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Emerson Electric Co

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Samson Controls Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ZECO VALVE GROUP

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Avcon Controls Pvt Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 The Weir Group plc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Schlumberger Limited

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 KITZ Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Flowserve Corporation

List of Figures

- Figure 1: Global APAC Valves Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America APAC Valves Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America APAC Valves Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Asia Pacific APAC Valves Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Asia Pacific APAC Valves Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Europe APAC Valves Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Europe APAC Valves Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America APAC Valves Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America APAC Valves Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East APAC Valves Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East APAC Valves Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: Asia Pacific APAC Valves Market Revenue (Million), by Type 2024 & 2032

- Figure 13: Asia Pacific APAC Valves Market Revenue Share (%), by Type 2024 & 2032

- Figure 14: Asia Pacific APAC Valves Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 15: Asia Pacific APAC Valves Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 16: Asia Pacific APAC Valves Market Revenue (Million), by Country 2024 & 2032

- Figure 17: Asia Pacific APAC Valves Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global APAC Valves Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global APAC Valves Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global APAC Valves Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Global APAC Valves Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global APAC Valves Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: APAC Valves Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global APAC Valves Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: APAC Valves Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global APAC Valves Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: APAC Valves Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global APAC Valves Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: APAC Valves Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global APAC Valves Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: APAC Valves Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global APAC Valves Market Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Global APAC Valves Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 17: Global APAC Valves Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: China APAC Valves Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: India APAC Valves Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Japan APAC Valves Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: South Korea APAC Valves Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: ASEAN APAC Valves Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Oceania APAC Valves Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Asia Pacific APAC Valves Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Valves Market?

The projected CAGR is approximately 5.10%.

2. Which companies are prominent players in the APAC Valves Market?

Key companies in the market include Flowserve Corporation, Forbes Marshall, DomBor Valve, XHVAL, Alfa Laval Corporate AB, Emerson Electric Co, Samson Controls Inc, ZECO VALVE GROUP, Avcon Controls Pvt Ltd, The Weir Group plc, Schlumberger Limited, KITZ Corporation.

3. What are the main segments of the APAC Valves Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Valve Use in the Oil and Gas Industry; Increased Utilization of Ball Valves and Butterfly Valves.

6. What are the notable trends driving market growth?

Oil & Gas Industry Expected to Hold a Significant Market Share.

7. Are there any restraints impacting market growth?

Low resistance to cavitation & choke and limited throttling in case of low pressure.

8. Can you provide examples of recent developments in the market?

March 2022 - HYDAC announced HPK16SE/SF piloted directional control valve. The valve is currently available for cavities of size 16. This valve withstands working pressures up to 5,000 psi and flows up to 40 gallons per minute.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Valves Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Valves Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Valves Market?

To stay informed about further developments, trends, and reports in the APAC Valves Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence