Key Insights

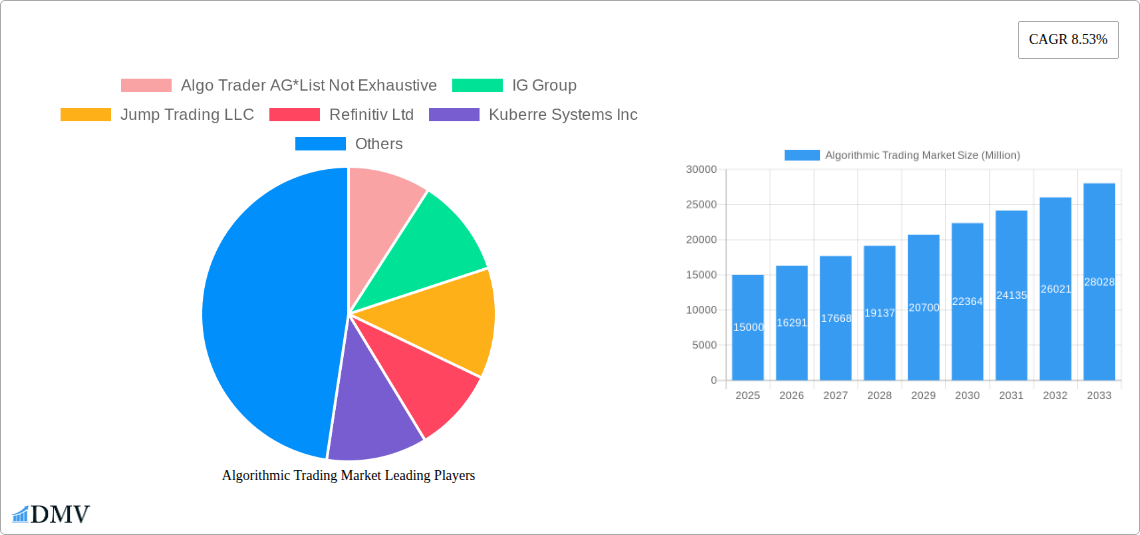

The algorithmic trading market is experiencing robust growth, driven by the increasing adoption of sophisticated trading strategies and technological advancements. The market's expansion is fueled by several key factors. Institutional investors are increasingly leveraging algorithmic trading for high-frequency trading (HFT) and quantitative strategies to gain a competitive edge in the market. The rise of retail investors embracing automated trading platforms, coupled with the expanding availability of user-friendly software tools, further propels market growth. Furthermore, the increasing complexity of financial markets necessitates the use of algorithms for efficient portfolio management and risk mitigation. The on-cloud deployment model is gaining traction due to its scalability, cost-effectiveness, and accessibility. Large enterprises are adopting algorithmic trading solutions more readily than SMEs, reflecting their greater need for sophisticated trading capabilities and larger budgets. While data privacy concerns and regulatory changes pose certain challenges, the overall market outlook remains positive, with a projected compound annual growth rate (CAGR) of 8.53% from 2025 to 2033.

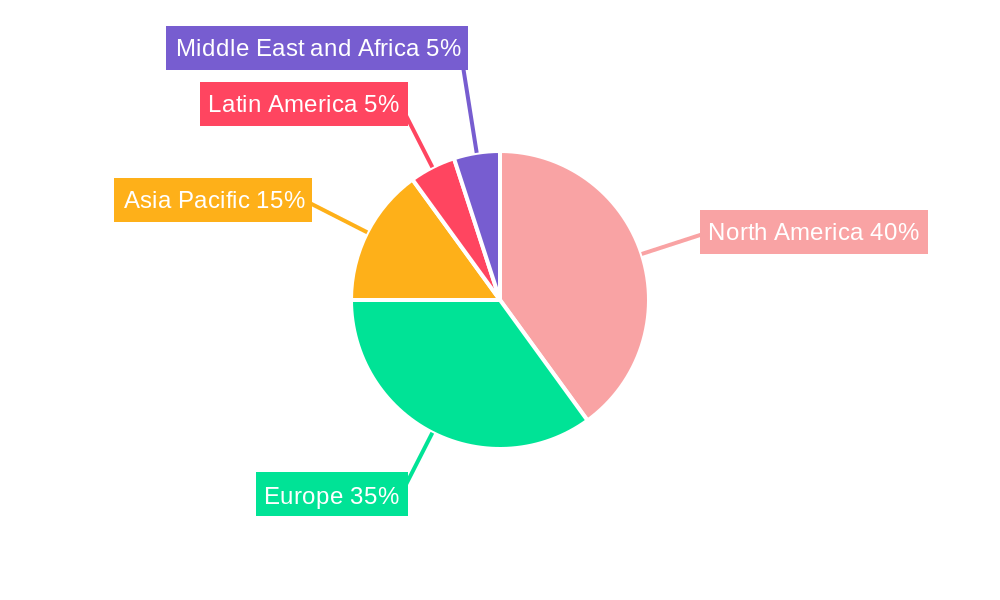

The market segmentation reveals a diverse landscape. Solutions and services constitute the core offerings, while software tools are a significant component of the algorithmic trading ecosystem. The dominance of large enterprises in adoption reflects the higher investment capacity required for these sophisticated systems. While the exact regional breakdown is not provided, it is reasonable to assume North America and Europe currently hold a larger market share due to their developed financial markets and technological infrastructure. However, the Asia-Pacific region is anticipated to witness significant growth in the coming years driven by increasing financial market activity and technological advancements in the region. Competition among established players like Algo Trader AG, IG Group, and Refinitiv, alongside emerging players like Kuberre Systems and 63 Moons Technologies, will further shape the market dynamics and drive innovation. This competitive landscape will likely result in continuous improvements in algorithmic trading technologies and the expansion of services catering to a broader range of investors.

Algorithmic Trading Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the Algorithmic Trading Market, projecting a market valuation of $XX Million by 2033. It covers market dynamics, competitive landscape, technological advancements, and future growth opportunities, offering invaluable insights for stakeholders across the industry. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year. The report utilizes data from the historical period (2019-2024) to forecast market trends from 2025 to 2033.

Algorithmic Trading Market Market Composition & Trends

The Algorithmic Trading Market is characterized by a dynamic interplay of concentrated players and emerging innovators. Market share is significantly influenced by technological capabilities, regulatory compliance, and successful M&A activities. The report details the market concentration, revealing a concentrated market structure with leading players holding a significant portion, estimated to be XX% of market share in 2025. Key factors driving market composition include:

- Innovation Catalysts: Rapid technological advancements, including artificial intelligence (AI), machine learning (ML), and high-frequency trading (HFT) strategies, continuously reshape the market landscape.

- Regulatory Landscapes: Evolving regulations worldwide significantly influence market participation and operational strategies, especially impacting retail investors’ involvement.

- Substitute Products: While algorithmic trading offers advanced capabilities, traditional methods and manual trading still maintain a presence, particularly in niche segments and smaller organizations.

- End-User Profiles: The market caters to a diverse clientele, including institutional investors, retail investors, long-term traders, and short-term traders, each possessing unique needs and preferences. Market segmentation is elaborated in detail further below.

- M&A Activities: Consolidation within the market through mergers and acquisitions (M&A) has become a significant trend, increasing capital investment in this space. Notable deals have aggregated to a total value of $XX Million between 2019 and 2024.

Algorithmic Trading Market Industry Evolution

The Algorithmic Trading Market has witnessed exponential growth over the past few years, driven primarily by technological advancements and the increasing adoption of sophisticated trading strategies by institutional and retail investors alike. The market experienced a Compound Annual Growth Rate (CAGR) of XX% from 2019 to 2024, and is projected to maintain a CAGR of XX% during the forecast period (2025-2033), reaching $XX Million by 2033. This growth is fueled by:

- Technological Advancements: AI, ML, and big data analytics are transforming algorithmic trading strategies, enabling more accurate predictions and faster execution speeds. The increasing sophistication of trading algorithms significantly increases accuracy and profit margins.

- Shifting Consumer Demands: The rising demand for automated, efficient, and data-driven trading solutions, especially amongst retail investors using increasingly sophisticated tools, is driving adoption. Furthermore, the demand for customized solutions tailored to specific investment strategies continues to shape market evolution.

- Market Penetration: Increased smartphone usage and internet connectivity has resulted in rising penetration of algorithmic trading in emerging markets and increased trading in smaller organizations. The number of active algorithmic traders increased by XX% between 2019 and 2024.

Leading Regions, Countries, or Segments in Algorithmic Trading Market

North America currently dominates the algorithmic trading market, driven by high technological advancement, strong regulatory frameworks, and a significant concentration of financial institutions. However, the Asia-Pacific region is witnessing rapid growth.

- By Types of Traders: Institutional investors represent the largest segment, accounting for XX% of the market share in 2025, followed by retail investors at XX%. This is largely due to higher investment volumes from institutional investors, while the retail investor segment is rapidly growing driven by enhanced accessibility to algorithmic trading software and platforms.

- By Component: Solutions dominate the market, representing XX% of the market, and include high-frequency trading platforms and other trading solutions.

- By Deployment: Cloud-based deployment is gaining momentum due to increased cost-effectiveness, flexibility, and scalability, surpassing on-premise deployments.

- By Organization Size: Large enterprises constitute the largest user segment owing to their higher capital investment capacity and resources.

Key drivers for dominance include:

- Investment Trends: Significant capital investment in fintech and algorithmic trading technologies fuels the market's expansion, particularly in North America and Asia-Pacific.

- Regulatory Support: Supportive regulatory frameworks and policies in specific regions encourage innovation and adoption.

Algorithmic Trading Market Product Innovations

Recent product innovations focus on enhancing speed, accuracy, and efficiency of algorithmic trading. New platforms leverage AI and ML for improved risk management, personalized trading strategies, and real-time market analysis. These innovations incorporate advanced analytics and customizable features to cater to diverse trading styles, resulting in enhanced portfolio optimization and reduced latency.

Propelling Factors for Algorithmic Trading Market Growth

Several factors propel the Algorithmic Trading Market's growth:

- Technological Advancements: AI and ML integration enables sophisticated trading algorithms and accurate predictions.

- Economic Factors: Increased market volatility and the need for efficient portfolio management drive algorithmic trading adoption.

- Regulatory Changes: Evolution of regulatory frameworks supporting technological advancements and investor protection fosters growth.

Obstacles in the Algorithmic Trading Market Market

The market faces significant obstacles:

- Regulatory Challenges: Stricter regulations and compliance requirements can increase operational costs and limit market accessibility.

- Supply Chain Disruptions: The global chip shortage impacted access to advanced hardware required for high-frequency trading and complex computations.

- Competitive Pressures: Intense competition and the need for continuous innovation present significant challenges for established companies and newcomers alike.

Future Opportunities in Algorithmic Trading Market

Future growth hinges on:

- Expansion into Emerging Markets: Untapped markets in developing economies offer significant growth potential.

- New Technologies: Blockchain technology and quantum computing could revolutionize the trading ecosystem.

- Personalized Trading Solutions: Tailored solutions catering to individual investor needs will gain prominence.

Major Players in the Algorithmic Trading Market Ecosystem

- Algo Trader AG *List Not Exhaustive

- IG Group

- Jump Trading LLC

- Refinitiv Ltd

- Kuberre Systems Inc

- MetaQuotes Software Corp

- 63 Moons Technologies Limited

- ARGO SE

- Thomson Reuters

- Symphony Fintech Solutions Pvt Ltd

- Info Reach Inc

- Virtu Financial Inc

Key Developments in Algorithmic Trading Market Industry

- June 2023: DoubleVerify launched DV Algorithmic Optimizer with Scibids, enhancing digital advertising ROI through AI-powered optimization.

- June 2023: KuCoin Futures partnered with Kryll, integrating automated trading bots and TradingView signals into its platform.

Strategic Algorithmic Trading Market Market Forecast

The Algorithmic Trading Market is poised for sustained growth, driven by technological innovation and increasing demand for sophisticated trading strategies. The convergence of AI, ML, and big data analytics will fuel further advancements, creating new opportunities and expanding market potential throughout the forecast period. The market's future is bright, particularly considering the ongoing expansion into new geographical regions and the increasing adoption of cloud-based solutions.

Algorithmic Trading Market Segmentation

-

1. Types of Traders

- 1.1. Institutional Investors

- 1.2. Retail Investors

- 1.3. Long-term Traders

- 1.4. Short-term Traders

-

2. Component

-

2.1. Solutions

- 2.1.1. Platforms

- 2.1.2. Software Tools

- 2.2. Services

-

2.1. Solutions

-

3. Deployment

- 3.1. On-cloud

- 3.2. On-premise

-

4. Organization Size

- 4.1. Small and Medium Enterprises

- 4.2. Large Enterprises

Algorithmic Trading Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Algorithmic Trading Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.53% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rising Demand for Fast

- 3.2.2 Reliable

- 3.2.3 and Effective Order Execution; Growing Demand for Market Surveillance Augmented by Reduced Transaction Costs

- 3.3. Market Restrains

- 3.3.1. Instant Loss of Liquidity

- 3.4. Market Trends

- 3.4.1. On-cloud Deployment Segment is expected to drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Algorithmic Trading Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Types of Traders

- 5.1.1. Institutional Investors

- 5.1.2. Retail Investors

- 5.1.3. Long-term Traders

- 5.1.4. Short-term Traders

- 5.2. Market Analysis, Insights and Forecast - by Component

- 5.2.1. Solutions

- 5.2.1.1. Platforms

- 5.2.1.2. Software Tools

- 5.2.2. Services

- 5.2.1. Solutions

- 5.3. Market Analysis, Insights and Forecast - by Deployment

- 5.3.1. On-cloud

- 5.3.2. On-premise

- 5.4. Market Analysis, Insights and Forecast - by Organization Size

- 5.4.1. Small and Medium Enterprises

- 5.4.2. Large Enterprises

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Latin America

- 5.5.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Types of Traders

- 6. North America Algorithmic Trading Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Types of Traders

- 6.1.1. Institutional Investors

- 6.1.2. Retail Investors

- 6.1.3. Long-term Traders

- 6.1.4. Short-term Traders

- 6.2. Market Analysis, Insights and Forecast - by Component

- 6.2.1. Solutions

- 6.2.1.1. Platforms

- 6.2.1.2. Software Tools

- 6.2.2. Services

- 6.2.1. Solutions

- 6.3. Market Analysis, Insights and Forecast - by Deployment

- 6.3.1. On-cloud

- 6.3.2. On-premise

- 6.4. Market Analysis, Insights and Forecast - by Organization Size

- 6.4.1. Small and Medium Enterprises

- 6.4.2. Large Enterprises

- 6.1. Market Analysis, Insights and Forecast - by Types of Traders

- 7. Europe Algorithmic Trading Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Types of Traders

- 7.1.1. Institutional Investors

- 7.1.2. Retail Investors

- 7.1.3. Long-term Traders

- 7.1.4. Short-term Traders

- 7.2. Market Analysis, Insights and Forecast - by Component

- 7.2.1. Solutions

- 7.2.1.1. Platforms

- 7.2.1.2. Software Tools

- 7.2.2. Services

- 7.2.1. Solutions

- 7.3. Market Analysis, Insights and Forecast - by Deployment

- 7.3.1. On-cloud

- 7.3.2. On-premise

- 7.4. Market Analysis, Insights and Forecast - by Organization Size

- 7.4.1. Small and Medium Enterprises

- 7.4.2. Large Enterprises

- 7.1. Market Analysis, Insights and Forecast - by Types of Traders

- 8. Asia Pacific Algorithmic Trading Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Types of Traders

- 8.1.1. Institutional Investors

- 8.1.2. Retail Investors

- 8.1.3. Long-term Traders

- 8.1.4. Short-term Traders

- 8.2. Market Analysis, Insights and Forecast - by Component

- 8.2.1. Solutions

- 8.2.1.1. Platforms

- 8.2.1.2. Software Tools

- 8.2.2. Services

- 8.2.1. Solutions

- 8.3. Market Analysis, Insights and Forecast - by Deployment

- 8.3.1. On-cloud

- 8.3.2. On-premise

- 8.4. Market Analysis, Insights and Forecast - by Organization Size

- 8.4.1. Small and Medium Enterprises

- 8.4.2. Large Enterprises

- 8.1. Market Analysis, Insights and Forecast - by Types of Traders

- 9. Latin America Algorithmic Trading Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Types of Traders

- 9.1.1. Institutional Investors

- 9.1.2. Retail Investors

- 9.1.3. Long-term Traders

- 9.1.4. Short-term Traders

- 9.2. Market Analysis, Insights and Forecast - by Component

- 9.2.1. Solutions

- 9.2.1.1. Platforms

- 9.2.1.2. Software Tools

- 9.2.2. Services

- 9.2.1. Solutions

- 9.3. Market Analysis, Insights and Forecast - by Deployment

- 9.3.1. On-cloud

- 9.3.2. On-premise

- 9.4. Market Analysis, Insights and Forecast - by Organization Size

- 9.4.1. Small and Medium Enterprises

- 9.4.2. Large Enterprises

- 9.1. Market Analysis, Insights and Forecast - by Types of Traders

- 10. Middle East and Africa Algorithmic Trading Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Types of Traders

- 10.1.1. Institutional Investors

- 10.1.2. Retail Investors

- 10.1.3. Long-term Traders

- 10.1.4. Short-term Traders

- 10.2. Market Analysis, Insights and Forecast - by Component

- 10.2.1. Solutions

- 10.2.1.1. Platforms

- 10.2.1.2. Software Tools

- 10.2.2. Services

- 10.2.1. Solutions

- 10.3. Market Analysis, Insights and Forecast - by Deployment

- 10.3.1. On-cloud

- 10.3.2. On-premise

- 10.4. Market Analysis, Insights and Forecast - by Organization Size

- 10.4.1. Small and Medium Enterprises

- 10.4.2. Large Enterprises

- 10.1. Market Analysis, Insights and Forecast - by Types of Traders

- 11. North America Algorithmic Trading Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Algorithmic Trading Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Algorithmic Trading Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Algorithmic Trading Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Algorithmic Trading Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Algo Trader AG*List Not Exhaustive

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 IG Group

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Jump Trading LLC

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Refinitiv Ltd

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Kuberre Systems Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 MetaQuotes Software Corp

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 63 Moons Technologies Limited

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 ARGO SE

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Thomson Reuters

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Symphony Fintech Solutions Pvt Ltd

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Info Reach Inc

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Virtu Financial Inc

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.1 Algo Trader AG*List Not Exhaustive

List of Figures

- Figure 1: Global Algorithmic Trading Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Algorithmic Trading Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Algorithmic Trading Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Algorithmic Trading Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Algorithmic Trading Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Algorithmic Trading Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Algorithmic Trading Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Algorithmic Trading Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Algorithmic Trading Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Algorithmic Trading Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Algorithmic Trading Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Algorithmic Trading Market Revenue (Million), by Types of Traders 2024 & 2032

- Figure 13: North America Algorithmic Trading Market Revenue Share (%), by Types of Traders 2024 & 2032

- Figure 14: North America Algorithmic Trading Market Revenue (Million), by Component 2024 & 2032

- Figure 15: North America Algorithmic Trading Market Revenue Share (%), by Component 2024 & 2032

- Figure 16: North America Algorithmic Trading Market Revenue (Million), by Deployment 2024 & 2032

- Figure 17: North America Algorithmic Trading Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 18: North America Algorithmic Trading Market Revenue (Million), by Organization Size 2024 & 2032

- Figure 19: North America Algorithmic Trading Market Revenue Share (%), by Organization Size 2024 & 2032

- Figure 20: North America Algorithmic Trading Market Revenue (Million), by Country 2024 & 2032

- Figure 21: North America Algorithmic Trading Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Europe Algorithmic Trading Market Revenue (Million), by Types of Traders 2024 & 2032

- Figure 23: Europe Algorithmic Trading Market Revenue Share (%), by Types of Traders 2024 & 2032

- Figure 24: Europe Algorithmic Trading Market Revenue (Million), by Component 2024 & 2032

- Figure 25: Europe Algorithmic Trading Market Revenue Share (%), by Component 2024 & 2032

- Figure 26: Europe Algorithmic Trading Market Revenue (Million), by Deployment 2024 & 2032

- Figure 27: Europe Algorithmic Trading Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 28: Europe Algorithmic Trading Market Revenue (Million), by Organization Size 2024 & 2032

- Figure 29: Europe Algorithmic Trading Market Revenue Share (%), by Organization Size 2024 & 2032

- Figure 30: Europe Algorithmic Trading Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Europe Algorithmic Trading Market Revenue Share (%), by Country 2024 & 2032

- Figure 32: Asia Pacific Algorithmic Trading Market Revenue (Million), by Types of Traders 2024 & 2032

- Figure 33: Asia Pacific Algorithmic Trading Market Revenue Share (%), by Types of Traders 2024 & 2032

- Figure 34: Asia Pacific Algorithmic Trading Market Revenue (Million), by Component 2024 & 2032

- Figure 35: Asia Pacific Algorithmic Trading Market Revenue Share (%), by Component 2024 & 2032

- Figure 36: Asia Pacific Algorithmic Trading Market Revenue (Million), by Deployment 2024 & 2032

- Figure 37: Asia Pacific Algorithmic Trading Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 38: Asia Pacific Algorithmic Trading Market Revenue (Million), by Organization Size 2024 & 2032

- Figure 39: Asia Pacific Algorithmic Trading Market Revenue Share (%), by Organization Size 2024 & 2032

- Figure 40: Asia Pacific Algorithmic Trading Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Asia Pacific Algorithmic Trading Market Revenue Share (%), by Country 2024 & 2032

- Figure 42: Latin America Algorithmic Trading Market Revenue (Million), by Types of Traders 2024 & 2032

- Figure 43: Latin America Algorithmic Trading Market Revenue Share (%), by Types of Traders 2024 & 2032

- Figure 44: Latin America Algorithmic Trading Market Revenue (Million), by Component 2024 & 2032

- Figure 45: Latin America Algorithmic Trading Market Revenue Share (%), by Component 2024 & 2032

- Figure 46: Latin America Algorithmic Trading Market Revenue (Million), by Deployment 2024 & 2032

- Figure 47: Latin America Algorithmic Trading Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 48: Latin America Algorithmic Trading Market Revenue (Million), by Organization Size 2024 & 2032

- Figure 49: Latin America Algorithmic Trading Market Revenue Share (%), by Organization Size 2024 & 2032

- Figure 50: Latin America Algorithmic Trading Market Revenue (Million), by Country 2024 & 2032

- Figure 51: Latin America Algorithmic Trading Market Revenue Share (%), by Country 2024 & 2032

- Figure 52: Middle East and Africa Algorithmic Trading Market Revenue (Million), by Types of Traders 2024 & 2032

- Figure 53: Middle East and Africa Algorithmic Trading Market Revenue Share (%), by Types of Traders 2024 & 2032

- Figure 54: Middle East and Africa Algorithmic Trading Market Revenue (Million), by Component 2024 & 2032

- Figure 55: Middle East and Africa Algorithmic Trading Market Revenue Share (%), by Component 2024 & 2032

- Figure 56: Middle East and Africa Algorithmic Trading Market Revenue (Million), by Deployment 2024 & 2032

- Figure 57: Middle East and Africa Algorithmic Trading Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 58: Middle East and Africa Algorithmic Trading Market Revenue (Million), by Organization Size 2024 & 2032

- Figure 59: Middle East and Africa Algorithmic Trading Market Revenue Share (%), by Organization Size 2024 & 2032

- Figure 60: Middle East and Africa Algorithmic Trading Market Revenue (Million), by Country 2024 & 2032

- Figure 61: Middle East and Africa Algorithmic Trading Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Algorithmic Trading Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Algorithmic Trading Market Revenue Million Forecast, by Types of Traders 2019 & 2032

- Table 3: Global Algorithmic Trading Market Revenue Million Forecast, by Component 2019 & 2032

- Table 4: Global Algorithmic Trading Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 5: Global Algorithmic Trading Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 6: Global Algorithmic Trading Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Global Algorithmic Trading Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Algorithmic Trading Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Algorithmic Trading Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Algorithmic Trading Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Algorithmic Trading Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Algorithmic Trading Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Algorithmic Trading Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Algorithmic Trading Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Algorithmic Trading Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Algorithmic Trading Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Algorithmic Trading Market Revenue Million Forecast, by Types of Traders 2019 & 2032

- Table 18: Global Algorithmic Trading Market Revenue Million Forecast, by Component 2019 & 2032

- Table 19: Global Algorithmic Trading Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 20: Global Algorithmic Trading Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 21: Global Algorithmic Trading Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Algorithmic Trading Market Revenue Million Forecast, by Types of Traders 2019 & 2032

- Table 23: Global Algorithmic Trading Market Revenue Million Forecast, by Component 2019 & 2032

- Table 24: Global Algorithmic Trading Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 25: Global Algorithmic Trading Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 26: Global Algorithmic Trading Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Global Algorithmic Trading Market Revenue Million Forecast, by Types of Traders 2019 & 2032

- Table 28: Global Algorithmic Trading Market Revenue Million Forecast, by Component 2019 & 2032

- Table 29: Global Algorithmic Trading Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 30: Global Algorithmic Trading Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 31: Global Algorithmic Trading Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global Algorithmic Trading Market Revenue Million Forecast, by Types of Traders 2019 & 2032

- Table 33: Global Algorithmic Trading Market Revenue Million Forecast, by Component 2019 & 2032

- Table 34: Global Algorithmic Trading Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 35: Global Algorithmic Trading Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 36: Global Algorithmic Trading Market Revenue Million Forecast, by Country 2019 & 2032

- Table 37: Global Algorithmic Trading Market Revenue Million Forecast, by Types of Traders 2019 & 2032

- Table 38: Global Algorithmic Trading Market Revenue Million Forecast, by Component 2019 & 2032

- Table 39: Global Algorithmic Trading Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 40: Global Algorithmic Trading Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 41: Global Algorithmic Trading Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Algorithmic Trading Market?

The projected CAGR is approximately 8.53%.

2. Which companies are prominent players in the Algorithmic Trading Market?

Key companies in the market include Algo Trader AG*List Not Exhaustive, IG Group, Jump Trading LLC, Refinitiv Ltd, Kuberre Systems Inc, MetaQuotes Software Corp, 63 Moons Technologies Limited, ARGO SE, Thomson Reuters, Symphony Fintech Solutions Pvt Ltd, Info Reach Inc, Virtu Financial Inc.

3. What are the main segments of the Algorithmic Trading Market?

The market segments include Types of Traders, Component, Deployment, Organization Size.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Fast. Reliable. and Effective Order Execution; Growing Demand for Market Surveillance Augmented by Reduced Transaction Costs.

6. What are the notable trends driving market growth?

On-cloud Deployment Segment is expected to drive the Market Growth.

7. Are there any restraints impacting market growth?

Instant Loss of Liquidity.

8. Can you provide examples of recent developments in the market?

June 2023: DoubleVerify, one of the leading software platforms for digital media measurement, data, and analytics, announced the launch of DV Algorithmic Optimizer, an advanced measure and optimization offering with Scibids, one of the global leaders in artificial intelligence (AI) for digital marketing. The combination of DV's proprietary attention signals and Scibids' AI-powered ad decisioning enables advertisers to identify the performing inventory that maximizes business outcomes and advertising ROI without sacrificing scale.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Algorithmic Trading Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Algorithmic Trading Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Algorithmic Trading Market?

To stay informed about further developments, trends, and reports in the Algorithmic Trading Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence