Key Insights

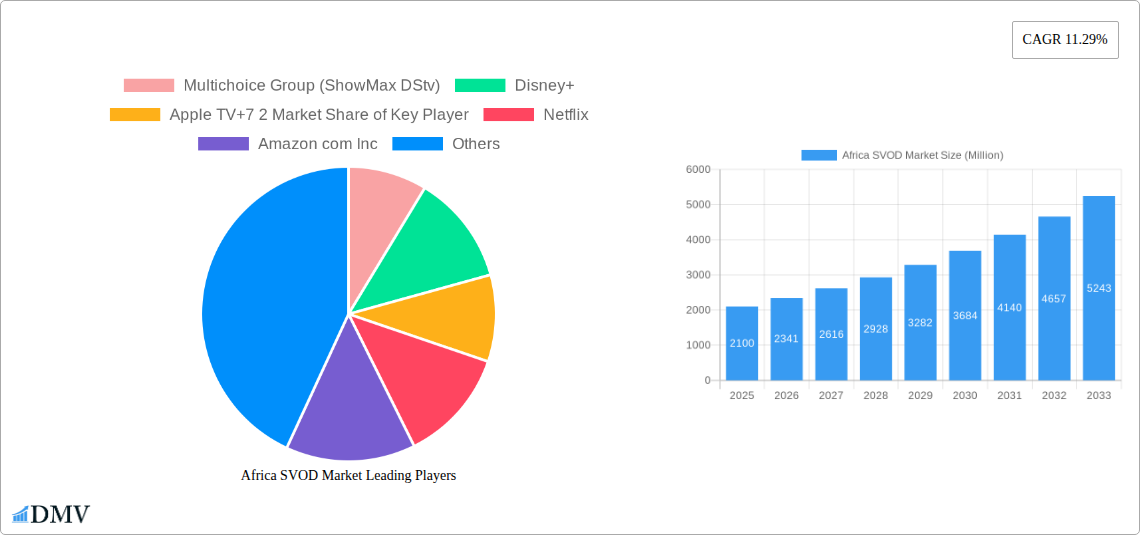

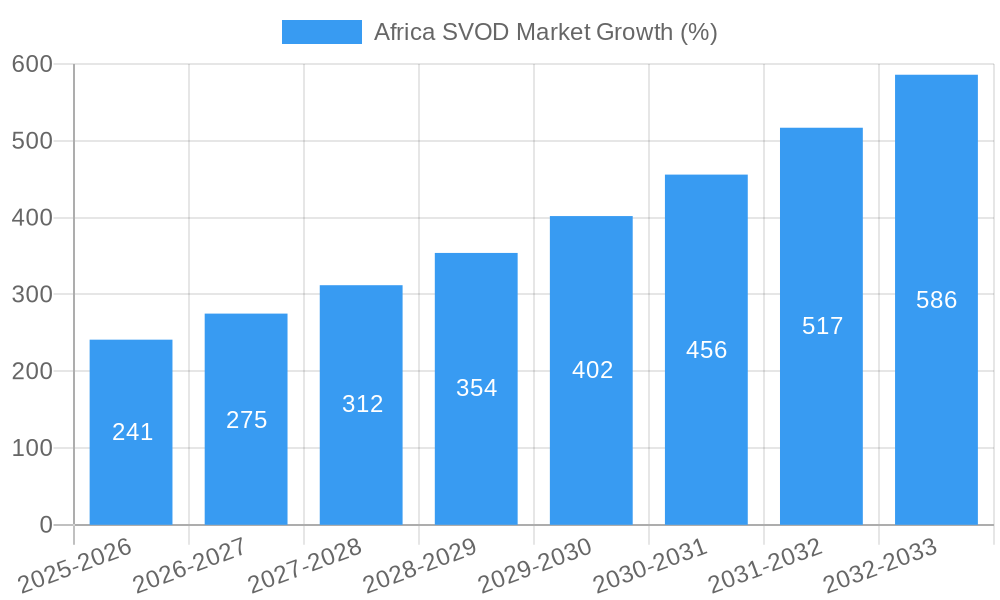

The African Subscription Video on Demand (SVOD) market is experiencing robust growth, projected to reach $2.10 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 11.29% from 2025 to 2033. This expansion is driven by increasing smartphone penetration, affordable data plans, and a rising young population with a high appetite for digital entertainment. The prevalence of mobile-first consumption further fuels this growth, making SVOD services accessible even in areas with limited broadband infrastructure. Key players like Netflix, Amazon Prime Video, ShowMax, and Disney+ are vying for market share, offering diverse content tailored to local preferences. However, challenges remain, including inconsistent internet connectivity in certain regions and affordability concerns, particularly in lower-income segments. The market is segmented by forecasting type (short, medium, and long-range) and end-user (transportation, aviation, energy, BFSI, agriculture, and others), reflecting diverse applications beyond pure entertainment. Growth will likely be concentrated in key markets like South Africa, Kenya, and Nigeria, driven by higher disposable incomes and greater digital literacy. Future expansion will depend on continued investment in infrastructure, the creation of localized content, and the development of flexible subscription models to cater to the diverse economic landscape of Africa.

The long-range forecasting segment is expected to see significant growth due to increased investment in infrastructure development and the need for long-term strategic planning by businesses and governments. The BFSI sector is likely to be a major driver, employing SVOD for training, internal communications, and customer engagement. The dominance of certain players is anticipated to continue, though new entrants and the potential emergence of niche platforms offering hyper-localized content will present ongoing competitive challenges. Successfully navigating these challenges and capitalizing on the market's potential will require a combination of strategic content acquisition, effective marketing tailored to local audiences, and the development of robust technical solutions to address the infrastructural limitations prevalent in certain regions. The market’s success will ultimately hinge on delivering a high-quality, affordable, and accessible entertainment experience to a diverse and growing consumer base.

Africa SVOD Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the dynamic African SVOD market, offering crucial data and forecasts for stakeholders seeking to understand and capitalize on its growth potential. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. We delve into market composition, key players, technological advancements, and future opportunities, providing a comprehensive overview for informed decision-making. The report utilizes a combination of qualitative and quantitative data to deliver a complete picture of this expanding market, valued at xx Million in 2025 and projected to reach xx Million by 2033.

Africa SVOD Market Market Composition & Trends

The African SVOD market is characterized by a diverse landscape of established players and emerging entrants. Market concentration is moderate, with key players like Multichoice Group (ShowMax DStv), Netflix, Amazon.com Inc, Disney+, Apple TV+, and VideoPlay holding significant shares, although the exact distribution remains dynamic. Innovation is driven by the demand for localized content, improved streaming quality, and affordable subscription models. Regulatory landscapes vary across African nations, influencing market access and content regulations. Substitute products, including traditional television and free-to-air broadcasting, still hold relevance, though the SVOD market is progressively gaining traction. End-users are increasingly diverse, spanning various demographics and income levels. M&A activity has been observed, with deal values ranging from xx Million to xx Million, reflecting a consolidation trend within the sector.

- Market Share Distribution (2025): Multichoice Group (ShowMax DStv): xx%; Netflix: xx%; Amazon.com Inc: xx%; Disney+: xx%; Apple TV+: xx%; VideoPlay: xx%; Others: xx%

- M&A Deal Value (2019-2024): Total value estimated at xx Million.

- Key Innovation Catalysts: Localized content creation, technological advancements in streaming infrastructure, and flexible subscription options.

- Regulatory Landscape: Varies significantly across countries, impacting content licensing and market access.

Africa SVOD Market Industry Evolution

The African SVOD market has witnessed remarkable growth since 2019, fueled by increasing internet penetration, smartphone adoption, and a growing appetite for on-demand entertainment. The market experienced a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024), and this growth trajectory is expected to continue, albeit at a potentially moderated pace, during the forecast period (2025-2033). This moderation may be attributed to market saturation in certain regions, increased competition, and economic fluctuations. Technological advancements, including improved streaming technologies (e.g., 4K, HDR) and the adoption of mobile-first strategies, are pivotal in driving market evolution. Shifting consumer demands, particularly for localized and culturally relevant content, are shaping platform strategies. The increased use of mobile devices for streaming is changing the viewer experience. The adoption rate of SVOD services has increased significantly with xx% of households now subscribing compared to xx% in 2019.

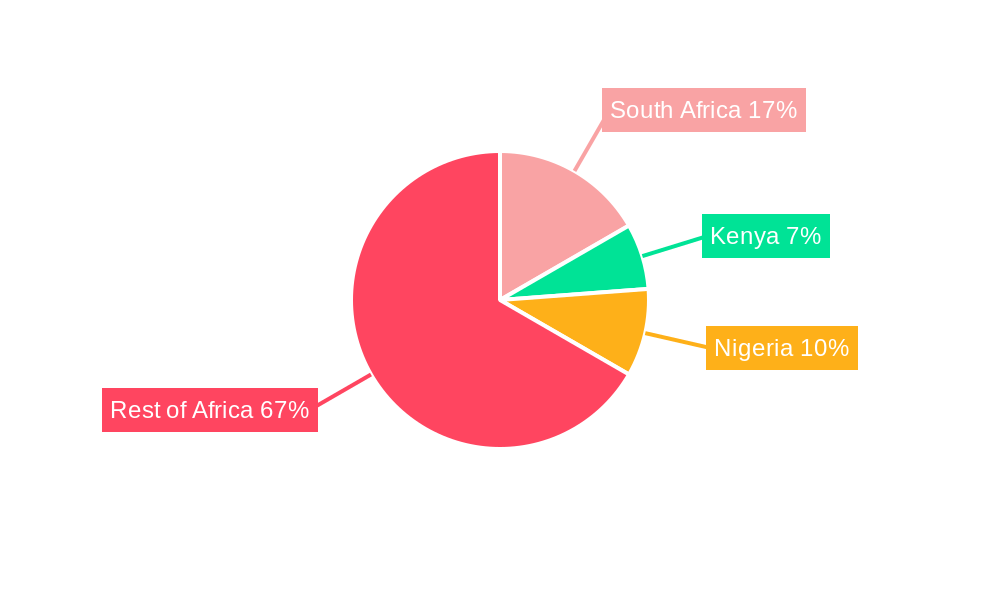

Leading Regions, Countries, or Segments in Africa SVOD Market

While the entire African continent presents opportunities, certain regions and segments demonstrate faster growth. South Africa, Nigeria, and Kenya are currently leading in terms of SVOD subscription penetration and revenue generation. Within forecasting types, medium-range forecasting (1-5 years) currently dominates the market due to the need for both short-term agility and longer-term strategic planning. In terms of end-users, the BFSI sector shows high adoption, driven by corporate entertainment and employee engagement initiatives.

- Key Drivers in South Africa: High internet penetration, established digital infrastructure, and strong local production of content.

- Key Drivers in Nigeria: Large population, increasing disposable income, and a thriving Nollywood film industry.

- Key Drivers in Kenya: Rising smartphone penetration and increasing mobile data consumption.

- Dominant Forecasting Type: Medium-range forecasting, owing to the balance between short-term responsiveness and long-term planning.

- Leading End-User Segment: Banking, Financial Services, and Insurance (BFSI), driven by corporate adoption of entertainment and employee engagement tools. The Others segment shows potential for significant growth in the coming years.

Africa SVOD Market Product Innovations

Recent innovations include enhanced personalization algorithms, improved user interfaces, and the integration of interactive features. Platforms are also focusing on producing original African content, often in local languages, to cater to the diverse audience. These advancements aim to enhance user experience, boost engagement, and create unique selling propositions, fostering customer loyalty and driving growth within this competitive market.

Propelling Factors for Africa SVOD Market Growth

Technological advancements like improved mobile network infrastructure and affordable smartphones are pivotal in driving market expansion. Economic factors such as rising disposable incomes and increased urbanization contribute to higher subscription rates. Favorable regulatory environments, promoting local content creation and investment in digital infrastructure, support industry growth.

Obstacles in the Africa SVOD Market Market

High costs associated with data consumption, particularly in regions with limited internet infrastructure, can hinder growth. Regulatory hurdles and content licensing complexities, which vary significantly across different African countries, pose challenges. Intense competition among various SVOD platforms, along with the continued appeal of free-to-air options, exerts pressure on market share and profitability.

Future Opportunities in Africa SVOD Market

Untapped markets in less-penetrated regions of Africa, coupled with the potential for increased adoption in existing markets, hold significant potential. The integration of new technologies such as 5G, enhanced personalization options and expanding into the gaming space, represent further growth opportunities. The focus on localized content and collaborations with local creators is set to enhance user engagement.

Major Players in the Africa SVOD Market Ecosystem

- Multichoice Group (ShowMax DStv)

- Disney+

- Apple TV+

- Netflix

- Amazon.com Inc

- VideoPlay

Key Developments in Africa SVOD Market Industry

- February 2023: Amazon Prime Video announced a multi-picture licensing arrangement with South Africa's Known Associates, adding over 20 South African films to its platform, boosting its local content library and market presence.

- August 2022: Netflix announced a slate of new African originals, further highlighting its commitment to investing in and showcasing local talent and stories. This reinforces Netflix's competitive advantage within the market.

Strategic Africa SVOD Market Market Forecast

The African SVOD market is poised for sustained growth, driven by increasing smartphone adoption, improving internet infrastructure, and the rising demand for localized content. The focus on original productions, strategic partnerships, and innovative subscription models will continue to shape market dynamics. The long-term outlook remains optimistic, with substantial opportunities for both established and emerging players to capitalize on this expanding market.

Africa SVOD Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Africa SVOD Market Segmentation By Geography

- 1. Kenya

- 2. South Africa

- 3. Nigeria

Africa SVOD Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.29% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Intensification of Competition as Several Global Players Enter the Market to capture the Nascent audience; Enticing Marketing Strategies like Free Mobile Plans

- 3.2.2 Regional Partnerships

- 3.2.3 etc. are anticipated to aid the Long Time Growth of Market

- 3.3. Market Restrains

- 3.3.1. Higher Pricing Plans act as a Barrier for Adoption

- 3.4. Market Trends

- 3.4.1. Drama Genre is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa SVOD Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Kenya

- 5.6.2. South Africa

- 5.6.3. Nigeria

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Kenya Africa SVOD Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South Africa Africa SVOD Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Nigeria Africa SVOD Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. South Africa Africa SVOD Market Analysis, Insights and Forecast, 2019-2031

- 10. Sudan Africa SVOD Market Analysis, Insights and Forecast, 2019-2031

- 11. Uganda Africa SVOD Market Analysis, Insights and Forecast, 2019-2031

- 12. Tanzania Africa SVOD Market Analysis, Insights and Forecast, 2019-2031

- 13. Kenya Africa SVOD Market Analysis, Insights and Forecast, 2019-2031

- 14. Rest of Africa Africa SVOD Market Analysis, Insights and Forecast, 2019-2031

- 15. Competitive Analysis

- 15.1. Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 Multichoice Group (ShowMax DStv)

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Disney+

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 Apple TV+7 2 Market Share of Key Player

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 Netflix

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 Amazon com Inc

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 VideoPlay

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.1 Multichoice Group (ShowMax DStv)

List of Figures

- Figure 1: Africa SVOD Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa SVOD Market Share (%) by Company 2024

List of Tables

- Table 1: Africa SVOD Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa SVOD Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Africa SVOD Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Africa SVOD Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Africa SVOD Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Africa SVOD Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Africa SVOD Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Africa SVOD Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: South Africa Africa SVOD Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Sudan Africa SVOD Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Uganda Africa SVOD Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Tanzania Africa SVOD Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Kenya Africa SVOD Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Africa Africa SVOD Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Africa SVOD Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 16: Africa SVOD Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 17: Africa SVOD Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 18: Africa SVOD Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 19: Africa SVOD Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 20: Africa SVOD Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Africa SVOD Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 22: Africa SVOD Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 23: Africa SVOD Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 24: Africa SVOD Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 25: Africa SVOD Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 26: Africa SVOD Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Africa SVOD Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 28: Africa SVOD Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 29: Africa SVOD Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 30: Africa SVOD Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 31: Africa SVOD Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 32: Africa SVOD Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa SVOD Market?

The projected CAGR is approximately 11.29%.

2. Which companies are prominent players in the Africa SVOD Market?

Key companies in the market include Multichoice Group (ShowMax DStv), Disney+, Apple TV+7 2 Market Share of Key Player, Netflix, Amazon com Inc, VideoPlay.

3. What are the main segments of the Africa SVOD Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.10 Million as of 2022.

5. What are some drivers contributing to market growth?

Intensification of Competition as Several Global Players Enter the Market to capture the Nascent audience; Enticing Marketing Strategies like Free Mobile Plans. Regional Partnerships. etc. are anticipated to aid the Long Time Growth of Market.

6. What are the notable trends driving market growth?

Drama Genre is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

Higher Pricing Plans act as a Barrier for Adoption.

8. Can you provide examples of recent developments in the market?

February 2023: Amazon Prime Video announced a multi-picture licensing arrangement with South Africa's Known Associates, the parent company of Johannesburg-based Known Associates Entertainment (KAE) and Cape Town-based Moonlighting Films, during the Joburg Film Festival on Thursday. Over 20 South African feature films, including Zane Meas' "Klip Anker Baai," Marvin-Lee Beukes' "Tickets," Jahmil Qubeka's "You Are My Favourite Place," and Norman Maake's "Piet's Sake 2," will be available exclusively on Prime Video.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa SVOD Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa SVOD Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa SVOD Market?

To stay informed about further developments, trends, and reports in the Africa SVOD Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence