Key Insights

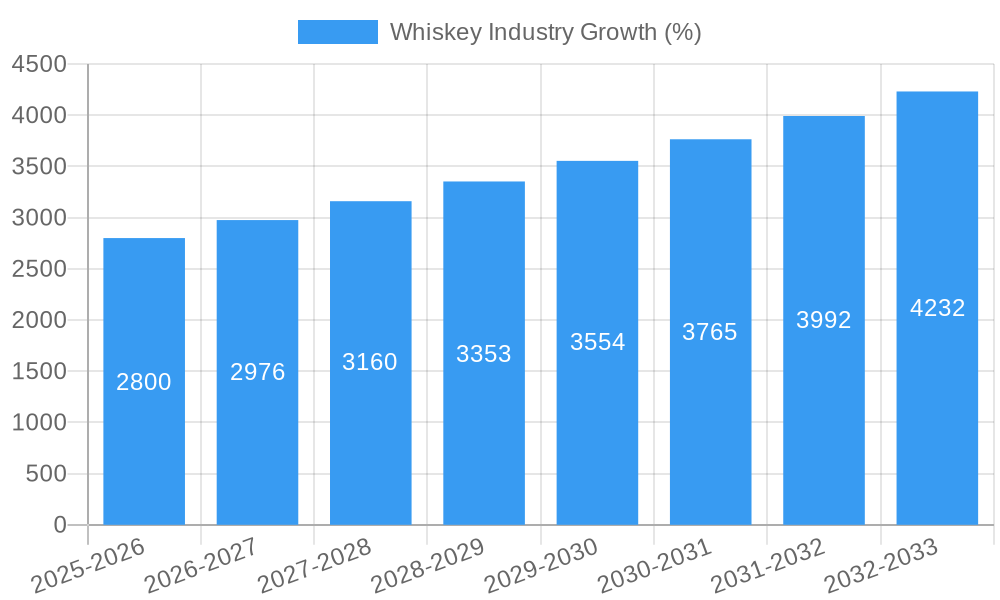

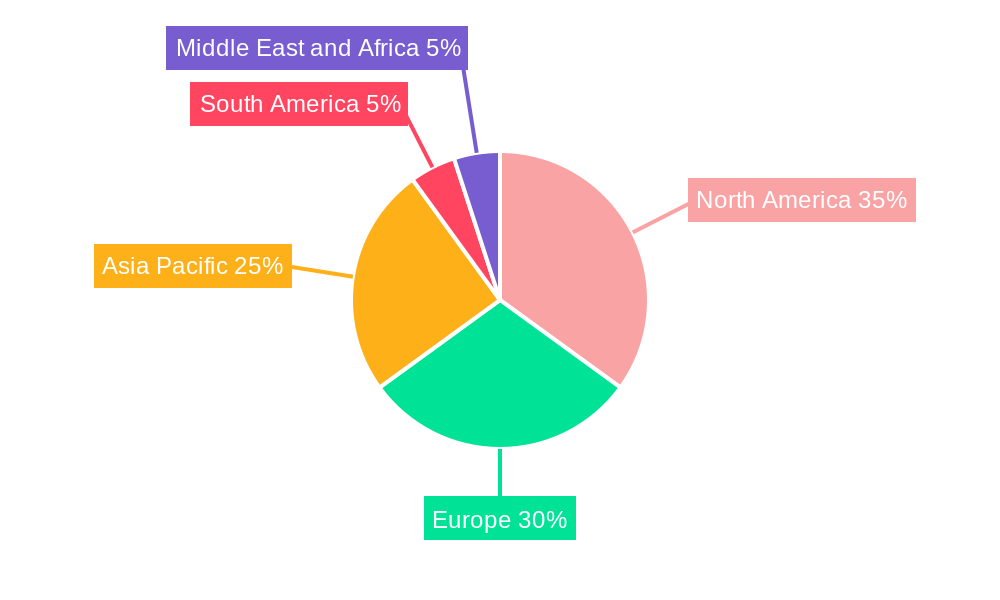

The global whiskey market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 5.60% from 2025 to 2033. This expansion is fueled by several key drivers. The rising disposable incomes in developing economies, coupled with a growing preference for premium spirits among millennials and Gen Z, significantly boosts demand. Furthermore, increasing tourism and the expanding global distribution networks facilitate market penetration. Strategic marketing campaigns emphasizing whiskey's heritage and craftsmanship, along with the emergence of innovative product variations like flavored whiskeys and ready-to-drink cocktails, further contribute to market growth. However, stringent regulations on alcohol consumption in certain regions and the potential impact of health concerns regarding excessive alcohol intake pose challenges to market expansion. The market is segmented by product type (American, Irish, Scotch, Canadian, and others) and distribution channel (on-trade and off-trade), with Scotch whisky currently holding a dominant market share. Competition is fierce, with major players like Diageo, Pernod Ricard, and Brown-Forman vying for market leadership through product innovation, brand building, and strategic acquisitions. Regional variations in consumption patterns exist, with North America and Europe representing significant market segments, while Asia-Pacific shows considerable growth potential.

The forecast for the whiskey market through 2033 indicates sustained growth, although the pace may slightly fluctuate depending on economic conditions and evolving consumer preferences. The premiumization trend is expected to persist, with higher-priced, single-malt and small-batch whiskeys driving significant revenue growth. The on-trade segment, encompassing bars and restaurants, is anticipated to recover strongly post-pandemic, contributing to market expansion. Meanwhile, the off-trade segment (retail stores) will continue to benefit from the convenience and increasing availability of whiskey in diverse formats and price points. Companies will likely focus on expanding their product portfolios to cater to evolving consumer tastes, while also investing in sustainable and responsible production practices to address growing environmental concerns. The continued rise of e-commerce is also anticipated to reshape the distribution landscape.

Whiskey Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the global whiskey industry, encompassing market trends, competitive dynamics, and future growth prospects from 2019 to 2033. Valued at $XX Million in 2025, the market is poised for significant expansion, driven by factors such as evolving consumer preferences and technological advancements. This report is an indispensable resource for stakeholders seeking insights into this dynamic sector.

Whiskey Industry Market Composition & Trends

This section offers a deep dive into the market's competitive landscape, evaluating market concentration, innovation drivers, regulatory changes, substitute products, end-user behavior, and mergers & acquisitions (M&A) activity within the $XX Million whiskey market.

- Market Concentration: The global whiskey market exhibits moderate concentration, with key players like Diageo PLC, Pernod Ricard SA, and Brown-Forman Corporation holding significant market share. Precise figures for market share distribution will be detailed in the full report.

- Innovation Catalysts: Premiumization, craft distilling, and innovative flavor profiles are key drivers of market innovation. The rise of single malt and unique flavor combinations fuels competition.

- Regulatory Landscape: Varying regulations across different countries influence production, distribution, and marketing, creating both opportunities and challenges. A detailed analysis of specific regulations by region will be provided.

- Substitute Products: While whiskey holds its own, competition from other alcoholic beverages including craft beers, spirits, and ready-to-drink cocktails requires constant innovation.

- End-User Profiles: The report examines changing consumer preferences, targeting key demographics, and the growing demand for premium and ethically sourced whiskey.

- M&A Activity: The report analyzes recent mergers and acquisitions, such as those involving Diageo India, providing insights into deal values (totalling $XX Million in the past five years, estimated) and their impact on market dynamics.

Whiskey Industry Industry Evolution

This section analyzes the evolution of the whiskey industry ($XX Million market in 2025), tracing its growth trajectory from 2019 to 2033. It examines technological advancements, shifts in consumer demands, and the resulting impact on market share. The historical period (2019-2024) reveals a Compound Annual Growth Rate (CAGR) of XX%, with the forecast period (2025-2033) projecting a CAGR of XX%, reaching a market valuation of $XX Million by 2033. This growth is fueled by factors such as increasing disposable incomes in emerging markets, a rise in preference for premium spirits, and the growing popularity of whiskey-based cocktails. Technological advancements in distilling techniques and quality control contribute to consistent product improvement.

Leading Regions, Countries, or Segments in Whiskey Industry

This section identifies the leading regions, countries, and segments within the $XX Million whiskey market.

- Product Type: Scotch Whisky remains the dominant product type, owing to its established reputation and global presence. American whiskey, driven by bourbon's increasing popularity, is showing rapid growth, while Irish and Canadian whiskey maintain stable but smaller market shares. "Other Product Types" represent a niche market with potential for future expansion.

- Distribution Channel: The off-trade channel (retail sales) holds the largest share due to increased accessibility, while the on-trade (restaurants and bars) remains a significant segment, especially for premium whiskey experiences.

The dominance of specific regions and countries is driven by various factors, including production costs, consumer preference, historical factors, and trade agreements. These factors will be thoroughly detailed in the full report.

Whiskey Industry Product Innovations

Recent years have witnessed significant product innovation within the whiskey industry, with a focus on unique flavor profiles, limited-edition releases, and sustainable production methods. For instance, William Grant & Sons' Glenfiddich travel retail exclusive range exemplifies this trend. Other key innovations include the incorporation of new barrel types, finishing techniques, and the rise of non-traditional whiskey styles (e.g., flavored whiskeys) catering to evolving consumer preferences. This results in a richer and more diversified product offering.

Propelling Factors for Whiskey Industry Growth

The growth of the whiskey industry is fueled by several key factors:

- Rising Disposable Incomes: Increased affluence in emerging markets translates to higher spending on premium alcoholic beverages.

- Changing Consumer Preferences: The shift towards premiumization, fueled by the demand for unique and sophisticated tasting notes, elevates the value of the whiskey market.

- Favorable Regulatory Environment: Supportive government policies in key markets facilitate industry growth.

Obstacles in the Whiskey Industry Market

The whiskey industry faces several challenges, including:

- Supply Chain Disruptions: Global events (e.g., pandemics, geopolitical instability) can disrupt the supply chain, impacting production and distribution.

- Intense Competition: The industry is highly competitive, with major players vying for market share, requiring innovation and branding to stand out.

- Regulatory hurdles: Strict regulations concerning alcohol production, labeling, and distribution impose constraints on market expansion.

Future Opportunities in Whiskey Industry

The whiskey market presents several opportunities for future growth:

- Expansion in Emerging Markets: Untapped potential in developing nations with growing middle classes offers significant growth opportunities.

- E-commerce Growth: Online sales are expected to increase, requiring adaptation to digital distribution.

- Sustainable Production: Consumer demand for environmentally friendly practices creates opportunities for sustainable distilling techniques.

Major Players in the Whiskey Industry Ecosystem

- Pernod Ricard SA

- Kirin Holdings Company Limited (Fuji Gotemba)

- Asahi Group Holdings Ltd

- Bacardi Limited

- The Brown Forman Corporation

- Whyte & Mackay

- The Edrington Group

- William Grant & Sons Ltd

- Suntory Beverage & Food Ltd

- Diageo PLC

Key Developments in Whiskey Industry Industry

- August 2021: Pernod Ricard S.A. launched "The Chuan Whiskey," a brand deeply rooted in Chinese culture.

- March 2022: Diageo India introduced Godawan Single Malt, expanding its Indian portfolio.

- October 2022: William Grant & Sons launched a travel retail exclusive Glenfiddich range (Vat 01-04 with varying ABV percentages).

These developments highlight the industry's ongoing innovation and expansion into new markets.

Strategic Whiskey Industry Market Forecast

The whiskey industry's future growth is promising. Continued premiumization, expansion into new markets, and strategic product innovations are key catalysts. The forecast period (2025-2033) anticipates robust growth, with a projected market value exceeding $XX Million by 2033. Emerging markets and the increasing popularity of craft whiskeys present exciting opportunities for both established players and new entrants.

Whiskey Industry Segmentation

-

1. Product Type

- 1.1. American Whisky

- 1.2. Irish Whisky

- 1.3. Scotch Whisky

- 1.4. Canadian Whisky

- 1.5. Other Product Types

-

2. Distribution Channel

- 2.1. On-trade

- 2.2. Off-trade

Whiskey Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Spain

- 2.2. United Kingdom

- 2.3. Germany

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Whiskey Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Flavored Spirits; Growing Consumption of Premium Alcoholic Beverages

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations Pertaining to Spirits

- 3.4. Market Trends

- 3.4.1. Growing Consumers Preferences Toward Brand Ownership

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Whiskey Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. American Whisky

- 5.1.2. Irish Whisky

- 5.1.3. Scotch Whisky

- 5.1.4. Canadian Whisky

- 5.1.5. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-trade

- 5.2.2. Off-trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Whiskey Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. American Whisky

- 6.1.2. Irish Whisky

- 6.1.3. Scotch Whisky

- 6.1.4. Canadian Whisky

- 6.1.5. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. On-trade

- 6.2.2. Off-trade

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Whiskey Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. American Whisky

- 7.1.2. Irish Whisky

- 7.1.3. Scotch Whisky

- 7.1.4. Canadian Whisky

- 7.1.5. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. On-trade

- 7.2.2. Off-trade

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Whiskey Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. American Whisky

- 8.1.2. Irish Whisky

- 8.1.3. Scotch Whisky

- 8.1.4. Canadian Whisky

- 8.1.5. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. On-trade

- 8.2.2. Off-trade

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Whiskey Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. American Whisky

- 9.1.2. Irish Whisky

- 9.1.3. Scotch Whisky

- 9.1.4. Canadian Whisky

- 9.1.5. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. On-trade

- 9.2.2. Off-trade

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Whiskey Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. American Whisky

- 10.1.2. Irish Whisky

- 10.1.3. Scotch Whisky

- 10.1.4. Canadian Whisky

- 10.1.5. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. On-trade

- 10.2.2. Off-trade

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. North America Whiskey Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 11.1.4 Rest of North America

- 12. Europe Whiskey Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Spain

- 12.1.2 United Kingdom

- 12.1.3 Germany

- 12.1.4 France

- 12.1.5 Italy

- 12.1.6 Russia

- 12.1.7 Rest of Europe

- 13. Asia Pacific Whiskey Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 Rest of Asia Pacific

- 14. South America Whiskey Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Rest of South America

- 15. Middle East and Africa Whiskey Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 South Africa

- 15.1.2 Saudi Arabia

- 15.1.3 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Pernod Ricard SA

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Kirin Holdings Company Limited (Fuji Gotemba)*List Not Exhaustive

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Asahi Group Holdings Ltd

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Bacardi Limited

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 The Brown Forman Corporation

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Whyte & Mackay

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 The Edrington Group

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 William Grant & Sons Ltd

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Suntory Beverage & Food Ltd

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Diageo PLC

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Pernod Ricard SA

List of Figures

- Figure 1: Global Whiskey Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Whiskey Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Whiskey Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Whiskey Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Whiskey Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Whiskey Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Whiskey Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Whiskey Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Whiskey Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Whiskey Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Whiskey Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Whiskey Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 13: North America Whiskey Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 14: North America Whiskey Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 15: North America Whiskey Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 16: North America Whiskey Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Whiskey Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Whiskey Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 19: Europe Whiskey Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 20: Europe Whiskey Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 21: Europe Whiskey Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 22: Europe Whiskey Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Whiskey Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Whiskey Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 25: Asia Pacific Whiskey Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 26: Asia Pacific Whiskey Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 27: Asia Pacific Whiskey Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 28: Asia Pacific Whiskey Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Whiskey Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: South America Whiskey Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 31: South America Whiskey Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 32: South America Whiskey Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 33: South America Whiskey Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 34: South America Whiskey Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: South America Whiskey Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Whiskey Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 37: Middle East and Africa Whiskey Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 38: Middle East and Africa Whiskey Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 39: Middle East and Africa Whiskey Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 40: Middle East and Africa Whiskey Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East and Africa Whiskey Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Whiskey Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Whiskey Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Global Whiskey Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Global Whiskey Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Whiskey Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Whiskey Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Whiskey Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Whiskey Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America Whiskey Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Whiskey Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Spain Whiskey Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Whiskey Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Germany Whiskey Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: France Whiskey Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Italy Whiskey Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Russia Whiskey Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of Europe Whiskey Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Whiskey Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: China Whiskey Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Japan Whiskey Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: India Whiskey Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Australia Whiskey Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of Asia Pacific Whiskey Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Whiskey Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Brazil Whiskey Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Argentina Whiskey Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Rest of South America Whiskey Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Global Whiskey Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 29: South Africa Whiskey Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Saudi Arabia Whiskey Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of Middle East and Africa Whiskey Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Whiskey Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 33: Global Whiskey Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 34: Global Whiskey Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 35: United States Whiskey Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Canada Whiskey Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Mexico Whiskey Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of North America Whiskey Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Whiskey Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 40: Global Whiskey Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 41: Global Whiskey Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Spain Whiskey Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: United Kingdom Whiskey Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Germany Whiskey Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: France Whiskey Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Italy Whiskey Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Russia Whiskey Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Europe Whiskey Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global Whiskey Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 50: Global Whiskey Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 51: Global Whiskey Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 52: China Whiskey Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Japan Whiskey Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: India Whiskey Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Australia Whiskey Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Asia Pacific Whiskey Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Global Whiskey Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 58: Global Whiskey Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 59: Global Whiskey Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 60: Brazil Whiskey Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Argentina Whiskey Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Rest of South America Whiskey Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: Global Whiskey Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 64: Global Whiskey Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 65: Global Whiskey Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 66: South Africa Whiskey Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 67: Saudi Arabia Whiskey Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: Rest of Middle East and Africa Whiskey Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Whiskey Industry?

The projected CAGR is approximately 5.60%.

2. Which companies are prominent players in the Whiskey Industry?

Key companies in the market include Pernod Ricard SA, Kirin Holdings Company Limited (Fuji Gotemba)*List Not Exhaustive, Asahi Group Holdings Ltd, Bacardi Limited, The Brown Forman Corporation, Whyte & Mackay, The Edrington Group, William Grant & Sons Ltd, Suntory Beverage & Food Ltd, Diageo PLC.

3. What are the main segments of the Whiskey Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Flavored Spirits; Growing Consumption of Premium Alcoholic Beverages.

6. What are the notable trends driving market growth?

Growing Consumers Preferences Toward Brand Ownership.

7. Are there any restraints impacting market growth?

Stringent Government Regulations Pertaining to Spirits.

8. Can you provide examples of recent developments in the market?

October 2022: William Grant & Sons launched their travel retail exclusive range of whiskies under its Glenfiddich whisky brand. The range included four exclusive types of whiskies: Vat 01 is 40% ABV, Vat 02 is 43% ABV, Vat 03 is 50.2% ABV, and Vat 04 is 47.8% ABV.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Whiskey Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Whiskey Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Whiskey Industry?

To stay informed about further developments, trends, and reports in the Whiskey Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence