Key Insights

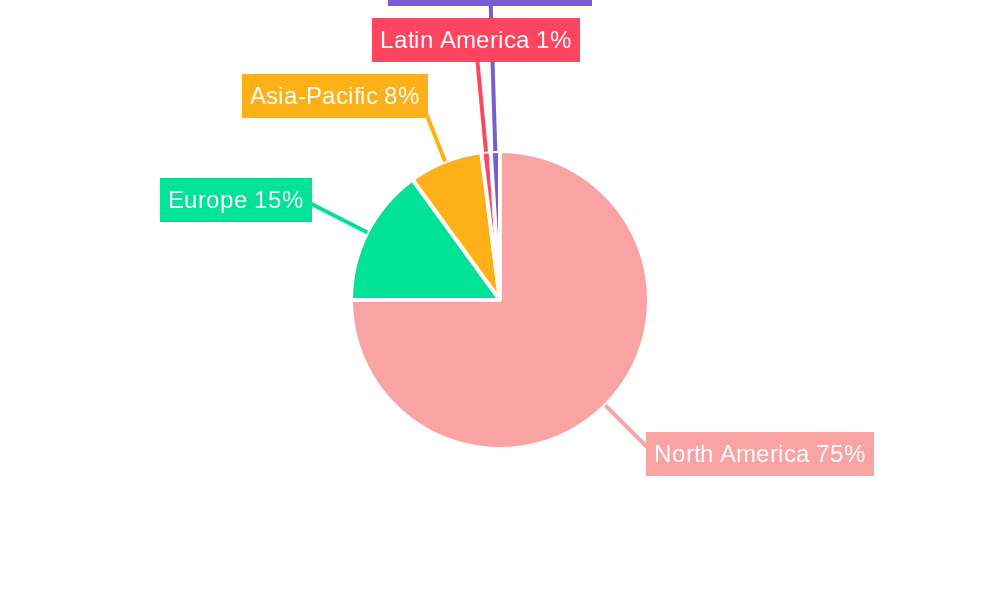

The US energy drink market, a dynamic and rapidly evolving sector, is projected to experience robust growth throughout the forecast period (2025-2033). While precise market size figures for 2025 aren't provided, leveraging the given CAGR of 3.72% and considering the substantial existing market, we can reasonably estimate a 2025 market value of approximately $20 billion. This growth is fueled by several key drivers. The increasing prevalence of busy lifestyles and demanding work schedules contribute to heightened consumer demand for convenient energy boosts. Furthermore, the proliferation of innovative product variations, such as sugar-free, low-calorie, and natural/organic energy drinks, caters to expanding health-conscious consumer preferences. The market segmentation, dominated by traditional energy drinks but exhibiting strong growth in natural and functional options, reflects this evolving demand. Major players like Red Bull, Monster Beverage Corporation, and PepsiCo are aggressively competing through product diversification, marketing initiatives, and strategic acquisitions, shaping the market landscape. The distribution channels—off-trade (retail stores) and on-trade (restaurants, bars)—both contribute significantly to market reach.

However, the market faces certain challenges. While the health-conscious segment is expanding, concerns about the high sugar and caffeine content of traditional energy drinks remain a significant restraint. Regulatory scrutiny regarding ingredients and marketing practices also poses a potential obstacle to growth. Despite these hurdles, the increasing popularity of energy shots, alongside the continued innovation within the natural/organic segment, are expected to mitigate these restraints and propel market expansion. Competition is fierce, necessitating continuous product innovation and effective marketing strategies for brands to maintain their market share. The geographical focus on North America, particularly the United States, with its large and affluent consumer base, ensures a strong foundation for continued market growth. The forecast period suggests that the market will continue its upward trajectory, driven by consumer demand, product innovation, and the strategic maneuvers of key industry players.

This insightful report provides a comprehensive analysis of the US Energy Drink Market, offering a detailed overview of market trends, leading players, and future growth projections. Covering the period from 2019 to 2033, with a focus on 2025, this report is an essential resource for stakeholders seeking to understand and capitalize on the dynamic energy drink landscape. The market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033.

US Energy Drink Market Composition & Trends

This section delves into the competitive dynamics of the US energy drink market, examining market concentration, innovation, regulatory factors, and the influence of mergers and acquisitions (M&A). The market is characterized by a blend of established giants and emerging players, leading to intense competition and continuous innovation.

Market Concentration: The market is moderately concentrated, with key players like Monster Beverage Corporation, PepsiCo Inc, and Red Bull GmbH holding significant market share. However, smaller players and niche brands are also carving out their space, particularly in the natural/organic and low-calorie segments.

Innovation Catalysts: Consumer demand for healthier and functional beverages drives innovation, with new product launches focused on natural ingredients, functional benefits, and diverse flavor profiles. This is evident in the rise of natural/organic energy drinks and the increasing popularity of sugar-free options.

Regulatory Landscape: The regulatory landscape impacts ingredients, labeling requirements, and marketing claims. Changes in regulations can significantly influence market dynamics and product formulation.

Substitute Products: Other functional beverages, such as sports drinks and coffee, compete for consumer preference. The level of competition varies based on product features and target consumers.

End-User Profiles: The primary consumers are young adults and athletes seeking an energy boost. However, the market is expanding to include broader demographics as preferences evolve.

M&A Activities: Recent M&A activity highlights the market's consolidation and the strategic importance of acquiring brands and production capabilities. For instance, Monster Beverage Corporation's acquisition of Bang Energy in July 2023 for approximately USD 362 Million demonstrates the significant investment in this dynamic sector.

- Market Share Distribution (2025): Monster Beverage Corporation (xx%), Red Bull GmbH (xx%), PepsiCo Inc (xx%), Others (xx%)

- M&A Deal Value (2019-2024): xx Million

US Energy Drink Market Industry Evolution

The US energy drink market has witnessed substantial growth over the past decade, driven by several factors including increasing health consciousness, evolving consumer preferences, and technological advancements in product formulation and packaging.

The market experienced a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024), and is projected to maintain a CAGR of xx% throughout the forecast period (2025-2033). Technological advancements, such as improved extraction methods for natural ingredients and innovative packaging solutions (e.g., sustainable and convenient formats), have played a crucial role in shaping market trends.

Shifting consumer demands have also significantly influenced the industry's evolution. The growing awareness of health and wellness has led to an increase in demand for low-calorie, sugar-free, and natural energy drinks. This shift has compelled manufacturers to reformulate their products and introduce new offerings to cater to this growing segment of consumers. In addition, the increasing popularity of energy shots, as a more compact and convenient option has also contributed to the market’s transformation.

Leading Regions, Countries, or Segments in US Energy Drink Market

The US energy drink market displays regional variations in consumption patterns and preferences, with certain segments experiencing faster growth than others. While precise data on regional dominance isn't provided, the following offers insights into potential trends:

Leading Segments:

Packaging Type: Metal cans currently dominate due to their portability, durability, and cost-effectiveness. However, PET bottles are gaining traction due to their lightweight and environmentally friendly attributes. Glass bottles hold a niche market with premium offerings.

Distribution Channel: The off-trade channel (grocery stores, convenience stores, etc.) holds a significant majority of the market share, due to wide consumer reach and accessibility. However, the on-trade segment (restaurants, bars, etc.) demonstrates steady growth.

Soft Drink Type: Traditional energy drinks still hold a significant portion of the market. However, sugar-free/low-calorie options and natural/organic drinks are rapidly expanding as health and wellness trends grow. Energy shots are another growing segment due to convenience.

Key Drivers:

Investment Trends: Significant investments in marketing, research and development, and new product launches by leading companies fuels the market's growth.

Regulatory Support: While regulations might constrain some aspects, the market benefits from a fairly open regulatory environment that encourages innovation within established guidelines.

US Energy Drink Market Product Innovations

Recent innovations focus on healthier formulations with natural ingredients, functional benefits beyond energy, and enhanced taste profiles. Companies are emphasizing sustainability through recyclable packaging and reduced sugar content. Unique selling propositions often center around natural ingredients, unique flavor blends, and functional additions like vitamins or antioxidants. Technological advancements in extraction and preservation methods enable manufacturers to deliver high-quality products while catering to health-conscious consumers.

Propelling Factors for US Energy Drink Market Growth

Several factors drive market growth, including increasing consumer demand for functional beverages, a young and active population, and growing disposable incomes. Technological advancements allow for more efficient production and innovative product formulations. Favorable regulatory environments encourage competition and innovation. The rise in popularity of functional beverages and a focus on health and wellness initiatives are also key drivers.

Obstacles in the US Energy Drink Market

The market faces challenges including increasing health concerns regarding high sugar content and potential adverse health effects, fluctuating raw material prices, and intense competition leading to price wars. Supply chain disruptions can cause production delays, leading to potential shortages. Stringent regulatory requirements for labeling and ingredients can also pose significant obstacles to market entry and expansion for some companies.

Future Opportunities in US Energy Drink Market

Emerging opportunities include expanding into niche markets like organic, functional, and plant-based energy drinks, leveraging technological advancements in personalization and customization, and adapting to evolving consumer preferences toward healthier options. Growth is expected in e-commerce sales and expanding into under-penetrated regions.

Major Players in the US Energy Drink Market Ecosystem

- Woodbolt Distribution LLC

- Seven & I Holdings Co Ltd

- Monster Beverage Corporation

- PepsiCo Inc

- DAS Labs LLC

- Red Bull GmbH

- Living Essentials LLC

- Zevia LL

- The Coca-Cola Company

- N V E Pharmaceuticals

- Congo Brands

Key Developments in US Energy Drink Market Industry

- July 2023: Monster Beverage Corporation acquired Bang Energy for approximately USD 362 Million, significantly altering market dynamics.

- July 2023: WWE and Nutrabolt launched a co-branded energy drink, expanding the market reach of both brands.

- July 2023: Zevia LLC is exploring new distribution channels to boost sales of its single-serve beverages.

Strategic US Energy Drink Market Market Forecast

The US energy drink market is poised for continued growth driven by innovation in product formulations and expansion into new markets. Consumer preferences for healthier and functional beverages will shape future trends. Technological advancements and strategic alliances will further propel market expansion and innovation. The market is expected to witness steady growth throughout the forecast period, driven by both existing and emerging players vying for a larger share of the market.

US Energy Drink Market Segmentation

-

1. Soft Drink Type

- 1.1. Energy Shots

- 1.2. Natural/Organic Energy Drinks

- 1.3. Sugar-free or Low-calories Energy Drinks

- 1.4. Traditional Energy Drinks

- 1.5. Other Energy Drinks

-

2. Packaging Type

- 2.1. Glass Bottles

- 2.2. Metal Can

- 2.3. PET Bottles

-

3. Distribution Channel

-

3.1. Off-trade

- 3.1.1. Convenience Stores

- 3.1.2. Online Retail

- 3.1.3. Supermarket/Hypermarket

- 3.1.4. Others

- 3.2. On-trade

-

3.1. Off-trade

US Energy Drink Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Energy Drink Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.72% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Consumer Awareness about Health and Fitness; Increasing the Use of Casein and Caseinate in Food and Beverage Industry

- 3.3. Market Restrains

- 3.3.1. High Competition From Alternative Protein Sources

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Energy Drink Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 5.1.1. Energy Shots

- 5.1.2. Natural/Organic Energy Drinks

- 5.1.3. Sugar-free or Low-calories Energy Drinks

- 5.1.4. Traditional Energy Drinks

- 5.1.5. Other Energy Drinks

- 5.2. Market Analysis, Insights and Forecast - by Packaging Type

- 5.2.1. Glass Bottles

- 5.2.2. Metal Can

- 5.2.3. PET Bottles

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Off-trade

- 5.3.1.1. Convenience Stores

- 5.3.1.2. Online Retail

- 5.3.1.3. Supermarket/Hypermarket

- 5.3.1.4. Others

- 5.3.2. On-trade

- 5.3.1. Off-trade

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 6. North America US Energy Drink Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 6.1.1. Energy Shots

- 6.1.2. Natural/Organic Energy Drinks

- 6.1.3. Sugar-free or Low-calories Energy Drinks

- 6.1.4. Traditional Energy Drinks

- 6.1.5. Other Energy Drinks

- 6.2. Market Analysis, Insights and Forecast - by Packaging Type

- 6.2.1. Glass Bottles

- 6.2.2. Metal Can

- 6.2.3. PET Bottles

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Off-trade

- 6.3.1.1. Convenience Stores

- 6.3.1.2. Online Retail

- 6.3.1.3. Supermarket/Hypermarket

- 6.3.1.4. Others

- 6.3.2. On-trade

- 6.3.1. Off-trade

- 6.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 7. South America US Energy Drink Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 7.1.1. Energy Shots

- 7.1.2. Natural/Organic Energy Drinks

- 7.1.3. Sugar-free or Low-calories Energy Drinks

- 7.1.4. Traditional Energy Drinks

- 7.1.5. Other Energy Drinks

- 7.2. Market Analysis, Insights and Forecast - by Packaging Type

- 7.2.1. Glass Bottles

- 7.2.2. Metal Can

- 7.2.3. PET Bottles

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Off-trade

- 7.3.1.1. Convenience Stores

- 7.3.1.2. Online Retail

- 7.3.1.3. Supermarket/Hypermarket

- 7.3.1.4. Others

- 7.3.2. On-trade

- 7.3.1. Off-trade

- 7.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 8. Europe US Energy Drink Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 8.1.1. Energy Shots

- 8.1.2. Natural/Organic Energy Drinks

- 8.1.3. Sugar-free or Low-calories Energy Drinks

- 8.1.4. Traditional Energy Drinks

- 8.1.5. Other Energy Drinks

- 8.2. Market Analysis, Insights and Forecast - by Packaging Type

- 8.2.1. Glass Bottles

- 8.2.2. Metal Can

- 8.2.3. PET Bottles

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Off-trade

- 8.3.1.1. Convenience Stores

- 8.3.1.2. Online Retail

- 8.3.1.3. Supermarket/Hypermarket

- 8.3.1.4. Others

- 8.3.2. On-trade

- 8.3.1. Off-trade

- 8.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 9. Middle East & Africa US Energy Drink Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 9.1.1. Energy Shots

- 9.1.2. Natural/Organic Energy Drinks

- 9.1.3. Sugar-free or Low-calories Energy Drinks

- 9.1.4. Traditional Energy Drinks

- 9.1.5. Other Energy Drinks

- 9.2. Market Analysis, Insights and Forecast - by Packaging Type

- 9.2.1. Glass Bottles

- 9.2.2. Metal Can

- 9.2.3. PET Bottles

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Off-trade

- 9.3.1.1. Convenience Stores

- 9.3.1.2. Online Retail

- 9.3.1.3. Supermarket/Hypermarket

- 9.3.1.4. Others

- 9.3.2. On-trade

- 9.3.1. Off-trade

- 9.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 10. Asia Pacific US Energy Drink Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 10.1.1. Energy Shots

- 10.1.2. Natural/Organic Energy Drinks

- 10.1.3. Sugar-free or Low-calories Energy Drinks

- 10.1.4. Traditional Energy Drinks

- 10.1.5. Other Energy Drinks

- 10.2. Market Analysis, Insights and Forecast - by Packaging Type

- 10.2.1. Glass Bottles

- 10.2.2. Metal Can

- 10.2.3. PET Bottles

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Off-trade

- 10.3.1.1. Convenience Stores

- 10.3.1.2. Online Retail

- 10.3.1.3. Supermarket/Hypermarket

- 10.3.1.4. Others

- 10.3.2. On-trade

- 10.3.1. Off-trade

- 10.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 11. United States US Energy Drink Market Analysis, Insights and Forecast, 2019-2031

- 12. Canada US Energy Drink Market Analysis, Insights and Forecast, 2019-2031

- 13. Mexico US Energy Drink Market Analysis, Insights and Forecast, 2019-2031

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Woodbolt Distribution LLC

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Seven & I Holdings Co Ltd

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Monster Beverage Corporation

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 PepsiCo Inc

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 DAS Labs LLC

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Red Bull GmbH

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Living Essentials LLC

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Zevia LL

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 The Coca-Cola Company

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 N V E Pharmaceuticals

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Congo Brands

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.1 Woodbolt Distribution LLC

List of Figures

- Figure 1: Global US Energy Drink Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America US Energy Drink Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America US Energy Drink Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America US Energy Drink Market Revenue (Million), by Soft Drink Type 2024 & 2032

- Figure 5: North America US Energy Drink Market Revenue Share (%), by Soft Drink Type 2024 & 2032

- Figure 6: North America US Energy Drink Market Revenue (Million), by Packaging Type 2024 & 2032

- Figure 7: North America US Energy Drink Market Revenue Share (%), by Packaging Type 2024 & 2032

- Figure 8: North America US Energy Drink Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 9: North America US Energy Drink Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 10: North America US Energy Drink Market Revenue (Million), by Country 2024 & 2032

- Figure 11: North America US Energy Drink Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: South America US Energy Drink Market Revenue (Million), by Soft Drink Type 2024 & 2032

- Figure 13: South America US Energy Drink Market Revenue Share (%), by Soft Drink Type 2024 & 2032

- Figure 14: South America US Energy Drink Market Revenue (Million), by Packaging Type 2024 & 2032

- Figure 15: South America US Energy Drink Market Revenue Share (%), by Packaging Type 2024 & 2032

- Figure 16: South America US Energy Drink Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 17: South America US Energy Drink Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 18: South America US Energy Drink Market Revenue (Million), by Country 2024 & 2032

- Figure 19: South America US Energy Drink Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe US Energy Drink Market Revenue (Million), by Soft Drink Type 2024 & 2032

- Figure 21: Europe US Energy Drink Market Revenue Share (%), by Soft Drink Type 2024 & 2032

- Figure 22: Europe US Energy Drink Market Revenue (Million), by Packaging Type 2024 & 2032

- Figure 23: Europe US Energy Drink Market Revenue Share (%), by Packaging Type 2024 & 2032

- Figure 24: Europe US Energy Drink Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 25: Europe US Energy Drink Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 26: Europe US Energy Drink Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe US Energy Drink Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Middle East & Africa US Energy Drink Market Revenue (Million), by Soft Drink Type 2024 & 2032

- Figure 29: Middle East & Africa US Energy Drink Market Revenue Share (%), by Soft Drink Type 2024 & 2032

- Figure 30: Middle East & Africa US Energy Drink Market Revenue (Million), by Packaging Type 2024 & 2032

- Figure 31: Middle East & Africa US Energy Drink Market Revenue Share (%), by Packaging Type 2024 & 2032

- Figure 32: Middle East & Africa US Energy Drink Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 33: Middle East & Africa US Energy Drink Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 34: Middle East & Africa US Energy Drink Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East & Africa US Energy Drink Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Asia Pacific US Energy Drink Market Revenue (Million), by Soft Drink Type 2024 & 2032

- Figure 37: Asia Pacific US Energy Drink Market Revenue Share (%), by Soft Drink Type 2024 & 2032

- Figure 38: Asia Pacific US Energy Drink Market Revenue (Million), by Packaging Type 2024 & 2032

- Figure 39: Asia Pacific US Energy Drink Market Revenue Share (%), by Packaging Type 2024 & 2032

- Figure 40: Asia Pacific US Energy Drink Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 41: Asia Pacific US Energy Drink Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 42: Asia Pacific US Energy Drink Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Asia Pacific US Energy Drink Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global US Energy Drink Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global US Energy Drink Market Revenue Million Forecast, by Soft Drink Type 2019 & 2032

- Table 3: Global US Energy Drink Market Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 4: Global US Energy Drink Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 5: Global US Energy Drink Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global US Energy Drink Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States US Energy Drink Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada US Energy Drink Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico US Energy Drink Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global US Energy Drink Market Revenue Million Forecast, by Soft Drink Type 2019 & 2032

- Table 11: Global US Energy Drink Market Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 12: Global US Energy Drink Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 13: Global US Energy Drink Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United States US Energy Drink Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Canada US Energy Drink Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico US Energy Drink Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global US Energy Drink Market Revenue Million Forecast, by Soft Drink Type 2019 & 2032

- Table 18: Global US Energy Drink Market Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 19: Global US Energy Drink Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 20: Global US Energy Drink Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Brazil US Energy Drink Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Argentina US Energy Drink Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of South America US Energy Drink Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global US Energy Drink Market Revenue Million Forecast, by Soft Drink Type 2019 & 2032

- Table 25: Global US Energy Drink Market Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 26: Global US Energy Drink Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 27: Global US Energy Drink Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: United Kingdom US Energy Drink Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Germany US Energy Drink Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: France US Energy Drink Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Italy US Energy Drink Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Spain US Energy Drink Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Russia US Energy Drink Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Benelux US Energy Drink Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Nordics US Energy Drink Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Rest of Europe US Energy Drink Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global US Energy Drink Market Revenue Million Forecast, by Soft Drink Type 2019 & 2032

- Table 38: Global US Energy Drink Market Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 39: Global US Energy Drink Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 40: Global US Energy Drink Market Revenue Million Forecast, by Country 2019 & 2032

- Table 41: Turkey US Energy Drink Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Israel US Energy Drink Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: GCC US Energy Drink Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: North Africa US Energy Drink Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: South Africa US Energy Drink Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Rest of Middle East & Africa US Energy Drink Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Global US Energy Drink Market Revenue Million Forecast, by Soft Drink Type 2019 & 2032

- Table 48: Global US Energy Drink Market Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 49: Global US Energy Drink Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 50: Global US Energy Drink Market Revenue Million Forecast, by Country 2019 & 2032

- Table 51: China US Energy Drink Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: India US Energy Drink Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Japan US Energy Drink Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: South Korea US Energy Drink Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: ASEAN US Energy Drink Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Oceania US Energy Drink Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Rest of Asia Pacific US Energy Drink Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Energy Drink Market?

The projected CAGR is approximately 3.72%.

2. Which companies are prominent players in the US Energy Drink Market?

Key companies in the market include Woodbolt Distribution LLC, Seven & I Holdings Co Ltd, Monster Beverage Corporation, PepsiCo Inc, DAS Labs LLC, Red Bull GmbH, Living Essentials LLC, Zevia LL, The Coca-Cola Company, N V E Pharmaceuticals, Congo Brands.

3. What are the main segments of the US Energy Drink Market?

The market segments include Soft Drink Type, Packaging Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Consumer Awareness about Health and Fitness; Increasing the Use of Casein and Caseinate in Food and Beverage Industry.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

High Competition From Alternative Protein Sources.

8. Can you provide examples of recent developments in the market?

July 2023: Monster Beverage Corporation announced that its subsidiary, Blast Asset Acquisition LLC, completed its acquisition of substantially all of the assets of Vital Pharmaceuticals, Inc. and certain of its affiliates (collectively, “Bang Energy”) for approximately USD 362 million. The acquired assets include Bang Energy beverages and a beverage production facility in Phoenix, Arizona.July 2023: WWE and Nutrabolt, owner of the C4 brand, announced an expansion to their multi-year partnership with the launch of their first-ever co-branded product collaboration: WWE-inspired flavors of C4 Ultimate Pre-Workout Powder and C4 Ultimate Energy Drink.July 2023: The Los Angeles-based company Zevia LLC is considering getting a new distribution partner to expand its base business from selling multi-packs in grocery stores to selling single-serve cold beverages in c-stores.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Energy Drink Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Energy Drink Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Energy Drink Market?

To stay informed about further developments, trends, and reports in the US Energy Drink Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence