Key Insights

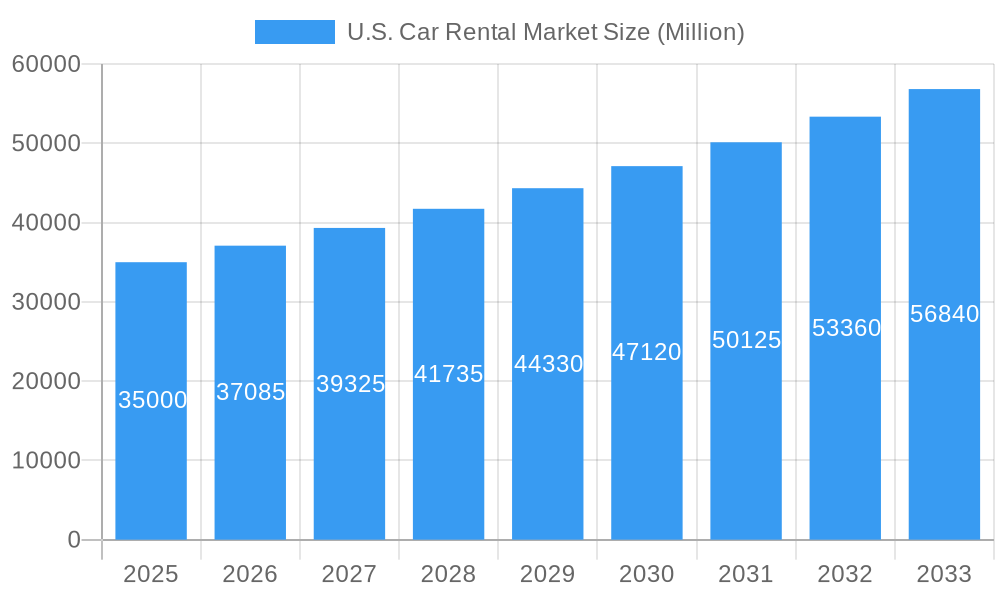

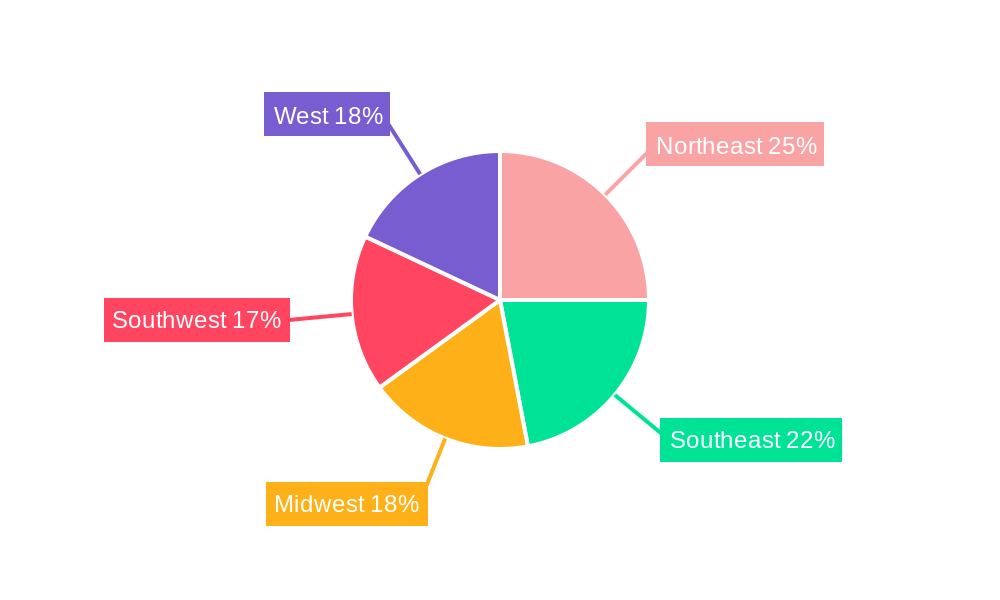

The U.S. car rental market, valued at approximately $35 billion in 2025, is projected to experience robust growth, driven by a rising number of domestic and international travelers, increased business travel, and the burgeoning popularity of road trips. The market's 5.70% CAGR indicates a steady expansion through 2033, with significant opportunities across various segments. The preference for online booking platforms continues to increase, fueled by convenience and competitive pricing. While the luxury and premium car segments represent a lucrative niche, the economy/budget car segment dominates overall market share due to price sensitivity among a larger customer base. Geographic variations exist, with densely populated regions like the Northeast and West experiencing higher demand. The increasing adoption of technology, such as mobile apps for seamless booking and keyless entry, is transforming the customer experience and fostering competition. However, challenges remain, including fluctuating fuel prices, economic uncertainties affecting discretionary spending, and the emergence of alternative transportation options like ride-sharing services. Successful players will need to adapt to these dynamics by offering innovative solutions, leveraging technology, and providing excellent customer service to maintain a competitive edge.

U.S. Car Rental Market Market Size (In Billion)

Despite these challenges, the long-term outlook for the U.S. car rental market remains positive. The projected growth is fueled by several factors, including the anticipated rebound in air travel post-pandemic, continued expansion of the tourism sector, and the growing adoption of rental cars for leisure purposes. Companies are increasingly investing in fleet modernization and sustainability initiatives, responding to growing environmental concerns and customer preferences. Effective fleet management, strategic partnerships with hotels and airlines, and targeted marketing campaigns are key strategies for maintaining market share and profitability. The competitive landscape is characterized by both large multinational corporations and regional players, leading to continuous innovation and improved services for consumers. The market’s evolution will depend significantly on the successful navigation of these trends and challenges.

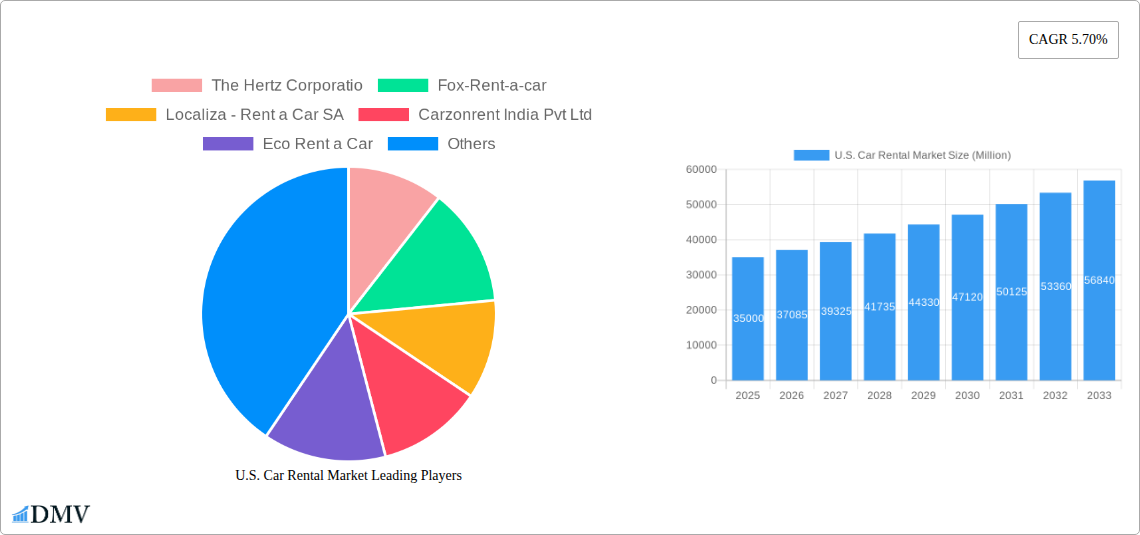

U.S. Car Rental Market Company Market Share

U.S. Car Rental Market Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the U.S. car rental market, offering valuable insights into market trends, competitive dynamics, and future growth opportunities. Covering the period from 2019 to 2033, with a focus on 2025, this report is an essential resource for stakeholders seeking to understand and capitalize on this dynamic sector. The market is projected to reach xx Million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033).

U.S. Car Rental Market Composition & Trends

This section delves into the intricacies of the U.S. car rental market landscape. We analyze market concentration, revealing the market share distribution amongst key players like Enterprise Holdings Inc, Avis Budget Group Inc, Hertz, and Alamo. The report quantifies the impact of mergers and acquisitions (M&A) activities, evaluating deal values exceeding xx Million in recent years and their influence on market consolidation. Innovation catalysts, such as the rise of mobile booking platforms and the integration of advanced technologies, are meticulously examined. Further, the report explores the regulatory environment, including licensing requirements and environmental regulations, and analyzes the impact of substitute products like ride-sharing services (Uber and Lyft) on market demand. End-user profiles are segmented by vehicle type (luxury, economy), booking method (online, offline), and application (leisure, business), providing a detailed understanding of consumer behavior.

- Market Share Distribution (2024): Enterprise Holdings Inc (xx%), Avis Budget Group Inc (xx%), Hertz (xx%), Alamo (xx%), Others (xx%).

- M&A Activity (2019-2024): Total deal value exceeding xx Million. Key deals include [Specific examples of significant M&A activity].

- Regulatory Landscape: Detailed analysis of federal and state regulations impacting the industry.

- Substitute Products: Impact assessment of ride-sharing services and their influence on market share.

U.S. Car Rental Market Industry Evolution

This section traces the evolution of the U.S. car rental market from 2019 to 2024, analyzing growth trajectories, technological advancements, and shifting consumer preferences. The impact of the COVID-19 pandemic and its subsequent recovery are carefully considered, along with the rise of subscription services and the increasing adoption of electric vehicles (EVs) within the rental fleet. We analyze data points, including annual growth rates, penetration rates of online booking platforms, and consumer adoption rates for various vehicle classes, providing a granular view of market dynamics. The shift in consumer preferences towards sustainability and technological advancements like AI-powered booking systems and autonomous vehicles are examined for their long-term effects on the market structure.

Leading Regions, Countries, or Segments in U.S. Car Rental Market

This section identifies the dominant segments within the U.S. car rental market. We analyze leading regions based on rental volume and revenue, identifying key growth drivers such as tourism hotspots and business travel hubs. The dominance of specific vehicle segments (economy/budget cars vs. luxury/premium cars) is analyzed based on rental rates, customer preferences, and fleet composition. The preference for online vs. offline booking methods is explored, highlighting the influence of technological advancements and consumer behavior. Finally, we examine the demand from different application segments (leisure/tourism vs. business), considering factors like seasonal variations and corporate travel patterns.

- Key Drivers (Economy/Budget Cars): Cost-effectiveness, affordability, high demand from budget travelers.

- Key Drivers (Online Access): Convenience, ease of use, wider choice of vehicles and locations.

- Key Drivers (Leisure/Tourism): Seasonal fluctuations in demand, strong correlation with tourist arrivals.

- Dominant Region: [Specific Region, e.g., California] due to [Reasons for dominance, e.g., large population, significant tourism].

U.S. Car Rental Market Product Innovations

This section highlights the latest product innovations in the U.S. car rental market, focusing on technological advancements that enhance the customer experience and operational efficiency. The report examines the introduction of new vehicle models, including electric and hybrid options, and analyzes the adoption rate of innovative technologies like mobile apps, self-service kiosks, and keyless entry systems. The unique selling propositions (USPs) of various rental companies are compared, highlighting their competitive strategies and market positioning.

Propelling Factors for U.S. Car Rental Market Growth

Several factors are driving the growth of the U.S. car rental market. The expanding tourism sector, fueled by increased disposable incomes and the rising popularity of domestic and international travel, contributes significantly to the demand for rental vehicles. Technological advancements, such as improved online booking platforms and the introduction of autonomous vehicles, enhance efficiency and customer satisfaction. Favorable government policies, such as infrastructure development projects that improve road networks, further contribute to market expansion.

Obstacles in the U.S. Car Rental Market Market

The U.S. car rental market faces several challenges. Fluctuations in fuel prices directly impact operational costs and rental rates. Intense competition from ride-sharing services and the increasing adoption of personal vehicle ownership pose significant threats to market growth. Supply chain disruptions, such as semiconductor shortages, can limit the availability of new vehicles, hindering fleet expansion and affecting rental availability. Stringent environmental regulations and increasing pressure to adopt sustainable practices require significant investments in fleet modernization.

Future Opportunities in U.S. Car Rental Market

The U.S. car rental market presents several promising future opportunities. The growing adoption of electric and hybrid vehicles offers a chance to cater to environmentally conscious consumers. The expansion into underserved markets and the development of innovative subscription models can drive market expansion. The integration of advanced technologies, such as AI-powered chatbots and personalized recommendations, can enhance the customer experience and create new revenue streams.

Major Players in the U.S. Car Rental Market Ecosystem

- The Hertz Corporation

- Fox Rent-a-Car

- Localiza - Rent a Car SA

- Carzonrent India Pvt Ltd

- Eco Rent a Car

- Alamo

- Enterprise Holdings Inc

- Advantage Rent-a-Car

- USCARS

- Sixt SE

- Ace Rent-a-car

- Avis Budget Group Inc

Key Developments in U.S. Car Rental Market Industry

- [Month, Year]: Enterprise Holdings Inc announces a significant investment in its EV fleet.

- [Month, Year]: Avis Budget Group Inc partners with a technology company to integrate AI-powered booking systems.

- [Month, Year]: Hertz acquires a smaller rental company, expanding its market reach.

- [Month, Year]: New regulations on emissions are introduced, impacting the car rental industry.

Strategic U.S. Car Rental Market Market Forecast

The U.S. car rental market is poised for sustained growth, driven by increasing tourism, technological advancements, and the growing adoption of EVs. The market is expected to witness significant expansion, with opportunities for both established players and new entrants. Strategic investments in technology, fleet modernization, and customer experience will be critical to achieving success in this competitive landscape. The focus on sustainability and the integration of innovative solutions will shape the future of the U.S. car rental market.

U.S. Car Rental Market Segmentation

-

1. Application

- 1.1. Leisure/Tourism

- 1.2. Business

-

2. Vehicle

- 2.1. Luxury/Premium Cars

- 2.2. Economy/Budget Cars

-

3. Booking

- 3.1. Online Access

- 3.2. Offline Access

U.S. Car Rental Market Segmentation By Geography

- 1. U.S.

U.S. Car Rental Market Regional Market Share

Geographic Coverage of U.S. Car Rental Market

U.S. Car Rental Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Exponential Increase in Automotive Sector

- 3.3. Market Restrains

- 3.3.1. Digitization of R&D Operations in Automotive Sector

- 3.4. Market Trends

- 3.4.1. Rise in Tourism Industry Driving the Vehicle Rental Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. U.S. Car Rental Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Leisure/Tourism

- 5.1.2. Business

- 5.2. Market Analysis, Insights and Forecast - by Vehicle

- 5.2.1. Luxury/Premium Cars

- 5.2.2. Economy/Budget Cars

- 5.3. Market Analysis, Insights and Forecast - by Booking

- 5.3.1. Online Access

- 5.3.2. Offline Access

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. U.S.

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 The Hertz Corporatio

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Fox-Rent-a-car

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Localiza - Rent a Car SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Carzonrent India Pvt Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Eco Rent a Car

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Alamo

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Enterprise Holdings Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Advantage Rent-a-car

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 USCARS

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sixt SE

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Ace Rent-a-car

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Avis Budget Group Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 The Hertz Corporatio

List of Figures

- Figure 1: U.S. Car Rental Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: U.S. Car Rental Market Share (%) by Company 2025

List of Tables

- Table 1: U.S. Car Rental Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: U.S. Car Rental Market Revenue undefined Forecast, by Vehicle 2020 & 2033

- Table 3: U.S. Car Rental Market Revenue undefined Forecast, by Booking 2020 & 2033

- Table 4: U.S. Car Rental Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: U.S. Car Rental Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: U.S. Car Rental Market Revenue undefined Forecast, by Vehicle 2020 & 2033

- Table 7: U.S. Car Rental Market Revenue undefined Forecast, by Booking 2020 & 2033

- Table 8: U.S. Car Rental Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the U.S. Car Rental Market?

The projected CAGR is approximately 6.2%.

2. Which companies are prominent players in the U.S. Car Rental Market?

Key companies in the market include The Hertz Corporatio, Fox-Rent-a-car, Localiza - Rent a Car SA, Carzonrent India Pvt Ltd, Eco Rent a Car, Alamo, Enterprise Holdings Inc, Advantage Rent-a-car, USCARS, Sixt SE, Ace Rent-a-car, Avis Budget Group Inc.

3. What are the main segments of the U.S. Car Rental Market?

The market segments include Application, Vehicle, Booking.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Exponential Increase in Automotive Sector.

6. What are the notable trends driving market growth?

Rise in Tourism Industry Driving the Vehicle Rental Market.

7. Are there any restraints impacting market growth?

Digitization of R&D Operations in Automotive Sector.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "U.S. Car Rental Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the U.S. Car Rental Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the U.S. Car Rental Market?

To stay informed about further developments, trends, and reports in the U.S. Car Rental Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence