Key Insights

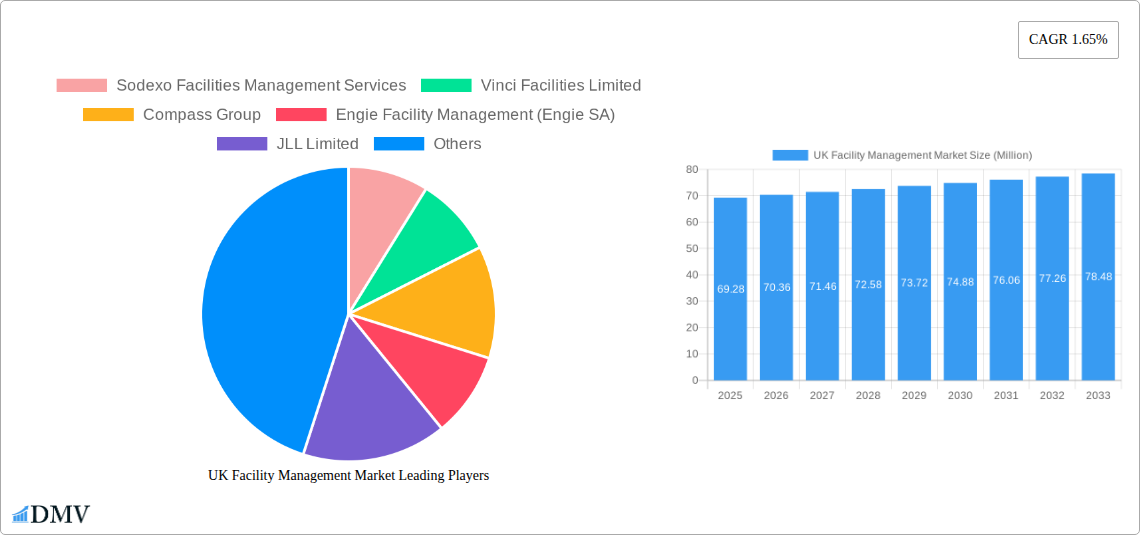

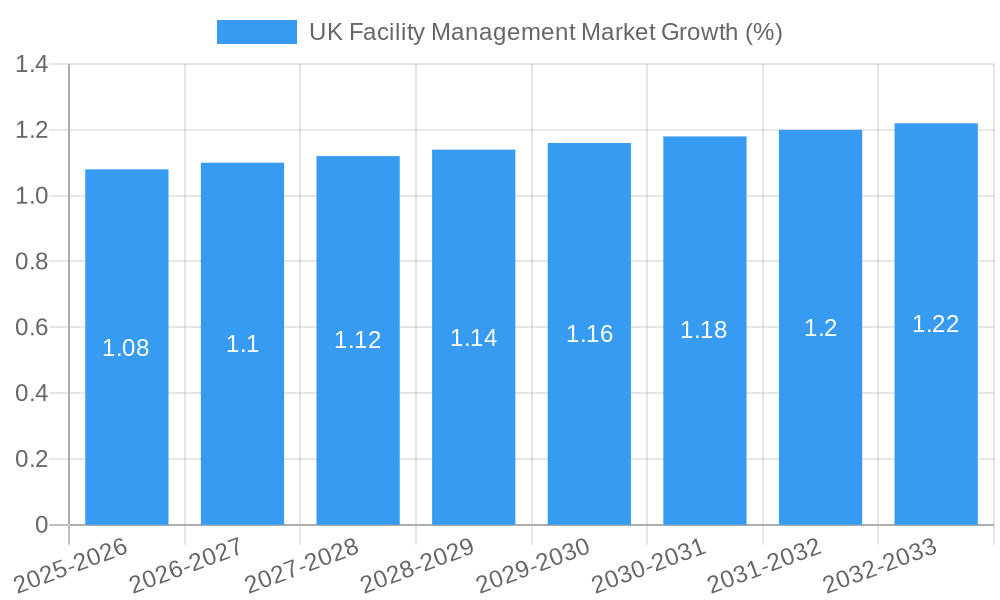

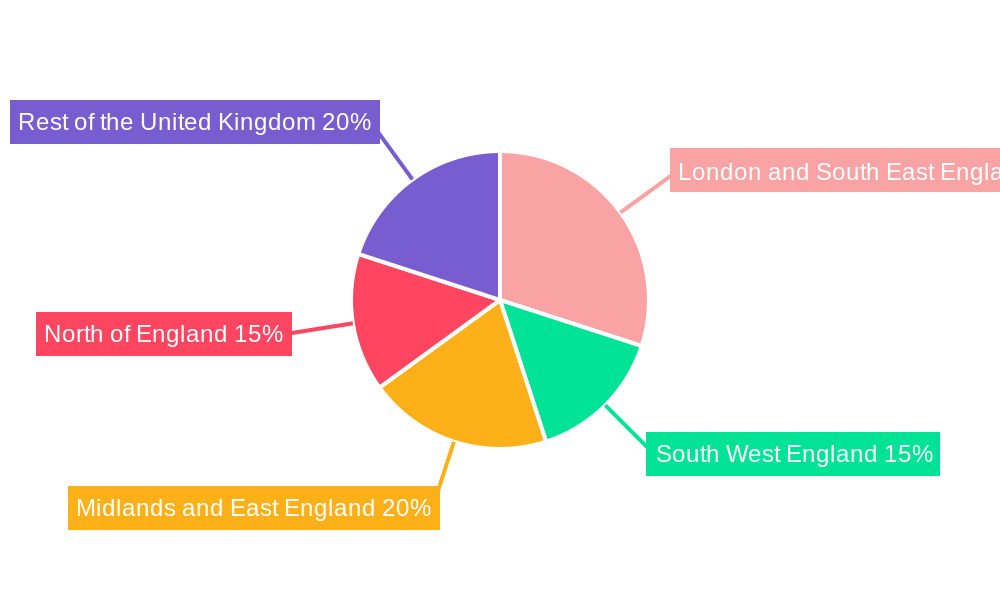

The UK facility management (FM) market, valued at £69.28 million in 2025, is projected to experience steady growth, driven by increasing urbanization, a rising focus on workplace efficiency, and the growing adoption of sustainable practices within businesses and public institutions. The market's Compound Annual Growth Rate (CAGR) of 1.65% suggests a consistent, albeit moderate, expansion over the forecast period (2025-2033). Key growth drivers include the increasing demand for outsourced FM services from organizations seeking to streamline operations and reduce internal costs, the burgeoning adoption of smart building technologies and data-driven FM solutions to optimize energy efficiency and resource management, and a heightened awareness of the importance of workplace health and safety, necessitating specialized FM services. While the market faces potential restraints such as economic fluctuations and skilled labor shortages within the FM sector, these are likely to be offset by the long-term trends towards improved operational efficiency and sustainable building practices. Segment analysis reveals strong demand across various sectors, including commercial real estate, institutional facilities, and public infrastructure projects, with both hard FM (mechanical, electrical, plumbing) and soft FM (cleaning, security, catering) services contributing significantly to market revenue. The dominance of outsourced FM services, compared to in-house solutions, points to the increasing preference for specialized expertise and cost-effectiveness. Leading players such as Sodexo, Vinci, Compass Group, and JLL dominate the market, leveraging their extensive experience and strong client networks. Regional variations within the UK are anticipated, with London and the South East experiencing potentially higher growth due to the concentration of businesses and infrastructure projects.

The continued growth trajectory of the UK FM market is underpinned by its integral role in supporting the smooth functioning of diverse industries. Technological advancements are reshaping the landscape, fostering innovative solutions for space optimization, waste management, and energy consumption. This technological shift, coupled with increasing regulatory pressure towards sustainability and heightened occupant well-being, positions the UK FM market for sustained expansion throughout the forecast period. The competitive landscape, while dominated by established players, also welcomes smaller, specialized FM providers catering to niche markets. This dynamic interplay fosters innovation and competitive pricing, ultimately benefiting clients by offering a wide range of services tailored to specific needs and budgets. The market's resilience and adaptability, combined with consistent demand from across multiple sectors, suggest a positive outlook for the future of facility management in the UK.

UK Facility Management Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the UK Facility Management market, offering invaluable insights for stakeholders seeking to understand market dynamics, identify growth opportunities, and make informed strategic decisions. The report covers the period 2019-2033, with a focus on 2025 as the base and estimated year. The analysis delves into market size, segmentation, leading players, and future projections, providing a holistic view of this dynamic sector. The market is projected to reach xx Million by 2033.

UK Facility Management Market Composition & Trends

The UK Facility Management market is a highly competitive landscape characterized by a mix of large multinational corporations and specialized regional players. Market concentration is moderate, with the top five players commanding approximately xx% market share in 2024. Innovation is driven by increasing demand for sustainable and technologically advanced FM solutions, such as smart building technologies and IoT integration. Stringent regulatory frameworks, including environmental regulations and health & safety standards, significantly influence market practices. Substitute products, such as in-house FM teams, present competitive pressure, particularly for smaller providers. End-user profiles vary widely, ranging from commercial real estate giants to small businesses and public sector organizations. M&A activity has been moderately active in recent years, with deal values ranging from xx Million to xx Million.

- Market Share Distribution (2024): Top 5 players: xx%; Others: xx%

- M&A Deal Value (2019-2024): Average: xx Million; Range: xx Million - xx Million

- Key Innovation Catalysts: Smart building technologies, IoT, AI-driven analytics, sustainable FM practices.

- Regulatory Landscape: Emphasis on environmental sustainability, health & safety compliance, data privacy regulations.

UK Facility Management Market Industry Evolution

The UK Facility Management market has experienced consistent growth over the historical period (2019-2024), driven by factors such as increasing urbanization, rising demand for outsourced services, and a growing awareness of the importance of efficient facility management. The market witnessed a Compound Annual Growth Rate (CAGR) of xx% during this period. Technological advancements, such as the adoption of Building Information Modeling (BIM) and cloud-based FM software, have significantly improved operational efficiency and service delivery. Shifting consumer demands, particularly a focus on sustainability and data-driven insights, are further shaping market evolution. The forecast period (2025-2033) anticipates continued growth, fueled by ongoing technological innovation, increasing investment in infrastructure, and government initiatives promoting sustainable practices. Growth rates are expected to remain healthy, with a projected CAGR of xx% throughout the forecast period.

Leading Regions, Countries, or Segments in UK Facility Management Market

The London and South East England region dominates the UK Facility Management market, driven by high concentrations of commercial and institutional clients, substantial infrastructure investments, and a robust business environment. The high concentration of large corporate headquarters and significant public sector institutions in this area fuels substantial demand for outsourced facility management services.

Key Drivers (London and South East England):

- High concentration of commercial and institutional clients.

- Substantial infrastructure investments.

- Strong economic growth.

- Government initiatives promoting sustainable development.

Dominant Segments:

- By Offering Type: Outsourced Facility Management holds a larger share due to cost-effectiveness and expertise. Soft FM is experiencing faster growth driven by demand for specialized services.

- By End-user Industry: Commercial sector constitutes a major share, followed by Institutional and Public/Infrastructure sectors.

- By Facility Management Type: Outsourced Facility Management is experiencing faster growth compared to In-house Facility Management.

UK Facility Management Market Product Innovations

Recent innovations in the UK Facility Management market include the integration of IoT sensors for real-time monitoring of building systems, AI-powered predictive maintenance solutions, and the development of cloud-based platforms for improved data management and collaboration. These innovations enhance operational efficiency, reduce costs, and improve sustainability. The unique selling propositions of these new offerings centre on improved cost-effectiveness, enhanced building performance and increased operational transparency.

Propelling Factors for UK Facility Management Market Growth

The UK Facility Management market's growth is propelled by several factors. Technological advancements, like AI and IoT, optimize resource allocation and maintenance, reducing costs for businesses. Strong economic growth fuels increased investment in infrastructure projects, requiring robust FM services. Government regulations promoting sustainable buildings and operational practices further drive market expansion. The increasing focus on workplace experience and employee well-being also contributes significantly.

Obstacles in the UK Facility Management Market Market

The UK Facility Management market faces challenges, including stringent regulatory compliance, supply chain disruptions impacting the procurement of materials and skilled labor, and intensifying competition among numerous providers. These challenges contribute to increased operational costs and can limit growth potential. The uncertainty of the global economy also presents a major threat to forecast accuracy.

Future Opportunities in UK Facility Management Market

Emerging opportunities include expanding into specialized sectors, integrating advanced technologies (AI, IoT) into core services, and offering tailored sustainability solutions. Growth is expected in smart building management, predictive maintenance, and data-driven facility optimization, catering to evolving customer demands.

Major Players in the UK Facility Management Market Ecosystem

- Sodexo Facilities Management Services Sodexo

- Vinci Facilities Limited Vinci Facilities

- Compass Group Compass Group

- Engie Facility Management (Engie SA) Engie

- JLL Limited JLL

- CBRE Group Inc CBRE

- Andron Facilities Management

- Aramark Facilities Services

- Atalian Servest Atalian Servest

- Atlas FM Ltd

- Amey PLC Amey

- EMCOR Facilities Services Inc EMCOR

- Kier Group PLC Kier

- ISS UK ISS

- Serco Group PLC Serco

- Mitie Group PLC Mitie

Key Developments in UK Facility Management Market Industry

- March 2024: Sodexo Health & Care secured a new 10-year contract worth EUR 38 Million annually to provide catering, retail, and soft FM services at two Stoke-on-Trent hospitals. This signifies a continued commitment to long-term partnerships within the healthcare sector.

- March 2024: Mitie joined the Crown Commercial Service’s Healthcare Soft Facilities Management Framework agreement. This enhances their ability to bid for NHS contracts, strengthening their position in the public sector.

Strategic UK Facility Management Market Market Forecast

The UK Facility Management market is poised for continued growth, driven by technological innovation, sustainable development initiatives, and increasing demand for specialized services. Opportunities exist in smart building technologies, data analytics, and integrated service offerings. The market's future potential is substantial, with significant growth expected across various segments and regions.

UK Facility Management Market Segmentation

-

1. Facility Management Type

- 1.1. In-House Facility Management

-

1.2. Outsourced Facility Management

- 1.2.1. Single FM

- 1.2.2. Bundled FM

- 1.2.3. Integrated FM

-

2. Offering Type

-

2.1. Hard FM

- 2.1.1. Building O&M and Property Services

- 2.1.2. Mechanical, Electrical, and Plumbing Services

- 2.1.3. Other Hard FM Services (includes Energy Services)

-

2.2. Soft FM

- 2.2.1. Safety and Security Services

- 2.2.2. Office Support Services

- 2.2.3. Janitorial Services

- 2.2.4. Catering Services

- 2.2.5. Other Soft FM Services

-

2.1. Hard FM

-

3. End-user Industry

- 3.1. Commercial

- 3.2. Institutional

- 3.3. Public/Infrastructure

- 3.4. Industrial

- 3.5. Other End-user Industries

UK Facility Management Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Facility Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.65% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Trend Toward Commoditization of FM; Growing Demand for IFM and Outsourcing of Non-core Operations from Emerging Verticals; Renewed Emphasis on Workplace Optimization and Productivity

- 3.3. Market Restrains

- 3.3.1. Market Saturation in the Public Sector; Growing Competition Expected to Impact Profit Margins of Existing Vendors

- 3.4. Market Trends

- 3.4.1. Single FM Service is Expected to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Facility Management Type

- 5.1.1. In-House Facility Management

- 5.1.2. Outsourced Facility Management

- 5.1.2.1. Single FM

- 5.1.2.2. Bundled FM

- 5.1.2.3. Integrated FM

- 5.2. Market Analysis, Insights and Forecast - by Offering Type

- 5.2.1. Hard FM

- 5.2.1.1. Building O&M and Property Services

- 5.2.1.2. Mechanical, Electrical, and Plumbing Services

- 5.2.1.3. Other Hard FM Services (includes Energy Services)

- 5.2.2. Soft FM

- 5.2.2.1. Safety and Security Services

- 5.2.2.2. Office Support Services

- 5.2.2.3. Janitorial Services

- 5.2.2.4. Catering Services

- 5.2.2.5. Other Soft FM Services

- 5.2.1. Hard FM

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Commercial

- 5.3.2. Institutional

- 5.3.3. Public/Infrastructure

- 5.3.4. Industrial

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Facility Management Type

- 6. North America UK Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Facility Management Type

- 6.1.1. In-House Facility Management

- 6.1.2. Outsourced Facility Management

- 6.1.2.1. Single FM

- 6.1.2.2. Bundled FM

- 6.1.2.3. Integrated FM

- 6.2. Market Analysis, Insights and Forecast - by Offering Type

- 6.2.1. Hard FM

- 6.2.1.1. Building O&M and Property Services

- 6.2.1.2. Mechanical, Electrical, and Plumbing Services

- 6.2.1.3. Other Hard FM Services (includes Energy Services)

- 6.2.2. Soft FM

- 6.2.2.1. Safety and Security Services

- 6.2.2.2. Office Support Services

- 6.2.2.3. Janitorial Services

- 6.2.2.4. Catering Services

- 6.2.2.5. Other Soft FM Services

- 6.2.1. Hard FM

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Commercial

- 6.3.2. Institutional

- 6.3.3. Public/Infrastructure

- 6.3.4. Industrial

- 6.3.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Facility Management Type

- 7. South America UK Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Facility Management Type

- 7.1.1. In-House Facility Management

- 7.1.2. Outsourced Facility Management

- 7.1.2.1. Single FM

- 7.1.2.2. Bundled FM

- 7.1.2.3. Integrated FM

- 7.2. Market Analysis, Insights and Forecast - by Offering Type

- 7.2.1. Hard FM

- 7.2.1.1. Building O&M and Property Services

- 7.2.1.2. Mechanical, Electrical, and Plumbing Services

- 7.2.1.3. Other Hard FM Services (includes Energy Services)

- 7.2.2. Soft FM

- 7.2.2.1. Safety and Security Services

- 7.2.2.2. Office Support Services

- 7.2.2.3. Janitorial Services

- 7.2.2.4. Catering Services

- 7.2.2.5. Other Soft FM Services

- 7.2.1. Hard FM

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Commercial

- 7.3.2. Institutional

- 7.3.3. Public/Infrastructure

- 7.3.4. Industrial

- 7.3.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Facility Management Type

- 8. Europe UK Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Facility Management Type

- 8.1.1. In-House Facility Management

- 8.1.2. Outsourced Facility Management

- 8.1.2.1. Single FM

- 8.1.2.2. Bundled FM

- 8.1.2.3. Integrated FM

- 8.2. Market Analysis, Insights and Forecast - by Offering Type

- 8.2.1. Hard FM

- 8.2.1.1. Building O&M and Property Services

- 8.2.1.2. Mechanical, Electrical, and Plumbing Services

- 8.2.1.3. Other Hard FM Services (includes Energy Services)

- 8.2.2. Soft FM

- 8.2.2.1. Safety and Security Services

- 8.2.2.2. Office Support Services

- 8.2.2.3. Janitorial Services

- 8.2.2.4. Catering Services

- 8.2.2.5. Other Soft FM Services

- 8.2.1. Hard FM

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Commercial

- 8.3.2. Institutional

- 8.3.3. Public/Infrastructure

- 8.3.4. Industrial

- 8.3.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Facility Management Type

- 9. Middle East & Africa UK Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Facility Management Type

- 9.1.1. In-House Facility Management

- 9.1.2. Outsourced Facility Management

- 9.1.2.1. Single FM

- 9.1.2.2. Bundled FM

- 9.1.2.3. Integrated FM

- 9.2. Market Analysis, Insights and Forecast - by Offering Type

- 9.2.1. Hard FM

- 9.2.1.1. Building O&M and Property Services

- 9.2.1.2. Mechanical, Electrical, and Plumbing Services

- 9.2.1.3. Other Hard FM Services (includes Energy Services)

- 9.2.2. Soft FM

- 9.2.2.1. Safety and Security Services

- 9.2.2.2. Office Support Services

- 9.2.2.3. Janitorial Services

- 9.2.2.4. Catering Services

- 9.2.2.5. Other Soft FM Services

- 9.2.1. Hard FM

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Commercial

- 9.3.2. Institutional

- 9.3.3. Public/Infrastructure

- 9.3.4. Industrial

- 9.3.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Facility Management Type

- 10. Asia Pacific UK Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Facility Management Type

- 10.1.1. In-House Facility Management

- 10.1.2. Outsourced Facility Management

- 10.1.2.1. Single FM

- 10.1.2.2. Bundled FM

- 10.1.2.3. Integrated FM

- 10.2. Market Analysis, Insights and Forecast - by Offering Type

- 10.2.1. Hard FM

- 10.2.1.1. Building O&M and Property Services

- 10.2.1.2. Mechanical, Electrical, and Plumbing Services

- 10.2.1.3. Other Hard FM Services (includes Energy Services)

- 10.2.2. Soft FM

- 10.2.2.1. Safety and Security Services

- 10.2.2.2. Office Support Services

- 10.2.2.3. Janitorial Services

- 10.2.2.4. Catering Services

- 10.2.2.5. Other Soft FM Services

- 10.2.1. Hard FM

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Commercial

- 10.3.2. Institutional

- 10.3.3. Public/Infrastructure

- 10.3.4. Industrial

- 10.3.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Facility Management Type

- 11. England UK Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 12. Wales UK Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 13. Scotland UK Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 14. Northern UK Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 15. Ireland UK Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Sodexo Facilities Management Services

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Vinci Facilities Limited

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Compass Group

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Engie Facility Management (Engie SA)

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 JLL Limited

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 CBRE Group Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Andron Facilities Management

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Aramark Facilities Services7 2 Market Share Analysi

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Atalian Servest

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Atlas FM Ltd

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Amey PLC

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 EMCOR Facilities Services Inc

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Kier Group PLC

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.14 ISS UK

- 16.2.14.1. Overview

- 16.2.14.2. Products

- 16.2.14.3. SWOT Analysis

- 16.2.14.4. Recent Developments

- 16.2.14.5. Financials (Based on Availability)

- 16.2.15 Serco Group PLC

- 16.2.15.1. Overview

- 16.2.15.2. Products

- 16.2.15.3. SWOT Analysis

- 16.2.15.4. Recent Developments

- 16.2.15.5. Financials (Based on Availability)

- 16.2.16 Mitie Group PLC

- 16.2.16.1. Overview

- 16.2.16.2. Products

- 16.2.16.3. SWOT Analysis

- 16.2.16.4. Recent Developments

- 16.2.16.5. Financials (Based on Availability)

- 16.2.1 Sodexo Facilities Management Services

List of Figures

- Figure 1: Global UK Facility Management Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: United kingdom Region UK Facility Management Market Revenue (Million), by Country 2024 & 2032

- Figure 3: United kingdom Region UK Facility Management Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America UK Facility Management Market Revenue (Million), by Facility Management Type 2024 & 2032

- Figure 5: North America UK Facility Management Market Revenue Share (%), by Facility Management Type 2024 & 2032

- Figure 6: North America UK Facility Management Market Revenue (Million), by Offering Type 2024 & 2032

- Figure 7: North America UK Facility Management Market Revenue Share (%), by Offering Type 2024 & 2032

- Figure 8: North America UK Facility Management Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 9: North America UK Facility Management Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 10: North America UK Facility Management Market Revenue (Million), by Country 2024 & 2032

- Figure 11: North America UK Facility Management Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: South America UK Facility Management Market Revenue (Million), by Facility Management Type 2024 & 2032

- Figure 13: South America UK Facility Management Market Revenue Share (%), by Facility Management Type 2024 & 2032

- Figure 14: South America UK Facility Management Market Revenue (Million), by Offering Type 2024 & 2032

- Figure 15: South America UK Facility Management Market Revenue Share (%), by Offering Type 2024 & 2032

- Figure 16: South America UK Facility Management Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 17: South America UK Facility Management Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 18: South America UK Facility Management Market Revenue (Million), by Country 2024 & 2032

- Figure 19: South America UK Facility Management Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe UK Facility Management Market Revenue (Million), by Facility Management Type 2024 & 2032

- Figure 21: Europe UK Facility Management Market Revenue Share (%), by Facility Management Type 2024 & 2032

- Figure 22: Europe UK Facility Management Market Revenue (Million), by Offering Type 2024 & 2032

- Figure 23: Europe UK Facility Management Market Revenue Share (%), by Offering Type 2024 & 2032

- Figure 24: Europe UK Facility Management Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 25: Europe UK Facility Management Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 26: Europe UK Facility Management Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe UK Facility Management Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Middle East & Africa UK Facility Management Market Revenue (Million), by Facility Management Type 2024 & 2032

- Figure 29: Middle East & Africa UK Facility Management Market Revenue Share (%), by Facility Management Type 2024 & 2032

- Figure 30: Middle East & Africa UK Facility Management Market Revenue (Million), by Offering Type 2024 & 2032

- Figure 31: Middle East & Africa UK Facility Management Market Revenue Share (%), by Offering Type 2024 & 2032

- Figure 32: Middle East & Africa UK Facility Management Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 33: Middle East & Africa UK Facility Management Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 34: Middle East & Africa UK Facility Management Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East & Africa UK Facility Management Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Asia Pacific UK Facility Management Market Revenue (Million), by Facility Management Type 2024 & 2032

- Figure 37: Asia Pacific UK Facility Management Market Revenue Share (%), by Facility Management Type 2024 & 2032

- Figure 38: Asia Pacific UK Facility Management Market Revenue (Million), by Offering Type 2024 & 2032

- Figure 39: Asia Pacific UK Facility Management Market Revenue Share (%), by Offering Type 2024 & 2032

- Figure 40: Asia Pacific UK Facility Management Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 41: Asia Pacific UK Facility Management Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 42: Asia Pacific UK Facility Management Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Asia Pacific UK Facility Management Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global UK Facility Management Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global UK Facility Management Market Revenue Million Forecast, by Facility Management Type 2019 & 2032

- Table 3: Global UK Facility Management Market Revenue Million Forecast, by Offering Type 2019 & 2032

- Table 4: Global UK Facility Management Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: Global UK Facility Management Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global UK Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: England UK Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Wales UK Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Scotland UK Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Northern UK Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Ireland UK Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global UK Facility Management Market Revenue Million Forecast, by Facility Management Type 2019 & 2032

- Table 13: Global UK Facility Management Market Revenue Million Forecast, by Offering Type 2019 & 2032

- Table 14: Global UK Facility Management Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 15: Global UK Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United States UK Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Canada UK Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico UK Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global UK Facility Management Market Revenue Million Forecast, by Facility Management Type 2019 & 2032

- Table 20: Global UK Facility Management Market Revenue Million Forecast, by Offering Type 2019 & 2032

- Table 21: Global UK Facility Management Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 22: Global UK Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Brazil UK Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Argentina UK Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Rest of South America UK Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global UK Facility Management Market Revenue Million Forecast, by Facility Management Type 2019 & 2032

- Table 27: Global UK Facility Management Market Revenue Million Forecast, by Offering Type 2019 & 2032

- Table 28: Global UK Facility Management Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 29: Global UK Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: United Kingdom UK Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Germany UK Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: France UK Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Italy UK Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Spain UK Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Russia UK Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Benelux UK Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Nordics UK Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Europe UK Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global UK Facility Management Market Revenue Million Forecast, by Facility Management Type 2019 & 2032

- Table 40: Global UK Facility Management Market Revenue Million Forecast, by Offering Type 2019 & 2032

- Table 41: Global UK Facility Management Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 42: Global UK Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 43: Turkey UK Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Israel UK Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: GCC UK Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: North Africa UK Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: South Africa UK Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Middle East & Africa UK Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global UK Facility Management Market Revenue Million Forecast, by Facility Management Type 2019 & 2032

- Table 50: Global UK Facility Management Market Revenue Million Forecast, by Offering Type 2019 & 2032

- Table 51: Global UK Facility Management Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 52: Global UK Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 53: China UK Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: India UK Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Japan UK Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: South Korea UK Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: ASEAN UK Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Oceania UK Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Rest of Asia Pacific UK Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Facility Management Market?

The projected CAGR is approximately 1.65%.

2. Which companies are prominent players in the UK Facility Management Market?

Key companies in the market include Sodexo Facilities Management Services, Vinci Facilities Limited, Compass Group, Engie Facility Management (Engie SA), JLL Limited, CBRE Group Inc, Andron Facilities Management, Aramark Facilities Services7 2 Market Share Analysi, Atalian Servest, Atlas FM Ltd, Amey PLC, EMCOR Facilities Services Inc, Kier Group PLC, ISS UK, Serco Group PLC, Mitie Group PLC.

3. What are the main segments of the UK Facility Management Market?

The market segments include Facility Management Type, Offering Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 69.28 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Trend Toward Commoditization of FM; Growing Demand for IFM and Outsourcing of Non-core Operations from Emerging Verticals; Renewed Emphasis on Workplace Optimization and Productivity.

6. What are the notable trends driving market growth?

Single FM Service is Expected to Hold Significant Share.

7. Are there any restraints impacting market growth?

Market Saturation in the Public Sector; Growing Competition Expected to Impact Profit Margins of Existing Vendors.

8. Can you provide examples of recent developments in the market?

March 2024: Sodexo Health & Care extended established partnerships for catering, retail, and soft FM services at two hospitals at Stoke-on-Trent in Staffordshire. Under a new 10-year contract worth EUR 38 million a year covering both hospitals as part of a Private Finance Initiative (PFI), Sodexo will continue to deliver catering, retail, and soft FM services throughout the PFI and the retained estate at both hospitals.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Facility Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Facility Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Facility Management Market?

To stay informed about further developments, trends, and reports in the UK Facility Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence