Key Insights

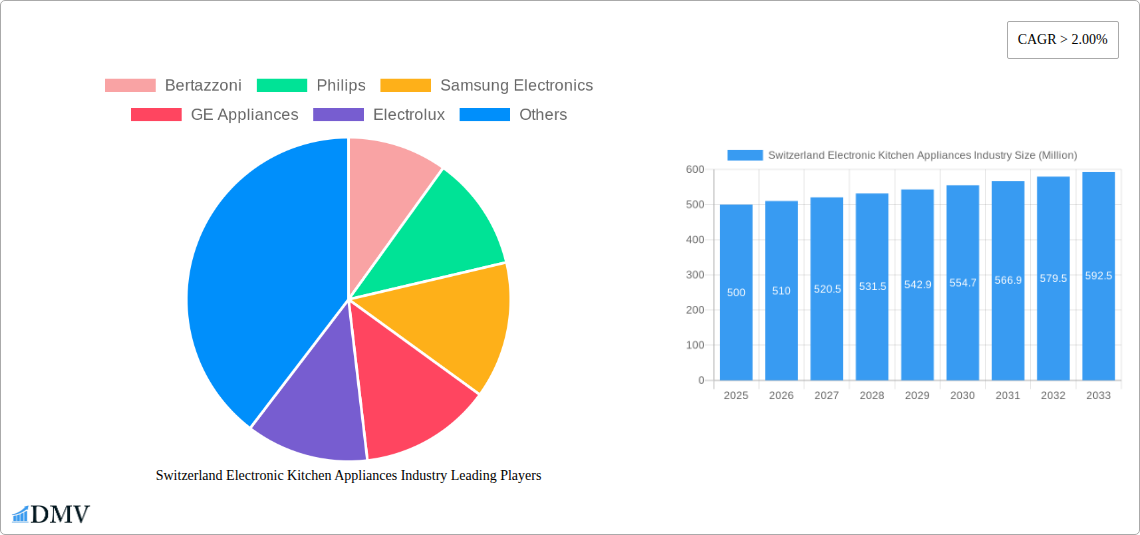

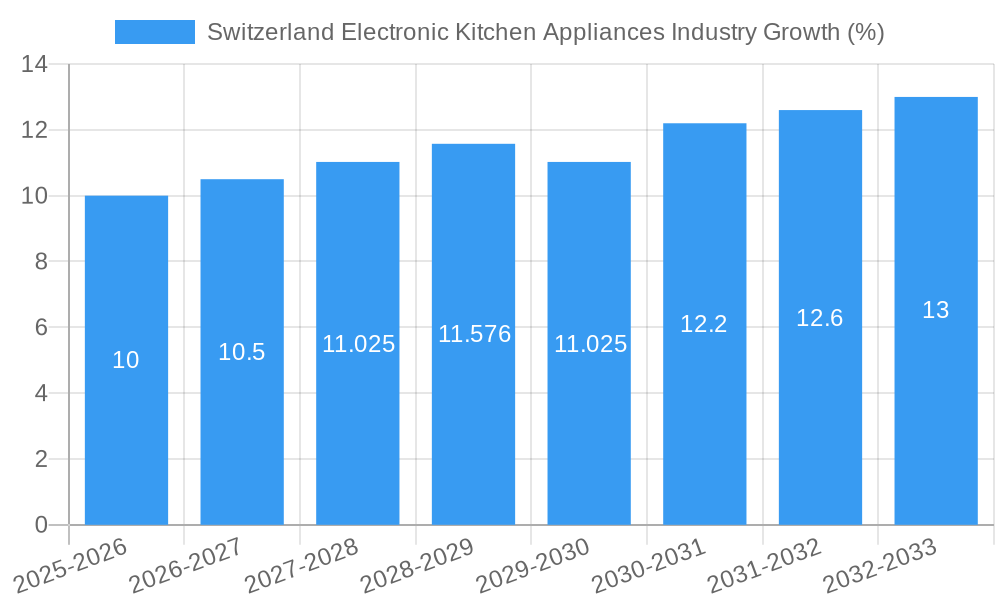

The Swiss electronic kitchen appliance market, valued at an estimated CHF 500 million in 2025, is projected to experience robust growth, driven by increasing disposable incomes, a preference for convenience, and the rising adoption of smart home technologies. The market's Compound Annual Growth Rate (CAGR) exceeding 2% indicates a steady expansion over the forecast period (2025-2033). Key growth drivers include the rising popularity of premium, energy-efficient appliances, fueled by eco-conscious consumerism and government initiatives promoting energy conservation. The market is segmented by product type (food processing, small kitchen appliances, large kitchen appliances, and others) and distribution channel (offline and online). While offline channels currently dominate, online sales are experiencing significant growth, driven by the convenience of e-commerce and increased online shopping penetration in Switzerland. The competitive landscape is characterized by a mix of global giants like Whirlpool, Electrolux, and Samsung, alongside specialized brands like KitchenAid and Bertazzoni catering to high-end consumer preferences. Factors such as high living costs and a relatively small market size could potentially restrain market growth, although the increasing adoption of innovative technologies and design is likely to mitigate these factors.

The forecast for the Swiss electronic kitchen appliance market is positive, with continuous growth expected throughout the forecast period. Premiumization, encompassing features like smart connectivity and improved functionalities, is a significant trend. The increasing demand for sustainable and energy-efficient appliances presents an opportunity for brands that prioritize eco-friendly design and manufacturing. The shift towards online sales channels presents challenges and opportunities for both established and new players, necessitating effective digital marketing strategies and robust e-commerce infrastructure. The ongoing focus on kitchen renovations and improvements in Swiss households further supports the positive outlook for the market. Competitors will need to adapt to evolving consumer preferences by offering diverse product portfolios and seamless omnichannel experiences.

Switzerland Electronic Kitchen Appliances Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Switzerland electronic kitchen appliances market, offering a comprehensive overview of its current state, future trajectory, and key players. Spanning the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report is an invaluable resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The market size in 2025 is estimated at xx Million CHF, and is projected to reach xx Million CHF by 2033.

Switzerland Electronic Kitchen Appliances Industry Market Composition & Trends

The Swiss electronic kitchen appliances market exhibits a moderately concentrated landscape, with a few major players holding significant market share. Bertazzoni, Philips, Samsung Electronics, GE Appliances, Electrolux, Whirlpool, Morphy Richards, KitchenAid, and Panasonic Corporation are key competitors. Market share distribution is dynamic, with ongoing competition influencing pricing and innovation. The market is driven by increasing disposable incomes, a rising preference for convenience, and the adoption of smart home technologies. Stringent energy efficiency regulations and a growing awareness of sustainability are also shaping the market. The regulatory landscape is relatively stable, fostering a predictable business environment. Substitute products, such as traditional cooking methods, pose limited competition due to the convenience and efficiency offered by modern electronic appliances. The end-user profile is diverse, encompassing households of varying sizes and income levels, with a particular focus on quality and design. M&A activity in the Swiss market has been relatively modest in recent years, with deal values estimated at xx Million CHF over the historical period (2019-2024). Innovation is primarily driven by improvements in energy efficiency, smart features, and design aesthetics.

- Market Concentration: Moderately concentrated, with top players holding approximately xx% market share.

- Innovation Catalysts: Smart home integration, energy efficiency standards, and design innovation.

- Regulatory Landscape: Stable, with a focus on energy efficiency and safety regulations.

- Substitute Products: Traditional cooking methods pose minimal threat.

- End-User Profiles: Diverse, encompassing households of all sizes and income levels.

- M&A Activity (2019-2024): Estimated value of xx Million CHF.

Switzerland Electronic Kitchen Appliances Industry Industry Evolution

The Swiss electronic kitchen appliances market has witnessed consistent growth during the historical period (2019-2024), driven by factors such as rising disposable incomes and changing consumer lifestyles. Technological advancements, including the incorporation of smart features and improved energy efficiency, have further stimulated growth. Consumer demand has shifted towards premium and multi-functional appliances, emphasizing convenience and ease of use. The market experienced an average annual growth rate (AAGR) of xx% during 2019-2024. The forecast period (2025-2033) anticipates continued growth, albeit at a slightly moderated pace, driven by sustained consumer demand and ongoing technological innovation. The adoption rate of smart kitchen appliances is expected to increase significantly over the forecast period, driven by advancements in connectivity and user-friendly interfaces. The market is likely to see increased competition from both domestic and international players, leading to price adjustments and enhanced product offerings.

Leading Regions, Countries, or Segments in Switzerland Electronic Kitchen Appliances Industry

Within Switzerland, urban areas exhibit the highest demand for electronic kitchen appliances, driven by higher disposable incomes and greater consumer awareness of advanced technologies. The small kitchen appliances segment, encompassing products such as blenders, toasters, and coffee makers, commands the largest market share, fueled by a strong demand for convenience and compact designs. Online channels are gaining traction, facilitated by increased internet penetration and e-commerce growth, though offline channels remain dominant.

- Key Drivers for Urban Area Dominance: Higher disposable income, greater consumer awareness of technology.

- Key Drivers for Small Kitchen Appliance Segment Dominance: Convenience, compact designs, wide range of options.

- Key Drivers for Offline Channel Dominance: Established retail infrastructure, consumer preference for physical examination of products.

- Key Drivers for Online Channel Growth: Increased internet penetration, e-commerce expansion.

Switzerland Electronic Kitchen Appliances Industry Product Innovations

Recent innovations in the Swiss market focus on energy-efficient motors, smart connectivity features, and improved user interfaces. Manufacturers are emphasizing intuitive designs, enhanced safety mechanisms, and improved durability. Unique selling propositions include sophisticated cooking programs, personalized settings, and voice-activated controls. Technological advancements like induction cooking and precise temperature control contribute significantly to consumer appeal.

Propelling Factors for Switzerland Electronic Kitchen Appliances Industry Growth

Growth in the Swiss electronic kitchen appliances market is propelled by rising disposable incomes among consumers, increasing demand for convenience and time-saving devices, and the widespread adoption of smart home technology. Government regulations promoting energy efficiency and sustainable practices also play a significant role. The expansion of e-commerce platforms and improved logistics infrastructure are further contributing factors.

Obstacles in the Switzerland Electronic Kitchen Appliances Industry Market

The market faces challenges such as high import tariffs, leading to increased product prices and potentially impacting consumer purchasing decisions. Supply chain disruptions, particularly related to semiconductor components, could lead to production delays and increased costs. Intense competition from both domestic and international players further adds complexity to the market dynamics.

Future Opportunities in Switzerland Electronic Kitchen Appliances Industry

Future opportunities lie in the growing adoption of smart kitchen appliances with advanced features like AI-powered cooking assistance and integrated recipe management systems. The market will continue to see growth in the premium segment, focusing on design, performance, and sustainability. Expansion into niche markets, targeting specific dietary needs or cooking preferences, presents additional avenues for growth.

Major Players in the Switzerland Electronic Kitchen Appliances Industry Ecosystem

- Bertazzoni

- Philips

- Samsung Electronics

- GE Appliances

- Electrolux

- Whirlpool

- Morphy Richards

- KitchenAid

- Panasonic Corporation

Key Developments in Switzerland Electronic Kitchen Appliances Industry Industry

- 2022 Q4: Samsung Electronics launched its new line of smart ovens featuring AI-powered cooking assistance.

- 2023 Q1: Electrolux announced a partnership with a Swiss retailer to expand its online sales channels.

- 2023 Q3: Whirlpool introduced a new range of energy-efficient refrigerators meeting the latest Swiss sustainability standards.

Strategic Switzerland Electronic Kitchen Appliances Industry Market Forecast

The Swiss electronic kitchen appliances market is poised for continued growth over the forecast period (2025-2033), driven by sustained consumer demand, technological advancements, and the expanding adoption of smart home technology. The market will witness increased competition, necessitating innovation and strategic partnerships to maintain a competitive edge. The premium segment is expected to experience particularly strong growth, reflecting a shift towards higher-quality and feature-rich appliances.

Switzerland Electronic Kitchen Appliances Industry Segmentation

-

1. BY Product type

- 1.1. Food Processing

- 1.2. Small Kitchen

- 1.3. Large Kitchen

- 1.4. Others

-

2. Channel

- 2.1. Offline

- 2.2. Online

Switzerland Electronic Kitchen Appliances Industry Segmentation By Geography

- 1. Switzerland

Switzerland Electronic Kitchen Appliances Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in New Offices in South Korea; Wide Range of Design Broadening Consumer Base

- 3.3. Market Restrains

- 3.3.1. Fluctuations in Raw Material Prices and Rise in Shipping Prices; Intense Competition from Both Local and International Players

- 3.4. Market Trends

- 3.4.1. Small Cooking Appliances are Innovating Rapidly Compared to Major Appliances

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Switzerland Electronic Kitchen Appliances Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by BY Product type

- 5.1.1. Food Processing

- 5.1.2. Small Kitchen

- 5.1.3. Large Kitchen

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Channel

- 5.2.1. Offline

- 5.2.2. Online

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Switzerland

- 5.1. Market Analysis, Insights and Forecast - by BY Product type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Bertazzoni

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Philips

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Samsung Electronics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 GE Appliances

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Electrolux

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Whirlpool

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Morphy Richards

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 KitchenAid

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Panasonic Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Bertazzoni

List of Figures

- Figure 1: Switzerland Electronic Kitchen Appliances Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Switzerland Electronic Kitchen Appliances Industry Share (%) by Company 2024

List of Tables

- Table 1: Switzerland Electronic Kitchen Appliances Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Switzerland Electronic Kitchen Appliances Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Switzerland Electronic Kitchen Appliances Industry Revenue Million Forecast, by BY Product type 2019 & 2032

- Table 4: Switzerland Electronic Kitchen Appliances Industry Volume K Unit Forecast, by BY Product type 2019 & 2032

- Table 5: Switzerland Electronic Kitchen Appliances Industry Revenue Million Forecast, by Channel 2019 & 2032

- Table 6: Switzerland Electronic Kitchen Appliances Industry Volume K Unit Forecast, by Channel 2019 & 2032

- Table 7: Switzerland Electronic Kitchen Appliances Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Switzerland Electronic Kitchen Appliances Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: Switzerland Electronic Kitchen Appliances Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Switzerland Electronic Kitchen Appliances Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: Switzerland Electronic Kitchen Appliances Industry Revenue Million Forecast, by BY Product type 2019 & 2032

- Table 12: Switzerland Electronic Kitchen Appliances Industry Volume K Unit Forecast, by BY Product type 2019 & 2032

- Table 13: Switzerland Electronic Kitchen Appliances Industry Revenue Million Forecast, by Channel 2019 & 2032

- Table 14: Switzerland Electronic Kitchen Appliances Industry Volume K Unit Forecast, by Channel 2019 & 2032

- Table 15: Switzerland Electronic Kitchen Appliances Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Switzerland Electronic Kitchen Appliances Industry Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Switzerland Electronic Kitchen Appliances Industry?

The projected CAGR is approximately > 2.00%.

2. Which companies are prominent players in the Switzerland Electronic Kitchen Appliances Industry?

Key companies in the market include Bertazzoni, Philips, Samsung Electronics, GE Appliances, Electrolux, Whirlpool, Morphy Richards, KitchenAid, Panasonic Corporation.

3. What are the main segments of the Switzerland Electronic Kitchen Appliances Industry?

The market segments include BY Product type, Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in New Offices in South Korea; Wide Range of Design Broadening Consumer Base.

6. What are the notable trends driving market growth?

Small Cooking Appliances are Innovating Rapidly Compared to Major Appliances.

7. Are there any restraints impacting market growth?

Fluctuations in Raw Material Prices and Rise in Shipping Prices; Intense Competition from Both Local and International Players.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Switzerland Electronic Kitchen Appliances Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Switzerland Electronic Kitchen Appliances Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Switzerland Electronic Kitchen Appliances Industry?

To stay informed about further developments, trends, and reports in the Switzerland Electronic Kitchen Appliances Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence