Key Insights

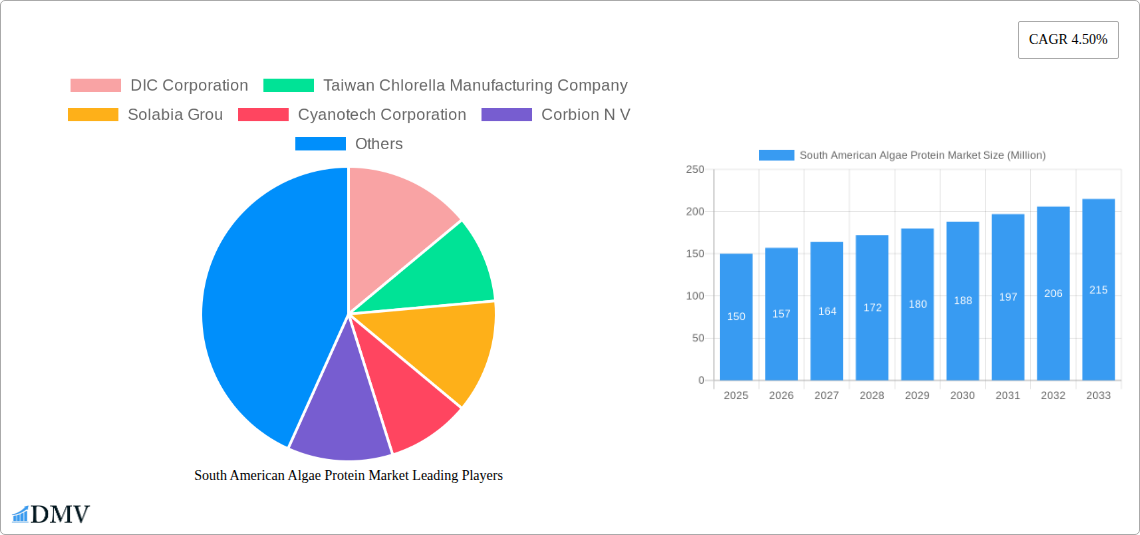

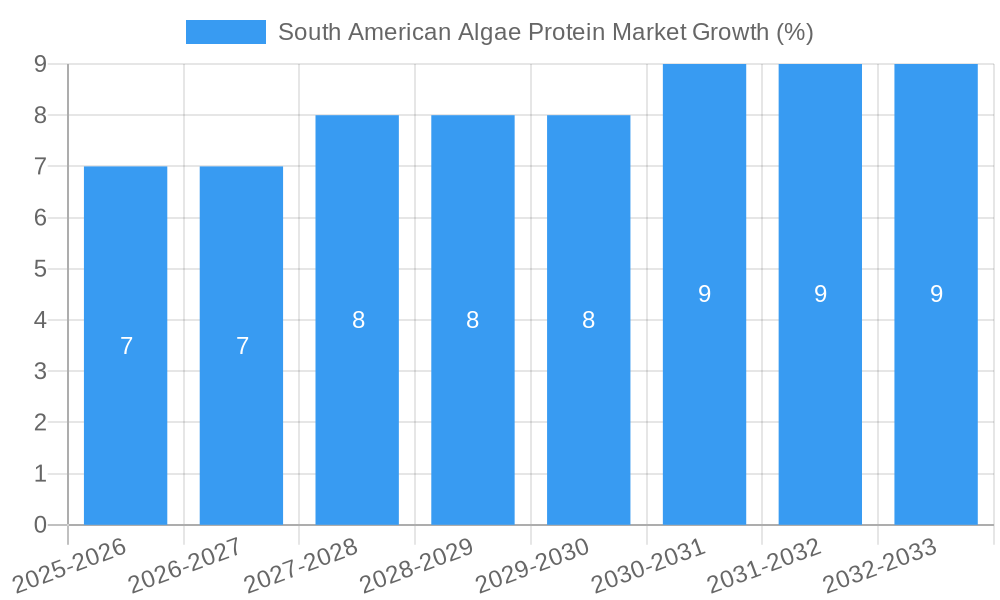

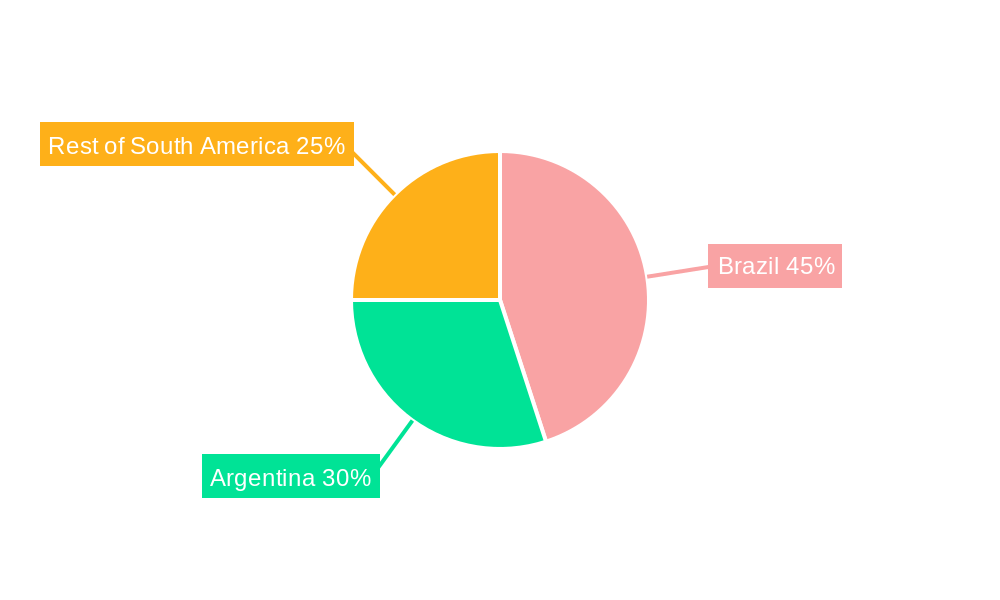

The South American algae protein market, currently experiencing robust growth, is projected to reach a significant size in the coming years. Driven by increasing consumer awareness of the health benefits of plant-based proteins and the rising demand for sustainable food sources, the market is witnessing a surge in the consumption of algae-based protein products. The region's substantial agricultural sector and favorable climatic conditions further contribute to the market's expansion. Key segments driving growth include spirulina and chlorella, primarily utilized in food & beverage and dietary supplement applications. While the pharmaceutical segment shows promising potential, it currently holds a smaller market share. Brazil and Argentina lead the South American market, fueled by a burgeoning health-conscious population and a strong focus on nutritional advancements within the food and beverage industry. However, challenges such as high production costs, limited awareness in certain regions, and regulatory hurdles related to novel food products need to be addressed for sustained growth.

Despite these challenges, the forecast period of 2025-2033 presents significant opportunities. The ongoing research and development efforts focused on enhancing the production efficiency and cost-effectiveness of algae protein are expected to alleviate some constraints. Furthermore, increased government support for sustainable agriculture and growing partnerships between established food companies and algae protein producers are expected to significantly accelerate market expansion. The entry of new players and the diversification of product applications, such as incorporating algae protein into functional foods and beverages, are poised to further fuel market growth across South America. The market's CAGR of 4.50% suggests a steady and consistent upward trajectory, with a significant expansion expected in the forecast period.

South American Algae Protein Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the burgeoning South American Algae Protein Market, offering a comprehensive overview of its current state, future trajectory, and key players. With a meticulous study period spanning 2019-2033 (Base Year: 2025, Estimated Year: 2025, Forecast Period: 2025-2033, Historical Period: 2019-2024), this report is an indispensable resource for stakeholders seeking to understand and capitalize on this dynamic market. The market is projected to reach xx Million by 2033, presenting significant growth opportunities.

South American Algae Protein Market Composition & Trends

The South American Algae Protein market exhibits a moderately fragmented landscape, with key players like DIC Corporation, Taiwan Chlorella Manufacturing Company, Solabia Group, Cyanotech Corporation, Corbion N V, Roquette Freres, and EID Parry vying for market share. Innovation is driven by the increasing demand for sustainable and nutritious protein sources, alongside advancements in algae cultivation and extraction technologies. Regulatory landscapes vary across South American nations, impacting market entry and product approvals. Substitute products include soy protein and pea protein, posing competitive pressure. End-users primarily include food & beverage manufacturers, dietary supplement producers, and pharmaceutical companies. M&A activities have been relatively modest in recent years, with total deal values estimated at xx Million during the historical period. Market share distribution is currently skewed towards established players, with the top 5 companies holding an estimated 60% market share in 2025.

- Market Concentration: Moderately fragmented

- Innovation Catalysts: Sustainable protein demand, technological advancements

- Regulatory Landscape: Varied across South American nations

- Substitute Products: Soy protein, pea protein

- End-User Profile: Food & beverage, dietary supplements, pharmaceuticals

- M&A Activity: Estimated xx Million in deal values (2019-2024)

South American Algae Protein Market Industry Evolution

The South American Algae Protein market has witnessed significant growth over the past five years, fueled by rising consumer awareness of the health benefits of algae protein and the increasing demand for plant-based alternatives. The market experienced a CAGR of xx% during the historical period (2019-2024), and is projected to maintain a robust growth trajectory throughout the forecast period (2025-2033), driven by factors such as increasing health consciousness, growing adoption of vegan and vegetarian lifestyles, and the rising prevalence of chronic diseases. Technological advancements in algae cultivation techniques and protein extraction methods have enhanced product quality and reduced production costs, further accelerating market expansion. Consumer demand is shifting towards high-quality, functional algae-based products with specific health benefits, creating opportunities for product diversification and innovation. This is further bolstered by the rising popularity of functional foods and beverages. The adoption of algae protein in food and beverage applications is steadily increasing, with projected adoption rates reaching xx% by 2033, compared to xx% in 2025.

Leading Regions, Countries, or Segments in South American Algae Protein Market

The Brazilian market currently dominates the South American Algae Protein landscape, driven by its large and growing population, rising disposable incomes, and a favorable regulatory environment. The Spirulina segment holds the largest market share by type, followed by Chlorella. Within applications, the food & beverage sector is the leading consumer of algae protein, followed by dietary supplements.

Key Drivers:

- Brazil: Large population, rising disposable incomes, favorable regulations.

- Spirulina Segment: High nutritional value, established market presence.

- Food & Beverage Application: Widespread use in various products, increasing consumer acceptance.

Dominance Factors:

Brazil's large and growing consumer base, coupled with increasing health consciousness and a burgeoning demand for plant-based alternatives, contributes significantly to its leading market position. The popularity of Spirulina, due to its recognized nutritional benefits and existing market penetration, fuels its dominance within the product type segment. The widespread integration of algae protein into food and beverage applications further underscores the dominance of this application segment.

South American Algae Protein Market Product Innovations

Recent innovations have focused on enhancing the functionality and palatability of algae protein. New extraction techniques have improved the protein yield and reduced the presence of undesirable flavors. Formulations are being developed to incorporate algae protein into various food products, overcoming challenges related to texture and taste. Furthermore, targeted applications in specialized foods for specific health conditions (e.g., high protein for weight management, enhanced nutrients for senior health) are gaining traction.

Propelling Factors for South American Algae Protein Market Growth

Several factors are driving the growth of the South American Algae Protein market. These include the increasing demand for sustainable and environmentally friendly protein sources, rising health consciousness among consumers, technological advancements in algae cultivation and processing, and supportive government policies promoting the development of the algae industry. Furthermore, the increasing adoption of plant-based diets and the growing awareness of the health benefits of algae protein are also significant contributing factors.

Obstacles in the South American Algae Protein Market

Challenges include the relatively high cost of production compared to traditional protein sources, the need for further research to address potential allergenicity concerns, and variations in regulatory frameworks across different South American countries, creating hurdles for market entry and expansion. Supply chain complexities and the fluctuating price of raw materials also pose challenges. Competition from established protein sources further limits market penetration in some sectors. These factors limit adoption by some segments which result in a slower market growth compared to some other geographical locations.

Future Opportunities in South American Algae Protein Market

Significant opportunities exist in expanding the application of algae protein into novel food products, developing value-added ingredients for specialized markets (e.g., sports nutrition, infant formula), and exploring new markets within South America, especially in countries with high growth potential. Further research into the health benefits of algae protein and its potential to address malnutrition can unlock new market opportunities. Investing in sustainable cultivation and processing technologies to reduce costs and improve efficiency presents a significant pathway for future growth.

Major Players in the South American Algae Protein Market Ecosystem

- DIC Corporation

- Taiwan Chlorella Manufacturing Company

- Solabia Group

- Cyanotech Corporation

- Corbion N V

- Roquette Freres

- EID Parry

Key Developments in South American Algae Protein Market Industry

- 2022 Q4: Solabia Group launched a new line of algae-based protein ingredients targeting the dietary supplement market.

- 2023 Q1: DIC Corporation announced a strategic partnership with a local South American producer to expand its algae cultivation capacity.

- 2024 Q2: New regulations regarding the labeling and safety of algae-based products were implemented in Brazil, impacting market dynamics.

- 2025 Q3: Cyanotech Corporation invested in a new algae processing facility in Chile to meet the growing demand.

Strategic South American Algae Protein Market Forecast

The South American Algae Protein market is poised for significant growth over the next decade. Driven by increasing consumer demand for sustainable and nutritious protein sources, technological advancements, and favorable regulatory developments in key markets, the market is expected to experience substantial expansion. Focus on product innovation, expansion into new markets, and sustainable production practices will be crucial for companies to thrive in this dynamic landscape. The market’s potential for growth is substantial, presenting lucrative opportunities for both established players and new entrants.

South American Algae Protein Market Segmentation

-

1. Type

- 1.1. Spirulina

- 1.2. Chlorella

- 1.3. Other Types

-

2. Application

- 2.1. Food & Beverages

- 2.2. Dietary Supplements

- 2.3. Pharmaceuticals

- 2.4. Other Applications

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Rest of South America

South American Algae Protein Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South American Algae Protein Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Inclination Toward Low-Sugar/Sugar-free Beverages

- 3.3. Market Restrains

- 3.3.1. Concerns Over Health Issues Associated with Functional Beverages

- 3.4. Market Trends

- 3.4.1. Spirulina is Witnessing A Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South American Algae Protein Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Spirulina

- 5.1.2. Chlorella

- 5.1.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food & Beverages

- 5.2.2. Dietary Supplements

- 5.2.3. Pharmaceuticals

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil South American Algae Protein Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Spirulina

- 6.1.2. Chlorella

- 6.1.3. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Food & Beverages

- 6.2.2. Dietary Supplements

- 6.2.3. Pharmaceuticals

- 6.2.4. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Argentina South American Algae Protein Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Spirulina

- 7.1.2. Chlorella

- 7.1.3. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Food & Beverages

- 7.2.2. Dietary Supplements

- 7.2.3. Pharmaceuticals

- 7.2.4. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of South America South American Algae Protein Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Spirulina

- 8.1.2. Chlorella

- 8.1.3. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Food & Beverages

- 8.2.2. Dietary Supplements

- 8.2.3. Pharmaceuticals

- 8.2.4. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Brazil South American Algae Protein Market Analysis, Insights and Forecast, 2019-2031

- 10. Argentina South American Algae Protein Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of South America South American Algae Protein Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 DIC Corporation

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Taiwan Chlorella Manufacturing Company

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Solabia Grou

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Cyanotech Corporation

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Corbion N V

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Roquette Freres

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 EID Parry

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.1 DIC Corporation

List of Figures

- Figure 1: South American Algae Protein Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South American Algae Protein Market Share (%) by Company 2024

List of Tables

- Table 1: South American Algae Protein Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South American Algae Protein Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: South American Algae Protein Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: South American Algae Protein Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: South American Algae Protein Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: South American Algae Protein Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Brazil South American Algae Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Argentina South American Algae Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of South America South American Algae Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South American Algae Protein Market Revenue Million Forecast, by Type 2019 & 2032

- Table 11: South American Algae Protein Market Revenue Million Forecast, by Application 2019 & 2032

- Table 12: South American Algae Protein Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 13: South American Algae Protein Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: South American Algae Protein Market Revenue Million Forecast, by Type 2019 & 2032

- Table 15: South American Algae Protein Market Revenue Million Forecast, by Application 2019 & 2032

- Table 16: South American Algae Protein Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: South American Algae Protein Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: South American Algae Protein Market Revenue Million Forecast, by Type 2019 & 2032

- Table 19: South American Algae Protein Market Revenue Million Forecast, by Application 2019 & 2032

- Table 20: South American Algae Protein Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: South American Algae Protein Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South American Algae Protein Market?

The projected CAGR is approximately 4.50%.

2. Which companies are prominent players in the South American Algae Protein Market?

Key companies in the market include DIC Corporation, Taiwan Chlorella Manufacturing Company, Solabia Grou, Cyanotech Corporation, Corbion N V, Roquette Freres, EID Parry.

3. What are the main segments of the South American Algae Protein Market?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Inclination Toward Low-Sugar/Sugar-free Beverages.

6. What are the notable trends driving market growth?

Spirulina is Witnessing A Significant Growth.

7. Are there any restraints impacting market growth?

Concerns Over Health Issues Associated with Functional Beverages.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South American Algae Protein Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South American Algae Protein Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South American Algae Protein Market?

To stay informed about further developments, trends, and reports in the South American Algae Protein Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence