Key Insights

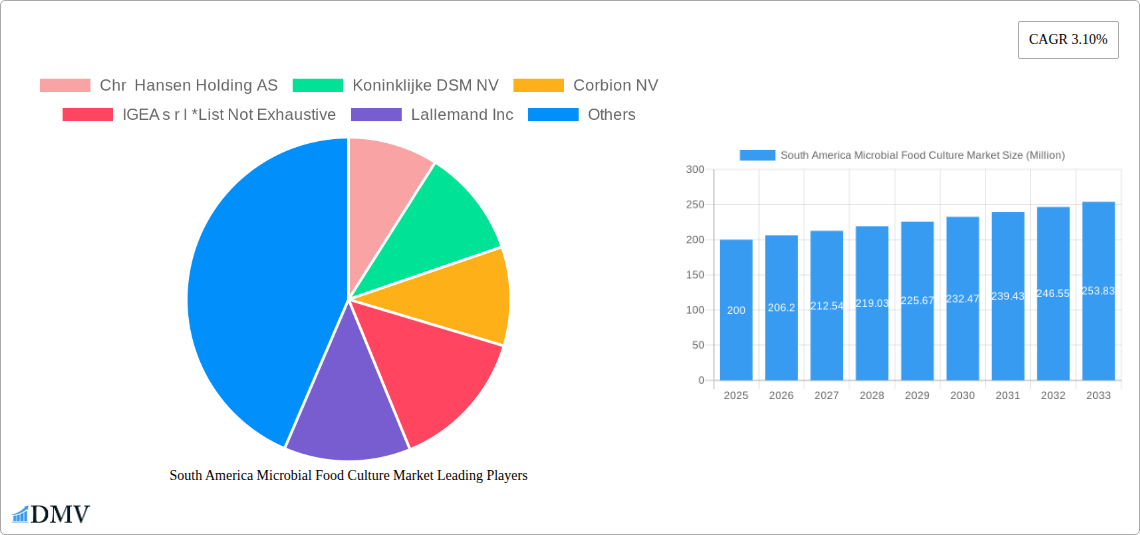

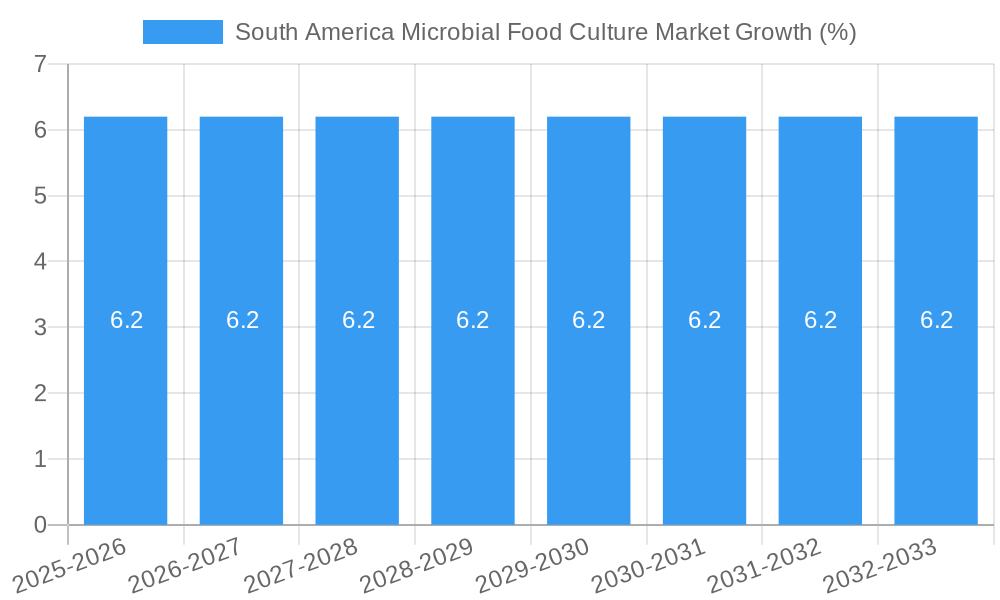

The South American microbial food culture market, valued at approximately $XX million in 2025, is projected to experience steady growth, driven by increasing demand for healthier and more convenient food products. The Compound Annual Growth Rate (CAGR) of 3.10% from 2025 to 2033 indicates a promising outlook, fueled by several key factors. The rising popularity of fermented foods and beverages, along with the growing awareness of probiotics' health benefits, significantly contributes to market expansion. The bakery and confectionery sector is a major consumer, utilizing cultures for improved texture, flavor, and shelf life. The dairy industry also represents a substantial segment, employing cultures in cheese, yogurt, and other fermented dairy products. Growth is further stimulated by advancements in culture technology, leading to more efficient and versatile products for food manufacturers. However, challenges such as fluctuating raw material prices and stringent regulatory requirements could potentially temper growth. Brazil and Argentina represent the largest markets within South America, while the "Rest of South America" segment displays significant albeit slower growth potential. Further segmentation by type (starter cultures, adjunct and aroma cultures, probiotics) allows for a more granular understanding of market dynamics. The competitive landscape features a mix of global players like Chr. Hansen, DSM, and Corbion, alongside regional producers, leading to a dynamic market with opportunities for both established and emerging companies.

The market's segmentation provides valuable insights into specific growth opportunities. The probiotic segment is anticipated to show particularly strong growth, mirroring the global trend towards functional foods. Within the end-industry segment, the dairy sector is expected to maintain its leading position, due to the widespread consumption of fermented dairy products in South America. The beverage industry also presents a notable opportunity, particularly with the increasing popularity of functional beverages incorporating probiotics. Geographical expansion within South America, beyond Brazil and Argentina, will be a key strategic focus for market players. Investment in research and development focusing on novel cultures and tailored solutions for specific food applications is crucial for maintaining a competitive edge. Companies are also likely to focus on sustainable practices and traceability to meet the growing consumer demand for transparency in the food supply chain.

South America Microbial Food Culture Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the South America Microbial Food Culture Market, offering a comprehensive overview of its current state, future trends, and key players. Valued at xx Million in 2025, the market is poised for significant growth during the forecast period (2025-2033). The study covers the historical period (2019-2024) and utilizes 2025 as the base year. This report is essential for stakeholders seeking to understand market dynamics, identify opportunities, and make informed business decisions.

South America Microbial Food Culture Market Composition & Trends

The South American Microbial Food Culture market exhibits a moderately concentrated landscape, with key players like Chr. Hansen Holding AS, Koninklijke DSM NV, Corbion NV, IGEA s.r.l., Lallemand Inc., and others vying for market share. Market share distribution is currently estimated at xx% for Chr. Hansen, xx% for DSM, xx% for Corbion, and the remaining xx% distributed amongst other players and smaller regional producers. Innovation is driven by consumer demand for healthier and more natural food products, along with advancements in microbial strain development and fermentation technologies. The regulatory landscape, while evolving, presents both opportunities and challenges, particularly regarding labeling and safety standards. Substitute products, such as chemical preservatives and flavor enhancers, pose a competitive threat, while the increasing focus on clean-label products fuels market growth. End-user profiles vary significantly across the segments, with a growing emphasis on functional foods and personalized nutrition. M&A activity has been relatively modest in recent years, with deal values averaging around xx Million annually.

- Market Concentration: Moderately Concentrated

- Innovation Catalysts: Consumer demand for clean-label products, technological advancements in strain development.

- Regulatory Landscape: Evolving, influencing labeling and safety regulations.

- Substitute Products: Chemical preservatives, flavor enhancers.

- M&A Activity: Moderate, average deal value of xx Million annually.

South America Microbial Food Culture Market Industry Evolution

The South American Microbial Food Culture market has experienced consistent growth over the past few years, driven by factors such as rising disposable incomes, changing dietary habits, and increasing awareness of the health benefits of fermented foods. The market's Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) was approximately xx%, with a projected CAGR of xx% during the forecast period (2025-2033). Technological advancements, including high-throughput screening and genetic engineering, have enabled the development of novel microbial strains with improved functionalities. Consumer demand is shifting towards natural and functional ingredients, which boosts the demand for microbial cultures. This includes increased preference for probiotics and fermented products offering digestive benefits. Adoption of microbial cultures across food categories is increasing, with dairy and bakery segments showing the highest adoption rates. The market is witnessing the integration of advanced analytics and process optimization to enhance efficiency and improve product quality.

Leading Regions, Countries, or Segments in South America Microbial Food Culture Market

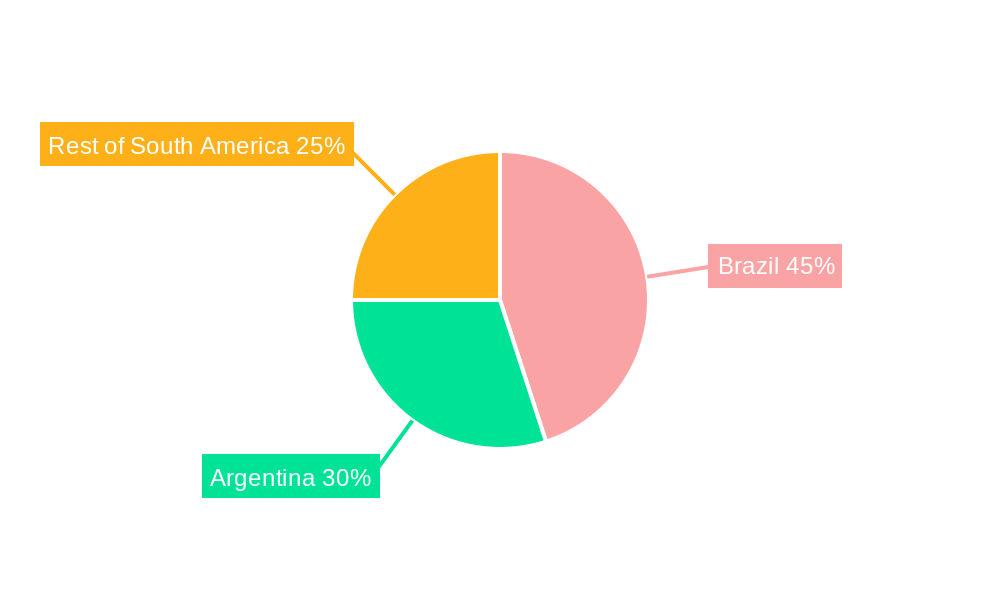

Brazil dominates the South American Microbial Food Culture market, accounting for approximately xx% of the total market value in 2025. This leadership is attributed to factors such as a large and growing food and beverage industry, high consumer demand for processed foods, and a relatively well-developed infrastructure for food production. Argentina holds the second-largest market share, approximately xx%, driven by similar factors, though on a smaller scale. The "Rest of South America" region is projected to experience significant growth.

By Type:

- Starter Cultures: This segment dominates due to its widespread use in various food applications.

- Probiotics: Experiencing rapid growth due to rising health consciousness.

- Adjunct and Aroma Cultures: Growing steadily, contributing to improved flavor profiles.

By End-Industry:

- Dairy: Largest segment due to the extensive use of microbial cultures in yogurt, cheese, and other dairy products.

- Bakery & Confectionery: Significant usage in bread, pastries, and other baked goods.

- Beverages: Growing demand for fermented beverages fuels the growth in this segment.

Key Drivers:

- Brazil: Large and growing food and beverage sector, high demand for processed foods, relatively advanced food production infrastructure.

- Argentina: Similar drivers to Brazil, albeit on a smaller scale.

- Rest of South America: Rapidly developing economies and increasing consumer spending.

South America Microbial Food Culture Market Product Innovations

Recent innovations include the development of high-performance starter cultures tailored for specific food applications, resulting in improved texture, taste, and shelf life. Probiotic strains with enhanced viability and efficacy are also gaining traction. The incorporation of advanced fermentation technologies, including precision fermentation, further improves production efficiency. Unique selling propositions often center around enhanced functionalities, such as improved probiotic viability, or the development of cultures tailored to specific regional preferences.

Propelling Factors for South America Microbial Food Culture Market Growth

Several factors drive market growth, including increasing demand for functional foods and beverages enriched with probiotics and prebiotics. Rising consumer awareness of the health benefits associated with fermented foods also fuels market expansion. Economic growth across South America contributes to increased disposable incomes and spending on premium food products. Government initiatives promoting food safety and standardization also create favorable conditions for market expansion.

Obstacles in the South America Microbial Food Culture Market

Market growth is constrained by factors such as supply chain disruptions and the volatility of raw material prices. Regulatory complexities related to food safety standards and labeling regulations may hinder market expansion. The presence of numerous small players and limited production capacity can pose a challenge to larger companies seeking expansion. The availability of affordable and reliable cold chain infrastructure in certain regions presents logistical challenges.

Future Opportunities in South America Microbial Food Culture Market

Emerging opportunities include the expansion into new food categories, such as plant-based alternatives and personalized nutrition products. The incorporation of advanced technologies like artificial intelligence and machine learning into production processes holds immense potential. Increasing consumer demand for convenient and ready-to-eat meals presents opportunities for developing tailored microbial cultures for such products.

Major Players in the South America Microbial Food Culture Market Ecosystem

- Chr. Hansen Holding AS

- Koninklijke DSM NV

- Corbion NV

- IGEA s.r.l.

- Lallemand Inc.

Key Developments in South America Microbial Food Culture Market Industry

- 2022 Q3: Launch of a new probiotic strain by Chr. Hansen optimized for dairy applications in the Brazilian market.

- 2023 Q1: DSM announces investment in a new fermentation facility in Argentina to increase production capacity.

- 2024 Q2: Corbion partners with a local distributor to expand its reach in the Rest of South America region.

- (Further developments can be added as they become available)

Strategic South America Microbial Food Culture Market Forecast

The South America Microbial Food Culture market is expected to exhibit strong growth in the coming years, driven by several factors, including the increasing demand for healthy and convenient food options. The market is poised to benefit from continued innovation in microbial strain development and fermentation technologies. The rising adoption of plant-based foods will create significant opportunities for manufacturers offering specialized microbial cultures. The market is likely to witness further consolidation through mergers and acquisitions, shaping the competitive landscape. The projected CAGR is expected to remain above xx% during the forecast period (2025-2033).

South America Microbial Food Culture Market Segmentation

-

1. Type

- 1.1. Starter Cultures

- 1.2. Adjunct and Aroma Cultures

- 1.3. Probiotics

-

2. End-Industry

- 2.1. Bakery and Confectionery

- 2.2. Dairy

- 2.3. Fruits and Vegetables

- 2.4. Beverages

- 2.5. Other End-user Industries

South America Microbial Food Culture Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Microbial Food Culture Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Rising Awareness of the Health Benefits Associated with Collagen Consumption; Rising Sport and Fitness Trends Drives the Market Growth

- 3.3. Market Restrains

- 3.3.1. Concerns over the Source and Animal Welfare in Collagen Extraction Limit the Market Growth

- 3.4. Market Trends

- 3.4.1. Rising Demand for Starter Culture in Food & Beverage Industries

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Microbial Food Culture Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Starter Cultures

- 5.1.2. Adjunct and Aroma Cultures

- 5.1.3. Probiotics

- 5.2. Market Analysis, Insights and Forecast - by End-Industry

- 5.2.1. Bakery and Confectionery

- 5.2.2. Dairy

- 5.2.3. Fruits and Vegetables

- 5.2.4. Beverages

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil South America Microbial Food Culture Market Analysis, Insights and Forecast, 2019-2031

- 7. Argentina South America Microbial Food Culture Market Analysis, Insights and Forecast, 2019-2031

- 8. Rest of South America South America Microbial Food Culture Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Chr Hansen Holding AS

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Koninklijke DSM NV

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Corbion NV

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 IGEA s r l *List Not Exhaustive

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Lallemand Inc

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.1 Chr Hansen Holding AS

List of Figures

- Figure 1: South America Microbial Food Culture Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America Microbial Food Culture Market Share (%) by Company 2024

List of Tables

- Table 1: South America Microbial Food Culture Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America Microbial Food Culture Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: South America Microbial Food Culture Market Revenue Million Forecast, by End-Industry 2019 & 2032

- Table 4: South America Microbial Food Culture Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: South America Microbial Food Culture Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Brazil South America Microbial Food Culture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Argentina South America Microbial Food Culture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Rest of South America South America Microbial Food Culture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South America Microbial Food Culture Market Revenue Million Forecast, by Type 2019 & 2032

- Table 10: South America Microbial Food Culture Market Revenue Million Forecast, by End-Industry 2019 & 2032

- Table 11: South America Microbial Food Culture Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Brazil South America Microbial Food Culture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Argentina South America Microbial Food Culture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Chile South America Microbial Food Culture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Colombia South America Microbial Food Culture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Peru South America Microbial Food Culture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Venezuela South America Microbial Food Culture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Ecuador South America Microbial Food Culture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Bolivia South America Microbial Food Culture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Paraguay South America Microbial Food Culture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Uruguay South America Microbial Food Culture Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Microbial Food Culture Market?

The projected CAGR is approximately 3.10%.

2. Which companies are prominent players in the South America Microbial Food Culture Market?

Key companies in the market include Chr Hansen Holding AS, Koninklijke DSM NV, Corbion NV, IGEA s r l *List Not Exhaustive, Lallemand Inc.

3. What are the main segments of the South America Microbial Food Culture Market?

The market segments include Type, End-Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

The Rising Awareness of the Health Benefits Associated with Collagen Consumption; Rising Sport and Fitness Trends Drives the Market Growth.

6. What are the notable trends driving market growth?

Rising Demand for Starter Culture in Food & Beverage Industries.

7. Are there any restraints impacting market growth?

Concerns over the Source and Animal Welfare in Collagen Extraction Limit the Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Microbial Food Culture Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Microbial Food Culture Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Microbial Food Culture Market?

To stay informed about further developments, trends, and reports in the South America Microbial Food Culture Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence