Key Insights

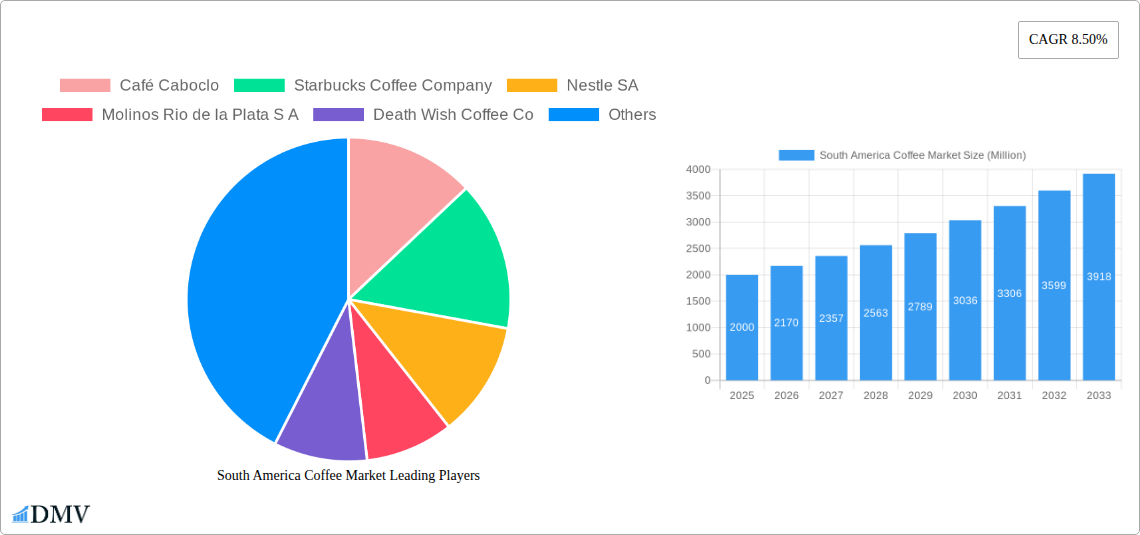

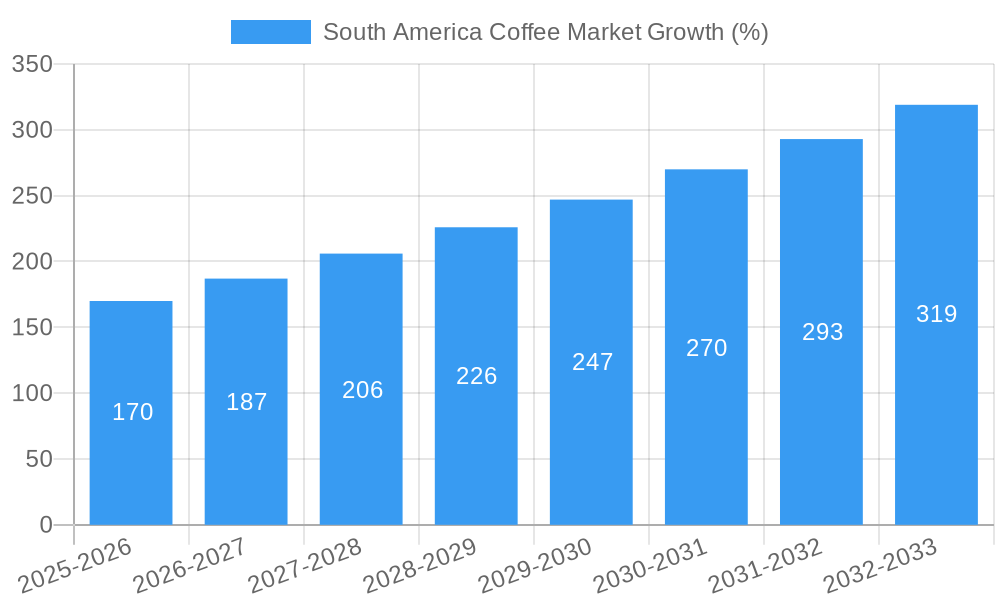

The South American coffee market, valued at approximately $XX million in 2025, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) of 8.5% from 2025 to 2033. This expansion is fueled by several key drivers. Rising disposable incomes across the region, particularly in burgeoning middle classes, are increasing coffee consumption. A growing preference for premium coffee varieties and specialty coffee shops contributes to higher average spending per capita. Furthermore, the increasing popularity of convenient formats like coffee pods and capsules is driving market expansion. The strong coffee-growing heritage of countries like Brazil and Colombia provides a solid foundation for domestic production and export, further bolstering market growth. However, challenges remain. Fluctuations in coffee bean prices due to climatic conditions and global supply chain disruptions pose a risk. Increased competition from international coffee brands necessitates continuous innovation and adaptation by local players. Segmentation analysis reveals strong growth in both the convenience store and online retail channels, reflecting evolving consumer preferences and shopping habits.

The market segmentation reveals a diverse landscape. Whole bean coffee remains a significant segment, catering to traditional coffee drinkers, while the growing popularity of convenient options like instant coffee and coffee pods and capsules is driving considerable market share gains. The distribution channel analysis shows the dominance of supermarkets and hypermarkets, followed by strong growth in the online retail sector. This underscores the importance of multi-channel strategies for coffee companies to succeed. Major players like Nestle SA, JDE Peet's, and regional brands like Café Caboclo and Cafes La Virginia S A are vying for market dominance, employing various strategies to capture consumer attention. Future growth will likely depend on innovative product offerings, effective marketing campaigns, and strategic partnerships to penetrate new consumer segments and geographical regions. The forecast period suggests a promising outlook for the South American coffee market, with continued expansion fueled by strong consumer demand and a dynamic industry landscape.

South America Coffee Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the South America coffee market, offering invaluable insights for stakeholders seeking to navigate this dynamic and lucrative sector. The study period spans 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report leverages extensive data from the historical period (2019-2024) to provide accurate predictions and strategic recommendations. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx%.

South America Coffee Market Composition & Trends

This section delves into the competitive landscape, innovation drivers, regulatory environment, and market dynamics of the South America coffee market. The report analyzes market concentration, revealing the market share distribution amongst key players such as Nestle SA, Starbucks Coffee Company, JDE Peet's, and others. The analysis also incorporates information on mergers and acquisitions (M&A) activities, providing details on deal values and their impact on market structure. It further examines the influence of substitute products, evolving consumer preferences, and regulatory changes impacting market growth. The report explores the diverse end-user profiles and their purchasing patterns, providing a detailed understanding of market segmentation.

- Market Concentration: xx% of the market is controlled by the top 5 players.

- M&A Activity: Total deal value for coffee-related M&A in South America between 2019-2024 reached approximately xx Million.

- Innovation Catalysts: Growing consumer demand for specialty coffee and sustainable sourcing practices are major drivers.

- Regulatory Landscape: Varying regulations across South American countries influence pricing and distribution.

- Substitute Products: Tea and other beverages compete for market share.

South America Coffee Market Industry Evolution

This section charts the evolution of the South America coffee market, outlining growth trajectories, technological advancements, and shifts in consumer preferences. It provides detailed insights into market growth rates across different segments and regions, highlighting the adoption of new technologies like e-commerce and sustainable farming practices. The report also analyzes the impact of changing consumer demands, such as the growing popularity of single-serve coffee pods and the increasing preference for ethically sourced coffee.

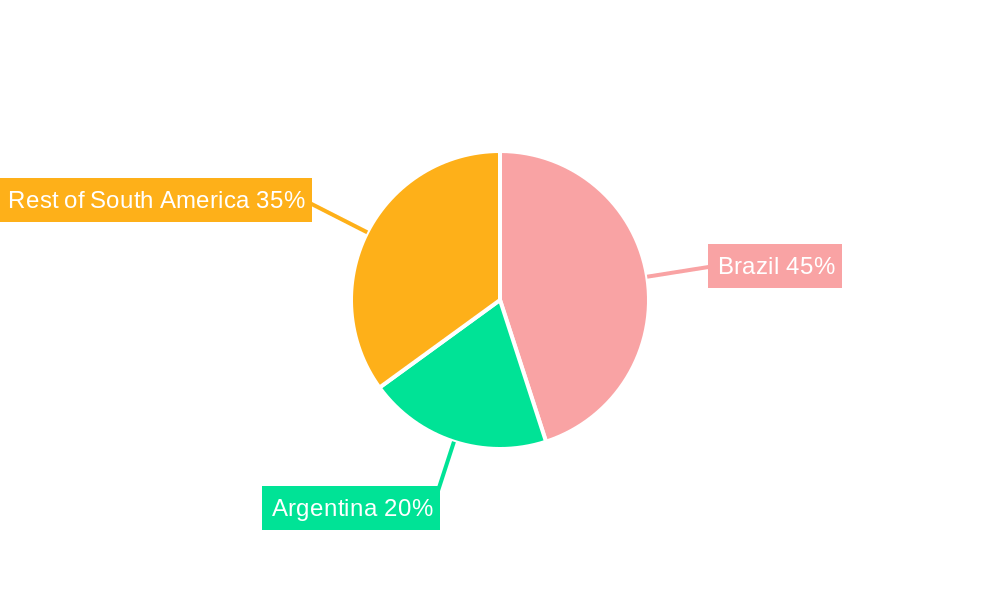

Leading Regions, Countries, or Segments in South America Coffee Market

This segment identifies the dominant regions, countries, and product types/distribution channels within the South America coffee market. The analysis meticulously examines factors such as investment trends, regulatory support, and consumer behavior, which contribute to the dominance of certain regions or segments. Brazil's significant coffee production is examined in detail, alongside the growth of specific segments such as ground coffee and online retail channels.

- Dominant Region: Brazil, owing to its high production volume and established coffee culture.

- Leading Product Type: Ground coffee, due to its widespread accessibility and affordability.

- Primary Distribution Channel: Supermarkets/Hypermarkets, due to their reach and established distribution networks.

- Key Drivers for Brazil's Dominance: Large-scale coffee production, strong domestic consumption, and robust export markets.

- Key Drivers for Ground Coffee's Popularity: Familiarity, affordability, and convenience.

- Key Drivers for Supermarkets' Dominance: Extensive reach, established supply chains, and promotional opportunities.

South America Coffee Market Product Innovations

This section highlights the innovative products shaping the South America coffee market. Recent product launches and technological advancements are examined, such as the introduction of new coffee blends, sustainable packaging options, and innovative brewing methods. The focus is on unique selling propositions (USPs) and the impact of these innovations on market competitiveness. Examples include single-serve coffee pods and instant coffee variants catering to evolving consumer needs.

Propelling Factors for South America Coffee Market Growth

This section identifies the key growth drivers impacting the South America coffee market, categorized into technological, economic, and regulatory influences. Specific examples include the rising disposable incomes in certain regions, increased adoption of e-commerce platforms, and supportive government policies promoting sustainable coffee production. The increasing preference for premium and specialty coffee also contributes to market expansion.

Obstacles in the South America Coffee Market

This section details the challenges and restraints that could impede the growth of the South America coffee market. These include regulatory hurdles, supply chain disruptions (e.g., climate change impacting crop yields), and intense competition from both domestic and international players. The quantifiable impacts of these factors on market growth are evaluated.

Future Opportunities in South America Coffee Market

This section explores potential future opportunities within the South America coffee market. It focuses on emerging markets, technological advancements, and shifts in consumer preferences. The report highlights the potential for growth in specialty coffee segments, the adoption of sustainable farming practices, and the expansion of e-commerce channels.

Major Players in the South America Coffee Market Ecosystem

- Café Caboclo

- Starbucks Coffee Company

- Nestle SA

- Molinos Rio de la Plata S A

- Death Wish Coffee Co

- Cafes La Virginia S A

- Volcanica Coffee Company

- Pilao Coffee

- Cabrales S A

- JDE Peet's

Key Developments in South America Coffee Market Industry

- December 2021: Starbucks opened eight new cafe stores in Minas Gerais, Brazil, signifying expansion in a key coffee-producing region.

- April 2022: Starbucks and Nestlé launched a dedicated e-commerce site for Starbucks coffee products in Brazil, expanding online sales channels.

- May 2022: AriZona Beverages entered the coffee market with Sun Brew, introducing a new competitor with a focus on Central and South American beans.

Strategic South America Coffee Market Forecast

The South America coffee market is poised for continued growth driven by factors such as rising disposable incomes, evolving consumer preferences, and the increasing adoption of innovative brewing technologies. The market is expected to witness robust growth across various segments, with particular potential in specialty coffee, single-serve coffee pods, and online retail channels. This presents significant opportunities for both established players and new entrants to capitalize on this promising market.

South America Coffee Market Segmentation

-

1. Product Type

- 1.1. Whole Bean

- 1.2. Ground Coffee

- 1.3. Instant Coffee

- 1.4. Coffee Pods and Capsules

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Specialist Retailers

- 2.4. Online Retail Stores

- 2.5. Other Distribution Channels

South America Coffee Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Coffee Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Innovation in Vanillin Synthesis; Diverse Functionality of Vanillin In End-use Industries

- 3.3. Market Restrains

- 3.3.1. Supply Chain Variability Impacting Vanilla Bean Availability For Flavor Production

- 3.4. Market Trends

- 3.4.1. Increasing Spending Power Augmenting the Growth for Specialty Coffee

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Coffee Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Whole Bean

- 5.1.2. Ground Coffee

- 5.1.3. Instant Coffee

- 5.1.4. Coffee Pods and Capsules

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Specialist Retailers

- 5.2.4. Online Retail Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Brazil South America Coffee Market Analysis, Insights and Forecast, 2019-2031

- 7. Argentina South America Coffee Market Analysis, Insights and Forecast, 2019-2031

- 8. Rest of South America South America Coffee Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Café Caboclo

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Starbucks Coffee Company

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Nestle SA

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Molinos Rio de la Plata S A

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Death Wish Coffee Co

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Cafes La Virginia S A *List Not Exhaustive

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Volcanica Coffee Company

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Pilao Coffee

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Cabrales S A

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 JDE Peet's

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Café Caboclo

List of Figures

- Figure 1: South America Coffee Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America Coffee Market Share (%) by Company 2024

List of Tables

- Table 1: South America Coffee Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America Coffee Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: South America Coffee Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: South America Coffee Market Volume K Tons Forecast, by Product Type 2019 & 2032

- Table 5: South America Coffee Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: South America Coffee Market Volume K Tons Forecast, by Distribution Channel 2019 & 2032

- Table 7: South America Coffee Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: South America Coffee Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: South America Coffee Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: South America Coffee Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: Brazil South America Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Brazil South America Coffee Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 13: Argentina South America Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Argentina South America Coffee Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: Rest of South America South America Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America South America Coffee Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: South America Coffee Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 18: South America Coffee Market Volume K Tons Forecast, by Product Type 2019 & 2032

- Table 19: South America Coffee Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 20: South America Coffee Market Volume K Tons Forecast, by Distribution Channel 2019 & 2032

- Table 21: South America Coffee Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: South America Coffee Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 23: Brazil South America Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Brazil South America Coffee Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 25: Argentina South America Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Argentina South America Coffee Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 27: Chile South America Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Chile South America Coffee Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 29: Colombia South America Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Colombia South America Coffee Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 31: Peru South America Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Peru South America Coffee Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 33: Venezuela South America Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Venezuela South America Coffee Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 35: Ecuador South America Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Ecuador South America Coffee Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 37: Bolivia South America Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Bolivia South America Coffee Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 39: Paraguay South America Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Paraguay South America Coffee Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 41: Uruguay South America Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Uruguay South America Coffee Market Volume (K Tons) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Coffee Market?

The projected CAGR is approximately 8.50%.

2. Which companies are prominent players in the South America Coffee Market?

Key companies in the market include Café Caboclo, Starbucks Coffee Company, Nestle SA, Molinos Rio de la Plata S A, Death Wish Coffee Co, Cafes La Virginia S A *List Not Exhaustive, Volcanica Coffee Company, Pilao Coffee, Cabrales S A, JDE Peet's.

3. What are the main segments of the South America Coffee Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Innovation in Vanillin Synthesis; Diverse Functionality of Vanillin In End-use Industries.

6. What are the notable trends driving market growth?

Increasing Spending Power Augmenting the Growth for Specialty Coffee.

7. Are there any restraints impacting market growth?

Supply Chain Variability Impacting Vanilla Bean Availability For Flavor Production.

8. Can you provide examples of recent developments in the market?

In May 2022, AriZona Beverages announced its foray into the coffee space with Sun Brew with its new line of 100% Arabica coffee made with hand-selected beans from Central and South America. Sun Brew is available in three roast styles, namely, Snake Bite Blend, Cactus Blend, and Sedona Blend. The coffees are sold online at DrinkAriZona.com, Amazon.com, and at select grocery stores across South America.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Coffee Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Coffee Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Coffee Market?

To stay informed about further developments, trends, and reports in the South America Coffee Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence