Key Insights

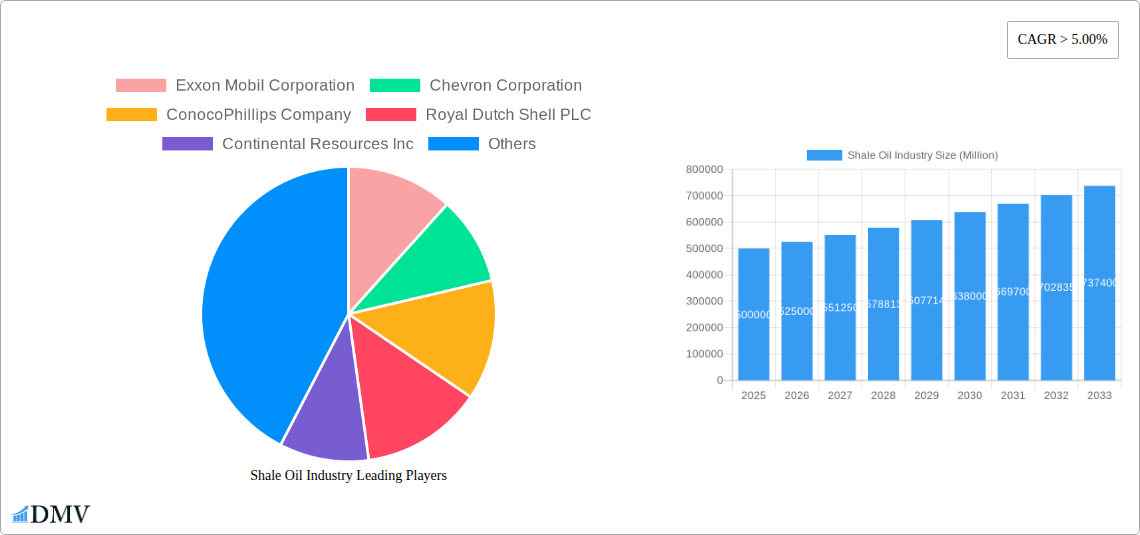

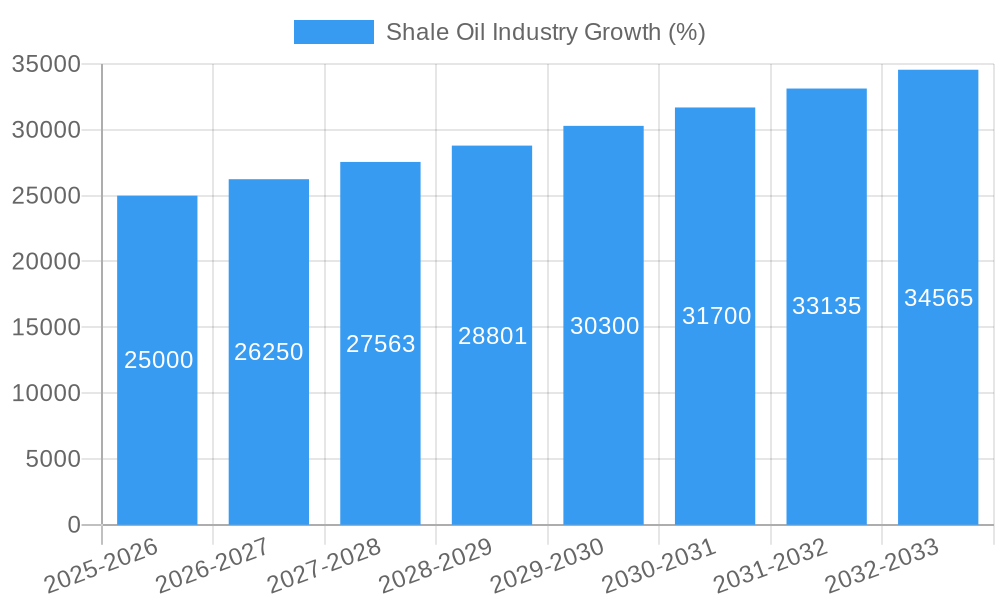

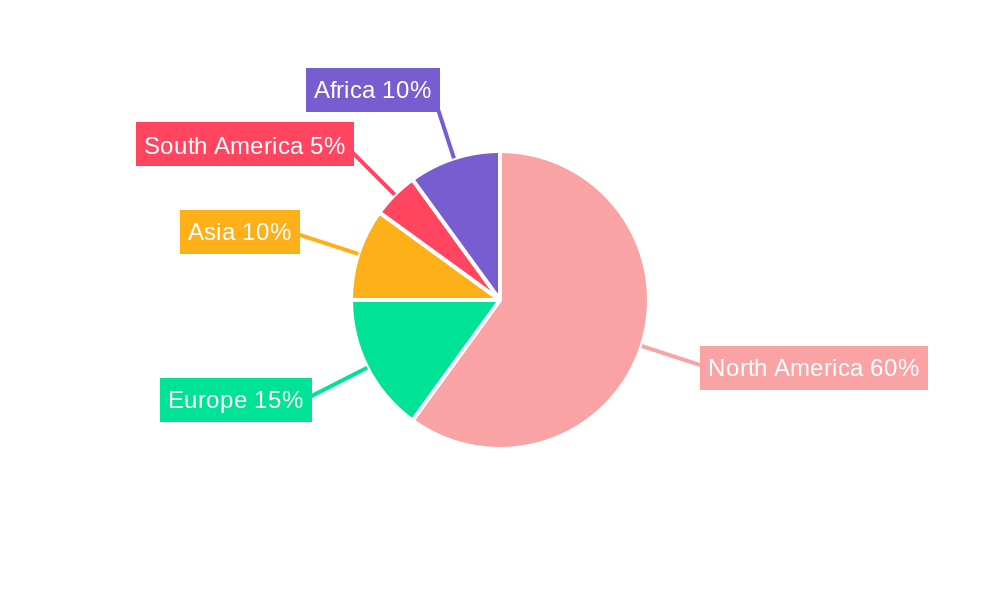

The shale oil industry, characterized by its unconventional extraction methods from shale formations, is experiencing robust growth. While precise market size figures for 2025 are not provided, a CAGR exceeding 5% from 2019-2033, coupled with a base year of 2025, suggests a significant market value. Considering global energy demands and the increasing adoption of hydraulic fracturing and horizontal drilling, a reasonable estimation places the 2025 market size at approximately $500 billion (USD). This growth is fueled by several key drivers: consistently high global oil prices, technological advancements improving extraction efficiency and reducing costs, and supportive government policies in key producing regions. However, the industry also faces challenges. Environmental concerns surrounding water usage, greenhouse gas emissions, and potential seismic activity associated with fracking present significant restraints. Furthermore, price volatility in the oil market remains a persistent risk, impacting profitability and investment decisions. Segmentation within the industry is likely multifaceted, encompassing exploration and production, services (like fracking and drilling), and midstream activities (pipelines and storage). Major players, such as ExxonMobil, Chevron, and Schlumberger, dominate the market, utilizing technological advantages and strategic partnerships to maintain their position. The forecast period (2025-2033) anticipates continued expansion, though the rate might fluctuate depending on geopolitical events, technological breakthroughs, and evolving environmental regulations. Regional distribution will likely continue to favor North America (especially the US), but growth is expected in other regions with abundant shale resources.

The future of the shale oil industry hinges on a delicate balance between meeting global energy demands and addressing environmental concerns. While technological innovation and economic incentives continue to drive expansion, stricter environmental regulations and the shift toward renewable energy sources will likely influence the growth trajectory. Successful companies will be those that can efficiently and responsibly extract shale oil, mitigating environmental impact and adapting to a changing regulatory landscape. This will involve continued investment in research and development to optimize extraction techniques, minimize environmental footprints, and ensure long-term sustainability of the industry. The focus will shift towards improved efficiency, reduced water usage, and responsible waste management to achieve greater public acceptance and contribute to more environmentally conscious energy production.

Shale Oil Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a comprehensive analysis of the global shale oil industry, encompassing market trends, technological advancements, key players, and future growth prospects. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report leverages extensive data from the historical period (2019-2024) to provide accurate and reliable projections. Expect detailed breakdowns, precise figures (in Millions), and actionable insights for stakeholders across the shale oil value chain.

Shale Oil Industry Market Composition & Trends

This section analyzes the competitive landscape of the shale oil industry, encompassing market concentration, innovation, regulation, substitution, end-user profiles, and M&A activities. We delve into the market share distribution among key players like Exxon Mobil Corporation, Chevron Corporation, ConocoPhillips Company, Royal Dutch Shell PLC, Continental Resources Inc, Murphy Oil Corporation, Occidental Petroleum Corporation, and Marathon Oil Corporation, alongside service providers such as Schlumberger Limited and Halliburton Company. The report will quantify the market concentration using metrics such as the Herfindahl-Hirschman Index (HHI) and examine the impact of M&A activities, including deal values exceeding $XX Million in recent years.

- Market Concentration: Analysis of market share distribution among major players, highlighting dominant firms and their strategic positions.

- Innovation Catalysts: Examination of technological breakthroughs driving efficiency gains and production increases in shale oil extraction.

- Regulatory Landscape: Assessment of evolving regulations and their influence on industry operations and investment decisions.

- Substitute Products: Evaluation of the impact of renewable energy sources and alternative fuels on shale oil demand.

- End-User Profiles: Detailed analysis of the diverse end-user segments consuming shale oil products and their specific demands.

- M&A Activity: Comprehensive review of mergers and acquisitions, including deal values and their impact on market consolidation.

Shale Oil Industry Industry Evolution

This section provides a detailed analysis of the shale oil industry's growth trajectory, examining technological advancements, shifting consumer demands, and the evolving global energy landscape. The report features a comprehensive analysis of production growth rates from 2019 to 2024, projecting a CAGR of XX% from 2025 to 2033. We will examine the adoption rates of key technologies such as horizontal drilling and hydraulic fracturing, evaluating their impact on overall production efficiency and cost reduction. The influence of geopolitical events and changing consumer preferences on market dynamics will also be thoroughly explored. Specific data points include:

- Projected production growth rates from 2025 to 2033, segmented by region and technology.

- Adoption rates of key technological advancements, quantified by market penetration and industry impact.

- Analysis of evolving consumer demands and preferences concerning energy sources and environmental sustainability.

- Evaluation of the influence of macroeconomic factors, geopolitical events, and regulatory changes on industry growth.

Leading Regions, Countries, or Segments in Shale Oil Industry

This section identifies the leading regions and countries in the shale oil industry based on production volume, investment levels, and regulatory frameworks. The dominant regions will be analyzed in depth, exploring the key drivers responsible for their market leadership. We will determine the dominant region based on metrics such as total production volume and revenue generation.

Key Drivers (for the dominant region):

- Favorable geological conditions and resource abundance.

- Supportive government policies and regulatory frameworks.

- Significant investments in infrastructure and technology.

- Highly skilled workforce and technological expertise.

In-depth analysis of dominance factors, including geological characteristics, regulatory environment, and government support.

Shale Oil Industry Product Innovations

This section highlights recent product innovations and technological advancements in the shale oil industry, focusing on their unique selling propositions and performance metrics. This includes advancements in drilling techniques, enhanced oil recovery methods, and environmental protection technologies. We will showcase innovations enhancing efficiency and environmental sustainability while emphasizing market impact and adoption rates.

Propelling Factors for Shale Oil Industry Growth

Key growth drivers are examined, including technological advancements (e.g., horizontal drilling, hydraulic fracturing), economic factors (e.g., global energy demand), and regulatory influences (e.g., government incentives). Specific examples of these drivers and their impact on market expansion will be detailed.

Obstacles in the Shale Oil Industry Market

This section addresses significant challenges and restraints affecting the shale oil market. This includes regulatory hurdles (environmental regulations, permitting delays), supply chain disruptions (equipment shortages, labor constraints), and competitive pressures (price volatility, alternative energy sources). Quantifiable impacts of these restraints on market growth will be assessed.

Future Opportunities in Shale Oil Industry

Emerging opportunities in the shale oil industry will be explored, encompassing the development of new markets (e.g., emerging economies), technological advancements (e.g., artificial intelligence, machine learning in drilling operations), and shifts in consumer trends (e.g., increasing demand for cleaner energy).

Major Players in the Shale Oil Industry Ecosystem

- Exxon Mobil Corporation

- Chevron Corporation

- ConocoPhillips Company

- Royal Dutch Shell PLC

- Continental Resources Inc

- Murphy Oil Corporation

- Occidental Petroleum Corporation

- Marathon Oil Corporation

- Schlumberger Limited

- Halliburton Company

- List Not Exhaustive

Key Developments in Shale Oil Industry Industry

- July 2022: Oilex and Schlumberger secured a contract for hydraulic fracturing, coiled tubing, nitrogen, and perforation services for the Cambay C-77H well re-frac in Gujarat, India. This highlights the continued demand for specialized services in established shale oil regions.

- April 2022: CNX Resources Corporation and Evolution Well Services extended their contract for four years, showcasing the growing adoption of electric fracturing technology for enhanced efficiency and environmental considerations.

Strategic Shale Oil Industry Market Forecast

This section summarizes the key growth catalysts identified in the report, focusing on the long-term potential of the shale oil industry and the opportunities presented by technological innovation, expanding global energy demand, and strategic investments in key regions. The report projects substantial growth in the coming years, driven by a combination of factors, including continued technological advancements and sustained global energy demand, resulting in a market value of $XX Million by 2033.

Shale Oil Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Shale Oil Industry Segmentation By Geography

- 1. North America

- 2. South America

- 3. Europe

- 4. Asia Pacific

- 5. Middle East and Africa

Shale Oil Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Growing Petrochemical Industry to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Shale Oil Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Asia Pacific

- 5.6.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America Shale Oil Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South America Shale Oil Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Europe Shale Oil Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Asia Pacific Shale Oil Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Middle East and Africa Shale Oil Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Exxon Mobil Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Chevron Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ConocoPhillips Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Royal Dutch Shell PLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Continental Resources Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Murphy Oil Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Occidental Petroleum Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Marathon Oil Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Schlumberger Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Halliburton Company*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Exxon Mobil Corporation

List of Figures

- Figure 1: Global Shale Oil Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Shale Oil Industry Revenue (Million), by Production Analysis 2024 & 2032

- Figure 3: North America Shale Oil Industry Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 4: North America Shale Oil Industry Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 5: North America Shale Oil Industry Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 6: North America Shale Oil Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 7: North America Shale Oil Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 8: North America Shale Oil Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 9: North America Shale Oil Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 10: North America Shale Oil Industry Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 11: North America Shale Oil Industry Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 12: North America Shale Oil Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: North America Shale Oil Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: South America Shale Oil Industry Revenue (Million), by Production Analysis 2024 & 2032

- Figure 15: South America Shale Oil Industry Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 16: South America Shale Oil Industry Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 17: South America Shale Oil Industry Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 18: South America Shale Oil Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 19: South America Shale Oil Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 20: South America Shale Oil Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 21: South America Shale Oil Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 22: South America Shale Oil Industry Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 23: South America Shale Oil Industry Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 24: South America Shale Oil Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: South America Shale Oil Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: Europe Shale Oil Industry Revenue (Million), by Production Analysis 2024 & 2032

- Figure 27: Europe Shale Oil Industry Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 28: Europe Shale Oil Industry Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 29: Europe Shale Oil Industry Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 30: Europe Shale Oil Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 31: Europe Shale Oil Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 32: Europe Shale Oil Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 33: Europe Shale Oil Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 34: Europe Shale Oil Industry Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 35: Europe Shale Oil Industry Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 36: Europe Shale Oil Industry Revenue (Million), by Country 2024 & 2032

- Figure 37: Europe Shale Oil Industry Revenue Share (%), by Country 2024 & 2032

- Figure 38: Asia Pacific Shale Oil Industry Revenue (Million), by Production Analysis 2024 & 2032

- Figure 39: Asia Pacific Shale Oil Industry Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 40: Asia Pacific Shale Oil Industry Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 41: Asia Pacific Shale Oil Industry Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 42: Asia Pacific Shale Oil Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 43: Asia Pacific Shale Oil Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 44: Asia Pacific Shale Oil Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 45: Asia Pacific Shale Oil Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 46: Asia Pacific Shale Oil Industry Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 47: Asia Pacific Shale Oil Industry Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 48: Asia Pacific Shale Oil Industry Revenue (Million), by Country 2024 & 2032

- Figure 49: Asia Pacific Shale Oil Industry Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East and Africa Shale Oil Industry Revenue (Million), by Production Analysis 2024 & 2032

- Figure 51: Middle East and Africa Shale Oil Industry Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 52: Middle East and Africa Shale Oil Industry Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 53: Middle East and Africa Shale Oil Industry Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 54: Middle East and Africa Shale Oil Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 55: Middle East and Africa Shale Oil Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 56: Middle East and Africa Shale Oil Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 57: Middle East and Africa Shale Oil Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 58: Middle East and Africa Shale Oil Industry Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 59: Middle East and Africa Shale Oil Industry Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 60: Middle East and Africa Shale Oil Industry Revenue (Million), by Country 2024 & 2032

- Figure 61: Middle East and Africa Shale Oil Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Shale Oil Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Shale Oil Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Global Shale Oil Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Global Shale Oil Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Global Shale Oil Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Global Shale Oil Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Global Shale Oil Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global Shale Oil Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 9: Global Shale Oil Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 10: Global Shale Oil Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 11: Global Shale Oil Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 12: Global Shale Oil Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 13: Global Shale Oil Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Shale Oil Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 15: Global Shale Oil Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 16: Global Shale Oil Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 17: Global Shale Oil Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 18: Global Shale Oil Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 19: Global Shale Oil Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Shale Oil Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 21: Global Shale Oil Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 22: Global Shale Oil Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 23: Global Shale Oil Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 24: Global Shale Oil Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 25: Global Shale Oil Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global Shale Oil Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 27: Global Shale Oil Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 28: Global Shale Oil Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 29: Global Shale Oil Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 30: Global Shale Oil Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 31: Global Shale Oil Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global Shale Oil Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 33: Global Shale Oil Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 34: Global Shale Oil Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 35: Global Shale Oil Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 36: Global Shale Oil Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 37: Global Shale Oil Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Shale Oil Industry?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Shale Oil Industry?

Key companies in the market include Exxon Mobil Corporation, Chevron Corporation, ConocoPhillips Company, Royal Dutch Shell PLC, Continental Resources Inc, Murphy Oil Corporation, Occidental Petroleum Corporation, Marathon Oil Corporation, Schlumberger Limited, Halliburton Company*List Not Exhaustive.

3. What are the main segments of the Shale Oil Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Growing Petrochemical Industry to Drive the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In July 2022, Oilex and Schlumberger won a contract for the supply by Schlumberger of hydraulic fracturing services, coiled tubing and nitrogen services, and perforation services for the planned re-frac of the Cambay C-77H well in Gujarat, India.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Shale Oil Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Shale Oil Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Shale Oil Industry?

To stay informed about further developments, trends, and reports in the Shale Oil Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence