Key Insights

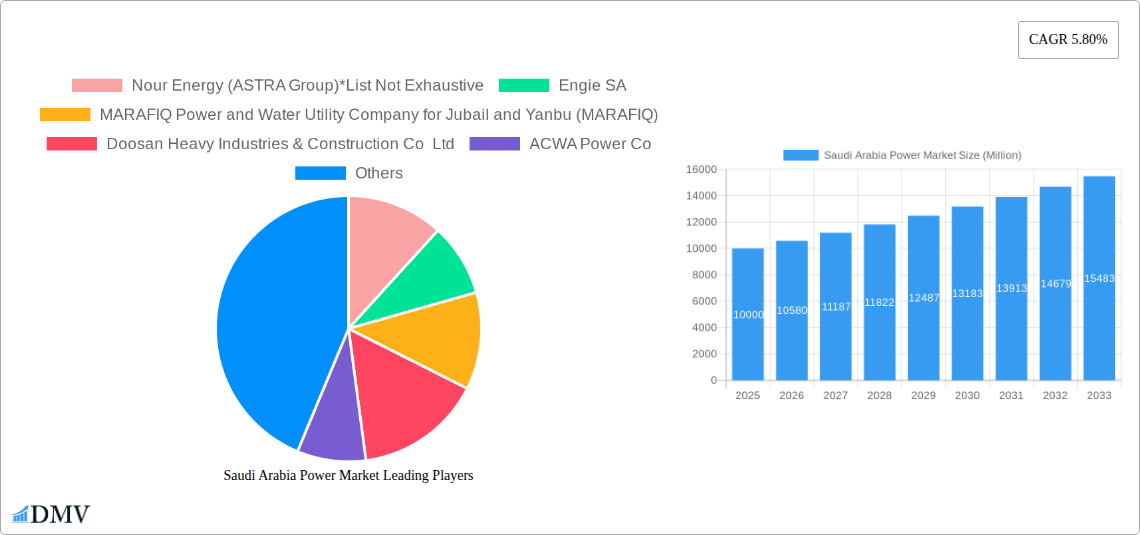

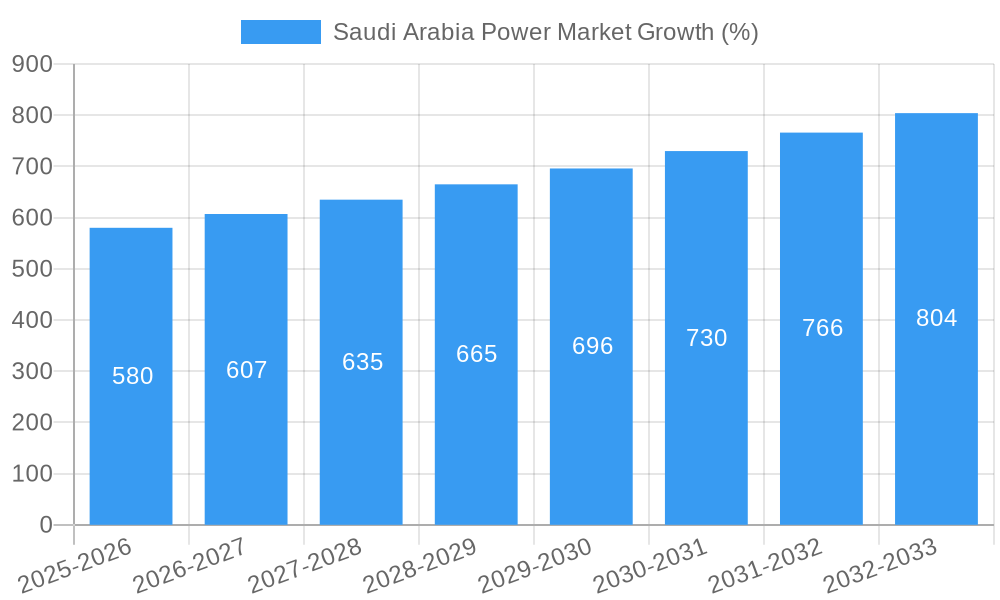

The Saudi Arabian power market is experiencing robust growth, fueled by the nation's ambitious Vision 2030 initiatives aimed at diversifying its economy and expanding its infrastructure. With a projected CAGR of 5.80% from 2025 to 2033, the market is expected to reach significant size. Several key drivers contribute to this expansion, including substantial investments in renewable energy sources to meet increasing energy demands and reduce reliance on fossil fuels. The growing industrial and commercial sectors, alongside population growth and urbanization, are further stimulating electricity consumption. While the market faces some restraints, such as the intermittent nature of renewable energy and the need for grid modernization to accommodate the influx of renewable power, these challenges are being actively addressed through strategic planning and technological advancements. The market is segmented by installation location (indoor, outdoor), capacity (medium voltage, high voltage), and end-user (commercial and industrial, utility, residential), providing a nuanced view of market dynamics. Major players like ACWA Power, Saudi Electricity Company, and international firms like Engie are actively shaping the market landscape through significant project investments and technological innovations.

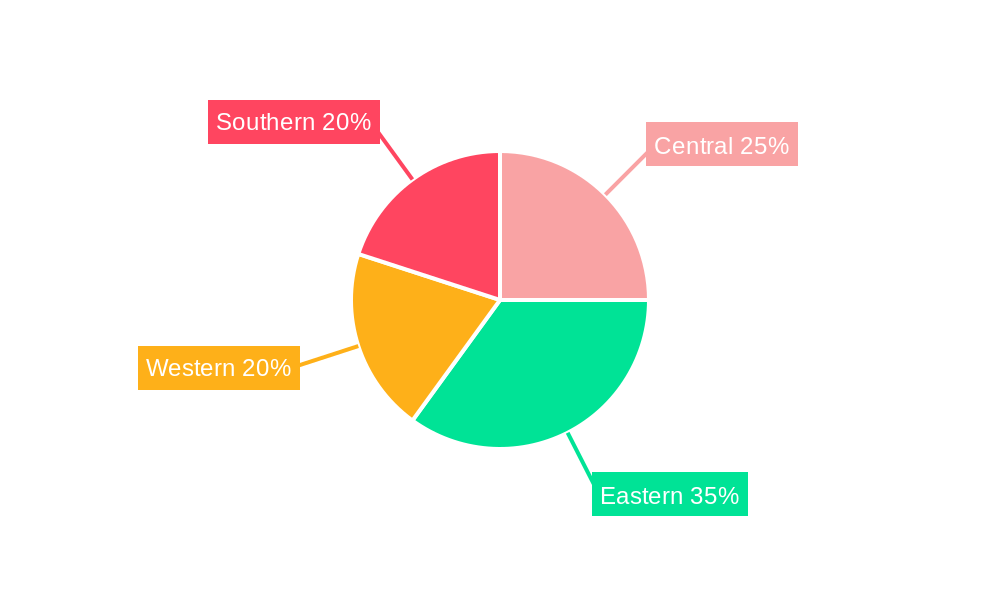

The regional distribution of the market across Saudi Arabia's Central, Eastern, Western, and Southern regions reflects varying levels of industrial activity and population density. The Eastern region, for example, given its significant hydrocarbon industry, likely commands a substantial share of the market. However, government investment in renewable energy projects is expected to diversify this regional distribution over the forecast period, promoting more balanced growth across all regions. The dominance of large-scale projects within the utility segment highlights the importance of government-led initiatives in driving market growth. Continued focus on enhancing grid infrastructure and fostering technological advancements in energy storage will be crucial for sustaining this upward trajectory and ensuring the reliable supply of electricity to meet the Kingdom's burgeoning energy needs.

Saudi Arabia Power Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Saudi Arabia power market, encompassing market trends, industry evolution, key players, and future forecasts from 2019 to 2033. With a base year of 2025 and a forecast period extending to 2033, this report is an invaluable resource for stakeholders seeking to understand and capitalize on the opportunities within this dynamic sector. The report leverages extensive data analysis and incorporates key industry developments to offer a comprehensive overview of this rapidly evolving market, projecting a market value of xx Million by 2033.

Saudi Arabia Power Market Composition & Trends

This section delves into the intricate structure of the Saudi Arabian power market, examining market concentration, innovative drivers, regulatory frameworks, substitute products, end-user profiles, and mergers and acquisitions (M&A) activities.

Market Concentration: The Saudi Arabian power market exhibits a moderately concentrated structure, with key players like ACWA Power Co, Saudi Electricity Company (SEC) SJSC, and Engie SA holding significant market share. However, the entry of new players and the increasing adoption of renewable energy sources are gradually shifting the competitive landscape. We estimate that the top 5 players account for approximately xx% of the market share in 2025.

Innovation Catalysts: Government initiatives promoting renewable energy, such as the Vision 2030 plan, are driving innovation in the sector. This includes the development of large-scale solar and wind power projects and advancements in energy storage technologies.

Regulatory Landscape: The regulatory environment is undergoing significant changes to support the nation's energy diversification goals. This includes supportive policies and streamlined permitting processes for renewable energy projects.

Substitute Products: While fossil fuels still dominate the power generation mix, there's a growing adoption of renewable energy sources as substitutes, driven by government policy and environmental concerns.

End-User Profiles: The market caters to diverse end-users, including residential, commercial and industrial consumers, and the utility sector. The industrial sector is projected to dominate, accounting for xx% of total consumption in 2025.

M&A Activities: The power sector has witnessed considerable M&A activity in recent years, with deal values exceeding xx Million in the period 2019-2024. These activities have primarily focused on expanding renewable energy capacity and strengthening market positions.

Saudi Arabia Power Market Industry Evolution

This section analyzes the transformative journey of the Saudi Arabia power market, focusing on growth trajectories, technological innovations, and evolving consumer preferences from 2019 to 2033. The market is witnessing a significant shift towards renewable energy sources, driven by ambitious national targets and abundant solar and wind resources. The annual growth rate (AGR) for the renewable energy segment is estimated at xx% during the forecast period (2025-2033), surpassing the overall market AGR of xx%. This transition is reflected in increasing investments in renewable energy projects, technological advancements in solar PV and wind turbine technologies, and a growing preference for cleaner energy sources amongst consumers. The adoption rate of smart grid technologies is also expected to increase, facilitating better integration of renewable energy and improving grid efficiency. This evolution is supported by a supportive regulatory environment, fostering competition and driving innovation in the sector. Government incentives, including subsidies and tax breaks, have been crucial in facilitating the adoption of renewable energy technologies. The market has also seen an increasing trend towards energy efficiency measures, with consumers adopting energy-saving appliances and practices to reduce their energy consumption. The transition towards a more sustainable and diversified energy sector is further evidenced by the increasing number of renewable energy projects under development, and the significant investments being made by both domestic and international players.

Leading Regions, Countries, or Segments in Saudi Arabia Power Market

This section highlights the leading segments within the Saudi Arabia power market based on installation location, capacity, and end-user.

Installation Location: Outdoor installations dominate the market due to the vast land availability and abundant solar irradiation.

Capacity: High-voltage installations represent a larger market segment due to the needs of large-scale power generation and transmission infrastructure.

End-User: The utility sector is the largest segment, followed by the industrial sector. This dominance is driven by the high energy demand of large-scale industrial operations and the national grid's requirements.

Key Drivers:

Investment Trends: Significant investments in renewable energy projects are driving growth in the utility and industrial segments.

Regulatory Support: Government policies promoting renewable energy and energy efficiency are fostering market expansion.

The dominance of these segments is primarily attributed to the scale of utility-scale renewable energy projects and the significant energy requirements of Saudi Arabia's rapidly growing industrial sector. The government's strong commitment to Vision 2030 and its focus on diversifying the energy mix further reinforces the growth outlook for these specific market segments.

Saudi Arabia Power Market Product Innovations

The Saudi Arabian power market is witnessing the introduction of advanced technologies, including high-efficiency solar panels, next-generation wind turbines, and sophisticated energy storage systems. These innovations aim to enhance energy efficiency, reduce costs, and improve grid stability. The unique selling proposition of many new products lies in their ability to seamlessly integrate with smart grid infrastructure, optimizing energy distribution and minimizing waste. This technological advancement is crucial for meeting Saudi Arabia's renewable energy targets and improving the overall reliability of the power grid.

Propelling Factors for Saudi Arabia Power Market Growth

Several factors are driving the growth of the Saudi Arabia power market:

Government Initiatives: Vision 2030's focus on renewable energy is a major catalyst, attracting significant investments.

Economic Growth: The country's robust economic growth fuels increasing energy demand across all sectors.

Technological Advancements: Innovations in renewable energy technologies are making them increasingly cost-competitive.

Obstacles in the Saudi Arabia Power Market

Challenges facing the market include:

Regulatory Hurdles: Navigating complex regulatory processes can slow down project implementation.

Supply Chain Disruptions: Global supply chain issues can impact the availability of crucial components.

Competitive Pressures: Competition among power producers can create price pressures.

Future Opportunities in Saudi Arabia Power Market

Future opportunities include:

Expansion of Renewable Energy: Untapped potential in solar and wind power presents significant opportunities.

Smart Grid Technologies: Investments in smart grids can enhance efficiency and grid reliability.

Energy Storage Solutions: Growing demand for energy storage systems to support renewable integration.

Major Players in the Saudi Arabia Power Market Ecosystem

- Nour Energy (ASTRA Group)

- Engie SA

- MARAFIQ Power and Water Utility Company for Jubail and Yanbu (MARAFIQ)

- Doosan Heavy Industries & Construction Co Ltd

- ACWA Power Co

- Shandong Electric Power Construction Corporation III (SEPCO III)

- Electricite de France SA (EDF)

- Saudi Electricity Company (SEC) SJSC

- Arabian Electrical Transmission Line Construction Company (AETCON)

- Masdar Abu Dhabi Future Energy Co

Key Developments in Saudi Arabia Power Market Industry

November 2022: ACWA Power signed an agreement to build the world's largest single-site solar power plant (2,060 MW) in Al Shuaibah, signifying a major step towards renewable energy adoption.

December 2022: Announcement of 10 new renewable energy projects (7 GW combined capacity) demonstrates the Kingdom's commitment to its renewable energy targets and the reduction of reliance on fossil fuels. This initiative aligns directly with the national target of producing 15.1 TWh of renewable energy by 2024.

Strategic Saudi Arabia Power Market Forecast

The Saudi Arabia power market is poised for significant growth driven by ambitious renewable energy targets, economic expansion, and technological advancements. The shift towards renewable energy sources will continue to reshape the market landscape, creating substantial opportunities for both domestic and international players. The forecast period will likely see sustained high growth rates in renewable energy segments, contributing to a substantial increase in overall market value by 2033. The successful execution of Vision 2030's energy diversification plans will be a key determinant of the market's future trajectory.

Saudi Arabia Power Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Saudi Arabia Power Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Power Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Diversification of Energy Sources from Oil and Gas to Cleaner Energy Sources4.; Supportive Government Policies for Increasing Renewable Power Capacity

- 3.3. Market Restrains

- 3.3.1. The Unstable Geopolitics of the Country

- 3.4. Market Trends

- 3.4.1. Thermal Power Source to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Power Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Central Saudi Arabia Power Market Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Saudi Arabia Power Market Analysis, Insights and Forecast, 2019-2031

- 8. Western Saudi Arabia Power Market Analysis, Insights and Forecast, 2019-2031

- 9. Southern Saudi Arabia Power Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Nour Energy (ASTRA Group)*List Not Exhaustive

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Engie SA

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 MARAFIQ Power and Water Utility Company for Jubail and Yanbu (MARAFIQ)

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Doosan Heavy Industries & Construction Co Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 ACWA Power Co

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Shandong Electric Power Construction Corporation III (SEPCO III)

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Electricite de France SA (EDF)

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Saudi Electricity Company (SEC) SJSC

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Arabian Electrical Transmission Line Construction Company ( AETCON )

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Masdar Abu Dhabi Future Energy Co

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Nour Energy (ASTRA Group)*List Not Exhaustive

List of Figures

- Figure 1: Saudi Arabia Power Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Power Market Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Power Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Power Market Volume gigawatt Forecast, by Region 2019 & 2032

- Table 3: Saudi Arabia Power Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 4: Saudi Arabia Power Market Volume gigawatt Forecast, by Production Analysis 2019 & 2032

- Table 5: Saudi Arabia Power Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 6: Saudi Arabia Power Market Volume gigawatt Forecast, by Consumption Analysis 2019 & 2032

- Table 7: Saudi Arabia Power Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 8: Saudi Arabia Power Market Volume gigawatt Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 9: Saudi Arabia Power Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 10: Saudi Arabia Power Market Volume gigawatt Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 11: Saudi Arabia Power Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 12: Saudi Arabia Power Market Volume gigawatt Forecast, by Price Trend Analysis 2019 & 2032

- Table 13: Saudi Arabia Power Market Revenue Million Forecast, by Region 2019 & 2032

- Table 14: Saudi Arabia Power Market Volume gigawatt Forecast, by Region 2019 & 2032

- Table 15: Saudi Arabia Power Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Saudi Arabia Power Market Volume gigawatt Forecast, by Country 2019 & 2032

- Table 17: Central Saudi Arabia Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Central Saudi Arabia Power Market Volume (gigawatt) Forecast, by Application 2019 & 2032

- Table 19: Eastern Saudi Arabia Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Eastern Saudi Arabia Power Market Volume (gigawatt) Forecast, by Application 2019 & 2032

- Table 21: Western Saudi Arabia Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Western Saudi Arabia Power Market Volume (gigawatt) Forecast, by Application 2019 & 2032

- Table 23: Southern Saudi Arabia Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Southern Saudi Arabia Power Market Volume (gigawatt) Forecast, by Application 2019 & 2032

- Table 25: Saudi Arabia Power Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 26: Saudi Arabia Power Market Volume gigawatt Forecast, by Production Analysis 2019 & 2032

- Table 27: Saudi Arabia Power Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 28: Saudi Arabia Power Market Volume gigawatt Forecast, by Consumption Analysis 2019 & 2032

- Table 29: Saudi Arabia Power Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 30: Saudi Arabia Power Market Volume gigawatt Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 31: Saudi Arabia Power Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 32: Saudi Arabia Power Market Volume gigawatt Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 33: Saudi Arabia Power Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 34: Saudi Arabia Power Market Volume gigawatt Forecast, by Price Trend Analysis 2019 & 2032

- Table 35: Saudi Arabia Power Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Saudi Arabia Power Market Volume gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Power Market?

The projected CAGR is approximately 5.80%.

2. Which companies are prominent players in the Saudi Arabia Power Market?

Key companies in the market include Nour Energy (ASTRA Group)*List Not Exhaustive, Engie SA, MARAFIQ Power and Water Utility Company for Jubail and Yanbu (MARAFIQ), Doosan Heavy Industries & Construction Co Ltd, ACWA Power Co, Shandong Electric Power Construction Corporation III (SEPCO III), Electricite de France SA (EDF), Saudi Electricity Company (SEC) SJSC, Arabian Electrical Transmission Line Construction Company ( AETCON ), Masdar Abu Dhabi Future Energy Co.

3. What are the main segments of the Saudi Arabia Power Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Diversification of Energy Sources from Oil and Gas to Cleaner Energy Sources4.; Supportive Government Policies for Increasing Renewable Power Capacity.

6. What are the notable trends driving market growth?

Thermal Power Source to Dominate the Market.

7. Are there any restraints impacting market growth?

The Unstable Geopolitics of the Country.

8. Can you provide examples of recent developments in the market?

November 2022: ACWA Power signed an agreement with Water and Electricity Holding Company (Badeel) to build the world's largest single-site solar-power plant in Al Shuaibah, Mecca province. The plant was projected to have a generation capacity of 2,060 MW and commissioned in 2025.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Power Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Power Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Power Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Power Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence