Key Insights

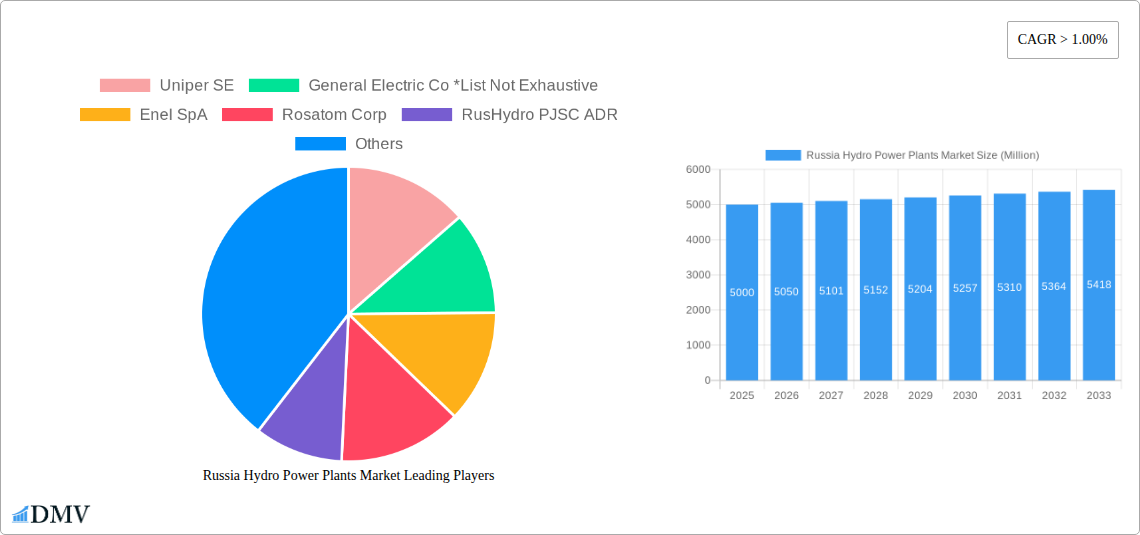

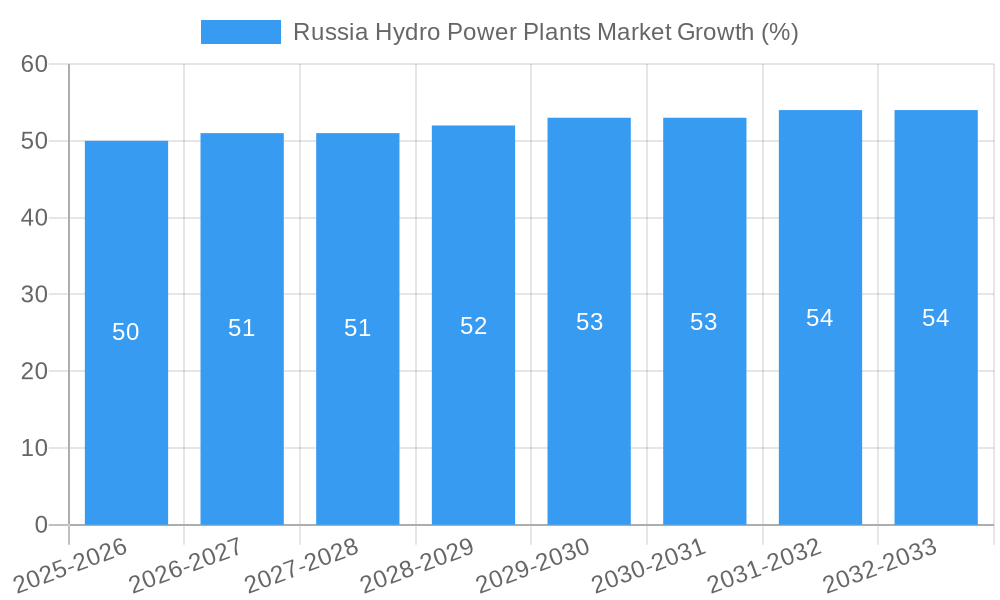

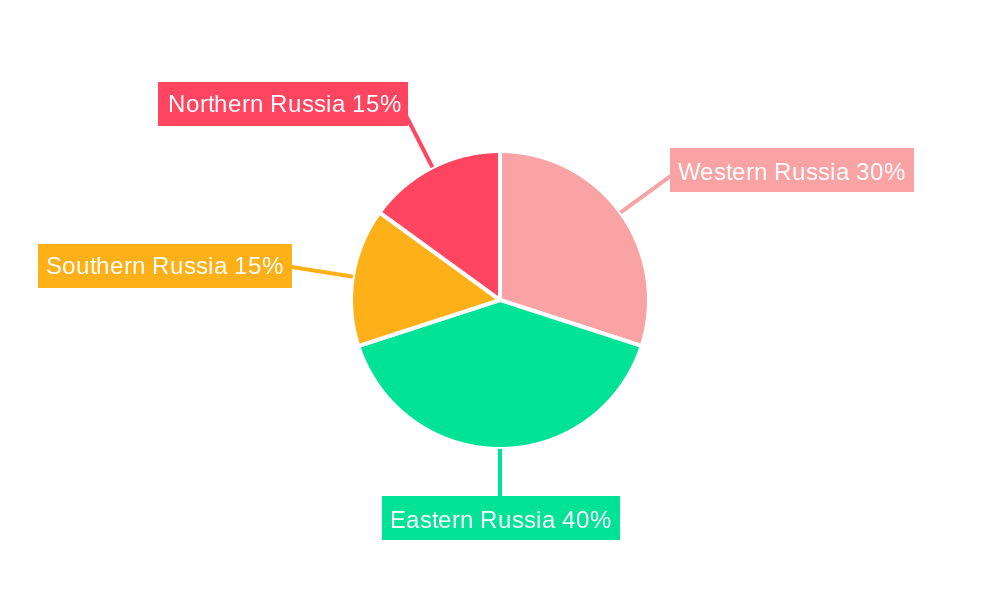

The Russia Hydro Power Plants market, exhibiting a CAGR exceeding 1.00%, presents a significant investment opportunity. While the precise market size in 2025 is unavailable, considering a conservative estimate and the existing substantial hydroelectric infrastructure in Russia, particularly in Siberia, we can project a 2025 market value of approximately $5 billion USD. This substantial valuation is driven by the country's abundant water resources, particularly in regions like Siberia and the Far East, which are crucial for generating renewable energy. Further growth is fueled by the increasing demand for cleaner energy sources to mitigate climate change and reduce reliance on fossil fuels. Government initiatives promoting renewable energy adoption and modernization of existing hydroelectric plants will further bolster market expansion. However, challenges remain, including the geographical dispersion of resources, necessitating substantial investment in transmission infrastructure, and environmental concerns related to dam construction and its impact on river ecosystems. The market is segmented by generation type (Thermal, Hydroelectric, Renewable, Other), with Hydroelectric naturally dominating. Key players like Uniper SE, General Electric, Enel SpA, and Rosatom Corp are actively involved, strategically positioning themselves to capitalize on these opportunities. Regional variations exist, with Western, Eastern, Southern, and Northern Russia each presenting unique market dynamics based on resource availability and infrastructure development.

The forecast period (2025-2033) anticipates sustained growth, driven by ongoing government investment in renewable energy projects and upgrades to existing hydropower facilities. The market's segmentation allows for tailored strategies. For instance, focusing on improving the efficiency of existing hydroelectric plants, alongside developing new facilities in less explored areas, presents lucrative opportunities. Though environmental regulations and potential investment hurdles are restraints, the long-term prospects for the Russia Hydro Power Plants market remain positive given the country's commitment to energy diversification and the considerable untapped potential of its hydroelectric resources. A deeper analysis of specific regional markets, including factors such as regulatory frameworks and environmental impact assessments, will be crucial for precise forecasting and strategic decision-making.

Russia Hydro Power Plants Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Russia Hydro Power Plants Market, offering a comprehensive overview of market dynamics, key players, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for stakeholders seeking to understand and capitalize on the opportunities within this dynamic sector. The report meticulously examines market composition, industry evolution, leading segments, and key developments, providing actionable intelligence to support strategic decision-making. Expected market value predictions are included where data is unavailable.

Russia Hydro Power Plants Market Market Composition & Trends

This section delves into the intricate landscape of the Russian hydro power plants market, examining market concentration, innovation, regulatory factors, substitute products, end-user profiles, and merger & acquisition (M&A) activity. We analyze market share distribution amongst key players and provide insights into the values of significant M&A deals. The analysis encompasses the historical period (2019-2024) and extends to the forecast period (2025-2033), providing a comprehensive understanding of market evolution. The market is characterized by a moderate level of concentration, with a few dominant players and several smaller regional operators. Innovation is driven by the need for increased efficiency and the integration of renewable energy sources. Stringent environmental regulations and evolving energy policies are significant influencing factors. While limited substitute products exist, the market faces competition from other generation sources like thermal and renewable energy. The end-user profile consists primarily of the national grid and industrial consumers. M&A activity has been relatively modest in recent years, with deal values averaging around xx Million annually.

- Market Share Distribution (2024): RusHydro PJSC ADR: xx%; Inter RAO UES PJSC: xx%; Gazprom PJSC: xx%; Others: xx%.

- Average M&A Deal Value (2019-2024): xx Million.

- Key Regulatory Bodies: [List key regulatory bodies and their influence].

- Substitute Products: Thermal power plants, wind farms, solar plants.

Russia Hydro Power Plants Market Industry Evolution

This section provides a detailed analysis of the Russia Hydro Power Plants Market’s growth trajectory, focusing on technological advancements and shifts in consumer demand. The analysis incorporates historical data (2019-2024) and forecasts for the future (2025-2033). We examine the factors driving market growth, including government initiatives, technological advancements in hydropower generation, and the increasing demand for sustainable energy. The market has witnessed a steady growth rate of xx% annually during the historical period, largely attributed to investments in upgrading existing infrastructure and building new plants. Technological advancements, such as improved turbine designs and smart grid integration, have significantly enhanced efficiency and reliability. Shifting consumer demands towards environmentally friendly energy solutions further contribute to the market’s positive trajectory. The forecast period anticipates a continued upward trend, driven by governmental support for renewable energy and increasing private sector involvement. We project a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, leading to a market value of xx Million by 2033.

Leading Regions, Countries, or Segments in Russia Hydro Power Plants Market

The hydroelectric segment dominates the Russian power generation market due to the country’s vast hydro resources and significant existing infrastructure. The Siberian Federal District and the Far Eastern Federal District are the leading regions owing to abundant water resources and established hydropower plants. Key drivers of this dominance include significant government investment in hydropower infrastructure development, favorable regulatory policies promoting renewable energy, and the relatively lower cost of hydropower generation compared to other sources. Other generation sources like thermal power continue to play a significant role, but the market trend leans towards a greater share for hydroelectric and renewable sources.

- Key Drivers for Hydroelectric Dominance:

- Substantial government investment in infrastructure projects.

- Favorable regulatory policies promoting renewable energy development.

- Relatively low generation cost compared to thermal and other power sources.

- Abundant water resources, particularly in Siberia and the Far East.

- Projected Market Share (2033): Hydroelectric: xx%; Thermal: xx%; Renewable: xx%; Other: xx%.

Russia Hydro Power Plants Market Product Innovations

Recent innovations focus on enhancing the efficiency and sustainability of hydropower plants. This includes advanced turbine designs for improved energy conversion, smart grid integration for optimized power distribution, and the incorporation of renewable energy sources alongside hydropower for hybrid systems. These innovations enhance the operational efficiency and environmental friendliness of the power generation process, leading to reduced carbon emissions and improved overall performance. The unique selling propositions of these advancements include increased power generation capacity, reduced maintenance costs, and enhanced grid stability.

Propelling Factors for Russia Hydro Power Plants Market Growth

Several factors are propelling the growth of the Russia Hydro Power Plants Market. Government policies supporting renewable energy sources and modernization of existing infrastructure are crucial. The increasing demand for electricity and the drive to reduce carbon emissions are further catalysts. Significant investments in new hydropower projects, coupled with technological advancements, enhance market growth.

Obstacles in the Russia Hydro Power Plants Market Market

Challenges include the impact of Western sanctions, impacting access to equipment and technology. Geopolitical instability and fluctuating energy prices pose significant risks. Environmental concerns and regulations related to dam construction and water management require careful consideration.

Future Opportunities in Russia Hydro Power Plants Market

Future opportunities lie in the modernization of existing hydropower plants, the development of small-scale hydropower projects in remote areas, and integration with other renewable energy sources. The development of advanced technologies, such as pumped hydro storage, to address grid stability issues, presents significant potential for growth.

Major Players in the Russia Hydro Power Plants Market Ecosystem

- Uniper SE

- General Electric Co

- Enel SpA

- Rosatom Corp

- RusHydro PJSC ADR

- Inter RAO UES PJSC

- Rosseti PJSC

- Gazprom PJSC

Key Developments in Russia Hydro Power Plants Market Industry

- Nov 2021: RusHydro announced plans for three new small hydropower plants in the Northern Caucasus (Verkhnebaksanskaya, Nikhaloyskaya, and Mogokhskaya), totaling 96MW capacity, expected to be commissioned before 2028. This signifies investment in smaller-scale hydro projects and expansion into new regions.

- Sept 2022: Suspension of the 100 MW Sputnik solar plant in Volgograd Oblast due to Western sanctions highlights the impact of geopolitical factors on energy projects. This demonstrates the vulnerability of the market to external pressures.

Strategic Russia Hydro Power Plants Market Market Forecast

The Russia Hydro Power Plants Market is poised for continued growth, driven by government support for renewable energy, modernization efforts, and the increasing demand for electricity. Despite challenges, the vast hydro resources and ongoing investments in infrastructure suggest a positive outlook for the market in the coming years. The market is expected to reach xx Million by 2033, with hydroelectric power remaining a dominant segment.

Russia Hydro Power Plants Market Segmentation

-

1. Generation

- 1.1. Thermal

- 1.2. Hydroelectric

- 1.3. Renewable

- 1.4. Other Generations

- 2. Transmission and Distribution

Russia Hydro Power Plants Market Segmentation By Geography

- 1. Russia

Russia Hydro Power Plants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 1.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; High Power Demand due to the Growing Population4.; Upcoming Power Generation Projects

- 3.3. Market Restrains

- 3.3.1. 4.; The New Government's Intentions to Reduce Private Investments

- 3.4. Market Trends

- 3.4.1. Thermal Power Generation a Major Source of Energy

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Hydro Power Plants Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Generation

- 5.1.1. Thermal

- 5.1.2. Hydroelectric

- 5.1.3. Renewable

- 5.1.4. Other Generations

- 5.2. Market Analysis, Insights and Forecast - by Transmission and Distribution

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Generation

- 6. Western Russia Russia Hydro Power Plants Market Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Russia Russia Hydro Power Plants Market Analysis, Insights and Forecast, 2019-2031

- 8. Southern Russia Russia Hydro Power Plants Market Analysis, Insights and Forecast, 2019-2031

- 9. Northern Russia Russia Hydro Power Plants Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Uniper SE

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 General Electric Co *List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Enel SpA

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Rosatom Corp

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 RusHydro PJSC ADR

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Inter RAO UES PJSC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Rosseti PJSC

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Gazprom PJSC

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Uniper SE

List of Figures

- Figure 1: Russia Hydro Power Plants Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Russia Hydro Power Plants Market Share (%) by Company 2024

List of Tables

- Table 1: Russia Hydro Power Plants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Russia Hydro Power Plants Market Revenue Million Forecast, by Generation 2019 & 2032

- Table 3: Russia Hydro Power Plants Market Revenue Million Forecast, by Transmission and Distribution 2019 & 2032

- Table 4: Russia Hydro Power Plants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Russia Hydro Power Plants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Western Russia Russia Hydro Power Plants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Eastern Russia Russia Hydro Power Plants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Southern Russia Russia Hydro Power Plants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Northern Russia Russia Hydro Power Plants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Russia Hydro Power Plants Market Revenue Million Forecast, by Generation 2019 & 2032

- Table 11: Russia Hydro Power Plants Market Revenue Million Forecast, by Transmission and Distribution 2019 & 2032

- Table 12: Russia Hydro Power Plants Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Hydro Power Plants Market?

The projected CAGR is approximately > 1.00%.

2. Which companies are prominent players in the Russia Hydro Power Plants Market?

Key companies in the market include Uniper SE, General Electric Co *List Not Exhaustive, Enel SpA, Rosatom Corp, RusHydro PJSC ADR, Inter RAO UES PJSC, Rosseti PJSC, Gazprom PJSC.

3. What are the main segments of the Russia Hydro Power Plants Market?

The market segments include Generation, Transmission and Distribution.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; High Power Demand due to the Growing Population4.; Upcoming Power Generation Projects.

6. What are the notable trends driving market growth?

Thermal Power Generation a Major Source of Energy.

7. Are there any restraints impacting market growth?

4.; The New Government's Intentions to Reduce Private Investments.

8. Can you provide examples of recent developments in the market?

Sept 2022: The government of Russia announced the construction of the 100 MW Sputnik solar plant in Russia's Volgograd oblast had been suspended due to Western sanctions imposed in response to the Russian invasion of Ukraine.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Hydro Power Plants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Hydro Power Plants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Hydro Power Plants Market?

To stay informed about further developments, trends, and reports in the Russia Hydro Power Plants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence