Key Insights

The Polish ceramic tile market, estimated at 8.25 billion in 2025, is poised for significant expansion, projected to achieve a Compound Annual Growth Rate (CAGR) of 5.31% between 2025 and 2033. This robust growth is propelled by increasing construction activity in both residential and commercial sectors, driven by new developments and renovation projects. Rising disposable incomes and elevated living standards in Poland further fuel demand. Evolving design preferences for aesthetically appealing and durable ceramic tiles, including glazed and scratch-free varieties, are also key growth catalysts. The versatility of ceramic tiles for various applications, such as flooring and wall coverings in diverse construction projects, broadens market appeal. Leading manufacturers like Cerrad, Paradyz Group, and Cersanit are strengthening their market presence through innovative products and strategic marketing. However, volatile raw material costs and potential economic instability represent notable challenges to industry expansion. The market is segmented by product type (glazed, porcelain, scratch-free), application (floor, wall), construction type (new, renovation), and end-user (residential, commercial), offering detailed insights into specific market segments.

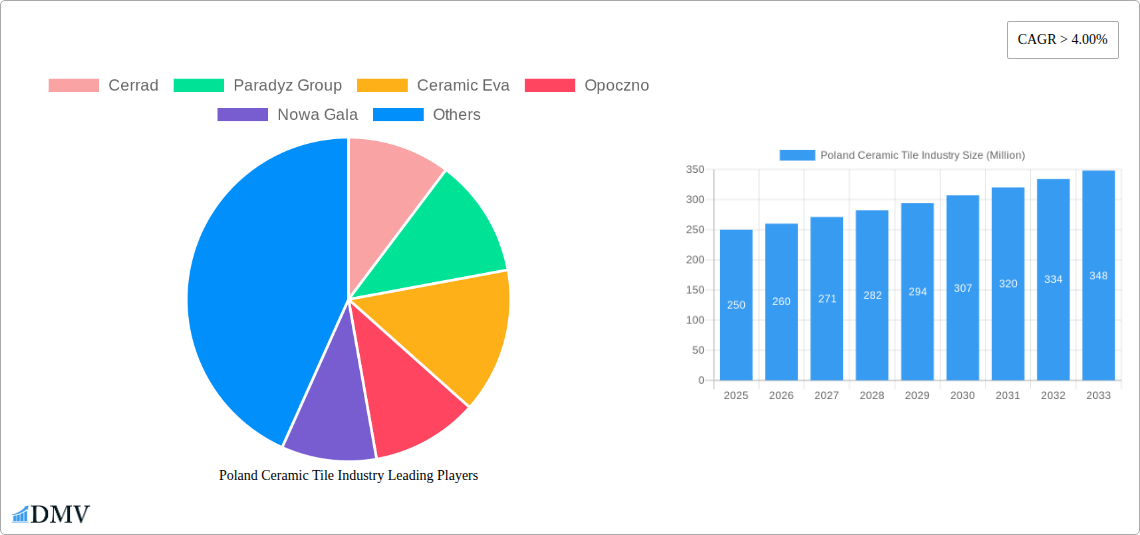

Poland Ceramic Tile Industry Market Size (In Billion)

The market's future trajectory will be shaped by sustained economic growth in Poland, innovation in tile design and technology, including sustainable options, and evolving competitive dynamics through new entrants and potential mergers. Government regulations concerning construction and building materials will also influence market trends. Strategic planning requires a thorough analysis of these factors to ensure accurate market forecasting. Continued emphasis on high-quality, aesthetically pleasing, and durable products, combined with effective marketing and distribution, will be paramount for success in this competitive and growing market.

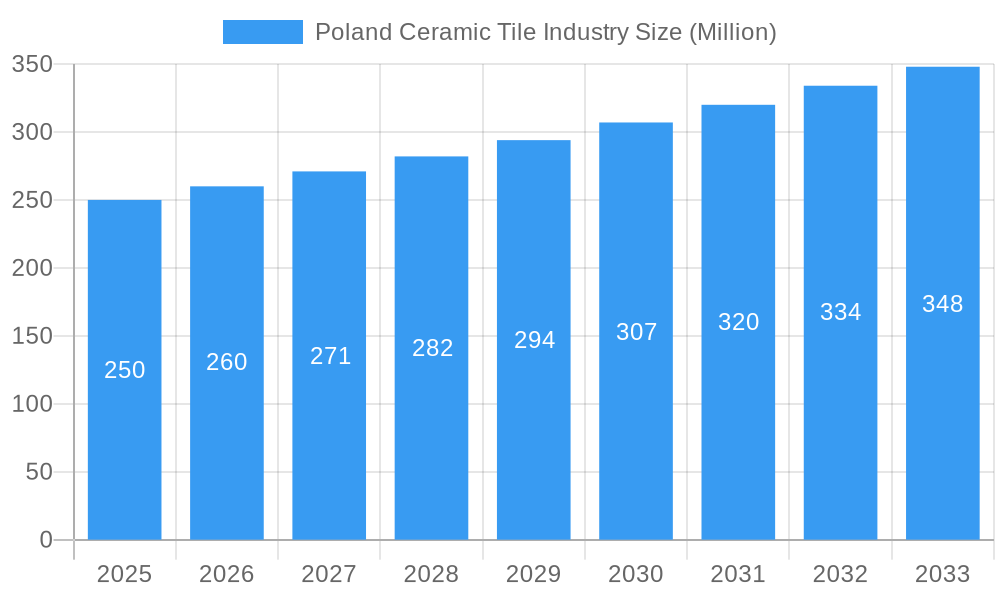

Poland Ceramic Tile Industry Company Market Share

Poland Ceramic Tile Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Poland ceramic tile industry, covering market size, trends, leading players, and future growth prospects from 2019 to 2033. The study period spans from 2019-2024 (historical period) and extends to 2033 (forecast period), with 2025 serving as the base and estimated year. This report is crucial for stakeholders seeking to understand the dynamics of this thriving market, valued at xx Million in 2025.

Poland Ceramic Tile Industry Market Composition & Trends

This section delves into the competitive landscape of the Polish ceramic tile market, examining market concentration, innovation drivers, regulatory factors, substitute products, end-user profiles, and merger & acquisition (M&A) activity. The market is characterized by a mix of large established players and smaller specialized companies. Market share distribution is currently dominated by a few key players like Cerrad and Paradyz Group, each holding xx% and xx% respectively, while other companies including Opoczno, Cersanit, and Nowa Gala together account for approximately xx%. This concentration leaves room for smaller companies to find niches and innovate.

- Market Concentration: Highly concentrated, with top 5 players holding approximately xx% market share in 2025.

- Innovation Catalysts: Focus on large-format tiles, innovative pressing technology (as evidenced by Ceramika Paradyz's investment), and eco-friendly materials.

- Regulatory Landscape: Compliance with EU building regulations and environmental standards are key. (Specific details on regulations will be provided in the full report).

- Substitute Products: Other flooring materials (e.g., wood, vinyl) represent a significant competitive pressure.

- End-User Profiles: Residential (both new construction and renovation) and commercial sectors are major consumers. The growth of commercial construction in Poland is likely to boost the demand for ceramic tiles.

- M&A Activity: Recent activity includes Ceramika Paradyż's expansion into Germany (Ceramika Paradyz Deutschland GmbH). The total value of M&A deals within the observed period (2019-2024) is estimated at xx Million. Further analysis will be included in the complete report.

Poland Ceramic Tile Industry Industry Evolution

This section analyzes the evolution of the Polish ceramic tile industry, considering market growth trajectories, technological advancements, and changing consumer preferences. The industry experienced consistent growth during the historical period (2019-2024), with an estimated Compound Annual Growth Rate (CAGR) of xx%. This growth is largely driven by the expanding construction sector and rising disposable incomes leading to increased renovation activity. Technological advancements, particularly in large-format tiles and improved manufacturing processes, have significantly enhanced product quality and efficiency. Consumer trends are shifting toward more sustainable and aesthetically diverse tile options. The report will provide detailed data on specific growth rates for each segment.

Leading Regions, Countries, or Segments in Poland Ceramic Tile Industry

The Polish ceramic tile market is regionally diverse, with demand varying across different regions based on construction activity and consumer preferences. However, urban centers and regions experiencing rapid economic growth are likely to showcase the highest demand. Segmentation analysis reveals the following:

- By Product Type: Porcelain tiles hold the largest market share (xx%) due to their durability and versatility. Glazed tiles remain popular for their aesthetic appeal. Scratch-free tiles are a growing niche segment experiencing high growth potential.

- By Application: Floor tiles dominate the market (xx%), driven by their functional necessity in both residential and commercial projects. Wall tiles represent a significant segment (xx%), driven by aesthetic and design preferences.

- By Construction Type: New construction (xx%) is a large market segment, while the replacement and renovation segment (xx%) offers substantial growth potential fueled by increasing home ownership rates.

- By End-User Type: Residential replacement projects, due to a growing number of renovations and the rise in standards of living, are currently witnessing increased demand in 2025. Commercial sector demand remains significant, driven by infrastructural development and retail expansion. Industry-specific demands remain a smaller segment in comparison.

Key Drivers:

- Investment Trends: Significant investments in advanced manufacturing technologies are boosting production efficiency and product quality.

- Regulatory Support: Government initiatives promoting sustainable building practices indirectly benefit the ceramic tile industry.

Poland Ceramic Tile Industry Product Innovations

Recent product innovations in the Polish ceramic tile market include the introduction of larger format tiles, enhanced surface textures, and increased focus on eco-friendly materials. Technological advancements in digital printing allow for high-fidelity designs. Unique selling propositions include improved durability, stain resistance, and ease of maintenance. Specific examples of innovative products and their performance metrics will be extensively detailed in the complete report.

Propelling Factors for Poland Ceramic Tile Industry Growth

The growth of the Polish ceramic tile industry is fueled by several key factors: a robust construction sector, rising disposable incomes driving home improvements, technological advancements leading to superior products, and favorable government policies supporting the construction industry. The increasing popularity of large-format tiles and the adoption of sustainable manufacturing practices are further adding to market expansion.

Obstacles in the Poland Ceramic Tile Industry Market

The Polish ceramic tile industry faces challenges including intense competition from both domestic and international players, fluctuations in raw material costs, and potential supply chain disruptions. Environmental regulations also impose some limitations on production. The full report will provide quantified analysis of the impact of these challenges on market growth and profitability.

Future Opportunities in Poland Ceramic Tile Industry

Future growth opportunities lie in expanding into new market segments (e.g., specialized niche products), leveraging technological advancements (e.g., smart tiles, 3D printing), and focusing on sustainable and eco-friendly products. Further analysis of emerging markets and technological advancements will be available in the full report.

Major Players in the Poland Ceramic Tile Industry Ecosystem

- Cerrad

- Paradyz Group

- Ceramic Eva

- Opoczno

- Nowa Gala

- Dagma

- Ceramika Konskie Sp Zoo

- Villeroy & Boch Polska

- Fea Ceramics

- Cersanit

Key Developments in Poland Ceramic Tile Industry Industry

- December 22, 2020: Ceramika Paradyż invested PLN 125 Million (approximately xx Million) in globally innovative technology, focusing on large-format tiles and simultaneous dyeing. This significantly enhanced their production capabilities and product offerings.

- April 8, 2021: Ceramika Paradyż launched Ceramika Paradyz Deutschland GmbH, expanding its market reach into Germany, Austria, Switzerland, and France. This strategic move broadened the company's distribution network and increased its market share.

- September 28, 2021: Cerrad collaborated with La Mania Home, leveraging brand synergy to expand market reach and introduce innovative design collaborations.

Strategic Poland Ceramic Tile Industry Market Forecast

The Polish ceramic tile industry is poised for continued growth over the forecast period (2025-2033), driven by sustained construction activity, increasing consumer spending, and ongoing product innovation. The market is expected to experience a CAGR of xx%, reaching a value of xx Million by 2033. Focusing on sustainable materials and digitalized manufacturing will be key to success.

Poland Ceramic Tile Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Poland Ceramic Tile Industry Segmentation By Geography

- 1. Poland

Poland Ceramic Tile Industry Regional Market Share

Geographic Coverage of Poland Ceramic Tile Industry

Poland Ceramic Tile Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.31% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Level of Income and Living Standard; Rise in Demand for Vaccum cleaners in Household and Commercial space

- 3.3. Market Restrains

- 3.3.1. Rise in price of Consumer Electronics globally Post Covid; Supply Chain disruptions and Increasing Raw material prices affect the production side.

- 3.4. Market Trends

- 3.4.1. Poland Ceramic Tiles Exports

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Poland Ceramic Tile Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Poland

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cerrad

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Paradyz Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ceramic Eva

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Opoczno

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nowa Gala

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Dagma

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ceramika Konskie Sp Zoo

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Villeroy & Boch Polska

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Fea Ceramics**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Cersanit

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Cerrad

List of Figures

- Figure 1: Poland Ceramic Tile Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Poland Ceramic Tile Industry Share (%) by Company 2025

List of Tables

- Table 1: Poland Ceramic Tile Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Poland Ceramic Tile Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Poland Ceramic Tile Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Poland Ceramic Tile Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Poland Ceramic Tile Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Poland Ceramic Tile Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Poland Ceramic Tile Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: Poland Ceramic Tile Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Poland Ceramic Tile Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Poland Ceramic Tile Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Poland Ceramic Tile Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Poland Ceramic Tile Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Poland Ceramic Tile Industry?

The projected CAGR is approximately 5.31%.

2. Which companies are prominent players in the Poland Ceramic Tile Industry?

Key companies in the market include Cerrad, Paradyz Group, Ceramic Eva, Opoczno, Nowa Gala, Dagma, Ceramika Konskie Sp Zoo, Villeroy & Boch Polska, Fea Ceramics**List Not Exhaustive, Cersanit.

3. What are the main segments of the Poland Ceramic Tile Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.25 billion as of 2022.

5. What are some drivers contributing to market growth?

Increase in Level of Income and Living Standard; Rise in Demand for Vaccum cleaners in Household and Commercial space.

6. What are the notable trends driving market growth?

Poland Ceramic Tiles Exports.

7. Are there any restraints impacting market growth?

Rise in price of Consumer Electronics globally Post Covid; Supply Chain disruptions and Increasing Raw material prices affect the production side..

8. Can you provide examples of recent developments in the market?

April 8, 2021: Ceramika Paradyż, one of the enterprises producing ceramic tiles, opened a new company in Germany - Ceramika Paradyz Deutschland GmbH. It aims to sell dedicated products and provide comprehensive services in Germany, Austria, Switzerland, and France. On September 28, 2021, there was a collaboration between Cerrad and La Mania Home.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Poland Ceramic Tile Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Poland Ceramic Tile Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Poland Ceramic Tile Industry?

To stay informed about further developments, trends, and reports in the Poland Ceramic Tile Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence