Key Insights

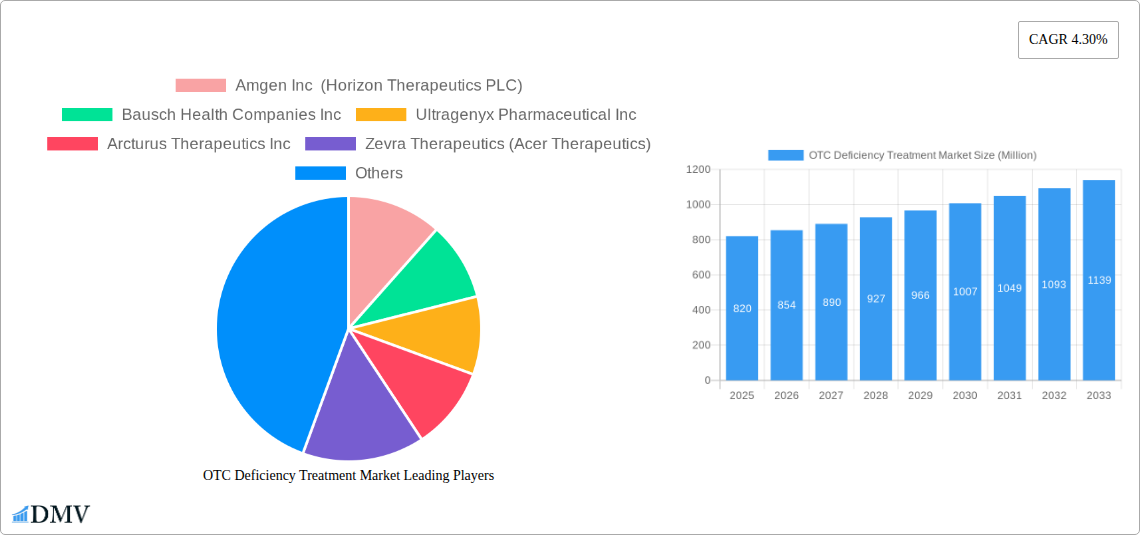

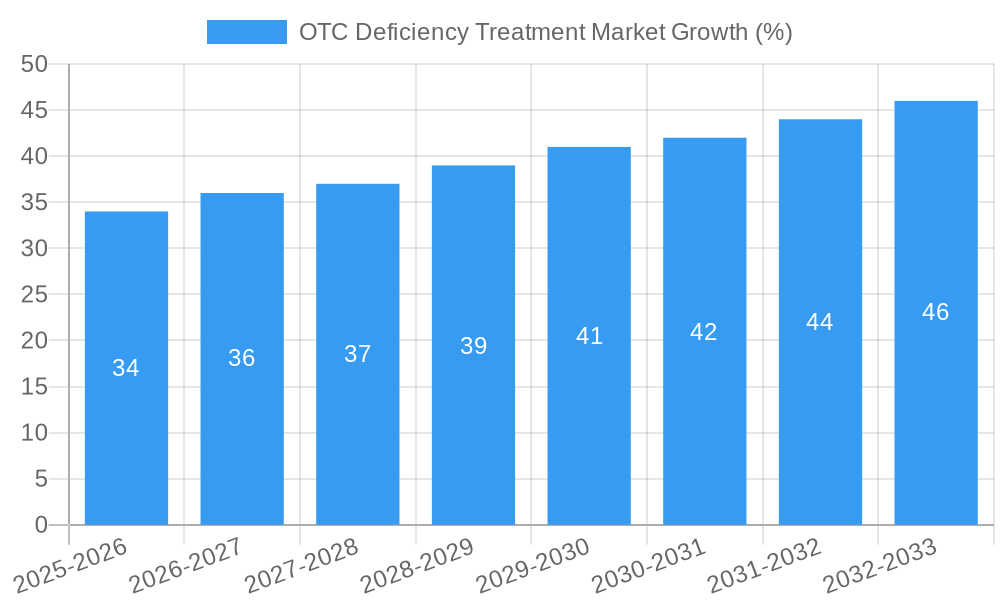

The over-the-counter (OTC) deficiency treatment market, valued at $820 million in 2025, is projected to experience robust growth, driven by increasing awareness of nutritional deficiencies and a rising preference for self-care solutions. A compound annual growth rate (CAGR) of 4.3% from 2025 to 2033 suggests a market size exceeding $1.2 billion by the end of the forecast period. Key drivers include the growing prevalence of micronutrient deficiencies linked to lifestyle factors, increased accessibility of OTC supplements, and rising consumer spending on health and wellness products. Expanding e-commerce platforms and targeted digital marketing campaigns are further fueling market expansion. While regulatory hurdles and concerns about product efficacy and safety pose some constraints, the market's trajectory is largely positive. The segment breakdown likely encompasses various deficiency types – iron, vitamin D, B vitamins, etc. – each with varying growth rates reflecting their specific prevalence and consumer demand. Leading companies like Amgen, Bausch Health, and Abbott are leveraging their established distribution networks and brand recognition to maintain market share and introduce innovative products. Future growth will hinge on the development of more effective and convenient formulations, personalized nutritional solutions, and rigorous quality control measures to build consumer trust.

The competitive landscape is characterized by both large multinational corporations and smaller specialized firms. Large players benefit from established distribution channels and extensive marketing resources, while smaller companies often focus on niche segments or innovative product development. Strategic partnerships and mergers and acquisitions are anticipated as major players seek to expand their product portfolios and market reach. The regional distribution of the market is likely concentrated in developed economies initially, with emerging markets exhibiting growth potential as healthcare infrastructure and consumer awareness improve. Further market segmentation by product type (tablets, capsules, liquids), distribution channel (pharmacies, supermarkets, online retailers), and deficiency type will provide a more granular understanding of market dynamics and offer opportunities for targeted marketing and product development.

OTC Deficiency Treatment Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the OTC Deficiency Treatment Market, offering crucial insights for stakeholders seeking to navigate this dynamic landscape. With a comprehensive study period spanning 2019-2033 (base year 2025, forecast period 2025-2033), this report delivers a 360° view of market trends, competitive dynamics, and future growth potential. The market is projected to reach xx Million by 2033.

OTC Deficiency Treatment Market Market Composition & Trends

The OTC deficiency treatment market exhibits a moderately consolidated structure, with several key players vying for market share. Market concentration is influenced by factors such as R&D investments, regulatory approvals, and successful product launches. Innovation is a key driver, with companies focusing on developing novel therapies to address unmet medical needs and improve patient outcomes. The regulatory landscape plays a significant role, with stringent approval processes and evolving guidelines impacting market access and product lifecycle management. Substitute products, while limited, present a degree of competitive pressure. End-users primarily consist of hospitals, specialized clinics, and individual patients with OTC deficiency. Mergers and acquisitions (M&A) are increasingly common, reflecting strategic moves by companies to expand their product portfolios and enhance their market presence.

- Market Share Distribution (2024): Amgen Inc. (xx%), Bausch Health Companies Inc. (xx%), Ultragenyx Pharmaceutical Inc. (xx%), Others (xx%)

- Recent M&A Activity: The acquisition of Horizon Therapeutics PLC by Amgen Inc. in October 2023 for USD 27.8 Billion significantly reshaped the market landscape. The acquisition of Acer Therapeutics Inc. by Zevra Therapeutics Inc. in November 2023 further consolidated the industry. Total M&A deal value in the last 5 years: xx Billion.

OTC Deficiency Treatment Market Industry Evolution

The OTC deficiency treatment market has witnessed significant growth over the historical period (2019-2024), driven primarily by increasing awareness of OTC deficiency, rising prevalence rates, and advancements in therapeutic approaches. The market is expected to maintain a robust growth trajectory during the forecast period (2025-2033), with a Compound Annual Growth Rate (CAGR) of xx%. This growth is fueled by several key factors, including technological advancements leading to improved diagnostics and treatment options, changing consumer demands for more effective and convenient therapies, and increased government initiatives to support research and development in rare diseases. The adoption of novel therapies, such as targeted therapies and gene therapies, is expected to increase significantly, contributing to market expansion. Specific data points on adoption rates will be included in the full report.

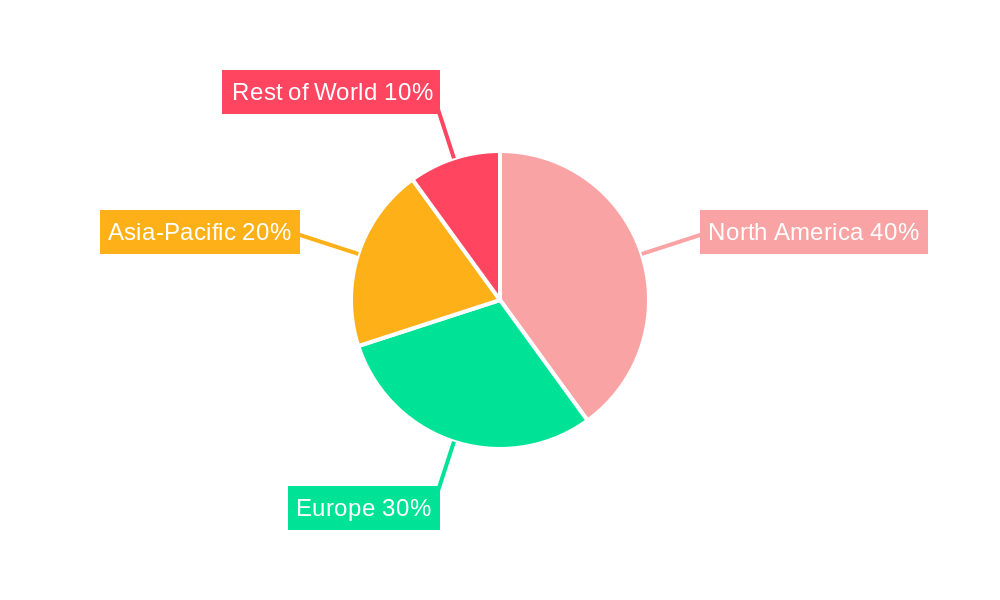

Leading Regions, Countries, or Segments in OTC Deficiency Treatment Market

The North American region currently dominates the OTC deficiency treatment market, driven by several factors.

- Key Drivers in North America:

- High prevalence of OTC deficiency.

- Robust healthcare infrastructure and significant investments in R&D.

- Favorable regulatory environment supporting new drug approvals.

- High healthcare expenditure per capita.

The dominance of North America is further bolstered by the presence of major pharmaceutical companies, significant investment in clinical trials and research, and a supportive regulatory framework. While other regions, such as Europe and Asia-Pacific, are experiencing growth, they lag behind North America due to varying factors including healthcare infrastructure, regulatory hurdles, and lower awareness levels. Detailed analysis of regional variations in prevalence rates, treatment adoption, and market access will be provided in the full report.

OTC Deficiency Treatment Market Product Innovations

Recent years have seen significant advancements in OTC deficiency treatment, with a focus on developing novel therapies that offer improved efficacy, safety, and convenience. These innovations include improved formulations, targeted therapies with reduced side effects, and the exploration of gene therapies offering potential long-term solutions. The unique selling propositions of these products often center on improved patient outcomes, enhanced compliance, and reduced healthcare burden. Performance metrics, such as efficacy rates and safety profiles, are key indicators of product success.

Propelling Factors for OTC Deficiency Treatment Market Growth

Several factors are driving the growth of the OTC deficiency treatment market. Technological advancements are leading to more effective diagnostics and treatments, improved patient outcomes are increasing awareness and demand, and regulatory support is stimulating further R&D. Economic factors, such as rising healthcare expenditure and increased insurance coverage, also contribute to market expansion.

Obstacles in the OTC Deficiency Treatment Market Market

Despite significant growth potential, the OTC deficiency treatment market faces several challenges. Stringent regulatory pathways for drug approval can significantly delay market entry. Supply chain disruptions can impact the availability of treatment options, and intense competition among market players creates pricing pressures. These challenges could collectively impact market growth by an estimated xx% in the coming years.

Future Opportunities in OTC Deficiency Treatment Market

Emerging opportunities in the OTC deficiency treatment market include the development of personalized therapies, expansion into underserved markets, and leveraging digital health technologies to improve patient management. The growing adoption of telemedicine and remote patient monitoring provides opportunities for enhancing patient care and access to treatment.

Major Players in the OTC Deficiency Treatment Market Ecosystem

- Amgen Inc. (Amgen Inc.)

- Bausch Health Companies Inc. (Bausch Health Companies Inc.)

- Ultragenyx Pharmaceutical Inc. (Ultragenyx Pharmaceutical Inc.)

- Arcturus Therapeutics Inc. (Arcturus Therapeutics Inc.)

- Zevra Therapeutics (Acer Therapeutics)

- iECURE

- Danone Group (Nutricia) (Danone Group)

- Abbott (Abbott)

- Reckitt Benckiser (Reckitt Benckiser)

- Nestle (Nestle)

- Moderna Inc. (Moderna Inc.)

- Duchesnay Pharmaceutical Group-DPG (Medunik USA)

- Eurocept Pharmaceuticals Holding (Lucane Pharma)

- List Not Exhaustive

Key Developments in OTC Deficiency Treatment Market Industry

- November 2023: Zevra Therapeutics Inc. acquired Acer Therapeutics Inc., strengthening its position in rare disease treatments.

- October 2023: Amgen's acquisition of Horizon Therapeutics PLC for USD 27.8 Billion expanded its rare disease portfolio and market share.

- December 2022: FDA approval of OLPRUVA (sodium phenylbutyrate) for urea cycle disorders, including OTC deficiency, marked a significant therapeutic advancement.

Strategic OTC Deficiency Treatment Market Market Forecast

The OTC deficiency treatment market is poised for continued growth, driven by innovative therapies, rising prevalence rates, and increased investment in R&D. Future opportunities lie in personalized medicine, expansion into new markets, and technological advancements in diagnostics and treatment. The market's robust growth trajectory, coupled with ongoing innovation, suggests significant potential for long-term expansion.

OTC Deficiency Treatment Market Segmentation

-

1. Treatment Type

- 1.1. Glycerol Phenylbutyrate

- 1.2. Sodium Phenylbutyrate

- 1.3. Sodium Phenylacetate and Sodium Benzoate

- 1.4. Other Tr

-

2. Route of Administration

- 2.1. Oral

- 2.2. Intravenous

-

3. Distribution Channel

- 3.1. Hospital Pharmacies

- 3.2. Retail Pharmacies

- 3.3. Online Pharmacies

- 3.4. Other Di

OTC Deficiency Treatment Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

- 4. Rest of the World

OTC Deficiency Treatment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Product Approvals With Novel Pipeline Products for Ornithine Transcarbamylase (OTC) Deficiency Treatment; Growing Awareness for Disease with Campaigns Organized by Public and Private Entities; Favorable Reimbursement Scenario and Patient Assistance Programs

- 3.3. Market Restrains

- 3.3.1. Rising Product Approvals With Novel Pipeline Products for Ornithine Transcarbamylase (OTC) Deficiency Treatment; Growing Awareness for Disease with Campaigns Organized by Public and Private Entities; Favorable Reimbursement Scenario and Patient Assistance Programs

- 3.4. Market Trends

- 3.4.1. The Glycerol Phenylbutyrate Segment is Expected to Witness Significant Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global OTC Deficiency Treatment Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Treatment Type

- 5.1.1. Glycerol Phenylbutyrate

- 5.1.2. Sodium Phenylbutyrate

- 5.1.3. Sodium Phenylacetate and Sodium Benzoate

- 5.1.4. Other Tr

- 5.2. Market Analysis, Insights and Forecast - by Route of Administration

- 5.2.1. Oral

- 5.2.2. Intravenous

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Hospital Pharmacies

- 5.3.2. Retail Pharmacies

- 5.3.3. Online Pharmacies

- 5.3.4. Other Di

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Treatment Type

- 6. North America OTC Deficiency Treatment Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Treatment Type

- 6.1.1. Glycerol Phenylbutyrate

- 6.1.2. Sodium Phenylbutyrate

- 6.1.3. Sodium Phenylacetate and Sodium Benzoate

- 6.1.4. Other Tr

- 6.2. Market Analysis, Insights and Forecast - by Route of Administration

- 6.2.1. Oral

- 6.2.2. Intravenous

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Hospital Pharmacies

- 6.3.2. Retail Pharmacies

- 6.3.3. Online Pharmacies

- 6.3.4. Other Di

- 6.1. Market Analysis, Insights and Forecast - by Treatment Type

- 7. Europe OTC Deficiency Treatment Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Treatment Type

- 7.1.1. Glycerol Phenylbutyrate

- 7.1.2. Sodium Phenylbutyrate

- 7.1.3. Sodium Phenylacetate and Sodium Benzoate

- 7.1.4. Other Tr

- 7.2. Market Analysis, Insights and Forecast - by Route of Administration

- 7.2.1. Oral

- 7.2.2. Intravenous

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Hospital Pharmacies

- 7.3.2. Retail Pharmacies

- 7.3.3. Online Pharmacies

- 7.3.4. Other Di

- 7.1. Market Analysis, Insights and Forecast - by Treatment Type

- 8. Asia Pacific OTC Deficiency Treatment Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Treatment Type

- 8.1.1. Glycerol Phenylbutyrate

- 8.1.2. Sodium Phenylbutyrate

- 8.1.3. Sodium Phenylacetate and Sodium Benzoate

- 8.1.4. Other Tr

- 8.2. Market Analysis, Insights and Forecast - by Route of Administration

- 8.2.1. Oral

- 8.2.2. Intravenous

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Hospital Pharmacies

- 8.3.2. Retail Pharmacies

- 8.3.3. Online Pharmacies

- 8.3.4. Other Di

- 8.1. Market Analysis, Insights and Forecast - by Treatment Type

- 9. Rest of the World OTC Deficiency Treatment Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Treatment Type

- 9.1.1. Glycerol Phenylbutyrate

- 9.1.2. Sodium Phenylbutyrate

- 9.1.3. Sodium Phenylacetate and Sodium Benzoate

- 9.1.4. Other Tr

- 9.2. Market Analysis, Insights and Forecast - by Route of Administration

- 9.2.1. Oral

- 9.2.2. Intravenous

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Hospital Pharmacies

- 9.3.2. Retail Pharmacies

- 9.3.3. Online Pharmacies

- 9.3.4. Other Di

- 9.1. Market Analysis, Insights and Forecast - by Treatment Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Amgen Inc (Horizon Therapeutics PLC)

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Bausch Health Companies Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Ultragenyx Pharmaceutical Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Arcturus Therapeutics Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Zevra Therapeutics (Acer Therapeutics)

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 iECURE

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Danone Group (Nutricia)

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Abbott

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Reckitt Benckiser

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Nestle

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Moderna Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Duchesnay Pharmaceutical Group-DPG(Medunik�USA)

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Eurocept Pharmaceuticals Holding (Lucane Pharma)*List Not Exhaustive

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.1 Amgen Inc (Horizon Therapeutics PLC)

List of Figures

- Figure 1: Global OTC Deficiency Treatment Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global OTC Deficiency Treatment Market Volume Breakdown (Billion, %) by Region 2024 & 2032

- Figure 3: North America OTC Deficiency Treatment Market Revenue (Million), by Treatment Type 2024 & 2032

- Figure 4: North America OTC Deficiency Treatment Market Volume (Billion), by Treatment Type 2024 & 2032

- Figure 5: North America OTC Deficiency Treatment Market Revenue Share (%), by Treatment Type 2024 & 2032

- Figure 6: North America OTC Deficiency Treatment Market Volume Share (%), by Treatment Type 2024 & 2032

- Figure 7: North America OTC Deficiency Treatment Market Revenue (Million), by Route of Administration 2024 & 2032

- Figure 8: North America OTC Deficiency Treatment Market Volume (Billion), by Route of Administration 2024 & 2032

- Figure 9: North America OTC Deficiency Treatment Market Revenue Share (%), by Route of Administration 2024 & 2032

- Figure 10: North America OTC Deficiency Treatment Market Volume Share (%), by Route of Administration 2024 & 2032

- Figure 11: North America OTC Deficiency Treatment Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 12: North America OTC Deficiency Treatment Market Volume (Billion), by Distribution Channel 2024 & 2032

- Figure 13: North America OTC Deficiency Treatment Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 14: North America OTC Deficiency Treatment Market Volume Share (%), by Distribution Channel 2024 & 2032

- Figure 15: North America OTC Deficiency Treatment Market Revenue (Million), by Country 2024 & 2032

- Figure 16: North America OTC Deficiency Treatment Market Volume (Billion), by Country 2024 & 2032

- Figure 17: North America OTC Deficiency Treatment Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: North America OTC Deficiency Treatment Market Volume Share (%), by Country 2024 & 2032

- Figure 19: Europe OTC Deficiency Treatment Market Revenue (Million), by Treatment Type 2024 & 2032

- Figure 20: Europe OTC Deficiency Treatment Market Volume (Billion), by Treatment Type 2024 & 2032

- Figure 21: Europe OTC Deficiency Treatment Market Revenue Share (%), by Treatment Type 2024 & 2032

- Figure 22: Europe OTC Deficiency Treatment Market Volume Share (%), by Treatment Type 2024 & 2032

- Figure 23: Europe OTC Deficiency Treatment Market Revenue (Million), by Route of Administration 2024 & 2032

- Figure 24: Europe OTC Deficiency Treatment Market Volume (Billion), by Route of Administration 2024 & 2032

- Figure 25: Europe OTC Deficiency Treatment Market Revenue Share (%), by Route of Administration 2024 & 2032

- Figure 26: Europe OTC Deficiency Treatment Market Volume Share (%), by Route of Administration 2024 & 2032

- Figure 27: Europe OTC Deficiency Treatment Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 28: Europe OTC Deficiency Treatment Market Volume (Billion), by Distribution Channel 2024 & 2032

- Figure 29: Europe OTC Deficiency Treatment Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 30: Europe OTC Deficiency Treatment Market Volume Share (%), by Distribution Channel 2024 & 2032

- Figure 31: Europe OTC Deficiency Treatment Market Revenue (Million), by Country 2024 & 2032

- Figure 32: Europe OTC Deficiency Treatment Market Volume (Billion), by Country 2024 & 2032

- Figure 33: Europe OTC Deficiency Treatment Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Europe OTC Deficiency Treatment Market Volume Share (%), by Country 2024 & 2032

- Figure 35: Asia Pacific OTC Deficiency Treatment Market Revenue (Million), by Treatment Type 2024 & 2032

- Figure 36: Asia Pacific OTC Deficiency Treatment Market Volume (Billion), by Treatment Type 2024 & 2032

- Figure 37: Asia Pacific OTC Deficiency Treatment Market Revenue Share (%), by Treatment Type 2024 & 2032

- Figure 38: Asia Pacific OTC Deficiency Treatment Market Volume Share (%), by Treatment Type 2024 & 2032

- Figure 39: Asia Pacific OTC Deficiency Treatment Market Revenue (Million), by Route of Administration 2024 & 2032

- Figure 40: Asia Pacific OTC Deficiency Treatment Market Volume (Billion), by Route of Administration 2024 & 2032

- Figure 41: Asia Pacific OTC Deficiency Treatment Market Revenue Share (%), by Route of Administration 2024 & 2032

- Figure 42: Asia Pacific OTC Deficiency Treatment Market Volume Share (%), by Route of Administration 2024 & 2032

- Figure 43: Asia Pacific OTC Deficiency Treatment Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 44: Asia Pacific OTC Deficiency Treatment Market Volume (Billion), by Distribution Channel 2024 & 2032

- Figure 45: Asia Pacific OTC Deficiency Treatment Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 46: Asia Pacific OTC Deficiency Treatment Market Volume Share (%), by Distribution Channel 2024 & 2032

- Figure 47: Asia Pacific OTC Deficiency Treatment Market Revenue (Million), by Country 2024 & 2032

- Figure 48: Asia Pacific OTC Deficiency Treatment Market Volume (Billion), by Country 2024 & 2032

- Figure 49: Asia Pacific OTC Deficiency Treatment Market Revenue Share (%), by Country 2024 & 2032

- Figure 50: Asia Pacific OTC Deficiency Treatment Market Volume Share (%), by Country 2024 & 2032

- Figure 51: Rest of the World OTC Deficiency Treatment Market Revenue (Million), by Treatment Type 2024 & 2032

- Figure 52: Rest of the World OTC Deficiency Treatment Market Volume (Billion), by Treatment Type 2024 & 2032

- Figure 53: Rest of the World OTC Deficiency Treatment Market Revenue Share (%), by Treatment Type 2024 & 2032

- Figure 54: Rest of the World OTC Deficiency Treatment Market Volume Share (%), by Treatment Type 2024 & 2032

- Figure 55: Rest of the World OTC Deficiency Treatment Market Revenue (Million), by Route of Administration 2024 & 2032

- Figure 56: Rest of the World OTC Deficiency Treatment Market Volume (Billion), by Route of Administration 2024 & 2032

- Figure 57: Rest of the World OTC Deficiency Treatment Market Revenue Share (%), by Route of Administration 2024 & 2032

- Figure 58: Rest of the World OTC Deficiency Treatment Market Volume Share (%), by Route of Administration 2024 & 2032

- Figure 59: Rest of the World OTC Deficiency Treatment Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 60: Rest of the World OTC Deficiency Treatment Market Volume (Billion), by Distribution Channel 2024 & 2032

- Figure 61: Rest of the World OTC Deficiency Treatment Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 62: Rest of the World OTC Deficiency Treatment Market Volume Share (%), by Distribution Channel 2024 & 2032

- Figure 63: Rest of the World OTC Deficiency Treatment Market Revenue (Million), by Country 2024 & 2032

- Figure 64: Rest of the World OTC Deficiency Treatment Market Volume (Billion), by Country 2024 & 2032

- Figure 65: Rest of the World OTC Deficiency Treatment Market Revenue Share (%), by Country 2024 & 2032

- Figure 66: Rest of the World OTC Deficiency Treatment Market Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global OTC Deficiency Treatment Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global OTC Deficiency Treatment Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Global OTC Deficiency Treatment Market Revenue Million Forecast, by Treatment Type 2019 & 2032

- Table 4: Global OTC Deficiency Treatment Market Volume Billion Forecast, by Treatment Type 2019 & 2032

- Table 5: Global OTC Deficiency Treatment Market Revenue Million Forecast, by Route of Administration 2019 & 2032

- Table 6: Global OTC Deficiency Treatment Market Volume Billion Forecast, by Route of Administration 2019 & 2032

- Table 7: Global OTC Deficiency Treatment Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 8: Global OTC Deficiency Treatment Market Volume Billion Forecast, by Distribution Channel 2019 & 2032

- Table 9: Global OTC Deficiency Treatment Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Global OTC Deficiency Treatment Market Volume Billion Forecast, by Region 2019 & 2032

- Table 11: Global OTC Deficiency Treatment Market Revenue Million Forecast, by Treatment Type 2019 & 2032

- Table 12: Global OTC Deficiency Treatment Market Volume Billion Forecast, by Treatment Type 2019 & 2032

- Table 13: Global OTC Deficiency Treatment Market Revenue Million Forecast, by Route of Administration 2019 & 2032

- Table 14: Global OTC Deficiency Treatment Market Volume Billion Forecast, by Route of Administration 2019 & 2032

- Table 15: Global OTC Deficiency Treatment Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 16: Global OTC Deficiency Treatment Market Volume Billion Forecast, by Distribution Channel 2019 & 2032

- Table 17: Global OTC Deficiency Treatment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global OTC Deficiency Treatment Market Volume Billion Forecast, by Country 2019 & 2032

- Table 19: United States OTC Deficiency Treatment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: United States OTC Deficiency Treatment Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 21: Canada OTC Deficiency Treatment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Canada OTC Deficiency Treatment Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 23: Mexico OTC Deficiency Treatment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Mexico OTC Deficiency Treatment Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 25: Global OTC Deficiency Treatment Market Revenue Million Forecast, by Treatment Type 2019 & 2032

- Table 26: Global OTC Deficiency Treatment Market Volume Billion Forecast, by Treatment Type 2019 & 2032

- Table 27: Global OTC Deficiency Treatment Market Revenue Million Forecast, by Route of Administration 2019 & 2032

- Table 28: Global OTC Deficiency Treatment Market Volume Billion Forecast, by Route of Administration 2019 & 2032

- Table 29: Global OTC Deficiency Treatment Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 30: Global OTC Deficiency Treatment Market Volume Billion Forecast, by Distribution Channel 2019 & 2032

- Table 31: Global OTC Deficiency Treatment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global OTC Deficiency Treatment Market Volume Billion Forecast, by Country 2019 & 2032

- Table 33: Germany OTC Deficiency Treatment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Germany OTC Deficiency Treatment Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 35: United Kingdom OTC Deficiency Treatment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: United Kingdom OTC Deficiency Treatment Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 37: France OTC Deficiency Treatment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: France OTC Deficiency Treatment Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 39: Italy OTC Deficiency Treatment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Italy OTC Deficiency Treatment Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 41: Spain OTC Deficiency Treatment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Spain OTC Deficiency Treatment Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 43: Rest of Europe OTC Deficiency Treatment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Rest of Europe OTC Deficiency Treatment Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 45: Global OTC Deficiency Treatment Market Revenue Million Forecast, by Treatment Type 2019 & 2032

- Table 46: Global OTC Deficiency Treatment Market Volume Billion Forecast, by Treatment Type 2019 & 2032

- Table 47: Global OTC Deficiency Treatment Market Revenue Million Forecast, by Route of Administration 2019 & 2032

- Table 48: Global OTC Deficiency Treatment Market Volume Billion Forecast, by Route of Administration 2019 & 2032

- Table 49: Global OTC Deficiency Treatment Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 50: Global OTC Deficiency Treatment Market Volume Billion Forecast, by Distribution Channel 2019 & 2032

- Table 51: Global OTC Deficiency Treatment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 52: Global OTC Deficiency Treatment Market Volume Billion Forecast, by Country 2019 & 2032

- Table 53: China OTC Deficiency Treatment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: China OTC Deficiency Treatment Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 55: Japan OTC Deficiency Treatment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Japan OTC Deficiency Treatment Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 57: India OTC Deficiency Treatment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: India OTC Deficiency Treatment Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 59: Australia OTC Deficiency Treatment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Australia OTC Deficiency Treatment Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 61: South Korea OTC Deficiency Treatment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: South Korea OTC Deficiency Treatment Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 63: Rest of Asia Pacific OTC Deficiency Treatment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Rest of Asia Pacific OTC Deficiency Treatment Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 65: Global OTC Deficiency Treatment Market Revenue Million Forecast, by Treatment Type 2019 & 2032

- Table 66: Global OTC Deficiency Treatment Market Volume Billion Forecast, by Treatment Type 2019 & 2032

- Table 67: Global OTC Deficiency Treatment Market Revenue Million Forecast, by Route of Administration 2019 & 2032

- Table 68: Global OTC Deficiency Treatment Market Volume Billion Forecast, by Route of Administration 2019 & 2032

- Table 69: Global OTC Deficiency Treatment Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 70: Global OTC Deficiency Treatment Market Volume Billion Forecast, by Distribution Channel 2019 & 2032

- Table 71: Global OTC Deficiency Treatment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 72: Global OTC Deficiency Treatment Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the OTC Deficiency Treatment Market?

The projected CAGR is approximately 4.30%.

2. Which companies are prominent players in the OTC Deficiency Treatment Market?

Key companies in the market include Amgen Inc (Horizon Therapeutics PLC), Bausch Health Companies Inc, Ultragenyx Pharmaceutical Inc, Arcturus Therapeutics Inc, Zevra Therapeutics (Acer Therapeutics), iECURE, Danone Group (Nutricia), Abbott, Reckitt Benckiser, Nestle, Moderna Inc, Duchesnay Pharmaceutical Group-DPG(Medunik�USA), Eurocept Pharmaceuticals Holding (Lucane Pharma)*List Not Exhaustive.

3. What are the main segments of the OTC Deficiency Treatment Market?

The market segments include Treatment Type, Route of Administration, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.82 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Product Approvals With Novel Pipeline Products for Ornithine Transcarbamylase (OTC) Deficiency Treatment; Growing Awareness for Disease with Campaigns Organized by Public and Private Entities; Favorable Reimbursement Scenario and Patient Assistance Programs.

6. What are the notable trends driving market growth?

The Glycerol Phenylbutyrate Segment is Expected to Witness Significant Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

Rising Product Approvals With Novel Pipeline Products for Ornithine Transcarbamylase (OTC) Deficiency Treatment; Growing Awareness for Disease with Campaigns Organized by Public and Private Entities; Favorable Reimbursement Scenario and Patient Assistance Programs.

8. Can you provide examples of recent developments in the market?

November 2023: Zevra Therapeutics Inc. acquired Acer Therapeutics Inc., which marked an important milestone in executing Zevra's strategy to become a leader in products of treatments for rare diseases such as urea cycle disorders.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "OTC Deficiency Treatment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the OTC Deficiency Treatment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the OTC Deficiency Treatment Market?

To stay informed about further developments, trends, and reports in the OTC Deficiency Treatment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence