Key Insights

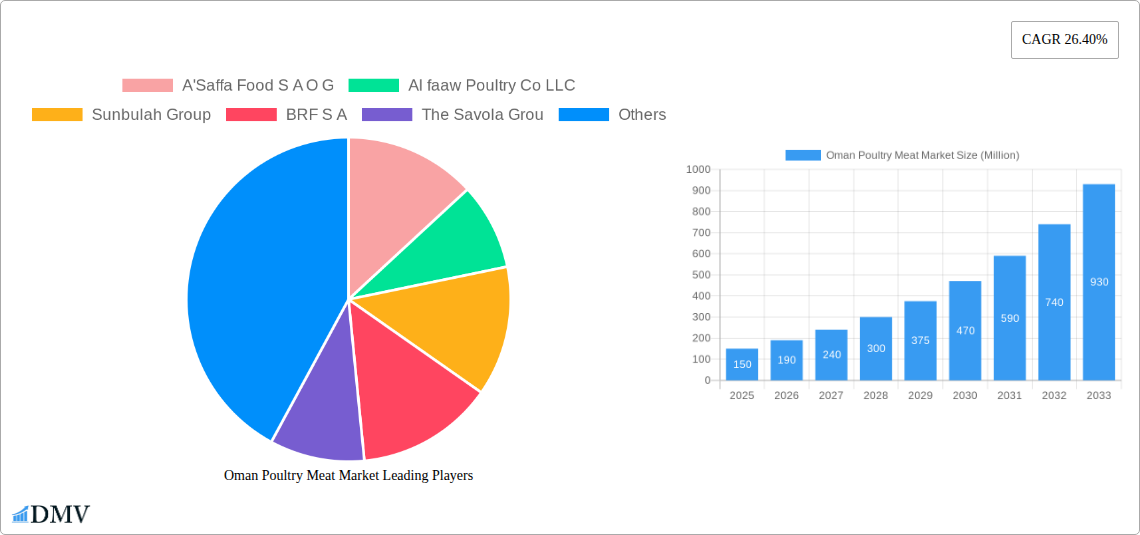

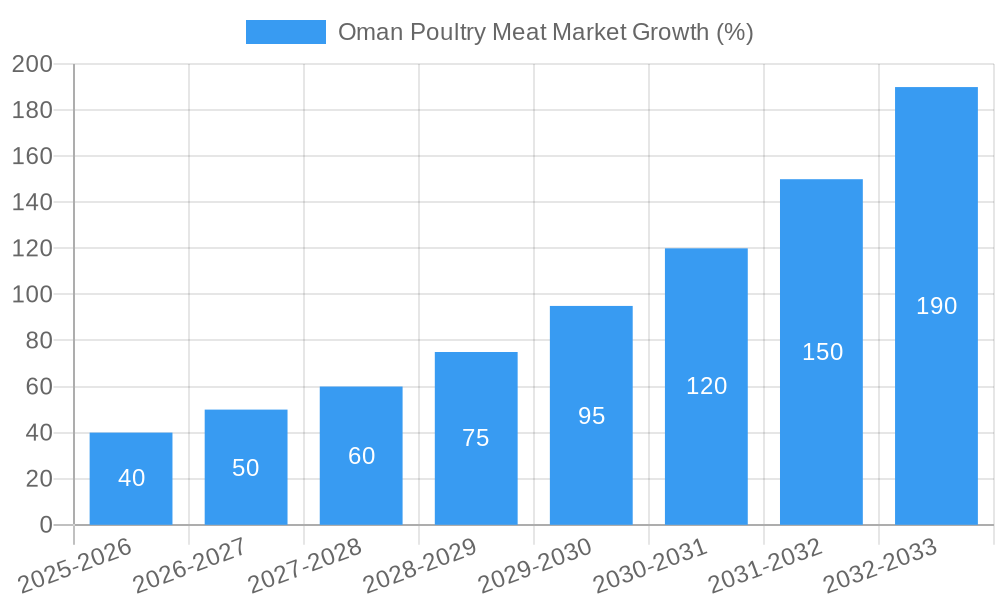

The Oman poultry meat market exhibits robust growth potential, driven by a rising population, increasing urbanization, and shifting dietary preferences towards protein-rich foods. The market's 26.40% CAGR indicates significant expansion, particularly within the forecast period of 2025-2033. Key growth drivers include rising disposable incomes enabling greater spending on poultry products, the increasing popularity of convenient ready-to-eat options (canned, processed), and the growing food service industry (on-trade). While the off-trade channel (supermarkets, retail) currently dominates, the on-trade segment, encompassing restaurants and hotels, is projected to experience considerable growth, fueled by rising tourism and a preference for dining out. The market is segmented by distribution channel (off-trade, on-trade) and form (canned, fresh/chilled, frozen, processed), with fresh/chilled poultry dominating due to consumer preference for freshness and perceived health benefits. However, processed and canned poultry are experiencing increased demand due to convenience and longer shelf life. Major players like A'Saffa Food S A O G, Al faaw Poultry Co LLC, and Sunbulah Group are actively participating in the market, competing on price, quality, and product diversification. Growth may be moderated by potential fluctuations in feed prices and government regulations impacting poultry production. Future market success will depend on efficient supply chain management, innovative product offerings, and a focus on consumer preferences for convenience, health, and sustainability.

The competitive landscape is characterized by both local and international players. Local companies benefit from understanding local consumer preferences and distribution networks, while multinational corporations bring in expertise in advanced poultry farming techniques and global market trends. The market is projected to see a shift towards more value-added products, such as marinated and seasoned poultry, catering to evolving consumer tastes. Sustainability and ethical sourcing are becoming increasingly important factors influencing consumer purchasing decisions, creating an opportunity for companies to differentiate themselves through eco-friendly and responsible farming practices. Further growth is anticipated through targeted marketing campaigns highlighting the health benefits and affordability of poultry meat compared to other protein sources. Expansion into new distribution channels and retail formats, such as online grocery delivery services, will further contribute to market expansion.

Oman Poultry Meat Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Oman poultry meat market, encompassing historical data (2019-2024), the current market scenario (Base Year: 2025), and a comprehensive forecast (2025-2033). It delves into market dynamics, competitive landscapes, and future growth potential, offering valuable insights for stakeholders including producers, distributors, investors, and government agencies. The report covers a market valued at xx Million in 2025, projected to reach xx Million by 2033.

Oman Poultry Meat Market Composition & Trends

This section offers a granular analysis of the Oman poultry meat market's structure and prevailing trends. We evaluate market concentration, revealing the market share distribution amongst key players like A'Saffa Food S A O G, Al faaw Poultry Co LLC, Sunbulah Group, BRF S A, The Savola Group, IFFCO Group, JBS SA, and Al Zain Farms LLC. We examine the impact of M&A activities, quantifying deal values where possible (e.g., xx Million for a specific deal in 2022), and assessing their influence on market consolidation. Furthermore, the report analyzes innovation drivers, focusing on technological advancements in poultry farming and processing. Regulatory landscapes impacting production, distribution, and labeling are meticulously scrutinized, alongside an examination of substitute products and their market penetration. Finally, we profile end-users, categorizing their consumption patterns and preferences to understand market demand.

- Market Concentration: A detailed analysis of market share held by each major player.

- M&A Activity: Review of significant mergers and acquisitions, including deal values where available.

- Innovation Catalysts: Examination of technological advancements driving market growth.

- Regulatory Landscape: Assessment of government regulations and their impact on the market.

- Substitute Products: Analysis of competing protein sources and their market share.

- End-User Profiles: Segmentation of consumers based on consumption habits and preferences.

Oman Poultry Meat Market Industry Evolution

This section traces the evolution of the Oman poultry meat market, examining its growth trajectory from 2019 to 2024 and projecting future growth (2025-2033). We analyze growth rates, pinpointing periods of accelerated expansion and identifying contributing factors. Technological advancements, such as automated poultry farming systems and improved processing techniques, are assessed for their impact on efficiency and production capacity. The report explores the evolving consumer preferences, including a shift towards healthier options like organic poultry and the growing demand for convenience formats. Data points like adoption rates of new technologies and changing consumer spending patterns are incorporated to provide a comprehensive view of the market’s evolution.

Leading Regions, Countries, or Segments in Oman Poultry Meat Market

This section identifies the dominant segments within the Oman poultry meat market across distribution channels (Off-Trade, On-Trade), and product forms (Canned, Fresh/Chilled, Frozen, Processed). We analyze the key factors contributing to the dominance of each segment.

- Distribution Channel: Off-Trade is analyzed in detail, evaluating factors contributing to its large market share, such as supermarket chains and retail distribution. On-Trade is examined, considering its growth drivers.

- Product Form: The market share of Fresh/Chilled, Frozen, Canned, and Processed poultry are evaluated and their driving forces are explored.

- Key Drivers: Bullet points highlight investment trends, regulatory support, consumer preferences, and logistical advantages for each dominant segment.

- Dominance Factors: In-depth analysis of factors contributing to the market leadership of specific segments.

Oman Poultry Meat Market Product Innovations

This section highlights recent product innovations in the Oman poultry meat market, focusing on new product applications and their performance metrics. We discuss unique selling propositions (USPs), such as organic certification, value-added processing (e.g., marinated products), and ready-to-eat meals. Technological advancements in packaging, extending shelf life and enhancing food safety, are also discussed.

Propelling Factors for Oman Poultry Meat Market Growth

Several factors are driving the growth of the Oman poultry meat market. Increasing per capita consumption driven by population growth and rising disposable incomes is a key factor. Government initiatives to support the agricultural sector and improve food security are creating favorable conditions for expansion. Technological advancements, leading to increased production efficiency and improved product quality, also contribute significantly to market growth.

Obstacles in the Oman Poultry Meat Market

Challenges in the Oman poultry meat market include fluctuating feed prices, impacting production costs. Competition from imported poultry products can also pressure local producers. Regulatory hurdles and complexities in obtaining licenses and permits can hinder market entry and expansion. Supply chain disruptions due to logistical challenges or disease outbreaks pose a significant threat.

Future Opportunities in Oman Poultry Meat Market

Future opportunities lie in exploring new product lines, such as value-added processed meats and ready-to-eat meals. Expanding into export markets and developing strong branding strategies to enhance product differentiation offer significant potential for growth. Investment in sustainable and environmentally friendly poultry farming practices can also attract environmentally conscious consumers.

Major Players in the Oman Poultry Meat Market Ecosystem

- A'Saffa Food S A O G

- Al faaw Poultry Co LLC

- Sunbulah Group

- BRF S A

- The Savola Group

- IFFCO Group

- JBS SA

- Al Zain Farms LLC

Key Developments in Oman Poultry Meat Market Industry

- January 2021: IFFCO Group plans to transform its recently acquired Indian subsidiary, 3 Fuji Foods, into a major manufacturing hub, expanding its market reach and portfolio.

- January 2021: Sunbulah Group launches a range of organic and gluten-free poultry products to meet growing consumer demand.

Strategic Oman Poultry Meat Market Forecast

The Oman poultry meat market is poised for continued growth driven by increasing demand, technological advancements, and government support. Opportunities exist in expanding product offerings, enhancing supply chain efficiency, and capitalizing on the growing preference for healthier and convenient poultry products. This market’s expansion reflects the nation’s growing population and evolving dietary habits, presenting substantial investment prospects for both domestic and international players.

Oman Poultry Meat Market Segmentation

-

1. Form

- 1.1. Canned

- 1.2. Fresh / Chilled

- 1.3. Frozen

-

1.4. Processed

-

1.4.1. By Processed Types

- 1.4.1.1. Deli Meats

- 1.4.1.2. Marinated/ Tenders

- 1.4.1.3. Meatballs

- 1.4.1.4. Nuggets

- 1.4.1.5. Sausages

- 1.4.1.6. Other Processed Poultry

-

1.4.1. By Processed Types

-

2. Distribution Channel

-

2.1. Off-Trade

- 2.1.1. Convenience Stores

- 2.1.2. Online Channel

- 2.1.3. Supermarkets and Hypermarkets

- 2.1.4. Others

- 2.2. On-Trade

-

2.1. Off-Trade

Oman Poultry Meat Market Segmentation By Geography

- 1. Oman

Oman Poultry Meat Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 26.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Urbanization; Growing Disposable Income

- 3.3. Market Restrains

- 3.3.1. High-price and additional delivery charges

- 3.4. Market Trends

- 3.4.1. Advancements in payment and delivery technologies propelling retail stores' sales

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Oman Poultry Meat Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Canned

- 5.1.2. Fresh / Chilled

- 5.1.3. Frozen

- 5.1.4. Processed

- 5.1.4.1. By Processed Types

- 5.1.4.1.1. Deli Meats

- 5.1.4.1.2. Marinated/ Tenders

- 5.1.4.1.3. Meatballs

- 5.1.4.1.4. Nuggets

- 5.1.4.1.5. Sausages

- 5.1.4.1.6. Other Processed Poultry

- 5.1.4.1. By Processed Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-Trade

- 5.2.1.1. Convenience Stores

- 5.2.1.2. Online Channel

- 5.2.1.3. Supermarkets and Hypermarkets

- 5.2.1.4. Others

- 5.2.2. On-Trade

- 5.2.1. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Oman

- 5.1. Market Analysis, Insights and Forecast - by Form

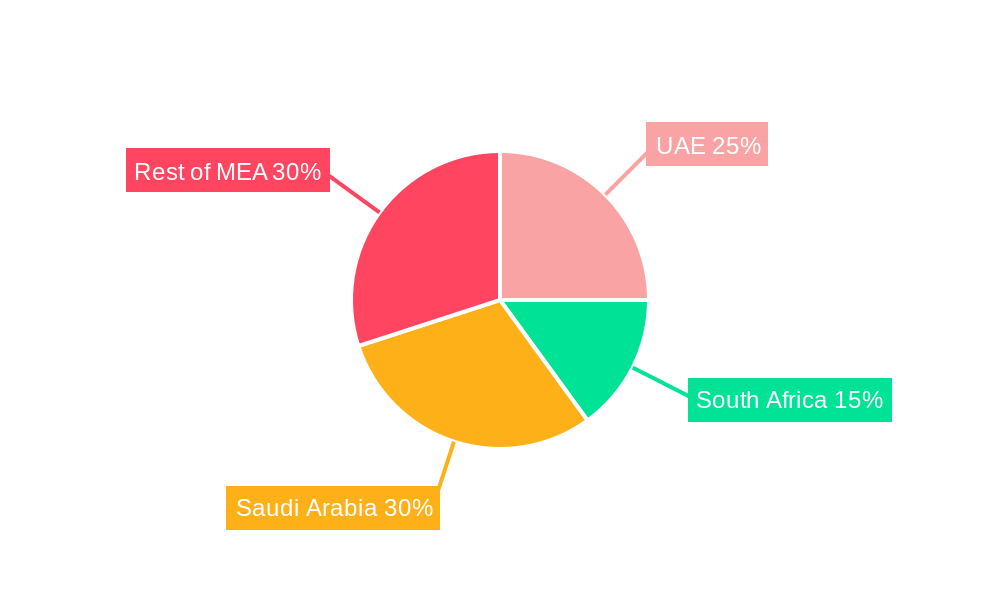

- 6. UAE Oman Poultry Meat Market Analysis, Insights and Forecast, 2019-2031

- 7. South Africa Oman Poultry Meat Market Analysis, Insights and Forecast, 2019-2031

- 8. Saudi Arabia Oman Poultry Meat Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of MEA Oman Poultry Meat Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 A'Saffa Food S A O G

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Al faaw Poultry Co LLC

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Sunbulah Group

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 BRF S A

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 The Savola Grou

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 IFFCO Group

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 JBS SA

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Al Zain Farms LLC

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 A'Saffa Food S A O G

List of Figures

- Figure 1: Oman Poultry Meat Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Oman Poultry Meat Market Share (%) by Company 2024

List of Tables

- Table 1: Oman Poultry Meat Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Oman Poultry Meat Market Revenue Million Forecast, by Form 2019 & 2032

- Table 3: Oman Poultry Meat Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Oman Poultry Meat Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Oman Poultry Meat Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: UAE Oman Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South Africa Oman Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Saudi Arabia Oman Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of MEA Oman Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Oman Poultry Meat Market Revenue Million Forecast, by Form 2019 & 2032

- Table 11: Oman Poultry Meat Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 12: Oman Poultry Meat Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oman Poultry Meat Market?

The projected CAGR is approximately 26.40%.

2. Which companies are prominent players in the Oman Poultry Meat Market?

Key companies in the market include A'Saffa Food S A O G, Al faaw Poultry Co LLC, Sunbulah Group, BRF S A, The Savola Grou, IFFCO Group, JBS SA, Al Zain Farms LLC.

3. What are the main segments of the Oman Poultry Meat Market?

The market segments include Form, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Urbanization; Growing Disposable Income.

6. What are the notable trends driving market growth?

Advancements in payment and delivery technologies propelling retail stores' sales.

7. Are there any restraints impacting market growth?

High-price and additional delivery charges.

8. Can you provide examples of recent developments in the market?

January 2021: IFFCO Group has planned to turn 3 Fuji Foods, its recently acquired company in India, into a major manufacturing base to serve customers across various markets and to consolidate its portfolio by exploring new opportunities.January 2021: Sunbulah Group announced the launch of a range of organic and gluten-free products and SKUs to meet the increasing demand.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oman Poultry Meat Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oman Poultry Meat Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oman Poultry Meat Market?

To stay informed about further developments, trends, and reports in the Oman Poultry Meat Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence