Key Insights

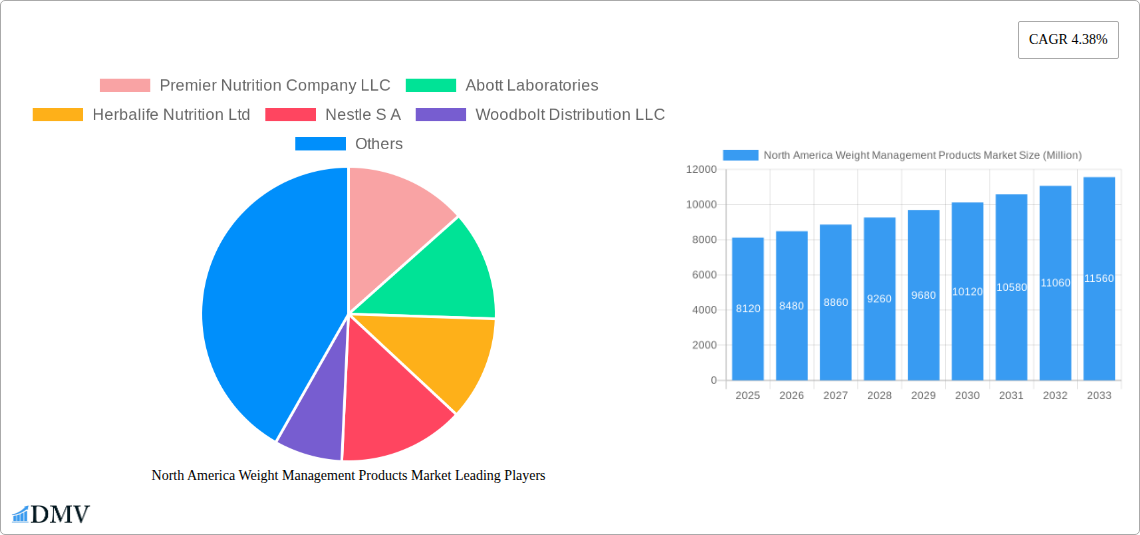

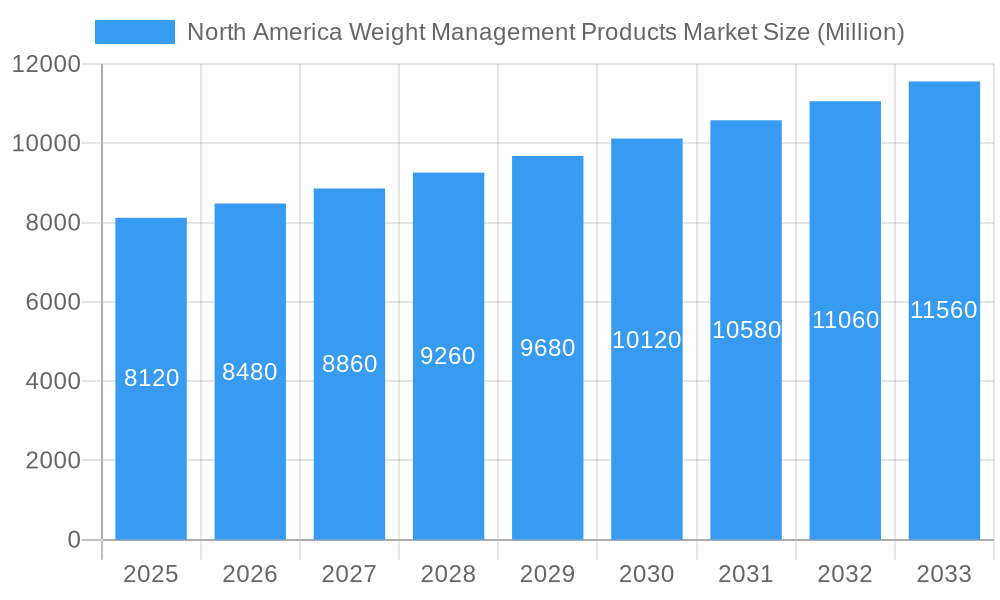

The North America weight management products market, valued at $8.12 billion in 2025, is projected to experience steady growth, driven by increasing health consciousness and rising obesity rates. A compound annual growth rate (CAGR) of 4.38% from 2025 to 2033 indicates a substantial market expansion over the forecast period. Key drivers include the growing prevalence of lifestyle diseases linked to obesity, increasing disposable incomes enabling consumers to invest in premium weight management solutions, and a surge in demand for convenient and effective products like meal replacements and supplements. The market is segmented by product type (meal replacements, beverages, and supplements) and distribution channels (hypermarkets/supermarkets, convenience stores, and other channels). Hypermarkets and supermarkets currently dominate distribution, but online channels are gaining traction, fueled by e-commerce growth and the convenience of home delivery. While the market faces some restraints, such as concerns regarding the safety and efficacy of certain products and fluctuating raw material costs, the overall outlook remains positive, driven by continuous innovation in product formulation and marketing strategies focusing on health and wellness. Leading players like Premier Nutrition, Abbott Laboratories, and Herbalife Nutrition are actively engaged in product development and strategic partnerships to maintain their market position and capitalize on the growth opportunities. The United States, as the largest economy in North America, holds the lion's share of the market, followed by Canada and Mexico. The continued focus on personalized nutrition plans and the integration of technology in weight management solutions are shaping future market trends.

North America Weight Management Products Market Market Size (In Billion)

The market's segmentation offers insights into consumer preferences and purchasing behavior. The meal replacement segment is likely to witness robust growth due to its convenience and effectiveness in managing calorie intake. The supplements segment, encompassing vitamins, minerals, and other functional ingredients, is expected to witness significant expansion due to increasing awareness of their role in supporting weight loss efforts. The beverage segment, encompassing weight-loss teas and protein shakes, is projected to contribute steadily to the overall market growth. The continued emphasis on healthy eating and the rising popularity of functional foods and beverages are contributing factors to the growth of this segment. The strategic alliances and acquisitions among leading market players will continue to shape the competitive landscape. Future growth will depend on the industry's ability to address consumer concerns around product safety and efficacy, and on effectively adapting to evolving health and wellness trends.

North America Weight Management Products Market Company Market Share

North America Weight Management Products Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the North America weight management products market, encompassing market size, trends, leading players, and future projections. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers stakeholders a comprehensive understanding of this dynamic market. The report's meticulous analysis covers key segments (meal replacements, beverages, and supplements) across various distribution channels (hypermarkets/supermarkets, convenience stores, and other channels), offering granular insights into market dynamics and growth drivers. The estimated market value in 2025 is expected to reach xx Million, providing a strong foundation for future forecasts.

North America Weight Management Products Market Composition & Trends

This section evaluates the North American weight management products market's competitive landscape, highlighting market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and M&A activities. The market is characterized by a moderately concentrated structure, with several major players commanding significant market share. However, the presence of numerous smaller players and ongoing innovation creates a dynamic and competitive environment.

Market Concentration & M&A Activity:

- Market share distribution: Premier Nutrition Company LLC holds an estimated xx% market share, followed by Abbott Laboratories at xx%, Herbalife Nutrition Ltd at xx%, and Nestle S.A. at xx%. The remaining market share is distributed among numerous smaller players.

- M&A Deal Values: The total value of M&A deals in the North American weight management products market between 2019 and 2024 is estimated at xx Million. These deals have primarily focused on expanding product portfolios and geographic reach.

Innovation Catalysts & Regulatory Landscape:

- The market is driven by continuous innovation in product formulations, including the development of functional foods and beverages with enhanced health benefits. The rising demand for natural and organic weight management products is also fueling innovation.

- Regulatory bodies such as the FDA play a significant role in shaping market dynamics. Regulations concerning labeling, ingredient safety, and marketing claims influence product development and market entry.

Substitute Products & End-User Profiles:

- Consumers increasingly consider alternative weight management strategies, including dietary changes and exercise regimes. These alternatives act as substitutes to some extent.

- The primary end-users are health-conscious individuals, athletes, and those with specific dietary requirements. The growing awareness of obesity and its associated health risks is broadening the consumer base.

North America Weight Management Products Market Industry Evolution

The North American weight management products market has witnessed substantial growth over the historical period (2019-2024), driven by several key factors. Technological advancements have led to the development of innovative products with improved efficacy and convenience. Simultaneously, evolving consumer preferences, including increasing demand for natural and organic ingredients, have shaped market trends. From 2019 to 2024, the market experienced a Compound Annual Growth Rate (CAGR) of xx%, reflecting the robust growth trajectory. This growth is projected to continue in the forecast period (2025-2033), with a projected CAGR of xx%. Increased consumer awareness of health and wellness, coupled with the rising prevalence of obesity, continues to fuel market expansion. The integration of digital platforms and e-commerce channels has facilitated market access and broadened consumer reach. Furthermore, technological advancements in product formulation, packaging, and delivery systems are constantly improving the consumer experience, driving market growth.

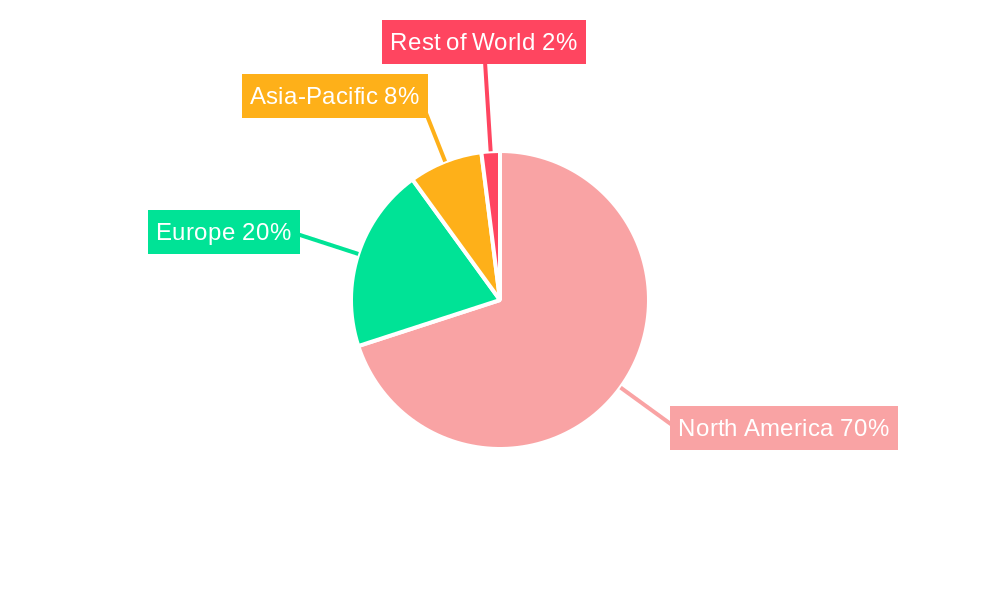

Leading Regions, Countries, or Segments in North America Weight Management Products Market

The United States dominates the North American weight management products market, accounting for the largest market share by both revenue and volume. This dominance is driven by several factors.

By Type:

- Supplements: This segment holds the largest market share due to consumer preference for convenient and targeted solutions for weight management. The ease of incorporation into existing routines contributes significantly to its popularity.

- Beverages: This segment is experiencing robust growth driven by the increasing demand for functional beverages that integrate weight management benefits into daily consumption.

- Meals: The meal replacement segment is gaining traction, particularly among consumers seeking convenient and nutritionally balanced options for weight management.

By Distribution Channel:

- Hypermarkets/Supermarkets: This channel commands the largest market share due to its widespread accessibility and extensive product assortment.

- Convenience Stores: This channel is gaining significance, catering to consumers seeking quick and convenient access to weight management products.

- Other Distribution Channels: Online retail and direct-to-consumer channels are rapidly gaining prominence, providing alternative avenues for accessing weight management products.

Key Drivers:

- Significant investments in research and development leading to innovative products.

- Government initiatives aimed at promoting healthy lifestyles.

- Favorable regulatory environment promoting market expansion.

North America Weight Management Products Market Product Innovations

Recent innovations have focused on enhancing product efficacy, taste, and convenience. Many new products incorporate natural ingredients, functional fibers, and advanced delivery systems. For instance, the incorporation of specific protein blends, prebiotics, and probiotics have improved digestibility and overall efficacy. The development of convenient formats, such as ready-to-drink beverages and single-serving packs, caters to busy lifestyles and improves adherence. Furthermore, personalized nutrition plans and mobile apps are being increasingly integrated to provide customized weight management strategies.

Propelling Factors for North America Weight Management Products Market Growth

Technological advancements, rising consumer awareness, and favorable regulatory environments are propelling the market's growth. Technological advancements in formulation, packaging, and delivery systems are improving the efficacy and user experience of weight management products. The rising prevalence of obesity and associated health problems is increasing consumer demand for effective solutions. Favorable government regulations supporting healthy lifestyles further incentivize market expansion.

Obstacles in the North America Weight Management Products Market

Regulatory hurdles, such as stringent labeling requirements and approval processes, can pose challenges to market entry and expansion. Supply chain disruptions caused by external factors (e.g., pandemics) can impact product availability and pricing. Intense competition among established players and the emergence of new entrants create competitive pressures. These pressures may reduce profit margins.

Future Opportunities in North America Weight Management Products Market

Emerging opportunities exist in the development of personalized weight management solutions leveraging technological advancements like artificial intelligence and big data analytics. Expansion into new markets, including untapped demographics, offers significant potential. Growing consumer demand for sustainable and ethically sourced ingredients creates opportunities for companies to capitalize on this trend.

Major Players in the North America Weight Management Products Market Ecosystem

- Premier Nutrition Company LLC

- Abott Laboratories

- Herbalife Nutrition Ltd

- Nestle S A

- Woodbolt Distribution LLC

- The Simply Good Foods Company

- Iovate Health Sciences International

- Glanbia PLC

- Ultimate Nutrition Inc

- Kellogg Company

Key Developments in North America Weight Management Products Market Industry

- July 2022: Herbalife Nutrition launched a new weight management product in the United States, formulated with litramine to reduce fat absorption.

- July 2022: Six Star Pro Nutrition partnered with Sierra Canyon School, providing athletes with its Whey Protein Plus.

- October 2022: MuscleTech released two new pre-workout formulations, EUPHORiQ and BURN iQ, featuring a paroxetine caffeine metabolite, available on MuscleTech.com and Amazon.

Strategic North America Weight Management Products Market Forecast

The North America weight management products market is poised for sustained growth driven by ongoing innovation, increasing consumer awareness of health and wellness, and favorable regulatory support. Emerging technologies and personalized solutions will further drive market expansion, presenting significant opportunities for established and emerging players. The market's projected CAGR over the forecast period signifies a promising future for the industry.

North America Weight Management Products Market Segmentation

-

1. Type

- 1.1. Meal

- 1.2. Beverage

- 1.3. Supplements

-

2. Distribution Channel

- 2.1. Hypermarkets/Supermarkets

- 2.2. Convenience Stores

- 2.3. Other Distribution Channels

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of the North America

North America Weight Management Products Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of the North America

North America Weight Management Products Market Regional Market Share

Geographic Coverage of North America Weight Management Products Market

North America Weight Management Products Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.38% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Focus on Maintaining Health and Well-Being; Launching Supplements For Specific Purposes and Targeted Population

- 3.3. Market Restrains

- 3.3.1. Supplement Consumption and Their Side-effects; Inclination Towards Substitute Products

- 3.4. Market Trends

- 3.4.1. Increasing Prevalence of Obesity Across the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Weight Management Products Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Meal

- 5.1.2. Beverage

- 5.1.3. Supplements

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hypermarkets/Supermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of the North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of the North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Weight Management Products Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Meal

- 6.1.2. Beverage

- 6.1.3. Supplements

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Hypermarkets/Supermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of the North America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Weight Management Products Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Meal

- 7.1.2. Beverage

- 7.1.3. Supplements

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Hypermarkets/Supermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of the North America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Mexico North America Weight Management Products Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Meal

- 8.1.2. Beverage

- 8.1.3. Supplements

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Hypermarkets/Supermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of the North America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the North America North America Weight Management Products Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Meal

- 9.1.2. Beverage

- 9.1.3. Supplements

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Hypermarkets/Supermarkets

- 9.2.2. Convenience Stores

- 9.2.3. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of the North America

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Premier Nutrition Company LLC

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Abott Laboratories

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Herbalife Nutrition Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Nestle S A

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Woodbolt Distribution LLC

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 The Simply Good Foods Company

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Iovate Health Sciences International

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Glanbia PLC*List Not Exhaustive

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Ultimate Nutrition Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Kellogg Company

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Premier Nutrition Company LLC

List of Figures

- Figure 1: North America Weight Management Products Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Weight Management Products Market Share (%) by Company 2025

List of Tables

- Table 1: North America Weight Management Products Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: North America Weight Management Products Market Volume K Units Forecast, by Type 2020 & 2033

- Table 3: North America Weight Management Products Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: North America Weight Management Products Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 5: North America Weight Management Products Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: North America Weight Management Products Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 7: North America Weight Management Products Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: North America Weight Management Products Market Volume K Units Forecast, by Region 2020 & 2033

- Table 9: North America Weight Management Products Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: North America Weight Management Products Market Volume K Units Forecast, by Type 2020 & 2033

- Table 11: North America Weight Management Products Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 12: North America Weight Management Products Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 13: North America Weight Management Products Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 14: North America Weight Management Products Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 15: North America Weight Management Products Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: North America Weight Management Products Market Volume K Units Forecast, by Country 2020 & 2033

- Table 17: North America Weight Management Products Market Revenue Million Forecast, by Type 2020 & 2033

- Table 18: North America Weight Management Products Market Volume K Units Forecast, by Type 2020 & 2033

- Table 19: North America Weight Management Products Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 20: North America Weight Management Products Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 21: North America Weight Management Products Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: North America Weight Management Products Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 23: North America Weight Management Products Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: North America Weight Management Products Market Volume K Units Forecast, by Country 2020 & 2033

- Table 25: North America Weight Management Products Market Revenue Million Forecast, by Type 2020 & 2033

- Table 26: North America Weight Management Products Market Volume K Units Forecast, by Type 2020 & 2033

- Table 27: North America Weight Management Products Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 28: North America Weight Management Products Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 29: North America Weight Management Products Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 30: North America Weight Management Products Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 31: North America Weight Management Products Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: North America Weight Management Products Market Volume K Units Forecast, by Country 2020 & 2033

- Table 33: North America Weight Management Products Market Revenue Million Forecast, by Type 2020 & 2033

- Table 34: North America Weight Management Products Market Volume K Units Forecast, by Type 2020 & 2033

- Table 35: North America Weight Management Products Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 36: North America Weight Management Products Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 37: North America Weight Management Products Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 38: North America Weight Management Products Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 39: North America Weight Management Products Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: North America Weight Management Products Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Weight Management Products Market?

The projected CAGR is approximately 4.38%.

2. Which companies are prominent players in the North America Weight Management Products Market?

Key companies in the market include Premier Nutrition Company LLC, Abott Laboratories, Herbalife Nutrition Ltd, Nestle S A, Woodbolt Distribution LLC, The Simply Good Foods Company, Iovate Health Sciences International, Glanbia PLC*List Not Exhaustive, Ultimate Nutrition Inc, Kellogg Company.

3. What are the main segments of the North America Weight Management Products Market?

The market segments include Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.12 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Focus on Maintaining Health and Well-Being; Launching Supplements For Specific Purposes and Targeted Population.

6. What are the notable trends driving market growth?

Increasing Prevalence of Obesity Across the Region.

7. Are there any restraints impacting market growth?

Supplement Consumption and Their Side-effects; Inclination Towards Substitute Products.

8. Can you provide examples of recent developments in the market?

October 2022: Two pre-workout formulations featuring the carefully formulated paroxetine caffeine metabolite were released by Muscle Tech. The brand made two new products, EUPHORiQand BURN iQ. These products are made available on MuscleTech.com and through online stores like Amazon.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units .

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Weight Management Products Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Weight Management Products Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Weight Management Products Market?

To stay informed about further developments, trends, and reports in the North America Weight Management Products Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence