Key Insights

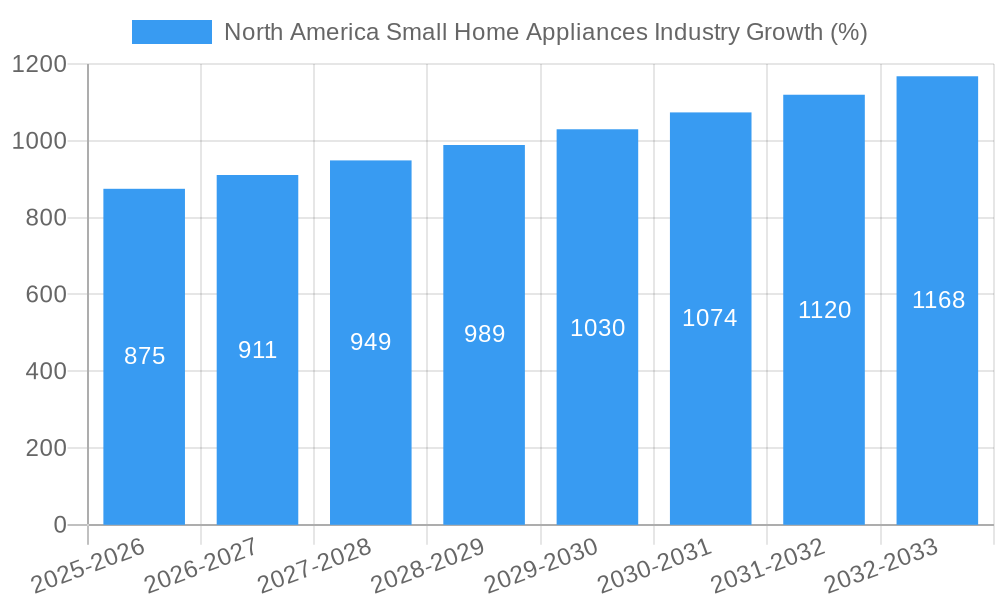

The North American small home appliances market, valued at approximately $XX million in 2025, is experiencing robust growth, projected to maintain a CAGR exceeding 3.50% from 2025 to 2033. This expansion is fueled by several key factors. Rising disposable incomes, particularly among younger demographics, are driving increased demand for convenience and time-saving appliances. The burgeoning popularity of meal prepping and home cooking, amplified by recent trends, contributes significantly to the growth of food processors, coffee makers, and grills and roasters. Furthermore, a growing emphasis on home improvement and upgrading kitchen appliances is bolstering market expansion. The increasing adoption of smart home technology and connected appliances presents another significant growth avenue, offering consumers enhanced control and convenience. Within the market, online sales channels are rapidly gaining traction, challenging traditional retail outlets like multi-branded and exclusive stores, while specialty stores maintain a strong presence catering to niche consumer demands. Leading brands like Panasonic, LG, Dyson, BSH, and Whirlpool are intensely competing for market share through product innovation, strategic partnerships, and effective marketing campaigns. However, challenges such as fluctuating raw material costs and economic uncertainties might influence the market trajectory in the coming years.

Despite these challenges, the long-term outlook remains positive. The continued shift toward smaller, more efficient living spaces is creating demand for space-saving appliances. The increasing focus on sustainability and energy efficiency is driving innovation in appliance design, leading to the adoption of energy-saving models. The diverse product portfolio, ranging from vacuum cleaners and food processors to coffee makers and hair dryers, provides ample opportunities for growth across various consumer segments. Regional variations exist within North America, with the United States likely maintaining the largest market share due to its substantial population and higher disposable incomes compared to Canada and Mexico. Future growth will heavily depend on maintaining innovative product development, effective marketing strategies, and adapting to evolving consumer preferences and technological advancements.

North America Small Home Appliances Industry: 2019-2033 Market Report

This comprehensive report provides an in-depth analysis of the North American small home appliances market, covering the period 2019-2033. With a focus on market trends, leading players, and future opportunities, this report is essential for stakeholders seeking to understand and capitalize on the dynamic landscape of this multi-billion-dollar industry. The report utilizes 2025 as its base and estimated year, offering a robust forecast for 2025-2033 built upon historical data from 2019-2024.

North America Small Home Appliances Industry Market Composition & Trends

The North American small home appliance market, valued at xx Million in 2024, is characterized by a moderately concentrated landscape with key players including Panasonic, LG, Dyson, BSH, Mabe, Whirlpool, GE, Bosch, Electrolux AB, and Samsung. Market share distribution is currently skewed towards established brands, but significant opportunities exist for innovative entrants. Innovation is driven by increasing consumer demand for smart appliances, energy efficiency, and aesthetically pleasing designs. Regulatory pressures focusing on energy consumption and material sourcing are shaping product development and manufacturing processes. Substitute products, such as manual tools or shared services, pose a minor threat, mostly impacting low-end segments. End-user profiles range from individual consumers to institutional buyers (e.g., hotels, restaurants), influencing product features and purchasing volumes. Mergers and acquisitions (M&A) activity in the sector has been moderate, with deal values averaging xx Million in recent years. For example, the BSH Group's USD 260 Million investment in a new Mexican factory reflects the strategic importance of the North American market.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share.

- M&A Activity: Average deal value: xx Million (2019-2024).

- Innovation Catalysts: Smart home integration, energy efficiency regulations, consumer demand for premium features.

- Regulatory Landscape: Increasing focus on energy efficiency and sustainable materials.

- Substitute Products: Limited impact, mainly in low-end segments.

North America Small Home Appliances Industry Industry Evolution

The North American small home appliance market has experienced a steady growth trajectory over the past five years, with a Compound Annual Growth Rate (CAGR) of xx% from 2019 to 2024. This growth is primarily attributed to rising disposable incomes, evolving consumer preferences towards convenience and premium features, and technological advancements that enhance product functionality and user experience. The adoption of smart home technologies, such as Wi-Fi connectivity and app-based controls, is rapidly increasing, creating new revenue streams and influencing product design. Consumer demand is shifting towards smaller, more efficient appliances tailored to modern living spaces and lifestyles, influencing the growth of certain segments. Furthermore, the increasing popularity of online retail channels is reshaping distribution models and providing access to wider consumer bases. Technological advancements such as improved motor technology in vacuum cleaners, advanced sensors in food processors, and energy-efficient heating elements in coffee makers are driving innovation and enhancing product performance. These improvements, along with heightened consumer awareness concerning sustainability, have propelled demand for energy-efficient products. The projected CAGR for 2025-2033 is estimated at xx%.

Leading Regions, Countries, or Segments in North America Small Home Appliances Industry

The United States dominates the North American small home appliances market, accounting for xx% of the total market value in 2024. Among distribution channels, online sales are witnessing the fastest growth, driven by the increasing penetration of e-commerce and the convenience of online shopping. In terms of product segments, vacuum cleaners and coffee makers represent the largest revenue contributors, fueled by strong consumer demand and technological innovation.

- Key Drivers for US Dominance: High disposable income, developed e-commerce infrastructure, strong brand presence.

- Key Drivers for Online Channel Growth: Convenience, wider product selection, competitive pricing.

- Key Drivers for Vacuum Cleaner & Coffee Maker Segment Dominance: High consumer demand, technological innovation, and diverse product offerings.

- Other significant segments: The market for food processors, grills and roasters are also displaying significant growth potential, driven by health and wellness trends and changing cooking habits.

North America Small Home Appliances Industry Product Innovations

The North American small home appliance market is experiencing a surge of innovation driven by consumer demand for convenience, efficiency, and sustainability. Recent advancements include the integration of smart features like voice assistants (Alexa, Google Assistant), robust mobile app connectivity for remote control and monitoring, and advanced energy-efficient designs utilizing brushless DC motors and intelligent sensor systems. Materials are increasingly chosen for both durability and sustainability, reflecting growing consumer awareness of environmental impact. High-demand products showcase these improvements, such as self-cleaning robotic vacuum cleaners with advanced navigation systems, automated coffee machines offering extensive customization (bean type, grind size, water temperature), and multi-functional food processors capable of a wide range of culinary tasks. These innovations are not only enhancing the user experience but also significantly improving performance metrics—faster cleaning times, quicker brewing speeds, and reduced energy and water consumption. Furthermore, the industry is seeing a rise in appliances designed for smaller living spaces, reflecting changing demographics and housing trends.

Propelling Factors for North America Small Home Appliances Industry Growth

The growth of the North American small home appliance market is fueled by a confluence of factors. Technological advancements, including seamless smart home integration, are a primary driver. Consumers are increasingly drawn to energy-efficient models, reflecting both cost savings and environmental concerns. Enhanced functionalities and specialized features cater to diverse lifestyles and needs. Rising disposable incomes, particularly within younger demographics, contribute to increased spending on premium appliances. Government regulations promoting energy efficiency, such as stricter energy star standards, incentivize manufacturers to develop and market more sustainable products, creating a virtuous cycle of innovation and market expansion. Finally, the increasing popularity of subscription services, bundling appliance maintenance and repair, is another factor that supports market expansion by increasing the longevity and usage of these appliances.

Obstacles in the North America Small Home Appliances Industry Market

The industry faces challenges like supply chain disruptions due to global events, impacting production and increasing costs. Intense competition from both established and emerging brands puts pressure on profit margins and necessitates continuous innovation. Fluctuations in raw material prices also impact manufacturing costs. Stringent regulatory requirements concerning product safety, energy efficiency, and environmental impact add to compliance costs and complexity.

Future Opportunities in North America Small Home Appliances Industry

The North American small home appliance industry presents substantial opportunities for growth and innovation. Expanding into niche markets, such as compact appliances tailored to smaller living spaces or specialized appliances catering to specific dietary needs (e.g., air fryers, specialized yogurt makers), remains a significant avenue for expansion. The continued development and adoption of sustainable and eco-friendly products, using recycled materials and minimizing environmental impact throughout the product lifecycle, is crucial. Furthermore, leveraging data analytics offers immense potential for improving customer targeting, personalization of product features, and proactive maintenance scheduling via connected apps. The integration of Artificial Intelligence (AI) for predictive maintenance and personalized recommendations, combined with the power of the Internet of Things (IoT) for remote monitoring and control, presents significant opportunities for innovation and the creation of value-added services, such as automated shopping lists based on appliance usage.

Major Players in the North America Small Home Appliances Industry Ecosystem

- Panasonic

- LG

- Dyson

- BSH

- Mabe

- Whirlpool

- GE

- Bosch

- Electrolux AB

- Samsung

Key Developments in North America Small Home Appliances Industry Industry

- March 2022: BSH Group's investment of over USD 260 Million in a new Mexican factory significantly expands its North American production capacity, demonstrating a strong commitment to the regional market and potentially impacting job creation and economic growth.

- January 2023: The Home Connectivity Alliance (HCA) released the HCA 1.0 interface specification, a crucial step towards greater interoperability and standardization within the connected home ecosystem. This will streamline the development and adoption of smart home appliances, leading to more seamless integration and a better consumer experience.

- [Add another recent development here with date and brief description]

Strategic North America Small Home Appliances Industry Market Forecast

The North American small home appliance market is poised for continued growth, driven by technological innovation, changing consumer preferences, and ongoing investments by major players. The market is expected to benefit from the increasing adoption of smart appliances, the growing preference for convenience and energy efficiency, and the expansion of e-commerce channels. The continued focus on sustainable and eco-friendly appliances will also drive market expansion in the coming years. The forecast period (2025-2033) anticipates substantial market expansion, particularly within the smart home appliance segment and online retail channels.

North America Small Home Appliances Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

North America Small Home Appliances Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Small Home Appliances Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Urbanization Booming the Sector; Modular Kitchens are Leading the Market

- 3.3. Market Restrains

- 3.3.1. High Cost of Appliances

- 3.4. Market Trends

- 3.4.1. Increase in the North America Small Appliances Average Volume per Capita

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Small Home Appliances Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. United States North America Small Home Appliances Industry Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Small Home Appliances Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Small Home Appliances Industry Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Small Home Appliances Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Panasonic

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 LG

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Dyson

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 BSH

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Mabe

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Whirlpool

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 GE**List Not Exhaustive

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Bosch

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Electrolux AB

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Samsung

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Panasonic

List of Figures

- Figure 1: North America Small Home Appliances Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Small Home Appliances Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Small Home Appliances Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Small Home Appliances Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: North America Small Home Appliances Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: North America Small Home Appliances Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: North America Small Home Appliances Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: North America Small Home Appliances Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: North America Small Home Appliances Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: North America Small Home Appliances Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States North America Small Home Appliances Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada North America Small Home Appliances Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Mexico North America Small Home Appliances Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of North America North America Small Home Appliances Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: North America Small Home Appliances Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 14: North America Small Home Appliances Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 15: North America Small Home Appliances Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 16: North America Small Home Appliances Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 17: North America Small Home Appliances Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 18: North America Small Home Appliances Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: United States North America Small Home Appliances Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Canada North America Small Home Appliances Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Mexico North America Small Home Appliances Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Small Home Appliances Industry?

The projected CAGR is approximately > 3.50%.

2. Which companies are prominent players in the North America Small Home Appliances Industry?

Key companies in the market include Panasonic, LG, Dyson, BSH, Mabe, Whirlpool, GE**List Not Exhaustive, Bosch, Electrolux AB, Samsung.

3. What are the main segments of the North America Small Home Appliances Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Urbanization Booming the Sector; Modular Kitchens are Leading the Market.

6. What are the notable trends driving market growth?

Increase in the North America Small Appliances Average Volume per Capita.

7. Are there any restraints impacting market growth?

High Cost of Appliances.

8. Can you provide examples of recent developments in the market?

Jan 2023: The Home Connectivity Alliance (HCA) released the HCA 1.0 interface specification at the Consumer Electronics Show in Las Vegas, providing an industry standard for Cloud-to-Cloud (C2C) compatibility across long-life appliances, HVAC systems, and TVs within the connected home ecosystem.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Small Home Appliances Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Small Home Appliances Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Small Home Appliances Industry?

To stay informed about further developments, trends, and reports in the North America Small Home Appliances Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence