Key Insights

The North American used truck market, a key sector of the commercial vehicle industry, is experiencing substantial expansion. This growth is attributed to rising freight volumes, the necessity of fleet modernization, and the cost-effectiveness of pre-owned vehicles. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2%. Advancements in refurbishment technologies and the proliferation of online marketplaces are further accelerating this trend. The market is segmented by vehicle class: light-duty, medium-duty, and heavy-duty trucks, serving diverse logistics and transportation needs. Key industry leaders include Arrow Truck Sales Inc., Gordon Truck Centers Inc., and major original equipment manufacturers (OEMs) such as General Motors and Volvo, who compete on price, quality, and service.

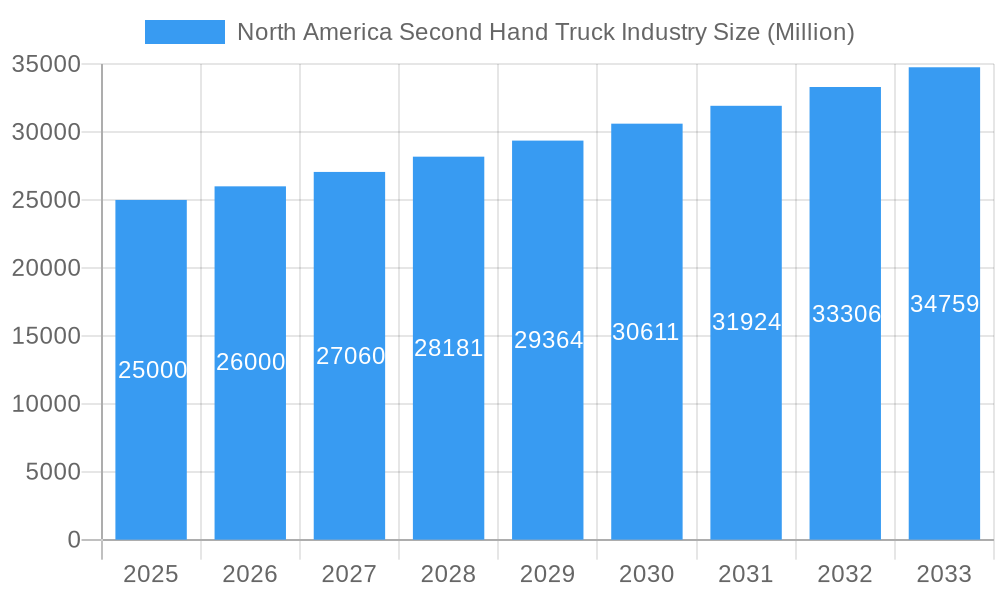

North America Second Hand Truck Industry Market Size (In Billion)

For the base year 2024, the market size was valued at 16103.28 million. The forecast period (2025-2033) indicates sustained demand from businesses of all sizes. Potential challenges include fuel price volatility, economic slowdowns impacting freight, and the availability of high-quality used trucks. Strategic inventory management and partnerships will be vital for navigating these obstacles. The increasing integration of telematics and data-driven maintenance in the used truck sector offers opportunities for enhanced asset utilization and reduced operational costs. This presents significant investment potential, contingent on adaptability to economic shifts and technological evolution.

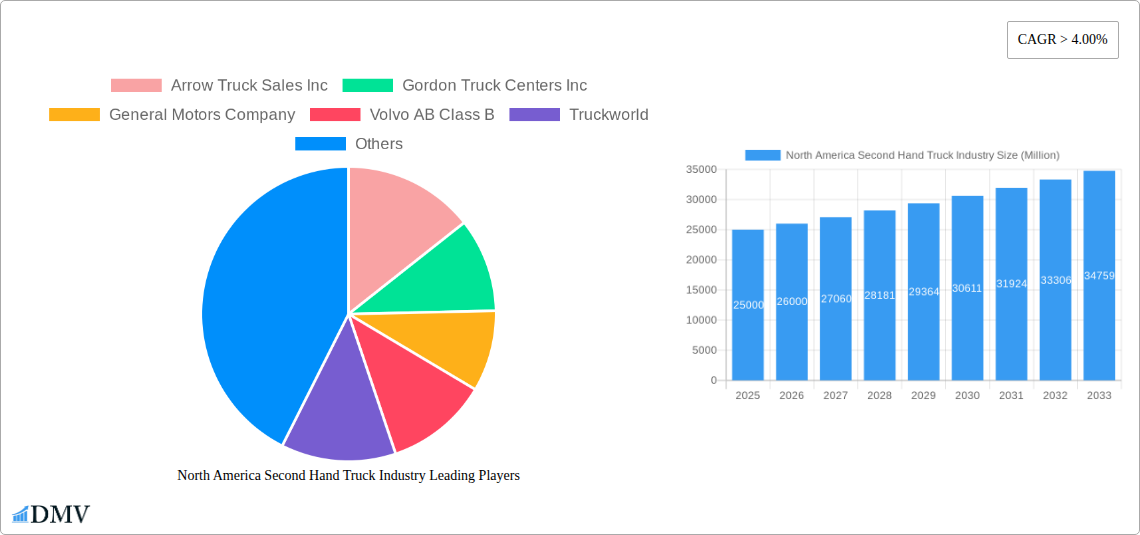

North America Second Hand Truck Industry Company Market Share

North America Second Hand Truck Industry: Market Analysis & Forecast (2019-2033)

This comprehensive report provides a detailed analysis of the North America second-hand truck market, offering invaluable insights for stakeholders across the industry. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report delves into market dynamics, key players, and future trends, empowering businesses to make informed strategic decisions. The market is valued at $XX Million in 2025 and is projected to reach $XX Million by 2033, exhibiting a CAGR of XX%.

North America Second Hand Truck Industry Market Composition & Trends

This section examines the competitive landscape, innovation drivers, regulatory influences, and market evolution within the North American used truck sector. The market is fragmented, with several key players competing for market share.

Market Share Distribution (2025): Arrow Truck Sales Inc. (XX%), Gordon Truck Centers Inc. (XX%), Paccar Inc. (XX%), Other Players (XX%). Note: These percentages are estimations. Precise figures require further proprietary data analysis.

M&A Activities: Significant M&A activity has been observed in recent years, with deal values exceeding $XX Million in the last 5 years, driven by consolidation efforts and expansion strategies. Examples include [insert specific examples of M&A activity with values if available, otherwise use "examples of strategic acquisitions and mergers aimed at expanding market reach and service offerings."].

Regulatory Landscape: Regulations regarding emissions, safety standards, and vehicle maintenance significantly impact the market. Upcoming changes in emissions regulations are expected to influence demand for specific types of used trucks.

End-User Profiles: The primary end-users include logistics companies, construction firms, and small businesses. The report provides a detailed analysis of the needs and preferences of each user segment.

Innovation Catalysts: Technological advancements such as telematics and predictive maintenance are driving innovation, creating opportunities for enhanced used truck valuations and improved fleet management. The adoption rate of these technologies is continuously increasing.

North America Second Hand Truck Industry Industry Evolution

The North American second-hand truck market has witnessed substantial growth over the historical period (2019-2024), primarily driven by increasing demand for transportation services and a preference for cost-effective solutions. The market exhibited an estimated CAGR of XX% during this period. Several factors have shaped this evolution, including:

Technological Advancements: The integration of telematics and advanced driver-assistance systems (ADAS) into used trucks is enhancing their functionality and reliability, thereby boosting their market value and consumer appeal.

Shifting Consumer Demands: An increasing focus on fuel efficiency and reduced emissions has led to greater demand for newer model used trucks with advanced technology.

Market Growth Trajectories: The forecast period (2025-2033) anticipates continued growth, although at a slightly moderated pace compared to the historical period. Several factors are expected to shape the future trajectories, including economic fluctuations, evolving logistics infrastructure, and regulatory changes. The market is predicted to see a CAGR of XX% during the forecast period.

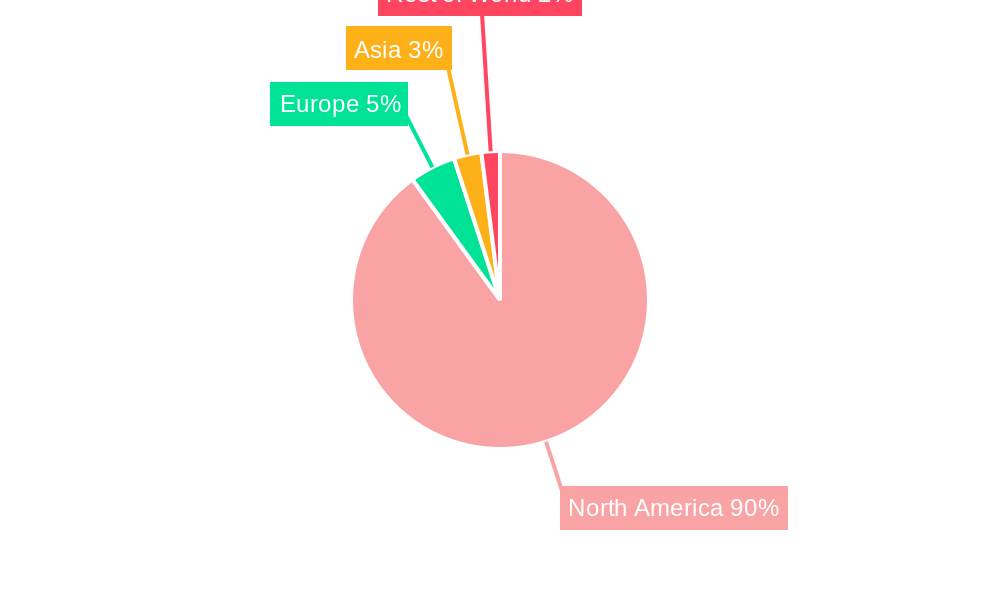

Leading Regions, Countries, or Segments in North America Second Hand Truck Industry

The analysis reveals that the Heavy-duty Truck segment dominates the North American second-hand truck market. This dominance is driven by several key factors:

- Key Drivers for Heavy-duty Truck Segment Dominance:

- High demand from long-haul trucking and freight transportation industries.

- Greater potential for extended operational life compared to light and medium-duty vehicles.

- Significant investment in upgrading and maintaining existing fleets.

- Strong regulatory support for safer and more efficient heavy-duty transportation.

The report further provides a regional breakdown analyzing market performance across major countries such as the US and Canada.

North America Second Hand Truck Industry Product Innovations

Recent innovations focus on enhancing the lifespan and resale value of used trucks. This includes the development of robust maintenance and repair technologies, the integration of advanced telematics systems for real-time monitoring, and the adoption of fuel-efficient engine upgrades. These enhancements enhance the overall performance and appeal of used trucks, making them more attractive to potential buyers. The introduction of certified pre-owned programs by major dealers is also influencing market trends.

Propelling Factors for North America Second Hand Truck Industry Growth

Several factors are driving the growth of the North American used truck market:

Economic Growth: Expansion in the logistics and construction sectors directly fuels the demand for transportation services, consequently increasing the need for used trucks.

Technological Advancements: Improvements in engine technology, telematics systems, and predictive maintenance lead to enhanced reliability and operational efficiency of used trucks.

Favorable Regulatory Environment: Certain policies and incentives promote efficient freight transportation and support the adoption of used vehicles over new ones, further stimulating the used truck market.

Obstacles in the North America Second Hand Truck Industry Market

The growth of this market faces certain challenges:

Supply Chain Disruptions: Global supply chain issues can impact the availability of parts and the overall supply of used trucks, affecting market stability.

Economic Downturns: Recessions can dampen demand due to decreased investment in transportation and logistics.

Stringent Emission Regulations: Compliance with ever-stricter emission standards might increase the cost of maintaining and operating older trucks.

Future Opportunities in North America Second Hand Truck Industry

The used truck market presents several attractive opportunities for future growth:

Expansion into Emerging Markets: Untapped potential exists in expanding services to underserved regions.

Technological Advancements: The integration of new technologies such as autonomous driving systems will open avenues for innovation and market expansion.

Sustainable Practices: Focusing on eco-friendly solutions and fuel-efficient trucks will attract environmentally conscious buyers.

Major Players in the North America Second Hand Truck Industry Ecosystem

- Arrow Truck Sales Inc.

- Gordon Truck Centers Inc.

- General Motors Company

- Volvo AB Class B

- Truckworld

- Isuzu Motor Ltd

- Paccar Inc.

- International Used Trucks

- Ryder System Inc.

- Ford Motor Company

Key Developments in North America Second Hand Truck Industry Industry

- 2023 Q2: Arrow Truck Sales Inc. announced a significant expansion of its online used truck inventory.

- 2022 Q4: New emission regulations came into effect across several states.

- 2021 Q3: Paccar Inc. launched a new certified pre-owned truck program.

- [Add further key developments with specific dates and impactful descriptions]

Strategic North America Second Hand Truck Industry Market Forecast

The North America second-hand truck market is poised for continued growth, driven by sustained demand from various sectors and the continuous integration of innovative technologies. The market is projected to benefit from improved logistics infrastructure, evolving consumer preferences, and favorable governmental policies. Emerging technological advancements are expected to reshape the market, leading to increased demand for used trucks equipped with enhanced features and technologies. The market is set to experience a robust expansion throughout the forecast period.

North America Second Hand Truck Industry Segmentation

-

1. Vehicle Type

- 1.1. Light-duty Truck

- 1.2. Medium-duty Truck

- 1.3. Heavy-duty Truck

-

2. Geography

- 2.1. United States

- 2.2. Canada

- 2.3. Rest of North America

North America Second Hand Truck Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Second Hand Truck Industry Regional Market Share

Geographic Coverage of North America Second Hand Truck Industry

North America Second Hand Truck Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Sales of Electric Vehicles are Expected to Drive the Market

- 3.3. Market Restrains

- 3.3.1. Lack of Infrastructure May Hamper the growth of the Market

- 3.4. Market Trends

- 3.4.1. Heavy Duty Trucks will Lead the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Second Hand Truck Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Light-duty Truck

- 5.1.2. Medium-duty Truck

- 5.1.3. Heavy-duty Truck

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United States

- 5.2.2. Canada

- 5.2.3. Rest of North America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. United States North America Second Hand Truck Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Light-duty Truck

- 6.1.2. Medium-duty Truck

- 6.1.3. Heavy-duty Truck

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United States

- 6.2.2. Canada

- 6.2.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Canada North America Second Hand Truck Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Light-duty Truck

- 7.1.2. Medium-duty Truck

- 7.1.3. Heavy-duty Truck

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United States

- 7.2.2. Canada

- 7.2.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Rest of North America North America Second Hand Truck Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Light-duty Truck

- 8.1.2. Medium-duty Truck

- 8.1.3. Heavy-duty Truck

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. United States

- 8.2.2. Canada

- 8.2.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Arrow Truck Sales Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Gordon Truck Centers Inc

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 General Motors Company

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Volvo AB Class B

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Truckworld

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Isuzu Motor Ltd

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Paccar Inc

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 International Used Trucks

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Ryder System Inc

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Ford Motor Company

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Arrow Truck Sales Inc

List of Figures

- Figure 1: North America Second Hand Truck Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: North America Second Hand Truck Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Second Hand Truck Industry Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 2: North America Second Hand Truck Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 3: North America Second Hand Truck Industry Revenue million Forecast, by Region 2020 & 2033

- Table 4: North America Second Hand Truck Industry Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 5: North America Second Hand Truck Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 6: North America Second Hand Truck Industry Revenue million Forecast, by Country 2020 & 2033

- Table 7: North America Second Hand Truck Industry Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 8: North America Second Hand Truck Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 9: North America Second Hand Truck Industry Revenue million Forecast, by Country 2020 & 2033

- Table 10: North America Second Hand Truck Industry Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 11: North America Second Hand Truck Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 12: North America Second Hand Truck Industry Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Second Hand Truck Industry?

The projected CAGR is approximately 7.2%.

2. Which companies are prominent players in the North America Second Hand Truck Industry?

Key companies in the market include Arrow Truck Sales Inc, Gordon Truck Centers Inc, General Motors Company, Volvo AB Class B, Truckworld, Isuzu Motor Ltd, Paccar Inc, International Used Trucks, Ryder System Inc, Ford Motor Company.

3. What are the main segments of the North America Second Hand Truck Industry?

The market segments include Vehicle Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 16103.28 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Sales of Electric Vehicles are Expected to Drive the Market.

6. What are the notable trends driving market growth?

Heavy Duty Trucks will Lead the Market.

7. Are there any restraints impacting market growth?

Lack of Infrastructure May Hamper the growth of the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Second Hand Truck Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Second Hand Truck Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Second Hand Truck Industry?

To stay informed about further developments, trends, and reports in the North America Second Hand Truck Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence