Key Insights

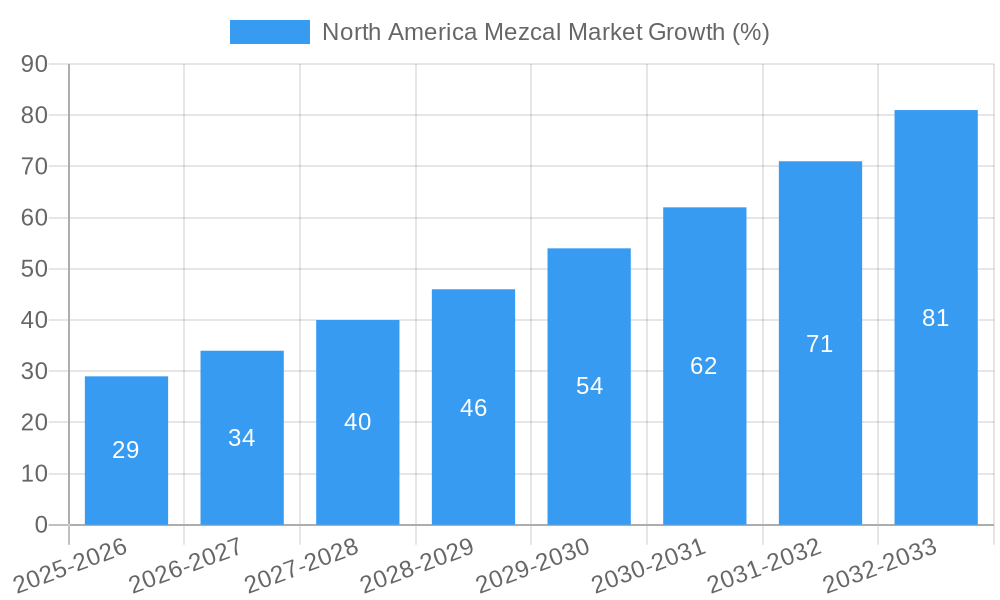

The North American Mezcal market, currently experiencing robust growth, is projected to reach a significant market size within the forecast period (2025-2033). Driven by increasing consumer awareness of premium spirits and a rising appreciation for authentic artisanal products, the market is witnessing a surge in demand, particularly for high-quality, small-batch Mezcal. The popularity of Mezcal, fueled by its unique smoky flavor profile and rich cultural heritage, is attracting a diverse range of consumers beyond traditional tequila drinkers. Key growth drivers include the expansion of distribution channels into both on-premise (restaurants, bars) and off-premise (liquor stores, online retailers) settings, as well as successful marketing campaigns highlighting the craft and tradition behind Mezcal production. The diverse range of Mezcal types—Joven, Reposado, Añejo—and the increasing availability of these varieties in the North American market further contribute to market expansion. While challenges such as price sensitivity and the need for increased consumer education regarding Mezcal’s nuances remain, the overall outlook for the North American Mezcal market is exceptionally positive.

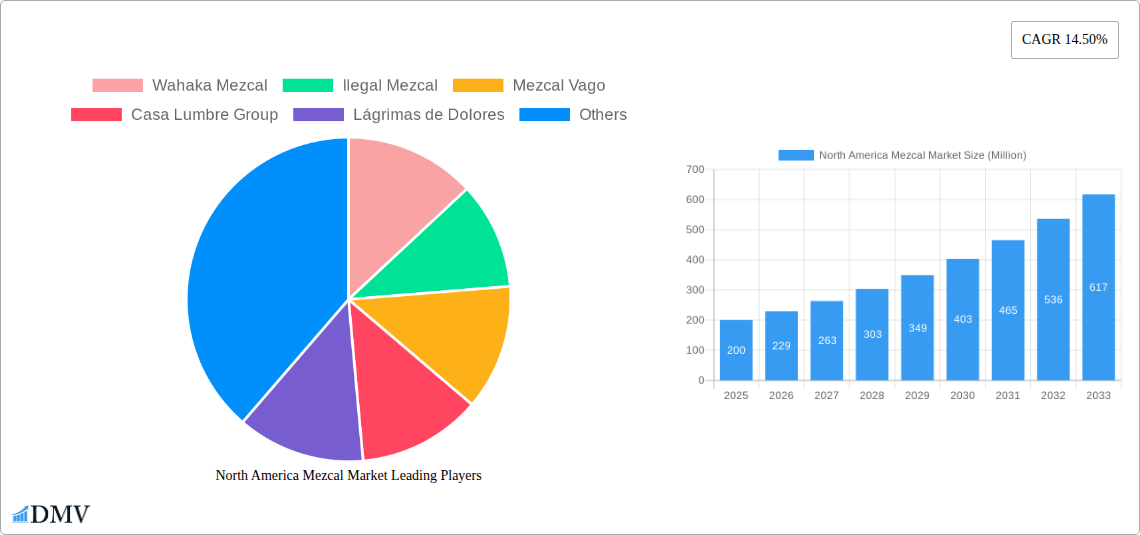

The segmentation of the North American Mezcal market reveals a strong preference for specific types and distribution channels. Assuming a current market size of approximately $200 million in 2025, (derived using the provided CAGR and a logical estimation based on industry trends), and given the growth drivers mentioned, a notable portion of this is likely attributed to the premium Añejo and Reposado segments, reflecting a trend towards higher-priced, aged Mezcal. The Off-Trade channel is anticipated to exhibit considerable growth, mirroring the increasing convenience and accessibility of purchasing premium spirits through online and retail channels. Successful marketing strategies by established players like Wahaka Mezcal, Ilegal Mezcal, and others have further accelerated market penetration, while newer entrants continue to add to the market's diversity and innovation. The competitive landscape is dynamic, with both established players and smaller producers vying for market share, indicating a promising environment for innovation and brand expansion. Continued focus on sustainability and ethical sourcing will become increasingly important as consumer preferences evolve.

North America Mezcal Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the North America Mezcal market, encompassing market size, trends, competitive landscape, and future growth prospects. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year. This report is crucial for stakeholders seeking to understand the dynamics of this rapidly evolving market and make informed strategic decisions. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

North America Mezcal Market Composition & Trends

The North America Mezcal market is characterized by a dynamic interplay of factors influencing its growth and evolution. Market concentration is currently [describe concentration level, e.g., moderately concentrated], with key players like Wahaka Mezcal, Ilegal Mezcal, Mezcal Vago, Casa Lumbre Group, Lágrimas de Dolores, William Grant & Sons Ltd, Rey Campero, El Silencio Holdings Inc, The Producer, Pernod Ricard, and Diageo PLC holding significant market share. However, the emergence of smaller, artisanal brands is also contributing to market diversity.

- Market Share Distribution: [Insert estimated market share distribution among top players. E.g., Wahaka Mezcal – 10%, Ilegal Mezcal – 8%, etc. If data is unavailable, state "Data unavailable, further research needed."]

- Innovation Catalysts: The market is witnessing continuous innovation in product types (e.g., Cristalino mezcal), packaging, and marketing strategies, driving premiumization and attracting new consumers.

- Regulatory Landscape: [Describe the regulatory environment, including any relevant laws or regulations affecting mezcal production and distribution in North America. Mention any anticipated changes.]

- Substitute Products: Tequila and other spirits compete with mezcal, but its unique flavor profile and growing popularity mitigate this challenge.

- End-User Profiles: The primary end-users are millennials and Gen Z, drawn to the artisanal nature and sophisticated taste of mezcal. However, broader consumer segments are increasingly embracing the beverage.

- M&A Activities: The recent acquisition of a majority stake in Código 1530 Tequila by Pernod Ricard (October 2022) exemplifies the growing interest in the premium agave spirits category, indicating potential for further consolidation within the mezcal market. [Insert estimated M&A deal values if available; otherwise, state "Data unavailable"].

North America Mezcal Market Industry Evolution

The North America Mezcal market has experienced significant growth over the historical period (2019-2024). This growth is fueled by increasing consumer awareness of mezcal's unique characteristics, rising disposable incomes, and a shift towards premium spirits. The market's trajectory indicates a continued upward trend, driven by factors such as:

- Increased Consumer Demand: The growing popularity of mezcal among younger demographics, coupled with its perceived premium status, has significantly boosted demand. [Insert specific data points on growth rates if available, e.g., "The market grew by X% between 2020 and 2024."]

- Premiumization Trends: The market is seeing a rise in premium and super-premium mezcal offerings, reflecting consumers' willingness to pay more for high-quality products.

- Technological Advancements: Innovations in production techniques and agave cultivation are improving quality and efficiency.

- Expanding Distribution Channels: Wider availability of mezcal through both on- and off-trade channels is increasing accessibility.

- Marketing & Branding Strategies: Effective marketing campaigns are effectively communicating the story and heritage behind mezcal, enhancing its appeal.

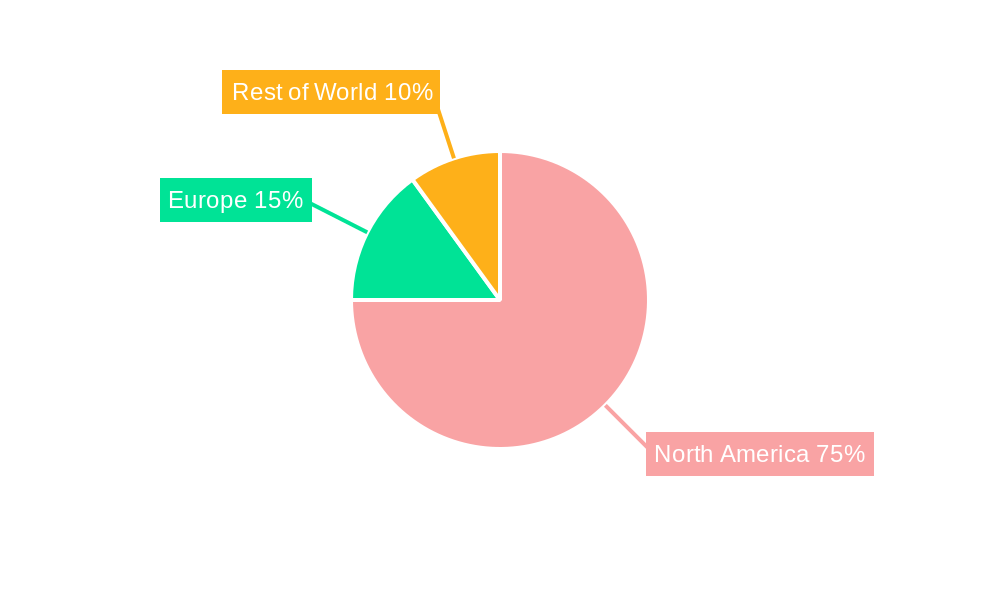

Leading Regions, Countries, or Segments in North America Mezcal Market

The United States is the dominant market for mezcal in North America, driven by high consumer demand and robust distribution networks. Specific segments exhibiting strong performance include:

By Type:

- Mezcal Joven: This segment holds the largest market share due to its accessibility and affordability. [Explain reasons for dominance, e.g., popular entry point, wider distribution.]

- Mezcal Reposado: Growing in popularity due to its balanced flavor profile. [Explain reasons for its growth.]

- Mezcal Añejo: A smaller but rapidly expanding segment, appealing to consumers seeking complex flavors and higher price points. [Explain reasons for growth.]

- Other Product Types: (e.g., Cristalino) Emerging as a niche but fast-growing segment, driven by innovation and unique flavor profiles. [Explain reasons for growth.]

By Distribution Channel:

- On-Trade Channel: Bars and restaurants play a significant role in introducing mezcal to new consumers. [Explain drivers for dominance, e.g., curated cocktail menus, experiential consumption.]

- Off-Trade Channel: Liquor stores and online retailers are increasingly important distribution channels. [Explain drivers for dominance, e.g., convenience, wider reach.]

Key Drivers:

- Investment Trends: Significant investment in mezcal production and marketing is boosting market growth.

- Regulatory Support: [Describe supportive government policies or initiatives (if any).]

North America Mezcal Market Product Innovations

Recent product innovations in the North America Mezcal market include the introduction of Cristalino mezcal, a clear, filtered variety, by Casa Lumbre (July 2022). This reflects a trend toward creating more accessible and versatile mezcal products appealing to a wider audience. The launch of The Producer’s Ensamble and Tepeztate mezcals (September 2021) in the US market also signifies innovative expansion strategies within this growing space. These new products are characterized by unique flavor profiles and high-quality production, differentiating them in the market.

Propelling Factors for North America Mezcal Market Growth

The North America Mezcal market’s growth is propelled by several factors:

- Rising Disposable Incomes: Increased spending power allows consumers to explore premium spirits like mezcal.

- Changing Consumer Preferences: A growing preference for artisanal and authentic products drives demand.

- Effective Marketing and Branding: Strategic marketing campaigns increase awareness and desirability.

- Expansion of Distribution Channels: Wider availability enhances accessibility.

Obstacles in the North America Mezcal Market

Challenges faced by the North America Mezcal market include:

- Supply Chain Disruptions: Dependence on agave cultivation can lead to supply constraints.

- Competition from other Spirits: Tequila and other spirits compete for consumer spending.

- Regulatory Hurdles: [Mention specific regulatory challenges, e.g., import/export restrictions, labeling requirements.]

- Pricing Pressures: Balancing pricing to remain competitive while maintaining profitability.

Future Opportunities in North America Mezcal Market

Future opportunities include:

- Expansion into New Markets: Increased penetration in less saturated regions within North America.

- Product Diversification: Introducing innovative mezcal variations to cater to evolving consumer preferences.

- Sustainable Production Practices: Adopting environmentally friendly cultivation methods to enhance brand reputation.

- Strengthening Brand Storytelling: Capitalizing on the rich cultural heritage of mezcal for marketing purposes.

Major Players in the North America Mezcal Market Ecosystem

- Wahaka Mezcal

- Ilegal Mezcal

- Mezcal Vago

- Casa Lumbre Group

- Lágrimas de Dolores

- William Grant & Sons Ltd

- Rey Campero

- El Silencio Holdings Inc

- The Producer

- Pernod Ricard

- Diageo PLC

Key Developments in North America Mezcal Market Industry

- October 2022: Pernod Ricard's acquisition of a majority shareholding in Código 1530 Tequila signals a significant investment in the premium agave category, potentially influencing future mezcal market dynamics.

- July 2022: Casa Lumbre's launch of Contraluz, the first premium Cristalino mezcal, showcases product innovation within the market.

- September 2021: The US launch of The Producer mezcal brand marks a notable entry into the North American market, potentially increasing competition.

Strategic North America Mezcal Market Forecast

The North America Mezcal market is poised for continued growth, driven by strong consumer demand, product innovation, and strategic investments by major players. The market's trajectory indicates a significant expansion in the coming years, presenting lucrative opportunities for established brands and new entrants alike. Continued premiumization and the exploration of new flavor profiles are expected to shape market trends.

North America Mezcal Market Segmentation

-

1. Type

- 1.1. Mezcal Joven

- 1.2. Mezcal Reposado

- 1.3. Mezcal Anejo

- 1.4. Other Product Types

-

2. Distribution Channel

- 2.1. On-Trade Channel

- 2.2. Off-Trade Channel

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America Mezcal Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Mezcal Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Trend of Consuming Cocktails; Rising Demand for Premium Spirits

- 3.3. Market Restrains

- 3.3.1. Affordability of the Product is Restraining the Market's Growth

- 3.4. Market Trends

- 3.4.1. Rising Popularity of Agave-based Beverages

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Mezcal Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Mezcal Joven

- 5.1.2. Mezcal Reposado

- 5.1.3. Mezcal Anejo

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-Trade Channel

- 5.2.2. Off-Trade Channel

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Mezcal Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Mezcal Joven

- 6.1.2. Mezcal Reposado

- 6.1.3. Mezcal Anejo

- 6.1.4. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. On-Trade Channel

- 6.2.2. Off-Trade Channel

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Mezcal Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Mezcal Joven

- 7.1.2. Mezcal Reposado

- 7.1.3. Mezcal Anejo

- 7.1.4. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. On-Trade Channel

- 7.2.2. Off-Trade Channel

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Mexico North America Mezcal Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Mezcal Joven

- 8.1.2. Mezcal Reposado

- 8.1.3. Mezcal Anejo

- 8.1.4. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. On-Trade Channel

- 8.2.2. Off-Trade Channel

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of North America North America Mezcal Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Mezcal Joven

- 9.1.2. Mezcal Reposado

- 9.1.3. Mezcal Anejo

- 9.1.4. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. On-Trade Channel

- 9.2.2. Off-Trade Channel

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. United States North America Mezcal Market Analysis, Insights and Forecast, 2019-2031

- 11. Canada North America Mezcal Market Analysis, Insights and Forecast, 2019-2031

- 12. Mexico North America Mezcal Market Analysis, Insights and Forecast, 2019-2031

- 13. Rest of North America North America Mezcal Market Analysis, Insights and Forecast, 2019-2031

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Wahaka Mezcal

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Ilegal Mezcal

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Mezcal Vago

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Casa Lumbre Group

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Lágrimas de Dolores

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 William Grant & Sons Ltd

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Rey Campero

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 El Silencio Holdings Inc

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 The Producer*List Not Exhaustive

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Pernod Ricard

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Diageo PLC

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.1 Wahaka Mezcal

List of Figures

- Figure 1: North America Mezcal Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Mezcal Market Share (%) by Company 2024

List of Tables

- Table 1: North America Mezcal Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Mezcal Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: North America Mezcal Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: North America Mezcal Market Volume Million Forecast, by Type 2019 & 2032

- Table 5: North America Mezcal Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: North America Mezcal Market Volume Million Forecast, by Distribution Channel 2019 & 2032

- Table 7: North America Mezcal Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 8: North America Mezcal Market Volume Million Forecast, by Geography 2019 & 2032

- Table 9: North America Mezcal Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: North America Mezcal Market Volume Million Forecast, by Region 2019 & 2032

- Table 11: North America Mezcal Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: North America Mezcal Market Volume Million Forecast, by Country 2019 & 2032

- Table 13: United States North America Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United States North America Mezcal Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 15: Canada North America Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Mezcal Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico North America Mezcal Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of North America North America Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of North America North America Mezcal Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 21: North America Mezcal Market Revenue Million Forecast, by Type 2019 & 2032

- Table 22: North America Mezcal Market Volume Million Forecast, by Type 2019 & 2032

- Table 23: North America Mezcal Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 24: North America Mezcal Market Volume Million Forecast, by Distribution Channel 2019 & 2032

- Table 25: North America Mezcal Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: North America Mezcal Market Volume Million Forecast, by Geography 2019 & 2032

- Table 27: North America Mezcal Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: North America Mezcal Market Volume Million Forecast, by Country 2019 & 2032

- Table 29: North America Mezcal Market Revenue Million Forecast, by Type 2019 & 2032

- Table 30: North America Mezcal Market Volume Million Forecast, by Type 2019 & 2032

- Table 31: North America Mezcal Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 32: North America Mezcal Market Volume Million Forecast, by Distribution Channel 2019 & 2032

- Table 33: North America Mezcal Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 34: North America Mezcal Market Volume Million Forecast, by Geography 2019 & 2032

- Table 35: North America Mezcal Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: North America Mezcal Market Volume Million Forecast, by Country 2019 & 2032

- Table 37: North America Mezcal Market Revenue Million Forecast, by Type 2019 & 2032

- Table 38: North America Mezcal Market Volume Million Forecast, by Type 2019 & 2032

- Table 39: North America Mezcal Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 40: North America Mezcal Market Volume Million Forecast, by Distribution Channel 2019 & 2032

- Table 41: North America Mezcal Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 42: North America Mezcal Market Volume Million Forecast, by Geography 2019 & 2032

- Table 43: North America Mezcal Market Revenue Million Forecast, by Country 2019 & 2032

- Table 44: North America Mezcal Market Volume Million Forecast, by Country 2019 & 2032

- Table 45: North America Mezcal Market Revenue Million Forecast, by Type 2019 & 2032

- Table 46: North America Mezcal Market Volume Million Forecast, by Type 2019 & 2032

- Table 47: North America Mezcal Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 48: North America Mezcal Market Volume Million Forecast, by Distribution Channel 2019 & 2032

- Table 49: North America Mezcal Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 50: North America Mezcal Market Volume Million Forecast, by Geography 2019 & 2032

- Table 51: North America Mezcal Market Revenue Million Forecast, by Country 2019 & 2032

- Table 52: North America Mezcal Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Mezcal Market?

The projected CAGR is approximately 14.50%.

2. Which companies are prominent players in the North America Mezcal Market?

Key companies in the market include Wahaka Mezcal, Ilegal Mezcal, Mezcal Vago, Casa Lumbre Group, Lágrimas de Dolores, William Grant & Sons Ltd, Rey Campero, El Silencio Holdings Inc, The Producer*List Not Exhaustive, Pernod Ricard, Diageo PLC.

3. What are the main segments of the North America Mezcal Market?

The market segments include Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Trend of Consuming Cocktails; Rising Demand for Premium Spirits.

6. What are the notable trends driving market growth?

Rising Popularity of Agave-based Beverages.

7. Are there any restraints impacting market growth?

Affordability of the Product is Restraining the Market's Growth.

8. Can you provide examples of recent developments in the market?

October 2022: Pernod Ricard announced the signing of an agreement for the acquisition of a majority shareholding of Código 1530 Tequila, a range of Ultra-Premium and Prestige tequila. This new investment into the fast-growing agave category, mainly driven by the US market, complements the Group's very comprehensive portfolio across price points and occasions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Mezcal Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Mezcal Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Mezcal Market?

To stay informed about further developments, trends, and reports in the North America Mezcal Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence