Key Insights

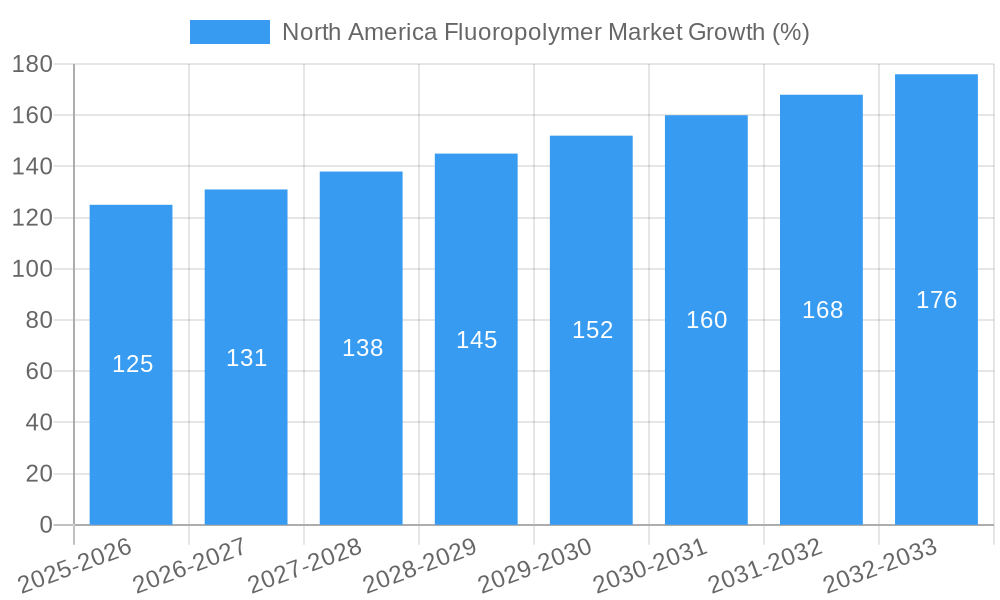

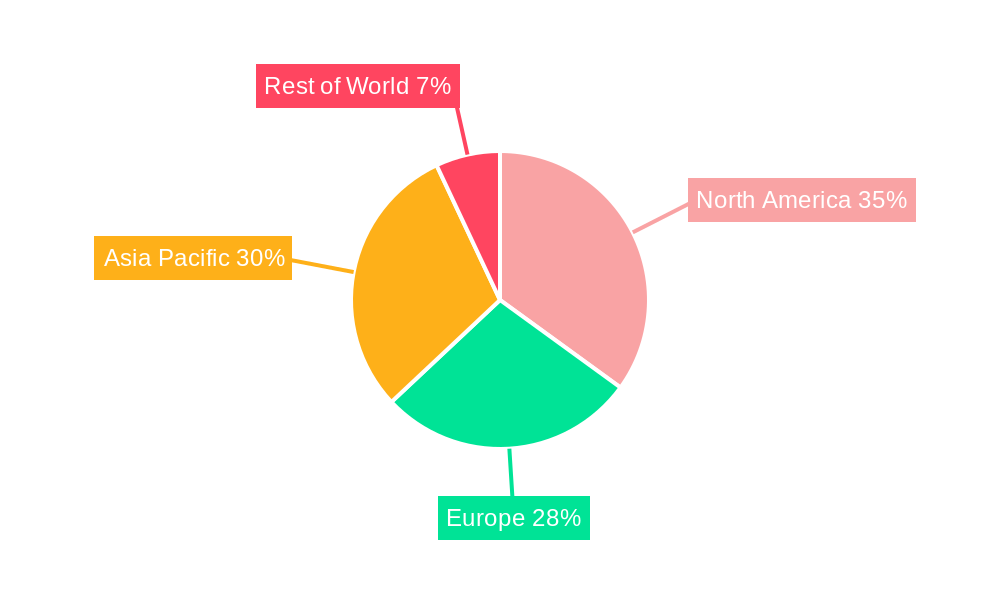

The North America fluoropolymer market is experiencing robust growth, driven by increasing demand across diverse end-use sectors. The market's expansion is fueled by several key factors, including the burgeoning automotive industry's need for lightweight and high-performance components, the rising adoption of fluoropolymers in the semiconductor and electronics manufacturing processes, and the growing demand for corrosion-resistant materials in the chemical processing industry. Furthermore, the increasing awareness of the environmental benefits of fluoropolymers, such as their durability and reduced waste generation compared to traditional materials, contributes to their market penetration. We estimate the North American market size to be approximately $2.5 billion in 2025, with a Compound Annual Growth Rate (CAGR) of around 5% projected through 2033. This growth is expected to be slightly higher than the global average due to the region's strong industrial base and technological advancements. Key players like 3M, DuPont, and Chemours are driving innovation through advanced product development and strategic partnerships, enhancing market competitiveness.

Despite the positive outlook, market growth faces some challenges. Fluctuations in raw material prices, particularly for fluorine-based chemicals, pose a significant constraint. Additionally, stringent environmental regulations surrounding the production and disposal of fluoropolymers require ongoing investment in sustainable manufacturing practices. However, the industry is actively adapting to these challenges through research and development focused on eco-friendly alternatives and improved recycling processes. Segmentation within the market reflects the varied applications, with PTFE, PFA, FEP, and PVDF being prominent types, each experiencing growth albeit at varying rates depending on end-use sector demand. The North American market is expected to continue its upward trajectory, driven by ongoing technological advancements and the increasing demand for high-performance materials across various industries.

North America Fluoropolymer Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the North America fluoropolymer market, offering a comprehensive overview of its current state, future trajectory, and key players. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period spanning 2025-2033, this study is an essential resource for stakeholders seeking to understand and capitalize on the opportunities within this dynamic market. The market is projected to reach xx Million by 2033.

North America Fluoropolymer Market Composition & Trends

The North American fluoropolymer market is characterized by a moderately concentrated landscape, with key players like 3M, AGC Inc, Arkema, Daikin Industries Ltd, DuPont, Gujarat Fluorochemicals Limited (GFL), Kureha Corporation, Solvay, and The Chemours Company holding significant market share. Market share distribution in 2025 is estimated as follows: 3M (xx%), DuPont (xx%), Chemours (xx%), Solvay (xx%), with remaining players collectively accounting for xx%. Innovation is a key driver, fueled by increasing demand for high-performance materials in diverse applications. Stringent regulatory frameworks surrounding environmental concerns and product safety significantly influence market dynamics. Substitute materials, such as silicone-based polymers, pose a competitive threat, impacting market growth. The end-user landscape is broad, encompassing automotive, aerospace, electronics, and chemical processing industries. Mergers and acquisitions (M&A) activity remains moderate, with deal values averaging xx Million in recent years. A notable example is the 2022 Solvay-Orbia partnership, boosting PVDF production capacity.

- Market Concentration: Moderately concentrated, with top players controlling a significant share.

- Innovation Catalysts: Demand for advanced materials, coupled with R&D investments.

- Regulatory Landscape: Stringent regulations impacting production and application.

- Substitute Products: Silicone-based polymers and other alternatives.

- End-User Profiles: Automotive, aerospace, electronics, chemical processing.

- M&A Activity: Moderate activity, with deal values averaging xx Million.

North America Fluoropolymer Market Industry Evolution

The North American fluoropolymer market has experienced steady growth over the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of xx%. This growth is projected to continue during the forecast period (2025-2033), although at a slightly moderated pace of xx% CAGR, driven by factors such as increasing demand from the electronics industry (especially for semiconductor applications) and expanding applications in renewable energy sectors. Technological advancements, particularly in the development of specialized fluoropolymers with enhanced properties (such as improved chemical resistance, thermal stability, and dielectric strength), have significantly contributed to market growth. Furthermore, shifting consumer preferences towards sustainable and environmentally friendly products are driving demand for fluoropolymers with reduced environmental impact. Adoption rates of novel fluoropolymer-based materials are increasing across various sectors, particularly in aerospace and automotive applications, reflecting the materials' superior performance characteristics. The automotive industry’s increasing adoption of electric vehicles (EVs) presents a significant growth opportunity due to increased demand for high-performance fluoropolymers in battery systems.

Leading Regions, Countries, or Segments in North America Fluoropolymer Market

The Northeastern United States emerges as the dominant region in the North American fluoropolymer market, driven by strong presence of major manufacturers and high concentration of end-user industries. The high concentration of electronics and automotive manufacturers significantly contributes to its market dominance.

- Key Drivers for Northeastern US Dominance:

- High concentration of manufacturing facilities: Major fluoropolymer producers have significant manufacturing capabilities in this region.

- Strong end-user demand: High demand from electronics, automotive, and aerospace sectors.

- Favorable regulatory environment: Supportive government policies and infrastructure.

- Skilled workforce: Availability of a skilled workforce capable of handling complex manufacturing processes.

This regional dominance is underpinned by a robust manufacturing base and substantial demand from key end-use sectors. Other regions show promising growth potential but lag behind due to factors such as underdeveloped infrastructure and limited access to advanced technologies. Specific states within the Northeast, including but not limited to New York and Pennsylvania, contribute significantly to this regional leadership.

North America Fluoropolymer Market Product Innovations

Recent product innovations in the North American fluoropolymer market highlight a focus on enhanced performance and expanded applications. AGC Inc.'s Fluon+ Composites, for example, improves the performance of carbon fiber-reinforced thermoplastic composites used in diverse industries. These innovations emphasize improved chemical resistance, temperature stability, and dielectric strength, enabling applications in demanding environments. The market also witnesses development of fluoropolymers with improved processability and reduced environmental impact, driven by sustainable manufacturing practices. The continuous search for higher performance and specialized properties drives the market forward, broadening the range of applications for these materials.

Propelling Factors for North America Fluoropolymer Market Growth

Several factors propel the North American fluoropolymer market's growth. Technological advancements lead to new, high-performance materials, widening application possibilities. The burgeoning electronics industry, especially semiconductors, drives demand for specialized fluoropolymers. Furthermore, the rising adoption of EVs and the growth of the renewable energy sector necessitates materials with exceptional durability and chemical resistance. Finally, favorable government policies supporting green technologies and sustainable manufacturing indirectly boost market expansion.

Obstacles in the North America Fluoropolymer Market

The North American fluoropolymer market faces certain obstacles. Stringent environmental regulations concerning fluorocarbon emissions and waste disposal increase manufacturing costs. Supply chain disruptions, especially concerning raw materials, can impact production and pricing. Furthermore, intense competition among established players and the emergence of substitute materials exert downward pressure on profit margins. These factors collectively influence the overall growth trajectory of the market.

Future Opportunities in North America Fluoropolymer Market

Future opportunities include the expansion into niche applications, such as fuel cells and advanced battery technologies. The development of more sustainable and recyclable fluoropolymers addresses environmental concerns and fosters growth. The growing demand in emerging industries like renewable energy and water purification also presents significant market expansion potential. Further advancements in material science and process technology pave the way for new specialized applications.

Major Players in the North America Fluoropolymer Market Ecosystem

- 3M

- AGC Inc

- Arkema

- Daikin Industries Ltd

- DuPont

- Gujarat Fluorochemicals Limited (GFL)

- Kureha Corporation

- Solvay

- The Chemours Company

Key Developments in North America Fluoropolymer Market Industry

November 2022: Solvay and Orbia announced a framework agreement to form a partnership for the production of suspension-grade polyvinylidene fluoride (PVDF) for battery materials, resulting in the largest capacity in North America. This significantly boosts the supply of PVDF, a crucial material for lithium-ion batteries, and positively impacts the market.

October 2022: AGC Inc. introduced Fluon+ Composites functionalized fluoropolymers, enhancing the performance of carbon fiber-reinforced thermoplastic composites. This innovation expands the applications of fluoropolymers in diverse sectors, driving market growth.

July 2022: Daikin Industries Ltd. invested in TeraWatt Technology, a US-based start-up, to develop battery technologies. This strategic investment reflects the growing importance of fluoropolymers in energy storage solutions and enhances the technological advancement within the industry.

Strategic North America Fluoropolymer Market Forecast

The North American fluoropolymer market is poised for continued growth, driven by technological advancements, expanding applications in diverse industries, and increasing demand from the renewable energy and electronics sectors. Future opportunities lie in developing sustainable and high-performance materials catering to the evolving needs of various industries. The market's growth trajectory suggests a promising outlook for stakeholders willing to embrace innovation and adapt to market dynamics. The ongoing investments in research and development, alongside strategic partnerships and acquisitions, are anticipated to propel market expansion and consolidate the market landscape in the coming years.

North America Fluoropolymer Market Segmentation

-

1. End User Industry

- 1.1. Aerospace

- 1.2. Automotive

- 1.3. Building and Construction

- 1.4. Electrical and Electronics

- 1.5. Industrial and Machinery

- 1.6. Packaging

- 1.7. Other End-user Industries

-

2. Sub Resin Type

- 2.1. Ethylenetetrafluoroethylene (ETFE)

- 2.2. Fluorinated Ethylene-propylene (FEP)

- 2.3. Polytetrafluoroethylene (PTFE)

- 2.4. Polyvinylfluoride (PVF)

- 2.5. Polyvinylidene Fluoride (PVDF)

- 2.6. Other Sub Resin Types

North America Fluoropolymer Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Fluoropolymer Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of % from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Fluoropolymer Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Aerospace

- 5.1.2. Automotive

- 5.1.3. Building and Construction

- 5.1.4. Electrical and Electronics

- 5.1.5. Industrial and Machinery

- 5.1.6. Packaging

- 5.1.7. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Sub Resin Type

- 5.2.1. Ethylenetetrafluoroethylene (ETFE)

- 5.2.2. Fluorinated Ethylene-propylene (FEP)

- 5.2.3. Polytetrafluoroethylene (PTFE)

- 5.2.4. Polyvinylfluoride (PVF)

- 5.2.5. Polyvinylidene Fluoride (PVDF)

- 5.2.6. Other Sub Resin Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 3M

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AGC Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Arkema

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Daikin Industries Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 DuPont

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Gujarat Fluorochemicals Limited (GFL)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kureha Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Solvay

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 The Chemours Compan

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 3M

List of Figures

- Figure 1: North America Fluoropolymer Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Fluoropolymer Market Share (%) by Company 2024

List of Tables

- Table 1: North America Fluoropolymer Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Fluoropolymer Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 3: North America Fluoropolymer Market Revenue Million Forecast, by Sub Resin Type 2019 & 2032

- Table 4: North America Fluoropolymer Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America Fluoropolymer Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 6: North America Fluoropolymer Market Revenue Million Forecast, by Sub Resin Type 2019 & 2032

- Table 7: North America Fluoropolymer Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States North America Fluoropolymer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada North America Fluoropolymer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Mexico North America Fluoropolymer Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Fluoropolymer Market?

The projected CAGR is approximately N/A%.

2. Which companies are prominent players in the North America Fluoropolymer Market?

Key companies in the market include 3M, AGC Inc, Arkema, Daikin Industries Ltd, DuPont, Gujarat Fluorochemicals Limited (GFL), Kureha Corporation, Solvay, The Chemours Compan.

3. What are the main segments of the North America Fluoropolymer Market?

The market segments include End User Industry, Sub Resin Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

November 2022: Solvay and Orbia announced a framework agreement to form a partnership for the production of suspension-grade polyvinylidene fluoride (PVDF) for battery materials, resulting in the largest capacity in North America.October 2022: AGC Inc. introduced Fluon+ Composites functionalized fluoropolymers that improve the performance of carbon fiber-reinforced thermoplastic (CFRP and CFRTP) composites used in automobiles, aircraft, sports products, and printed circuit boards.July 2022: Daikin Industries Ltd. invested in a US-based start-up company, TeraWatt Technology, to develop applications and further enhance battery technologies for lithium-ion batteries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Fluoropolymer Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Fluoropolymer Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Fluoropolymer Market?

To stay informed about further developments, trends, and reports in the North America Fluoropolymer Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence