Key Insights

The North American Floating Liquefied Natural Gas (FLNG) market is poised for significant growth, driven by increasing demand for natural gas, particularly in regions with limited pipeline infrastructure. The market's expansion is fueled by several factors, including the development of offshore gas fields, the growing adoption of cleaner energy sources (with LNG being a transition fuel), and government initiatives supporting energy security. The market segmentation reveals a dynamic landscape with varying growth trajectories across different liquefaction capacities. Large-scale FLNG units (over 2.5 MTPA) are expected to dominate the market due to their economies of scale and suitability for large-scale gas projects. However, the small- and medium-scale segments will also experience growth, driven by the need for flexible and adaptable solutions for smaller gas fields and potentially decentralized LNG production. The diverse range of propulsion systems, including diesel-electric, hybrid, and emerging low-carbon options, reflects the industry's ongoing commitment to sustainability and technological innovation. The deployment type also plays a crucial role, with offshore platforms and transportable FLNG units catering to distinct project needs.

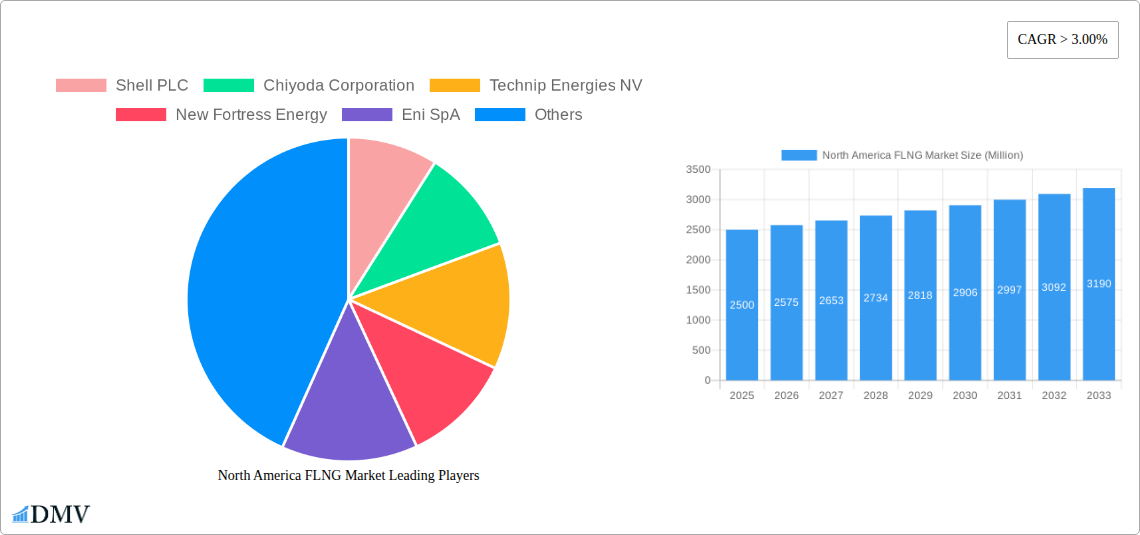

Key players such as Shell PLC, Chiyoda Corporation, Technip Energies NV, New Fortress Energy, Eni SpA, and Black & Veatch are actively shaping market dynamics through technological advancements, strategic partnerships, and project development. While challenges such as high upfront capital costs and regulatory complexities exist, the long-term outlook for the North American FLNG market remains optimistic, with substantial growth potential projected through 2033. The market is expected to attract further investment, technological innovation, and increased participation from both established and emerging players as the demand for LNG continues to grow, spurred by global energy transition efforts and the need for energy security. The geographical focus on North America highlights opportunities stemming from both domestic gas production and export potential.

North America FLNG Market: A Comprehensive Report (2019-2033)

This insightful report delivers a comprehensive analysis of the North America Floating Liquefied Natural Gas (FLNG) market, offering a detailed forecast from 2025 to 2033. With a focus on market dynamics, technological advancements, and key players, this report is essential for stakeholders seeking to understand and capitalize on opportunities within this rapidly evolving sector. The report covers the historical period (2019-2024), with 2025 as the base and estimated year. The study period encompasses 2019-2033, providing a long-term perspective on market trends and growth projections. The total market value is predicted to reach xx Million by 2033.

North America FLNG Market Composition & Trends

This section provides a detailed examination of the North America FLNG market's competitive landscape, encompassing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and mergers & acquisitions (M&A) activities. The report analyzes market share distribution among key players, including Shell PLC, Chiyoda Corporation, Technip Energies NV, New Fortress Energy, Eni SpA, and Black & Veatch Holding Company. We delve into the strategic implications of M&A activities, providing an assessment of deal values and their impact on market consolidation. Innovation catalysts, such as advancements in liquefaction technologies and propulsion systems, are also examined. Regulatory landscapes across North America are analyzed, highlighting variations in policies and their effect on market growth. Finally, the report profiles key end-users and analyzes the impact of substitute products on market dynamics. Expected market share distribution in 2025 is as follows: Shell PLC (xx%), Chiyoda Corporation (xx%), Technip Energies NV (xx%), New Fortress Energy (xx%), Eni SpA (xx%), Black & Veatch Holding Company (xx%), Others (xx%). Total M&A deal value in the historical period was approximately xx Million.

- Market Concentration: Analysis of market share distribution among leading players.

- Innovation Catalysts: Exploration of technological advancements driving market growth.

- Regulatory Landscape: Assessment of regulatory frameworks and their impact.

- Substitute Products: Evaluation of alternative solutions and their market penetration.

- End-User Profiles: Characterization of key industry segments and their specific needs.

- M&A Activities: Analysis of mergers and acquisitions, including deal values and strategic implications.

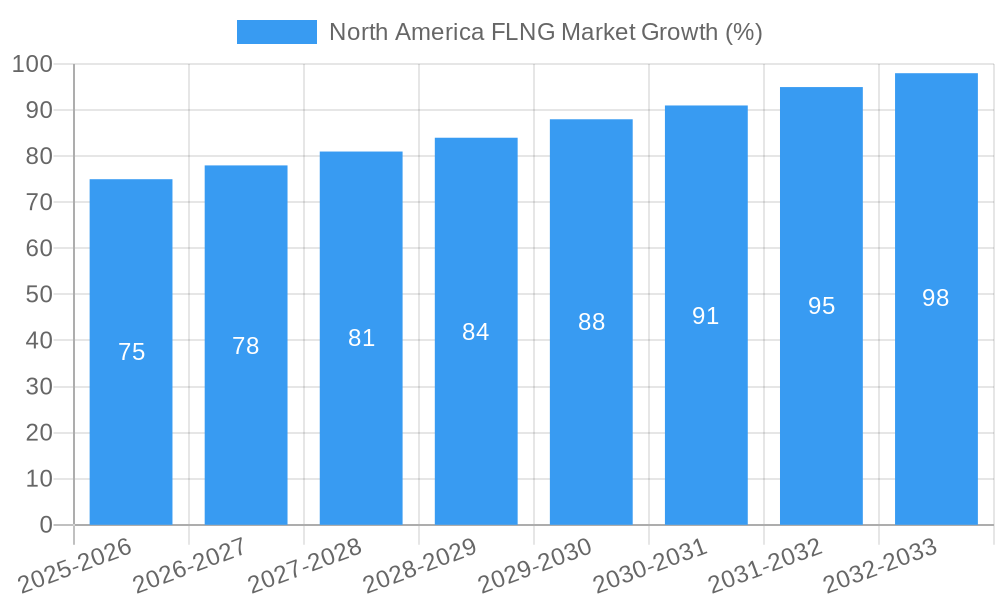

North America FLNG Market Industry Evolution

This section provides a comprehensive overview of the North American FLNG market's evolutionary trajectory. It traces the market's growth trajectory from 2019 to 2024, analyzing key growth drivers and obstacles. Technological advancements, such as the development of more efficient liquefaction processes and the introduction of hybrid and low-carbon propulsion systems, are analyzed in detail. The report further examines how shifting consumer demands, particularly the growing preference for cleaner energy sources, are shaping the market. Specific data points, such as compound annual growth rates (CAGRs) and adoption rates of new technologies, are presented to support the analysis. The transition from traditional diesel-electric systems to more environmentally friendly options will be a key focus, highlighting the expected market shift and the timeline for adoption. The impact of fluctuating natural gas prices and government policies designed to promote cleaner energy will also be analyzed. The report explores the predicted CAGR for the forecast period (2025-2033) to be xx%.

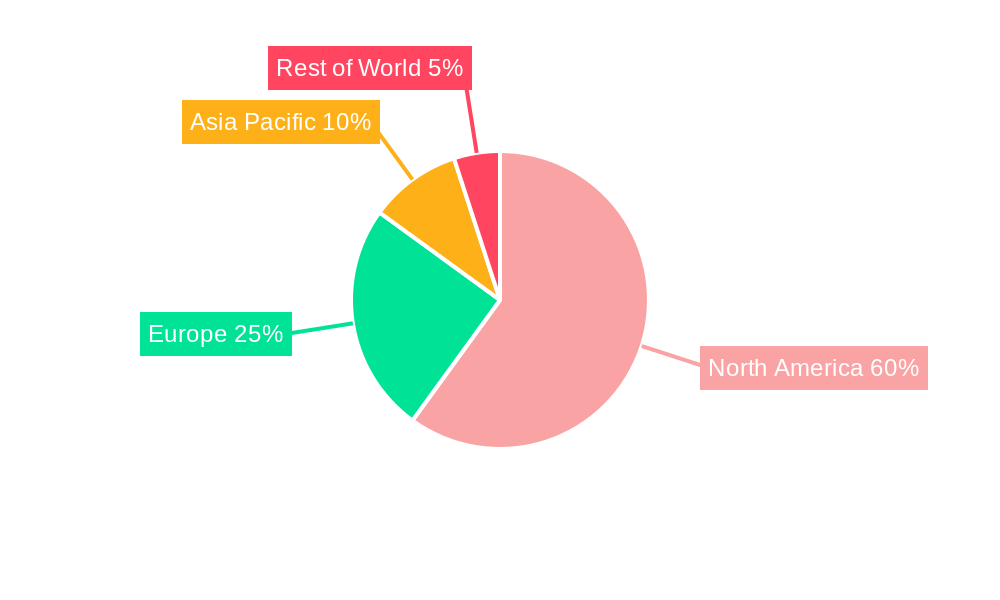

Leading Regions, Countries, or Segments in North America FLNG Market

This section identifies the dominant regions, countries, and segments within the North American FLNG market, considering liquefaction capacity (small-scale, medium-scale, large-scale), propulsion systems (diesel-electric, hybrid, low-carbon), and deployment types (offshore platform, transportable FLNG). It pinpoints the factors contributing to their dominance, including favorable regulatory environments, robust investment trends, and strategic partnerships.

- Liquefaction Capacity: Large-scale FLNG units are anticipated to dominate due to economies of scale and the increasing demand for LNG exports.

- Propulsion System: The market is shifting towards hybrid and low-carbon propulsion systems due to stringent environmental regulations and a focus on sustainability.

- Deployment Type: Offshore platform deployments are currently more prevalent; however, transportable FLNG units are gaining traction due to their flexibility and adaptability.

The Gulf of Mexico is projected as the leading region due to its abundant natural gas reserves and existing infrastructure. Government support for offshore energy projects and the strategic location for export to global markets are also key contributing factors.

North America FLNG Market Product Innovations

This section examines recent product innovations, encompassing novel applications and performance metrics for FLNG technologies. It highlights the unique selling propositions of new FLNG designs, emphasizing improvements in efficiency, environmental performance, and operational flexibility. Technological advancements, including innovations in liquefaction processes, energy storage, and emission reduction technologies, are discussed. The focus is on the competitive advantages provided by these innovations and their potential impact on market growth.

Propelling Factors for North America FLNG Market Growth

Several key factors are driving growth in the North America FLNG market. Rising global demand for LNG, coupled with the abundance of natural gas reserves in North America, creates a favorable environment for FLNG development. Government support for energy infrastructure projects, coupled with investments in advanced technologies, are also significant contributors. Furthermore, the increasing focus on environmental sustainability is driving the adoption of low-carbon FLNG solutions, further propelling market expansion. These factors are expected to contribute significantly to the market's growth over the forecast period.

Obstacles in the North America FLNG Market

The North America FLNG market faces several challenges. Stringent environmental regulations and the high initial investment costs associated with FLNG projects can pose significant barriers. Supply chain disruptions and geopolitical instability can also impact project timelines and costs. Furthermore, intense competition among major players could lead to price pressures and reduced profitability. These factors can collectively hinder market growth.

Future Opportunities in North America FLNG Market

The future of the North America FLNG market presents several promising opportunities. The development of new LNG export terminals and the expansion of existing facilities are expected to drive significant growth. Technological advancements, such as improvements in liquefaction efficiency and the use of renewable energy sources, will unlock further opportunities. Furthermore, the growing demand for LNG in emerging markets will create new export opportunities for North American FLNG projects.

Major Players in the North America FLNG Market Ecosystem

- Shell PLC

- Chiyoda Corporation

- Technip Energies NV

- New Fortress Energy

- Eni SpA

- Black & Veatch Holding Company

Key Developments in North America FLNG Market Industry

- April 2022: New Fortress Energy Inc. (NFE) announced plans to launch the US FLNG project in 2023, with a capacity of approximately 2.8 MTPA. This development signals significant investment in the US FLNG sector and indicates potential for increased LNG exports.

- July 2022: New Fortress Energy (NFE) and Pemex signed a deal to develop the Lakach offshore gas field and deploy FLNG solutions. This joint venture highlights the growing interest in FLNG projects in Mexico and its potential to expand LNG supply to global markets.

Strategic North America FLNG Market Forecast

The North America FLNG market is poised for significant growth driven by increasing global LNG demand, technological advancements, and supportive government policies. The ongoing shift towards cleaner energy sources, coupled with investments in low-carbon FLNG technologies, will further fuel market expansion. The anticipated increase in export capacity and the development of new projects are projected to substantially increase market size and revenue generation in the coming years. The market is expected to experience considerable growth, with a significant contribution from large-scale FLNG projects and the adoption of innovative technologies.

North America FLNG Market Segmentation

- 1. United States

- 2. Canada

- 3. Rest of North America

North America FLNG Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America FLNG Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Modernization and Upgrades of Existing Military Aircraft Fleets4.; Increasing Defense Budgets

- 3.3. Market Restrains

- 3.3.1. 4.; Shift Toward Unmanned Aircraft

- 3.4. Market Trends

- 3.4.1. Upcoming FLNG Projects Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America FLNG Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by United States

- 5.2. Market Analysis, Insights and Forecast - by Canada

- 5.3. Market Analysis, Insights and Forecast - by Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by United States

- 6. United States North America FLNG Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America FLNG Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America FLNG Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America FLNG Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Shell PLC

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Chiyoda Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Technip Energies NV

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 New Fortress Energy

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Eni SpA

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Black & Veatch Holding Company

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.1 Shell PLC

List of Figures

- Figure 1: North America FLNG Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America FLNG Market Share (%) by Company 2024

List of Tables

- Table 1: North America FLNG Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America FLNG Market Volume metric tonnes Forecast, by Region 2019 & 2032

- Table 3: North America FLNG Market Revenue Million Forecast, by United States 2019 & 2032

- Table 4: North America FLNG Market Volume metric tonnes Forecast, by United States 2019 & 2032

- Table 5: North America FLNG Market Revenue Million Forecast, by Canada 2019 & 2032

- Table 6: North America FLNG Market Volume metric tonnes Forecast, by Canada 2019 & 2032

- Table 7: North America FLNG Market Revenue Million Forecast, by Rest of North America 2019 & 2032

- Table 8: North America FLNG Market Volume metric tonnes Forecast, by Rest of North America 2019 & 2032

- Table 9: North America FLNG Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: North America FLNG Market Volume metric tonnes Forecast, by Region 2019 & 2032

- Table 11: North America FLNG Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: North America FLNG Market Volume metric tonnes Forecast, by Country 2019 & 2032

- Table 13: United States North America FLNG Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United States North America FLNG Market Volume (metric tonnes) Forecast, by Application 2019 & 2032

- Table 15: Canada North America FLNG Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America FLNG Market Volume (metric tonnes) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America FLNG Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico North America FLNG Market Volume (metric tonnes) Forecast, by Application 2019 & 2032

- Table 19: Rest of North America North America FLNG Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of North America North America FLNG Market Volume (metric tonnes) Forecast, by Application 2019 & 2032

- Table 21: North America FLNG Market Revenue Million Forecast, by United States 2019 & 2032

- Table 22: North America FLNG Market Volume metric tonnes Forecast, by United States 2019 & 2032

- Table 23: North America FLNG Market Revenue Million Forecast, by Canada 2019 & 2032

- Table 24: North America FLNG Market Volume metric tonnes Forecast, by Canada 2019 & 2032

- Table 25: North America FLNG Market Revenue Million Forecast, by Rest of North America 2019 & 2032

- Table 26: North America FLNG Market Volume metric tonnes Forecast, by Rest of North America 2019 & 2032

- Table 27: North America FLNG Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: North America FLNG Market Volume metric tonnes Forecast, by Country 2019 & 2032

- Table 29: United States North America FLNG Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: United States North America FLNG Market Volume (metric tonnes) Forecast, by Application 2019 & 2032

- Table 31: Canada North America FLNG Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Canada North America FLNG Market Volume (metric tonnes) Forecast, by Application 2019 & 2032

- Table 33: Mexico North America FLNG Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Mexico North America FLNG Market Volume (metric tonnes) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America FLNG Market?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the North America FLNG Market?

Key companies in the market include Shell PLC, Chiyoda Corporation, Technip Energies NV, New Fortress Energy, Eni SpA, Black & Veatch Holding Company.

3. What are the main segments of the North America FLNG Market?

The market segments include United States, Canada, Rest of North America.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Modernization and Upgrades of Existing Military Aircraft Fleets4.; Increasing Defense Budgets.

6. What are the notable trends driving market growth?

Upcoming FLNG Projects Expected to Drive the Market.

7. Are there any restraints impacting market growth?

4.; Shift Toward Unmanned Aircraft.

8. Can you provide examples of recent developments in the market?

July 2022: New Fortress Energy (NFE) signed a deal with Mexican state-owned petroleum company Pemex to develop the Lakach offshore gas field and deploy FLNG solutions jointly. The agreement involves the joint development of the Lakach deepwater natural gas field for Pemex to supply natural gas to Mexico's onshore domestic market and for NFE to produce LNG for export to global markets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in metric tonnes.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America FLNG Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America FLNG Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America FLNG Market?

To stay informed about further developments, trends, and reports in the North America FLNG Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence