Key Insights

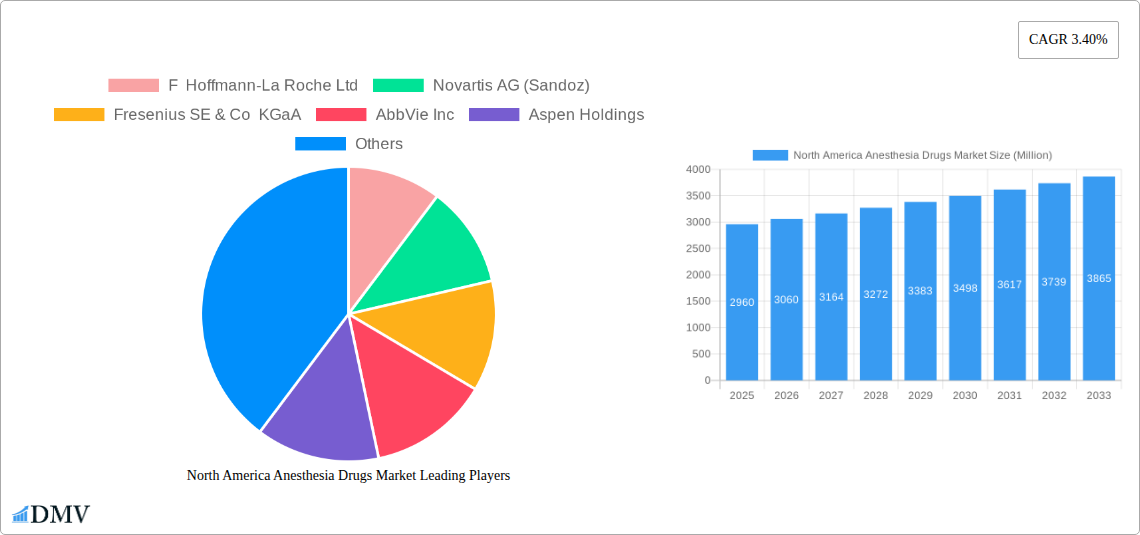

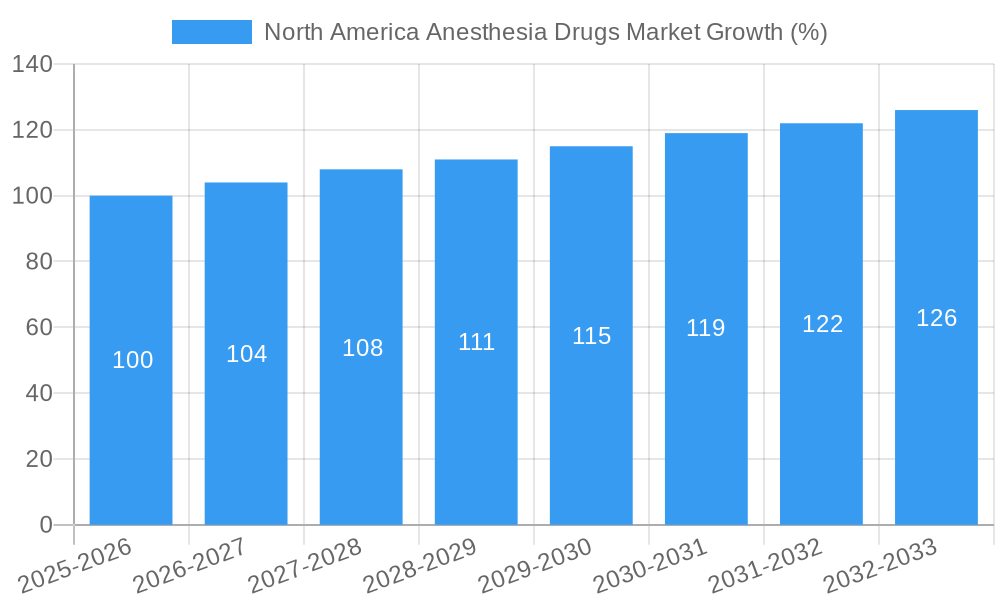

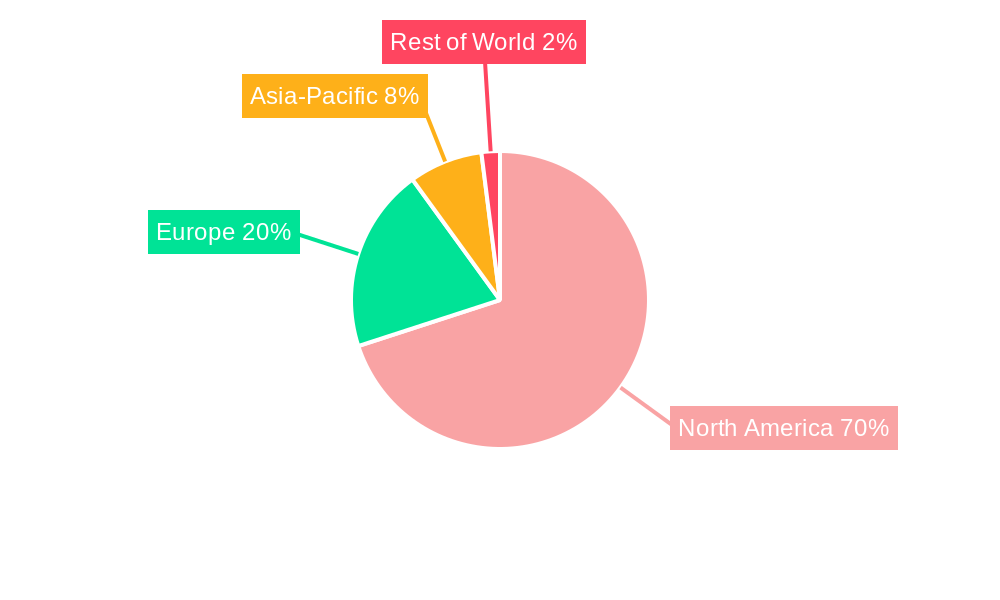

The North America anesthesia drugs market, valued at $2.96 billion in 2025, is projected to experience steady growth, driven primarily by the increasing prevalence of chronic diseases necessitating surgical interventions and the rising number of elective surgeries. The market's Compound Annual Growth Rate (CAGR) of 3.40% from 2019 to 2024 suggests a continued, albeit moderate, expansion through 2033. Several factors contribute to this growth. Firstly, advancements in anesthesia techniques and the development of safer, more effective drugs are expanding the application of anesthesia across various surgical specialties, including general, plastic, cosmetic, and dental surgeries. Secondly, the aging population in North America is a significant driver, as older individuals are more prone to requiring surgical procedures. Finally, increased healthcare expenditure and improved healthcare infrastructure are supporting market expansion. However, potential restraints include stringent regulatory approvals for new drug introductions and the rising prevalence of alternative anesthetic techniques, which could temper market growth to some extent. The market segmentation reveals a strong preference for inhalation routes of administration alongside a substantial demand for general anesthesia drugs. Major players like F Hoffmann-La Roche Ltd, Novartis AG (Sandoz), and Pfizer Inc are actively involved in research and development, striving to maintain their market presence and introduce innovative products. The United States, with its sizable healthcare sector and advanced medical infrastructure, is expected to dominate the North American market.

Specific segments within the North America anesthesia drugs market exhibit varying growth trajectories. Inhalation anesthesia, for example, while remaining prominent, might see slower growth compared to specialized anesthetic agents developed for particular procedures within plastic or cosmetic surgeries. The competitive landscape is fiercely contested, with established pharmaceutical giants facing challenges from emerging players. This necessitates continuous innovation and strategic partnerships to secure market share. The ongoing focus on safety profiles and efficacy, along with cost considerations, are shaping both patient preferences and prescribing practices, influencing the overall market dynamics. The forecast period (2025-2033) presents opportunities for growth, but sustained success will hinge on adapting to evolving regulatory requirements and addressing unmet clinical needs.

North America Anesthesia Drugs Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the North America anesthesia drugs market, offering a comprehensive overview of market dynamics, trends, and future prospects. Covering the period from 2019 to 2033, with a base year of 2025, this report is an invaluable resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The market is projected to reach xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033).

North America Anesthesia Drugs Market Composition & Trends

This section delves into the intricate composition of the North America anesthesia drugs market, examining key aspects that shape its trajectory. We analyze market concentration, identifying the dominant players and their respective market shares. The report also explores the innovative landscape, highlighting technological advancements and their impact on market growth. Furthermore, we provide an in-depth assessment of the regulatory environment, including FDA approvals and their influence on market access and product development. The impact of substitute products and emerging therapies are also discussed, along with an analysis of M&A activities within the industry, including deal values and their implications for market consolidation. End-user profiles across various surgical specialties are profiled, providing a granular understanding of market demand drivers.

- Market Concentration: The market is moderately concentrated, with the top 5 players holding an estimated xx% market share in 2024.

- Innovation Catalysts: Advancements in drug delivery systems and the development of novel anesthetic agents are driving innovation.

- Regulatory Landscape: Stringent regulatory approvals (e.g., FDA) significantly influence market entry and product lifecycle.

- Substitute Products: Regional variations in anesthetic preferences and access to alternative pain management techniques influence market dynamics.

- M&A Activity: Consolidation through mergers and acquisitions is anticipated to continue, shaping the competitive landscape. Total M&A deal value in 2024 was estimated at xx Million.

- End-User Profiles: Hospitals and ambulatory surgical centers are the primary end-users, with increasing demand from specialized clinics.

North America Anesthesia Drugs Market Industry Evolution

This section provides a detailed analysis of the North America anesthesia drugs market's historical and projected growth, technological advancements, and evolving consumer demands. The report analyzes growth trajectories from 2019 to 2024, highlighting key factors influencing market expansion. Technological advancements such as improved drug delivery systems and enhanced monitoring technologies are examined, alongside their impact on market adoption rates. Shifting consumer demands, particularly toward minimally invasive procedures and improved patient outcomes, are explored.

The report quantifies the market's evolution with specific data points, including year-over-year growth rates and adoption metrics for new technologies. Factors such as increased surgical procedures and rising healthcare expenditure contribute to the market’s expansion, while potential challenges such as the emergence of generic drugs and price pressure from payers are analyzed. The impact of technological changes on treatment protocols and the rise of personalized medicine are also detailed.

Leading Regions, Countries, or Segments in North America Anesthesia Drugs Market

This section identifies the dominant regions, countries, and segments within the North America anesthesia drugs market. We analyze market performance across different routes of administration (Inhalation, Injection, Other Routes of Administration), applications (General Surgeries, Plastic Surgery, Cosmetic Surgeries, Dental Surgeries, Other Applications), and drug types (General Anesthesia Drugs, Local Anesthesia Drugs).

- Dominant Segments: Injection is the leading route of administration, followed by inhalation. General surgeries comprise the largest application segment.

- Key Drivers (Injection): High efficacy, established safety profiles, and suitability for a wide range of surgical procedures drive the dominance of injection-based anesthetics.

- Key Drivers (General Surgeries): The high volume of general surgeries across North America fuels the demand for general anesthesia drugs.

- Regional Variations: Market growth varies across different regions, influenced by factors such as healthcare infrastructure and demographics.

North America Anesthesia Drugs Market Product Innovations

This section showcases recent product innovations in the anesthesia drugs market, including novel anesthetic agents, advanced delivery systems, and improved monitoring technologies. We highlight the unique selling propositions of these innovations and their impact on clinical practice. For example, the emergence of targeted drug delivery systems and biocompatible materials has enhanced patient safety and efficacy. Technological advancements such as real-time monitoring capabilities and personalized dosing strategies are analyzed, focusing on their contribution to improved patient care and reduced adverse events.

Propelling Factors for North America Anesthesia Drugs Market Growth

Several factors are driving the growth of the North America anesthesia drugs market. The increasing prevalence of chronic diseases necessitating surgical interventions fuels demand for anesthetics. Technological advancements, such as improved drug delivery systems and monitoring devices, enhance efficacy and safety. Favorable regulatory environments and increasing healthcare spending also contribute significantly to market expansion. Furthermore, the growing adoption of minimally invasive surgical procedures further strengthens market growth.

Obstacles in the North America Anesthesia Drugs Market

The North America anesthesia drugs market faces certain challenges. Stringent regulatory hurdles, including lengthy approval processes and rigorous safety testing, can delay market entry of new products. Supply chain disruptions and price pressures from payers can also impede market growth. Finally, intense competition among established players and emerging companies can impact profitability.

Future Opportunities in North America Anesthesia Drugs Market

The North America anesthesia drugs market presents significant future opportunities. The emergence of new drug targets and advancements in drug delivery technologies offer potential for innovation. Expansion into niche therapeutic areas, such as regional anesthesia and pain management, presents untapped market potential. Moreover, the development of personalized anesthesia strategies based on patient-specific factors offers considerable growth opportunities.

Major Players in the North America Anesthesia Drugs Market Ecosystem

- F Hoffmann-La Roche Ltd

- Novartis AG (Sandoz)

- Fresenius SE & Co KGaA

- AbbVie Inc

- Aspen Holdings

- Avet Pharmaceuticals Inc

- Eisai Co Ltd

- Baxter International

- B Braun SE

- Pfizer Inc

Key Developments in North America Anesthesia Drugs Market Industry

- September 2022: Harrow and Sintetica received FDA approval for IHEEZO (chloroprocaine hydrochloride ophthalmic gel), expanding the market for local anesthetics.

- April 2022: GE Healthcare received FDA pre-market approval for its End-Tidal (Et) Control software, improving general anesthesia delivery.

Strategic North America Anesthesia Drugs Market Forecast

The North America anesthesia drugs market is poised for continued growth, driven by advancements in drug delivery systems, increasing surgical procedures, and rising healthcare spending. Emerging technologies like personalized anesthesia and targeted drug delivery systems offer substantial growth potential. The market is expected to witness strategic partnerships and collaborations, shaping the competitive landscape and driving innovation. The forecast period (2025-2033) presents significant opportunities for market players to expand their presence and market share.

North America Anesthesia Drugs Market Segmentation

-

1. Drug Type

-

1.1. General Anesthesia Drugs

- 1.1.1. Propofol

- 1.1.2. Sevoflurane

- 1.1.3. Desflurane

- 1.1.4. Dexmedetomidine

- 1.1.5. Remifentanil

- 1.1.6. Midazolam

- 1.1.7. Other General Anesthesia Drugs

-

1.2. Local Anesthesia Drugs

- 1.2.1. Bupivacaine

- 1.2.2. Ropivacaine

- 1.2.3. Lidocaine

- 1.2.4. Chloroprocaine

- 1.2.5. Prilocaine

- 1.2.6. Benzocaine

- 1.2.7. Other Local Anesthesia Drugs

-

1.1. General Anesthesia Drugs

-

2. Route of Administration

- 2.1. Inhalation

- 2.2. Injection

- 2.3. Other Routes of Administration

-

3. Application

- 3.1. General Surgeries

- 3.2. Plastic Surgery

- 3.3. Cosmetic Surgeries

- 3.4. Dental Surgeries

- 3.5. Other Applications

-

4. Geography

- 4.1. United States

- 4.2. Canada

- 4.3. Mexico

North America Anesthesia Drugs Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Anesthesia Drugs Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Number of Surgeries; Growing Investment in R&D by the Pharmaceutical Companies

- 3.3. Market Restrains

- 3.3.1. Side Effects of General Anesthetics; Regulatory Issues

- 3.4. Market Trends

- 3.4.1. Inhalation Segment is Expected to Grow Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Anesthesia Drugs Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Drug Type

- 5.1.1. General Anesthesia Drugs

- 5.1.1.1. Propofol

- 5.1.1.2. Sevoflurane

- 5.1.1.3. Desflurane

- 5.1.1.4. Dexmedetomidine

- 5.1.1.5. Remifentanil

- 5.1.1.6. Midazolam

- 5.1.1.7. Other General Anesthesia Drugs

- 5.1.2. Local Anesthesia Drugs

- 5.1.2.1. Bupivacaine

- 5.1.2.2. Ropivacaine

- 5.1.2.3. Lidocaine

- 5.1.2.4. Chloroprocaine

- 5.1.2.5. Prilocaine

- 5.1.2.6. Benzocaine

- 5.1.2.7. Other Local Anesthesia Drugs

- 5.1.1. General Anesthesia Drugs

- 5.2. Market Analysis, Insights and Forecast - by Route of Administration

- 5.2.1. Inhalation

- 5.2.2. Injection

- 5.2.3. Other Routes of Administration

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. General Surgeries

- 5.3.2. Plastic Surgery

- 5.3.3. Cosmetic Surgeries

- 5.3.4. Dental Surgeries

- 5.3.5. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.5.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Drug Type

- 6. United States North America Anesthesia Drugs Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Drug Type

- 6.1.1. General Anesthesia Drugs

- 6.1.1.1. Propofol

- 6.1.1.2. Sevoflurane

- 6.1.1.3. Desflurane

- 6.1.1.4. Dexmedetomidine

- 6.1.1.5. Remifentanil

- 6.1.1.6. Midazolam

- 6.1.1.7. Other General Anesthesia Drugs

- 6.1.2. Local Anesthesia Drugs

- 6.1.2.1. Bupivacaine

- 6.1.2.2. Ropivacaine

- 6.1.2.3. Lidocaine

- 6.1.2.4. Chloroprocaine

- 6.1.2.5. Prilocaine

- 6.1.2.6. Benzocaine

- 6.1.2.7. Other Local Anesthesia Drugs

- 6.1.1. General Anesthesia Drugs

- 6.2. Market Analysis, Insights and Forecast - by Route of Administration

- 6.2.1. Inhalation

- 6.2.2. Injection

- 6.2.3. Other Routes of Administration

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. General Surgeries

- 6.3.2. Plastic Surgery

- 6.3.3. Cosmetic Surgeries

- 6.3.4. Dental Surgeries

- 6.3.5. Other Applications

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.4.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Drug Type

- 7. Canada North America Anesthesia Drugs Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Drug Type

- 7.1.1. General Anesthesia Drugs

- 7.1.1.1. Propofol

- 7.1.1.2. Sevoflurane

- 7.1.1.3. Desflurane

- 7.1.1.4. Dexmedetomidine

- 7.1.1.5. Remifentanil

- 7.1.1.6. Midazolam

- 7.1.1.7. Other General Anesthesia Drugs

- 7.1.2. Local Anesthesia Drugs

- 7.1.2.1. Bupivacaine

- 7.1.2.2. Ropivacaine

- 7.1.2.3. Lidocaine

- 7.1.2.4. Chloroprocaine

- 7.1.2.5. Prilocaine

- 7.1.2.6. Benzocaine

- 7.1.2.7. Other Local Anesthesia Drugs

- 7.1.1. General Anesthesia Drugs

- 7.2. Market Analysis, Insights and Forecast - by Route of Administration

- 7.2.1. Inhalation

- 7.2.2. Injection

- 7.2.3. Other Routes of Administration

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. General Surgeries

- 7.3.2. Plastic Surgery

- 7.3.3. Cosmetic Surgeries

- 7.3.4. Dental Surgeries

- 7.3.5. Other Applications

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.4.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Drug Type

- 8. Mexico North America Anesthesia Drugs Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Drug Type

- 8.1.1. General Anesthesia Drugs

- 8.1.1.1. Propofol

- 8.1.1.2. Sevoflurane

- 8.1.1.3. Desflurane

- 8.1.1.4. Dexmedetomidine

- 8.1.1.5. Remifentanil

- 8.1.1.6. Midazolam

- 8.1.1.7. Other General Anesthesia Drugs

- 8.1.2. Local Anesthesia Drugs

- 8.1.2.1. Bupivacaine

- 8.1.2.2. Ropivacaine

- 8.1.2.3. Lidocaine

- 8.1.2.4. Chloroprocaine

- 8.1.2.5. Prilocaine

- 8.1.2.6. Benzocaine

- 8.1.2.7. Other Local Anesthesia Drugs

- 8.1.1. General Anesthesia Drugs

- 8.2. Market Analysis, Insights and Forecast - by Route of Administration

- 8.2.1. Inhalation

- 8.2.2. Injection

- 8.2.3. Other Routes of Administration

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. General Surgeries

- 8.3.2. Plastic Surgery

- 8.3.3. Cosmetic Surgeries

- 8.3.4. Dental Surgeries

- 8.3.5. Other Applications

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. United States

- 8.4.2. Canada

- 8.4.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Drug Type

- 9. North America North America Anesthesia Drugs Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1. undefined

- 10. United States North America Anesthesia Drugs Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1. undefined

- 11. Canada North America Anesthesia Drugs Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1. undefined

- 12. Mexico North America Anesthesia Drugs Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1. undefined

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 F Hoffmann-La Roche Ltd

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Novartis AG (Sandoz)

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Fresenius SE & Co KGaA

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 AbbVie Inc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Aspen Holdings

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Avet Pharmaceuticals Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Eisai Co Ltd

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Baxter International

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 B Braun SE

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Pfizer Inc

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 F Hoffmann-La Roche Ltd

List of Figures

- Figure 1: North America Anesthesia Drugs Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Anesthesia Drugs Market Share (%) by Company 2024

List of Tables

- Table 1: North America Anesthesia Drugs Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Anesthesia Drugs Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: North America Anesthesia Drugs Market Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 4: North America Anesthesia Drugs Market Volume K Unit Forecast, by Drug Type 2019 & 2032

- Table 5: North America Anesthesia Drugs Market Revenue Million Forecast, by Route of Administration 2019 & 2032

- Table 6: North America Anesthesia Drugs Market Volume K Unit Forecast, by Route of Administration 2019 & 2032

- Table 7: North America Anesthesia Drugs Market Revenue Million Forecast, by Application 2019 & 2032

- Table 8: North America Anesthesia Drugs Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 9: North America Anesthesia Drugs Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 10: North America Anesthesia Drugs Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 11: North America Anesthesia Drugs Market Revenue Million Forecast, by Region 2019 & 2032

- Table 12: North America Anesthesia Drugs Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 13: North America Anesthesia Drugs Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: North America Anesthesia Drugs Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 15: North America Anesthesia Drugs Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: North America Anesthesia Drugs Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 17: North America Anesthesia Drugs Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: North America Anesthesia Drugs Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 19: North America Anesthesia Drugs Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: North America Anesthesia Drugs Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 21: North America Anesthesia Drugs Market Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 22: North America Anesthesia Drugs Market Volume K Unit Forecast, by Drug Type 2019 & 2032

- Table 23: North America Anesthesia Drugs Market Revenue Million Forecast, by Route of Administration 2019 & 2032

- Table 24: North America Anesthesia Drugs Market Volume K Unit Forecast, by Route of Administration 2019 & 2032

- Table 25: North America Anesthesia Drugs Market Revenue Million Forecast, by Application 2019 & 2032

- Table 26: North America Anesthesia Drugs Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 27: North America Anesthesia Drugs Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 28: North America Anesthesia Drugs Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 29: North America Anesthesia Drugs Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: North America Anesthesia Drugs Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 31: North America Anesthesia Drugs Market Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 32: North America Anesthesia Drugs Market Volume K Unit Forecast, by Drug Type 2019 & 2032

- Table 33: North America Anesthesia Drugs Market Revenue Million Forecast, by Route of Administration 2019 & 2032

- Table 34: North America Anesthesia Drugs Market Volume K Unit Forecast, by Route of Administration 2019 & 2032

- Table 35: North America Anesthesia Drugs Market Revenue Million Forecast, by Application 2019 & 2032

- Table 36: North America Anesthesia Drugs Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 37: North America Anesthesia Drugs Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 38: North America Anesthesia Drugs Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 39: North America Anesthesia Drugs Market Revenue Million Forecast, by Country 2019 & 2032

- Table 40: North America Anesthesia Drugs Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 41: North America Anesthesia Drugs Market Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 42: North America Anesthesia Drugs Market Volume K Unit Forecast, by Drug Type 2019 & 2032

- Table 43: North America Anesthesia Drugs Market Revenue Million Forecast, by Route of Administration 2019 & 2032

- Table 44: North America Anesthesia Drugs Market Volume K Unit Forecast, by Route of Administration 2019 & 2032

- Table 45: North America Anesthesia Drugs Market Revenue Million Forecast, by Application 2019 & 2032

- Table 46: North America Anesthesia Drugs Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 47: North America Anesthesia Drugs Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 48: North America Anesthesia Drugs Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 49: North America Anesthesia Drugs Market Revenue Million Forecast, by Country 2019 & 2032

- Table 50: North America Anesthesia Drugs Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Anesthesia Drugs Market?

The projected CAGR is approximately 3.40%.

2. Which companies are prominent players in the North America Anesthesia Drugs Market?

Key companies in the market include F Hoffmann-La Roche Ltd, Novartis AG (Sandoz), Fresenius SE & Co KGaA, AbbVie Inc, Aspen Holdings, Avet Pharmaceuticals Inc, Eisai Co Ltd, Baxter International, B Braun SE, Pfizer Inc.

3. What are the main segments of the North America Anesthesia Drugs Market?

The market segments include Drug Type, Route of Administration, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.96 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Number of Surgeries; Growing Investment in R&D by the Pharmaceutical Companies.

6. What are the notable trends driving market growth?

Inhalation Segment is Expected to Grow Over the Forecast Period.

7. Are there any restraints impacting market growth?

Side Effects of General Anesthetics; Regulatory Issues.

8. Can you provide examples of recent developments in the market?

September 2022: Harrow, an eyecare pharmaceutical company exclusively focused on the discovery, development, and commercialization of innovative ophthalmic therapies, and Sintetica, S.A., a growing pharmaceutical company focused on analgesics, local anesthetics, and sterile injectable solutions, jointly received the U.S. Food and Drug Administration's (FDA) approval of IHEEZO (chloroprocaine hydrochloride ophthalmic gel) at 3% for ocular surface anesthesia. IHEEZO is a sterile, single-patient-use, physician-administered ophthalmic gel preparation containing no preservatives that is safe and effective for ocular surface anesthesia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Anesthesia Drugs Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Anesthesia Drugs Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Anesthesia Drugs Market?

To stay informed about further developments, trends, and reports in the North America Anesthesia Drugs Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence