Key Insights

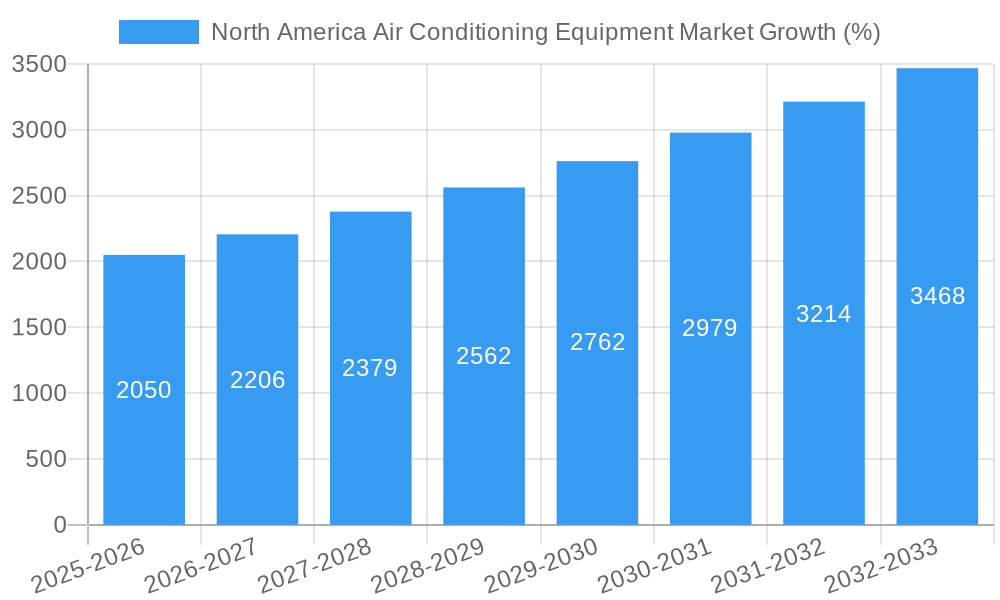

The North American air conditioning equipment market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by several key factors. Rising temperatures due to climate change are increasing the demand for residential and commercial air conditioning systems across the United States and Canada. Furthermore, stringent energy efficiency regulations, such as the minimum SEER (Seasonal Energy Efficiency Ratio) requirements, are pushing the adoption of high-efficiency units, stimulating market expansion. Growth is particularly strong in the segment of high-efficiency air conditioners (greater than 13 SEER), reflecting a consumer shift towards energy-saving and environmentally conscious options. The commercial and industrial sectors are also significant contributors, with ongoing construction and renovation projects fueling demand for larger-scale HVAC systems like chillers and packaged units. While economic downturns might temporarily constrain growth, the long-term outlook remains positive, supported by the sustained need for climate control and continuous technological advancements in the sector.

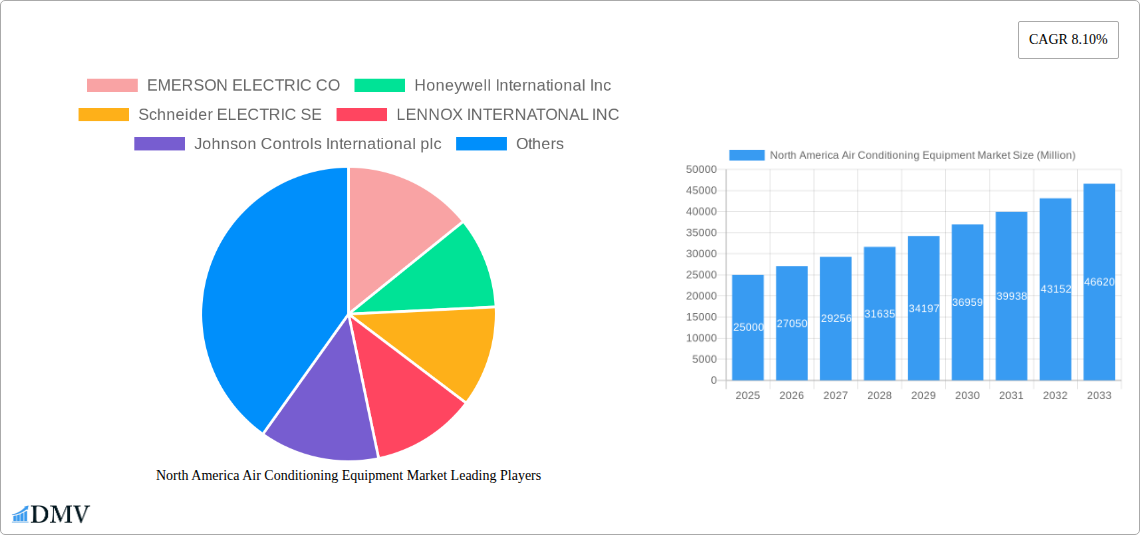

Market segmentation reveals significant opportunities within specific areas. The residential sector remains the largest segment, driven by rising disposable incomes and increasing housing construction. However, the commercial and industrial segments are poised for accelerated growth, driven by the increasing need for efficient climate control in large buildings and industrial facilities. The geographical distribution shows the United States as the dominant market, followed by Canada. Mexico, although a smaller contributor, exhibits considerable growth potential due to urbanization and rising living standards. Key players, such as Emerson Electric, Honeywell, and Johnson Controls, are leveraging their established brand presence and technological expertise to maintain market share, while emerging players are focusing on innovation and cost-effective solutions to gain traction. Competition is intense, driving innovation and price reductions, benefiting consumers and ultimately propelling the market’s expansion. The forecast period of 2025-2033 anticipates sustained growth, propelled by the aforementioned factors, projecting a significant increase in market value.

North America Air Conditioning Equipment Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the North America air conditioning equipment market, encompassing historical data (2019-2024), current estimates (2025), and future forecasts (2025-2033). It delves into market segmentation by type (unitary air conditioners, indoor packaged & roof tops, room air conditioners, packaged terminal air conditioners, chillers), end-user (residential, commercial & industrial), country (United States, Canada), and efficiency (low efficiency (≤13 SEER), high efficiency (>13 SEER)), offering a granular understanding of this dynamic industry. The report identifies key players, analyzes market trends, and forecasts future growth, providing valuable insights for stakeholders across the value chain.

North America Air Conditioning Equipment Market Composition & Trends

The North America air conditioning equipment market is characterized by a moderately concentrated landscape with key players holding significant market share. While precise market share distribution for 2025 requires detailed analysis within the full report, we predict EMERSON ELECTRIC CO, Honeywell International Inc, and Carrier GLOBAL corporation to hold leading positions. Innovation is driven by the increasing demand for energy-efficient solutions, stringent government regulations promoting higher SEER ratings, and the integration of smart technologies. The market is witnessing significant M&A activity, with deal values exceeding xx Million in the past five years, reflecting consolidation and expansion strategies by leading players. Substitute products, such as evaporative coolers, present niche competition, particularly in specific climatic regions. The end-user profile is diverse, encompassing residential, commercial, and industrial sectors, each with distinct needs and preferences.

- Market Concentration: Moderately concentrated, with top 5 players controlling approximately xx% of the market (2025 estimate).

- Innovation Catalysts: Stringent energy efficiency standards, increasing demand for smart HVAC systems, and advancements in refrigerant technology.

- Regulatory Landscape: Stringent regulations regarding refrigerants and energy efficiency are shaping market dynamics and driving innovation.

- Substitute Products: Evaporative coolers and natural ventilation systems pose limited competition.

- End-User Profiles: Residential users prioritize cost-effectiveness and ease of use, while commercial and industrial users focus on energy efficiency and system reliability.

- M&A Activities: Significant consolidation through mergers and acquisitions, with deal values totaling xx Million (2019-2024).

North America Air Conditioning Equipment Market Industry Evolution

The North America air conditioning equipment market has witnessed consistent growth over the historical period (2019-2024), driven by rising disposable incomes, increasing urbanization, and a growing awareness of indoor air quality. The market experienced a compound annual growth rate (CAGR) of xx% during this period. Technological advancements, particularly in inverter technology, variable refrigerant flow (VRF) systems, and smart home integration, have significantly improved energy efficiency and user experience. Shifting consumer demands towards eco-friendly and energy-efficient solutions are shaping product development strategies. The forecast period (2025-2033) is expected to see continued growth, propelled by factors such as increasing adoption of smart HVAC systems, rising government investments in green building initiatives, and ongoing improvements in air conditioning technology, resulting in a predicted CAGR of xx%. The market is expected to reach a value of xx Million by 2033.

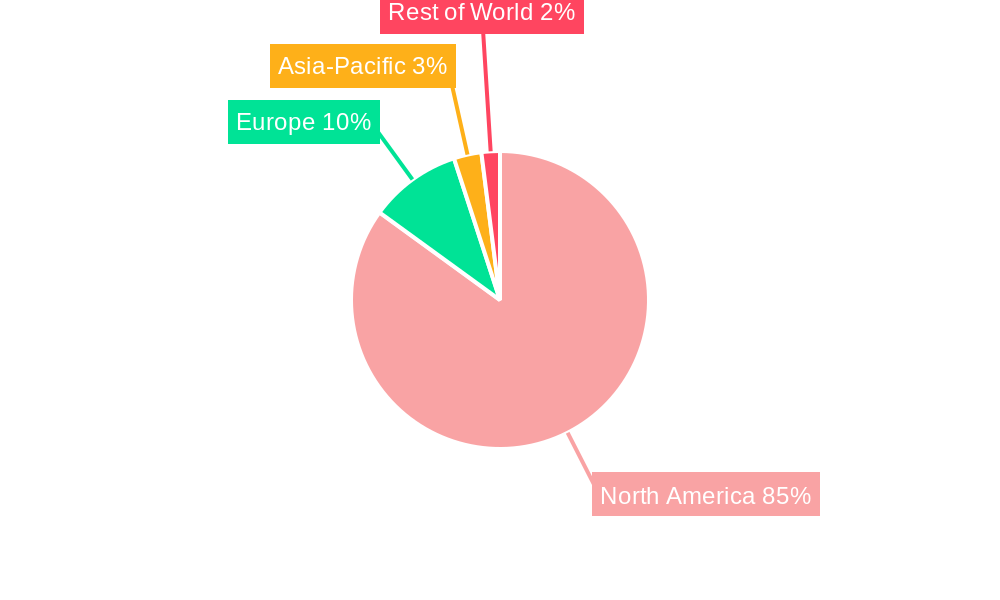

Leading Regions, Countries, or Segments in North America Air Conditioning Equipment Market

The United States dominates the North America air conditioning equipment market, accounting for approximately xx% of the total market value in 2025. This dominance stems from several factors:

- High Residential Penetration: High rates of homeownership and preference for air conditioning in most regions.

- Significant Commercial & Industrial Presence: Large-scale commercial buildings and industrial facilities drive substantial demand.

- Strong Government Support: Incentives for energy-efficient systems and building codes promoting higher energy standards.

Canada, while smaller, exhibits notable growth driven by increasing demand in its urban centers and government initiatives promoting energy efficiency. Within segments, the room air conditioner segment holds the largest market share, followed closely by unitary air conditioners. The high-efficiency segment (>13 SEER) is experiencing faster growth compared to the low-efficiency segment due to stricter energy efficiency regulations and increasing consumer preference for energy savings.

- Key Drivers (US): High residential penetration, large commercial and industrial sectors, and government support for energy-efficient technologies.

- Key Drivers (Canada): Urbanization, rising disposable incomes, and government incentives for energy efficiency.

- Dominant Segment (by type): Room Air Conditioners, driven by high residential demand.

- Dominant Segment (by efficiency): High-efficiency (>13 SEER) systems, due to regulatory mandates and consumer preferences.

North America Air Conditioning Equipment Market Product Innovations

Recent innovations focus on improving energy efficiency, enhancing smart home integration, and reducing environmental impact. This includes the development of variable-speed compressors, smart thermostats with advanced learning algorithms, and the use of eco-friendly refrigerants with lower global warming potential. Manufacturers are also emphasizing quieter operation, improved air filtration capabilities, and enhanced durability. Unique selling propositions (USPs) increasingly center around energy savings, smart features, and ease of installation and maintenance. The integration of IoT technologies allows for remote monitoring, diagnostics, and control, optimizing energy consumption and system performance.

Propelling Factors for North America Air Conditioning Equipment Market Growth

Several factors are driving market growth:

- Stringent Energy Efficiency Regulations: Government mandates for higher SEER ratings are pushing the adoption of energy-efficient technologies.

- Technological Advancements: Innovations in compressor technology, refrigerant development, and smart home integration are enhancing system efficiency and user experience.

- Rising Disposable Incomes: Increased purchasing power fuels demand for higher-end, energy-efficient systems, particularly in residential sectors.

- Climate Change: Rising temperatures in many regions are increasing the demand for air conditioning.

Obstacles in the North America Air Conditioning Equipment Market

Challenges hindering market growth include:

- Supply Chain Disruptions: Global supply chain bottlenecks and material shortages can impact production and availability.

- Fluctuating Raw Material Prices: Increases in the cost of raw materials, such as copper and aluminum, can impact manufacturing costs.

- Intense Competition: The market is characterized by intense competition among established players and emerging entrants.

- High Initial Investment Costs: The upfront cost of installing high-efficiency systems can be a barrier for some consumers.

Future Opportunities in North America Air Conditioning Equipment Market

Future opportunities include:

- Growing Demand for Smart HVAC Systems: The integration of smart technologies and IoT capabilities offers significant opportunities for growth.

- Expansion into Underserved Markets: There is potential for growth in underserved rural communities and regions with limited air conditioning penetration.

- Development of Sustainable Solutions: The demand for environmentally friendly refrigerants and energy-efficient technologies will drive innovation.

- Growth of the Commercial and Industrial Sectors: Large-scale projects and expansion in these sectors present substantial opportunities.

Major Players in the North America Air Conditioning Equipment Market Ecosystem

- EMERSON ELECTRIC CO

- Honeywell International Inc

- Schneider ELECTRIC SE

- LENNOX INTERNATONAL INC

- Johnson Controls International plc

- whirlpool corporation

- ROBERT BOSCH GMBH

- RHEEM MANUFACTURING COMPANY

- DAIKIN INDUSTRIES LTD

- Trane technologies plc (ingersol-rand plc)

- LG ELECTRONICS INC

- Carrier GLOBAL corporation (UNITED TECHNOLOGIES corporation)

- GE APPLIANCES

- ELECTROLUX AB

- Nortek AIR MANAGEMENT (Melrose industries plc)

Key Developments in North America Air Conditioning Equipment Industry

- May 2022: EcoFlow launched the EcoFlow Wave Portable Air Conditioner, offering 8 hours of runtime, flexible charging, and rapid cooling capabilities. This launch signifies a growing market for portable and energy-efficient air conditioning solutions targeting smaller spaces.

Strategic North America Air Conditioning Equipment Market Forecast

The North America air conditioning equipment market is poised for sustained growth over the forecast period (2025-2033), driven by technological advancements, increasing energy efficiency standards, and rising consumer demand for sustainable and smart solutions. Opportunities exist in expanding smart home integration, developing innovative refrigerants, and penetrating underserved markets. The market's continued expansion will be fueled by both the residential and commercial sectors, with a strong emphasis on energy-efficient and eco-friendly technologies. The focus on reducing carbon footprint and improving indoor air quality will be pivotal in shaping market dynamics in the coming years.

North America Air Conditioning Equipment Market Segmentation

-

1. Type

-

1.1. Unitary Air Conditioners

- 1.1.1. Ducted Splits

- 1.1.2. Ductless Mini-splits

- 1.1.3. Indoor Packaged and Roof Tops

- 1.2. Room Air Conditioners

- 1.3. Packaged Terminal Air Conditioners

- 1.4. Chillers

- 1.5. Variable Refrigerant Flow (VRF)

-

1.1. Unitary Air Conditioners

-

2. End User

- 2.1. Residential

- 2.2. Commercial and Industrial

-

3. Efficiency

- 3.1. Low Efficiency (13 SEER)

- 3.2. High Efficiency (>13 SEER)

North America Air Conditioning Equipment Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Air Conditioning Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Replacement of Existing Equipment with Better Performing Ones and Reinstating of Tax Credits for Heat Pumps

- 3.3. Market Restrains

- 3.3.1. High Initial Costs; Growing Competition to Limit Margin

- 3.4. Market Trends

- 3.4.1. United states is expected to hold significant demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Air Conditioning Equipment Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Unitary Air Conditioners

- 5.1.1.1. Ducted Splits

- 5.1.1.2. Ductless Mini-splits

- 5.1.1.3. Indoor Packaged and Roof Tops

- 5.1.2. Room Air Conditioners

- 5.1.3. Packaged Terminal Air Conditioners

- 5.1.4. Chillers

- 5.1.5. Variable Refrigerant Flow (VRF)

- 5.1.1. Unitary Air Conditioners

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Commercial and Industrial

- 5.3. Market Analysis, Insights and Forecast - by Efficiency

- 5.3.1. Low Efficiency (13 SEER)

- 5.3.2. High Efficiency (>13 SEER)

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Air Conditioning Equipment Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Air Conditioning Equipment Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Air Conditioning Equipment Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Air Conditioning Equipment Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 EMERSON ELECTRIC CO

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Honeywell International Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Schneider ELECTRIC SE

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 LENNOX INTERNATONAL INC

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Johnson Controls International plc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 whirlpool corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 ROBERT BOSCH GMBH

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 RHEEM MANUFACTURING COMPANY

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 DAIKIN INDUSTRIES LTD

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Trane technologies plc (ingersol-rand plc)

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 LG ELECTRONICS INC

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Carrier GLOBAL corporation (UNITED TECHNOLOGIES corporation)

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 GE APPLIANCES

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 ELECTROLUX AB

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Nortek AIR MANAGEMENT (Melrose industries plc) -

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.1 EMERSON ELECTRIC CO

List of Figures

- Figure 1: North America Air Conditioning Equipment Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Air Conditioning Equipment Market Share (%) by Company 2024

List of Tables

- Table 1: North America Air Conditioning Equipment Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Air Conditioning Equipment Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: North America Air Conditioning Equipment Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: North America Air Conditioning Equipment Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 5: North America Air Conditioning Equipment Market Revenue Million Forecast, by End User 2019 & 2032

- Table 6: North America Air Conditioning Equipment Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 7: North America Air Conditioning Equipment Market Revenue Million Forecast, by Efficiency 2019 & 2032

- Table 8: North America Air Conditioning Equipment Market Volume K Unit Forecast, by Efficiency 2019 & 2032

- Table 9: North America Air Conditioning Equipment Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: North America Air Conditioning Equipment Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: North America Air Conditioning Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: North America Air Conditioning Equipment Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: United States North America Air Conditioning Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United States North America Air Conditioning Equipment Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Canada North America Air Conditioning Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Air Conditioning Equipment Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Air Conditioning Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico North America Air Conditioning Equipment Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Rest of North America North America Air Conditioning Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of North America North America Air Conditioning Equipment Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: North America Air Conditioning Equipment Market Revenue Million Forecast, by Type 2019 & 2032

- Table 22: North America Air Conditioning Equipment Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 23: North America Air Conditioning Equipment Market Revenue Million Forecast, by End User 2019 & 2032

- Table 24: North America Air Conditioning Equipment Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 25: North America Air Conditioning Equipment Market Revenue Million Forecast, by Efficiency 2019 & 2032

- Table 26: North America Air Conditioning Equipment Market Volume K Unit Forecast, by Efficiency 2019 & 2032

- Table 27: North America Air Conditioning Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: North America Air Conditioning Equipment Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 29: United States North America Air Conditioning Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: United States North America Air Conditioning Equipment Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 31: Canada North America Air Conditioning Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Canada North America Air Conditioning Equipment Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 33: Mexico North America Air Conditioning Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Mexico North America Air Conditioning Equipment Market Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Air Conditioning Equipment Market?

The projected CAGR is approximately 8.10%.

2. Which companies are prominent players in the North America Air Conditioning Equipment Market?

Key companies in the market include EMERSON ELECTRIC CO, Honeywell International Inc, Schneider ELECTRIC SE, LENNOX INTERNATONAL INC, Johnson Controls International plc, whirlpool corporation, ROBERT BOSCH GMBH, RHEEM MANUFACTURING COMPANY, DAIKIN INDUSTRIES LTD, Trane technologies plc (ingersol-rand plc), LG ELECTRONICS INC, Carrier GLOBAL corporation (UNITED TECHNOLOGIES corporation), GE APPLIANCES, ELECTROLUX AB, Nortek AIR MANAGEMENT (Melrose industries plc) -.

3. What are the main segments of the North America Air Conditioning Equipment Market?

The market segments include Type, End User, Efficiency.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Replacement of Existing Equipment with Better Performing Ones and Reinstating of Tax Credits for Heat Pumps.

6. What are the notable trends driving market growth?

United states is expected to hold significant demand.

7. Are there any restraints impacting market growth?

High Initial Costs; Growing Competition to Limit Margin.

8. Can you provide examples of recent developments in the market?

In May 2022 - EcoFlow launched EcoFlow Wave Portable Air Conditioners that offers 8 hours of runtime and flexible charging methods designed under the budget of 40 pounds making it ideal for cabins, small apartments and RVs. Additionaly, EcoFlow Wave requires eight minutes to lower the temprature in an 86ft² (8m²) space from 84 to 75 (30 to 24).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Air Conditioning Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Air Conditioning Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Air Conditioning Equipment Market?

To stay informed about further developments, trends, and reports in the North America Air Conditioning Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence