Key Insights

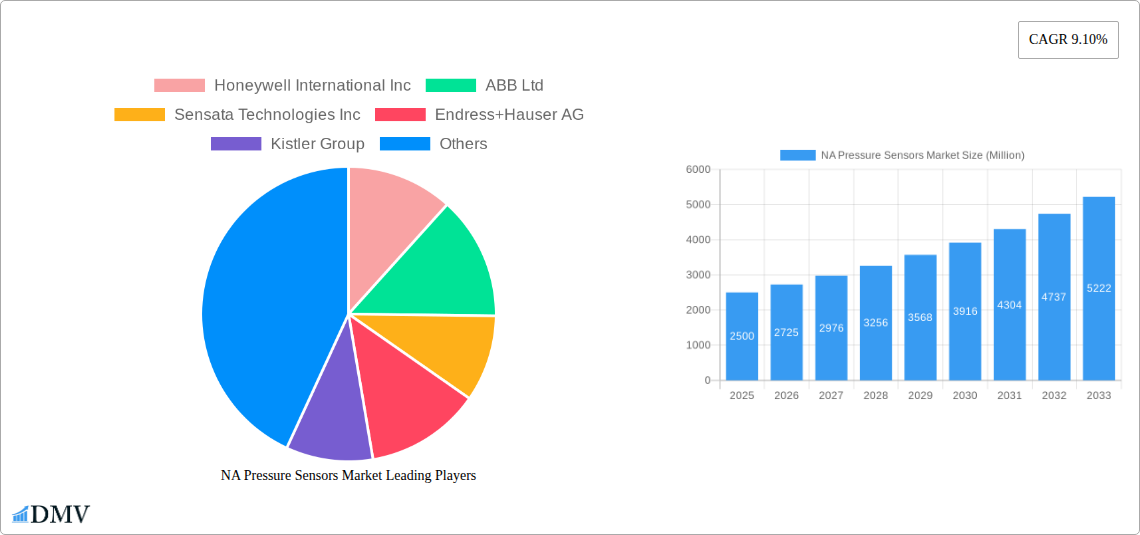

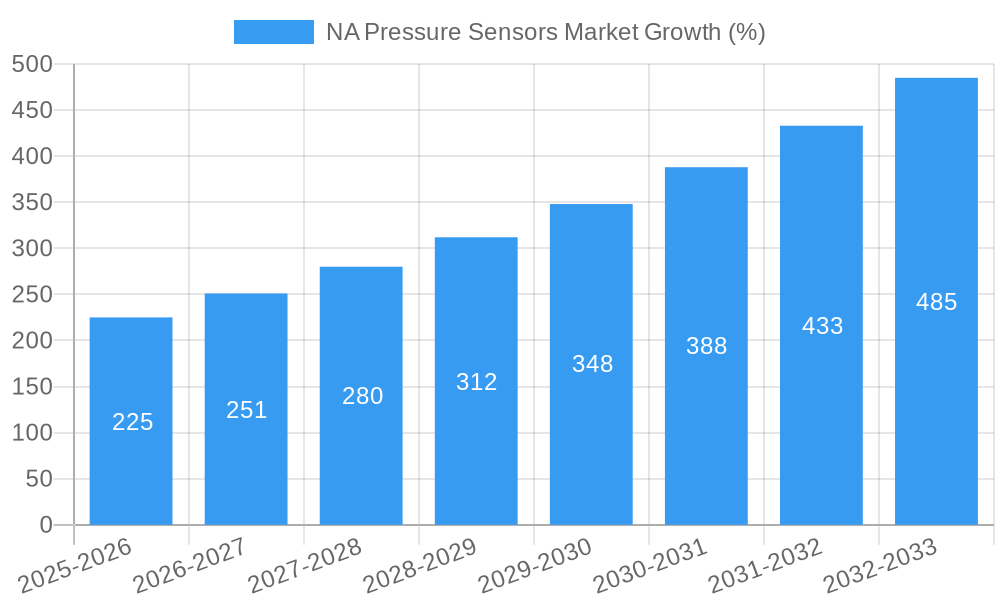

The North American pressure sensor market is experiencing robust growth, driven by increasing automation across various sectors and the proliferation of smart devices. The market's Compound Annual Growth Rate (CAGR) of 9.10% from 2019 to 2024 suggests a significant expansion, projected to continue through 2033. Key application areas, such as automotive (tire pressure monitoring systems, fuel injection, and brake systems), medical devices (blood pressure monitors, ventilators), and industrial automation, are fueling this demand. The automotive segment is particularly significant, with the rising adoption of advanced driver-assistance systems (ADAS) and electric vehicles (EVs) leading to a surge in pressure sensor integration. Furthermore, the growing need for precise pressure measurements in medical applications, coupled with increasing consumer electronics integration (smartwatches, fitness trackers), contributes to overall market expansion. While a precise market size for 2025 is not available, considering the provided CAGR and a hypothetical 2024 market size (derived through backward calculation based on the 9.1% CAGR from the historical period), a reasonable estimation can be made for 2025's market value in North America. This figure would serve as a foundation for estimating subsequent year's values based on the projected CAGR. Challenges such as stringent regulatory requirements and high initial investment costs for advanced sensor technologies could potentially restrain market growth, but overall, the long-term outlook for the North American pressure sensor market remains positive.

The competitive landscape is marked by the presence of both established industry giants like Honeywell, ABB, and Sensata Technologies, and specialized sensor manufacturers. These companies continuously invest in research and development to improve sensor accuracy, reliability, and miniaturization. The focus is shifting towards the development of smart sensors with enhanced data processing capabilities and improved connectivity, leveraging the Internet of Things (IoT) for data analytics and predictive maintenance. Innovation in materials science is also impacting the market, leading to the creation of pressure sensors with better performance characteristics and extended lifespans. North America's well-established industrial base and strong technological infrastructure provide a fertile ground for the growth and adoption of advanced pressure sensing technologies, further underpinning the market's optimistic trajectory.

North America Pressure Sensors Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a comprehensive analysis of the North America pressure sensors market, offering crucial data and forecasts for stakeholders seeking to understand this dynamic industry. From market size and segmentation to key players and future trends, this report offers a complete overview of the NA pressure sensor landscape, covering the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of xx%.

NA Pressure Sensors Market Composition & Trends

The North American pressure sensors market exhibits a moderately concentrated structure, with key players like Honeywell International Inc, ABB Ltd, Sensata Technologies Inc, and Endress+Hauser AG holding significant market share. However, the presence of several smaller, specialized firms fosters innovation and competition. The market is driven by technological advancements, particularly in areas like miniaturization, improved accuracy, and increased integration with smart systems. Stringent regulatory compliance standards, particularly within the automotive and medical sectors, significantly influence product design and market entry. Substitute products, such as optical sensors, pose a moderate threat, although pressure sensors remain dominant due to their reliability and established cost-effectiveness. End-user profiles span a wide range, including automotive, medical, consumer electronics, industrial, aerospace & defense, food & beverage, and HVAC sectors. M&A activity within the sector has been moderate, with deal values ranging from xx Million to xx Million in recent years, primarily focused on enhancing technological capabilities and expanding market reach. Market share distribution is dynamic, with larger players leveraging their brand recognition and economies of scale while smaller players focus on niche applications and innovative technologies.

- Market Concentration: Moderately concentrated, with top players holding significant shares.

- Innovation Catalysts: Technological advancements, particularly in miniaturization and smart integration.

- Regulatory Landscape: Stringent standards impacting product design and market entry.

- Substitute Products: Moderate threat from optical sensors.

- End-User Profiles: Diverse, spanning automotive, medical, industrial, and consumer sectors.

- M&A Activity: Moderate activity, with deal values ranging from xx Million to xx Million.

NA Pressure Sensors Market Industry Evolution

The North American pressure sensors market has witnessed substantial growth throughout the historical period (2019-2024), driven primarily by increasing demand across diverse sectors. The automotive industry remains the dominant driver, spurred by the growing adoption of advanced driver-assistance systems (ADAS) and stricter emission regulations. Medical applications are rapidly expanding, fueled by advancements in minimally invasive surgery, remote patient monitoring, and the rising prevalence of chronic diseases requiring continuous pressure monitoring. Technological advancements, including the development of MEMS (Microelectromechanical Systems) sensors, have significantly improved sensor accuracy, reliability, and cost-effectiveness, leading to wider adoption across various applications. Consumer electronics integration continues to grow, with pressure sensors becoming integral to smartphones, wearables, and other smart devices. Market growth trajectories have been influenced by economic fluctuations and technological disruptions, with periods of faster growth followed by periods of consolidation. Adoption rates are higher in developed regions like the United States and Canada, reflecting higher disposable income and technological maturity. The overall growth rate during the historical period (2019-2024) was approximately xx%, with projections suggesting continued growth but at a slightly moderated pace in the forecast period (2025-2033). Shifting consumer demands for smaller, more energy-efficient, and more accurate sensors are driving innovation and influencing market dynamics.

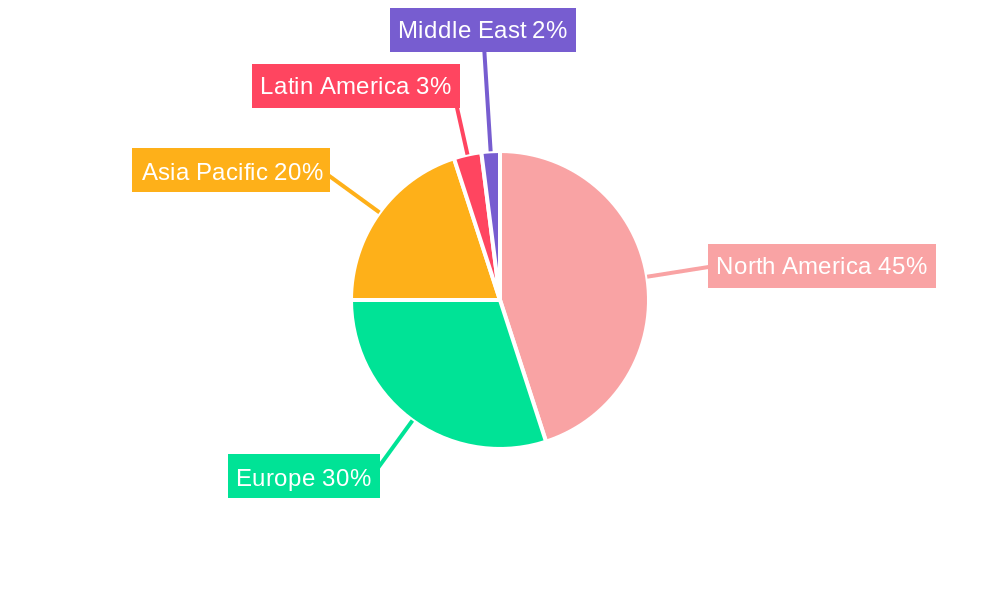

Leading Regions, Countries, or Segments in NA Pressure Sensors Market

The United States dominates the North American pressure sensors market, driven by strong automotive manufacturing, robust medical device development, and a large consumer electronics market. Canada follows as a significant contributor, particularly in the industrial and energy sectors.

- United States: Strong automotive manufacturing, extensive medical device development, large consumer electronics market.

- Canada: Significant contributor, particularly in industrial and energy sectors.

Within application segments, the automotive sector holds the largest market share, driven by escalating demand for tire pressure monitoring systems (TPMS), brake pressure sensors, and other crucial safety features. The medical segment demonstrates substantial growth potential due to increasing demand for advanced medical devices and remote patient monitoring solutions.

- Automotive: Dominates due to TPMS, brake pressure sensors, and safety features. High growth in advanced driver assistance systems (ADAS).

- Medical: Significant growth due to demand for advanced medical devices and remote patient monitoring. Continuous Positive Airway Pressure (CPAP) devices are a key application.

- Industrial: Steady growth driven by automation and process control needs.

- Other applications: Consumer electronics, Aerospace and Defense, Food and Beverage, HVAC also show consistent growth, driven by various factors including smart home technology and increased safety regulations.

NA Pressure Sensors Market Product Innovations

Recent product innovations have focused on miniaturization, enhanced accuracy, and increased integration capabilities. MEMS-based sensors are gaining prominence due to their cost-effectiveness and suitability for integration into various applications. Advanced features, such as digital output, integrated signal conditioning, and enhanced temperature compensation, are increasingly sought after. The development of smart sensors, capable of self-diagnosis and remote monitoring, is transforming the industry, offering potential for predictive maintenance and optimized system performance. Unique selling propositions often center on higher accuracy, extended operational life, and improved resistance to harsh environmental conditions.

Propelling Factors for NA Pressure Sensors Market Growth

Technological advancements, including the development of highly accurate and miniaturized sensors, drive market growth. Stringent regulatory standards, especially in the automotive and medical industries, mandate the use of reliable pressure sensors for safety and performance. The increasing adoption of advanced driver-assistance systems (ADAS) fuels demand within the automotive sector. Growth in the medical sector is spurred by the rising prevalence of chronic diseases requiring continuous pressure monitoring and advancements in minimally invasive surgical procedures. Economic factors, such as investments in infrastructure and manufacturing, also contribute to market expansion.

Obstacles in the NA Pressure Sensors Market

Supply chain disruptions can lead to production delays and increased costs. Intense competition from established players and emerging entrants puts pressure on pricing and profit margins. The development of alternative technologies, such as optical sensors, poses a moderate threat to the market share of traditional pressure sensors. Regulatory hurdles and compliance requirements can increase the cost and complexity of product development and market entry. The global chip shortage experienced in recent years has also impacted production volumes.

Future Opportunities in NA Pressure Sensors Market

The integration of pressure sensors with Internet of Things (IoT) devices presents significant growth opportunities. Advancements in artificial intelligence (AI) and machine learning (ML) enable the development of smart sensors for predictive maintenance and improved system performance. Expansion into emerging markets with growing healthcare and industrial sectors will offer new revenue streams. The development of more energy-efficient, durable, and smaller sensors will cater to the increasing demand for miniaturization in various applications.

Major Players in the NA Pressure Sensors Market Ecosystem

- Honeywell International Inc

- ABB Ltd

- Sensata Technologies Inc

- Endress+Hauser AG

- Kistler Group

- Bosch Sensortec GmbH

- Siemens AG

- Yokogawa Corporation

- Invensys Ltd

- Rockwell Automation Inc

- All Sensors Corporation

- GMS Instruments BV

- Rosemount Inc (Emerson Electric Company)

Key Developments in NA Pressure Sensors Market Industry

- March 2021: Frost and Sullivan recognizes XSENSOR Technology Corporation with the 2021 North America Technology Innovation Leadership Award for its Intelligent Dynamic Sensing platform. This highlights the increasing focus on advanced sensing technologies and AI-powered analysis within the market.

Strategic NA Pressure Sensors Market Forecast

The North American pressure sensors market is poised for sustained growth, driven by technological advancements, increasing demand across diverse sectors, and the integration of sensors into IoT and smart systems. The continued development of high-precision, miniaturized sensors and the expansion into new applications, such as wearable healthcare monitoring, will shape market dynamics in the coming years. The market's potential is significant, with considerable growth opportunities across various segments and geographic locations. The forecast period (2025-2033) anticipates robust growth, propelled by technological innovation and expanding application areas, paving the way for considerable market expansion.

NA Pressure Sensors Market Segmentation

-

1. Application

- 1.1. Automotive

- 1.2. Medical

- 1.3. Consumer Electronics

- 1.4. Industrial

- 1.5. Aerospace and Defence

- 1.6. Food and Beverage

- 1.7. HVAC

-

2. Pressure Sensor Type

- 2.1. Analog Pressure Sensors

- 2.2. Digital Pressure Sensors

- 2.3. Programmable Pressure Sensors

-

3. Pressure Range

- 3.1. Low Pressure Sensors (0-100 psi)

- 3.2. Medium Pressure Sensors (100-1000 psi)

- 3.3. High Pressure Sensors (>1000 psi)

NA Pressure Sensors Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

NA Pressure Sensors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growth Of End-user Verticals

- 3.2.2 such as Automotive and Healthcare; Increasing Adoption of MEMS and NEMS Systems in the Industry

- 3.3. Market Restrains

- 3.3.1. High Costs Associated with Sensing Products

- 3.4. Market Trends

- 3.4.1. Automotive Industry to Show Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global NA Pressure Sensors Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Automotive

- 5.1.2. Medical

- 5.1.3. Consumer Electronics

- 5.1.4. Industrial

- 5.1.5. Aerospace and Defence

- 5.1.6. Food and Beverage

- 5.1.7. HVAC

- 5.2. Market Analysis, Insights and Forecast - by Pressure Sensor Type

- 5.2.1. Analog Pressure Sensors

- 5.2.2. Digital Pressure Sensors

- 5.2.3. Programmable Pressure Sensors

- 5.3. Market Analysis, Insights and Forecast - by Pressure Range

- 5.3.1. Low Pressure Sensors (0-100 psi)

- 5.3.2. Medium Pressure Sensors (100-1000 psi)

- 5.3.3. High Pressure Sensors (>1000 psi)

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America NA Pressure Sensors Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Europe NA Pressure Sensors Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Asia Pacific NA Pressure Sensors Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Latin America NA Pressure Sensors Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Middle East NA Pressure Sensors Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ABB Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sensata Technologies Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Endress+Hauser AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kistler Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Bosch Sensortec GmbH

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Siemens AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Yokogawa Corporation*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Invensys Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Rockwell Automation Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 All Sensors Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 GMS Instruments BV

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Rosemount Inc (Emerson Electric Company)

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global NA Pressure Sensors Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America NA Pressure Sensors Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America NA Pressure Sensors Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe NA Pressure Sensors Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe NA Pressure Sensors Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific NA Pressure Sensors Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific NA Pressure Sensors Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America NA Pressure Sensors Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America NA Pressure Sensors Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East NA Pressure Sensors Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East NA Pressure Sensors Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America NA Pressure Sensors Market Revenue (Million), by Application 2024 & 2032

- Figure 13: North America NA Pressure Sensors Market Revenue Share (%), by Application 2024 & 2032

- Figure 14: North America NA Pressure Sensors Market Revenue (Million), by Pressure Sensor Type 2024 & 2032

- Figure 15: North America NA Pressure Sensors Market Revenue Share (%), by Pressure Sensor Type 2024 & 2032

- Figure 16: North America NA Pressure Sensors Market Revenue (Million), by Pressure Range 2024 & 2032

- Figure 17: North America NA Pressure Sensors Market Revenue Share (%), by Pressure Range 2024 & 2032

- Figure 18: North America NA Pressure Sensors Market Revenue (Million), by Country 2024 & 2032

- Figure 19: North America NA Pressure Sensors Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global NA Pressure Sensors Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global NA Pressure Sensors Market Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Global NA Pressure Sensors Market Revenue Million Forecast, by Pressure Sensor Type 2019 & 2032

- Table 4: Global NA Pressure Sensors Market Revenue Million Forecast, by Pressure Range 2019 & 2032

- Table 5: Global NA Pressure Sensors Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global NA Pressure Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: NA Pressure Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global NA Pressure Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: NA Pressure Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global NA Pressure Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: NA Pressure Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global NA Pressure Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: NA Pressure Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global NA Pressure Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: NA Pressure Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global NA Pressure Sensors Market Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Global NA Pressure Sensors Market Revenue Million Forecast, by Pressure Sensor Type 2019 & 2032

- Table 18: Global NA Pressure Sensors Market Revenue Million Forecast, by Pressure Range 2019 & 2032

- Table 19: Global NA Pressure Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: United States NA Pressure Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Canada NA Pressure Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Mexico NA Pressure Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the NA Pressure Sensors Market?

The projected CAGR is approximately 9.10%.

2. Which companies are prominent players in the NA Pressure Sensors Market?

Key companies in the market include Honeywell International Inc, ABB Ltd, Sensata Technologies Inc, Endress+Hauser AG, Kistler Group, Bosch Sensortec GmbH, Siemens AG, Yokogawa Corporation*List Not Exhaustive, Invensys Ltd, Rockwell Automation Inc, All Sensors Corporation, GMS Instruments BV, Rosemount Inc (Emerson Electric Company).

3. What are the main segments of the NA Pressure Sensors Market?

The market segments include Application, Pressure Sensor Type, Pressure Range.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growth Of End-user Verticals. such as Automotive and Healthcare; Increasing Adoption of MEMS and NEMS Systems in the Industry.

6. What are the notable trends driving market growth?

Automotive Industry to Show Significant Growth.

7. Are there any restraints impacting market growth?

High Costs Associated with Sensing Products.

8. Can you provide examples of recent developments in the market?

March 2021 - Frost and Sullivan recognize XSENSOR Technology Corporation with the 2021 North America Technology Innovation Leadership Award. Its Intelligent Dynamic Sensing platform enables precise measurements, high-quality visualizations, smart data, and artificial intelligence (AI)-powered analysis to optimize product performance, comfort, and safety. The patented technology employs high accuracy and reliability sensor elements to reveal the pressure distribution data between static and dynamic surfaces.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "NA Pressure Sensors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the NA Pressure Sensors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the NA Pressure Sensors Market?

To stay informed about further developments, trends, and reports in the NA Pressure Sensors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence