Key Insights

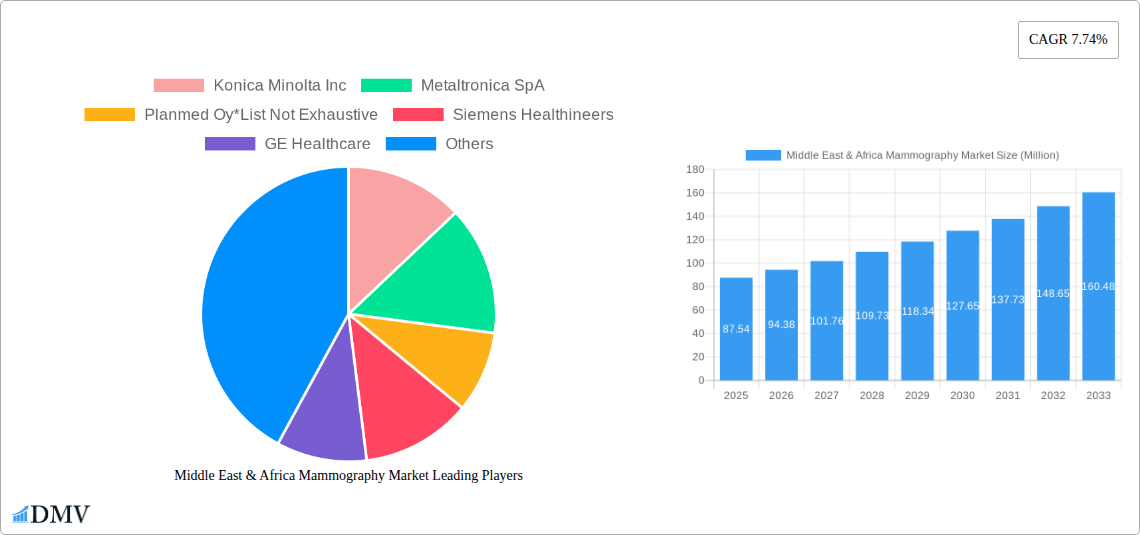

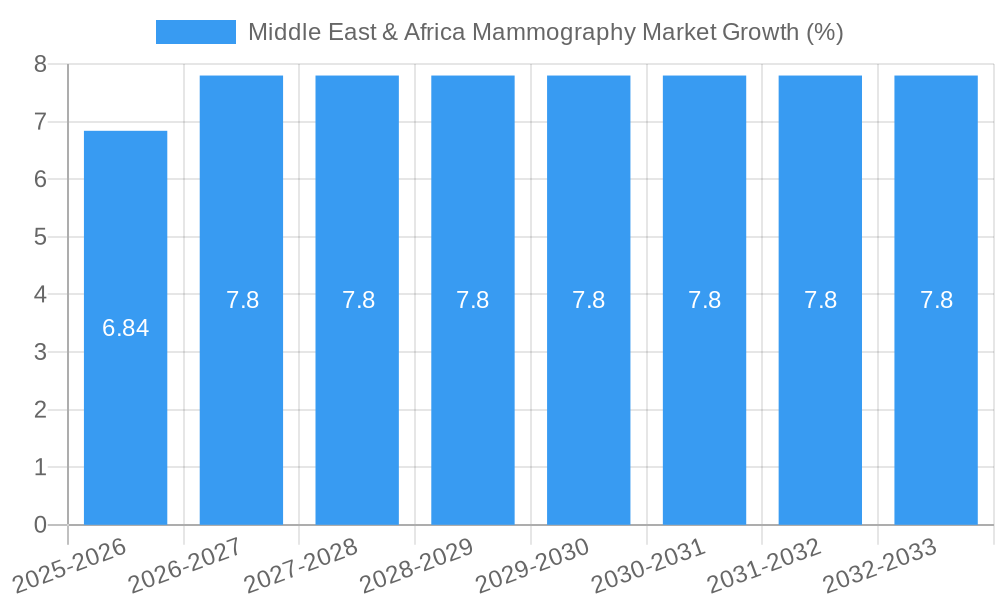

The Middle East & Africa mammography market, valued at $87.54 million in 2025, is projected to experience robust growth, driven by rising prevalence of breast cancer, increasing awareness about early detection, and expanding healthcare infrastructure across the region. The compound annual growth rate (CAGR) of 7.74% from 2025 to 2033 signifies a significant market expansion. Key growth drivers include increasing government initiatives promoting preventative healthcare, rising disposable incomes leading to greater access to advanced diagnostic technologies, and a growing number of specialized clinics and hospitals offering mammography services. The market is segmented by product type (digital systems, analog systems, breast tomosynthesis, film screen systems, and others) and end-users (hospitals, specialty clinics, and diagnostic centers). Digital mammography systems are expected to dominate the market due to their superior image quality, ease of use, and ability to facilitate faster diagnosis. While challenges exist, such as limited healthcare infrastructure in certain regions and high costs associated with advanced technologies, the overall market outlook remains positive, fueled by a growing need for accurate and timely breast cancer screening. The increasing adoption of tele-radiology and AI-powered diagnostic tools is further expected to contribute to market growth in the forecast period.

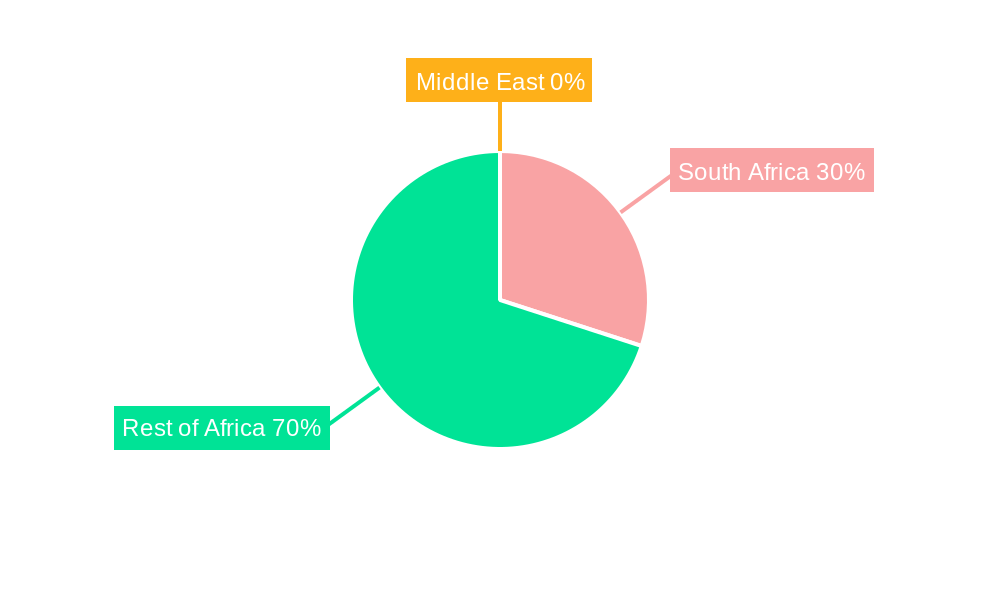

The market's segmentation by region highlights varying growth rates across the African continent. South Africa, with its relatively developed healthcare infrastructure, is expected to hold a significant market share. However, other regions within Africa (Sudan, Uganda, Tanzania, Kenya, and Rest of Africa) present significant untapped potential, particularly as healthcare access expands and awareness campaigns gain traction. Leading companies like Konica Minolta, Siemens Healthineers, GE Healthcare, Hologic, and Philips are actively participating in this market, either directly or through partnerships, competing to provide high-quality mammography systems and services. The market's growth trajectory suggests a substantial increase in the number of mammography screenings performed across the Middle East and Africa over the next decade.

Middle East & Africa Mammography Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Middle East & Africa Mammography Market, offering a comprehensive overview of its current state, future trajectory, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on this dynamic market. The total market value is predicted to reach xx Million by 2033.

Middle East & Africa Mammography Market Composition & Trends

The Middle East & Africa Mammography Market is characterized by a moderately concentrated landscape, with key players like Konica Minolta Inc, Siemens Healthineers, GE Healthcare, Hologic Inc, Koninklijke Philips NV, Fujifilm Holdings Corporation, and others vying for market share. Market concentration is further influenced by the varying levels of healthcare infrastructure development across the region. Innovation is driven by the need for improved diagnostic accuracy, reduced radiation exposure, and enhanced patient comfort. Regulatory landscapes vary across countries, impacting market access and product approvals. Substitute products, such as ultrasound, pose a degree of competition, while increasing awareness about breast cancer and improved healthcare investment fuel market growth. M&A activity within the market has been relatively moderate, with deal values averaging approximately xx Million in recent years. A significant portion of M&A activity has focused on enhancing technology portfolios and expanding regional presence.

- Market Share Distribution: The top 5 players account for approximately xx% of the market.

- M&A Deal Values (2019-2024): Averaged xx Million per deal.

- Key Growth Drivers: Increasing awareness of breast cancer, rising healthcare expenditure, and technological advancements.

- Challenges: Uneven healthcare infrastructure across the region, and regulatory complexities.

Middle East & Africa Mammography Market Industry Evolution

The Middle East & Africa Mammography Market has witnessed significant growth over the historical period (2019-2024), fueled by rising healthcare spending, increased breast cancer awareness campaigns, and technological advancements in mammography systems. The market experienced a Compound Annual Growth Rate (CAGR) of xx% during this period, with digital mammography systems witnessing the highest adoption rate. Technological advancements, such as digital breast tomosynthesis and AI-powered image analysis, are revolutionizing diagnostic accuracy and efficiency. Shifting consumer demands are reflected in the preference for minimally invasive procedures and faster diagnostic turnaround times. The forecast period (2025-2033) is projected to showcase continued growth, with a CAGR of xx%, driven by factors such as increasing investments in healthcare infrastructure, government initiatives to improve women's health, and the expansion of private healthcare providers. The increasing adoption of digital mammography systems is expected to further drive market expansion, with a projected adoption rate of xx% by 2033. Furthermore, the growing prevalence of breast cancer in the region is a key factor fueling market growth.

Leading Regions, Countries, or Segments in Middle East & Africa Mammography Market

The South Africa and UAE are presently the leading markets within the Middle East and Africa region, exhibiting the highest growth rates and adoption of advanced mammography technologies. This dominance is attributed to several factors:

- South Africa: Robust healthcare infrastructure, government support for cancer screening programs, and a relatively high prevalence of breast cancer.

- UAE: High healthcare spending, strong private sector involvement, and a focus on advanced medical technologies.

Key Drivers:

- Investment Trends: Significant investments in healthcare infrastructure and technology modernization.

- Regulatory Support: Government initiatives promoting breast cancer awareness and early detection.

By Product Type: Digital mammography systems constitute the largest segment, owing to their superior image quality, reduced radiation exposure, and ease of image storage and retrieval. This is closely followed by Breast Tomosynthesis, gaining traction due to its improved diagnostic capabilities.

By End Users: Hospitals and Diagnostic Centers represent the major end-user segment.

Middle East & Africa Mammography Market Product Innovations

Recent innovations include advanced digital mammography systems with improved image clarity and reduced radiation dose, along with AI-powered image analysis software that enhances diagnostic accuracy and efficiency. Breast tomosynthesis systems are gaining traction due to their 3D imaging capabilities, allowing for better detection of subtle lesions. These advancements offer unique selling propositions, such as improved diagnostic accuracy, reduced radiation exposure, and faster turnaround times, leading to enhanced patient care and workflow optimization within healthcare facilities.

Propelling Factors for Middle East & Africa Mammography Market Growth

The market's expansion is primarily driven by the increasing prevalence of breast cancer in the region, coupled with rising healthcare expenditure and government initiatives to improve healthcare infrastructure. Technological advancements such as digital mammography, tomosynthesis, and AI-driven diagnostic tools are significantly improving diagnostic accuracy and efficiency. Furthermore, increasing awareness campaigns focused on early detection and improved access to healthcare services are also contributing to this growth.

Obstacles in the Middle East & Africa Mammography Market Market

Challenges include uneven healthcare infrastructure across the region, particularly in rural areas, resulting in limited access to mammography services. Supply chain disruptions and high costs associated with advanced mammography equipment can also hinder market growth. Moreover, regulatory complexities and variations in reimbursement policies across countries pose additional barriers.

Future Opportunities in Middle East & Africa Mammography Market

Expanding into underserved rural regions presents significant growth opportunities. The adoption of telehealth technologies and AI-powered diagnostic tools holds the potential to increase access to mammography services in remote areas. Furthermore, technological advancements, such as AI-assisted image analysis, offer prospects for improved diagnostic accuracy and efficiency.

Major Players in the Middle East & Africa Mammography Market Ecosystem

- Konica Minolta Inc

- Metaltronica SpA

- Planmed Oy

- Siemens Healthineers

- GE Healthcare

- Hologic Inc

- Allengers

- Koninklijke Philips NV

- Canon Medical Systems Corporation

- Fujifilm Holdings Corporation

Key Developments in Middle East & Africa Mammography Market Industry

- October 2022: Premier Chupu Stanley Mathabatha and Health Minister Dr. Joe Phaahla launched Breast Cancer Awareness Month in South Africa, donating mammography equipment to ST Ritas Rural Hospital. This highlights government support for expanding access to screening.

- October 2022: The Pink Caravan campaign in the UAE provided free mammograms and screenings, increasing awareness and early detection rates, thereby driving demand for mammography services.

Strategic Middle East & Africa Mammography Market Forecast

The Middle East & Africa Mammography Market is poised for continued growth, driven by increasing healthcare investment, rising breast cancer prevalence, and technological advancements. The expansion into underserved markets and the adoption of innovative technologies will further fuel market expansion. The market's future potential remains substantial, offering significant opportunities for both established players and new entrants.

Middle East & Africa Mammography Market Segmentation

-

1. Product Type

- 1.1. Digital Systems

- 1.2. Analog Systems

- 1.3. Breast Tomosynthesis

- 1.4. Film Screen Systems

- 1.5. Other Product Types

-

2. End Users

- 2.1. Hospitals

- 2.2. Specialty Clinics

- 2.3. Diagnostic Centers

-

3. Geography

- 3.1. GCC

- 3.2. South Africa

- 3.3. Rest of Middle-East and Africa

Middle East & Africa Mammography Market Segmentation By Geography

- 1. GCC

- 2. South Africa

- 3. Rest of Middle East and Africa

Middle East & Africa Mammography Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.74% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Burden of Breast Cancer; Technological Advancements in the Field of Breast Imaging; Investment from Various Organizations in Breast Cancer Screening Campaigns

- 3.3. Market Restrains

- 3.3.1. Risk of Adverse Effects from Radiation Exposure Coupled with Lack of Reimbursement

- 3.4. Market Trends

- 3.4.1. Digital Mammography Segment is Expected to Hold a Significant Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East & Africa Mammography Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Digital Systems

- 5.1.2. Analog Systems

- 5.1.3. Breast Tomosynthesis

- 5.1.4. Film Screen Systems

- 5.1.5. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End Users

- 5.2.1. Hospitals

- 5.2.2. Specialty Clinics

- 5.2.3. Diagnostic Centers

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. GCC

- 5.3.2. South Africa

- 5.3.3. Rest of Middle-East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. GCC

- 5.4.2. South Africa

- 5.4.3. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. GCC Middle East & Africa Mammography Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Digital Systems

- 6.1.2. Analog Systems

- 6.1.3. Breast Tomosynthesis

- 6.1.4. Film Screen Systems

- 6.1.5. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by End Users

- 6.2.1. Hospitals

- 6.2.2. Specialty Clinics

- 6.2.3. Diagnostic Centers

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. GCC

- 6.3.2. South Africa

- 6.3.3. Rest of Middle-East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South Africa Middle East & Africa Mammography Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Digital Systems

- 7.1.2. Analog Systems

- 7.1.3. Breast Tomosynthesis

- 7.1.4. Film Screen Systems

- 7.1.5. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by End Users

- 7.2.1. Hospitals

- 7.2.2. Specialty Clinics

- 7.2.3. Diagnostic Centers

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. GCC

- 7.3.2. South Africa

- 7.3.3. Rest of Middle-East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Rest of Middle East and Africa Middle East & Africa Mammography Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Digital Systems

- 8.1.2. Analog Systems

- 8.1.3. Breast Tomosynthesis

- 8.1.4. Film Screen Systems

- 8.1.5. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by End Users

- 8.2.1. Hospitals

- 8.2.2. Specialty Clinics

- 8.2.3. Diagnostic Centers

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. GCC

- 8.3.2. South Africa

- 8.3.3. Rest of Middle-East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South Africa Middle East & Africa Mammography Market Analysis, Insights and Forecast, 2019-2031

- 10. Sudan Middle East & Africa Mammography Market Analysis, Insights and Forecast, 2019-2031

- 11. Uganda Middle East & Africa Mammography Market Analysis, Insights and Forecast, 2019-2031

- 12. Tanzania Middle East & Africa Mammography Market Analysis, Insights and Forecast, 2019-2031

- 13. Kenya Middle East & Africa Mammography Market Analysis, Insights and Forecast, 2019-2031

- 14. Rest of Africa Middle East & Africa Mammography Market Analysis, Insights and Forecast, 2019-2031

- 15. Competitive Analysis

- 15.1. Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 Konica Minolta Inc

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Metaltronica SpA

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 Planmed Oy*List Not Exhaustive

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 Siemens Healthineers

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 GE Healthcare

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 Hologic Inc

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 Allengers

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.8 Koninklijke Philips NV

- 15.2.8.1. Overview

- 15.2.8.2. Products

- 15.2.8.3. SWOT Analysis

- 15.2.8.4. Recent Developments

- 15.2.8.5. Financials (Based on Availability)

- 15.2.9 Canon Medical Systems Corporation

- 15.2.9.1. Overview

- 15.2.9.2. Products

- 15.2.9.3. SWOT Analysis

- 15.2.9.4. Recent Developments

- 15.2.9.5. Financials (Based on Availability)

- 15.2.10 Fujifilm Holdings Corporation

- 15.2.10.1. Overview

- 15.2.10.2. Products

- 15.2.10.3. SWOT Analysis

- 15.2.10.4. Recent Developments

- 15.2.10.5. Financials (Based on Availability)

- 15.2.1 Konica Minolta Inc

List of Figures

- Figure 1: Middle East & Africa Mammography Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East & Africa Mammography Market Share (%) by Company 2024

List of Tables

- Table 1: Middle East & Africa Mammography Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East & Africa Mammography Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Middle East & Africa Mammography Market Revenue Million Forecast, by End Users 2019 & 2032

- Table 4: Middle East & Africa Mammography Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Middle East & Africa Mammography Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Middle East & Africa Mammography Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: South Africa Middle East & Africa Mammography Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Sudan Middle East & Africa Mammography Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Uganda Middle East & Africa Mammography Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Tanzania Middle East & Africa Mammography Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Kenya Middle East & Africa Mammography Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Africa Middle East & Africa Mammography Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Middle East & Africa Mammography Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 14: Middle East & Africa Mammography Market Revenue Million Forecast, by End Users 2019 & 2032

- Table 15: Middle East & Africa Mammography Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 16: Middle East & Africa Mammography Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Middle East & Africa Mammography Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 18: Middle East & Africa Mammography Market Revenue Million Forecast, by End Users 2019 & 2032

- Table 19: Middle East & Africa Mammography Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 20: Middle East & Africa Mammography Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Middle East & Africa Mammography Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 22: Middle East & Africa Mammography Market Revenue Million Forecast, by End Users 2019 & 2032

- Table 23: Middle East & Africa Mammography Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 24: Middle East & Africa Mammography Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East & Africa Mammography Market?

The projected CAGR is approximately 7.74%.

2. Which companies are prominent players in the Middle East & Africa Mammography Market?

Key companies in the market include Konica Minolta Inc, Metaltronica SpA, Planmed Oy*List Not Exhaustive, Siemens Healthineers, GE Healthcare, Hologic Inc, Allengers, Koninklijke Philips NV, Canon Medical Systems Corporation, Fujifilm Holdings Corporation.

3. What are the main segments of the Middle East & Africa Mammography Market?

The market segments include Product Type, End Users, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 87.54 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Burden of Breast Cancer; Technological Advancements in the Field of Breast Imaging; Investment from Various Organizations in Breast Cancer Screening Campaigns.

6. What are the notable trends driving market growth?

Digital Mammography Segment is Expected to Hold a Significant Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

Risk of Adverse Effects from Radiation Exposure Coupled with Lack of Reimbursement.

8. Can you provide examples of recent developments in the market?

October 2022: Premier Chupu Stanley Mathabatha and Health Minister Dr. Joe Phaahla launched Breast Cancer Awareness Month by handing over radiology equipment, mammograms, and CT scan at ST Ritas Rural Hospital in South Africa.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East & Africa Mammography Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East & Africa Mammography Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East & Africa Mammography Market?

To stay informed about further developments, trends, and reports in the Middle East & Africa Mammography Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence