Key Insights

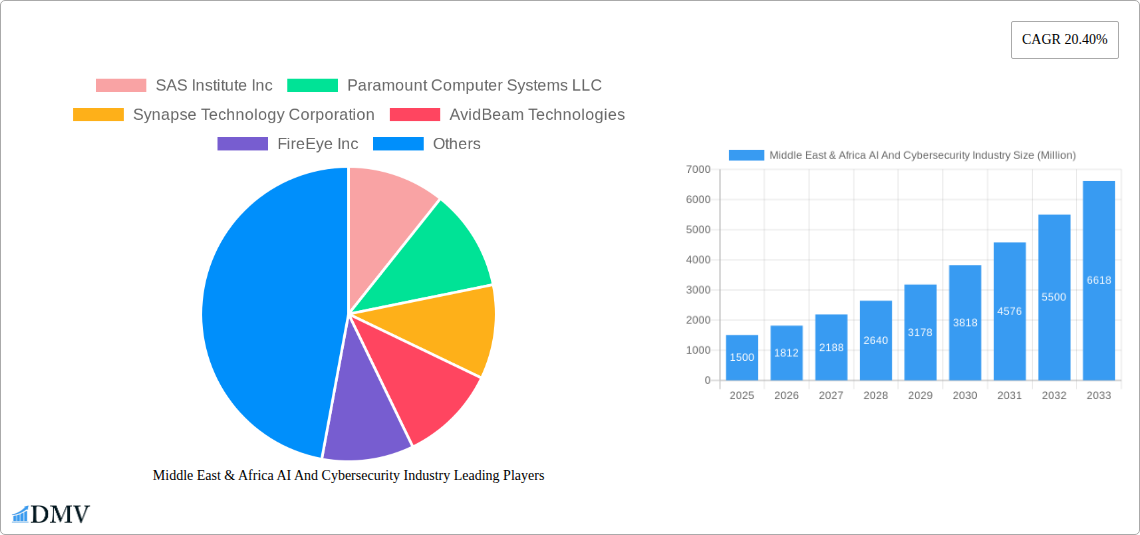

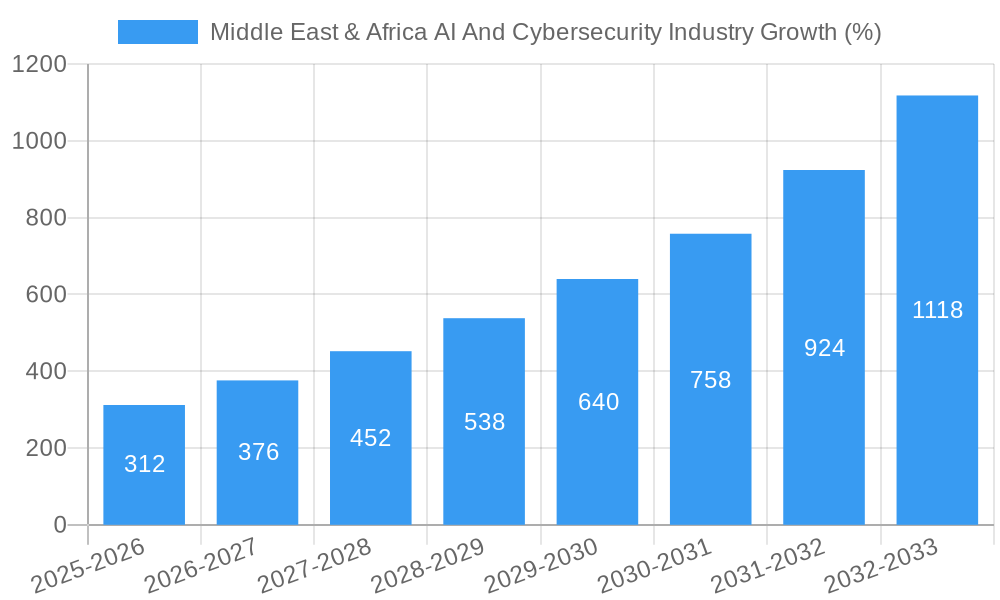

The Middle East and Africa (MEA) AI and cybersecurity market is experiencing robust growth, driven by increasing digital transformation initiatives across various sectors and a heightened awareness of cybersecurity threats. The market, valued at approximately $XX million in 2025 (assuming a logical extrapolation from the provided CAGR and market size), is projected to expand at a Compound Annual Growth Rate (CAGR) of 20.40% from 2025 to 2033. Key drivers include the rising adoption of cloud computing, the proliferation of IoT devices, and the increasing sophistication of cyberattacks targeting governments, financial institutions (BFSI), and critical infrastructure. Government regulations mandating enhanced cybersecurity measures further fuel market expansion. The substantial investments in digital infrastructure development across the MEA region, particularly in countries like the UAE, Saudi Arabia, and Egypt, create a fertile ground for AI and cybersecurity solutions. Growth is segmented across hardware, software, and services components, with a strong demand for advanced threat detection and prevention solutions, AI-powered security analytics, and managed security services. While data privacy concerns and the skills gap in cybersecurity professionals pose challenges, the overall market outlook remains exceptionally positive.

The MEA region’s diverse landscape presents unique opportunities and challenges. While countries like the UAE and Saudi Arabia are leading the charge in AI and cybersecurity adoption, other nations are at varying stages of development. This disparity necessitates tailored solutions and strategic partnerships to address specific regional needs. The growth of big data analytics within the cybersecurity sector is particularly notable, enabling organizations to proactively identify and mitigate threats. The competitive landscape is characterized by a mix of international technology giants and regional players, creating a dynamic ecosystem of innovation and competition. Future growth will hinge on continuous technological advancements, effective regulatory frameworks, and the development of a skilled workforce capable of managing and leveraging these complex systems. The forecast period of 2025-2033 suggests a significant expansion of this market, potentially surpassing $XXX million by 2033 (assuming continued CAGR).

Middle East & Africa AI and Cybersecurity Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the burgeoning Middle East & Africa (MEA) AI and cybersecurity industry, offering invaluable insights for stakeholders seeking to navigate this rapidly evolving landscape. The study period covers 2019-2033, with 2025 serving as the base and estimated year. The forecast period spans 2025-2033, while the historical period encompasses 2019-2024. The report projects a market valued at xx Million by 2025, with substantial growth anticipated throughout the forecast period.

Middle East & Africa AI And Cybersecurity Industry Market Composition & Trends

This section delves into the MEA AI and cybersecurity market's intricate composition, examining market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and mergers & acquisitions (M&A) activity. We analyze the market share distribution among key players like SAS Institute Inc, Microsoft Corporation, and Amazon Web Services Inc, revealing a moderately concentrated market with significant opportunities for emerging players. The report further quantifies M&A deal values in the sector, revealing a trend of consolidation and strategic partnerships. Innovation is driven by the increasing adoption of AI-powered cybersecurity solutions and the growing need to protect critical infrastructure. Stringent data privacy regulations, while posing challenges, also catalyze innovation. The report explores the impact of substitute products and services, as well as the evolving end-user profiles across various sectors, including IT & Telecom, BFSI (Banking, Financial Services, and Insurance), and Public & Government institutions. The analysis includes a detailed overview of the prevalent M&A activity, including deal values and strategic implications. Market share distribution among leading players will be presented graphically and numerically. The influence of regional regulatory landscapes, including their impact on market entry and growth, will also be covered extensively. The report estimates that the market size will be xx Million in 2025.

Middle East & Africa AI And Cybersecurity Industry Industry Evolution

This section traces the evolutionary path of the MEA AI and cybersecurity industry, charting market growth trajectories, technological leaps, and the shifting preferences of consumers and businesses. The analysis focuses on the compound annual growth rate (CAGR) for the forecast period, supported by specific data points on the adoption rates of AI and cybersecurity solutions across different sectors. The report will highlight the increasing sophistication of cyber threats and the corresponding development of advanced defensive technologies, including AI-driven threat detection and response systems. It will also analyze the impact of evolving consumer demands, including heightened awareness of data privacy and security risks, on market trends. Specific examples of technological advancements, such as the integration of blockchain technology and the rise of cloud-based security solutions, will be discussed at length, along with their impact on market growth and adoption rates. Growth rate analysis is included for segments like Hardware, Software, Services across all the end-user Industries listed.

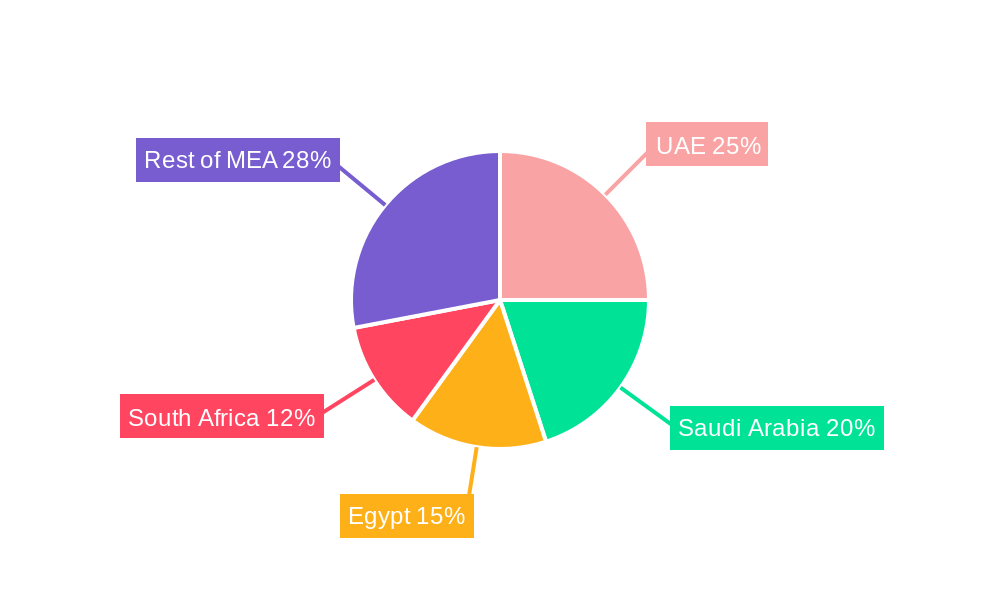

Leading Regions, Countries, or Segments in Middle East & Africa AI And Cybersecurity Industry

This section identifies the dominant regions, countries, and segments within the MEA AI and cybersecurity market. The analysis will pinpoint the leading segments (Hardware, Software, Services) and end-user industries (IT & Telecom, Retail, Public & Government, BFSI, Manufacturing & Construction, Healthcare, Other). Key drivers such as investment trends, regulatory support, and market maturity will be presented via bullet points, with deeper exploration via paragraphs. The report will explain why certain regions (e.g., the UAE, Saudi Arabia, South Africa) are leading the market compared to others (e.g., Morocco, Rest of MEA).

- UAE: High government investments in digital infrastructure and smart city initiatives.

- Saudi Arabia: Government initiatives like Vision 2030 driving digital transformation and cybersecurity investments; November 2022 licensing of QVALON and Faceki illustrates this.

- South Africa: Growing digital economy and increasing awareness of cybersecurity threats.

- Egypt: Significant government spending on IT infrastructure and digitalization efforts.

- Software Segment: Fastest growing segment due to high demand for AI-powered solutions.

- IT & Telecom: Highest adoption rates due to critical infrastructure reliance.

- BFSI: Significant investments in fraud detection and prevention systems.

The in-depth analysis will uncover the reasons behind the dominance of these regions and segments, explaining the interplay of economic factors, technological maturity, regulatory environment, and consumer behavior.

Middle East & Africa AI And Cybersecurity Industry Product Innovations

This section highlights recent product innovations, their applications, and key performance indicators. We’ll discuss the unique selling propositions (USPs) of cutting-edge AI-powered cybersecurity solutions, emphasizing technological advancements in areas such as threat intelligence, predictive analytics, and automated incident response. The focus will be on showcasing the advancements in areas such as AI-driven threat detection, predictive analytics, and automated incident response systems. The section will also feature examples of successful product launches and their impact on the market.

Propelling Factors for Middle East & Africa AI And Cybersecurity Industry Growth

The robust growth of the MEA AI and cybersecurity market is fueled by several key drivers. Firstly, the rapid digital transformation across various sectors generates a heightened need for robust cybersecurity solutions. Secondly, substantial government investments in digital infrastructure and smart city projects stimulate demand for advanced security measures. Thirdly, the increasing sophistication of cyberattacks and the rising awareness of data privacy concerns further propel market growth. Finally, supportive regulatory frameworks encouraging the adoption of AI and cybersecurity technologies contribute significantly.

Obstacles in the Middle East & Africa AI And Cybersecurity Industry Market

Despite promising growth prospects, the MEA AI and cybersecurity market faces challenges. Regulatory complexities surrounding data privacy and cross-border data transfers create hurdles for businesses. Supply chain disruptions can impact the availability and affordability of essential technologies. The intense competition among both established and emerging players may lead to price wars and margin pressures. A skills gap in cybersecurity professionals and the cost of high-end security solutions also act as constraints. The report will quantify these obstacles with data.

Future Opportunities in Middle East & Africa AI And Cybersecurity Industry

The future of the MEA AI and cybersecurity market is bright. Emerging opportunities lie in expanding into underserved markets, capitalizing on the growing adoption of cloud-based security solutions, and focusing on niche sectors like IoT security and critical infrastructure protection. Further innovation in AI-powered threat detection and response systems will continue to open new avenues for growth. The report will also analyze the potential impact of new technologies, such as quantum computing, on the industry's future.

Major Players in the Middle East & Africa AI And Cybersecurity Industry Ecosystem

This section profiles key players shaping the MEA AI and cybersecurity landscape. This list is not exhaustive.

- SAS Institute Inc

- Paramount Computer Systems LLC

- Synapse Technology Corporation

- AvidBeam Technologies

- FireEye Inc

- Trend Micro Inc

- Symantec Corporation (Norton LifeLock)

- Teradata Corporation

- DTS Solutions Inc

- Cisco Systems Inc

- Microsoft Corporation

- QlikTech International AB

- TIBCO Software Inc

- Amazon Web Services Inc

- NEC Corporation

- Nvidia Corporation

- Tableau Software LLC (Salesforce com Inc)

- SAP SE

Key Developments in Middle East & Africa AI And Cybersecurity Industry Industry

- July 2022: Liquid C2, a Cassava Technologies business, opened its first Cyber Security Fusion Centre (CSFC) in Nairobi, Kenya. This new center offers cybersecurity services using Microsoft Sentinel and Microsoft Defender.

- November 2022: The Saudi Ministry of Finance granted business licenses to QVALON and Faceki, two AI companies, signifying the kingdom's commitment to fostering the AI sector.

Strategic Middle East & Africa AI And Cybersecurity Industry Market Forecast

The MEA AI and cybersecurity market is poised for robust growth driven by ongoing digital transformation, increased government investment, and escalating cyber threats. The increasing adoption of AI-powered solutions and the demand for advanced cybersecurity measures across key sectors will contribute significantly to market expansion. Emerging technologies like blockchain and quantum computing present both challenges and opportunities that will reshape the industry. Continued focus on talent development and addressing regulatory challenges will be key to unlocking the full potential of this dynamic market.

Middle East & Africa AI And Cybersecurity Industry Segmentation

-

1. Component

- 1.1. Hardware

- 1.2. Software

- 1.3. Services

-

2. End-user Industry

- 2.1. IT & Telecom

- 2.2. Retail

- 2.3. Public & Government institutions

- 2.4. BFSI

- 2.5. Manufacturing And Construction

- 2.6. Healthcare

- 2.7. Other End-user Industries

-

3. Type

-

3.1. Cyber Security Market

- 3.1.1. Network

- 3.1.2. Cloud

- 3.1.3. Application

- 3.1.4. End-point

- 3.1.5. Wireless Network

- 3.1.6. Other Security Types

-

3.2. Big Data Analytics Market

- 3.2.1. Data Discovery & Visualization

- 3.2.2. Advanced Analytics

-

3.1. Cyber Security Market

Middle East & Africa AI And Cybersecurity Industry Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East & Africa AI And Cybersecurity Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 20.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Favorable Governmental Policies and Collaborations Undertaken by Technology Enablers in the Region; Growth in Adoption of IoT in Retail and BFSI Sector; Growing End-user Applications and Need for Real-time Analysis

- 3.3. Market Restrains

- 3.3.1. Lack of Standardization for Security of Digital Content

- 3.4. Market Trends

- 3.4.1. Rise in the Government initiatives and scalable IT infrastructure

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East & Africa AI And Cybersecurity Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. Services

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. IT & Telecom

- 5.2.2. Retail

- 5.2.3. Public & Government institutions

- 5.2.4. BFSI

- 5.2.5. Manufacturing And Construction

- 5.2.6. Healthcare

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Type

- 5.3.1. Cyber Security Market

- 5.3.1.1. Network

- 5.3.1.2. Cloud

- 5.3.1.3. Application

- 5.3.1.4. End-point

- 5.3.1.5. Wireless Network

- 5.3.1.6. Other Security Types

- 5.3.2. Big Data Analytics Market

- 5.3.2.1. Data Discovery & Visualization

- 5.3.2.2. Advanced Analytics

- 5.3.1. Cyber Security Market

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. South Africa Middle East & Africa AI And Cybersecurity Industry Analysis, Insights and Forecast, 2019-2031

- 7. Sudan Middle East & Africa AI And Cybersecurity Industry Analysis, Insights and Forecast, 2019-2031

- 8. Uganda Middle East & Africa AI And Cybersecurity Industry Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania Middle East & Africa AI And Cybersecurity Industry Analysis, Insights and Forecast, 2019-2031

- 10. Kenya Middle East & Africa AI And Cybersecurity Industry Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa Middle East & Africa AI And Cybersecurity Industry Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 SAS Institute Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Paramount Computer Systems LLC

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Synapse Technology Corporation

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 AvidBeam Technologies

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 FireEye Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Trend Micro Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Symantec Corporation (Norton LifeLock)

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Teradata Corporation

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 DTS Solutions Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Cisco Systems Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Microsoft Corporation

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 QlikTech International AB

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 TIBCO Software Inc *List Not Exhaustive

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Amazon Web Services Inc

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.15 NEC Corporation

- 12.2.15.1. Overview

- 12.2.15.2. Products

- 12.2.15.3. SWOT Analysis

- 12.2.15.4. Recent Developments

- 12.2.15.5. Financials (Based on Availability)

- 12.2.16 Nvidia Corporation

- 12.2.16.1. Overview

- 12.2.16.2. Products

- 12.2.16.3. SWOT Analysis

- 12.2.16.4. Recent Developments

- 12.2.16.5. Financials (Based on Availability)

- 12.2.17 Tableau Software LLC (Salesforce com Inc )

- 12.2.17.1. Overview

- 12.2.17.2. Products

- 12.2.17.3. SWOT Analysis

- 12.2.17.4. Recent Developments

- 12.2.17.5. Financials (Based on Availability)

- 12.2.18 SAP SE

- 12.2.18.1. Overview

- 12.2.18.2. Products

- 12.2.18.3. SWOT Analysis

- 12.2.18.4. Recent Developments

- 12.2.18.5. Financials (Based on Availability)

- 12.2.1 SAS Institute Inc

List of Figures

- Figure 1: Middle East & Africa AI And Cybersecurity Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East & Africa AI And Cybersecurity Industry Share (%) by Company 2024

List of Tables

- Table 1: Middle East & Africa AI And Cybersecurity Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East & Africa AI And Cybersecurity Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 3: Middle East & Africa AI And Cybersecurity Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Middle East & Africa AI And Cybersecurity Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 5: Middle East & Africa AI And Cybersecurity Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Middle East & Africa AI And Cybersecurity Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: South Africa Middle East & Africa AI And Cybersecurity Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Sudan Middle East & Africa AI And Cybersecurity Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Uganda Middle East & Africa AI And Cybersecurity Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Tanzania Middle East & Africa AI And Cybersecurity Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Kenya Middle East & Africa AI And Cybersecurity Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Africa Middle East & Africa AI And Cybersecurity Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Middle East & Africa AI And Cybersecurity Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 14: Middle East & Africa AI And Cybersecurity Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 15: Middle East & Africa AI And Cybersecurity Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Middle East & Africa AI And Cybersecurity Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Saudi Arabia Middle East & Africa AI And Cybersecurity Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: United Arab Emirates Middle East & Africa AI And Cybersecurity Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Israel Middle East & Africa AI And Cybersecurity Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Qatar Middle East & Africa AI And Cybersecurity Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Kuwait Middle East & Africa AI And Cybersecurity Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Oman Middle East & Africa AI And Cybersecurity Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Bahrain Middle East & Africa AI And Cybersecurity Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Jordan Middle East & Africa AI And Cybersecurity Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Lebanon Middle East & Africa AI And Cybersecurity Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East & Africa AI And Cybersecurity Industry?

The projected CAGR is approximately 20.40%.

2. Which companies are prominent players in the Middle East & Africa AI And Cybersecurity Industry?

Key companies in the market include SAS Institute Inc, Paramount Computer Systems LLC, Synapse Technology Corporation, AvidBeam Technologies, FireEye Inc, Trend Micro Inc, Symantec Corporation (Norton LifeLock), Teradata Corporation, DTS Solutions Inc, Cisco Systems Inc, Microsoft Corporation, QlikTech International AB, TIBCO Software Inc *List Not Exhaustive, Amazon Web Services Inc, NEC Corporation, Nvidia Corporation, Tableau Software LLC (Salesforce com Inc ), SAP SE.

3. What are the main segments of the Middle East & Africa AI And Cybersecurity Industry?

The market segments include Component, End-user Industry, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Favorable Governmental Policies and Collaborations Undertaken by Technology Enablers in the Region; Growth in Adoption of IoT in Retail and BFSI Sector; Growing End-user Applications and Need for Real-time Analysis.

6. What are the notable trends driving market growth?

Rise in the Government initiatives and scalable IT infrastructure.

7. Are there any restraints impacting market growth?

Lack of Standardization for Security of Digital Content.

8. Can you provide examples of recent developments in the market?

November 2022 - The Saudi Ministry of Finance declared that it permitted two more artificial intelligence companies to operate in the kingdom. QVALON and Faceki thus have business licenses in Saudi Arabia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East & Africa AI And Cybersecurity Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East & Africa AI And Cybersecurity Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East & Africa AI And Cybersecurity Industry?

To stay informed about further developments, trends, and reports in the Middle East & Africa AI And Cybersecurity Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence