Key Insights

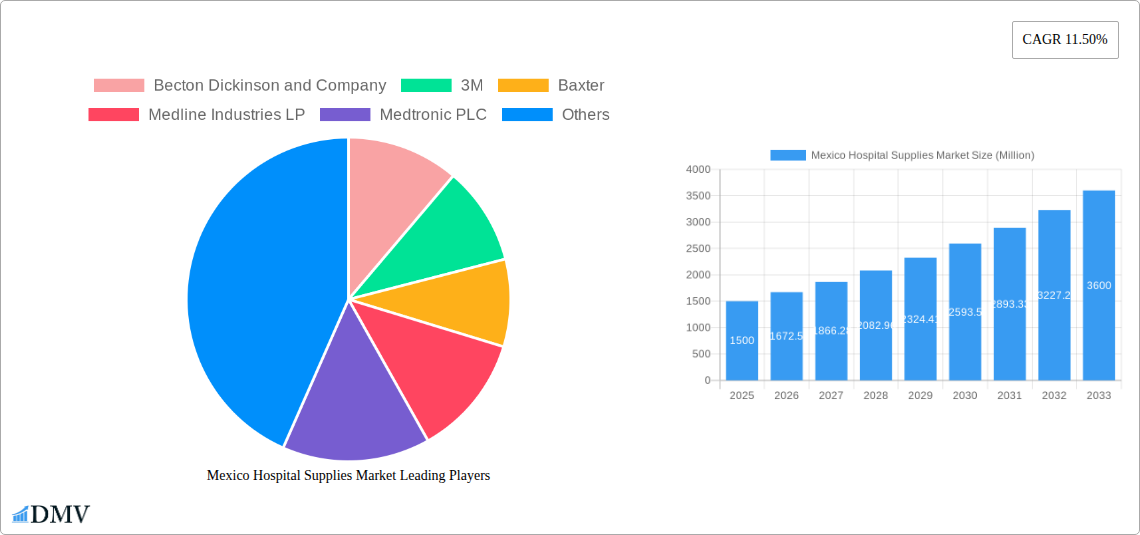

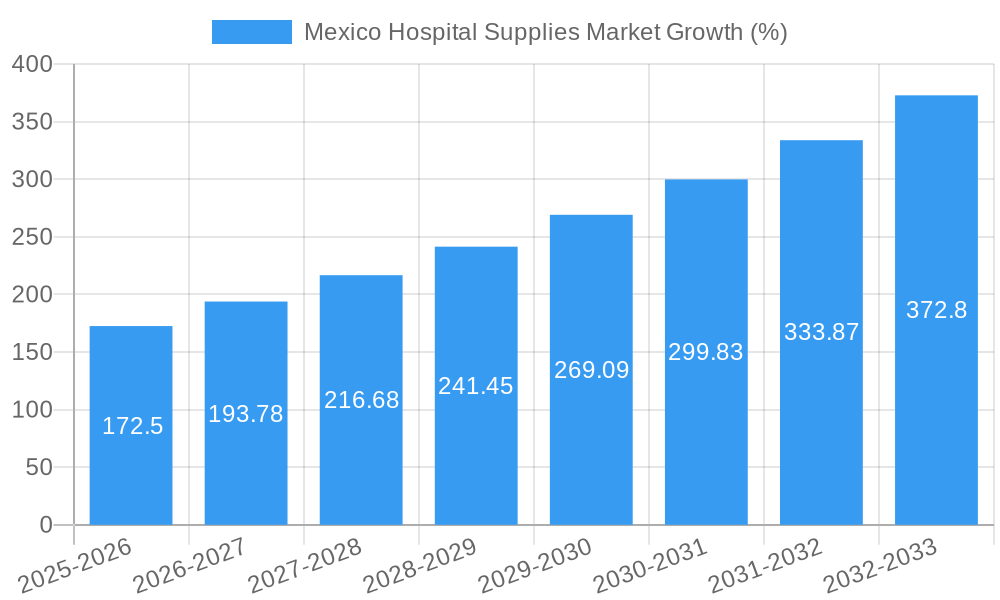

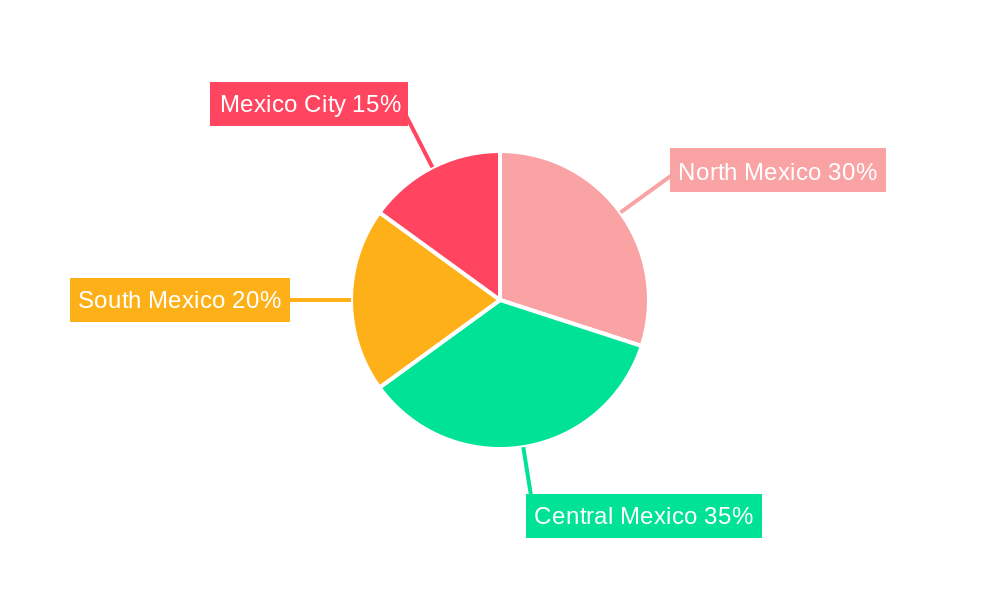

The Mexico hospital supplies market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 11.50% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, the increasing prevalence of chronic diseases like diabetes and cardiovascular conditions necessitates a higher demand for medical supplies. Secondly, Mexico's growing elderly population requires more extensive healthcare, including hospital stays and subsequent supply needs. Government initiatives to improve healthcare infrastructure and access are also contributing to market growth. Furthermore, rising disposable incomes and increased health insurance coverage are enabling greater access to quality healthcare, directly impacting the demand for hospital supplies. However, challenges remain. Price fluctuations in raw materials and potential regulatory hurdles could restrain market expansion. The market is segmented by product type (Patient Examination Devices, Operating Room Equipment, Mobility Aids, Sterilization Equipment, Disposable Supplies, Syringes & Needles, and Others) and end-user (Hospitals, Clinics, Ambulatory Surgery Centers, Diagnostic Labs, and Long-Term Care Facilities), with Hospitals holding the largest market share due to their high volume consumption. Geographically, the market is divided into North, Central, and South Mexico, including Mexico City, with the latter expected to maintain a significant share due to its concentration of healthcare facilities. Leading players such as Becton Dickinson, 3M, Baxter, Medline Industries, Medtronic, and others compete intensely, focusing on product innovation and strategic partnerships to maintain market leadership.

The competitive landscape is dynamic, with both multinational corporations and domestic players vying for market share. Companies are focusing on providing technologically advanced products, coupled with efficient distribution networks to cater to the growing demand. The increasing adoption of advanced medical technologies, like minimally invasive surgical procedures, directly impacts the demand for specific supplies. Future growth is expected to be driven by the expansion of private healthcare facilities, improving healthcare infrastructure in underserved regions, and increased focus on preventative healthcare. The market's segmentation offers opportunities for specialized players catering to niche areas, creating further diversification and growth within individual segments. The projected growth makes the Mexico hospital supplies market an attractive investment opportunity for businesses focused on healthcare and medical technology.

Mexico Hospital Supplies Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Mexico Hospital Supplies Market, offering a comprehensive overview of its current state, future trends, and key players. From market size and segmentation to growth drivers and challenges, this report equips stakeholders with the knowledge needed to navigate this dynamic market. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period spans 2025-2033, while the historical period encompasses 2019-2024. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033.

Mexico Hospital Supplies Market Composition & Trends

The Mexico Hospital Supplies Market is a complex landscape characterized by a moderate level of concentration, with key players such as Becton Dickinson and Company, 3M, Baxter, Medline Industries LP, Medtronic PLC, Fisher & Paykel Healthcare Limited, Cardinal Health, Abbott, Koninklijke Philips NV, and Boston Scientific Corporation competing for market share. Market share distribution is currently estimated at approximately xx% for the top five players, indicating a fragmented yet competitive environment. Innovation is driven by increasing demand for advanced medical technologies, particularly in areas like minimally invasive surgery and remote patient monitoring. The regulatory landscape, primarily governed by COFEPRIS (Comisión Federal para la Protección contra Riesgos Sanitarios), significantly influences market access and product approvals. Substitute products, though limited, pose a competitive threat in certain segments. The market sees consistent M&A activity, with deal values averaging xx Million annually in recent years. End-users span a broad range including hospitals, clinics, ambulatory surgery centers, diagnostic laboratories, and long-term care facilities.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share.

- Innovation Catalysts: Demand for advanced medical technologies and digital health solutions.

- Regulatory Landscape: Primarily governed by COFEPRIS.

- Substitute Products: Limited, but posing a niche competitive threat.

- M&A Activity: Average deal value approximately xx Million annually.

- End-User Profile: Diverse, encompassing hospitals, clinics, ambulatory surgery centers, and long-term care facilities.

Mexico Hospital Supplies Market Industry Evolution

The Mexico Hospital Supplies Market has experienced steady growth over the past five years, fueled by factors such as increasing healthcare expenditure, rising prevalence of chronic diseases, and government initiatives to improve healthcare infrastructure. The market's growth trajectory has shown a Compound Annual Growth Rate (CAGR) of approximately xx% during the historical period (2019-2024). Technological advancements, particularly in areas like minimally invasive surgery and telemedicine, are transforming the market, driving demand for sophisticated equipment and supplies. Consumer demands are shifting towards higher quality, more efficient, and technologically advanced products. The adoption rate of telehealth solutions has increased significantly in recent years, with a xx% rise observed between 2020 and 2024. Further growth is anticipated, driven by the increasing affordability of these technologies and supportive government policies. The market is witnessing a growing preference for disposable medical supplies owing to hygiene and infection control concerns. The rising number of surgeries and medical procedures has contributed significantly to increased demand.

Leading Regions, Countries, or Segments in Mexico Hospital Supplies Market

The Mexico City region currently dominates the hospital supplies market, driven by a high concentration of hospitals and healthcare facilities, along with substantial investment in healthcare infrastructure. Growth in this region is projected to continue at a CAGR of xx% over the forecast period.

Key Drivers:

- High Concentration of Healthcare Facilities: Mexico City houses a significant number of hospitals and specialized medical centers.

- Government Investments: Significant public and private investment in healthcare infrastructure.

- Stronger Regulatory Environment: Comparatively robust regulatory oversight compared to other regions.

Leading Product Segments:

- Disposable Hospital Supplies: High demand due to hygiene and infection control concerns.

- Patient Examination Devices: Steady growth driven by the increasing number of diagnostic procedures.

- Operating Room Equipment: Growing demand fueled by the increasing number of surgical procedures.

Leading End-User Segments:

- Hospitals: The largest end-user segment, accounting for approximately xx% of market share.

- Clinics: Significant contributor to market growth, with a projected CAGR of xx% over the forecast period.

Mexico Hospital Supplies Market Product Innovations

Recent innovations focus on improving efficiency, reducing costs, and enhancing patient care. This includes the development of advanced disposable supplies with enhanced sterility and biocompatibility, minimally invasive surgical instruments, and connected medical devices that enable remote patient monitoring and data analysis. These innovations leverage materials science and advanced manufacturing technologies to improve product performance, reliability, and user-friendliness. Unique selling propositions often include improved safety features, enhanced efficacy, and reduced environmental impact through sustainable materials and designs.

Propelling Factors for Mexico Hospital Supplies Market Growth

The Mexico Hospital Supplies Market is propelled by several key factors:

- Increasing Healthcare Expenditure: Government initiatives and private investment are driving healthcare spending growth.

- Rising Prevalence of Chronic Diseases: The aging population and increasing incidence of chronic illnesses fuel demand for medical supplies.

- Technological Advancements: Innovation in medical devices and supplies is improving patient care and efficiency.

- Government Regulations: Regulations promoting healthcare quality and safety standards further spur market growth.

Obstacles in the Mexico Hospital Supplies Market

The market faces challenges including:

- Supply Chain Disruptions: Global events and logistical issues can impact supply availability and costs.

- Regulatory Hurdles: Navigating regulatory approvals can be time-consuming and complex.

- Competitive Pressures: Intense competition among domestic and international players.

- Pricing Pressures: Negotiations with healthcare providers can lead to price reductions, impacting profitability.

Future Opportunities in Mexico Hospital Supplies Market

Future opportunities include:

- Expansion into Underserved Regions: Increased access to healthcare in rural areas presents significant growth potential.

- Technological Advancements: The adoption of AI, robotics, and telemedicine presents new opportunities for innovation.

- Focus on Sustainability: Demand for eco-friendly medical supplies is growing.

Major Players in the Mexico Hospital Supplies Market Ecosystem

- Becton Dickinson and Company

- 3M

- Baxter

- Medline Industries LP

- Medtronic PLC

- Fisher & Paykel Healthcare Limited

- Cardinal Health

- Abbott

- Koninklijke Philips NV

- Boston Scientific Corporation

Key Developments in Mexico Hospital Supplies Market Industry

- September 2022: MEDU Protection, a Mexico-based startup, secured USD 4 Million in funding for reusable PPE, reducing medical waste.

- February 2022: Hoy Health launched telemedicine services in Mexico via its HoyDOCO platform, expanding access to healthcare.

Strategic Mexico Hospital Supplies Market Forecast

The Mexico Hospital Supplies Market is poised for continued growth, driven by sustained investments in healthcare infrastructure, technological advancements, and an expanding aging population. The market's future potential is significant, particularly in areas such as telemedicine and minimally invasive surgery. The predicted CAGR for the forecast period (2025-2033) is estimated to be xx%, indicating a robust growth outlook. Strategic investments in innovation and expansion into underserved regions will be crucial for market players seeking long-term success.

Mexico Hospital Supplies Market Segmentation

-

1. Product

- 1.1. Patient Examination Devices

- 1.2. Operating Room Equipment

- 1.3. Mobility Aids and Transportation Equipment

- 1.4. Sterilization and Disinfectant Equipment

- 1.5. Disposable Hospital Supplies

- 1.6. Syringes and Needles

- 1.7. Other Products

Mexico Hospital Supplies Market Segmentation By Geography

- 1. Mexico

Mexico Hospital Supplies Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Geriatric Population and In-patient Admissions in Hospitals; Rise in Chronic and Infectious Diseases; Growing Public Awareness about Hospital Acquired Infections

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Procedures; Growing Popularity of Home Care Services

- 3.4. Market Trends

- 3.4.1. Sterilization and Disinfectant Equipment Segment is Expected to Witness Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Hospital Supplies Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Patient Examination Devices

- 5.1.2. Operating Room Equipment

- 5.1.3. Mobility Aids and Transportation Equipment

- 5.1.4. Sterilization and Disinfectant Equipment

- 5.1.5. Disposable Hospital Supplies

- 5.1.6. Syringes and Needles

- 5.1.7. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Becton Dickinson and Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 3M

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Baxter

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Medline Industries LP

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Medtronic PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Fisher & Paykel Healthcare Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cardinal Health

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Abbott

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Koninklijke Philips NV

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Boston Scientific Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Mexico Hospital Supplies Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Mexico Hospital Supplies Market Share (%) by Company 2024

List of Tables

- Table 1: Mexico Hospital Supplies Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Mexico Hospital Supplies Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Mexico Hospital Supplies Market Revenue Million Forecast, by Product 2019 & 2032

- Table 4: Mexico Hospital Supplies Market Volume K Unit Forecast, by Product 2019 & 2032

- Table 5: Mexico Hospital Supplies Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Mexico Hospital Supplies Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 7: Mexico Hospital Supplies Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Mexico Hospital Supplies Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 9: Mexico Hospital Supplies Market Revenue Million Forecast, by Product 2019 & 2032

- Table 10: Mexico Hospital Supplies Market Volume K Unit Forecast, by Product 2019 & 2032

- Table 11: Mexico Hospital Supplies Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Mexico Hospital Supplies Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Hospital Supplies Market?

The projected CAGR is approximately 11.50%.

2. Which companies are prominent players in the Mexico Hospital Supplies Market?

Key companies in the market include Becton Dickinson and Company, 3M, Baxter, Medline Industries LP, Medtronic PLC, Fisher & Paykel Healthcare Limited, Cardinal Health, Abbott, Koninklijke Philips NV, Boston Scientific Corporation.

3. What are the main segments of the Mexico Hospital Supplies Market?

The market segments include Product.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Geriatric Population and In-patient Admissions in Hospitals; Rise in Chronic and Infectious Diseases; Growing Public Awareness about Hospital Acquired Infections.

6. What are the notable trends driving market growth?

Sterilization and Disinfectant Equipment Segment is Expected to Witness Growth.

7. Are there any restraints impacting market growth?

Stringent Regulatory Procedures; Growing Popularity of Home Care Services.

8. Can you provide examples of recent developments in the market?

September 2022: A Mexico-based startup, MEDU Protection, scored USD 4 million for personal protective equipment (PPE). The PPE can be reused for up to 50 washes and can limit medical waste.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Hospital Supplies Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Hospital Supplies Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Hospital Supplies Market?

To stay informed about further developments, trends, and reports in the Mexico Hospital Supplies Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence