Key Insights

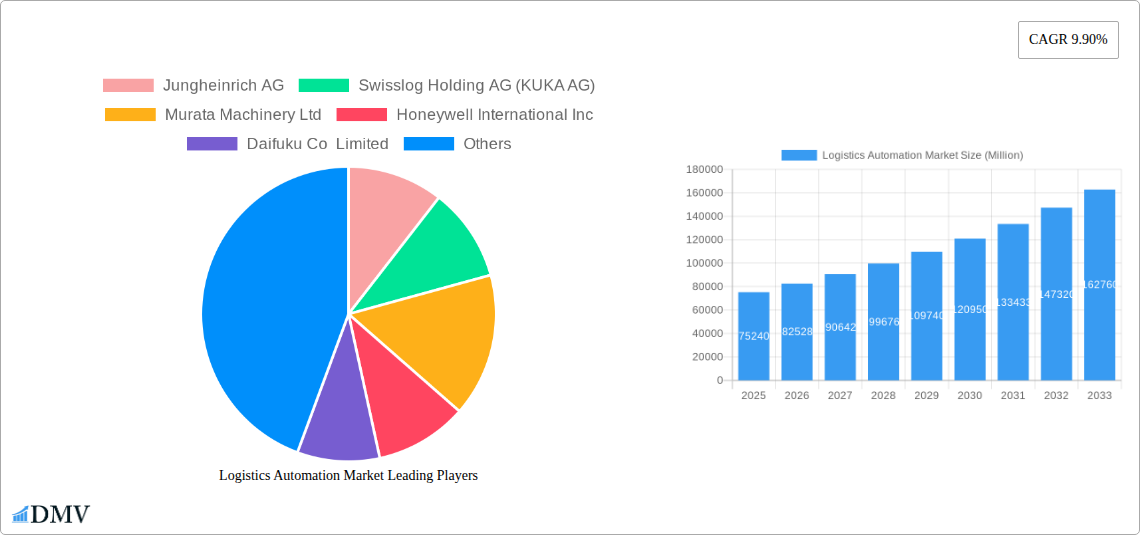

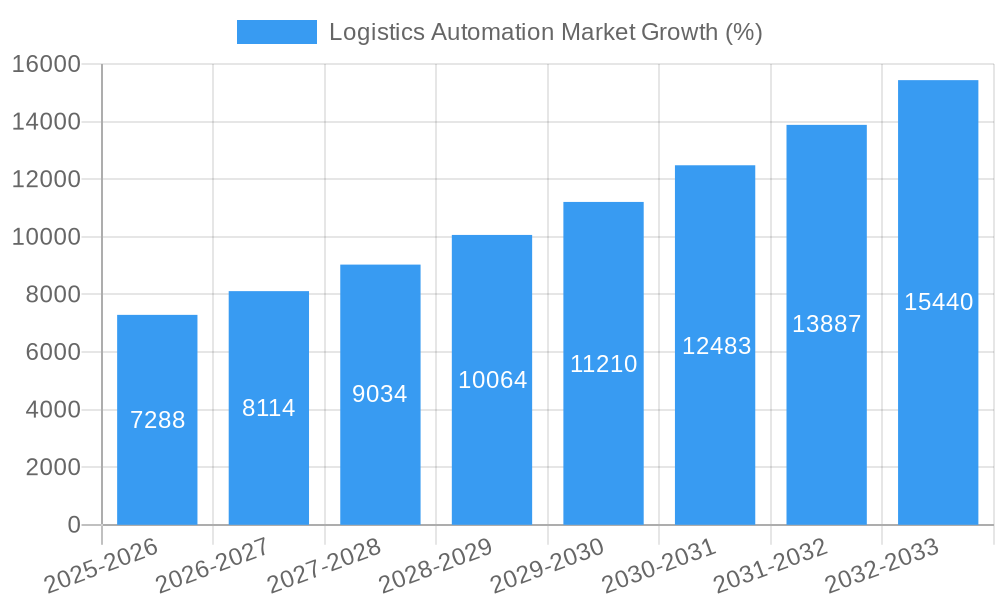

The global logistics automation market is experiencing robust growth, projected to reach \$75.24 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 9.90% from 2025 to 2033. This expansion is fueled by several key factors. E-commerce continues its explosive growth, demanding faster and more efficient order fulfillment. Simultaneously, labor shortages across the logistics sector are driving the adoption of automated solutions to improve productivity and reduce reliance on manual labor. Increased focus on supply chain optimization and resilience, particularly in the wake of recent global disruptions, is further bolstering market demand. Specific growth drivers include the rising adoption of mobile robots (AGVs and AMRs), advanced warehouse management systems (WMS), and automated storage and retrieval systems (AS/RS). The integration of Artificial Intelligence (AI) and machine learning is enhancing automation capabilities, leading to more intelligent and efficient warehouse operations. Further, the increasing demand for improved traceability and transparency throughout the supply chain is fostering the adoption of automatic identification and data collection (AIDC) systems.

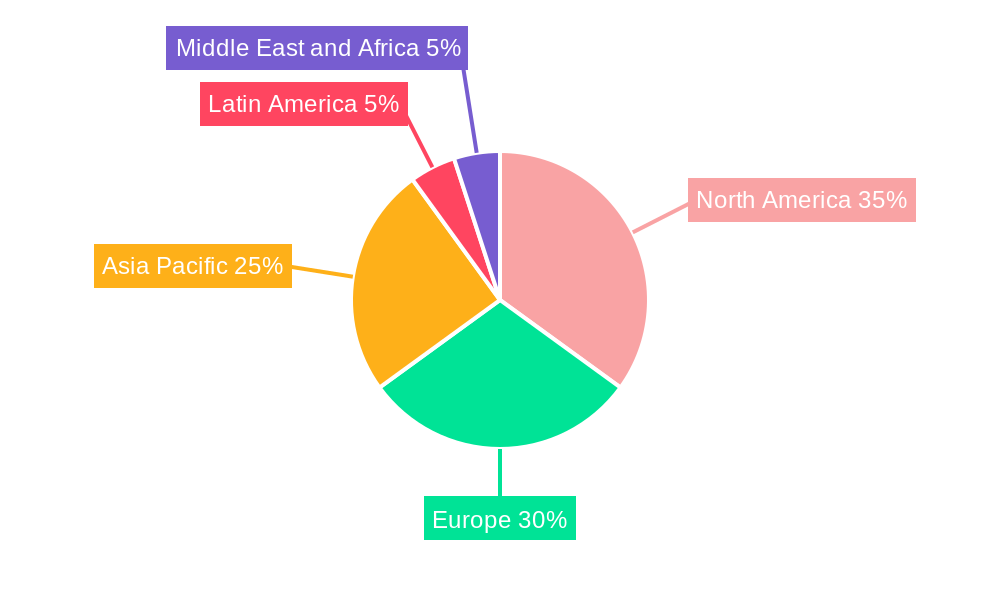

Segmentation analysis reveals significant opportunities across various components. Hardware segments like mobile robots, AS/RS, and automated sorting systems are experiencing substantial growth due to their ability to automate repetitive tasks and enhance warehouse throughput. The software and services segments are also witnessing significant expansion, driven by the increasing need for integrated solutions and specialized expertise in implementation and maintenance. Geographically, North America and Europe currently hold significant market share, but the Asia-Pacific region is expected to exhibit the fastest growth rate due to the burgeoning e-commerce sector and substantial investments in infrastructure development. Competition in the market is intense, with established players like Jungheinrich AG, Swisslog, and Dematic alongside newer entrants innovating rapidly. This competitive landscape drives continuous improvement in technology and cost-effectiveness, further accelerating market expansion.

Logistics Automation Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the Logistics Automation Market, encompassing market trends, technological advancements, competitive landscape, and future growth projections from 2019 to 2033. The study covers a wide range of segments, including hardware (mobile robots, AS/RS, sorting systems, etc.), software, and services, across diverse end-user industries. With a base year of 2025 and a forecast period of 2025-2033, this report is an indispensable resource for stakeholders seeking to navigate this rapidly evolving market. The total market value is projected to reach xx Million by 2033, representing a significant growth opportunity.

Logistics Automation Market Composition & Trends

This section delves into the intricate dynamics of the Logistics Automation Market, evaluating market concentration, innovation drivers, regulatory landscapes, substitute products, end-user profiles, and M&A activities. Market share distribution among key players reveals a moderately concentrated market, with the top 5 players holding an estimated 40% market share in 2024. Innovation catalysts, such as the rising adoption of AI and IoT technologies, are driving significant market growth. Stringent regulatory frameworks focusing on safety and data privacy are shaping market practices. Substitute products, while present, are limited due to the specialized nature of automation solutions. End-users, spanning e-commerce, manufacturing, and retail, are driving demand. M&A activity has been robust, with xx Million in total deal value recorded in the last five years, indicating significant consolidation within the industry.

- Market Concentration: Moderately concentrated, with top 5 players holding ~40% market share (2024).

- Innovation Catalysts: AI, IoT, and cloud computing.

- Regulatory Landscape: Focus on safety, data privacy, and environmental impact.

- Substitute Products: Limited due to specialized nature of automation solutions.

- End-User Profiles: E-commerce, manufacturing, retail, healthcare.

- M&A Activity: Total deal value of xx Million over the last five years.

Logistics Automation Market Industry Evolution

The Logistics Automation Market has witnessed remarkable growth over the historical period (2019-2024), driven by the exponential rise of e-commerce and the increasing need for supply chain efficiency. The market exhibited a Compound Annual Growth Rate (CAGR) of xx% during this period. Technological advancements, such as the emergence of autonomous mobile robots (AMRs) and advanced warehouse management systems (WMS), have been pivotal in driving this growth. Evolving consumer demands for faster delivery times and increased transparency in supply chains are further fueling market expansion. The forecast period (2025-2033) anticipates continued robust growth, with a projected CAGR of xx%, driven by sustained adoption of automation solutions across various sectors. The penetration rate of automated solutions is expected to increase from xx% in 2024 to xx% by 2033. This growth will be particularly pronounced in developing economies where increasing labor costs and a growing e-commerce sector are creating favorable conditions for automation adoption.

Leading Regions, Countries, or Segments in Logistics Automation Market

North America currently holds the largest market share, driven by high adoption rates in the e-commerce and manufacturing sectors, coupled with significant investments in automation technologies. Within this region, the United States and Canada are key markets. Europe follows closely, propelled by a robust industrial base and government initiatives promoting automation. Asia-Pacific is emerging as a high-growth region, driven by a burgeoning e-commerce sector and increasing labor costs. Specific segment dominance varies:

- Services: By end-user industry, e-commerce currently dominates, but manufacturing and healthcare are showing strong growth.

- Warehouse Automation: Automated Storage and Retrieval Systems (AS/RS) holds the largest share of the component market.

- Hardware: Mobile Robots (AGVs and AMRs) are experiencing the fastest growth rate, driven by their flexibility and adaptability.

Key Drivers:

- High Investment: Significant venture capital and private equity investments in automation startups.

- Government Support: Incentives and tax breaks promoting automation adoption.

- Technological Advancements: Continued development of more sophisticated and cost-effective automation solutions.

Logistics Automation Market Product Innovations

Recent innovations in logistics automation have focused on improving efficiency, accuracy, and scalability. The development of autonomous mobile robots (AMRs) with advanced navigation capabilities and collaborative robotics allows for seamless integration into existing warehouse operations. Advanced warehouse management systems (WMS) with AI-powered optimization features enhance inventory management, order fulfillment, and resource allocation. The integration of Internet of Things (IoT) sensors improves real-time tracking and monitoring of goods, facilitating proactive maintenance and predictive analytics. These innovations lead to increased throughput, reduced operational costs, and enhanced overall supply chain visibility.

Propelling Factors for Logistics Automation Market Growth

The Logistics Automation market is experiencing exponential growth, fueled by several converging factors. Firstly, the dramatic rise of e-commerce necessitates faster and more efficient fulfillment processes, driving demand for automated solutions. Secondly, labor shortages and rising labor costs are pushing businesses towards automation to maintain productivity and control costs. Thirdly, technological advancements are making automation solutions more affordable, accessible, and user-friendly, thereby expanding their adoption across various industries. Finally, favorable government regulations and incentives are further promoting the adoption of logistics automation technologies.

Obstacles in the Logistics Automation Market

Despite the significant growth potential, several challenges hinder the widespread adoption of logistics automation. High initial investment costs for advanced systems can be a significant barrier for smaller businesses. Integration complexities with existing legacy systems can be time-consuming and expensive. Concerns surrounding job displacement due to automation necessitate workforce retraining and upskilling initiatives. Supply chain disruptions, particularly the impact of semiconductor shortages, can delay deployment and increase costs. Lastly, cybersecurity risks related to connected automation systems need to be effectively addressed to protect sensitive data.

Future Opportunities in Logistics Automation Market

Future opportunities lie in the expansion into new and emerging markets, particularly in developing economies experiencing rapid industrialization. The development of more sophisticated AI-powered solutions for predictive maintenance, autonomous delivery systems, and intelligent warehouse optimization will continue to drive market growth. The integration of blockchain technology for enhanced supply chain transparency and traceability presents a significant opportunity. Furthermore, the increasing demand for sustainable and environmentally friendly logistics solutions will fuel the adoption of green automation technologies.

Major Players in the Logistics Automation Market Ecosystem

- Jungheinrich AG

- Swisslog Holding AG (KUKA AG)

- Murata Machinery Ltd

- Honeywell International Inc

- Daifuku Co Limited

- Beumer Group GmbH & Co KG

- SSI Schaefer AG

- TGW Logistics Group GmbH

- Kardex Group

- WITRON Logistik

- SAP SE

- Oracle Corporation

- One Network Enterprises Inc

- Vanderlande Industries BV

- Dematic Corp (Kion Group AG)

- Knapp AG

- Mecalux SA

Key Developments in Logistics Automation Market Industry

- April 2023: TGW Logistics Group launched innovative visualization dashboards for optimizing intralogistics system performance, integrating data from various software sources.

- March 2023: KNAPP AG unveiled innovative robotics for automation and digitalization at LogiMAT 2023, promoting its "zero-touch fulfillment" approach.

Strategic Logistics Automation Market Forecast

The Logistics Automation Market is poised for sustained growth throughout the forecast period (2025-2033), driven by continued technological advancements, increasing adoption across various industries, and favorable regulatory environments. The market is expected to witness significant expansion in emerging economies, alongside the proliferation of AI-powered solutions and sustainable automation technologies. This presents significant opportunities for businesses to capitalize on this rapidly growing market and contribute to the efficient and effective transformation of global supply chains.

Logistics Automation Market Segmentation

-

1. Type

- 1.1. Fixed

- 1.2. Flexible

- 1.3. Mobile

-

2. Application

- 2.1. Warehousing

- 2.2. Transportation

- 2.3. Distribution

-

3. End User

- 3.1. Manufacturing

- 3.2. Retail

- 3.3. Healthcare

Logistics Automation Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Latin America

- 5. Middle East and Africa

Logistics Automation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Exponential Growth of the E-commerce Industry and Customer Expectation; Increasing Manufacturing Complexity and Technology Availability; Improved Efficiency and Workforce Safety

- 3.3. Market Restrains

- 3.3.1. Optimizing Battery Life of Hearable Device

- 3.4. Market Trends

- 3.4.1. Mobile Robots (AGV and AMR) are Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Logistics Automation Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Fixed

- 5.1.2. Flexible

- 5.1.3. Mobile

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Warehousing

- 5.2.2. Transportation

- 5.2.3. Distribution

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Manufacturing

- 5.3.2. Retail

- 5.3.3. Healthcare

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Logistics Automation Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Fixed

- 6.1.2. Flexible

- 6.1.3. Mobile

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Warehousing

- 6.2.2. Transportation

- 6.2.3. Distribution

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Manufacturing

- 6.3.2. Retail

- 6.3.3. Healthcare

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Logistics Automation Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Fixed

- 7.1.2. Flexible

- 7.1.3. Mobile

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Warehousing

- 7.2.2. Transportation

- 7.2.3. Distribution

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Manufacturing

- 7.3.2. Retail

- 7.3.3. Healthcare

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Logistics Automation Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Fixed

- 8.1.2. Flexible

- 8.1.3. Mobile

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Warehousing

- 8.2.2. Transportation

- 8.2.3. Distribution

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Manufacturing

- 8.3.2. Retail

- 8.3.3. Healthcare

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Logistics Automation Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Fixed

- 9.1.2. Flexible

- 9.1.3. Mobile

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Warehousing

- 9.2.2. Transportation

- 9.2.3. Distribution

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Manufacturing

- 9.3.2. Retail

- 9.3.3. Healthcare

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Logistics Automation Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Fixed

- 10.1.2. Flexible

- 10.1.3. Mobile

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Warehousing

- 10.2.2. Transportation

- 10.2.3. Distribution

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Manufacturing

- 10.3.2. Retail

- 10.3.3. Healthcare

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Europe Logistics Automation Market Analysis, Insights and Forecast, 2019-2031

- 12. Asia Pacific Logistics Automation Market Analysis, Insights and Forecast, 2019-2031

- 13. Latin America Logistics Automation Market Analysis, Insights and Forecast, 2019-2031

- 14. Middle East and Africa Logistics Automation Market Analysis, Insights and Forecast, 2019-2031

- 15. Competitive Analysis

- 15.1. Global Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 Jungheinrich AG

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Swisslog Holding AG (KUKA AG)

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 Murata Machinery Ltd

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 Honeywell International Inc

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 Daifuku Co Limited

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 Beumer Group GmbH & Co KG

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 SSI Schaefer AG

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.8 TGW Logistics Group GmbH

- 15.2.8.1. Overview

- 15.2.8.2. Products

- 15.2.8.3. SWOT Analysis

- 15.2.8.4. Recent Developments

- 15.2.8.5. Financials (Based on Availability)

- 15.2.9 Kardex Group

- 15.2.9.1. Overview

- 15.2.9.2. Products

- 15.2.9.3. SWOT Analysis

- 15.2.9.4. Recent Developments

- 15.2.9.5. Financials (Based on Availability)

- 15.2.10 WITRON Logistik

- 15.2.10.1. Overview

- 15.2.10.2. Products

- 15.2.10.3. SWOT Analysis

- 15.2.10.4. Recent Developments

- 15.2.10.5. Financials (Based on Availability)

- 15.2.11 SAP SE

- 15.2.11.1. Overview

- 15.2.11.2. Products

- 15.2.11.3. SWOT Analysis

- 15.2.11.4. Recent Developments

- 15.2.11.5. Financials (Based on Availability)

- 15.2.12 Oracle Corporation

- 15.2.12.1. Overview

- 15.2.12.2. Products

- 15.2.12.3. SWOT Analysis

- 15.2.12.4. Recent Developments

- 15.2.12.5. Financials (Based on Availability)

- 15.2.13 One Network Enterprises Inc

- 15.2.13.1. Overview

- 15.2.13.2. Products

- 15.2.13.3. SWOT Analysis

- 15.2.13.4. Recent Developments

- 15.2.13.5. Financials (Based on Availability)

- 15.2.14 Vanderlande Industries BV

- 15.2.14.1. Overview

- 15.2.14.2. Products

- 15.2.14.3. SWOT Analysis

- 15.2.14.4. Recent Developments

- 15.2.14.5. Financials (Based on Availability)

- 15.2.15 Dematic Corp (Kion Group AG)

- 15.2.15.1. Overview

- 15.2.15.2. Products

- 15.2.15.3. SWOT Analysis

- 15.2.15.4. Recent Developments

- 15.2.15.5. Financials (Based on Availability)

- 15.2.16 Knapp AG

- 15.2.16.1. Overview

- 15.2.16.2. Products

- 15.2.16.3. SWOT Analysis

- 15.2.16.4. Recent Developments

- 15.2.16.5. Financials (Based on Availability)

- 15.2.17 Mecalux SA

- 15.2.17.1. Overview

- 15.2.17.2. Products

- 15.2.17.3. SWOT Analysis

- 15.2.17.4. Recent Developments

- 15.2.17.5. Financials (Based on Availability)

- 15.2.1 Jungheinrich AG

List of Figures

- Figure 1: Global Logistics Automation Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Logistics Automation Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Logistics Automation Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Logistics Automation Market Revenue (Million), by Type 2024 & 2032

- Figure 5: North America Logistics Automation Market Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Logistics Automation Market Revenue (Million), by Application 2024 & 2032

- Figure 7: North America Logistics Automation Market Revenue Share (%), by Application 2024 & 2032

- Figure 8: North America Logistics Automation Market Revenue (Million), by End User 2024 & 2032

- Figure 9: North America Logistics Automation Market Revenue Share (%), by End User 2024 & 2032

- Figure 10: North America Logistics Automation Market Revenue (Million), by Country 2024 & 2032

- Figure 11: North America Logistics Automation Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: Europe Logistics Automation Market Revenue (Million), by Type 2024 & 2032

- Figure 13: Europe Logistics Automation Market Revenue Share (%), by Type 2024 & 2032

- Figure 14: Europe Logistics Automation Market Revenue (Million), by Application 2024 & 2032

- Figure 15: Europe Logistics Automation Market Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Logistics Automation Market Revenue (Million), by End User 2024 & 2032

- Figure 17: Europe Logistics Automation Market Revenue Share (%), by End User 2024 & 2032

- Figure 18: Europe Logistics Automation Market Revenue (Million), by Country 2024 & 2032

- Figure 19: Europe Logistics Automation Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Logistics Automation Market Revenue (Million), by Type 2024 & 2032

- Figure 21: Asia Logistics Automation Market Revenue Share (%), by Type 2024 & 2032

- Figure 22: Asia Logistics Automation Market Revenue (Million), by Application 2024 & 2032

- Figure 23: Asia Logistics Automation Market Revenue Share (%), by Application 2024 & 2032

- Figure 24: Asia Logistics Automation Market Revenue (Million), by End User 2024 & 2032

- Figure 25: Asia Logistics Automation Market Revenue Share (%), by End User 2024 & 2032

- Figure 26: Asia Logistics Automation Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Asia Logistics Automation Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Latin America Logistics Automation Market Revenue (Million), by Type 2024 & 2032

- Figure 29: Latin America Logistics Automation Market Revenue Share (%), by Type 2024 & 2032

- Figure 30: Latin America Logistics Automation Market Revenue (Million), by Application 2024 & 2032

- Figure 31: Latin America Logistics Automation Market Revenue Share (%), by Application 2024 & 2032

- Figure 32: Latin America Logistics Automation Market Revenue (Million), by End User 2024 & 2032

- Figure 33: Latin America Logistics Automation Market Revenue Share (%), by End User 2024 & 2032

- Figure 34: Latin America Logistics Automation Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Latin America Logistics Automation Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Logistics Automation Market Revenue (Million), by Type 2024 & 2032

- Figure 37: Middle East and Africa Logistics Automation Market Revenue Share (%), by Type 2024 & 2032

- Figure 38: Middle East and Africa Logistics Automation Market Revenue (Million), by Application 2024 & 2032

- Figure 39: Middle East and Africa Logistics Automation Market Revenue Share (%), by Application 2024 & 2032

- Figure 40: Middle East and Africa Logistics Automation Market Revenue (Million), by End User 2024 & 2032

- Figure 41: Middle East and Africa Logistics Automation Market Revenue Share (%), by End User 2024 & 2032

- Figure 42: Middle East and Africa Logistics Automation Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Middle East and Africa Logistics Automation Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Logistics Automation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Logistics Automation Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Logistics Automation Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Logistics Automation Market Revenue Million Forecast, by End User 2019 & 2032

- Table 5: Global Logistics Automation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Logistics Automation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Europe Logistics Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Asia Pacific Logistics Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Latin America Logistics Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Middle East and Africa Logistics Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Logistics Automation Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Global Logistics Automation Market Revenue Million Forecast, by Application 2019 & 2032

- Table 13: Global Logistics Automation Market Revenue Million Forecast, by End User 2019 & 2032

- Table 14: Global Logistics Automation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Global Logistics Automation Market Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Global Logistics Automation Market Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Global Logistics Automation Market Revenue Million Forecast, by End User 2019 & 2032

- Table 18: Global Logistics Automation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Global Logistics Automation Market Revenue Million Forecast, by Type 2019 & 2032

- Table 20: Global Logistics Automation Market Revenue Million Forecast, by Application 2019 & 2032

- Table 21: Global Logistics Automation Market Revenue Million Forecast, by End User 2019 & 2032

- Table 22: Global Logistics Automation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Global Logistics Automation Market Revenue Million Forecast, by Type 2019 & 2032

- Table 24: Global Logistics Automation Market Revenue Million Forecast, by Application 2019 & 2032

- Table 25: Global Logistics Automation Market Revenue Million Forecast, by End User 2019 & 2032

- Table 26: Global Logistics Automation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Global Logistics Automation Market Revenue Million Forecast, by Type 2019 & 2032

- Table 28: Global Logistics Automation Market Revenue Million Forecast, by Application 2019 & 2032

- Table 29: Global Logistics Automation Market Revenue Million Forecast, by End User 2019 & 2032

- Table 30: Global Logistics Automation Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Logistics Automation Market?

The projected CAGR is approximately 9.90%.

2. Which companies are prominent players in the Logistics Automation Market?

Key companies in the market include Jungheinrich AG, Swisslog Holding AG (KUKA AG), Murata Machinery Ltd, Honeywell International Inc, Daifuku Co Limited, Beumer Group GmbH & Co KG, SSI Schaefer AG, TGW Logistics Group GmbH, Kardex Group, WITRON Logistik, SAP SE, Oracle Corporation, One Network Enterprises Inc, Vanderlande Industries BV, Dematic Corp (Kion Group AG), Knapp AG, Mecalux SA.

3. What are the main segments of the Logistics Automation Market?

The market segments include Type, Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 75.24 Million as of 2022.

5. What are some drivers contributing to market growth?

Exponential Growth of the E-commerce Industry and Customer Expectation; Increasing Manufacturing Complexity and Technology Availability; Improved Efficiency and Workforce Safety.

6. What are the notable trends driving market growth?

Mobile Robots (AGV and AMR) are Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Optimizing Battery Life of Hearable Device.

8. Can you provide examples of recent developments in the market?

April 2023: TGW Logistics Group announced to offer of new and existing customer innovative visualization dashboards for optimizing the performance of the intralogistics system. With the help of this dashboard, data from many different software sources can be combined, analyzed, and processed graphically, from goods-in monitoring to the warehouse area to the sorters and scanners.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Logistics Automation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Logistics Automation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Logistics Automation Market?

To stay informed about further developments, trends, and reports in the Logistics Automation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence