Key Insights

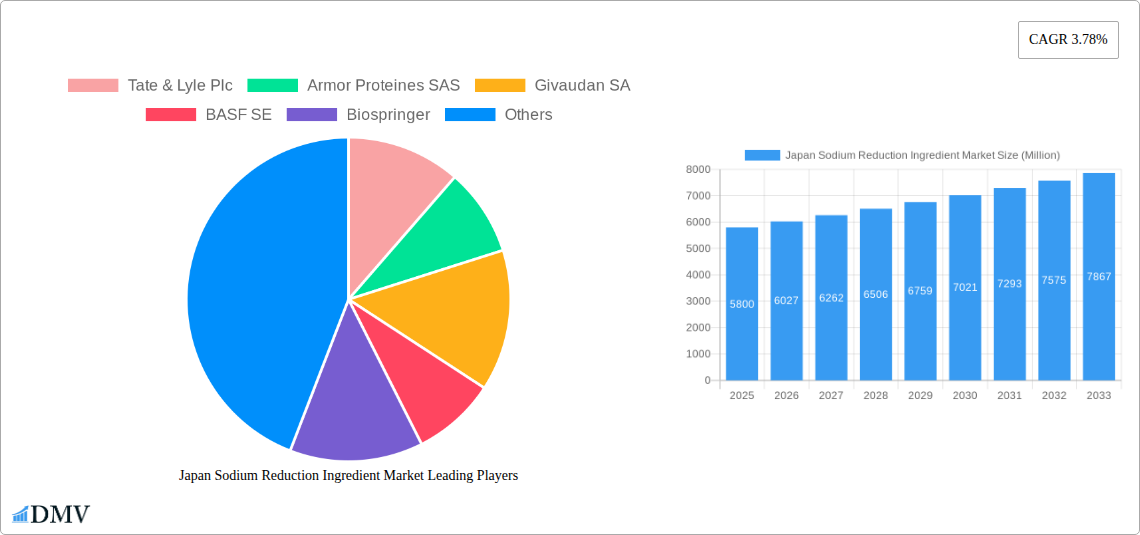

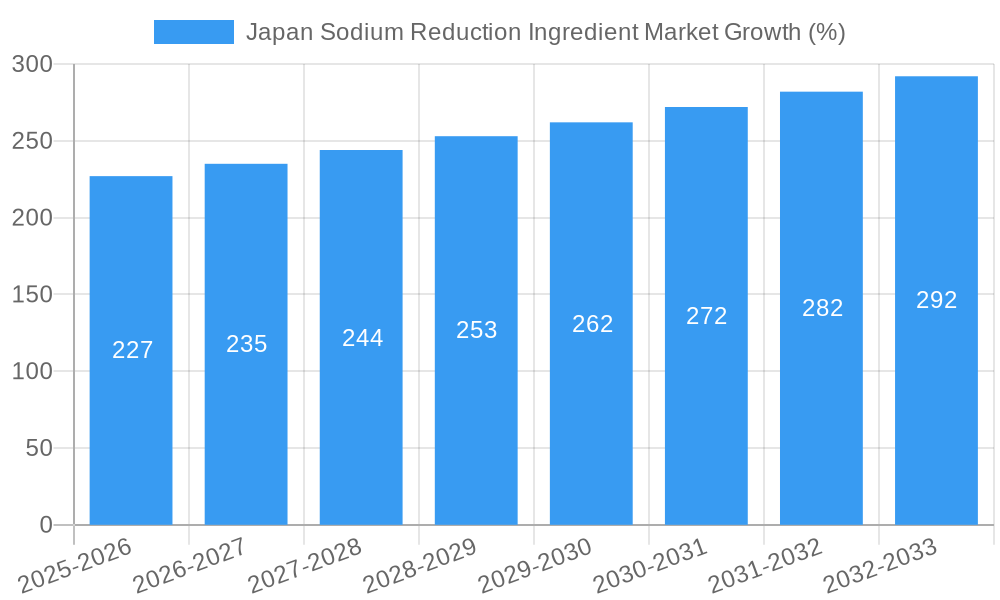

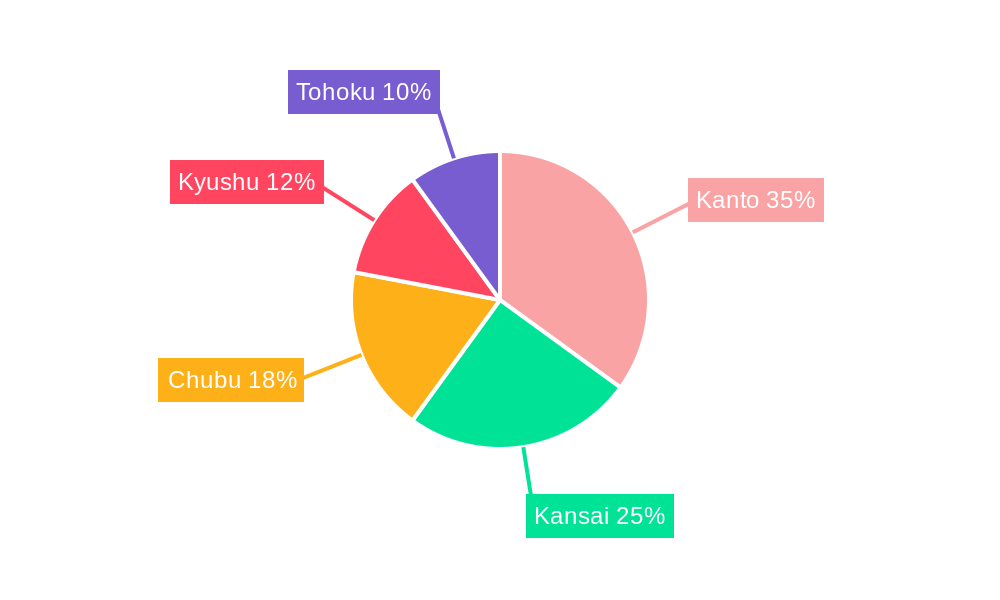

The Japan sodium reduction ingredient market, valued at approximately ¥58 billion (assuming "Million" refers to million Yen) in 2025, is projected to experience steady growth with a Compound Annual Growth Rate (CAGR) of 3.78% from 2025 to 2033. This growth is driven by increasing health consciousness among Japanese consumers, coupled with government initiatives promoting sodium reduction in food products to combat rising hypertension rates. Key market segments include amino acids & glutamates, mineral salts, and yeast extracts, used extensively across various applications like bakery & confectionery, condiments, and processed meats. The rising popularity of healthier eating habits and the demand for clean-label products further fuel market expansion. Competition is strong, with major players like Tate & Lyle, Ajinomoto, and Givaudan offering innovative solutions and catering to specific consumer needs. Regional variations exist within Japan, with Kanto, Kansai, and Chubu regions likely holding larger market shares due to higher population density and greater consumption of processed foods. While the market faces some restraints such as the ingrained preference for salty flavors in traditional Japanese cuisine and potential challenges in maintaining the taste and texture of food products after sodium reduction, the overall market outlook remains positive due to the aforementioned drivers.

The forecast for 2026-2033 suggests a gradual but consistent increase in market value, reflecting the sustained demand for sodium reduction ingredients. The market's segmentation offers opportunities for specialized ingredient suppliers to target specific applications and regional preferences. Companies are expected to invest in research and development to create innovative products that meet both health and taste requirements, potentially including solutions that mask the absence of sodium without significantly impacting the organoleptic characteristics of foods. The success of market participants hinges on understanding consumer preferences, regulatory compliance related to sodium reduction labeling, and adapting strategies to address regional variations in the market.

Japan Sodium Reduction Ingredient Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Japan Sodium Reduction Ingredient Market, offering valuable insights for stakeholders seeking to understand market dynamics, future trends, and strategic opportunities within this rapidly evolving sector. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report leverages extensive market research and data analysis to deliver a comprehensive overview of the market's current state and its projected trajectory. The market size is predicted to reach xx Million by 2033, reflecting significant growth opportunities.

Japan Sodium Reduction Ingredient Market Composition & Trends

This section delves into the intricate composition of the Japan Sodium Reduction Ingredient market, analyzing key trends and influencing factors. The report meticulously examines market concentration, revealing the market share distribution amongst key players like Ajinomoto Co., Inc., Kikkoman Corporation, and others. It explores the innovative catalysts driving market growth, including the increasing consumer demand for healthier food options and stringent government regulations aimed at reducing sodium intake. The competitive landscape is also assessed, including mergers and acquisitions (M&A) activities. Deal values of significant M&A activities are quantified and analyzed for their impact on market dynamics. The regulatory landscape, including specific Japanese regulations concerning food additives and labeling, are detailed. Finally, the analysis accounts for substitute products and their potential impact on market share. End-user profiles are characterized, outlining the specific needs and preferences of various segments within the food and beverage industry.

- Market Concentration: Analysis of market share held by top players (Ajinomoto Co., Inc. holds approximately xx% market share, Kikkoman Corporation holds approximately xx%, etc.).

- Innovation Catalysts: Focus on the development and adoption of clean-label sodium reduction ingredients.

- Regulatory Landscape: Detailed overview of Japanese regulations impacting the market.

- Substitute Products: Examination of alternative ingredients and their market penetration.

- End-User Profiles: Categorization of end-users based on their specific sodium reduction needs.

- M&A Activities: Analysis of recent mergers, acquisitions, and their implications, including estimated deal values of xx Million for significant transactions.

Japan Sodium Reduction Ingredient Market Industry Evolution

This section presents a comprehensive analysis of the Japan Sodium Reduction Ingredient market's evolutionary trajectory. The report meticulously charts the market's growth trajectory from 2019 to 2024, detailing historical growth rates and projecting future growth rates through 2033. This projection takes into account technological advancements, such as the development of novel sodium reduction technologies, and shifting consumer demands for healthier food options. The adoption rate of new technologies is quantified, and the impact of these technologies on market size and segmentation is explored. Specific data points, such as compound annual growth rates (CAGR) and adoption rates for specific sodium reduction solutions are provided, supported by detailed data visualization and analysis.

Leading Regions, Countries, or Segments in Japan Sodium Reduction Ingredient Market

This section identifies the dominant regions, countries, and segments within the Japan Sodium Reduction Ingredient Market. A detailed analysis is presented for leading segments, including:

By Product Type: Amino Acids & Glutamates, Mineral Salts, Yeast Extracts, Others. The report will identify the leading product type based on market share and growth potential, analyzing factors such as consumer preference, pricing, and technological advancements.

By Application: Bakery & Confectionery, Condiments, Seasonings & Sauces, Dairy & Frozen Foods, Meat & Seafood Products, Snacks and Savoury Products, Others. Similarly, the dominant application segment will be highlighted, with specific analysis of factors driving its dominance including regulatory pressures, consumer demand, and industry trends.

Key Drivers (Examples):

- Investment Trends: Significant investments in R&D of sodium reduction technologies in the xx region.

- Regulatory Support: Favorable regulatory environment for the use of specific sodium reduction ingredients in the xx segment.

The analysis includes in-depth exploration of dominance factors, including consumer preference trends, cost-effectiveness, ease of use, and regulatory influences.

Japan Sodium Reduction Ingredient Market Product Innovations

Recent years have witnessed significant product innovations in the Japan Sodium Reduction Ingredient market. Key players have introduced new clean-label sodium reduction ingredients, enhancing product functionality and appeal. Technological advancements, like improved extraction and formulation techniques, have significantly impacted ingredient quality and performance. These innovations cater to growing consumer demand for healthier food products while complying with stringent regulatory guidelines. The report will detail specific examples of innovative products, their unique selling propositions, and their impact on market share. Key performance metrics, such as efficacy in sodium reduction and consumer acceptance, will be presented.

Propelling Factors for Japan Sodium Reduction Ingredient Market Growth

Several factors are driving the growth of the Japan Sodium Reduction Ingredient Market. Technological advancements, such as the development of novel sodium reduction technologies and improved extraction processes, are significantly increasing the availability and efficacy of these ingredients. Furthermore, increasing consumer awareness of the health risks associated with high sodium intake is driving demand for healthier food products. Stringent government regulations and public health initiatives further propel market growth by incentivizing food manufacturers to reduce sodium content. The economic factors include the increasing disposable income and purchasing power of consumers, leading to higher demand for value-added and healthier foods.

Obstacles in the Japan Sodium Reduction Ingredient Market

Despite substantial growth potential, several obstacles hinder the Japan Sodium Reduction Ingredient market's development. Regulatory challenges concerning ingredient approval and labeling requirements can create hurdles for new product launches. Supply chain disruptions, particularly those stemming from global events or natural disasters, can impact ingredient availability and pricing. Intense competition among established players and the emergence of new entrants also create pressure on profit margins. These factors potentially limit market growth and profitability. The report will quantify these impacts wherever data allows, for example, estimating the potential revenue loss from supply chain disruptions (e.g., xx Million).

Future Opportunities in Japan Sodium Reduction Ingredient Market

The Japan Sodium Reduction Ingredient market presents several exciting future opportunities. The expanding market for clean-label products presents a significant growth avenue, as consumers increasingly prefer ingredients with natural origins. Advancements in biotechnology and food science are continually leading to the development of new, high-performance sodium reduction ingredients. Emerging markets for functional foods and personalized nutrition also offer substantial growth potential. The report will highlight specific market segments with promising growth potential and technological advancements with significant implications for the future of the market.

Major Players in the Japan Sodium Reduction Ingredient Market Ecosystem

- Tate & Lyle Plc

- Armor Proteines SAS

- Givaudan SA

- BASF SE

- Biospringer

- Sensient Technologies Corp

- Cargill Inc

- Ajinomoto Co., Inc.

- Nippon Shokubai Co., Ltd.

- Kikkoman Corporation

Key Developments in Japan Sodium Reduction Ingredient Market Industry

- 2022 Q4: Launch of a new clean-label sodium reduction ingredient by Ajinomoto Co., Inc. This launch expanded the company's market share by approximately xx%.

- 2023 Q1: Partnership between Kikkoman Corporation and a major food manufacturer for a custom sodium reduction solution in ready-to-eat meals. This partnership resulted in an estimated xx Million increase in revenue for Kikkoman.

- 2023 Q2: Government investment of xx Million in research and development of novel sodium reduction technologies through a public-private partnership. This investment is expected to accelerate the development of new clean label options by approximately xx years.

Strategic Japan Sodium Reduction Ingredient Market Forecast

The Japan Sodium Reduction Ingredient market is poised for sustained growth, driven by technological innovations, increasing consumer health consciousness, and supportive government policies. New product launches and strategic partnerships will continue to shape market dynamics. The rising demand for clean-label products and functional foods presents significant opportunities for market expansion. The market is expected to experience robust growth, with significant potential for market expansion within specific segments, particularly those focused on natural and sustainable ingredient solutions.

Japan Sodium Reduction Ingredient Market Segmentation

-

1. Product Type

- 1.1. Amino Acids & Glutamates

- 1.2. Mineral Salts

- 1.3. Yeast Extracts

- 1.4. Others

-

2. Application

- 2.1. Bakery & Confectionery

- 2.2. Condiments, Seasonings & Sauces

- 2.3. Dairy & Frozen Foods

- 2.4. Meat & Seafood Products

- 2.5. Snacks and Savoury Products

- 2.6. Others

Japan Sodium Reduction Ingredient Market Segmentation By Geography

- 1. Japan

Japan Sodium Reduction Ingredient Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.78% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing awareness towards fitness among consumers; Demand for convenient fortified foods

- 3.3. Market Restrains

- 3.3.1. Increasing vegan culture in the market

- 3.4. Market Trends

- 3.4.1. Growing Consumer Awareness Toward High Sodium Intake

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Sodium Reduction Ingredient Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Amino Acids & Glutamates

- 5.1.2. Mineral Salts

- 5.1.3. Yeast Extracts

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bakery & Confectionery

- 5.2.2. Condiments, Seasonings & Sauces

- 5.2.3. Dairy & Frozen Foods

- 5.2.4. Meat & Seafood Products

- 5.2.5. Snacks and Savoury Products

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Kanto Japan Sodium Reduction Ingredient Market Analysis, Insights and Forecast, 2019-2031

- 7. Kansai Japan Sodium Reduction Ingredient Market Analysis, Insights and Forecast, 2019-2031

- 8. Chubu Japan Sodium Reduction Ingredient Market Analysis, Insights and Forecast, 2019-2031

- 9. Kyushu Japan Sodium Reduction Ingredient Market Analysis, Insights and Forecast, 2019-2031

- 10. Tohoku Japan Sodium Reduction Ingredient Market Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Tate & Lyle Plc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Armor Proteines SAS

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Givaudan SA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 BASF SE

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Biospringer

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sensient Technologies Corp*List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Cargill Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Ajinomoto Co. Inc.

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nippon Shokubai Co. Ltd.

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Kikkoman Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Tate & Lyle Plc

List of Figures

- Figure 1: Japan Sodium Reduction Ingredient Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Japan Sodium Reduction Ingredient Market Share (%) by Company 2024

List of Tables

- Table 1: Japan Sodium Reduction Ingredient Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Japan Sodium Reduction Ingredient Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Japan Sodium Reduction Ingredient Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Japan Sodium Reduction Ingredient Market Volume K Tons Forecast, by Product Type 2019 & 2032

- Table 5: Japan Sodium Reduction Ingredient Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Japan Sodium Reduction Ingredient Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 7: Japan Sodium Reduction Ingredient Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Japan Sodium Reduction Ingredient Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: Japan Sodium Reduction Ingredient Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Japan Sodium Reduction Ingredient Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: Kanto Japan Sodium Reduction Ingredient Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Kanto Japan Sodium Reduction Ingredient Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 13: Kansai Japan Sodium Reduction Ingredient Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Kansai Japan Sodium Reduction Ingredient Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: Chubu Japan Sodium Reduction Ingredient Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Chubu Japan Sodium Reduction Ingredient Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: Kyushu Japan Sodium Reduction Ingredient Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Kyushu Japan Sodium Reduction Ingredient Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: Tohoku Japan Sodium Reduction Ingredient Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Tohoku Japan Sodium Reduction Ingredient Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 21: Japan Sodium Reduction Ingredient Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 22: Japan Sodium Reduction Ingredient Market Volume K Tons Forecast, by Product Type 2019 & 2032

- Table 23: Japan Sodium Reduction Ingredient Market Revenue Million Forecast, by Application 2019 & 2032

- Table 24: Japan Sodium Reduction Ingredient Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 25: Japan Sodium Reduction Ingredient Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Japan Sodium Reduction Ingredient Market Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Sodium Reduction Ingredient Market?

The projected CAGR is approximately 3.78%.

2. Which companies are prominent players in the Japan Sodium Reduction Ingredient Market?

Key companies in the market include Tate & Lyle Plc, Armor Proteines SAS, Givaudan SA, BASF SE, Biospringer, Sensient Technologies Corp*List Not Exhaustive, Cargill Inc, Ajinomoto Co., Inc. , Nippon Shokubai Co., Ltd. , Kikkoman Corporation.

3. What are the main segments of the Japan Sodium Reduction Ingredient Market?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 5800 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing awareness towards fitness among consumers; Demand for convenient fortified foods.

6. What are the notable trends driving market growth?

Growing Consumer Awareness Toward High Sodium Intake.

7. Are there any restraints impacting market growth?

Increasing vegan culture in the market.

8. Can you provide examples of recent developments in the market?

Launch of new clean-label sodium reduction ingredients by major players.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Sodium Reduction Ingredient Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Sodium Reduction Ingredient Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Sodium Reduction Ingredient Market?

To stay informed about further developments, trends, and reports in the Japan Sodium Reduction Ingredient Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence