Key Insights

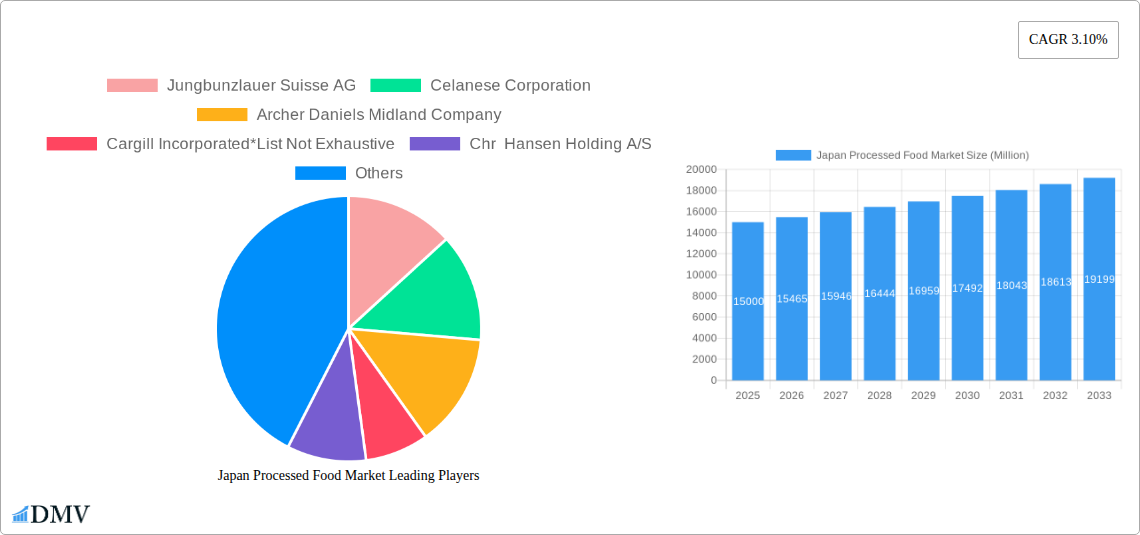

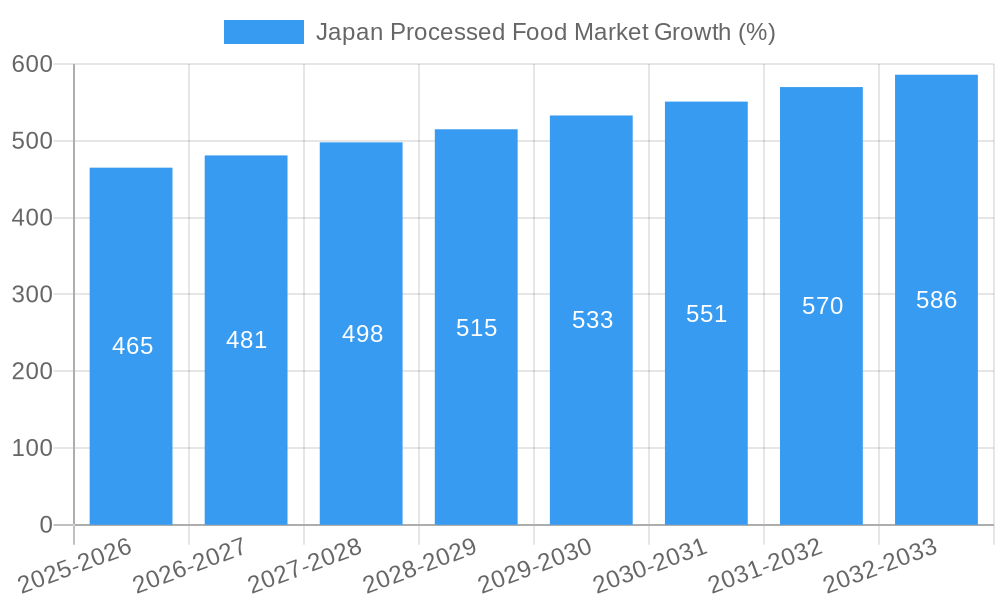

The Japan processed food market, valued at approximately ¥15 trillion (assuming a reasonable market size based on global trends and Japan's economic strength) in 2025, is projected to experience steady growth, exhibiting a compound annual growth rate (CAGR) of 3.10% from 2025 to 2033. This growth is primarily driven by several key factors. Firstly, the increasing urbanization and changing lifestyles in Japan are leading to higher demand for convenient and ready-to-eat processed food products. Secondly, the rising disposable incomes and a growing preference for diverse culinary experiences are fueling innovation and expansion within the processed food sector. Furthermore, advancements in food preservation technologies, particularly the use of natural preservatives, are playing a crucial role in enhancing the quality, shelf life, and appeal of processed foods. However, the market also faces challenges. Growing consumer awareness about health and nutrition is pushing demand towards healthier options with reduced sodium, sugar, and artificial additives. Stringent food safety regulations in Japan also pose a barrier to market entry for some players.

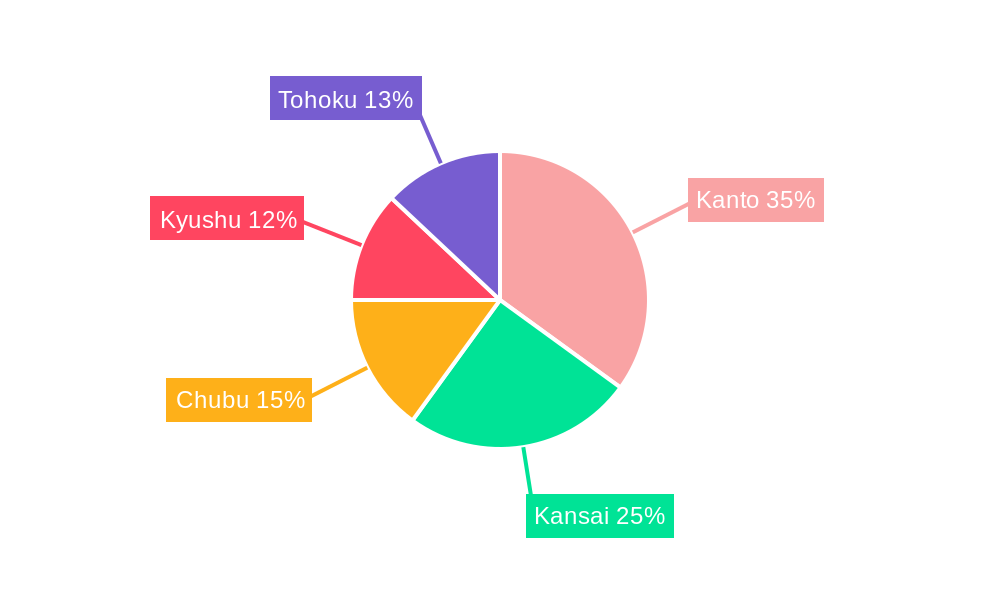

Segmentation analysis reveals that natural preservatives are gaining significant traction over synthetic counterparts, driven by increasing consumer preference for clean-label products. Within applications, the beverages segment dominates the market, followed by dairy and frozen products, reflecting the high consumption of these categories in Japan. However, the bakery, meat, poultry, and seafood segments are expected to demonstrate strong growth potential driven by evolving consumer tastes and the introduction of innovative processed food items. Key players like Jungbunzlauer Suisse AG, Celanese Corporation, and Cargill Incorporated are leveraging their technological capabilities and strong distribution networks to capitalize on this growth, while also focusing on adapting to the evolving demands of the Japanese consumer. Regional variations in consumption patterns exist, with the Kanto and Kansai regions representing the largest markets within Japan due to high population density and economic activity. The market's future trajectory will depend heavily on successful navigation of regulatory hurdles, consumer preferences for healthier options, and innovative product development.

Japan Processed Food Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Japan processed food market, offering a comprehensive overview of its current state, future trends, and key players. Covering the period from 2019 to 2033, with a focus on 2025, this study is essential for stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The market size is predicted to reach xx Million by 2033.

Japan Processed Food Market Market Composition & Trends

This section delves into the competitive landscape of the Japan processed food market, examining market concentration, innovation drivers, regulatory frameworks, substitute products, end-user preferences, and mergers & acquisitions (M&A) activities. We analyze market share distribution among key players, revealing the dominance of certain companies and the level of competition. The impact of regulatory changes on market dynamics is assessed, including implications for specific preservatives (natural and synthetic). The report also explores the influence of substitute products and evolving consumer preferences on market trends. Finally, we examine significant M&A activities, analyzing their value and impact on market consolidation. Data includes:

- Market Concentration: xx% market share held by top 5 players in 2025.

- M&A Activity: Analysis of xx M&A deals totaling xx Million in value during 2019-2024.

- Innovation Catalysts: Focus on advancements in preservation technologies and consumer demand for clean-label products.

- Regulatory Landscape: Detailed examination of Japanese food safety regulations and their influence on market players.

- End-User Profiles: Segmentation by application (Beverages, Dairy and Frozen Products, Bakery, Meat, Poultry, and Seafood, Confectionery, Sauces and Salad Mixes, Other Applications) and identification of key consumer trends.

Japan Processed Food Market Industry Evolution

This section provides a comprehensive analysis of the Japan processed food market's evolution from 2019 to 2033. We meticulously trace market growth trajectories, examining the factors that have propelled and potentially hampered expansion. Technological advancements in food preservation and processing are analyzed, including their adoption rates and impact on market dynamics. The evolving consumer preferences towards health and convenience are incorporated, influencing the demand for specific product categories and types of preservatives. Specific data points include:

- Growth Rates: A detailed analysis of historical (2019-2024) and projected (2025-2033) Compound Annual Growth Rate (CAGR).

- Technological Advancements: Evaluation of the impact of new preservation techniques, packaging innovations, and processing technologies on market growth.

- Shifting Consumer Demands: In-depth analysis of changing consumer preferences, including growing demand for natural preservatives, organic products, and convenience foods.

Leading Regions, Countries, or Segments in Japan Processed Food Market

This section identifies the leading regions, countries, and segments within the Japan processed food market, distinguishing between the dominant areas for natural and synthetic preservatives across various applications. We analyze the key drivers behind their dominance, including investment patterns, government support, and regional consumption habits.

- Dominant Segments: Analysis of market share for each segment (Natural Preservatives, Synthetic Preservatives; Beverages, Dairy and Frozen Products, Bakery, Meat, Poultry, and Seafood, Confectionery, Sauces and Salad Mixes, Other Applications).

- Key Drivers (by Segment):

- Beverages: High demand for extended shelf-life beverages.

- Dairy and Frozen Products: Stringent quality and safety regulations driving demand for effective preservatives.

- Bakery: Focus on maintaining freshness and texture.

- Meat, Poultry, and Seafood: Emphasis on food safety and preventing spoilage.

- Confectionery: Demand for extended shelf-life and maintaining product quality.

- Sauces and Salad Mixes: Focus on preservation and maintaining flavor profile.

- Other Applications: Growth driven by expansion into niche processed food categories.

- Regional Analysis: Detailed assessment of regional differences in market dynamics and consumer behavior.

Japan Processed Food Market Product Innovations

This section highlights recent product innovations in the Japan processed food market, focusing on new applications and their performance metrics. We showcase the unique selling propositions and technological advancements that have driven product development and market adoption. Examples include the introduction of novel natural preservatives and improved packaging technologies that extend shelf life.

Propelling Factors for Japan Processed Food Market Growth

The growth of the Japan processed food market is driven by a confluence of factors including increasing demand for convenient food, advancements in preservation technologies enabling extended shelf life, and favorable regulatory environments supporting the use of specific preservatives. Economic growth, changing lifestyles, and rising disposable incomes contribute significantly to this expansion.

Obstacles in the Japan Processed Food Market Market

Challenges facing the Japan processed food market include stringent regulations, increasing raw material costs, and fierce competition. Supply chain disruptions can also impact production and availability of processed foods. These factors can affect both profitability and market growth.

Future Opportunities in Japan Processed Food Market

Future opportunities lie in expanding into niche markets, developing innovative preservation technologies, and catering to evolving consumer demands. The focus on health and wellness provides an impetus for the introduction of clean-label and organic products, driving substantial market growth.

Major Players in the Japan Processed Food Market Ecosystem

- Jungbunzlauer Suisse AG

- Celanese Corporation

- Archer Daniels Midland Company

- Cargill Incorporated

- Chr Hansen Holding A/S

- Corbion NV

Key Developments in Japan Processed Food Market Industry

- [Month/Year]: Launch of a new natural preservative by [Company Name].

- [Month/Year]: Acquisition of [Company A] by [Company B], resulting in increased market share.

- [Month/Year]: Introduction of new food safety regulations impacting the use of certain preservatives.

Strategic Japan Processed Food Market Market Forecast

The Japan processed food market is poised for continued growth, driven by increasing demand for convenient and healthy food options. Technological advancements in food preservation and processing will play a key role in shaping market dynamics. The focus on clean-label products and sustainable practices will further influence consumer choices and market development, presenting both challenges and opportunities for market players.

Japan Processed Food Market Segmentation

-

1. Type

- 1.1. Natural Preservatives

- 1.2. Synthetic Preservatives

-

2. Application

- 2.1. Beverages

- 2.2. Dairy and Frozen Products

- 2.3. Bakery

- 2.4. Meat, Poultry, and Seafood

- 2.5. Confectionery

- 2.6. Sauces and Salad Mixes

- 2.7. Other Applications

Japan Processed Food Market Segmentation By Geography

- 1. Japan

Japan Processed Food Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Awareness and Extensive Promotions for Differentiated Food Ingredients; Favorable Regulatory Framework

- 3.3. Market Restrains

- 3.3.1. High Processing Cost and Low Yield of Flavonoids

- 3.4. Market Trends

- 3.4.1. Synthetic Food Preservatives Holds the Largest Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Processed Food Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Natural Preservatives

- 5.1.2. Synthetic Preservatives

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Beverages

- 5.2.2. Dairy and Frozen Products

- 5.2.3. Bakery

- 5.2.4. Meat, Poultry, and Seafood

- 5.2.5. Confectionery

- 5.2.6. Sauces and Salad Mixes

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Kanto Japan Processed Food Market Analysis, Insights and Forecast, 2019-2031

- 7. Kansai Japan Processed Food Market Analysis, Insights and Forecast, 2019-2031

- 8. Chubu Japan Processed Food Market Analysis, Insights and Forecast, 2019-2031

- 9. Kyushu Japan Processed Food Market Analysis, Insights and Forecast, 2019-2031

- 10. Tohoku Japan Processed Food Market Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Jungbunzlauer Suisse AG

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Celanese Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Archer Daniels Midland Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Cargill Incorporated*List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Chr Hansen Holding A/S

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Corbion NV

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.1 Jungbunzlauer Suisse AG

List of Figures

- Figure 1: Japan Processed Food Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Japan Processed Food Market Share (%) by Company 2024

List of Tables

- Table 1: Japan Processed Food Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Japan Processed Food Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Japan Processed Food Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Japan Processed Food Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Japan Processed Food Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Kanto Japan Processed Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Kansai Japan Processed Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Chubu Japan Processed Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Kyushu Japan Processed Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Tohoku Japan Processed Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Japan Processed Food Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Japan Processed Food Market Revenue Million Forecast, by Application 2019 & 2032

- Table 13: Japan Processed Food Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Processed Food Market?

The projected CAGR is approximately 3.10%.

2. Which companies are prominent players in the Japan Processed Food Market?

Key companies in the market include Jungbunzlauer Suisse AG, Celanese Corporation, Archer Daniels Midland Company, Cargill Incorporated*List Not Exhaustive, Chr Hansen Holding A/S, Corbion NV.

3. What are the main segments of the Japan Processed Food Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Awareness and Extensive Promotions for Differentiated Food Ingredients; Favorable Regulatory Framework.

6. What are the notable trends driving market growth?

Synthetic Food Preservatives Holds the Largest Market.

7. Are there any restraints impacting market growth?

High Processing Cost and Low Yield of Flavonoids.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Processed Food Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Processed Food Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Processed Food Market?

To stay informed about further developments, trends, and reports in the Japan Processed Food Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence