Key Insights

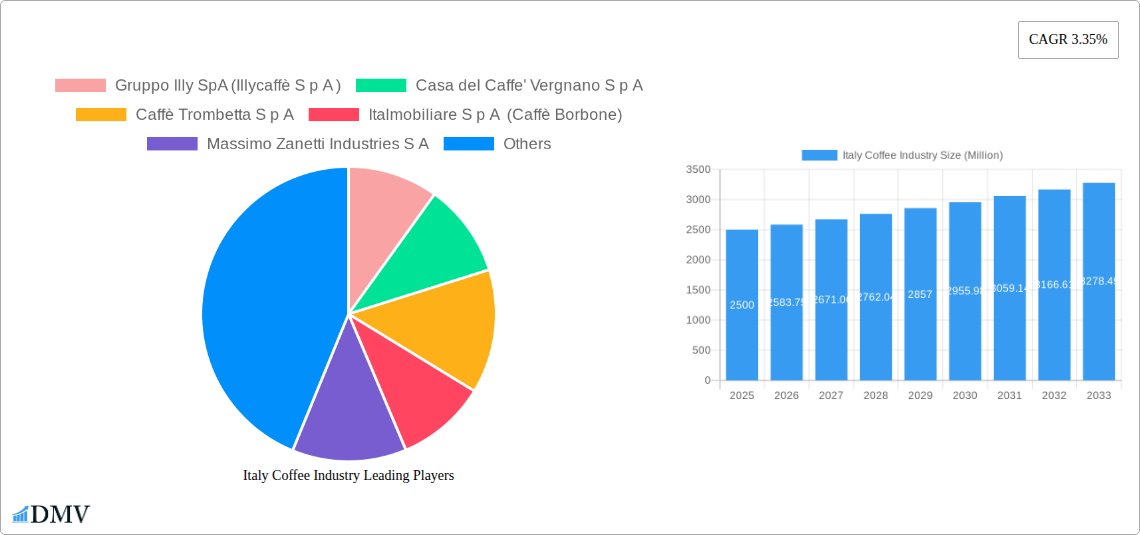

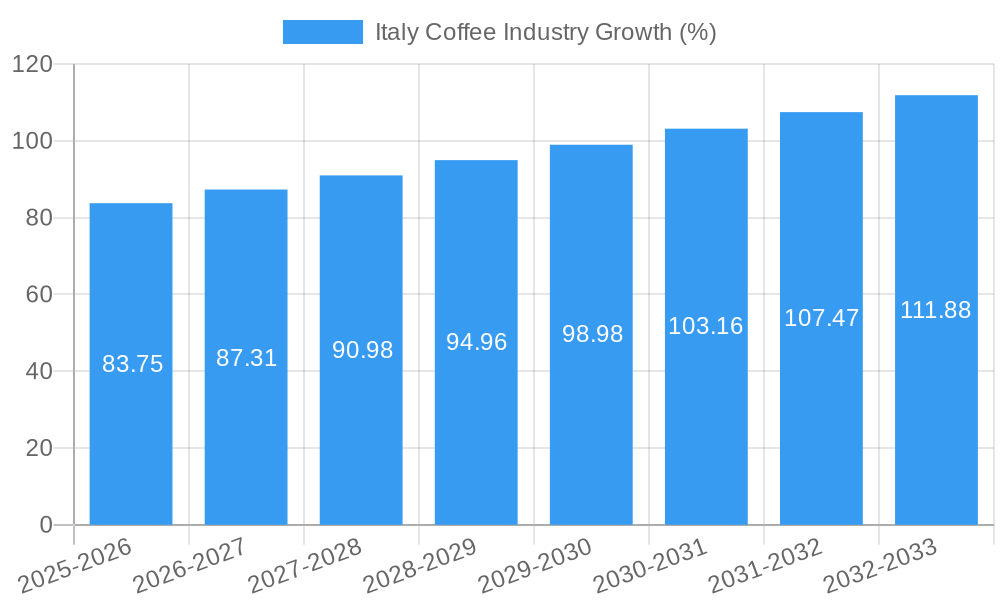

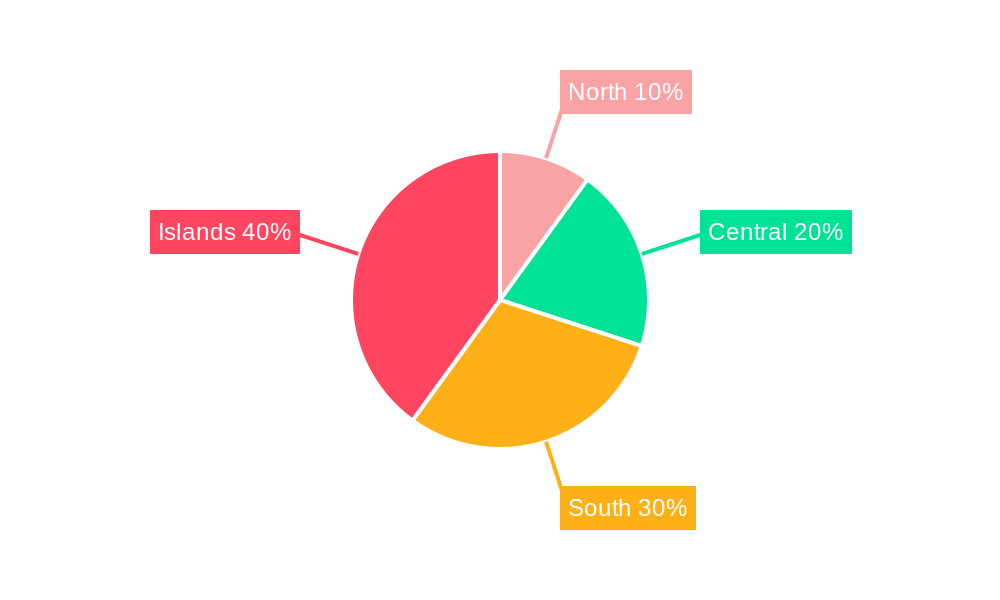

The Italian coffee industry, a cornerstone of the nation's culture and economy, exhibits robust growth potential, projected to expand steadily over the forecast period (2025-2033). With a 2025 market size estimated at €2.5 billion (assuming a reasonable market size based on European coffee market data and Italy's significant coffee consumption), the sector enjoys a compound annual growth rate (CAGR) of 3.35%. This growth is fueled by several key drivers. The increasing popularity of specialty coffee, encompassing single-origin beans, pour-over methods, and artisanal roasts, contributes significantly. Furthermore, the burgeoning café culture, particularly in urban areas, and a growing preference for premium coffee experiences drive demand. The strong presence of established Italian coffee brands like Lavazza, Illy, and Kimbo, known for their quality and heritage, further strengthens the market. However, the industry faces challenges, including fluctuations in global coffee bean prices and increasing competition from international coffee chains. The market is segmented by product type (whole bean, ground, instant, pods/capsules) and distribution channel (on-trade, off-trade), with the off-trade segment (supermarkets, online retailers) experiencing notable growth due to convenience and evolving consumer preferences. The dominance of established players underscores the importance of brand loyalty, while innovative product offerings and effective marketing strategies will be crucial for new entrants and smaller companies. Regional variations exist, with northern Italy potentially showing higher growth than the south, due to higher disposable incomes and a more established café culture in major cities.

The segmentation within the Italian coffee market presents both opportunities and challenges. While the traditional whole bean and ground coffee segments maintain a strong presence, the rapid growth of coffee pods and capsules demonstrates evolving consumer preferences for convenience. The on-trade channel, representing cafes and restaurants, remains a significant portion of the market, while the off-trade channel's expansion reflects the growing popularity of home coffee brewing. The presence of both large multinational corporations and smaller, artisanal roasters creates a diverse landscape. Strategic partnerships, sustainable sourcing initiatives, and a focus on innovation in product development and packaging will be critical to navigating these dynamics and maintaining a competitive edge. Further growth is anticipated through targeted marketing efforts focusing on the specific preferences of younger demographics and the continued emphasis on premium coffee experiences.

Italy Coffee Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Italy coffee industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year. The forecast period extends from 2025 to 2033, covering the historical period from 2019 to 2024. The report meticulously examines market size, trends, key players, and future projections, enabling informed decision-making and strategic planning. The Italian coffee market, valued at €XX Billion in 2024, is poised for significant growth, driven by evolving consumer preferences and technological advancements. This report will equip you with the critical understanding needed to succeed in this competitive landscape.

Italy Coffee Industry Market Composition & Trends

The Italian coffee market is characterized by a mix of established giants and emerging players, creating a complex but lucrative landscape. Market concentration is moderate, with several major players holding significant shares, but also leaving room for smaller, specialized brands. Innovation is a key driver, with companies constantly introducing new product formats (like pods and capsules) and sustainable sourcing practices. The regulatory environment is relatively stable, albeit subject to EU-wide regulations concerning food safety and labeling. Substitute products, such as tea and other beverages, present some competition, but the deeply ingrained coffee culture in Italy mitigates their impact. End-users range from individual consumers to the HoReCa (Hotels, Restaurants, and Cafés) sector, with distinct purchasing behaviors and preferences. Mergers and acquisitions (M&A) activity has been relatively robust, with significant deals reshaping the market dynamics.

- Market Share Distribution (2024 Estimate): Luigi Lavazza S p A: XX%; Gruppo Illy SpA (Illycaffè S p A): XX%; Massimo Zanetti Industries S A: XX%; Other players: XX%

- Recent M&A Activity: Coca-Cola Hellenic Bottling Company's acquisition of a 30% stake in Casa Del Caffè Vergnano in June 2021 demonstrates the growing interest in the Italian coffee market. Total M&A deal value in the period 2019-2024 is estimated at €XX Billion.

Italy Coffee Industry Industry Evolution

The Italian coffee industry has experienced consistent growth over the past five years, driven by a number of factors including increasing demand for premium coffee, innovative product development, and a growing preference for convenience. This growth is expected to continue throughout the forecast period, although at a slightly moderated pace. Technological advancements such as automation in coffee production, advanced roasting techniques, and the proliferation of smart coffee machines have increased efficiency and enhanced the overall quality of coffee products. Furthermore, the industry has witnessed a significant shift in consumer demands toward sustainable and ethically sourced coffee, with growing interest in fair trade, organic, and single-origin beans. This heightened awareness has forced companies to enhance their supply chain transparency and adopt environmentally friendly practices. This trend is likely to further accelerate the growth of the industry in the coming years.

- Average Annual Growth Rate (2019-2024): XX%

- Projected Annual Growth Rate (2025-2033): XX%

- Adoption Rate of Sustainable Coffee (2024): XX%

Leading Regions, Countries, or Segments in Italy Coffee Industry

The Italian coffee market is relatively concentrated geographically, with the northern regions (Lombardy, Veneto, Piedmont) and major cities like Rome and Milan showing strong demand due to higher population density and purchasing power. Within product types, ground coffee and coffee pods/capsules dominate, driven by convenience and ease of use. The on-trade channel (cafes, restaurants) remains a significant segment, reflecting Italy's strong coffee culture.

- Key Drivers for Ground Coffee Dominance: Established tradition, widespread availability, affordability.

- Key Drivers for Pod/Capsule Segment Growth: Convenience, consistent quality, ease of use.

- Key Drivers for On-Trade Channel Strength: Deeply ingrained coffee culture, social aspect of café visits.

Italy Coffee Industry Product Innovations

Recent innovations in the Italian coffee industry focus on sustainability, convenience, and enhanced flavor profiles. Companies are investing in single-serve brewing systems that minimize waste, developing new coffee blends to cater to evolving taste preferences, and integrating technology such as blockchain to ensure transparency throughout the supply chain. This includes the use of innovative packaging materials to enhance shelf life and reduce environmental impact. The emphasis on unique selling propositions like fair-trade sourcing and sustainable farming practices reflects consumers’ increasing awareness.

Propelling Factors for Italy Coffee Industry Growth

Several factors are fueling growth in the Italian coffee industry. Technological advancements in roasting and brewing techniques are leading to better-quality coffee and increased efficiency. The robust Italian economy supports disposable income for premium coffee consumption. Furthermore, favorable regulatory environments that promote innovation and fair trade practices are also supporting expansion.

Obstacles in the Italy Coffee Industry Market

Challenges facing the Italian coffee industry include intense competition from both domestic and international players, fluctuating prices of coffee beans due to global supply chain disruptions, and increasing regulatory pressure regarding environmental sustainability and ethical sourcing. These challenges could impact profitability and hinder growth if not properly addressed.

Future Opportunities in Italy Coffee Industry

The Italian coffee industry presents several exciting opportunities. The rising popularity of specialty coffee, including single-origin beans and cold brew, is creating new niche markets. The increasing demand for sustainable and ethically produced coffee is also opening doors for companies who can meet these expectations. Technological innovations like AI-powered coffee machines further improve customization and convenience.

Major Players in the Italy Coffee Industry Ecosystem

- Gruppo Illy SpA (Illycaffè S p A)

- Casa del Caffè Vergnano S p A

- Caffè Trombetta S p A

- Italmobiliare S p A (Caffè Borbone)

- Massimo Zanetti Industries S A

- Luigi Lavazza S p A

- Starbucks Corporation

- Kimbo S p A

- Maxingvest AG (Tchibo GmbH)

- Gruppo Gimoka S p a

- Nestlé S A

Key Developments in Italy Coffee Industry Industry

- January 2022: Starbucks opens its first drive-thru in Italy.

- June 2021: Coca-Cola HBC acquires a 30% stake in Casa Del Caffè Vergnano.

- March 2021: Massimo Zanetti Beverage Group launches Segafredo Storia, a sustainable coffee line using blockchain technology.

Strategic Italy Coffee Industry Market Forecast

The Italian coffee market is poised for continued growth, driven by premiumization, sustainability, and technological innovation. Future opportunities lie in tapping into the growing demand for specialty coffee and leveraging technology to enhance the consumer experience. This includes expanding into new distribution channels and capitalizing on the rising popularity of sustainable and ethically sourced coffee. The overall market shows strong potential, with significant growth expected over the next decade.

Italy Coffee Industry Segmentation

-

1. Product Type

- 1.1. Whole-Bean

- 1.2. Ground Coffee

- 1.3. Instant Coffee

- 1.4. Coffee Pods and Capsules

-

2. Distribution Channel

- 2.1. On-Trade

-

2.2. Off-Trade

- 2.2.1. Supermarket/Hypermarket

- 2.2.2. Convenience Stores

- 2.2.3. Specialist Retailers

- 2.2.4. Other Distribution Channels

Italy Coffee Industry Segmentation By Geography

- 1. Italy

Italy Coffee Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.35% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wide Applications and Functionality; Low Price and Easy Availability of Synthetic Phenethyl Alcohol

- 3.3. Market Restrains

- 3.3.1. Availability of Substitutes

- 3.4. Market Trends

- 3.4.1. Lifestyle and Culture Drives Coffee Market in Italy

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Coffee Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Whole-Bean

- 5.1.2. Ground Coffee

- 5.1.3. Instant Coffee

- 5.1.4. Coffee Pods and Capsules

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-Trade

- 5.2.2. Off-Trade

- 5.2.2.1. Supermarket/Hypermarket

- 5.2.2.2. Convenience Stores

- 5.2.2.3. Specialist Retailers

- 5.2.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Germany Italy Coffee Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Italy Coffee Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Italy Coffee Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Italy Coffee Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Italy Coffee Industry Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Europe Italy Coffee Industry Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Gruppo Illy SpA (Illycaffè S p A )

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Casa del Caffe' Vergnano S p A

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Caffè Trombetta S p A

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Italmobiliare S p A (Caffè Borbone)

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Massimo Zanetti Industries S A

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Luigi Lavazza S p A

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Starbucks Corporation*List Not Exhaustive

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Kimbo S p A

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Maxingvest AG (Tchibo GmbH)

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Gruppo Gimoka S p a

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Nestlé S A

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 Gruppo Illy SpA (Illycaffè S p A )

List of Figures

- Figure 1: Italy Coffee Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Italy Coffee Industry Share (%) by Company 2024

List of Tables

- Table 1: Italy Coffee Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Italy Coffee Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Italy Coffee Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Italy Coffee Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Italy Coffee Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Italy Coffee Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Italy Coffee Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Italy Coffee Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Italy Coffee Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Italy Coffee Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Europe Italy Coffee Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Italy Coffee Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 13: Italy Coffee Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 14: Italy Coffee Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Coffee Industry?

The projected CAGR is approximately 3.35%.

2. Which companies are prominent players in the Italy Coffee Industry?

Key companies in the market include Gruppo Illy SpA (Illycaffè S p A ), Casa del Caffe' Vergnano S p A, Caffè Trombetta S p A, Italmobiliare S p A (Caffè Borbone), Massimo Zanetti Industries S A, Luigi Lavazza S p A, Starbucks Corporation*List Not Exhaustive, Kimbo S p A, Maxingvest AG (Tchibo GmbH), Gruppo Gimoka S p a, Nestlé S A.

3. What are the main segments of the Italy Coffee Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Wide Applications and Functionality; Low Price and Easy Availability of Synthetic Phenethyl Alcohol.

6. What are the notable trends driving market growth?

Lifestyle and Culture Drives Coffee Market in Italy.

7. Are there any restraints impacting market growth?

Availability of Substitutes.

8. Can you provide examples of recent developments in the market?

In January 2022, Starbucks inaugurated its first drive-thru in Italy in Erbusco, Lombardy, as part of a new collaboration between Percassi, Starbucks' sole licensee partner in Italy, and the Q8 service station company.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Coffee Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Coffee Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Coffee Industry?

To stay informed about further developments, trends, and reports in the Italy Coffee Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence