Key Insights

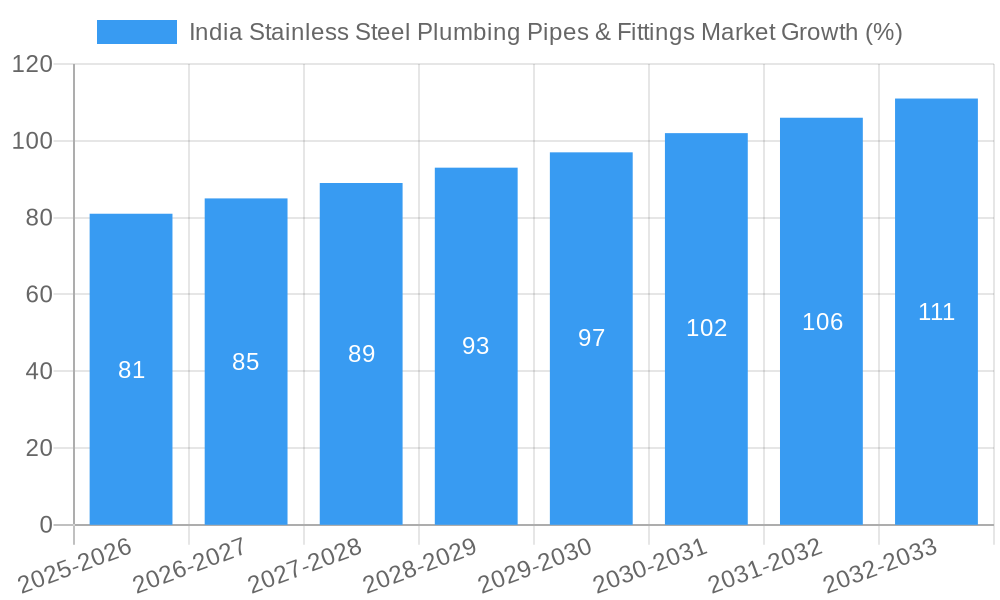

The India stainless steel plumbing pipes and fittings market is experiencing robust growth, driven by increasing urbanization, rising disposable incomes, and a preference for durable and hygienic plumbing solutions. The market, estimated at approximately ₹15000 million (USD 1800 million) in 2025, is projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 4.5% from 2025 to 2033. This growth is fueled by significant investments in infrastructure development, particularly in residential and non-residential construction projects across India's diverse regions. The increasing adoption of seamless pipes, owing to their superior strength and leak-resistance, is a key trend shaping market dynamics. While the organized sector dominates, the unorganized sector still holds a substantial share, presenting opportunities for consolidation and expansion. E-commerce is emerging as a prominent sales channel, complementing traditional retail networks and direct sales. However, fluctuating raw material prices and potential supply chain disruptions pose challenges to sustained growth. The market segmentation reveals a significant demand for stainless steel pipes and fittings in both residential and non-residential applications, with regional variations reflecting infrastructure development priorities. Key players like Jindal Stainless Ltd, APL Apollo, and Maharashtra Seamless Ltd are actively shaping the competitive landscape through product innovation and strategic expansion. The market's future trajectory indicates a continued upward trend, fueled by government initiatives promoting sustainable infrastructure and improved sanitation.

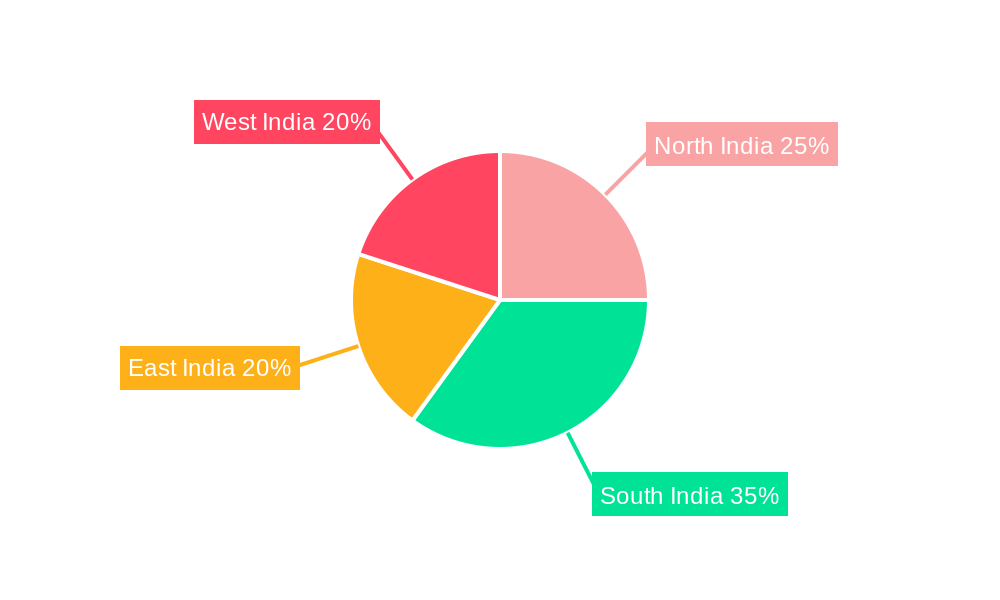

The southern and western regions of India are currently demonstrating stronger growth compared to the north and east. This disparity is likely attributable to higher levels of urbanization and infrastructure development in these regions. However, increasing government investments in infrastructure projects across all regions are expected to gradually narrow this regional gap. The fabricated pipe segment shows particular promise, offering flexibility and customization. To maintain a competitive edge, manufacturers are focusing on enhancing product quality, optimizing distribution networks, and exploring strategic partnerships. The long-term outlook remains positive, anticipating sustained growth driven by increasing demand and the inherent advantages of stainless steel in plumbing applications.

India Stainless Steel Plumbing Pipes & Fittings Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the India stainless steel plumbing pipes & fittings market, offering valuable insights for stakeholders across the value chain. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market size, growth drivers, challenges, and future opportunities. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx%.

India Stainless Steel Plumbing Pipes & Fittings Market Market Composition & Trends

This section delves into the intricate structure of the Indian stainless steel plumbing pipes & fittings market, analyzing its competitive landscape, innovation drivers, and regulatory influences. The market is segmented by sales channel (Retail, E-commerce, Direct), pipe type (Seamless, Welded, Fabricated), market structure (Organized, Unorganized), and end-user industry (Residential, Non-residential).

- Market Concentration: The market exhibits a moderately concentrated structure, with key players like Jindal Stainless Ltd, APL Apollo, and Maharashtra Seamless Ltd holding significant market share. However, the presence of numerous smaller players contributes to a competitive landscape. Precise market share distribution data for each player will be presented within the full report.

- Innovation Catalysts: The increasing demand for durable, hygienic, and aesthetically pleasing plumbing solutions fuels innovation in materials, designs, and manufacturing processes. The adoption of advanced technologies like precision welding and automated production lines enhances efficiency and product quality.

- Regulatory Landscape: Government regulations related to building codes, water conservation, and material standards impact market dynamics. Compliance with these standards is crucial for manufacturers and influences product development.

- Substitute Products: While stainless steel offers superior corrosion resistance and durability, alternative materials like copper and PVC pipes pose competitive pressure, particularly in price-sensitive segments.

- End-User Profiles: The residential sector represents a major share of demand, driven by rising urbanization and construction activity. The non-residential segment, encompassing commercial buildings and industrial facilities, presents considerable growth potential.

- M&A Activities: Recent mergers and acquisitions, such as Maharashtra Seamless Ltd's acquisition of United Seamless Tubular Private Limited, highlight consolidation trends and strategies to enhance market positioning and expand product portfolios. The report details the value and implications of major M&A deals within the market.

India Stainless Steel Plumbing Pipes & Fittings Market Industry Evolution

This section analyzes the evolutionary trajectory of the India stainless steel plumbing pipes & fittings market, tracing its growth patterns, technological advancements, and shifts in consumer preferences from 2019 to 2024 and projecting future trends. The market's growth is driven by factors such as rising disposable incomes, improving living standards, and increased infrastructure development. Technological advancements in manufacturing processes, surface treatments, and pipe designs contribute to product differentiation and enhanced performance. The report further analyzes evolving consumer preferences towards sustainable and energy-efficient plumbing systems. Detailed data on year-on-year growth rates and adoption metrics for various pipe types and sales channels will be provided in the full report.

Leading Regions, Countries, or Segments in India Stainless Steel Plumbing Pipes & Fittings Market

This section pinpoints the leading segments within the Indian stainless steel plumbing pipes and fittings market. Data and analysis will provide insights into the driving forces behind their prominence.

- Dominant Segment: The residential segment within the organized market structure currently leads in market share, fueled by rapid urbanization and rising construction activity across major metropolitan areas. The retail sales channel also dominates, reflecting a strong preference for traditional purchasing methods among consumers.

Key Drivers for Dominant Segments:

- Residential Sector: Rapid urbanization, rising disposable incomes, and increased construction activity drive strong demand for plumbing pipes and fittings in residential projects.

- Retail Sales Channel: Established distribution networks and consumer familiarity with this channel ensure wide reach and accessibility.

- Seamless Pipes: The superior strength and corrosion resistance of seamless pipes drive their popularity in premium segments.

In-depth Analysis: The detailed report will provide comprehensive geographic breakdowns showing the leading states and cities within the Indian market.

India Stainless Steel Plumbing Pipes & Fittings Market Product Innovations

Recent innovations encompass the development of aesthetically pleasing finishes, enhanced corrosion resistance through advanced coatings, and improved manufacturing processes resulting in higher precision and tighter tolerances. The focus is on developing sustainable and energy-efficient solutions, in line with growing environmental concerns. The report will provide specific examples of these innovations and their respective market penetration.

Propelling Factors for India Stainless Steel Plumbing Pipes & Fittings Market Growth

Several factors fuel market growth, including:

- Government Initiatives: Increased government investment in infrastructure projects such as affordable housing and improved sanitation facilities boosts demand.

- Technological Advancements: Innovations in pipe manufacturing, surface treatments, and material science improve durability and performance.

- Rising Disposable Incomes: The growth in disposable incomes across the country supports increased spending on home improvement and construction.

Obstacles in the India Stainless Steel Plumbing Pipes & Fittings Market Market

Challenges include:

- Fluctuating Raw Material Prices: Variations in the price of stainless steel impact production costs and profitability.

- Intense Competition: A fragmented market with several domestic and international players creates competitive pressure.

- Supply Chain Disruptions: Global disruptions can lead to delays in sourcing raw materials and components.

Future Opportunities in India Stainless Steel Plumbing Pipes & Fittings Market

Future opportunities lie in:

- Expansion into Tier II and III Cities: Untapped potential in smaller cities offers significant growth opportunities.

- Smart Plumbing Systems: Integration of smart technology into plumbing systems enhances efficiency and convenience.

- Focus on Sustainability: Eco-friendly and energy-efficient solutions are gaining traction.

Major Players in the India Stainless Steel Plumbing Pipes & Fittings Market Ecosystem

- Umiyatubes Private Limited

- Vishal Steel India

- Jindal Stainless Ltd

- Ratnamani Metals & Tubes Limited

- Nippon Steel Corporation

- Geberit Plumbing Technology India Private Limited

- Viega India Private Limited

- Steel Tubes India

- APL Apollo

- Maharashtra Seamless Ltd

- Sachiya Steel International

Key Developments in India Stainless Steel Plumbing Pipes & Fittings Market Industry

- April 2022: Jindal Stainless Limited (JSL) announced plans to expand its steel plant capacity to 25.2 MTPA in Angul, Odisha, by 2030, representing a significant investment boost for the region.

- February 2022: Maharashtra Seamless Ltd acquired the remaining 41.82% stake in United Seamless Tubular Private Limited, consolidating its position in the seamless pipes and tubes market.

Strategic India Stainless Steel Plumbing Pipes & Fittings Market Market Forecast

The Indian stainless steel plumbing pipes & fittings market is poised for robust growth, driven by sustained infrastructure development, increasing urbanization, and rising consumer spending. Technological advancements and innovative product offerings will further fuel market expansion. The report projects a significant increase in market value over the forecast period, creating lucrative opportunities for players across the value chain.

India Stainless Steel Plumbing Pipes & Fittings Market Segmentation

-

1. Type

- 1.1. Seamless

- 1.2. Welded

- 1.3. Fabricated

-

2. Market Structure

- 2.1. Organized

- 2.2. Unorganized

-

3. End-user Industry

- 3.1. Residential

- 3.2. Non-residential

-

4. Sales Channel

- 4.1. Retail

- 4.2. E-commerce

- 4.3. Direct

India Stainless Steel Plumbing Pipes & Fittings Market Segmentation By Geography

- 1. India

India Stainless Steel Plumbing Pipes & Fittings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Residential and Non-residential Industry; High Temperature and Corrosion Resistance Compared to Available Counterparts

- 3.3. Market Restrains

- 3.3.1. Increasing Polymer-based Substitutes such as PVC

- 3.4. Market Trends

- 3.4.1. Growing Demand for Stainless-Steel Welded Pipes

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Stainless Steel Plumbing Pipes & Fittings Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Seamless

- 5.1.2. Welded

- 5.1.3. Fabricated

- 5.2. Market Analysis, Insights and Forecast - by Market Structure

- 5.2.1. Organized

- 5.2.2. Unorganized

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Residential

- 5.3.2. Non-residential

- 5.4. Market Analysis, Insights and Forecast - by Sales Channel

- 5.4.1. Retail

- 5.4.2. E-commerce

- 5.4.3. Direct

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North India India Stainless Steel Plumbing Pipes & Fittings Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Stainless Steel Plumbing Pipes & Fittings Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Stainless Steel Plumbing Pipes & Fittings Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Stainless Steel Plumbing Pipes & Fittings Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Umiyatubes Private Limited

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Vishal Steel India

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Jindal Stainless Ltd*List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Ratnamani Metals & Tubes Limited

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Nippon Steel Corporation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Geberit Plumbing Technology India Private Limited

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Viega India Private Limited

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Steel Tubes India

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 APL Apollo

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Maharashtra Seamless Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Sachiya Steel International

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Umiyatubes Private Limited

List of Figures

- Figure 1: India Stainless Steel Plumbing Pipes & Fittings Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Stainless Steel Plumbing Pipes & Fittings Market Share (%) by Company 2024

List of Tables

- Table 1: India Stainless Steel Plumbing Pipes & Fittings Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Stainless Steel Plumbing Pipes & Fittings Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: India Stainless Steel Plumbing Pipes & Fittings Market Revenue Million Forecast, by Market Structure 2019 & 2032

- Table 4: India Stainless Steel Plumbing Pipes & Fittings Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: India Stainless Steel Plumbing Pipes & Fittings Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 6: India Stainless Steel Plumbing Pipes & Fittings Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: India Stainless Steel Plumbing Pipes & Fittings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: North India India Stainless Steel Plumbing Pipes & Fittings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South India India Stainless Steel Plumbing Pipes & Fittings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: East India India Stainless Steel Plumbing Pipes & Fittings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: West India India Stainless Steel Plumbing Pipes & Fittings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: India Stainless Steel Plumbing Pipes & Fittings Market Revenue Million Forecast, by Type 2019 & 2032

- Table 13: India Stainless Steel Plumbing Pipes & Fittings Market Revenue Million Forecast, by Market Structure 2019 & 2032

- Table 14: India Stainless Steel Plumbing Pipes & Fittings Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 15: India Stainless Steel Plumbing Pipes & Fittings Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 16: India Stainless Steel Plumbing Pipes & Fittings Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Stainless Steel Plumbing Pipes & Fittings Market?

The projected CAGR is approximately > 4.50%.

2. Which companies are prominent players in the India Stainless Steel Plumbing Pipes & Fittings Market?

Key companies in the market include Umiyatubes Private Limited, Vishal Steel India, Jindal Stainless Ltd*List Not Exhaustive, Ratnamani Metals & Tubes Limited, Nippon Steel Corporation, Geberit Plumbing Technology India Private Limited, Viega India Private Limited, Steel Tubes India, APL Apollo, Maharashtra Seamless Ltd, Sachiya Steel International.

3. What are the main segments of the India Stainless Steel Plumbing Pipes & Fittings Market?

The market segments include Type, Market Structure, End-user Industry, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Residential and Non-residential Industry; High Temperature and Corrosion Resistance Compared to Available Counterparts.

6. What are the notable trends driving market growth?

Growing Demand for Stainless-Steel Welded Pipes.

7. Are there any restraints impacting market growth?

Increasing Polymer-based Substitutes such as PVC.

8. Can you provide examples of recent developments in the market?

April 2022: Jindal Stainless Limited (JSL) planned to expand the capacity of the steel plant to 25.2 MTPA at Angul, Odhisha, by 2030. This capacity expansion is expected to increase JSPL's investment in Odisha to more than INR 1,25,000 crore (USD 15,875 million) from INR 45,000 crore (USD 5,715 million).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Stainless Steel Plumbing Pipes & Fittings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Stainless Steel Plumbing Pipes & Fittings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Stainless Steel Plumbing Pipes & Fittings Market?

To stay informed about further developments, trends, and reports in the India Stainless Steel Plumbing Pipes & Fittings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence