Key Insights

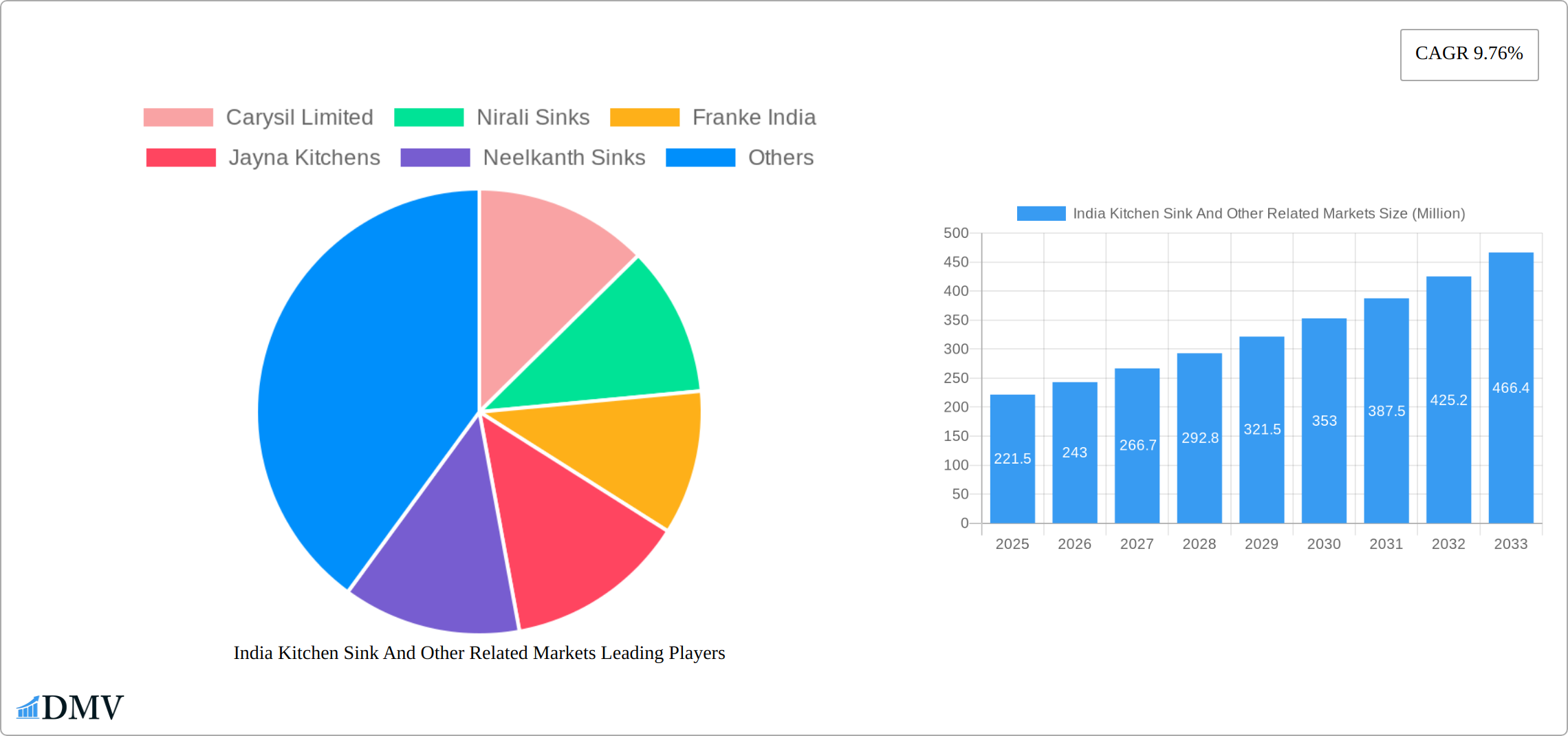

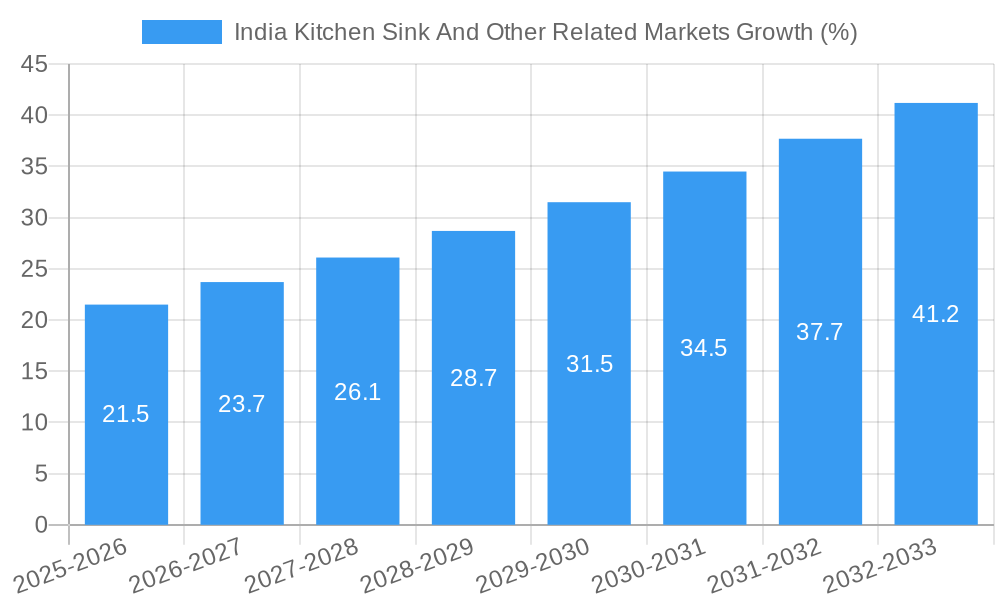

The India kitchen sink market, valued at ₹221.5 million in 2025, is projected for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 9.76% from 2025 to 2033. This expansion is fueled by several key drivers. Rising disposable incomes and a burgeoning middle class are significantly boosting demand for upgraded kitchen appliances, including high-quality kitchen sinks. The increasing popularity of modular kitchens and renovations in existing homes further contribute to market growth. A shift towards modern aesthetics and functionality, including integrated sinks and smart features, is shaping consumer preferences. Furthermore, a growing awareness of hygiene and sanitation is driving demand for durable, easy-to-clean sink materials like stainless steel. Competitive pricing strategies by established players like Carysil Limited, Franke India, and Cera Sanitaryware, alongside emerging players, ensure the market's dynamism. However, challenges such as fluctuating raw material costs and potential economic downturns could act as restraints on market growth. The market is segmented based on material (stainless steel, granite, composite), type (single, double, etc.), and price range, each catering to distinct consumer segments.

The forecast period (2025-2033) promises continued expansion, with a predicted market size exceeding ₹500 million by 2033 (this is a projection based on the provided CAGR and assumes consistent market conditions). Regional variations in demand exist, with urban areas and rapidly developing cities driving the highest growth. The competitive landscape is characterized by a mix of established national and international brands, and smaller regional players. Future growth will depend on continued economic development, successful marketing strategies targeting specific consumer segments, and innovation in materials and designs to cater to evolving consumer preferences. Strategic partnerships and collaborations may also play a significant role in shaping the future market trajectory.

India Kitchen Sink and Other Related Markets: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the India kitchen sink and related markets, offering a comprehensive overview of market dynamics, key players, and future growth projections. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report leverages extensive primary and secondary research to deliver actionable intelligence for stakeholders across the value chain. The market is projected to reach xx Million by 2033, exhibiting significant growth potential.

India Kitchen Sink and Other Related Markets Market Composition & Trends

This section dissects the competitive landscape, technological advancements, and regulatory influences shaping the Indian kitchen sink market. The market exhibits a moderately concentrated structure, with key players like Carysil Limited, Nirali Sinks, Franke India, and Cera Sanitaryware holding significant market share. However, smaller players and new entrants contribute to a dynamic environment. The total market value in 2024 was estimated at xx Million.

- Market Share Distribution (2024): Carysil Limited (xx%), Nirali Sinks (xx%), Franke India (xx%), Cera Sanitaryware (xx%), Others (xx%). (Note: Exact percentages unavailable, values are predicted)

- Innovation Catalysts: Growing consumer preference for modern, durable, and aesthetically pleasing sinks fuels innovation in materials (stainless steel, composite granite), design (integrated features, smart functionality), and manufacturing processes.

- Regulatory Landscape: Indian regulatory frameworks related to water conservation and material safety influence product design and manufacturing.

- Substitute Products: While traditional sinks remain dominant, the emergence of innovative materials and integrated systems presents subtle substitution pressures.

- End-User Profiles: The target market includes individual homeowners, builders, architects, and interior designers catering to both residential and commercial segments.

- M&A Activities: The past five years have witnessed xx Million in M&A activity within the sector (predicted value), primarily focused on expanding distribution networks and acquiring specialized technologies.

India Kitchen Sink and Other Related Markets Industry Evolution

The Indian kitchen sink market has experienced robust growth over the historical period (2019-2024), driven by rising disposable incomes, urbanization, and a preference for upgraded kitchen aesthetics. The market is poised for continued expansion, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological advancements, such as the introduction of smart sinks with integrated features (water filtration, waste disposal), are key drivers. Consumer demand is shifting towards premium and specialized sinks that enhance both functionality and design appeal. The growing adoption of online sales channels further fuels market expansion.

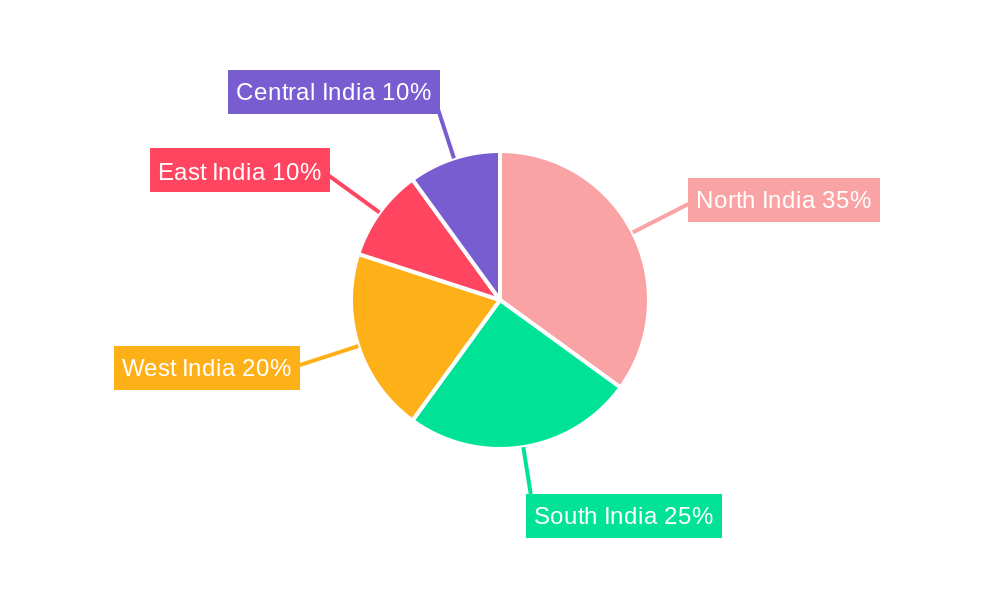

Leading Regions, Countries, or Segments in India Kitchen Sink and Other Related Markets

The report identifies the key regions driving the market's expansion. Metropolitan areas in major states show the highest adoption rates.

- Key Drivers:

- Investment Trends: Significant investments in real estate development and infrastructure projects fuel demand for kitchen renovations and new constructions.

- Regulatory Support: Government initiatives to improve sanitation and housing standards indirectly boost the market.

- Dominance Factors: Higher disposable incomes, increased construction activity, and a preference for modern kitchens in urban centers underpin regional dominance. The market in metropolitan areas is significantly larger than in rural areas. This is attributed to higher disposable incomes, greater exposure to global trends, and higher construction activity.

India Kitchen Sink and Other Related Markets Product Innovations

Recent innovations include the integration of smart functionalities like water filtration systems, touchless operation, and waste disposals within sink units. Materials are evolving from traditional stainless steel to composite granite and other durable, aesthetically pleasing options. The focus is on improving hygiene, durability, and overall kitchen efficiency. The introduction of Ruhe's Nano 304-Grade Kitchen Sink with integrated features exemplifies these advancements.

Propelling Factors for India Kitchen Sink and Other Related Markets Growth

Several factors drive market growth:

- Technological Advancements: Smart sinks with integrated features enhance user experience and increase adoption rates.

- Economic Growth: Rising disposable incomes and improved living standards fuel demand for upgraded kitchen amenities.

- Regulatory Influences: Government initiatives indirectly supporting the real estate and construction sectors stimulate market growth.

Obstacles in the India Kitchen Sink and Other Related Markets Market

Challenges facing the market include:

- Supply Chain Disruptions: Global supply chain volatility can impact material availability and production costs.

- Competitive Pressures: Intense competition among various brands necessitates continuous innovation and efficient cost management.

- Regulatory Compliance: Meeting diverse regulatory standards can present challenges for manufacturers.

Future Opportunities in India Kitchen Sink and Other Related Markets

Future opportunities exist in:

- Expanding into Tier 2 and Tier 3 Cities: Untapped market potential exists in smaller cities with growing urbanization and middle-class income.

- Developing Eco-Friendly Sinks: Demand for sustainable and environmentally responsible products is growing.

- Exploring Smart Home Integration: Integrating kitchen sinks with broader smart home ecosystems offers significant opportunities.

Major Players in the India Kitchen Sink and Other Related Markets Ecosystem

- Carysil Limited

- Nirali Sinks

- Franke India

- Jayna Kitchens

- Neelkanth Sinks

- Alveus India

- Shalimar Sinks

- Century Sinks

- Cera Sanitaryware

- Resteil India (List Not Exhaustive)

Key Developments in India Kitchen Sink and Other Related Markets Industry

- June 2024: Ruhe launches Nano 304-Grade Kitchen Sink with integrated waterfall, pull-out, and RO faucet.

- February 2024: Kohler enters the Indian market with its Cairn kitchen sink range.

Strategic India Kitchen Sink and Other Related Markets Market Forecast

The Indian kitchen sink market is projected to experience robust growth, driven by factors such as rising urbanization, increasing disposable incomes, and a preference for modern kitchen aesthetics. Technological innovations, like the incorporation of smart features and sustainable materials, will play a critical role in shaping future market dynamics. The potential for expansion into underserved markets and the growing adoption of online sales channels further contribute to the optimistic market outlook.

India Kitchen Sink And Other Related Markets Segmentation

-

1. Number of Bowls

- 1.1. Single

- 1.2. Double

- 1.3. Multi

-

2. Material

- 2.1. Metallic

- 2.2. Granite

-

3. Market

- 3.1. Kitchen Sink Market

- 3.2. Stainless Steel Market

- 3.3. Quartz Kitchen Sink Market

India Kitchen Sink And Other Related Markets Segmentation By Geography

- 1. India

India Kitchen Sink And Other Related Markets REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.76% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Urbanization is Driving the Market; Increased Spending on Home Decor and Adoption of Products in the Commercial Sector

- 3.3. Market Restrains

- 3.3.1. Rising Urbanization is Driving the Market; Increased Spending on Home Decor and Adoption of Products in the Commercial Sector

- 3.4. Market Trends

- 3.4.1. Berlin Leads in Total Warehousing Take-up

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Kitchen Sink And Other Related Markets Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Number of Bowls

- 5.1.1. Single

- 5.1.2. Double

- 5.1.3. Multi

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Metallic

- 5.2.2. Granite

- 5.3. Market Analysis, Insights and Forecast - by Market

- 5.3.1. Kitchen Sink Market

- 5.3.2. Stainless Steel Market

- 5.3.3. Quartz Kitchen Sink Market

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Number of Bowls

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Carysil Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nirali Sinks

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Franke India

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Jayna Kitchens

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Neelkanth Sinks

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Alveus India

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Shalimar Sinks

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Century Sinks

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Cera Sanitaryware

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Resteil India**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Carysil Limited

List of Figures

- Figure 1: India Kitchen Sink And Other Related Markets Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Kitchen Sink And Other Related Markets Share (%) by Company 2024

List of Tables

- Table 1: India Kitchen Sink And Other Related Markets Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Kitchen Sink And Other Related Markets Volume Million Forecast, by Region 2019 & 2032

- Table 3: India Kitchen Sink And Other Related Markets Revenue Million Forecast, by Number of Bowls 2019 & 2032

- Table 4: India Kitchen Sink And Other Related Markets Volume Million Forecast, by Number of Bowls 2019 & 2032

- Table 5: India Kitchen Sink And Other Related Markets Revenue Million Forecast, by Material 2019 & 2032

- Table 6: India Kitchen Sink And Other Related Markets Volume Million Forecast, by Material 2019 & 2032

- Table 7: India Kitchen Sink And Other Related Markets Revenue Million Forecast, by Market 2019 & 2032

- Table 8: India Kitchen Sink And Other Related Markets Volume Million Forecast, by Market 2019 & 2032

- Table 9: India Kitchen Sink And Other Related Markets Revenue Million Forecast, by Region 2019 & 2032

- Table 10: India Kitchen Sink And Other Related Markets Volume Million Forecast, by Region 2019 & 2032

- Table 11: India Kitchen Sink And Other Related Markets Revenue Million Forecast, by Number of Bowls 2019 & 2032

- Table 12: India Kitchen Sink And Other Related Markets Volume Million Forecast, by Number of Bowls 2019 & 2032

- Table 13: India Kitchen Sink And Other Related Markets Revenue Million Forecast, by Material 2019 & 2032

- Table 14: India Kitchen Sink And Other Related Markets Volume Million Forecast, by Material 2019 & 2032

- Table 15: India Kitchen Sink And Other Related Markets Revenue Million Forecast, by Market 2019 & 2032

- Table 16: India Kitchen Sink And Other Related Markets Volume Million Forecast, by Market 2019 & 2032

- Table 17: India Kitchen Sink And Other Related Markets Revenue Million Forecast, by Country 2019 & 2032

- Table 18: India Kitchen Sink And Other Related Markets Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Kitchen Sink And Other Related Markets?

The projected CAGR is approximately 9.76%.

2. Which companies are prominent players in the India Kitchen Sink And Other Related Markets?

Key companies in the market include Carysil Limited, Nirali Sinks, Franke India, Jayna Kitchens, Neelkanth Sinks, Alveus India, Shalimar Sinks, Century Sinks, Cera Sanitaryware, Resteil India**List Not Exhaustive.

3. What are the main segments of the India Kitchen Sink And Other Related Markets?

The market segments include Number of Bowls , Material , Market.

4. Can you provide details about the market size?

The market size is estimated to be USD 221.5 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Urbanization is Driving the Market; Increased Spending on Home Decor and Adoption of Products in the Commercial Sector.

6. What are the notable trends driving market growth?

Berlin Leads in Total Warehousing Take-up.

7. Are there any restraints impacting market growth?

Rising Urbanization is Driving the Market; Increased Spending on Home Decor and Adoption of Products in the Commercial Sector.

8. Can you provide examples of recent developments in the market?

In June 2024, Ruhe, a manufacturer, introduced a Nano 304-Grade Kitchen Sink. This innovative sink features an Integrated Waterfall, Pull-Out, and RO Faucet, measuring 30 x 18 x 9 inches.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Kitchen Sink And Other Related Markets," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Kitchen Sink And Other Related Markets report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Kitchen Sink And Other Related Markets?

To stay informed about further developments, trends, and reports in the India Kitchen Sink And Other Related Markets, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence