Key Insights

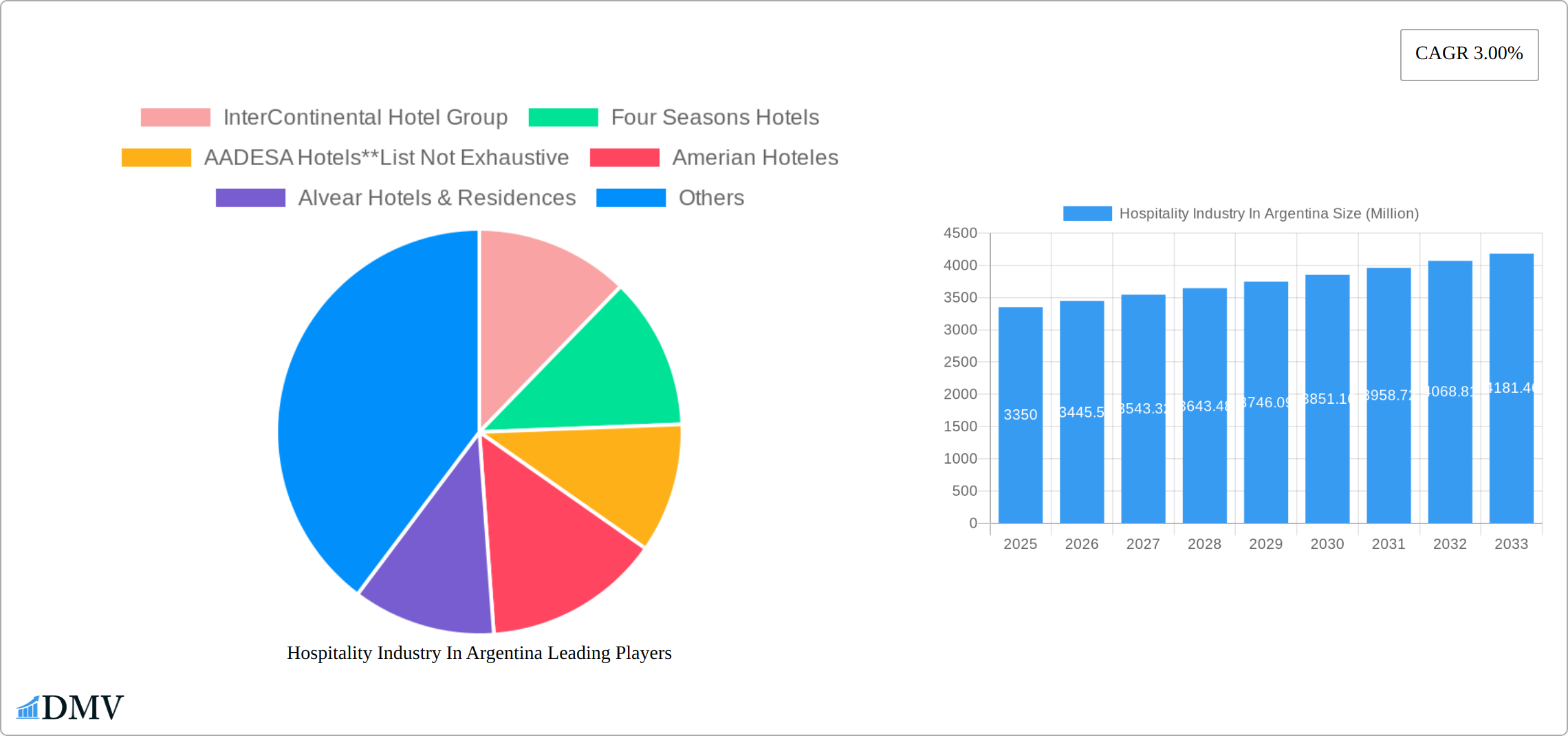

The Argentinian hospitality industry, valued at $3.35 billion in 2025, is projected to experience steady growth, with a Compound Annual Growth Rate (CAGR) of 3.00% from 2025 to 2033. This growth is fueled by several key drivers. Increased tourism, driven by Argentina's diverse landscapes and cultural attractions, is a major contributor. The rising disposable income of the middle class, coupled with a growing preference for domestic travel and leisure experiences, further stimulates demand. Furthermore, strategic investments in infrastructure, including improved transportation links and airport facilities, are enhancing accessibility and attracting more international visitors. The sector is segmented by hotel type (chain vs. independent) and by service level (budget/economy, mid-scale, luxury, and service apartments). While the luxury segment is expected to witness robust growth, driven by high-spending international tourists, the budget and economy segments are likely to be influenced by fluctuating economic conditions. However, potential restraints include macroeconomic volatility and inflationary pressures that can impact both consumer spending and investment decisions within the hospitality sector. Competition among established international hotel chains like Marriott International Inc., Accor SA, and InterContinental Hotel Group, alongside prominent local players like Alvear Hotels & Residences and Amerian Hoteles, further shapes the market dynamics.

Hospitality Industry In Argentina Market Size (In Billion)

The forecast period (2025-2033) anticipates continued expansion, albeit at a moderate pace. This reflects the inherent cyclicality of the tourism industry and potential vulnerabilities to global economic shifts. Strategic partnerships and innovations within the hospitality sector, such as the incorporation of technology-driven services and sustainable tourism practices, are crucial for sustained growth and competitiveness. The segmentation analysis provides valuable insights for targeted investment strategies and business development within specific niches of the Argentinian hospitality market. Successfully navigating the interplay between market drivers, restraints, and competitive pressures will be critical for hotels and hospitality providers to capitalize on future growth opportunities.

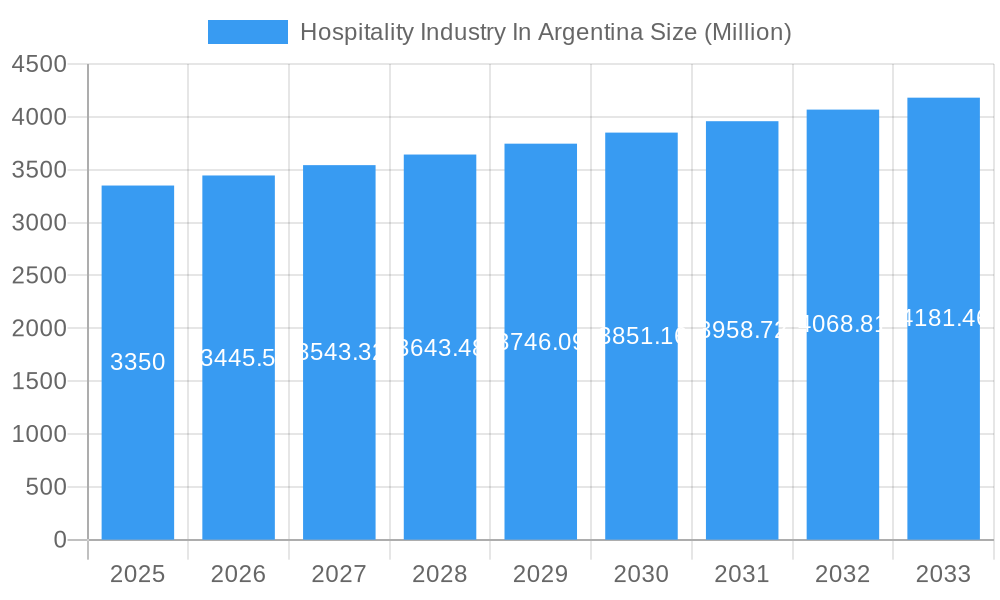

Hospitality Industry In Argentina Company Market Share

Argentina's Hospitality Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of Argentina's dynamic hospitality sector, encompassing market trends, leading players, and future projections. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers crucial data-driven insights for stakeholders seeking to navigate this vibrant market. The report analyzes market size exceeding $XX Million and projects future growth to $XX Million by 2033.

Hospitality Industry In Argentina Market Composition & Trends

This section evaluates the competitive landscape of Argentina's hospitality market, exploring market concentration, innovation drivers, regulatory frameworks, substitute offerings, and end-user demographics. The analysis also delves into mergers and acquisitions (M&A) activities, providing a comprehensive overview of market dynamics.

Market Concentration & Share Distribution: The Argentinian hospitality market displays a mix of international chains and domestic players. International chains like InterContinental Hotel Group, Four Seasons Hotels, Marriott International Inc, Accor SA, and Wyndham Hotel Group LLC hold significant market share, alongside established domestic players such as AADESA Hotels, Amerian Hoteles, Alvear Hotels & Residences, Hoteles Panaamericano, Alvarez Argelles Hoteles, Hotel Madero, and Fierro Hotels. However, a significant portion of the market is comprised of independent hotels. Precise market share data for each player remains unavailable (xx%).

- M&A Activity: While specific deal values for M&A activity in the Argentinian hospitality sector are not publicly available (xx Million USD), activity is expected to increase due to market consolidation and growth opportunities.

Innovation Catalysts: Innovation is driven by technology adoption (e.g., online booking platforms, revenue management systems), evolving consumer preferences for unique experiences, and the growing importance of sustainability.

Regulatory Landscape: Government regulations influence areas such as licensing, environmental standards, and labor laws. The launch of ReservAR AlojaMiento by FEHGRA demonstrates an effort to level the playing field in online distribution.

Substitute Products: Alternatives to traditional hotels include Airbnb and other short-term rental platforms, impacting market share among budget and mid-range segments.

End-User Profiles: The hospitality sector caters to diverse end-users, including business travelers, leisure tourists, and families, with varying needs and preferences influencing hotel choices.

Hospitality Industry In Argentina Industry Evolution

The Argentinian hospitality industry has navigated a dynamic landscape, characterized by fluctuating growth trajectories influenced by economic shifts and global events between 2019 and 2024. While this period saw periods of both expansion and contraction across various segments, the outlook for the forecast period (2025-2033) is decidedly more optimistic. We project a robust Compound Annual Growth Rate (CAGR) of approximately **[Insert specific XX% here]**.

This anticipated growth is underpinned by several key drivers: a resurgence in domestic tourism, the steady and progressive recovery of international visitor numbers, and the impactful implementation of government initiatives designed to bolster the sector. Furthermore, the pervasive integration of technological advancements, such as sophisticated online booking systems and the increasing demand for hyper-personalized guest experiences, will act as significant catalysts. The current adoption rate of these transformative technologies stands at around **[Insert specific XX% here]** and is forecast to climb to an impressive **[Insert specific XX% here]** by 2033. Concurrently, a palpable shift in consumer preferences towards unique, authentic, and sustainable travel experiences is reshaping the market. This evolution is actively fueling the ascent of boutique hotels and eco-tourism ventures, underscoring a growing emphasis on experiences over mere accommodation, thus compelling innovative service and amenity development.

Leading Regions, Countries, or Segments in Hospitality Industry In Argentina

This section meticulously identifies and analyzes the leading regions, countries, and segments that define Argentina's vibrant hospitality sector, elucidating the pivotal factors underpinning their prominence.

Dominant Segments:

- Luxury Hotels: Anchored in cosmopolitan hubs like Buenos Aires, luxury accommodations continue to be a powerful draw for discerning international travelers and high-net-worth domestic clientele, consistently commanding strong demand.

- Mid and Upper Mid-scale Hotels: This segment forms the backbone of the Argentinian hospitality market, adeptly balancing affordability with comfort. It serves the broadest spectrum of travelers, making it an indispensable and critical sector for overall industry health.

- Budget and Economy Hotels: Catering to the ever-growing demand for cost-effective travel solutions, budget and economy hotels are increasingly gaining traction, particularly among domestic tourists seeking value without compromising on essential comfort.

Key Drivers:

- Investment Trends: A notable uptick in investment directed towards hotel infrastructure, especially in regions experiencing high growth, is a significant contributor to the sector's expansion. This influx encompasses both substantial domestic capital and growing foreign investment.

- Regulatory Support: Proactive government incentives and strategic policies aimed at invigorating tourism are instrumental in fostering the growth and development of specific market segments.

- Tourism Growth: The sustained and robust growth in both domestic and international tourism remains a primary engine, consistently driving demand for a wide array of accommodation and ancillary services.

Hospitality Industry In Argentina Product Innovations

Recent innovations in Argentina's hospitality sector include the adoption of contactless technologies for check-in/check-out, personalized guest experiences through data analytics, and eco-friendly initiatives like water conservation and renewable energy adoption. These improvements focus on enhancing guest satisfaction and operational efficiency. The unique selling proposition of many establishments is now centered on creating immersive cultural experiences that connect guests to Argentina's unique heritage. Advanced booking and management systems, coupled with virtual reality tours, are gaining traction as well.

Propelling Factors for Hospitality Industry In Argentina Growth

A confluence of strategic factors is actively propelling the growth and evolution of Argentina's hospitality sector. Government-led initiatives, encompassing streamlined visa processes and substantial investments in infrastructure development, are significantly enhancing the nation's appeal as a tourist destination. The improving economic climate, coupled with a rise in disposable income among the Argentinian population, is acting as a powerful catalyst for domestic tourism. Complementing these macro trends, technological advancements, notably the enhancement of online booking platforms and the sophisticated application of revenue management systems, are optimizing operational efficiencies and elevating the overall guest experience, thereby fostering loyalty and repeat business.

Obstacles in the Hospitality Industry In Argentina Market

Despite the growth potential, challenges persist. Economic volatility and currency fluctuations impact investor confidence and operational stability. High inflation rates influence pricing strategies and operational costs. Supply chain disruptions can affect the availability of goods and services. Intense competition from both established chains and new entrants necessitates ongoing innovation and differentiation.

Future Opportunities in Hospitality Industry In Argentina

Future opportunities include the expansion of eco-tourism and experiential travel, catering to the growing demand for sustainable and culturally immersive experiences. Technological innovations, such as the implementation of AI-powered chatbots and personalized recommendations, create potential for enhanced guest services and operational efficiency. Growth in domestic tourism and the potential for increased international tourism provide significant growth prospects.

Major Players in the Hospitality Industry In Argentina Ecosystem

- InterContinental Hotel Group

- Four Seasons Hotels

- AADESA Hotels

- Amerian Hoteles

- Alvear Hotels & Residences

- Hoteles Panaamericano

- Alvarez Argelles Hoteles

- Hotel Madero

- Fierro Hotels

- Wyndham Hotel Group LLC

- NH Hotels Group SA

- Marriott International Inc

- Accor SA

Key Developments in Hospitality Industry In Argentina Industry

- June 2022: The launch of ReservAR AlojaMiento marked a significant step towards empowering local businesses. This innovative domestic online booking platform was established to champion local hotels and restaurants, advocating for more equitable online distribution channels and fostering greater financial sustainability within the sector.

- August 2023: IHG Hotels and Resorts strategically expanded its presence with the introduction of Garner an IHG Hotel, its new midscale conversion brand. This move specifically targets the burgeoning segment of budget-conscious travelers while simultaneously offering attractive returns for hotel owners. It underscores a clear commitment to growth within a highly competitive and crucial market segment.

Strategic Hospitality Industry In Argentina Market Forecast

The Argentinian hospitality market is poised for a period of substantial and sustained long-term growth. This optimistic forecast is anchored by the enduring strength of domestic tourism, the anticipated progressive recovery of international travel, and the accelerating adoption of innovative technological solutions. The projected period from 2025 to 2033 signals significant expansion potential across all market segments, with particularly promising growth anticipated within the mid-range and luxury offerings. Continued economic stabilization and the implementation of targeted government support strategies will be paramount in fully realizing this potential. Simultaneously, proactively addressing persistent challenges such as inflation and the critical need for infrastructure enhancements will be indispensable for ensuring the sector's sustainable and resilient future development.

Hospitality Industry In Argentina Segmentation

-

1. Type

- 1.1. Chain Hotels

- 1.2. Independent Hotels

-

2. Segment

- 2.1. Service Apartments

- 2.2. Budget and Economy Hotels

- 2.3. Mid and Upper Mid-scale Hotels

- 2.4. Luxury Hotels

Hospitality Industry In Argentina Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Hospitality Industry In Argentina Regional Market Share

Geographic Coverage of Hospitality Industry In Argentina

Hospitality Industry In Argentina REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Tourism Sector is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Rising Operational Costs are Restraining the Market

- 3.4. Market Trends

- 3.4.1. The Buenos Aries is Dominating the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hospitality Industry In Argentina Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Chain Hotels

- 5.1.2. Independent Hotels

- 5.2. Market Analysis, Insights and Forecast - by Segment

- 5.2.1. Service Apartments

- 5.2.2. Budget and Economy Hotels

- 5.2.3. Mid and Upper Mid-scale Hotels

- 5.2.4. Luxury Hotels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Hospitality Industry In Argentina Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Chain Hotels

- 6.1.2. Independent Hotels

- 6.2. Market Analysis, Insights and Forecast - by Segment

- 6.2.1. Service Apartments

- 6.2.2. Budget and Economy Hotels

- 6.2.3. Mid and Upper Mid-scale Hotels

- 6.2.4. Luxury Hotels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Hospitality Industry In Argentina Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Chain Hotels

- 7.1.2. Independent Hotels

- 7.2. Market Analysis, Insights and Forecast - by Segment

- 7.2.1. Service Apartments

- 7.2.2. Budget and Economy Hotels

- 7.2.3. Mid and Upper Mid-scale Hotels

- 7.2.4. Luxury Hotels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Hospitality Industry In Argentina Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Chain Hotels

- 8.1.2. Independent Hotels

- 8.2. Market Analysis, Insights and Forecast - by Segment

- 8.2.1. Service Apartments

- 8.2.2. Budget and Economy Hotels

- 8.2.3. Mid and Upper Mid-scale Hotels

- 8.2.4. Luxury Hotels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Hospitality Industry In Argentina Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Chain Hotels

- 9.1.2. Independent Hotels

- 9.2. Market Analysis, Insights and Forecast - by Segment

- 9.2.1. Service Apartments

- 9.2.2. Budget and Economy Hotels

- 9.2.3. Mid and Upper Mid-scale Hotels

- 9.2.4. Luxury Hotels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Hospitality Industry In Argentina Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Chain Hotels

- 10.1.2. Independent Hotels

- 10.2. Market Analysis, Insights and Forecast - by Segment

- 10.2.1. Service Apartments

- 10.2.2. Budget and Economy Hotels

- 10.2.3. Mid and Upper Mid-scale Hotels

- 10.2.4. Luxury Hotels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 InterContinental Hotel Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Four Seasons Hotels

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 AADESA Hotels**List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Amerian Hoteles

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Alvear Hotels & Residences

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hoteles Panaamericano

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Alvarez Argelles Hoteles

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hotel Madero

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Fierro Hotels

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Wyndham Hotel Group LLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 NH Hotels Group SA

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Marriott International Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Accor SA

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 InterContinental Hotel Group

List of Figures

- Figure 1: Global Hospitality Industry In Argentina Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Hospitality Industry In Argentina Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Hospitality Industry In Argentina Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Hospitality Industry In Argentina Revenue (Million), by Segment 2025 & 2033

- Figure 5: North America Hospitality Industry In Argentina Revenue Share (%), by Segment 2025 & 2033

- Figure 6: North America Hospitality Industry In Argentina Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Hospitality Industry In Argentina Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Hospitality Industry In Argentina Revenue (Million), by Type 2025 & 2033

- Figure 9: South America Hospitality Industry In Argentina Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America Hospitality Industry In Argentina Revenue (Million), by Segment 2025 & 2033

- Figure 11: South America Hospitality Industry In Argentina Revenue Share (%), by Segment 2025 & 2033

- Figure 12: South America Hospitality Industry In Argentina Revenue (Million), by Country 2025 & 2033

- Figure 13: South America Hospitality Industry In Argentina Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Hospitality Industry In Argentina Revenue (Million), by Type 2025 & 2033

- Figure 15: Europe Hospitality Industry In Argentina Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Hospitality Industry In Argentina Revenue (Million), by Segment 2025 & 2033

- Figure 17: Europe Hospitality Industry In Argentina Revenue Share (%), by Segment 2025 & 2033

- Figure 18: Europe Hospitality Industry In Argentina Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Hospitality Industry In Argentina Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Hospitality Industry In Argentina Revenue (Million), by Type 2025 & 2033

- Figure 21: Middle East & Africa Hospitality Industry In Argentina Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa Hospitality Industry In Argentina Revenue (Million), by Segment 2025 & 2033

- Figure 23: Middle East & Africa Hospitality Industry In Argentina Revenue Share (%), by Segment 2025 & 2033

- Figure 24: Middle East & Africa Hospitality Industry In Argentina Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Hospitality Industry In Argentina Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Hospitality Industry In Argentina Revenue (Million), by Type 2025 & 2033

- Figure 27: Asia Pacific Hospitality Industry In Argentina Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific Hospitality Industry In Argentina Revenue (Million), by Segment 2025 & 2033

- Figure 29: Asia Pacific Hospitality Industry In Argentina Revenue Share (%), by Segment 2025 & 2033

- Figure 30: Asia Pacific Hospitality Industry In Argentina Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Hospitality Industry In Argentina Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Hospitality Industry In Argentina Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Hospitality Industry In Argentina Revenue Million Forecast, by Segment 2020 & 2033

- Table 3: Global Hospitality Industry In Argentina Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Hospitality Industry In Argentina Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Hospitality Industry In Argentina Revenue Million Forecast, by Segment 2020 & 2033

- Table 6: Global Hospitality Industry In Argentina Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Hospitality Industry In Argentina Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Hospitality Industry In Argentina Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Hospitality Industry In Argentina Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Hospitality Industry In Argentina Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Hospitality Industry In Argentina Revenue Million Forecast, by Segment 2020 & 2033

- Table 12: Global Hospitality Industry In Argentina Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil Hospitality Industry In Argentina Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Hospitality Industry In Argentina Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Hospitality Industry In Argentina Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Hospitality Industry In Argentina Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global Hospitality Industry In Argentina Revenue Million Forecast, by Segment 2020 & 2033

- Table 18: Global Hospitality Industry In Argentina Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Hospitality Industry In Argentina Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Hospitality Industry In Argentina Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Hospitality Industry In Argentina Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Hospitality Industry In Argentina Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Hospitality Industry In Argentina Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Hospitality Industry In Argentina Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Hospitality Industry In Argentina Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Hospitality Industry In Argentina Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Hospitality Industry In Argentina Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Hospitality Industry In Argentina Revenue Million Forecast, by Type 2020 & 2033

- Table 29: Global Hospitality Industry In Argentina Revenue Million Forecast, by Segment 2020 & 2033

- Table 30: Global Hospitality Industry In Argentina Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey Hospitality Industry In Argentina Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel Hospitality Industry In Argentina Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC Hospitality Industry In Argentina Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Hospitality Industry In Argentina Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Hospitality Industry In Argentina Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Hospitality Industry In Argentina Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Hospitality Industry In Argentina Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global Hospitality Industry In Argentina Revenue Million Forecast, by Segment 2020 & 2033

- Table 39: Global Hospitality Industry In Argentina Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China Hospitality Industry In Argentina Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India Hospitality Industry In Argentina Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Hospitality Industry In Argentina Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Hospitality Industry In Argentina Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Hospitality Industry In Argentina Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Hospitality Industry In Argentina Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Hospitality Industry In Argentina Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hospitality Industry In Argentina?

The projected CAGR is approximately 3.00%.

2. Which companies are prominent players in the Hospitality Industry In Argentina?

Key companies in the market include InterContinental Hotel Group, Four Seasons Hotels, AADESA Hotels**List Not Exhaustive, Amerian Hoteles, Alvear Hotels & Residences, Hoteles Panaamericano, Alvarez Argelles Hoteles, Hotel Madero, Fierro Hotels, Wyndham Hotel Group LLC, NH Hotels Group SA, Marriott International Inc, Accor SA.

3. What are the main segments of the Hospitality Industry In Argentina?

The market segments include Type, Segment.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.35 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Tourism Sector is Driving the Market.

6. What are the notable trends driving market growth?

The Buenos Aries is Dominating the Market.

7. Are there any restraints impacting market growth?

Rising Operational Costs are Restraining the Market.

8. Can you provide examples of recent developments in the market?

June 2022: Argentina’s hotel and restaurant federation sought to level the playing field in online distribution by debuting a homegrown booking website. Federación Empresaria Hotelera Gastronómica de la República Argentina (FEHGRA) has launched ReservAR AlojaMiento, which promotes local, licensed establishments and whether they are affiliated with the association or not.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hospitality Industry In Argentina," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hospitality Industry In Argentina report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hospitality Industry In Argentina?

To stay informed about further developments, trends, and reports in the Hospitality Industry In Argentina, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence