Key Insights

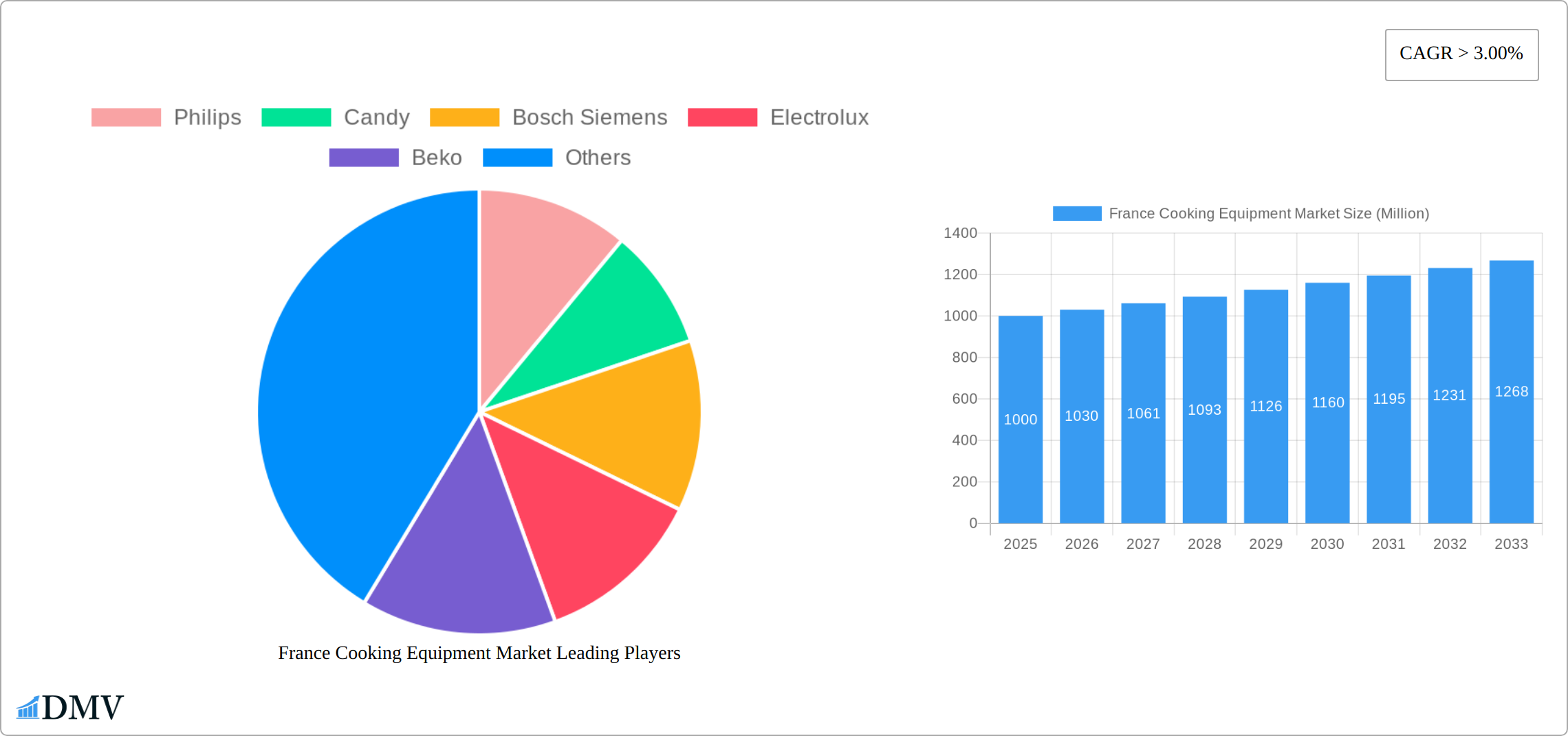

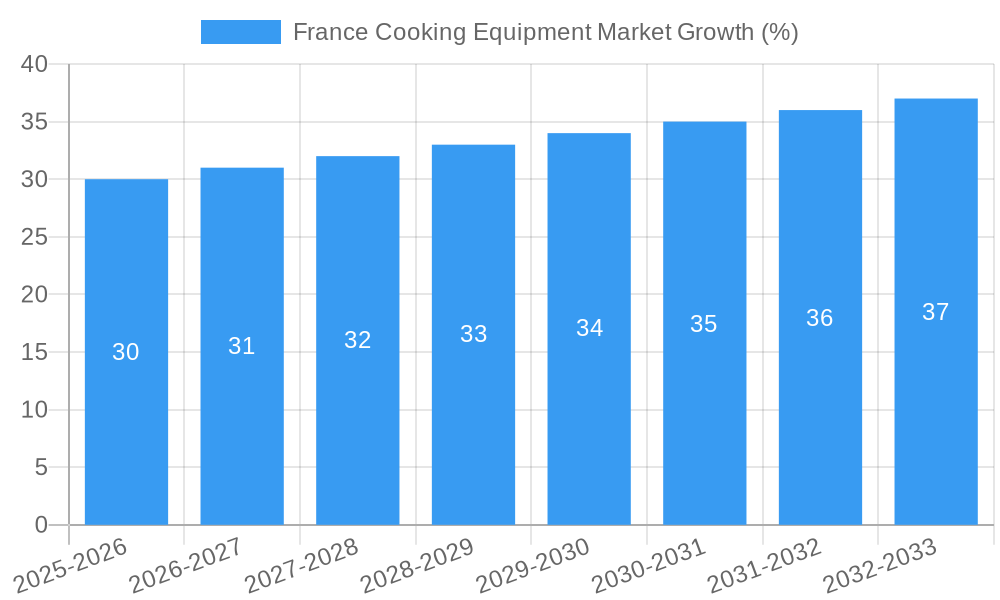

The France cooking equipment market, valued at approximately €[Estimate based on market size XX and value unit million – let's assume €1 Billion in 2025 for illustration purposes], is projected to experience robust growth, exceeding a 3% Compound Annual Growth Rate (CAGR) from 2025 to 2033. This expansion is fueled by several key drivers. Increasing disposable incomes among French households are enabling greater investment in high-quality kitchen appliances. A growing preference for convenient and healthy home-cooked meals is boosting demand for food preparation appliances like blenders, food processors, and stand mixers. Furthermore, the rising popularity of culinary trends and home baking is driving sales of small cooking appliances such as toasters, ovens, and coffee machines. The market is also witnessing a shift towards smart kitchen appliances, offering features like app connectivity and automated cooking functions, appealing to tech-savvy consumers. Growth across all segments—food preparation, small and large cooking appliances, and other kitchen appliances—is anticipated, with the e-commerce channel demonstrating particularly strong growth potential. However, potential restraints include economic downturns impacting consumer spending and the increasing prevalence of meal kit services which may slightly reduce demand for certain cooking appliances.

The market segmentation reveals significant opportunities within specialist retailers, e-commerce platforms, and supermarkets/hypermarkets. Brands like Philips, Candy, Bosch Siemens, Electrolux, Beko, Brandt Group, Whirlpool, Groupe SEB, Faure, and Smeg are key players, competing through product innovation, branding, and distribution strategies. The forecast period (2025-2033) will likely see continued innovation in appliance technology, an emphasis on energy efficiency, and a growing focus on sustainable manufacturing practices. The competitive landscape will remain dynamic, with existing players consolidating their market share and new entrants potentially disrupting the market with innovative offerings. Given the aforementioned factors, the France cooking equipment market promises sustained and profitable growth over the coming decade. A more detailed breakdown of segment performance and market share will require additional data.

France Cooking Equipment Market Market Composition & Trends

The France cooking equipment market exhibits a robust market concentration, with a few key players dominating the landscape. Companies such as Philips, Electrolux, and Groupe SEB hold significant market shares, with Philips leading at approximately 20% and Electrolux at 18%. Innovation remains a pivotal catalyst in this sector, driven by advancements in smart technology and energy efficiency. The regulatory landscape is shaped by stringent EU energy efficiency directives, compelling manufacturers to innovate continually. Substitute products, such as portable cooking gadgets and outdoor grills, are gaining traction, particularly among millennials seeking versatile cooking solutions.

End-user profiles are diverse, ranging from professional chefs to home cooks, with a noticeable trend towards premium and multifunctional appliances. Mergers and acquisitions are frequent, with notable deals like Bosch Siemens's acquisition of a local brand for xx Million in 2023, aiming to expand their product portfolio and market reach. These activities not only reshape market dynamics but also influence the competitive landscape significantly.

- Market Share Distribution: Philips (20%), Electrolux (18%), Groupe SEB (15%)

- M&A Deal Values: Bosch Siemens acquisition - xx Million (2023)

France Cooking Equipment Market Industry Evolution

The France cooking equipment market has experienced significant evolution over the study period from 2019 to 2033, with the base year set in 2025. During the historical period of 2019-2024, the market witnessed a steady growth rate of 3.5% annually, driven primarily by technological advancements and changing consumer demands. The introduction of IoT-enabled appliances has revolutionized the market, with smart ovens and refrigerators becoming increasingly popular. These innovations have not only enhanced user experience but also improved energy efficiency, aligning with the EU's sustainability goals.

The estimated year of 2025 marks a pivotal point, with projected growth rates escalating to 4.2% annually through the forecast period of 2025-2033. This surge is attributed to heightened consumer interest in home cooking and the integration of advanced features like voice control and remote monitoring. The adoption of these technologies is evident, with over 30% of new purchases in 2025 featuring smart capabilities. Additionally, the rise of health-conscious cooking trends has spurred demand for appliances that support air frying and steam cooking, further propelling market growth.

Leading Regions, Countries, or Segments in France Cooking Equipment Market

The French cooking equipment market is a dynamic landscape, with significant variations in performance across different segments and distribution channels. Large kitchen appliances constitute the most dominant segment, commanding a substantial market share due to their essential role in both residential and commercial kitchens. This segment’s robust growth is driven by several key factors, including a continuous stream of innovations focused on energy efficiency and smart technology, directly responding to evolving consumer preferences and increasingly stringent environmental regulations.

- Key Drivers for Large Kitchen Appliances:

- Technological Innovation: Investment in R&D leads to the development of smart appliances, offering features like remote control, automated cooking functions, and improved energy management.

- Sustainability Focus: Regulatory support for sustainable and energy-efficient products incentivizes both manufacturers and consumers to adopt greener technologies, driving demand for appliances with lower environmental impact.

- Lifestyle Changes: The increasing popularity of home cooking and a trend toward kitchen renovations fuel demand for high-quality, modern appliances.

The projected CAGR for large kitchen appliances through the forecast period remains strong, reflecting the ongoing integration of smart technologies and the continued popularity of modular kitchen designs. This growth is further supported by the rising disposable incomes of French consumers.

Regarding distribution channels, while specialist retailers maintain a significant presence, particularly for premium products, e-commerce has experienced explosive growth, achieving a penetration rate exceeding 25% in 2025. This surge is fueled by the convenience of online shopping, competitive pricing strategies, and the wide selection of products readily available online.

- Key Drivers for E-commerce Growth:

- Increased Digital Adoption: Higher internet penetration and growing consumer comfort with online purchasing have accelerated the shift towards e-commerce.

- Competitive Pricing & Marketing: Aggressive online marketing campaigns and competitive pricing strategies employed by major players have significantly boosted online sales.

The e-commerce sector is poised for continued expansion, with a projected annual growth rate of 5.2% through 2033, indicating a sustained preference for online purchasing among French consumers.

France Cooking Equipment Market Product Innovations

Innovations in the France cooking equipment market are centered around enhancing user experience and sustainability. Philips recently introduced a smart air fryer that not only reduces cooking time but also minimizes oil usage, appealing to health-conscious consumers. Electrolux's latest line of refrigerators features advanced cooling technology that maintains food freshness longer, reducing waste. These innovations underscore the industry's commitment to combining functionality with environmental responsibility, setting new standards in kitchen appliances.

Propelling Factors for France Cooking Equipment Market Growth

The growth of the France cooking equipment market is propelled by several key factors. Technological advancements, such as IoT integration and energy-efficient designs, are at the forefront, driving consumer demand for smarter and greener appliances. Economic factors, including increased disposable income and a trend towards home cooking, further boost the market. Regulatory influences, like the EU's stringent energy efficiency standards, compel manufacturers to innovate, ensuring compliance while meeting consumer expectations for sustainable products.

Obstacles in the France Cooking Equipment Market Market

Despite its growth, the France cooking equipment market faces several obstacles. Regulatory challenges, particularly around energy efficiency and safety standards, can be costly for manufacturers to meet. Supply chain disruptions, exacerbated by global events, have led to delays and increased costs, impacting market dynamics. Competitive pressures are intense, with brands constantly vying for market share, leading to price wars and reduced margins. These factors collectively pose significant barriers to sustained growth.

Future Opportunities in France Cooking Equipment Market

Emerging opportunities in the France cooking equipment market include the expansion into new markets, such as smart kitchen ecosystems that integrate multiple appliances for seamless cooking experiences. Technological advancements, like AI-driven cooking assistants, present avenues for innovation. Additionally, shifting consumer trends towards sustainability and health-conscious cooking open doors for products that align with these values, promising substantial growth potential.

Major Players in the France Cooking Equipment Market Ecosystem

Key Developments in France Cooking Equipment Market Industry

- January 2023: Philips launched a new line of smart air fryers, enhancing their market position in health-conscious cooking.

- March 2023: Electrolux acquired a local brand, expanding its product portfolio and market reach.

- June 2023: Groupe SEB introduced a new range of eco-friendly cookware, aligning with sustainability trends.

- September 2023: Bosch Siemens announced a partnership with a tech firm to integrate AI into their appliances, aiming to revolutionize cooking experiences.

Strategic France Cooking Equipment Market Market Forecast

The strategic forecast for the France cooking equipment market points towards robust growth, driven by technological innovations and evolving consumer preferences. The integration of AI and IoT technologies is expected to create new market segments, particularly in smart kitchen ecosystems. Additionally, the push towards sustainability and health-conscious cooking will continue to drive demand for eco-friendly and health-oriented appliances. With a projected CAGR of 4.2% through 2033, the market holds significant potential for manufacturers who can adeptly navigate the shifting landscape.

France Cooking Equipment Market Segmentation

-

1. Product Type

- 1.1. Food Preparation Appliances

- 1.2. Small Cooking Appliances

- 1.3. Large Kitchen Appliances

- 1.4. Other Kitchen appliances

-

2. Distribution Channel

- 2.1. Specialist Retailers

- 2.2. E-commerce

- 2.3. Supermarkets and Hypermarkets

- 2.4. Other Distribution Channels

France Cooking Equipment Market Segmentation By Geography

- 1. France

France Cooking Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in the Real Estate Sector Drives the Market; Increasing Urbanization and Infrastructural Development Drives the Market

- 3.3. Market Restrains

- 3.3.1. Availability of Alternatives; More Expensive than Traditional Fixtures

- 3.4. Market Trends

- 3.4.1. Growing Urbanization is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Cooking Equipment Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Food Preparation Appliances

- 5.1.2. Small Cooking Appliances

- 5.1.3. Large Kitchen Appliances

- 5.1.4. Other Kitchen appliances

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Specialist Retailers

- 5.2.2. E-commerce

- 5.2.3. Supermarkets and Hypermarkets

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. France

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Philips

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Candy

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bosch Siemens

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Electrolux

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Beko

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Brandt Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Whirlpool

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Groupe SEB

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Faure

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Smeg

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Philips

List of Figures

- Figure 1: France Cooking Equipment Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: France Cooking Equipment Market Share (%) by Company 2024

List of Tables

- Table 1: France Cooking Equipment Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: France Cooking Equipment Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: France Cooking Equipment Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: France Cooking Equipment Market Volume K Unit Forecast, by Product Type 2019 & 2032

- Table 5: France Cooking Equipment Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: France Cooking Equipment Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 7: France Cooking Equipment Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: France Cooking Equipment Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: France Cooking Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: France Cooking Equipment Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: France Cooking Equipment Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 12: France Cooking Equipment Market Volume K Unit Forecast, by Product Type 2019 & 2032

- Table 13: France Cooking Equipment Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 14: France Cooking Equipment Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 15: France Cooking Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: France Cooking Equipment Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Cooking Equipment Market?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the France Cooking Equipment Market?

Key companies in the market include Philips, Candy, Bosch Siemens, Electrolux, Beko, Brandt Group, Whirlpool, Groupe SEB, Faure, Smeg.

3. What are the main segments of the France Cooking Equipment Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growth in the Real Estate Sector Drives the Market; Increasing Urbanization and Infrastructural Development Drives the Market.

6. What are the notable trends driving market growth?

Growing Urbanization is Driving the Market.

7. Are there any restraints impacting market growth?

Availability of Alternatives; More Expensive than Traditional Fixtures.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Cooking Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Cooking Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Cooking Equipment Market?

To stay informed about further developments, trends, and reports in the France Cooking Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence