Key Insights

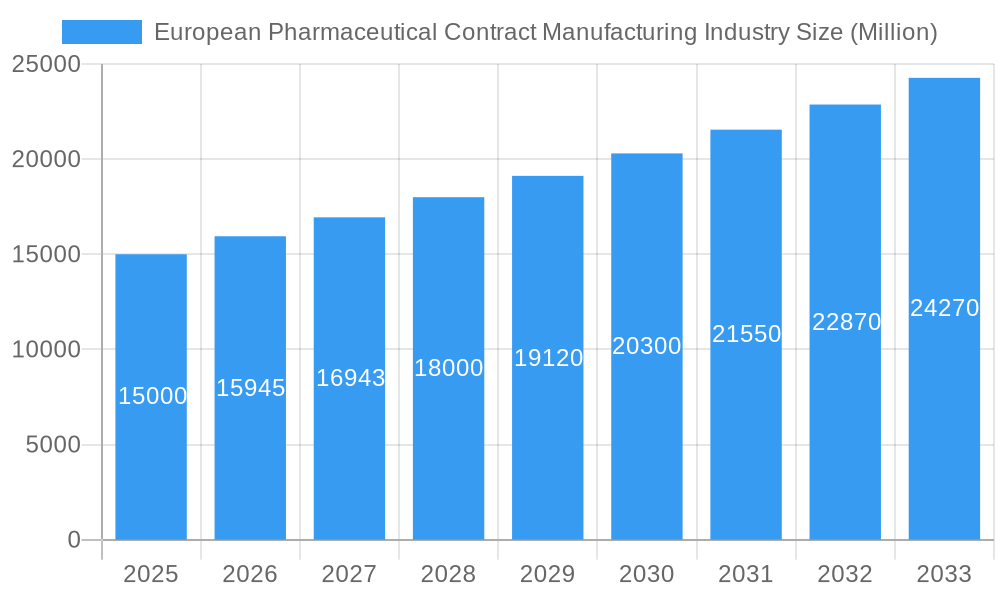

The European pharmaceutical contract manufacturing (PCM) market, valued at approximately €15 billion in 2025, is projected to experience robust growth, driven by several key factors. Increasing R&D expenditures by pharmaceutical companies, coupled with a growing demand for specialized drug products, particularly in the biologics and advanced therapy medicinal products (ATMPs) sectors, fuels the need for external manufacturing expertise. This trend is further amplified by the rising prevalence of chronic diseases across Europe and the subsequent surge in demand for pharmaceuticals. The market is segmented by service type, encompassing Active Pharmaceutical Ingredient (API) manufacturing, Finished Dosage Formulation (FDF) development and manufacturing, and injectable dose formulation secondary packaging. Geographically, Germany, the UK, France, and Italy represent significant market shares, reflecting established pharmaceutical industries and regulatory frameworks. However, smaller countries within Europe are also experiencing growth as companies seek cost-effective manufacturing solutions. Competitive pressures are driving innovation and efficiency improvements within the PCM industry, leading to a focus on automation, digitalization, and sustainable manufacturing practices.

European Pharmaceutical Contract Manufacturing Industry Market Size (In Billion)

Constraints to growth include stringent regulatory requirements and the associated costs of compliance, particularly concerning Good Manufacturing Practices (GMP). Furthermore, potential supply chain disruptions and fluctuations in raw material prices pose ongoing challenges. Despite these obstacles, the long-term outlook for the European PCM market remains positive, fueled by a continuous pipeline of new drug approvals and an increasing reliance on outsourcing by pharmaceutical firms aiming to optimize operational efficiency and reduce capital expenditure. Major players like Fareva, Famar, Lonza, and Recipharm are strategically positioning themselves to capitalize on this growth, investing in advanced technologies and expanding their manufacturing capabilities to meet the evolving demands of the industry. The industry's future success will depend on adapting to the changing regulatory landscape, maintaining supply chain resilience, and embracing technological advancements to deliver high-quality, cost-effective manufacturing solutions.

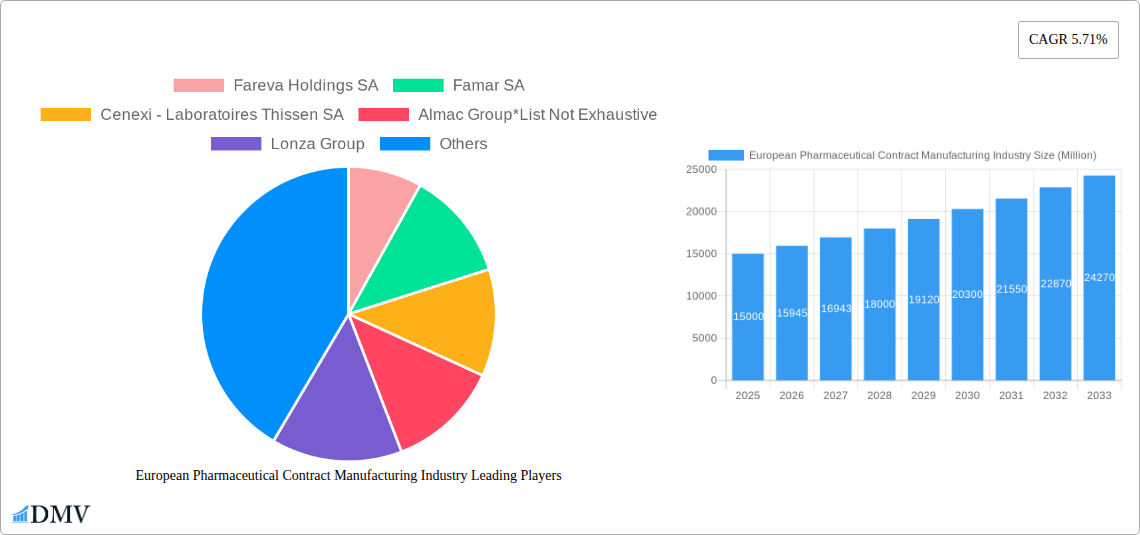

European Pharmaceutical Contract Manufacturing Industry Company Market Share

European Pharmaceutical Contract Manufacturing Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a comprehensive analysis of the European Pharmaceutical Contract Manufacturing (PCM) industry, offering a detailed understanding of market dynamics, competitive landscape, and future growth prospects. The study period spans 2019-2033, with 2025 as the base and estimated year. This report is invaluable for stakeholders including pharmaceutical companies, investors, and regulatory bodies seeking to navigate this dynamic market. The total market value is predicted to reach xx Million by 2033.

European Pharmaceutical Contract Manufacturing Industry Market Composition & Trends

This section evaluates the concentration, innovation, regulatory environment, substitute products, end-users, and mergers and acquisitions (M&A) within the European PCM market. We analyze market share distribution among key players, revealing a moderately concentrated market with significant opportunities for both established and emerging players. The report explores the influence of regulatory frameworks like EMA guidelines on innovation and market access. The impact of substitute products and the evolving end-user landscape (e.g., increased demand from biotech firms) are thoroughly examined.

- Market Concentration: The top 5 players account for approximately xx% of the market share in 2025, indicating a moderately concentrated market.

- Innovation Catalysts: Technological advancements in API synthesis, formulation technologies (e.g., advanced drug delivery systems), and digitalization are driving innovation.

- Regulatory Landscape: Stringent regulatory requirements from agencies like the EMA influence manufacturing processes and compliance costs.

- M&A Activities: The report analyzes recent M&A activities, including deal values and their impact on market consolidation, citing examples like MorphoSys' restructuring in 2022, involving over USD 250 Million in charges. Total M&A deal value during the historical period (2019-2024) was estimated at xx Million.

- Substitute Products: The emergence of alternative manufacturing technologies and outsourcing destinations is analyzed in terms of their impact on market share.

- End-User Profiles: The report profiles key end-users, including large pharmaceutical companies, biotech firms, and generic drug manufacturers.

European Pharmaceutical Contract Manufacturing Industry Industry Evolution

This section details the evolution of the European PCM market from 2019 to 2033. We analyze growth trajectories, technological progress, and evolving consumer demands. The shift towards advanced therapies, personalized medicines, and the increasing outsourcing of pharmaceutical manufacturing are key themes. The market experienced a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024), and is projected to grow at a CAGR of xx% during the forecast period (2025-2033). Key technological advancements, including automation, AI-driven process optimization, and continuous manufacturing, are discussed in relation to their adoption rates and impact on efficiency and cost reduction. The increasing demand for specialized services, such as sterile injectables and complex drug formulations, also contributes to this growth. Merck's restructuring in February 2022, creating Life Science Services (LSS), exemplifies the strategic focus on consolidating CDMO capabilities to meet evolving market demands.

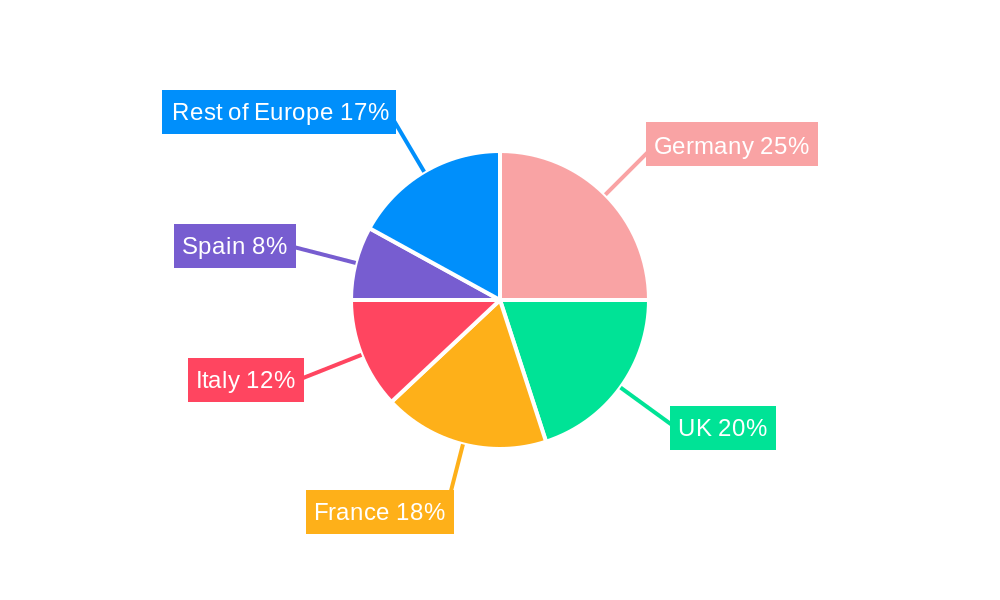

Leading Regions, Countries, or Segments in European Pharmaceutical Contract Manufacturing Industry

This section identifies the dominant regions, countries, and service types within the European PCM market. Germany, the UK, and France are major players, driven by established pharmaceutical industries, strong regulatory frameworks, and robust infrastructure.

By Country:

- Germany: Strong pharmaceutical industry, skilled workforce, and government support for life sciences.

- United Kingdom: Well-established pharmaceutical industry, access to skilled labor, and favorable regulatory environment.

- France: Strong presence of major pharmaceutical companies and a focus on innovation.

- Italy, Spain, Rest of Europe: These regions exhibit moderate growth driven by increasing pharmaceutical investments and outsourcing trends.

By Service Type:

- Active Pharmaceutical Ingredient (API) Manufacturing: High demand driven by the complexity of API synthesis, requiring specialized expertise.

- Finished Dosage Formulation (FDF) Development and Manufacturing: Significant growth due to increased demand for complex dosage forms and specialized formulations.

- Injectable Dose Formulation: Secondary Packaging: This segment benefits from the rising demand for injectables and the need for specialized packaging and handling.

European Pharmaceutical Contract Manufacturing Industry Product Innovations

Recent product innovations in the European PCM industry include advanced drug delivery systems (e.g., liposomes, nanoparticles), personalized medicine formulations, and continuous manufacturing technologies. These innovations enhance drug efficacy, improve patient compliance, and reduce manufacturing costs. Unique selling propositions include faster turnaround times, increased flexibility, and access to specialized expertise in complex drug development and manufacturing.

Propelling Factors for European Pharmaceutical Contract Manufacturing Industry Growth

Several factors contribute to the growth of the European PCM market. These include increased outsourcing by pharmaceutical companies, driven by cost reduction strategies and a focus on core competencies. Technological advancements like automation and digitalization improve efficiency and reduce production time. Favorable regulatory environments and government support for the life sciences sector also stimulate growth. The rising demand for specialized therapies and advanced drug delivery systems creates further growth opportunities.

Obstacles in the European Pharmaceutical Contract Manufacturing Industry Market

The European PCM market faces challenges such as stringent regulatory requirements, leading to higher compliance costs and longer approval processes. Supply chain disruptions, particularly concerning raw materials and active pharmaceutical ingredients (APIs), impact manufacturing capacity and timelines. Increased competition, especially from emerging markets, puts downward pressure on pricing. Furthermore, the need for skilled labor poses an ongoing challenge.

Future Opportunities in European Pharmaceutical Contract Manufacturing Industry

Future opportunities lie in expanding into emerging markets, focusing on advanced therapies (cell and gene therapies), and developing personalized medicine solutions. Investing in automation and digitalization to improve efficiency and reduce costs will be key. Collaborations and partnerships will be critical for accessing specialized expertise and technologies.

Major Players in the European Pharmaceutical Contract Manufacturing Industry Ecosystem

Key Developments in European Pharmaceutical Contract Manufacturing Industry Industry

- February 2022: Merck, Germany, restructured its business, consolidating CDMO and contract testing services into Life Science Services (LSS), enhancing its CDMO capabilities.

- March 2022: MorphoSys consolidated its work in Germany, incurring USD 254 Million in charges by abandoning US R&D efforts following the acquisition of Constellation Pharmaceuticals.

Strategic European Pharmaceutical Contract Manufacturing Industry Market Forecast

The European PCM market is poised for significant growth driven by the increasing demand for pharmaceutical products, technological advancements, and outsourcing trends. The market is expected to expand considerably over the forecast period, with opportunities for both established players and new entrants. Focusing on innovation, strategic partnerships, and addressing regulatory challenges will be crucial for success in this competitive landscape.

European Pharmaceutical Contract Manufacturing Industry Segmentation

-

1. Service Type

- 1.1. Active P

-

1.2. Finished

- 1.2.1. Solid Dose Formulation

- 1.2.2. Liquid Dose Formulation

- 1.2.3. Injectable Dose Formulation

- 1.3. Secondary Packaging

European Pharmaceutical Contract Manufacturing Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

European Pharmaceutical Contract Manufacturing Industry Regional Market Share

Geographic Coverage of European Pharmaceutical Contract Manufacturing Industry

European Pharmaceutical Contract Manufacturing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.71% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Outsourcing Volume by Pharmaceutical Companies; Increasing Investment in R&D

- 3.3. Market Restrains

- 3.3.1. Increasing Lead Time and Logistics Costs; Stringent Regulatory Requirements; Capacity Utilization Issues Affecting the Profitability of CMOs

- 3.4. Market Trends

- 3.4.1. Rising Investment in R&D will Drive The Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. European Pharmaceutical Contract Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Active P

- 5.1.2. Finished

- 5.1.2.1. Solid Dose Formulation

- 5.1.2.2. Liquid Dose Formulation

- 5.1.2.3. Injectable Dose Formulation

- 5.1.3. Secondary Packaging

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Fareva Holdings SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Famar SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Cenexi - Laboratoires Thissen SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Almac Group*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lonza Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Aenova Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Boehringer Ingelheim Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Recipharm AB

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Fareva Holdings SA

List of Figures

- Figure 1: European Pharmaceutical Contract Manufacturing Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: European Pharmaceutical Contract Manufacturing Industry Share (%) by Company 2025

List of Tables

- Table 1: European Pharmaceutical Contract Manufacturing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: European Pharmaceutical Contract Manufacturing Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: European Pharmaceutical Contract Manufacturing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 4: European Pharmaceutical Contract Manufacturing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United Kingdom European Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Germany European Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: France European Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Italy European Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Spain European Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Netherlands European Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Belgium European Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Sweden European Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Norway European Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Poland European Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Denmark European Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the European Pharmaceutical Contract Manufacturing Industry?

The projected CAGR is approximately 5.71%.

2. Which companies are prominent players in the European Pharmaceutical Contract Manufacturing Industry?

Key companies in the market include Fareva Holdings SA, Famar SA, Cenexi - Laboratoires Thissen SA, Almac Group*List Not Exhaustive, Lonza Group, Aenova Group, Boehringer Ingelheim Group, Recipharm AB.

3. What are the main segments of the European Pharmaceutical Contract Manufacturing Industry?

The market segments include Service Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Outsourcing Volume by Pharmaceutical Companies; Increasing Investment in R&D.

6. What are the notable trends driving market growth?

Rising Investment in R&D will Drive The Market Growth.

7. Are there any restraints impacting market growth?

Increasing Lead Time and Logistics Costs; Stringent Regulatory Requirements; Capacity Utilization Issues Affecting the Profitability of CMOs.

8. Can you provide examples of recent developments in the market?

March 2022: MorphoSys sacked US R&D to consolidate work in Germany, taking USD 254 million in charges. MorphoSys axed its early pipeline and U.S. R&D work that came with the USD 1.7 billion purchase of Constellation Pharmaceuticals, meaning a more than USD 250 million impairment charge as the German pharma shifted the focus home.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "European Pharmaceutical Contract Manufacturing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the European Pharmaceutical Contract Manufacturing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the European Pharmaceutical Contract Manufacturing Industry?

To stay informed about further developments, trends, and reports in the European Pharmaceutical Contract Manufacturing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence