Key Insights

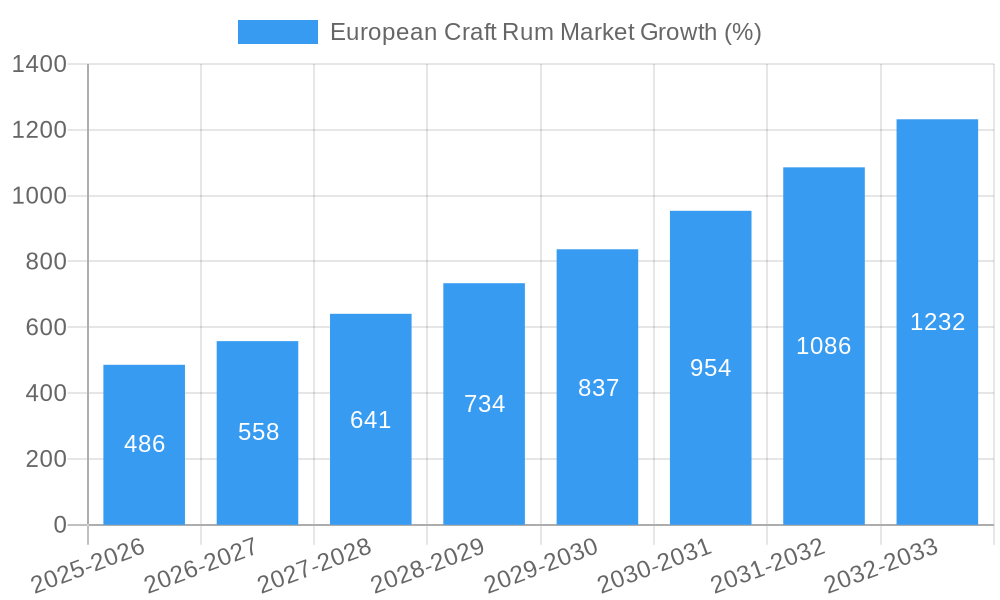

The European craft rum market, valued at €3.83 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 12.66% from 2025 to 2033. This surge is driven by several factors. Firstly, a rising consumer preference for premium and artisanal spirits fuels demand for high-quality, small-batch rums. Secondly, the increasing popularity of rum-based cocktails and mixed drinks in bars and restaurants (on-trade) significantly contributes to market expansion. Thirdly, the growing availability of craft rum through specialized retailers and online channels (off-trade) enhances accessibility for consumers. Finally, innovative flavor profiles and production techniques, including the use of locally sourced ingredients, further enhance the appeal of craft rum among discerning consumers.

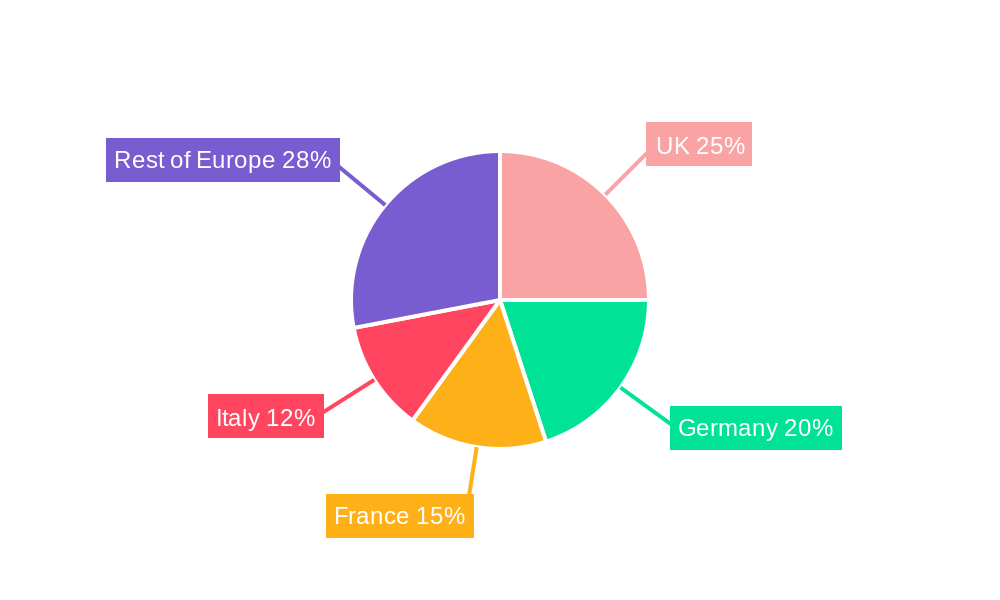

However, the market faces certain challenges. Increased production costs associated with premium ingredients and sustainable practices may impact profitability. Furthermore, intense competition from established rum brands and emerging craft distilleries requires continuous innovation and effective marketing strategies for sustained growth. Geographic variations exist within Europe; the UK, Germany, and France are expected to be leading markets due to high alcohol consumption and established craft beverage cultures, while other regions will exhibit varying growth rates based on consumer preferences and economic conditions. Market segmentation highlights the strong performance of the off-trade channel, reflecting the increasing popularity of home consumption and online purchasing. Key players like Bacardi, Diageo, and smaller craft distilleries are actively competing, driving product differentiation and market innovation. The forecast period (2025-2033) anticipates continued strong growth, driven by the factors mentioned above, though potential economic downturns could influence consumption patterns.

European Craft Rum Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the European craft rum market, offering a comprehensive overview of its current state, future trends, and key players. Covering the period from 2019 to 2033, with a focus on 2025, this study is essential for stakeholders seeking to understand and capitalize on the growth opportunities within this dynamic sector. The market is projected to reach xx Million by 2033.

European Craft Rum Market Composition & Trends

This section delves into the intricate composition of the European craft rum market, examining its concentration, innovation drivers, regulatory landscape, substitute products, and end-user profiles. We analyze the market share distribution among key players, revealing the competitive intensity and identifying potential areas for disruption. Furthermore, the report meticulously explores mergers and acquisitions (M&A) activities, analyzing deal values and their impact on market dynamics. The historical period (2019-2024) and the base year (2025) provide a robust foundation for forecasting market growth trajectory (2025-2033).

- Market Concentration: Analysis of market share held by top players like Diageo PLC, Bacardi Limited, and Pernod Ricard, revealing the level of competition. xx% of the market is controlled by the top 5 players (Estimated).

- Innovation Catalysts: Examination of factors driving innovation, such as consumer demand for premium and unique rums, and the adoption of new production techniques.

- Regulatory Landscape: Assessment of EU regulations impacting the production, distribution, and marketing of craft rum, including labeling requirements and alcohol taxation.

- Substitute Products: Identification and analysis of substitute beverages that compete with craft rum, such as whiskey, gin, and vodka. Analysis of their market impact and trends.

- End-User Profiles: Detailed profiling of craft rum consumers in Europe, including demographics, purchasing habits, and consumption patterns. Analysis of consumer preferences across different countries.

- M&A Activities: Comprehensive review of significant M&A deals in the European craft rum market during the study period, including deal values and strategic implications (e.g., Pernod Ricard's acquisition of The Whiskey Exchange). Estimated total M&A deal value during 2019-2024: xx Million.

European Craft Rum Market Industry Evolution

This section provides a detailed analysis of the European craft rum market's evolution, examining growth trajectories, technological advancements, and shifts in consumer preferences. We analyze historical growth rates and project future growth based on current market trends and anticipated industry developments. The impact of technological advancements on production efficiency, distribution, and marketing is critically assessed. We also examine changing consumer demands, such as increasing preference for organic and sustainable products, and their influence on market dynamics. Detailed examination of growth rates from 2019 to 2024 and projections for 2025-2033 will be provided. The rise of e-commerce platforms and direct-to-consumer sales will also be examined.

Leading Regions, Countries, or Segments in European Craft Rum Market

This section identifies the dominant regions, countries, and segments within the European craft rum market. We analyze key drivers of growth in leading segments (e.g., premium rum, organic rum) and regions.

Dominant Region: [Detailed analysis of the dominant region, including reasons for its dominance, e.g., UK, France].

Key Drivers:

- Investment Trends: Analysis of investment patterns in the craft rum sector in leading regions, including venture capital and private equity investments.

- Regulatory Support: Evaluation of the impact of supportive government policies in facilitating industry growth in specific regions.

- Consumer Preferences: Analysis of consumer preferences across regions, including insights into regional variations in taste and product preference.

Dominant Country: [Detailed analysis of the dominant country, including reasons for its dominance, e.g., UK]

Type Segmentation: A detailed breakdown of the market based on type (Whiskey, Gin, Vodka, Brandy, Rum, Other Types), highlighting the market share of each type and their growth trajectories. Rum is anticipated to be the dominant segment.

Distribution Channel Segmentation: Analysis of market share for on-trade (bars, restaurants) and off-trade (retail stores, online) channels, highlighting preferred distribution methods in each region. Off-trade is predicted to hold a larger market share.

European Craft Rum Market Product Innovations

This section highlights recent product innovations in the European craft rum market. It explores the unique selling propositions (USPs) of new products and examines the adoption of new technologies in production and packaging, focusing on how these innovations are shaping market competition and driving consumer interest. Examples include the use of unique aging techniques, innovative flavor profiles, and sustainable packaging solutions.

Propelling Factors for European Craft Rum Market Growth

This section identifies and analyzes the key growth drivers for the European craft rum market. These include increasing consumer demand for premium spirits, rising disposable incomes in several European countries, and supportive government policies promoting the craft spirits industry. Technological advancements in production and distribution will also be examined, as will the growing popularity of craft spirits among millennials and Gen Z consumers.

Obstacles in the European Craft Rum Market

This section examines the challenges and barriers hindering growth in the European craft rum market. These include increasing competition from established players, fluctuating raw material prices, and evolving regulatory frameworks. Supply chain disruptions and trade uncertainties also pose significant threats. The impact of these challenges on market growth will be quantified where possible.

Future Opportunities in European Craft Rum Market

This section highlights emerging opportunities for growth in the European craft rum market. This includes the potential for expansion into new markets, the development of innovative product lines (e.g., flavored rums, organic rums), and the leveraging of e-commerce platforms for enhanced sales and distribution. Moreover, the growth of sustainable and ethical production practices will create further opportunities.

Major Players in the European Craft Rum Market Ecosystem

- The British Honey Company (Union Distillers in Leicestershire)

- Suntory Holdings Limited (Beam Suntory Inc)

- Ian MacLeod Distillers Ltd

- Rémy Cointreau

- Nature HQ Ltd t/a The Apiarist

- JW Distillers Ltd

- Bacardi Limited

- The Edrington Group Limited

- Davide Campari-Milano NV

- Pernod Ricard

- Diageo PLC

Key Developments in European Craft Rum Market Industry

- Feb 2021: British Honey Company acquired Union Distillers in Leicestershire, expanding its product line and market reach.

- Sept 2021: Pernod Ricard acquired The Whiskey Exchange, strengthening its presence in the craft spirits market.

- Mar 2022: The Apiarist expanded its honey-infused spirits collection with a blended aged whiskey, introducing a new product category.

Strategic European Craft Rum Market Forecast

The European craft rum market is poised for continued growth, driven by increasing consumer demand for premium and artisanal products, coupled with the rise of e-commerce and a growing interest in sustainable practices within the industry. This, combined with targeted innovation and strategic acquisitions, points to a promising future for market expansion and enhanced profitability for key players. The market is expected to see a significant increase in value over the forecast period (2025-2033), with continued opportunities for both established and emerging brands.

European Craft Rum Market Segmentation

-

1. Type

- 1.1. Whiskey

- 1.2. Gin

- 1.3. Vodka

- 1.4. Brandy

- 1.5. Rum

- 1.6. Other Types

-

2. Distribution Channel

- 2.1. On-trade Channels

- 2.2. Off-trade Channels

European Craft Rum Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Russia

- 5. Spain

- 6. Italy

- 7. Rest of Europe

European Craft Rum Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.66% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Trend of Consuming Cocktails; Rising Demand for Premium Spirits

- 3.3. Market Restrains

- 3.3.1. Affordability of the Product is Restraining the Market's Growth

- 3.4. Market Trends

- 3.4.1. Increasing Number of Microbreweries Elevating the Demand for Craft Spirits

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. European Craft Rum Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Whiskey

- 5.1.2. Gin

- 5.1.3. Vodka

- 5.1.4. Brandy

- 5.1.5. Rum

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-trade Channels

- 5.2.2. Off-trade Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. France

- 5.3.4. Russia

- 5.3.5. Spain

- 5.3.6. Italy

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany European Craft Rum Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Whiskey

- 6.1.2. Gin

- 6.1.3. Vodka

- 6.1.4. Brandy

- 6.1.5. Rum

- 6.1.6. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. On-trade Channels

- 6.2.2. Off-trade Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Kingdom European Craft Rum Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Whiskey

- 7.1.2. Gin

- 7.1.3. Vodka

- 7.1.4. Brandy

- 7.1.5. Rum

- 7.1.6. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. On-trade Channels

- 7.2.2. Off-trade Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. France European Craft Rum Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Whiskey

- 8.1.2. Gin

- 8.1.3. Vodka

- 8.1.4. Brandy

- 8.1.5. Rum

- 8.1.6. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. On-trade Channels

- 8.2.2. Off-trade Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Russia European Craft Rum Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Whiskey

- 9.1.2. Gin

- 9.1.3. Vodka

- 9.1.4. Brandy

- 9.1.5. Rum

- 9.1.6. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. On-trade Channels

- 9.2.2. Off-trade Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Spain European Craft Rum Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Whiskey

- 10.1.2. Gin

- 10.1.3. Vodka

- 10.1.4. Brandy

- 10.1.5. Rum

- 10.1.6. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. On-trade Channels

- 10.2.2. Off-trade Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Italy European Craft Rum Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Whiskey

- 11.1.2. Gin

- 11.1.3. Vodka

- 11.1.4. Brandy

- 11.1.5. Rum

- 11.1.6. Other Types

- 11.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.2.1. On-trade Channels

- 11.2.2. Off-trade Channels

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Rest of Europe European Craft Rum Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - by Type

- 12.1.1. Whiskey

- 12.1.2. Gin

- 12.1.3. Vodka

- 12.1.4. Brandy

- 12.1.5. Rum

- 12.1.6. Other Types

- 12.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 12.2.1. On-trade Channels

- 12.2.2. Off-trade Channels

- 12.1. Market Analysis, Insights and Forecast - by Type

- 13. Germany European Craft Rum Market Analysis, Insights and Forecast, 2019-2031

- 14. France European Craft Rum Market Analysis, Insights and Forecast, 2019-2031

- 15. Italy European Craft Rum Market Analysis, Insights and Forecast, 2019-2031

- 16. United Kingdom European Craft Rum Market Analysis, Insights and Forecast, 2019-2031

- 17. Netherlands European Craft Rum Market Analysis, Insights and Forecast, 2019-2031

- 18. Sweden European Craft Rum Market Analysis, Insights and Forecast, 2019-2031

- 19. Rest of Europe European Craft Rum Market Analysis, Insights and Forecast, 2019-2031

- 20. Competitive Analysis

- 20.1. Market Share Analysis 2024

- 20.2. Company Profiles

- 20.2.1 The British Honey Company (Union Distillers in Leicestershire)

- 20.2.1.1. Overview

- 20.2.1.2. Products

- 20.2.1.3. SWOT Analysis

- 20.2.1.4. Recent Developments

- 20.2.1.5. Financials (Based on Availability)

- 20.2.2 Suntory Holdings Limited (Beam SuntoRy Inc )

- 20.2.2.1. Overview

- 20.2.2.2. Products

- 20.2.2.3. SWOT Analysis

- 20.2.2.4. Recent Developments

- 20.2.2.5. Financials (Based on Availability)

- 20.2.3 Ian MacLeod Distillers Ltd

- 20.2.3.1. Overview

- 20.2.3.2. Products

- 20.2.3.3. SWOT Analysis

- 20.2.3.4. Recent Developments

- 20.2.3.5. Financials (Based on Availability)

- 20.2.4 Rémy Cointreau

- 20.2.4.1. Overview

- 20.2.4.2. Products

- 20.2.4.3. SWOT Analysis

- 20.2.4.4. Recent Developments

- 20.2.4.5. Financials (Based on Availability)

- 20.2.5 Nature HQ Ltd t/a The Apiarist

- 20.2.5.1. Overview

- 20.2.5.2. Products

- 20.2.5.3. SWOT Analysis

- 20.2.5.4. Recent Developments

- 20.2.5.5. Financials (Based on Availability)

- 20.2.6 JW Distillers Ltd*List Not Exhaustive

- 20.2.6.1. Overview

- 20.2.6.2. Products

- 20.2.6.3. SWOT Analysis

- 20.2.6.4. Recent Developments

- 20.2.6.5. Financials (Based on Availability)

- 20.2.7 Bacardi Limited

- 20.2.7.1. Overview

- 20.2.7.2. Products

- 20.2.7.3. SWOT Analysis

- 20.2.7.4. Recent Developments

- 20.2.7.5. Financials (Based on Availability)

- 20.2.8 The Edrington Group Limited

- 20.2.8.1. Overview

- 20.2.8.2. Products

- 20.2.8.3. SWOT Analysis

- 20.2.8.4. Recent Developments

- 20.2.8.5. Financials (Based on Availability)

- 20.2.9 Davide Campari-Milano NV

- 20.2.9.1. Overview

- 20.2.9.2. Products

- 20.2.9.3. SWOT Analysis

- 20.2.9.4. Recent Developments

- 20.2.9.5. Financials (Based on Availability)

- 20.2.10 Pernod Ricard

- 20.2.10.1. Overview

- 20.2.10.2. Products

- 20.2.10.3. SWOT Analysis

- 20.2.10.4. Recent Developments

- 20.2.10.5. Financials (Based on Availability)

- 20.2.11 Diageo PLC

- 20.2.11.1. Overview

- 20.2.11.2. Products

- 20.2.11.3. SWOT Analysis

- 20.2.11.4. Recent Developments

- 20.2.11.5. Financials (Based on Availability)

- 20.2.1 The British Honey Company (Union Distillers in Leicestershire)

List of Figures

- Figure 1: European Craft Rum Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: European Craft Rum Market Share (%) by Company 2024

List of Tables

- Table 1: European Craft Rum Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: European Craft Rum Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: European Craft Rum Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: European Craft Rum Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: European Craft Rum Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany European Craft Rum Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France European Craft Rum Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy European Craft Rum Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom European Craft Rum Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands European Craft Rum Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden European Craft Rum Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe European Craft Rum Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: European Craft Rum Market Revenue Million Forecast, by Type 2019 & 2032

- Table 14: European Craft Rum Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 15: European Craft Rum Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: European Craft Rum Market Revenue Million Forecast, by Type 2019 & 2032

- Table 17: European Craft Rum Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 18: European Craft Rum Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: European Craft Rum Market Revenue Million Forecast, by Type 2019 & 2032

- Table 20: European Craft Rum Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 21: European Craft Rum Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: European Craft Rum Market Revenue Million Forecast, by Type 2019 & 2032

- Table 23: European Craft Rum Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 24: European Craft Rum Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: European Craft Rum Market Revenue Million Forecast, by Type 2019 & 2032

- Table 26: European Craft Rum Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 27: European Craft Rum Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: European Craft Rum Market Revenue Million Forecast, by Type 2019 & 2032

- Table 29: European Craft Rum Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 30: European Craft Rum Market Revenue Million Forecast, by Country 2019 & 2032

- Table 31: European Craft Rum Market Revenue Million Forecast, by Type 2019 & 2032

- Table 32: European Craft Rum Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 33: European Craft Rum Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the European Craft Rum Market?

The projected CAGR is approximately 12.66%.

2. Which companies are prominent players in the European Craft Rum Market?

Key companies in the market include The British Honey Company (Union Distillers in Leicestershire), Suntory Holdings Limited (Beam SuntoRy Inc ), Ian MacLeod Distillers Ltd, Rémy Cointreau, Nature HQ Ltd t/a The Apiarist, JW Distillers Ltd*List Not Exhaustive, Bacardi Limited, The Edrington Group Limited, Davide Campari-Milano NV, Pernod Ricard, Diageo PLC.

3. What are the main segments of the European Craft Rum Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.83 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Trend of Consuming Cocktails; Rising Demand for Premium Spirits.

6. What are the notable trends driving market growth?

Increasing Number of Microbreweries Elevating the Demand for Craft Spirits.

7. Are there any restraints impacting market growth?

Affordability of the Product is Restraining the Market's Growth.

8. Can you provide examples of recent developments in the market?

Mar 2022: An artisan label based in the United Kingdom, "The Apiarist," announced that it expanded its signature collection of honey-infused spirits by introducing blended aged whiskey.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "European Craft Rum Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the European Craft Rum Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the European Craft Rum Market?

To stay informed about further developments, trends, and reports in the European Craft Rum Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence