Key Insights

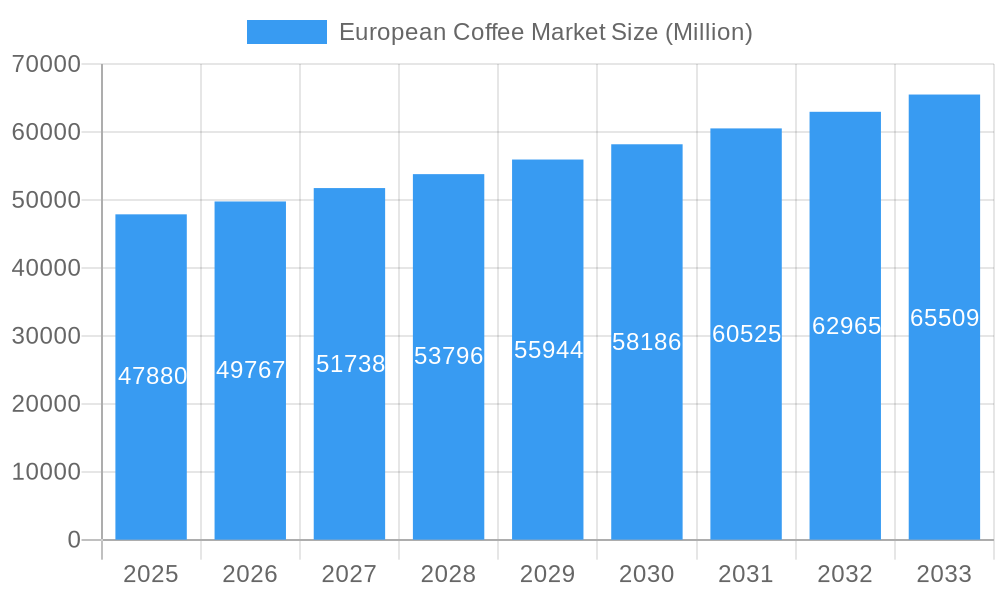

The European coffee market, valued at €47.88 billion in 2025, is projected to experience steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 3.96% from 2025 to 2033. This growth is fueled by several key factors. Increasing disposable incomes across Europe, particularly in emerging markets within the region, are driving higher coffee consumption. The rising popularity of specialty coffee, including single-origin beans and artisanal brewing methods, is further boosting market demand. Furthermore, the convenience offered by coffee pods and capsules contributes significantly to market expansion, particularly among younger consumers. However, the market faces some challenges, including fluctuating coffee bean prices due to global climate change and geopolitical instability. Increased competition among established players and the emergence of new entrants also pose a challenge. The segment breakdown reveals a diverse market: whole bean coffee retains a significant share, driven by the growing preference for high-quality brews; ground coffee remains a staple; instant coffee caters to convenience-seeking consumers; while coffee pods and capsules continue to gain traction, thanks to their ease of use and consistent quality. The distribution channels are segmented into on-trade (cafes, restaurants) and off-trade (supermarkets, online retailers), with off-trade channels experiencing robust growth due to the rise of e-commerce and home consumption. Germany, France, Italy, and the United Kingdom remain the major markets within Europe, demonstrating consistent demand and driving significant revenue generation for key players such as JAB Holding Company, Nestlé SA, and Starbucks Corporation.

European Coffee Market Market Size (In Billion)

The competitive landscape is characterized by a mix of multinational corporations and regional players. Large corporations leverage their established brands and distribution networks, while smaller players focus on niche segments, offering specialized products and unique branding strategies. Innovation in coffee processing, packaging, and brewing technology plays a crucial role in maintaining market dynamism. Future market growth will likely be driven by sustainable and ethical sourcing practices, with consumers showing increasing awareness of environmental and social impact. The continued penetration of coffee culture across various demographic groups, along with technological advancements, is expected to positively influence the market outlook during the forecast period. The robust growth in the European coffee market positions it as a key area for investment and further development.

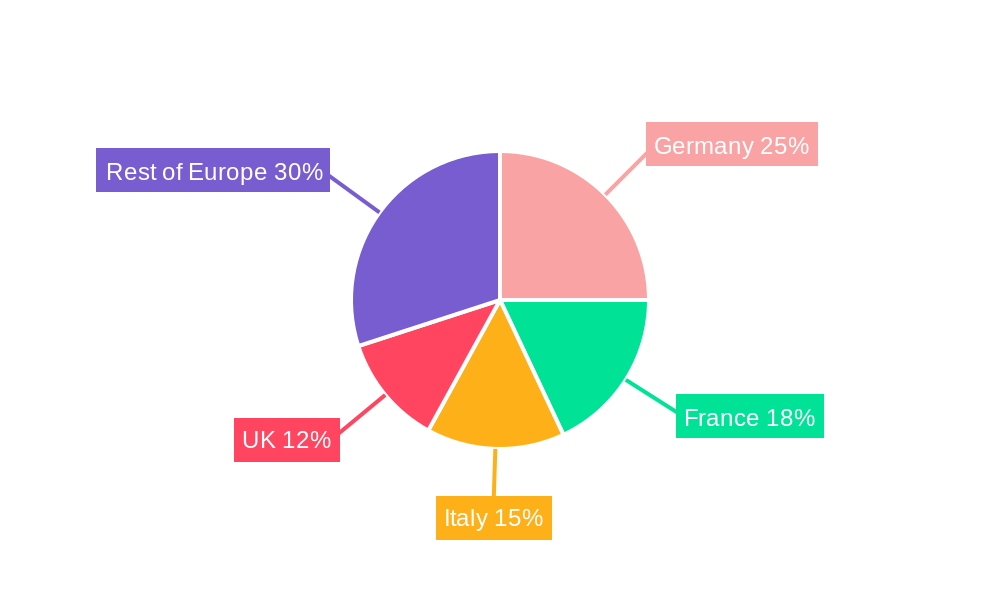

European Coffee Market Company Market Share

European Coffee Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the European coffee market, encompassing market trends, competitive landscape, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the opportunities within this dynamic market. The report analyzes a market valued at xx Million in 2025, projected to reach xx Million by 2033.

European Coffee Market Composition & Trends

This section delves into the intricate composition of the European coffee market, examining its concentration, innovation drivers, regulatory environment, substitute products, end-user profiles, and merger & acquisition (M&A) activities. The European coffee market exhibits a moderately concentrated structure, with key players like JAB Holding Company, Nestlé SA, and Luigi Lavazza SpA holding significant market share. However, smaller regional players and specialty coffee shops contribute significantly to market diversity.

- Market Share Distribution (2024): Nestlé SA (25%), JAB Holding Company (20%), Luigi Lavazza SpA (10%), Others (45%). These figures are estimates based on publicly available data and market research.

- Innovation Catalysts: Sustainability initiatives (e.g., compostable pods), technological advancements in brewing methods, and the growing demand for specialty coffee drive innovation.

- Regulatory Landscape: EU regulations on food safety and labeling significantly impact market operations. Specific directives on coffee labeling and sustainability certifications are key considerations.

- Substitute Products: Tea and other beverages pose a competitive threat, although coffee maintains its dominance due to strong consumer preference.

- End-User Profiles: The market caters to diverse consumer segments, including home users, cafes, restaurants, and offices. Changing consumer preferences, particularly towards convenience and ethical sourcing, significantly shape market dynamics.

- M&A Activities (2019-2024): While precise deal values are not publicly disclosed for all transactions, significant M&A activity has consolidated market share among major players, with an estimated total deal value exceeding xx Million. These activities have led to increased market concentration and reshaping of the competitive landscape.

European Coffee Market Industry Evolution

This section traces the evolution of the European coffee market, examining market growth trajectories, technological advancements, and shifts in consumer demands. The market has experienced consistent growth driven by rising disposable incomes, changing lifestyles, and a growing preference for premium coffee experiences. The industry has witnessed a shift towards convenience with the rise of single-serve coffee pods and capsules. Technological advancements in brewing technology, roasting techniques, and packaging have also enhanced the coffee experience. The market is also responding to growing consumer demand for ethically sourced and sustainably produced coffee. Specific data points on adoption rates and growth are difficult to acquire due to the fragmented nature of the market and private information held by companies. However, industry experts suggest a compounded annual growth rate (CAGR) of approximately 4-6% during the historical period and a projection of similar growth in the forecast period.

Leading Regions, Countries, or Segments in European Coffee Market

This section identifies the leading regions, countries, and segments within the European coffee market. While precise market share data for individual countries is not publicly available, Germany, Italy, France, and the UK are identified as key markets based on high per capita consumption, strong coffee culture, and significant industry presence.

By Product Type: Ground coffee remains the largest segment, followed by whole bean coffee, instant coffee, and coffee pods and capsules. The growth of coffee pods and capsules is significant, driven by convenience and ease of use.

By Distribution Channel: The off-trade (supermarkets, retail stores) segment dominates market share, while the on-trade (cafes, restaurants) segment contributes significantly to revenue generation and premium coffee consumption.

Key Drivers:

- Investment Trends: Significant investments in production facilities, marketing, and research & development drive the market.

- Regulatory Support: Favorable regulations and initiatives promoting sustainable coffee practices enhance industry growth.

The dominance of specific regions and segments is primarily driven by established coffee cultures, high levels of disposable income, and the presence of well-established market players. The market is expected to witness significant regional variation in growth driven by specific national consumer preferences.

European Coffee Market Product Innovations

Recent years have witnessed significant innovation in the European coffee market, particularly in the areas of packaging and brewing methods. Nescafé Dolce Gusto's Neo pods exemplify the trend towards sustainable, eco-friendly packaging, while other companies are introducing innovative brewing technologies to offer superior coffee experiences. The focus on convenience, sustainability, and premium quality drives ongoing product development. This includes the emergence of new coffee blends and flavors tailored to evolving consumer preferences and the expansion of plant-based milk alternatives in coffee drinks. Increased adoption of smart coffee makers and connected devices also contributes to product innovation.

Propelling Factors for European Coffee Market Growth

Several factors propel the growth of the European coffee market. Rising disposable incomes in many European countries provide consumers with increased purchasing power. The growing popularity of specialty coffee and the rise of coffee culture fuel premiumization trends. Technological innovations, such as advancements in brewing techniques and sustainable packaging, enhance the overall consumer experience. Government policies and regulations supporting sustainable coffee production practices also contribute to market growth.

Obstacles in the European Coffee Market Market

Despite its growth potential, the European coffee market faces various obstacles. Fluctuations in global coffee bean prices can affect production costs and profitability. Supply chain disruptions resulting from geopolitical instability or unforeseen events (e.g., pandemics) can impact market dynamics. Intense competition among numerous players, both large multinational corporations and smaller local businesses, can create price wars and margin pressure. Stringent EU regulations on food safety, labeling, and sustainability add to the operational complexity and compliance costs.

Future Opportunities in European Coffee Market

The European coffee market presents numerous future opportunities. The growing health-conscious consumer base drives demand for healthier coffee options, such as low-calorie and plant-based alternatives. The increasing adoption of e-commerce platforms and online coffee delivery services opens new market avenues. Technological advancements in sustainable packaging and innovative brewing systems offer potential for growth and differentiation. The rising interest in personalized coffee experiences and niche coffee varieties further contributes to future opportunities.

Major Players in the European Coffee Market Ecosystem

- JAB Holding Company

- Nestlé SA

- J J Darboven GmbH & Co KG

- Melitta Group

- The Kraft Heinz Company

- Krüger GmbH & Co KG

- Starbucks Corporation

- Strauss Group Ltd

- Maxingvest AG (Tchibo)

- Luigi Lavazza SpA

*List Not Exhaustive

Key Developments in European Coffee Market Industry

- December 2021: Starbucks introduced its new oat dairy alternative coffee in its espresso segment, expanding its offerings to cater to growing consumer demand for plant-based options.

- May 2022: Melitta and OFI partnered to enhance coffee traceability using blockchain technology, responding to rising consumer interest in ethical and sustainable sourcing.

- November 2022: Nescafé Dolce Gusto launched its Neo coffee pods, significantly reducing packaging waste and enhancing the product's environmental profile.

Strategic European Coffee Market Market Forecast

The European coffee market is poised for continued growth, driven by sustained consumer demand, innovation, and evolving consumer preferences. The forecast period anticipates robust expansion, with key drivers being the increasing popularity of specialty coffee, the rise of sustainable and ethically sourced coffee, and the ongoing development of innovative brewing technologies and packaging solutions. The market's future trajectory indicates significant potential for expansion and diversification across various segments and regions.

European Coffee Market Segmentation

-

1. Product Type

- 1.1. Whole Bean

- 1.2. Ground Coffee

- 1.3. Instant Coffee

- 1.4. Coffee Pods and Capsules

-

2. Distribution Channel

- 2.1. On-trade

-

2.2. Off-trade

- 2.2.1. Supermarkets/Hypermarkets

- 2.2.2. Convenience Stores

- 2.2.3. Specialist Retailers

- 2.2.4. Other Off-trade Channels

European Coffee Market Segmentation By Geography

- 1. United Kingdom

- 2. Germany

- 3. France

- 4. Russia

- 5. Italy

- 6. Spain

- 7. Rest of Europe

European Coffee Market Regional Market Share

Geographic Coverage of European Coffee Market

European Coffee Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.96% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Incidences of Food Allergies; Favorable Government Initiatives and Regulations for Food Safety

- 3.3. Market Restrains

- 3.3.1. Inconsistencies Involved in Food Allergen Declarations

- 3.4. Market Trends

- 3.4.1. Consumer Preference for Premium Coffee Fuels Growth in Specialty Coffee Shops Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. European Coffee Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Whole Bean

- 5.1.2. Ground Coffee

- 5.1.3. Instant Coffee

- 5.1.4. Coffee Pods and Capsules

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-trade

- 5.2.2. Off-trade

- 5.2.2.1. Supermarkets/Hypermarkets

- 5.2.2.2. Convenience Stores

- 5.2.2.3. Specialist Retailers

- 5.2.2.4. Other Off-trade Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.3.2. Germany

- 5.3.3. France

- 5.3.4. Russia

- 5.3.5. Italy

- 5.3.6. Spain

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United Kingdom European Coffee Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Whole Bean

- 6.1.2. Ground Coffee

- 6.1.3. Instant Coffee

- 6.1.4. Coffee Pods and Capsules

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. On-trade

- 6.2.2. Off-trade

- 6.2.2.1. Supermarkets/Hypermarkets

- 6.2.2.2. Convenience Stores

- 6.2.2.3. Specialist Retailers

- 6.2.2.4. Other Off-trade Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Germany European Coffee Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Whole Bean

- 7.1.2. Ground Coffee

- 7.1.3. Instant Coffee

- 7.1.4. Coffee Pods and Capsules

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. On-trade

- 7.2.2. Off-trade

- 7.2.2.1. Supermarkets/Hypermarkets

- 7.2.2.2. Convenience Stores

- 7.2.2.3. Specialist Retailers

- 7.2.2.4. Other Off-trade Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. France European Coffee Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Whole Bean

- 8.1.2. Ground Coffee

- 8.1.3. Instant Coffee

- 8.1.4. Coffee Pods and Capsules

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. On-trade

- 8.2.2. Off-trade

- 8.2.2.1. Supermarkets/Hypermarkets

- 8.2.2.2. Convenience Stores

- 8.2.2.3. Specialist Retailers

- 8.2.2.4. Other Off-trade Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Russia European Coffee Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Whole Bean

- 9.1.2. Ground Coffee

- 9.1.3. Instant Coffee

- 9.1.4. Coffee Pods and Capsules

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. On-trade

- 9.2.2. Off-trade

- 9.2.2.1. Supermarkets/Hypermarkets

- 9.2.2.2. Convenience Stores

- 9.2.2.3. Specialist Retailers

- 9.2.2.4. Other Off-trade Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Italy European Coffee Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Whole Bean

- 10.1.2. Ground Coffee

- 10.1.3. Instant Coffee

- 10.1.4. Coffee Pods and Capsules

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. On-trade

- 10.2.2. Off-trade

- 10.2.2.1. Supermarkets/Hypermarkets

- 10.2.2.2. Convenience Stores

- 10.2.2.3. Specialist Retailers

- 10.2.2.4. Other Off-trade Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Spain European Coffee Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Whole Bean

- 11.1.2. Ground Coffee

- 11.1.3. Instant Coffee

- 11.1.4. Coffee Pods and Capsules

- 11.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.2.1. On-trade

- 11.2.2. Off-trade

- 11.2.2.1. Supermarkets/Hypermarkets

- 11.2.2.2. Convenience Stores

- 11.2.2.3. Specialist Retailers

- 11.2.2.4. Other Off-trade Channels

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Rest of Europe European Coffee Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 12.1.1. Whole Bean

- 12.1.2. Ground Coffee

- 12.1.3. Instant Coffee

- 12.1.4. Coffee Pods and Capsules

- 12.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 12.2.1. On-trade

- 12.2.2. Off-trade

- 12.2.2.1. Supermarkets/Hypermarkets

- 12.2.2.2. Convenience Stores

- 12.2.2.3. Specialist Retailers

- 12.2.2.4. Other Off-trade Channels

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 JAB Holding Company

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Nestlé SA

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 J J Darboven GmbH & Co KG

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Melitta Group

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 The Kraft Heinz Company

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Krüger GmbH & Co KG

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Starbucks Corporation

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Strauss Group Ltd

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Maxingvest AG (Tchibo)*List Not Exhaustive

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Luigi Lavazza SpA

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 JAB Holding Company

List of Figures

- Figure 1: European Coffee Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: European Coffee Market Share (%) by Company 2025

List of Tables

- Table 1: European Coffee Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: European Coffee Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: European Coffee Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: European Coffee Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: European Coffee Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: European Coffee Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: European Coffee Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: European Coffee Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 9: European Coffee Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: European Coffee Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 11: European Coffee Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 12: European Coffee Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: European Coffee Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: European Coffee Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 15: European Coffee Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: European Coffee Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 17: European Coffee Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 18: European Coffee Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: European Coffee Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 20: European Coffee Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 21: European Coffee Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: European Coffee Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 23: European Coffee Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 24: European Coffee Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the European Coffee Market?

The projected CAGR is approximately 3.96%.

2. Which companies are prominent players in the European Coffee Market?

Key companies in the market include JAB Holding Company, Nestlé SA, J J Darboven GmbH & Co KG, Melitta Group, The Kraft Heinz Company, Krüger GmbH & Co KG, Starbucks Corporation, Strauss Group Ltd, Maxingvest AG (Tchibo)*List Not Exhaustive, Luigi Lavazza SpA.

3. What are the main segments of the European Coffee Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 47.88 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Incidences of Food Allergies; Favorable Government Initiatives and Regulations for Food Safety.

6. What are the notable trends driving market growth?

Consumer Preference for Premium Coffee Fuels Growth in Specialty Coffee Shops Market.

7. Are there any restraints impacting market growth?

Inconsistencies Involved in Food Allergen Declarations.

8. Can you provide examples of recent developments in the market?

November 2022: Nescafé Dolce Gusto unveiled its next-generation coffee pods and machines, referred to as Neo. Nestlé's new coffee pods use 70% less packaging than current capsules (by weight) and are paper-based and compostable. Nestlé's Swiss R&D Center for Systems has refined this product over the past five years.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "European Coffee Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the European Coffee Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the European Coffee Market?

To stay informed about further developments, trends, and reports in the European Coffee Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence