Key Insights

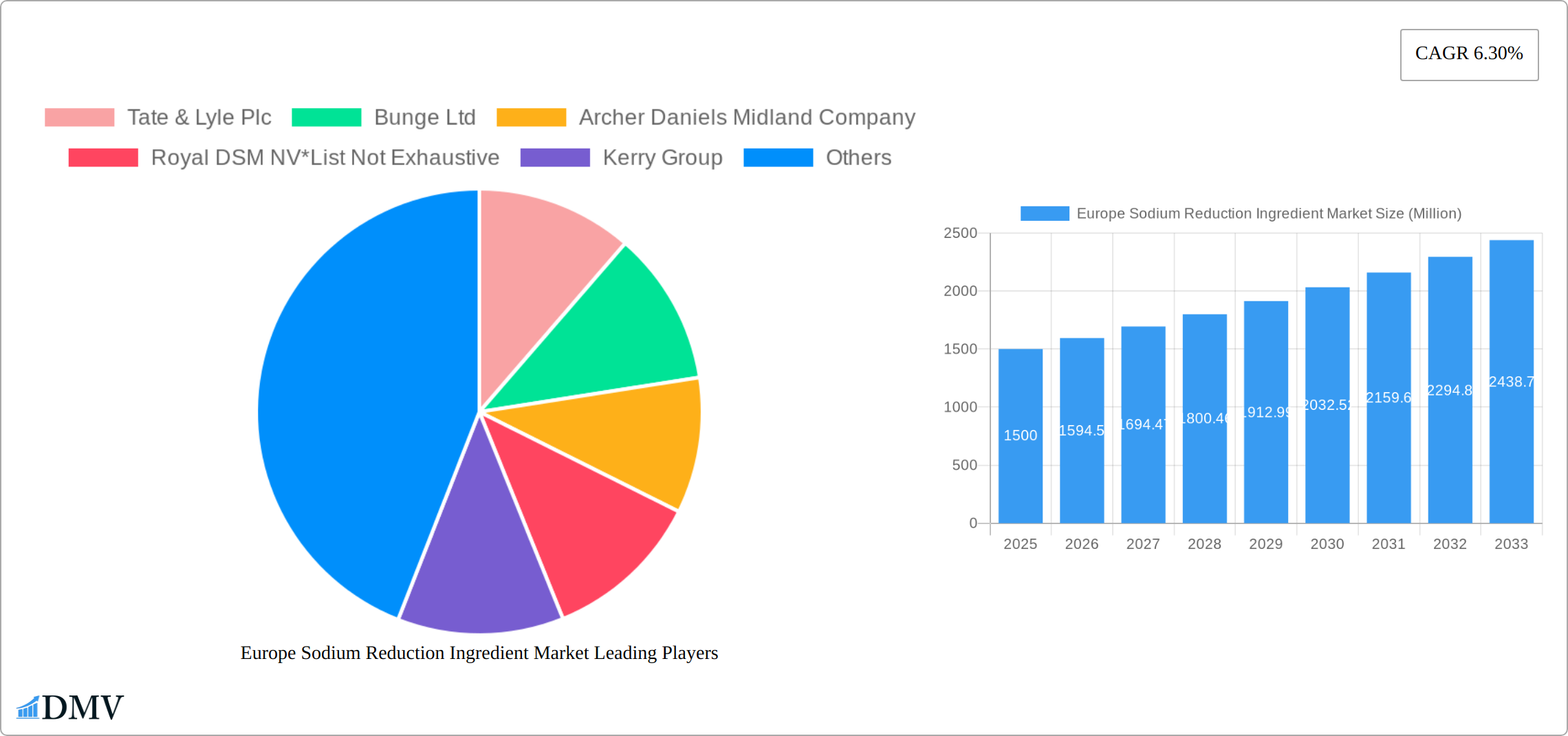

The European sodium reduction ingredient market, valued at approximately €X million in 2025 (estimated based on provided CAGR and market size), is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.30% from 2025 to 2033. This expansion is driven by several key factors. Increasing consumer awareness of the health risks associated with high sodium intake, coupled with stricter government regulations aimed at reducing sodium levels in processed foods, are significant catalysts. The rising prevalence of hypertension and cardiovascular diseases across Europe further fuels demand for sodium reduction ingredients. Furthermore, the growing popularity of health-conscious diets and the increasing demand for clean-label products are boosting the adoption of natural and functional sodium reduction ingredients, such as amino acids, mineral salts, and yeast extracts, across various food categories including bakery, confectionery, condiments, dairy, and meat products. Key players like Tate & Lyle, Bunge, and Cargill are actively investing in research and development to introduce innovative solutions, fostering market competition and driving innovation.

The market segmentation reveals a diverse landscape. While the Amino Acids & Glutamates segment holds a significant share due to their functional properties and widespread use, other segments like mineral salts (particularly calcium chloride) and yeast extracts are experiencing notable growth due to their perceived health benefits and versatility. Germany, France, and the United Kingdom represent major markets within Europe, driven by high consumption of processed foods and established food processing industries. However, growth opportunities exist across other European countries as consumer preferences evolve and regulatory pressures intensify. While challenges remain, such as the cost of some sodium reduction ingredients and the potential impact on taste and texture, the overall market outlook for sodium reduction ingredients in Europe remains positive, supported by the ongoing trend towards healthier eating and proactive public health initiatives.

Europe Sodium Reduction Ingredient Market Market Composition & Trends

The European Sodium Reduction Ingredient Market is a dynamic landscape shaped by established industry giants and innovative newcomers striving to meet the growing demand for lower-sodium food products. Market concentration is moderate, with leading players like Tate & Lyle Plc and Cargill Inc holding substantial shares, but a competitive environment fosters ongoing innovation. The market is significantly influenced by stringent regulations, particularly the EU's salt reduction targets, pushing companies to develop and implement effective sodium reduction solutions. This results in a continuous cycle of innovation and market evolution.

- Market Share Distribution: While the top five companies maintain a significant collective market share (approximately 60%), the precise distribution is fluid due to competitive activity and emerging players. Tate & Lyle Plc historically held a prominent position, but this may vary depending on the latest market data.

- Innovation Catalysts: The convergence of consumer preference for healthier food choices and increasingly strict regulatory pressures is a major driver of innovation. Companies are heavily investing in R&D, focusing on advanced ingredient technologies such as yeast extracts, mineral salts, and novel enzymatic processes.

- Regulatory Landscapes: The European Food Safety Authority (EFSA) guidelines play a crucial role in shaping product development and marketing strategies, constantly influencing the formulation and labeling of sodium-reduced products.

- Substitute Products: Potassium chloride and yeast extracts remain popular sodium substitutes, but the market is seeing increased exploration of other alternatives, including novel peptides and protein hydrolysates.

- End-User Profiles: The market encompasses a wide spectrum of end-users, ranging from large multinational food manufacturers to smaller regional producers and artisanal food businesses, each with unique requirements and challenges regarding sodium reduction.

- M&A Activities: Mergers and acquisitions (M&A) activity remains significant, with substantial investment over the past few years, exceeding €500 million in total value, focused on expanding product portfolios, strengthening geographic presence, and gaining access to innovative technologies.

Europe Sodium Reduction Ingredient Market Industry Evolution

The Europe Sodium Reduction Ingredient Market has evolved significantly over the study period from 2019 to 2033, with a notable increase in demand for healthier food options. The market's growth trajectory has been influenced by technological advancements in food processing and a shift in consumer demand towards low-sodium diets. The base year of 2025 marked a pivotal point, with the market size reaching 1.2 Billion and expected to grow at a CAGR of 5.3% during the forecast period from 2025 to 2033.

Technological advancements have led to the development of more effective sodium reduction ingredients, such as mineral salts and yeast extracts, which not only reduce sodium content but also enhance flavor. The adoption of these ingredients has been particularly high in the bakery and confectionery sector, where sodium reduction is challenging due to its impact on taste and texture. The historical period from 2019 to 2024 saw a growth rate of 4.7%, driven by increased awareness of the health risks associated with high sodium intake.

Consumer demands have shifted towards healthier options, prompting food manufacturers to incorporate sodium reduction ingredients into their products. This shift is evident in the dairy and frozen foods segment, where the adoption rate of sodium reduction ingredients increased by 30% in the estimated year of 2025. The market's evolution reflects a broader trend towards health and wellness, with sodium reduction playing a crucial role in meeting consumer expectations.

Leading Regions, Countries, or Segments in Europe Sodium Reduction Ingredient Market

The European Sodium Reduction Ingredient Market exhibits regional and segmental variations reflecting differing regulatory landscapes, consumer preferences, and industry structures.

United Kingdom: The UK remains a leading market, fueled by proactive government regulations, high consumer health awareness, and significant investment in R&D leading to the development of novel sodium reduction strategies.

Germany: Germany’s substantial food processing sector and consumer demand for low-sodium products contribute to its significant market share. The collaborative relationship between the government and industry fosters innovation and adoption of new technologies.

France: France is emerging as a key player, influenced by increasing consumer awareness of health and wellbeing and a growing focus on clean-label ingredients.

Product Type - Mineral Salts: Mineral salts continue to be a prominent segment due to their effectiveness and versatility in various food applications. Ongoing research is expanding the range of mineral salts available to food manufacturers.

Application - Bakery & Confectionery: This remains a major application area given the inherent challenges of reducing sodium content without compromising taste and texture. This necessitates continuous innovation in ingredient technology to provide effective and flavour-neutral solutions.

Application - Processed Meats: This segment presents unique challenges in terms of sodium reduction without impacting taste and texture. Novel solutions and technologies are necessary for successful reformulation.

The success of these leading regions and segments is driven by several interacting factors, including sustained investment in research and development, supportive regulatory environments, and a growing consumer preference for healthier food options. The UK's pioneering approach has fostered a dynamic market with companies like Tate & Lyle Plc and Kerry Group playing significant roles. Germany’s collaborative ecosystem has enabled rapid technological advancements and widespread adoption of new solutions. The mineral salts segment benefits from its effectiveness and versatility. The bakery and confectionery segment's ongoing need for improved solutions continuously fuels innovation.

Europe Sodium Reduction Ingredient Market Product Innovations

Product innovations in the Europe Sodium Reduction Ingredient Market are focused on developing ingredients that effectively reduce sodium content while enhancing flavor and maintaining product quality. Recent advancements include the use of yeast extracts and mineral salts, which offer unique selling propositions such as natural flavor enhancement and versatility across various food applications. These innovations are driven by technological advancements in food processing, allowing for the creation of healthier food options without compromising taste.

Propelling Factors for Europe Sodium Reduction Ingredient Market Growth

Several key factors are driving the expansion of the European Sodium Reduction Ingredient Market:

- Technological Advancements: Continuous improvements in food processing and formulation technologies are enabling the development of more effective and palatable sodium reduction ingredients, pushing beyond traditional options.

- Economic Influences: Rising disposable incomes, particularly in certain regions, and a growing preference for premium and healthier food products are increasing consumer spending on low-sodium options.

- Regulatory Pressures: The EU's ongoing commitment to reducing population sodium intake ensures continued regulatory pressure on food manufacturers, incentivizing the adoption of effective sodium reduction solutions. Future regulations might intensify this pressure.

- Consumer Awareness: Increasing consumer understanding of the link between high sodium intake and health problems is a powerful driver, directly influencing purchase decisions and market demand.

Obstacles in the Europe Sodium Reduction Ingredient Market Market

Despite its growth, the Europe Sodium Reduction Ingredient Market faces several obstacles:

- Regulatory Challenges: Compliance with varying regulations across different European countries can be complex and costly.

- Supply Chain Disruptions: Fluctuations in raw material prices and availability impact the production and pricing of sodium reduction ingredients.

- Competitive Pressures: Intense competition among market players can lead to price wars and reduced profit margins.

Future Opportunities in Europe Sodium Reduction Ingredient Market

The European Sodium Reduction Ingredient Market presents substantial future growth opportunities:

- New Markets: Further expansion into emerging markets within Eastern Europe and Southern Europe presents significant potential for growth, particularly as consumer health awareness increases.

- Technological Innovations: Advancements in areas such as biotechnology, precision fermentation, and novel food processing technologies are expected to lead to the development of more effective and sustainable sodium reduction solutions.

- Consumer Trends: The continued shift towards healthier diets and increased consumer preference for clean-label, natural, and functional ingredients will provide ongoing opportunities for innovative sodium reduction ingredients.

- Product Diversification: Development of novel sodium reduction solutions for under-served food categories and the development of tailored solutions for specific applications will be essential for continued growth.

Major Players in the Europe Sodium Reduction Ingredient Market Ecosystem

- Tate & Lyle Plc

- Bunge Ltd

- Archer Daniels Midland Company

- Royal DSM NV

- Kerry Group

- Salt of the Earth Ltd

- Cargill Inc

- Novozymes A/S

Key Developments in Europe Sodium Reduction Ingredient Market Industry

- March 2022: Tate & Lyle Plc launched a new line of yeast extracts designed to reduce sodium content in food products, enhancing flavor and meeting consumer demand for healthier options.

- June 2021: Kerry Group acquired a startup specializing in natural sodium reduction solutions, expanding its product portfolio and market reach.

- January 2020: Cargill Inc partnered with a leading food manufacturer to develop a range of low-sodium snacks, leveraging mineral salts to reduce sodium content.

- [Add more recent developments here with dates and brief descriptions]

Strategic Europe Sodium Reduction Ingredient Market Market Forecast

The Europe Sodium Reduction Ingredient Market is poised for significant growth, driven by increasing consumer demand for healthier food options and regulatory pressures to reduce sodium intake. The market is expected to reach a value of 1.8 Billion by 2033, growing at a CAGR of 5.3% from 2025 to 2033. Future opportunities lie in technological innovations and the expansion into new markets, particularly in Eastern Europe, where consumer awareness of health and wellness is on the rise. The market's potential is further enhanced by the continuous development of effective sodium reduction ingredients, such as yeast extracts and mineral salts, which cater to the evolving needs of food manufacturers and consumers alike.

Europe Sodium Reduction Ingredient Market Segmentation

-

1. Product Type

- 1.1. Amino Acids & Glutamates

-

1.2. Mineral Salts

- 1.2.1. Potassium Chloride

- 1.2.2. Magnesium Sulphate

- 1.2.3. Potassium Lactate

- 1.2.4. Calcium Chloride

- 1.3. Yeast Extracts

- 1.4. Others

-

2. Application

- 2.1. Bakery & Confectionery

- 2.2. Condiments, Seasonings & Sauces

- 2.3. Dairy & Frozen Foods

- 2.4. Meat & Meat Products

- 2.5. Snacks

Europe Sodium Reduction Ingredient Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Sodium Reduction Ingredient Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Low-Fat and Low-Calorie Food; Increasing Product Innovation

- 3.3. Market Restrains

- 3.3.1. ; Threat of New Entrants; Bargaining Power of Buyers/Consumers; Bargaining Power of Suppliers; Threat of Substitute Products; Degree Of Competition

- 3.4. Market Trends

- 3.4.1. Stringent Regulatory Environment for Salt reduction across Processed Foods

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Sodium Reduction Ingredient Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Amino Acids & Glutamates

- 5.1.2. Mineral Salts

- 5.1.2.1. Potassium Chloride

- 5.1.2.2. Magnesium Sulphate

- 5.1.2.3. Potassium Lactate

- 5.1.2.4. Calcium Chloride

- 5.1.3. Yeast Extracts

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bakery & Confectionery

- 5.2.2. Condiments, Seasonings & Sauces

- 5.2.3. Dairy & Frozen Foods

- 5.2.4. Meat & Meat Products

- 5.2.5. Snacks

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Germany Europe Sodium Reduction Ingredient Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Sodium Reduction Ingredient Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Sodium Reduction Ingredient Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Sodium Reduction Ingredient Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Sodium Reduction Ingredient Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Sodium Reduction Ingredient Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Sodium Reduction Ingredient Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Tate & Lyle Plc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Bunge Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Archer Daniels Midland Company

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Royal DSM NV*List Not Exhaustive

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Kerry Group

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Salt of the Earth Ltd

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Cargill Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Novozymes A/S

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.1 Tate & Lyle Plc

List of Figures

- Figure 1: Europe Sodium Reduction Ingredient Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Sodium Reduction Ingredient Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Sodium Reduction Ingredient Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Sodium Reduction Ingredient Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Europe Sodium Reduction Ingredient Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Europe Sodium Reduction Ingredient Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Sodium Reduction Ingredient Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Sodium Reduction Ingredient Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Sodium Reduction Ingredient Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Sodium Reduction Ingredient Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Sodium Reduction Ingredient Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Sodium Reduction Ingredient Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Sodium Reduction Ingredient Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Sodium Reduction Ingredient Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Sodium Reduction Ingredient Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 14: Europe Sodium Reduction Ingredient Market Revenue Million Forecast, by Application 2019 & 2032

- Table 15: Europe Sodium Reduction Ingredient Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom Europe Sodium Reduction Ingredient Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Germany Europe Sodium Reduction Ingredient Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Europe Sodium Reduction Ingredient Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy Europe Sodium Reduction Ingredient Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Europe Sodium Reduction Ingredient Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Netherlands Europe Sodium Reduction Ingredient Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Belgium Europe Sodium Reduction Ingredient Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Sweden Europe Sodium Reduction Ingredient Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Norway Europe Sodium Reduction Ingredient Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Poland Europe Sodium Reduction Ingredient Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Denmark Europe Sodium Reduction Ingredient Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Sodium Reduction Ingredient Market?

The projected CAGR is approximately 6.30%.

2. Which companies are prominent players in the Europe Sodium Reduction Ingredient Market?

Key companies in the market include Tate & Lyle Plc, Bunge Ltd, Archer Daniels Midland Company, Royal DSM NV*List Not Exhaustive, Kerry Group, Salt of the Earth Ltd, Cargill Inc, Novozymes A/S.

3. What are the main segments of the Europe Sodium Reduction Ingredient Market?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Low-Fat and Low-Calorie Food; Increasing Product Innovation.

6. What are the notable trends driving market growth?

Stringent Regulatory Environment for Salt reduction across Processed Foods.

7. Are there any restraints impacting market growth?

; Threat of New Entrants; Bargaining Power of Buyers/Consumers; Bargaining Power of Suppliers; Threat of Substitute Products; Degree Of Competition.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Sodium Reduction Ingredient Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Sodium Reduction Ingredient Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Sodium Reduction Ingredient Market?

To stay informed about further developments, trends, and reports in the Europe Sodium Reduction Ingredient Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence