Key Insights

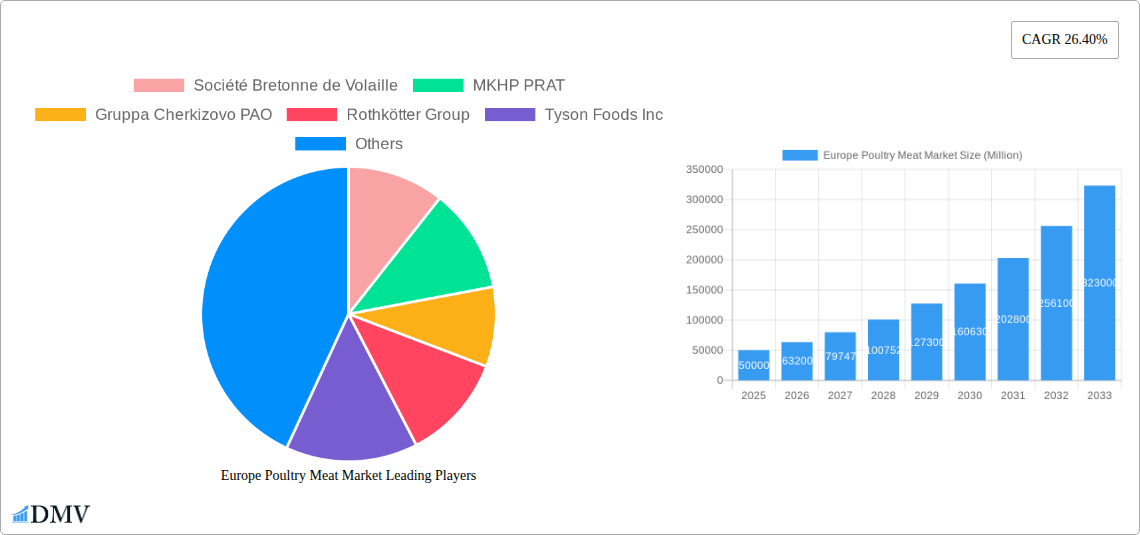

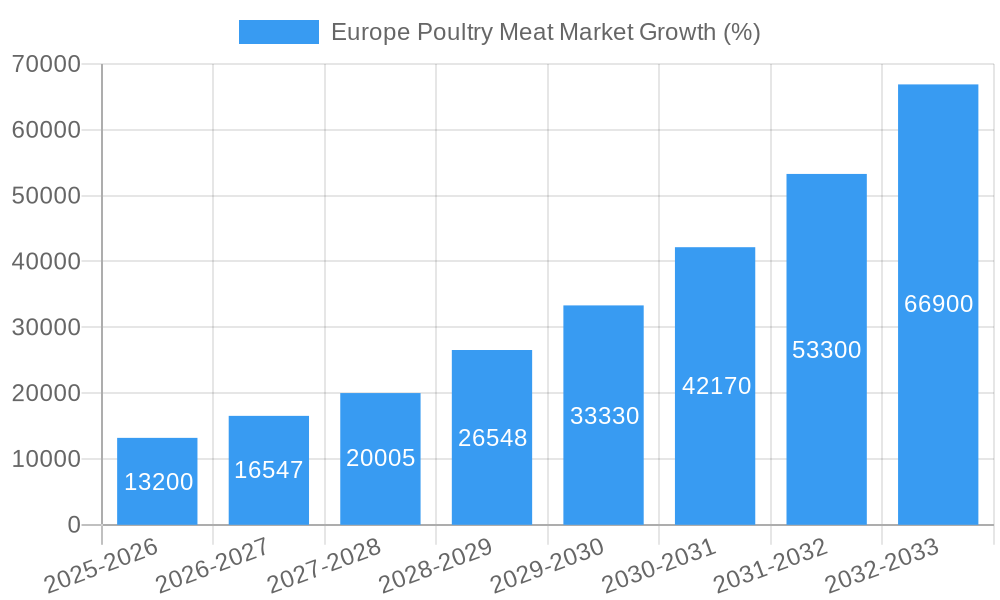

The European poultry meat market, valued at approximately €XX million in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 26.40% from 2025 to 2033. This significant expansion is driven by several key factors. Increasing consumer demand for affordable and readily available protein sources fuels market growth. Health-conscious consumers are increasingly opting for lean poultry meat options, furthering market demand. Furthermore, the rising popularity of processed poultry products, such as sausages, nuggets, and ready-to-eat meals, contributes to the market's expansion across various distribution channels. The on-trade sector (restaurants, hotels, etc.) is experiencing notable growth due to the increasing popularity of poultry in foodservice. Innovation in poultry farming practices, including sustainable and ethical farming methods, is also boosting consumer trust and, consequently, market growth. However, challenges exist, including fluctuating feed prices and potential disruptions to supply chains. The market is segmented by form (canned, fresh/chilled, frozen, processed) and distribution channel (off-trade, on-trade), with the fresh/chilled and off-trade segments currently dominating. Major players like Société Bretonne de Volaille, Tyson Foods, and JBS SA are fiercely competing for market share, driving innovation and price competition. Geographic growth is particularly strong in Western European nations like Germany, France, and the UK, fueled by high consumer spending and established distribution networks. Eastern European markets also show promise for future expansion.

The competitive landscape is characterized by a mix of large multinational corporations and regional players. The presence of major players fosters innovation and efficiency within the supply chain. Companies are investing heavily in research and development to improve product quality, sustainability, and production efficiency. Marketing efforts focus on highlighting the nutritional benefits of poultry meat and promoting convenience. Regulatory changes concerning food safety and animal welfare are influencing market dynamics, driving a shift towards more sustainable and ethical poultry production practices. Looking ahead, the continued expansion of the European poultry meat market is highly likely, fueled by consistent consumer demand and industry innovation. However, continued monitoring of external factors such as global economic conditions and geopolitical events is crucial for accurate market forecasting.

Europe Poultry Meat Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Europe poultry meat market, offering a comprehensive overview of its current state, future trends, and key players. Covering the period from 2019 to 2033, with a focus on 2025, this report is essential for stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The market is projected to reach xx Million by 2033.

Europe Poultry Meat Market Composition & Trends

This section delves into the intricate structure of the European poultry meat market, examining key aspects that shape its trajectory. We analyze market concentration, revealing the market share distribution among major players. We identify innovation catalysts, such as technological advancements in processing and packaging, and assess the influence of regulatory landscapes, including food safety standards and labeling requirements. The impact of substitute products, like plant-based alternatives, is also evaluated, alongside detailed profiles of end-users (retailers, food service, etc.). Finally, we examine the dynamics of mergers and acquisitions (M&A) within the industry, providing insights into deal values and their implications for market consolidation.

- Market Concentration: The European poultry meat market exhibits a moderately concentrated structure, with the top 10 players holding an estimated xx% market share in 2025.

- Innovation Catalysts: Automation in processing, sustainable packaging solutions, and traceability technologies are driving innovation.

- Regulatory Landscape: Stringent food safety regulations and labeling requirements influence market dynamics.

- Substitute Products: The rise of plant-based meat alternatives presents a growing challenge to traditional poultry meat producers.

- M&A Activity: Significant M&A activity was observed between 2019 and 2024, with total deal values exceeding xx Million. This consolidation is expected to continue.

Europe Poultry Meat Market Industry Evolution

This section provides a detailed analysis of the European poultry meat market's evolutionary path. We explore the market's growth trajectories, highlighting historical growth rates (2019-2024) and projecting future growth (2025-2033). The report examines technological advancements influencing production efficiency, product diversification, and supply chain optimization. Shifting consumer preferences, including demand for healthier options, convenience foods, and ethically sourced products, are also meticulously analyzed. This section showcases how these factors interplay to shape the market's overall development. For example, the adoption rate of automation in poultry processing plants increased by xx% between 2019 and 2024.

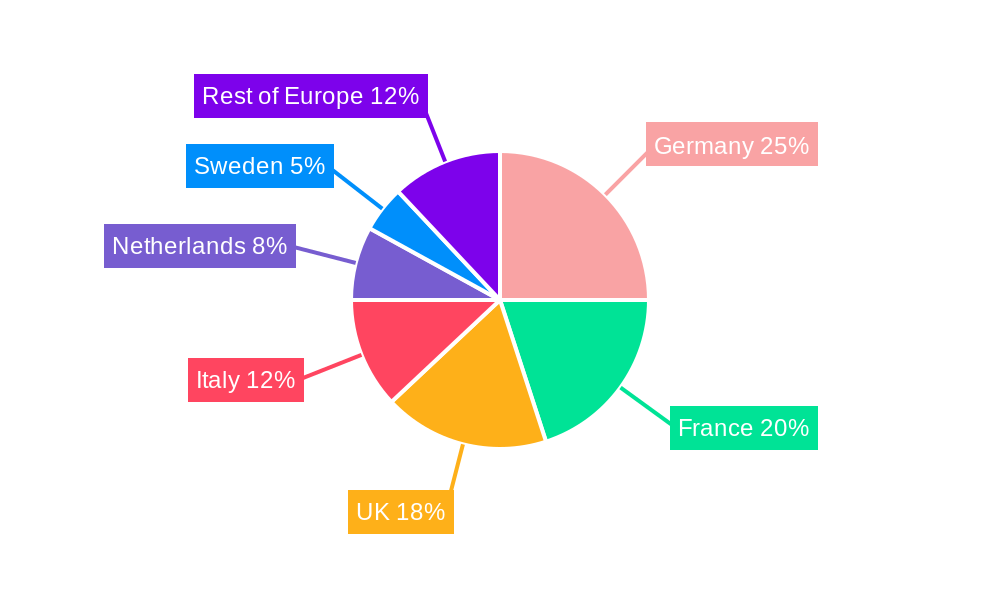

Leading Regions, Countries, or Segments in Europe Poultry Meat Market

This section identifies the dominant regions, countries, and segments within the European poultry meat market. We analyze the leading forms (Canned, Fresh/Chilled, Frozen, Processed) and distribution channels (Off-Trade, On-Trade), pinpointing the key factors driving their dominance. This involves an in-depth investigation of investment trends, regulatory support, and consumer preferences within each segment.

- Dominant Form: Fresh/Chilled poultry meat holds the largest market share, driven by consumer preference for freshness and perceived higher quality.

- Dominant Distribution Channel: Off-Trade channels (supermarkets, hypermarkets) dominate, reflecting the widespread availability and convenience of poultry meat.

- Key Drivers (Germany): Strong domestic consumption, efficient production infrastructure, and supportive government policies contribute to Germany’s leading position.

- Key Drivers (France): High poultry consumption, well-established processing industry, and a robust export market propel France's significant presence.

Europe Poultry Meat Market Product Innovations

Recent innovations in the European poultry meat market focus on enhanced convenience, health, and sustainability. This includes ready-to-cook meals, value-added processed products, and sustainably sourced poultry. Unique selling propositions (USPs) are increasingly centered on ethical sourcing, traceability, and reduced environmental impact. Technological advancements in processing and packaging are improving shelf life and product quality.

Propelling Factors for Europe Poultry Meat Market Growth

Several factors are driving the growth of the European poultry meat market. Increasing disposable incomes fuel demand, particularly for processed and convenience products. Technological advancements in production and processing lead to cost efficiencies and higher output. Favorable regulatory environments support industry growth, while evolving consumer preferences towards healthier and sustainable options present significant opportunities.

Obstacles in the Europe Poultry Meat Market

The European poultry meat market faces various challenges. Fluctuations in feed prices impact production costs, while stringent regulations and food safety standards can increase operational expenses. Supply chain disruptions, amplified by geopolitical events, can cause production delays and price volatility. Intense competition among established players and the emergence of plant-based alternatives pose significant challenges.

Future Opportunities in Europe Poultry Meat Market

Future growth opportunities lie in expanding into niche markets like organic and free-range poultry. Technological advancements in automation and precision farming can further enhance efficiency and sustainability. Meeting changing consumer demands for healthier, convenient, and ethically sourced products will be crucial for success. Growth in the Eastern European market presents a significant opportunity for expansion.

Major Players in the Europe Poultry Meat Market Ecosystem

- Société Bretonne de Volaille

- MKHP PRAT

- Gruppa Cherkizovo PAO

- Rothkötter Group

- Tyson Foods Inc

- Lambert Dodard Chancereul (LDC) Group

- PHW Group

- Veronesi Holding S p A

- Plukon Food Group

- Cargill Inc

- 2 Sisters Food Group

- JBS SA

Key Developments in Europe Poultry Meat Market Industry

- April 2023: Cherkizovo Group expanded their range of halal products under the Latifa brand, including turkey meat. This caters to growing demand for halal products.

- June 2023: Cherkizovo Group partnered with the Gastreet festival in Sochi, showcasing their culinary capabilities and brand presence.

- August 2023: Cherkizovo Group expanded their product line with over 200 new items, including various sausages and deli meats, boosting their product portfolio.

Strategic Europe Poultry Meat Market Forecast

The European poultry meat market is poised for continued growth, driven by sustained consumer demand, technological innovation, and strategic expansions by key players. Opportunities exist in catering to health-conscious consumers and leveraging sustainability initiatives. The market is expected to experience steady expansion throughout the forecast period (2025-2033), driven by the factors outlined throughout this report.

Europe Poultry Meat Market Segmentation

-

1. Form

- 1.1. Canned

- 1.2. Fresh / Chilled

- 1.3. Frozen

-

1.4. Processed

-

1.4.1. By Processed Types

- 1.4.1.1. Deli Meats

- 1.4.1.2. Marinated/ Tenders

- 1.4.1.3. Meatballs

- 1.4.1.4. Nuggets

- 1.4.1.5. Sausages

- 1.4.1.6. Other Processed Poultry

-

1.4.1. By Processed Types

-

2. Distribution Channel

-

2.1. Off-Trade

- 2.1.1. Convenience Stores

- 2.1.2. Online Channel

- 2.1.3. Supermarkets and Hypermarkets

- 2.1.4. Others

- 2.2. On-Trade

-

2.1. Off-Trade

Europe Poultry Meat Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Poultry Meat Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 26.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Urbanization; Growing Disposable Income

- 3.3. Market Restrains

- 3.3.1. High-price and additional delivery charges

- 3.4. Market Trends

- 3.4.1. Rising consumption of poultry meat boosting the market growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Poultry Meat Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Canned

- 5.1.2. Fresh / Chilled

- 5.1.3. Frozen

- 5.1.4. Processed

- 5.1.4.1. By Processed Types

- 5.1.4.1.1. Deli Meats

- 5.1.4.1.2. Marinated/ Tenders

- 5.1.4.1.3. Meatballs

- 5.1.4.1.4. Nuggets

- 5.1.4.1.5. Sausages

- 5.1.4.1.6. Other Processed Poultry

- 5.1.4.1. By Processed Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-Trade

- 5.2.1.1. Convenience Stores

- 5.2.1.2. Online Channel

- 5.2.1.3. Supermarkets and Hypermarkets

- 5.2.1.4. Others

- 5.2.2. On-Trade

- 5.2.1. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. Germany Europe Poultry Meat Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Poultry Meat Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Poultry Meat Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Poultry Meat Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Poultry Meat Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Poultry Meat Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Poultry Meat Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Société Bretonne de Volaille

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 MKHP PRAT

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Gruppa Cherkizovo PAO

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Rothkötter Group

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Tyson Foods Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Lambert Dodard Chancereul (LDC) Group

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 PHW Group

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Veronesi Holding S p A

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Plukon Food Group

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Cargill Inc

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 2 Sisters Food Group

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 JBS SA

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 Société Bretonne de Volaille

List of Figures

- Figure 1: Europe Poultry Meat Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Poultry Meat Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Poultry Meat Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Poultry Meat Market Revenue Million Forecast, by Form 2019 & 2032

- Table 3: Europe Poultry Meat Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Europe Poultry Meat Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Poultry Meat Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Poultry Meat Market Revenue Million Forecast, by Form 2019 & 2032

- Table 14: Europe Poultry Meat Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 15: Europe Poultry Meat Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom Europe Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Germany Europe Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Europe Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy Europe Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Europe Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Netherlands Europe Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Belgium Europe Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Sweden Europe Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Norway Europe Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Poland Europe Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Denmark Europe Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Poultry Meat Market?

The projected CAGR is approximately 26.40%.

2. Which companies are prominent players in the Europe Poultry Meat Market?

Key companies in the market include Société Bretonne de Volaille, MKHP PRAT, Gruppa Cherkizovo PAO, Rothkötter Group, Tyson Foods Inc, Lambert Dodard Chancereul (LDC) Group, PHW Group, Veronesi Holding S p A, Plukon Food Group, Cargill Inc, 2 Sisters Food Group, JBS SA.

3. What are the main segments of the Europe Poultry Meat Market?

The market segments include Form, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Urbanization; Growing Disposable Income.

6. What are the notable trends driving market growth?

Rising consumption of poultry meat boosting the market growth.

7. Are there any restraints impacting market growth?

High-price and additional delivery charges.

8. Can you provide examples of recent developments in the market?

August 2023: Cherkizovo Group expanded their line of products under the brands of Cherkizovo and Cherkizovo Premium by adding over 200 products including cooked and smoked sausages, dry sausages and a variety of deli meats.June 2023: Cherkizovo group announced the partnership with Gastreet festival in Sochi for the third consecutive time, and they presented dishes prepared by the company's chefs in the festival.April 2023: Cherkizovo Group expanded their range of halal products under Latifa brand. Apart from chicken, it now includes turkey meat produced on the Company’s own farms. The launch of new products is driven by the growing demand for halal meat among both Muslim and non-Muslim people in Russia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Poultry Meat Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Poultry Meat Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Poultry Meat Market?

To stay informed about further developments, trends, and reports in the Europe Poultry Meat Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence