Key Insights

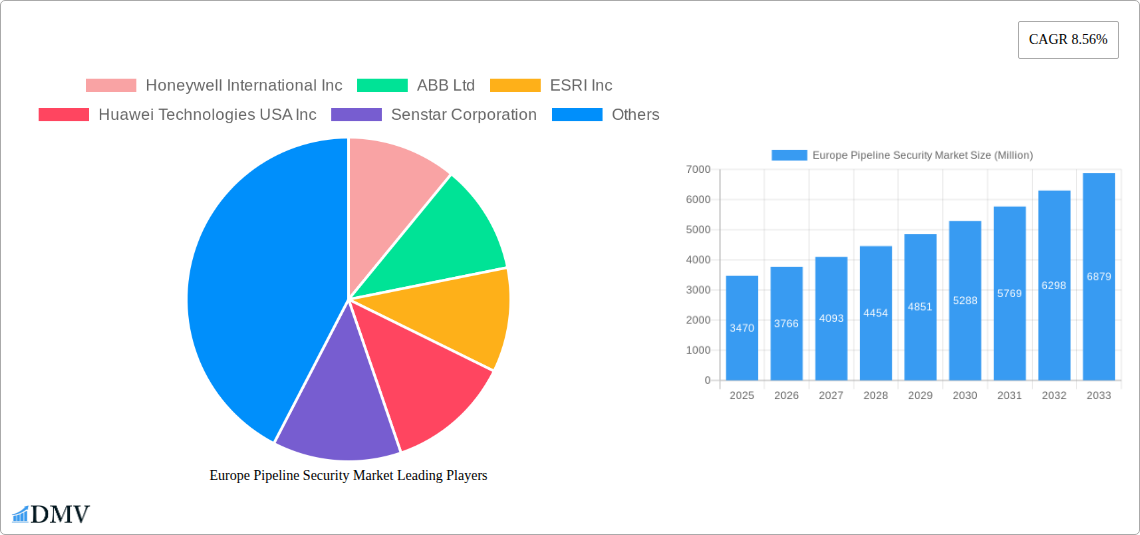

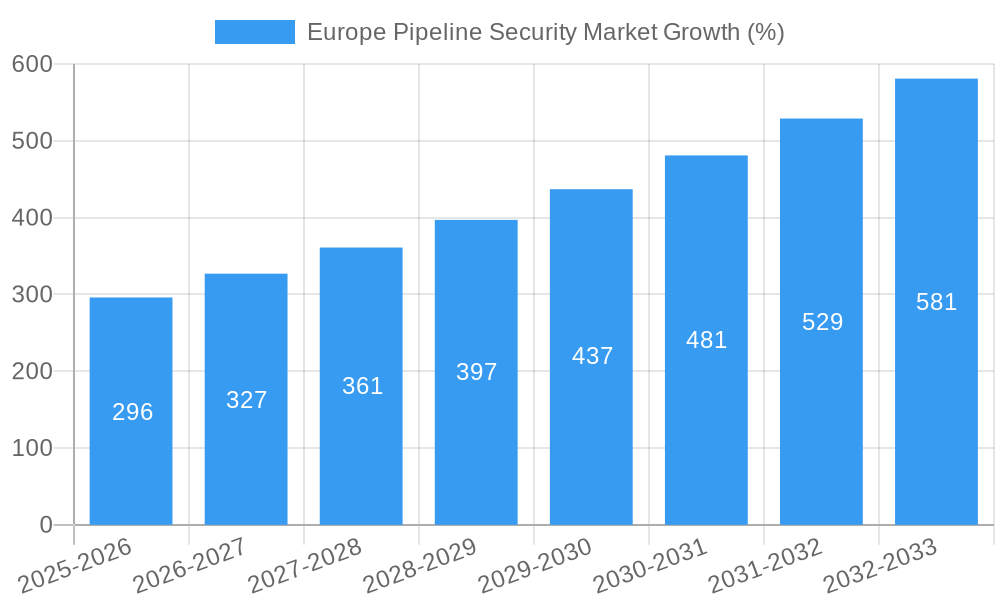

The European pipeline security market, valued at €3.47 billion in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 8.56% from 2025 to 2033. This expansion is driven by several key factors. Increasing cross-border energy transportation necessitates enhanced security measures to mitigate risks associated with terrorism, vandalism, and theft. Furthermore, the rising adoption of advanced technologies, such as SCADA systems, perimeter security systems, and sophisticated pipeline monitoring solutions, is fueling market growth. Stringent government regulations aimed at improving pipeline safety and operational efficiency are also contributing significantly. The market is segmented by product (natural gas, crude oil, hazardous liquids/chemicals, and others), technology (SCADA, perimeter security, industrial control systems security, video surveillance, and pipeline monitoring), and key European countries including Germany, the United Kingdom, France, Russia, and Spain. Germany, the UK, and France are expected to dominate the market due to their extensive pipeline networks and robust regulatory frameworks.

The market's growth trajectory is influenced by several trends. The increasing integration of IoT (Internet of Things) devices within pipeline infrastructure for real-time monitoring and predictive maintenance is a key trend. The growing adoption of cloud-based security solutions offers enhanced scalability and remote accessibility, contributing to market expansion. However, high initial investment costs associated with implementing advanced security systems and the potential for cyberattacks on interconnected pipeline networks could pose restraints on market growth. Nevertheless, the overall outlook for the European pipeline security market remains positive, fueled by continued investment in infrastructure modernization and heightened security concerns. Leading companies such as Honeywell, ABB, and Siemens are actively contributing to this growth through innovative product offerings and strategic partnerships.

Europe Pipeline Security Market: A Comprehensive Report (2019-2033)

This insightful report offers a comprehensive analysis of the Europe Pipeline Security Market, providing a detailed overview of market dynamics, key players, technological advancements, and future growth prospects. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report meticulously analyzes market trends, competitive landscape, and growth drivers, offering invaluable insights for stakeholders across the pipeline security ecosystem. The market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Europe Pipeline Security Market Composition & Trends

This section delves into the intricate structure of the Europe pipeline security market, examining market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and mergers & acquisitions (M&A) activities. The market exhibits a moderately concentrated landscape, with a few major players holding significant market share. However, the emergence of innovative technologies and smaller, specialized companies is fostering increased competition.

- Market Share Distribution: Honeywell International Inc., ABB Ltd., and Siemens AG collectively hold an estimated 40% market share in 2025. Smaller players account for the remaining 60%, indicating a fragmented yet competitive landscape.

- Innovation Catalysts: Stringent regulatory compliance requirements, increasing cyber threats, and the need for enhanced operational efficiency are major drivers of innovation within the market. Advancements in AI, IoT, and data analytics are shaping new solutions.

- Regulatory Landscape: The EU's focus on pipeline safety and cybersecurity regulations has significantly influenced market growth, driving demand for advanced security solutions. Stringent regulations on data privacy and security are also impacting the market.

- Substitute Products: While there are no direct substitutes for pipeline security systems, companies are exploring cost-effective alternatives and focusing on integration with existing infrastructure to reduce implementation costs.

- End-User Profiles: Key end-users include major oil and gas companies, chemical manufacturers, and government agencies responsible for pipeline infrastructure.

- M&A Activities: The past five years have witnessed several M&A deals, with a total estimated value of xx Million. These activities reflect the consolidation trend and the drive to enhance technological capabilities and expand market reach. These deals are driven by a need to broaden product portfolios and achieve economies of scale.

Europe Pipeline Security Market Industry Evolution

The Europe pipeline security market has experienced significant growth over the past few years, driven by several factors. Technological advancements, including the adoption of AI, IoT, and advanced analytics, are revolutionizing pipeline security management. The market is witnessing a shift from traditional perimeter security systems to more integrated and intelligent solutions that offer improved threat detection and response capabilities. The increasing prevalence of cyber threats is forcing pipeline operators to prioritize cybersecurity measures. This is reflected in the growing adoption of industrial control systems (ICS) security solutions and the increased focus on data protection. The market is also witnessing a growing emphasis on preventative measures to minimize the risk of pipeline breaches. This is driven by both regulatory requirements and the desire to protect the environment and reduce operational disruptions. Growth rates have averaged approximately 6% annually between 2019 and 2024, with a projected acceleration to 7% during the forecast period driven largely by increased regulatory scrutiny and the adoption of advanced technological solutions. Adoption rates of SCADA systems, for instance, have increased by approximately 15% annually during the same period, and are expected to maintain a similar growth trajectory in the coming years.

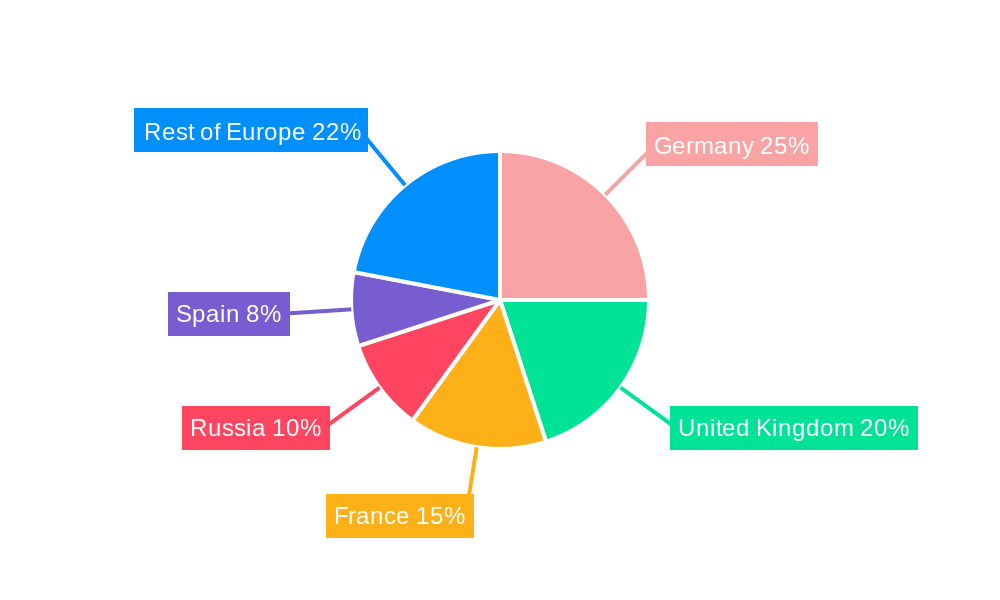

Leading Regions, Countries, or Segments in Europe Pipeline Security Market

- By Product: The natural gas segment holds the largest market share due to the extensive network of natural gas pipelines across Europe and increasing concerns regarding gas supply security.

- By Technology and Solution: SCADA systems and perimeter security/intruder detection systems constitute the dominant segments. The increasing integration of these systems with advanced analytics and AI-based solutions further fuels market growth.

- By Country: Germany, the United Kingdom, and France are the leading markets, driven by strong regulatory frameworks, substantial pipeline infrastructure, and high investments in security enhancements.

Key Drivers:

- Germany: High concentration of refineries and chemical plants, stringent regulations, and significant investments in infrastructure modernization.

- United Kingdom: Large pipeline network transporting both natural gas and crude oil, alongside a robust regulatory environment driving investments in security technologies.

- France: Extensive pipeline network and considerable government spending on infrastructure security.

- Russia: While facing geopolitical challenges impacting its market size, Russia still holds a significant position due to its extensive pipeline network. However, sanctions and geopolitical factors will significantly impact growth in the coming years.

- Spain: Growing investments in renewable energy infrastructure necessitate robust security measures for associated pipeline networks.

- Rest of Europe: A varied market landscape with diverse levels of pipeline infrastructure and regulatory frameworks. This region will likely witness moderate growth driven by increasing energy demands and infrastructure development.

Europe Pipeline Security Market Product Innovations

Recent innovations focus on integrating AI and machine learning into pipeline monitoring systems. These advancements enhance threat detection, predictive maintenance, and real-time response capabilities. Companies are also developing sophisticated solutions that combine multiple security technologies, providing a holistic and more effective approach to pipeline security. The development of smaller, more energy-efficient sensors is another key trend, enabling easier deployment and lower operational costs.

Propelling Factors for Europe Pipeline Security Market Growth

The market's growth is fueled by several factors including escalating cyber threats against pipeline infrastructure, stringent regulatory mandates enforcing advanced security measures, and the increasing adoption of sophisticated technologies like AI and IoT for enhanced monitoring and threat response. The rising global demand for energy coupled with expansion of pipeline infrastructure in various regions further fuels market expansion.

Obstacles in the Europe Pipeline Security Market

Key obstacles include the high initial investment costs associated with implementing advanced security systems, potential supply chain disruptions affecting the availability of crucial components, and intense competition among established and emerging players leading to price pressure. Furthermore, integrating new security technologies with legacy systems can be complex and time-consuming.

Future Opportunities in Europe Pipeline Security Market

The market presents significant opportunities in the expansion of pipeline networks, particularly related to renewable energy resources, the growing demand for cyber security solutions, and the increasing adoption of cloud-based platforms for data management and analysis. Development of advanced analytics and predictive maintenance solutions will also create substantial opportunities.

Major Players in the Europe Pipeline Security Market Ecosystem

- Honeywell International Inc

- ABB Ltd

- ESRI Inc

- Huawei Technologies USA Inc

- Senstar Corporation

- Rockwell Automation Inc

- Optasense Ltd

- General Electric Company

- Thales S

- Schneider Electric S E

- Siemens AG

Key Developments in Europe Pipeline Security Market Industry

- November 2022: Partnership between Ambient.ai and Axis Communication to seamlessly integrate Ambient.ai Platform and Axis Network Cameras, enhancing security solutions. This collaboration expanded the market reach of both companies and improved interoperability between security systems.

- March 2022: Gas Sensing Solutions launched a new line of high-precision, low-power methane gas sensors. This product launch addressed a significant need for improved gas leak detection and enhanced environmental safety measures. This increased the market's focus on advanced gas detection technologies.

Strategic Europe Pipeline Security Market Forecast

The Europe pipeline security market is poised for sustained growth, driven by technological advancements, regulatory pressures, and the increasing need to protect critical energy infrastructure. The market's future trajectory is highly promising, with continuous innovation in security technologies and expanding deployment across diverse pipeline applications. The focus on preventative measures, improved data analytics, and enhanced cyber resilience will be key growth catalysts in the coming years.

Europe Pipeline Security Market Segmentation

-

1. Product

- 1.1. Natural Gas

- 1.2. Crude Oil

- 1.3. Hazardous liquid pipelines/ Chemicals

- 1.4. Other Products

-

2. Technology and Solution

- 2.1. SCADA System

- 2.2. Perimeter Security/Intruder Detection System

- 2.3. Industrial Control Systems Security

- 2.4. Video Surveillance and GIS Mapping

- 2.5. Pipeline Monitoring

- 2.6. Other Technology and Solutions

Europe Pipeline Security Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Pipeline Security Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.56% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Spending of Oil and Gas Companies; Growing Worldwide Demand for Natural Gas; Increasing Requirement of SCADA System

- 3.3. Market Restrains

- 3.3.1. Scattered Facilities; High Implementation and Maintenance Costs

- 3.4. Market Trends

- 3.4.1. SCADA Segment to Hold a Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Pipeline Security Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Natural Gas

- 5.1.2. Crude Oil

- 5.1.3. Hazardous liquid pipelines/ Chemicals

- 5.1.4. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Technology and Solution

- 5.2.1. SCADA System

- 5.2.2. Perimeter Security/Intruder Detection System

- 5.2.3. Industrial Control Systems Security

- 5.2.4. Video Surveillance and GIS Mapping

- 5.2.5. Pipeline Monitoring

- 5.2.6. Other Technology and Solutions

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Germany Europe Pipeline Security Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Pipeline Security Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Pipeline Security Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Pipeline Security Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Pipeline Security Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Pipeline Security Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Pipeline Security Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Honeywell International Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 ABB Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 ESRI Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Huawei Technologies USA Inc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Senstar Corporation

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Rockwell Automation Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Optasense Ltd

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 General Electric Company

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Thales S

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Schneider Electric S E

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Siemens AG

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 Honeywell International Inc

List of Figures

- Figure 1: Europe Pipeline Security Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Pipeline Security Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Pipeline Security Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Pipeline Security Market Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Europe Pipeline Security Market Revenue Million Forecast, by Technology and Solution 2019 & 2032

- Table 4: Europe Pipeline Security Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Pipeline Security Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Pipeline Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Pipeline Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Pipeline Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Pipeline Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Pipeline Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Pipeline Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Pipeline Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Pipeline Security Market Revenue Million Forecast, by Product 2019 & 2032

- Table 14: Europe Pipeline Security Market Revenue Million Forecast, by Technology and Solution 2019 & 2032

- Table 15: Europe Pipeline Security Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom Europe Pipeline Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Germany Europe Pipeline Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Europe Pipeline Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy Europe Pipeline Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Europe Pipeline Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Netherlands Europe Pipeline Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Belgium Europe Pipeline Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Sweden Europe Pipeline Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Norway Europe Pipeline Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Poland Europe Pipeline Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Denmark Europe Pipeline Security Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Pipeline Security Market?

The projected CAGR is approximately 8.56%.

2. Which companies are prominent players in the Europe Pipeline Security Market?

Key companies in the market include Honeywell International Inc, ABB Ltd, ESRI Inc, Huawei Technologies USA Inc, Senstar Corporation, Rockwell Automation Inc, Optasense Ltd, General Electric Company, Thales S, Schneider Electric S E, Siemens AG.

3. What are the main segments of the Europe Pipeline Security Market?

The market segments include Product, Technology and Solution.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.47 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Spending of Oil and Gas Companies; Growing Worldwide Demand for Natural Gas; Increasing Requirement of SCADA System.

6. What are the notable trends driving market growth?

SCADA Segment to Hold a Significant Share.

7. Are there any restraints impacting market growth?

Scattered Facilities; High Implementation and Maintenance Costs.

8. Can you provide examples of recent developments in the market?

November 2022: To seamlessly integrate the Ambient.ai Platform and Axis Network Cameras, announced a partnership with Axis Communication, a leading supplier of solutions enhancing security and business performance.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Pipeline Security Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Pipeline Security Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Pipeline Security Market?

To stay informed about further developments, trends, and reports in the Europe Pipeline Security Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence